Public Disclosure Authorized - World Bank · Report No: 75089-ZM . INTERNATIONAL DEVELOPMENT...

Transcript of Public Disclosure Authorized - World Bank · Report No: 75089-ZM . INTERNATIONAL DEVELOPMENT...

Document of

The World Bank

FOR OFFICIAL USE ONLY

Report No: 75089-ZM

INTERNATIONAL DEVELOPMENT ASSOCIATION

INTERNATIONAL FINANCE CORPORATION

AND

MULTILATERAL INVESTMENT GUARANTEE AGENCY

COUNTRY PARTNERSHIP STRATEGY

FOR THE

REPUBLIC OF ZAMBIA

FOR THE PERIOD FY13-FY16

February 15, 2013

Zambia Country Management Unit

Africa Region

The International Finance Corporation

Africa Region

The Multilateral Investment Guarantee Agency

This document has a restricted distribution and may be used by recipients only in the performance of their duties. Its contents may not otherwise be disclosed without World Bank Authorization

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

i

CURRENCY EQUIVALENTS (Exchange Rate as of February 13, 2013)

Currency Unit = Kwacha (ZMW)

US$ 1 = ZMW 5.33

FISCAL YEAR

July 1 – June 30

ABBREVIATIONS AND ACRONYMS

AAA Analytical and Advisory Activities

ACET Africa Center for Economic Transformation

ADSP Agriculture Development Support Project

AfDB African Development Bank AFR Africa region APL Adaptable Program Loan APPSA Agricultural Productivity Program for

Southern Africa ARDE Annual Review of Development

Effectiveness ARPP Annual Report on Portfolio

Performance BDS Business Development Services BW Business Warehouse CAADP Comprehensive Africa Agriculture

Development Program CAE Country Assistance Evaluation CARDESA Center for Coordination of Agricultural

Research for Southern Africa CAS Country Assistance Strategy CASCR Country Assistance Strategy

Completion Report CBPP Contagious bovine pleuropneumonia CD Country Director CFR Corporate Finance and Risk

Management CIWA Cooperation in International Waters in

Africa CMU Country Management Unit CODE Committee on Development

Effectiveness COMESA Common Market for Eastern and

Southern Africa CP Cooperating Partner CPI Corruption Perception Index

CPFL Consumer Protection and Financial Literacy

CPS Country Partnership Strategy CSO Civil Society Organization DDCC District Development Coordinating

Committee DEC Development Economics DFGG Demand for Good Governance DFID United Kingdom Department for

International Development EITI Extractive Industries Transparency

Initiative ESSD Environmental and Socially Sustainable

Development network ESW Economic and Sector Work FBD Farm Block Development FDI Foreign Direct Investment FISP Farmer Input Support Program FM Financial Management FMD Foot and mouth disease FNDP Fifth National Development Plan FPD Financial and Private Sector

Development network FRA Food Reserve Agency GAC Governance and Anti-corruption GAFSP Global Agriculture and Food Security

Program GEF Global Environment Facility GDP Gross Domestic Product GRZ Government of the Republic Zambia GPF Global Partnership Facility HDN Human Development network HDI Human Development Index HIPC Heavily Indebted Poor Countries HR Human Resources HRITF Health Results Innovation Trust Fund IBRD International Bank for Reconstruction

and Development

ii

ICR Implementation Completion and Results Report

ICRR Implementation Completion and Results Report Review

ICT Information Communication Technology

IDA International Development Association IDSP Irrigation Development Support Project IEG Independent Evaluation Group IFC International Finance Corporation IFMIS Integrated Financial Management

Information System IFPRI International Food Policy Research

Institute IL Investment Loan ILO International Labor Organization IMF International Monetary Fund INF Infrastructure network ISF Investment Support Fund ISR Implementation Status and Results

Report JASZII Second Joint Assistance Strategy for

Zambia KfW Kreditanstalt Für Wiederaufbau KLC Knowledge and Learning Council LEAP Liquidity Enhanced Asset Program LCMS Living Conditions Monitoring Survey LCR Latin America and the Caribbean region LDAHP Livestock Development and Animal

Health Project LIC Low Income Country LWSC Lusaka Water and Sewerage Company MAG Mutual Accountability Group MCA Millennium Challenge Account MD Managing Director MDG Millennium Development Goals MDR Multilateral Debt Relieve MIC Middle-income country MIGA Multilateral Investment Guarantee

Agency MLGH Ministry of Local Government and

Housing MLT Matrix Leadership Team MMD Movement for Multi-Party Democracy MNA Middle East and North Africa region MOF Ministry of Finance MSME Medium, Small and Micro Enterprises MTEF Medium Team Expenditure Framework ND Newcastle disease NFNC National Food and Nutrition

Commission NGO Non-Governmental Organization NHSP National Health Strategic Plan NWASCO National Water Regulator National

Water Supply and Sanitation Council ODA Official Development Assistance

OPCS Operations Policy and Country Services PAF Performance Assessment Framework PDCC Provincial Development Coordinating

Committee PDO Project Development Objective PEFA Public Expenditure and Financial

Accountability PETS Public Expenditure Tracking Survey PF Patriotic Front PFM Public Financial Management PIU Project Implementation Unit PRBS Poverty Reduction Budget Support PREM Poverty Reduction and Economic

Management network PRSC Poverty Reduction Support Credit PPAR Project Performance Assessment Report PPCR Pilot Program for Climate Resilience PPIAF Public-Private Infrastructure Advisory

Facility PPP Public Private Partnership PSDRP Public Sector Development Reform

Program PSRP Public Sector Reform Program P4R Program for Results QAG Quality Assurance Group RDA Road Development Agency REC-TCC Regional Economic Communities

Transport Coordinating Committee ROSC-A&A Report on Observance of Standards and

Codes-Accounting and Auditing RRMP Road Rehabilitation Maintenance

Project SACMEQ Southern and Eastern Africa

Consortium for Monitoring Educational Quality

SADC South African Development Community

SAG Sector Advisory Groups SAR South Asia Region SB Sector Board SD Sector Director SDN Sustainable Development network SDR Special Drawing Rights SEED Support for Economic Expansion

Diversification SM Sector Manager SME Small and Medium Enterprise SMS Short Message Service SMU Sector Management Unit SNDP Sixth National Development Plan SSATP Sub-Saharan Africa Transport Policy

Program TA Technical Assistance TB Tuberculosis TF Trust Fund UNDP United Nation Development Program

iii

UNICEF United Nations Children’s Fund UNWTO United Nations World Tourism

Organization UPND United Party for National Development USAID United States Agency for International

Development US United States VP Vice President VPU Vice Presidential Unit WBG World Bank Group WBI World Bank Institute WGI World Governance Indicators WDR World Development Report WHO World Health Organization WSP Water and Sanitation Program WSPIP Water Sector Performance

Improvement project

ZANACO Zambia National Commercial Bank ZDHS Zambia Demographic and Health

Survey ZEITI Zambia Extractive Industries

Transparency Initiative ZICA Zambia Institute of Chartered

Accountants ZMLCI Zambian Mining Local Content

Initiative

IDA IFC MIGA Vice President: Makhtar Diop Bernard Sheahan (Acting) Michel Wormser Director: Kundhavi Kadiresan Cheikh Oumar Seydi Ravi Vish Task Team Leaders: Nalini Kumar Sylvain Kakou Stephan Dreyhaupt

iv

REPUBLIC OF ZAMBIA COUNTRY PARTNERSHIP STRATEGY

TABLE OF CONTENTS

EXECUTIVE SUMMARY .................................................................................................... vii

INTRODUCTION .................................................................................................................... 1

I. COUNTRY CONTEXT ........................................................................................................ 2

A. Institutional and Political Context ................................................................................ 2 B. Poverty and Social Context ........................................................................................... 3 C. Economic Context ......................................................................................................... 5 D. Key Development Challenges ....................................................................................... 9 E. Zambia’s Development Strategy................................................................................. 16 F. Development Partner Support ..................................................................................... 17

II. LESSONS LEARNED FROM A REVIEW OF THE PAST WBG ASSISTANCE ......... 18

A. Implementation of the last Country Assistance Strategy (CAS) ................................ 18 B. IDA, Trust Funds and Analytical and Advisory Services........................................... 19 C. Multilateral Investment Guarantee Agency ................................................................ 19 D. International Finance Corporation .............................................................................. 20 E. Lessons Learned.......................................................................................................... 20

III. THE COUNTRY PARTNERSHIP STRATEGY IN ZAMBIA ....................................... 21

A. The CPS and the WBG Strategies .............................................................................. 21 B. The Guiding Principles for WBG Engagement in Zambia ......................................... 22 C. WBG Financial Resources under the CPS .................................................................. 24 D. CPS Instruments.......................................................................................................... 25

IV. PROPOSED CPS OBJECTIVES AND EXPECTED RESULTS .................................... 25

A. Objective One: Reducing Poverty and the Vulnerability of the Poor ......................... 25 B. Objective Two: Improving Competitiveness and Infrastructure for Growth and

Employment ................................................................................................................ 30 C. Objective Three: Improving Governance and Strengthening Economic

Management ................................................................................................................ 35

V. RISKS AND MITIGATION .............................................................................................. 40

A. Political Risks ............................................................................................................. 40 B. Institutional Risks ....................................................................................................... 41 C. External Shocks .......................................................................................................... 42

EndNote .................................................................................................................................. 42

References ............................................................................................................................... 44

Annex 1: Zambia CPS Results Matrix .................................................................................... 48

Annex 2: Zambia at a Glance .................................................................................................. 58

v

Annex 3: Key Social Indicators .............................................................................................. 60

Annex 4a: Millennium Development Goals ........................................................................... 61

Annex 4b: Progress on MDGs for Zambia ............................................................................. 62

Annex 5: Key Economic Indicators ........................................................................................ 64

Annex 6: Key Exposure Indicators ........................................................................................ 66

Annex 7: Selected Indicators* of Bank Portfolio Performance and Management ................. 67

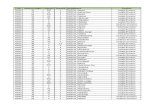

Annex 8: Operations Portfolio (IBRD/IDA and Grants) ........................................................ 68

Annex 9: On-going IDA Projects Approved before CPS by Sector ....................................... 69

Annex 10: World Bank Indicative Lending and AAA Plan FY13-16 .................................... 70

Table 1: Summary Lending ................................................................................................ 70 Table 2: Details on the Indicative Lending noted in Table 1 .............................................. 70 Table 3: World Bank Analytical and Advisory Activities under the Africa Strategy

by Fiscal Year ............................................................................................................. 72

Annex 11: Active Trust Fund Portfolio .................................................................................. 74

Annex 12: Zambia: IFC Investment Operations Program ...................................................... 76

Annex 13: Copper in Zambia .................................................................................................. 77

Annex 14: Regional Projects and Programs ........................................................................... 80

Annex 15: Client Survey and CPS consultations .................................................................... 84

Annex 16: Gender Integration in Projects .............................................................................. 86

Annex 17: Summary of Performance Indicator Ratings, 2008 and 2012 (draft) PEFA Assessments ............................................................................................................................ 88

Annex 18: Connecting the Non-State Actors with the State to Contribute to Greater Development Impact: Approach and Tools ............................................................................ 92

Annex 19: Zambia Cooperating Partners Division of Labor Matrix ...................................... 95

Annex 20: ZAMBIA CAS COMPLETION REPORT ........................................................... 96

vi

This Country Partnership Strategy was prepared under the guidance of Kundhavi Kadiresan, Country Director for Zambia, Malawi and Zimbabwe. The CPS core team included: Nalini Kumar (task team leader, Senior Operations Officer), Jumbe Ngoma, Ngao Mubanga and Patricia Palale. Major contributions to the report were made by the following members of the Zambia Country Team: Asumani Guloba, Sylvain Kakou (IFC), Praveen Kumar, Rosemary Musonda Sunkutu, Stephan Dreyhaupt (MIGA), Pazhayannur K. Subramanian and Vijay Pillai. Support to this team was provided by Lucy Mukuka, Cathleen Chuma Sosopi and Grace Soko. In addition to the above, the following made important contributions to this strategy: John Barham (IFC), Gunhild Berg, Sofia Bettencourt, Kate Bridges, Melissa Brown, Collins Chansa, Frank Douamba (IFC), Bhadra Durgabakshi, Indira Ekanayake, David Evans, Ben Gerike, Fareed Hassan, Conor Healy (MIGA), Wedex Ilunga, Martin Kachingwe, Daniel Kirkwood, Rama Lakshminarayanan, Bryan Land, John Makumba, Patricio Marquez, Ernest Matongo, John McIntire, Jean-Michel Pavy, Brian Mtonya, Alex Mwanakasale, Cecil Nundwe, Kathrin Plangemann, Thomas Ramin, Anwar Ravat, Bobak Rezaian, Justin Runji, Henry Schiembe (IFC), Barbara Mwila Kazimbaya-Senkwe, David Sislen, Cornelia Tesliuc, Ivan Velev, Michael Webster, Marcus Wishart and Willem Zijp. This CPS also acknowledges the significant contributions of the technical team from the Government of the Republic of Zambia, in particular the Secretariat from the Ministry of Finance.

vii

REPUBLIC OF ZAMBIA COUNTRY PARTNERSHIP STRATEGY

EXECUTIVE SUMMARY

Background: Zambia has had a long period of political stability. With strong growth in the last decade the country has reached lower middle income status. However, the economy remains mainly dependent on copper and more than 60 percent of Zambians live below the poverty line. Human development indicators lag the Sub-Saharan Africa average. Over the past decade the Gini coefficient worsened from 0.47 to 0.52. The potential and the need to increase agricultural productivity and develop the private sector remain huge.

Government development plan and CPS alignment: The Government that came to power in September 2011 aims for a better Zambia for all and identified poverty reduction, jobs creation and improving governance as its main priorities. The Sixth National Development Plan identifies the following overarching objectives: to accelerate infrastructure development, economic growth and diversification; promote rural investment and accelerate poverty reduction; and enhance human development. The CPS is aligned with the Government’s development priorities. In a country that displays both low income and middle income characteristics, the CPS will support three objectives that speak to the dual nature of Zambia’s development challenges and opportunities: (i) Reducing poverty and the vulnerability of the poor; (ii) Improving competitiveness and infrastructure for growth and employment: (iii) Improving governance and strengthening economic management. The specific activities supported have been identified through the systematic application of several guiding principles to enhance relevance and selectivity.

Aid flows to Zambia are declining and the Government is looking to the private market to raise resources. The Bank’s contribution to Zambia’s needs for development finance during the CPS period will be relatively small (IDA about US$100 million a year). Building on lessons of experience from the last CAS and working with other cooperating partners, World Bank, IFC and MIGA (WBG) will: (i) intervene pragmatically and selectively in areas where its limited resources can play a catalytic role and support public goods that provide the basis for economic development; (ii) increasingly leverage its global outreach and draw upon knowledge and partnerships to bring technical expertise and knowledge to bear on Zambia’s development; (iii) adopt an incremental approach to supporting reform that has proven effective in Zambia.

Reducing poverty and vulnerability of the poor: The WBG will provide support in areas such as research, extension, irrigation, rural roads, agri-business development, to help unlock the potential of the agriculture sector in which the majority of the poor, particularly women, are engaged. Programs designed to protect vulnerable families and promote job opportunities among them will be supported.

Improving competitiveness and infrastructure for growth and employment: IFC and World Bank will together provide support for enhancing the enabling environment for private sector development. Projects for improving supply and access to electricity, transport infrastructure, access to finance and better access to water for hydro-power generation and industry will be implemented. The CPS gives special attention to promoting greater regional integration and cooperation in matters of trade, transport policy, agricultural research and water resource management.

viii

Improving governance and strengthening economic management: Strengthening institutions and capacity so that Zambia can use its growing domestic resources and non-concessional borrowing effectively to support its development will be a priority. Other activities, such as building statistical capacity, monitoring and evaluation and providing timely and credible economic information to inform policy debate will also be supported.

The Bank will work with the Government to monitor portfolio performance and is taking several steps to improve portfolio quality and disbursements. There are political, institutional and external risks involved in achieving the results of the CPS but the WBG will take steps to mitigate those risks. A CPS progress report in 2014 will provide an opportunity to update the assessment of the country context and opportunities and risks.

1

REPUBLIC OF ZAMBIA COUNTRY PARTNERSHIP STRATEGY

INTRODUCTION

1. Zambia is riding on a number of successes. The economy has grown at 5.7 percent per annum over the last decade and Zambia was among the 10 fastest growing economies of Sub-Saharan Africa in 2012. Fast growth has enabled it to attain lower middle income country (MIC) status with a nominal per capita income of US$1,299 (2011). Investor confidence has been high as evidenced in the successful issue of the US$750 million Euro bond. In 2011 it successfully held national elections in which the long standing ruling party was defeated by the opposition and there was a peaceful transfer of power. 2. Zambia also presents difficult development challenges. The economy remains largely undiversified and mainly dependent on copper with economic activity mostly concentrated in the urban areas. Income distribution is highly unequal (0.52 Gini co-efficient) and on several development dimensions the country is indistinguishable or worse than many low income countries (LIC) (Table 1). Zambia is also lagging on a number of MDG targets—particularly those on extreme poverty and maternal and child mortality (Annex 4). Institutional capacity remains weak and according to the recent public sector governance surveys such as the World Governance Indicators (WGI) (see Annex 2) and Transparency International’s Corruption Perception Index (CPI) where Zambia ranked 91st out of 153, the country’s governance challenges need to be addressed. Recent Government actions (e.g. reversal of the railway concession, interest rate cap) are perceived by some sections of stakeholders as having created incoherence in the policy environment.

Table 1: Some development dimensions: Zambia, Lower middle income and Low income countries Zambia Lower Middle Income Low Income Zambia GNI per capita (Atlas) 2011 against average cut-off for lower middle income and low income countries(US$)

1,160 (1,299 nominal per capita)

1,026 or more (average cut off)*

1,025 or less (average cut off)*

Poverty rates PPP ($1.25 per day)/National Poverty line

68.5/60.5

Comparator countries Cameroon 10/39.9 Ghana28.6/28.5

Comparator countries Ethiopia 39/38.9 Uganda 38/24.5

Under 5 mortality per 1000 live births 119 69 108

Maternal mortality per 100,000 live births

591 300 590

Life expectancy 49 65 59 Source: WDI 2012, UNDP 2011a. Note: Latest available data. *As per World Bank July 2012 classification of low-income and lower middle income countries. Lower and upper middle income countries are separated at an average income of US $4,036.

3. The Government aims to reduce poverty, create jobs and make Zambia a prosperous MIC by 2030. The Government aims for a better Zambia for all and build on the country’s rich resources (land, water and minerals) and past achievements to make growth inclusive. The Vision 2030 document lays out the country’s aspirations and the challenges of achieving prosperous MIC status over the next generation. The Sixth National Development Plan (SNDP) elaborates the medium-term development objectives for the period 2011-2015 focusing on policies, strategies and programs that contribute to addressing the challenges of realizing broad-based pro-poor growth. In this context, though there is a mixed track record globally of converting mineral wealth into widely-shared prosperity, Zambia’s mining sector, with strengthened institutions and sounder policies, could

2

potentially contribute to broader development in the country. The Government is however, keen to diversify the economy and also effectively utilize Zambia’s other resources to promote inclusive growth. 4. In a country that displays both low income and middle income characteristics, the World Bank Group’s (WBG’s) role will be twofold i.e. contributing to poverty reduction and supporting the transition to a prosperous MIC. There is an urgency to tackle the country’s poverty and diversify the sources of growth. The overall resource needs to meet Zambia’s development goals are huge; but traditional aid is declining and the IDA envelope for Zambia is also limited (about US$100 million a year). However, the WBG’s global outreach to draw on partnerships and bring technical expertise and knowledge to bear on Zambia’s development is large. The latter could be utilized more effectively to strengthen institutions and improve economic management towards helping Zambia increase its own capacity to use its resources and institutions effectively. During the next four years, the WBG will position itself to transition from a lending institution to being a solutions one that, in the words of the WBG President Dr. Kim, “connects and convenes multiple stakeholders from around the world brokering knowledge exchange across institutional boundaries.” The WBG will also draw on its tremendous experience accumulated over decades of working with different countries to find the space in the current policy environment to support programs and projects that can effectively support Zambia’s development. The WBG’s strategic plan for support is laid out in this Country Partnership Strategy (CPS). 5. The CPS covers FY13-FY16 and reflects the Government’s priorities. The last WBG Country Assistance Strategy (CAS) (FY08-11) was discussed by the Board on April 8, 2008. In 2011, a CAS Progress Report (CASPR) extended that strategy until December 2012 to provide an opportunity to engage the newly elected Government in the preparation of the new strategy. The CPS reflects the Government’s development priorities as reflected in the development plan and Vision 2030 and is a “partnership” strategy prepared collaboratively with the Government and in consultation with civil society, cooperating partners (CPs), and other stakeholders. It puts forward an integrated World Bank, IFC and MIGA strategy—a WBG strategic plan—for supporting Zambia’s development. It also reflects the principles agreed upon by the CPs as articulated in the Second Joint Assistance Strategy for Zambia (JASZII) 2011-2015. 6. Outline of the CPS. The CPS has five chapters. The first chapter provides a country context followed by a description of the key development challenges, the country’s development plan and a summary of CPs support. Chapter II reviews the WBG’s past support to the country, Chapters III and IV lay out the key features of this CPS including objectives, guiding principles of engagement and expected results. Chapter V notes the risks and the strategy for mitigation. I. COUNTRY CONTEXT

A. Institutional and Political Context

7. The Zambian Government structure consists of three arms—the executive, the legislature and the judiciary. According to the current Constitution the President, is the head of the State and is also at the apex of the executive decision-making structure. The Presidential authority is exercised through a Cabinet, comprising ministers who are drawn from among elected or nominated Members of Parliament. Zambia has a centralized system of Government. A process to review the Constitution is currently underway and is likely to result in devolution of some powers to the lower levels of Government.

3

8. Zambia has relatively well designed systems, rules and laws1 that allow for both internal and external checks and balances, but they could be more effective. A process of reform over the last two decades led to improvements in administrative systems and procedures, such as improved service conditions and rationalized payroll, reforms in public financial management and the business environment. However, inadequate institutional capacity has created implementation challenges and made internal checks and balances difficult. Citizen oversight through social accountability is also weak. The Auditor Generals’ reports continue to report misuse and misappropriation of public resources with limited follow up of audit report issues and recommendations.

9. The peaceful transfer of power in the last elections from an incumbent party has solidified Zambia’s democratic credentials. This is the second time power was transferred from a longstanding incumbent to an opposition party (1991 and 2011). Zambia has held six successful and peaceful multi-party elections. In the September 2011 elections, Patriotic Front (PF) defeated the long-ruling Movement for Multi-Party Democracy (MMD).

10. The new Government also identified poverty reduction, jobs creation and improving governance as its main priorities, however, the Government’s policies are still evolving and the implementation strategy has yet to be concretized. There is also concern amongst some stakeholders consulted during the preparation of the CPS about the negative impact of policy incoherence on effective long-term planning and the environment for private sector development. While achieving inclusive growth in Zambia is a long term agenda, the Government has found it difficult to undertake much-needed policy reforms in sectors such as agriculture on which the vast majority of the very poor are dependent. Strengthening public sector implementation capacity would help with implementation of critical policy actions. B. Poverty and Social Context

11. Zambia’s rank in the United Nations Development Program (UNDP) Human Development Index (HDI), a composite measure of life expectancy, education, and incomes, is below the Sub-Saharan Africa average. In 2011 Zambia's HDI was 0.430, a rank of 164 out of 187 countries with comparable data. Overtime, the HDI for Sub-Saharan Africa increased from 0.365 in 1980 to 0.463 today, and Zambia falls below this regional average. 12. Despite robust annual growth in the last decade, poverty, particularly in the rural areas remains stubbornly high. The effect of economic growth on overall poverty reduction has been small, as much of the benefits of growth have accrued to those already above the poverty line. Growth was driven by industries such as mining, construction and financial services and did little to create jobs and expand opportunities beyond the small labor force already employed in these industries. The urban-centered growth also did not generate better incomes, health, nutrition and key services for the majority of Zambians living in the rural areas and dependent on agriculture. Rural poverty at 74 percent is more than double the urban poverty of 35 percent. Thirty nine percent of the population lives in extreme poverty, with insufficient consumption to meet daily minimum food requirements. Almost 90 percent

Table 2: Poverty Incidence by Province, 2010 Province Population

Share (%) Moderate Poverty Incidence (%)

Extreme Poverty Incidence (%)

Central 10.6 55.7 30.5 Copperbelt 14.0 39.7 18.3 Eastern 13.7 74.9 55.1 Luapula 8.2 80.2 61.8 Lusaka 13.5 34.4 13.8 Northern 12.7 72.5 50.2 North western 5.8 68.4 48.7 Southern 12.9 66.0 42.0 Western 7.6 74.1 56.0 Source: World Bank 2012a Note: People living in moderate poverty are those whose total expenditures are below the national poverty line. People living in extreme poverty have total expenditures that are below the food-poverty line.

4

of Zambians below the extreme poverty line are in rural areas, where the poverty gap ratio2 is far higher (20 versus 3.7 percent in urban areas) (World Bank 2012d). 13. Income inequality has been growing in Zambia. Disparities between the rural and urban areas increased overtime. Annual consumption growth was less than 1 percent for most of the rural population between 2006 and 2010, whereas growth in urban areas was about 2 percent for the first four quintiles and much higher for the wealthiest quintile (World Bank 2012d). Over the past decade the Gini coefficient worsened from 0.47 to 0.52. Interprovincial comparisons also show that rural provinces, such as Western, Northern, Luapula and Eastern, have much higher poverty levels (Table 2). The recent Economic Brief produced by the Bank also found that the distribution of opportunities for access to basic education, health and infrastructure services in Zambia closely mirrors the spatial distribution of poverty, implying that poorer regions have lower access to opportunities.3

14. Women face particular challenges. In 2010, poverty incidence among female-headed households was slightly higher than male –headed households (62.5 versus 60 percent). Zambian women’s opportunity to contribute to and benefit from productive participation in the labor force appears to be less than that of men. In 2009, the female labor force participation rate was 59.5 percent, compared to a rate of 79.2 percent for men. Vocational courses present an opportunity for more market-tailored education, but there are large gender disparities in this area. Women make up less than 20 percent of technical and vocational education programs and this negatively influences their productive participation in the formal workforce. In addition, in rural areas, it is usually customary law that determines land allocation and inheritance and the traditional rules regulating land allocation and inheritance disadvantage women. Women are also more likely to be in lower productivity jobs than men—for example more women work in agriculture and micro-enterprises while men are more likely to work in mining and small and medium-sized enterprises.

15. Both deforestation and climate change, if left unaddressed, will exacerbate poverty and curb economic growth and will make it more challenging for Zambia to achieve MDG 7 on environmental sustainability. Nearly sixty six percent of Zambia's land area is classified as forests but most of the resource is highly degraded and deforestation is occurring at 0.33 percent a year (WDI 2012). The poorest and most vulnerable tend to live in districts most exposed to frequent droughts and floods. With livelihoods that are highly dependent on climate sensitive agriculture and natural resources, they also have a low capacity to adapt. In the absence of adaptation, rainfall variability alone could keep an additional 300,000 Zambians below the poverty line and cost Zambia at least US$4.3 billion in lost GDP over the next decade. This could reduce future annual growth by 0.9 percentage points (World Bank 2009).

16. Progress has occurred on health indicators but Zambia may still not be able to meet the health related MDGs. The 2007 Zambia Demographic and Health Survey (ZDHS 2007) show notable reductions in maternal, infant and under five mortality rates between 2002 and 2007 (Table 3). However, the annual rates of reduction of 2.1 percent for under-5 mortality and 2.5 percent for maternal

Table 3. Progress in health related indicators 2002 2007 Maternal mortality per 100, 000 live births

729 591

Infant mortality per 1000 live births 95 70 Under five mortality per 100 live births

168 119

Source: ZDHS 2007

Figure 1. Proportion of 15 to 19 year olds who have completed each grade

Source: Analysis of SDA 1992; LCMS 2003, 2010

0

0.2

0.4

0.6

0.8

1

0 1 2 3 4 5 6 7 8 9

Propor

tion

Grade

1992

2003

2010

5

mortality for the period 1990–2011 are less than half the annual rates of reduction required to achieve the MDGs targets. 17. Zambia has achieved high levels of access to basic education but challenges remain. The primary completion rate (PCR) increased from 67 percent in 1998 to universal completion in 2010. The proportion of children aged 15 to 19 that complete each grade has also increased substantially between 1992 and 2010 (Figure 1). Regionally benchmarked learning assessment results however, show that Zambian students have severe learning deficits.4 Learning outcomes are also an issue at institutions of higher learning and the Government has commenced the review of education policy and the Education Act of 2011. The Government is also working on legislation to put in place a framework to regulate and improve education quality standards in private universities and tertiary institutions. Overcrowding in classrooms and gender inequalities in secondary and tertiary education still remain major challenges. C. Economic Context

18. Zambia’s land area of 753,000 square kilometers holds only about 13.5 million people, an average density of 18 persons per square kilometer. The countryside particularly is very sparsely populated, making service delivery a challenge. The country’s small population is however, growing at a relatively fast rate of 2.7 percent (Annex 3).5 The population is also young, with about half being under the age of 15 years. 19. Zambia’s young population faces limited economic opportunities mainly because of inadequate economic diversification. Underemployment is the main issue in the rural areas whereas open unemployment is more of an issue in the urban areas. Policy makers in Zambia are concerned about the serious social and political implications of economic exclusion of youth. Discussions with various youth groups as a part of the CPS consultations brought out concerns about limited access to information and finance, inadequate financial literacy, few jobs and limited opportunities for acquiring relevant technical skills as some of the challenges that this group faces.6

20. The agriculture sector employs more than 70 percent of the population but contributes about 14 percent to real Gross Domestic Product (GDP)7. Two-thirds of Zambians live in the rural areas and mostly depend on rain-fed agriculture whose overall productivity remains low even in comparison with LICs (Table 4).8 The mean size of the land holding is 3.27 hectares and the small-scale farming systems are overwhelmingly dominated by a single crop—maize. Nearly eighty three percent of all households grow maize (LCMS 2010).

21. Copper mining and processing are the mainstay of the Zambian economy, the engine of GDP growth in recent years and foreign exchange earnings (Annex 13). Mining and quarrying contribute about 12 percent to real GDP and 80 percent to exports (World Bank 2012d). Manufacturing and construction together contribute about 20 percent and services 54 percent. Part of the construction and services are a result of the mining sector. The copper industry’s potential, to contribute to poverty reduction remains under-utilized (Annex 13 Box 1). 22. Zambia has a dualistic private sector. About 200 large enterprises located mostly in urban areas produce the bulk of industrial output. These large capital-intensive enterprises, mostly in mining, and to a lesser extent manufacturing, have higher productivity but provide limited employment (7 percent). The medium, small and micro enterprises (MSMEs) are located mostly in rural areas (81

Table 4: Agriculture Productivity (value added per worker 2000$ in 2010) Zambia Lower middle

income Low income

214 786 288 Source: WDI 2012

6

percent) (Zambia Business Survey 2010). They have much lower productivity and employ 88 percent of the labor force. 23. Zambia’s land-locked position is a disadvantage in many ways, although its geographical location within Southern Africa is potentially conducive to increased regional trade. As a landlocked country Zambia confronts costs (both time and dollars) in accessing global markets. Delays at intermediate borders, high fuel prices and the poor quality of roads compound the adverse impact of the long distances from the ports (World Bank 2012c). The “land-linked” position, however, is advantageous for regional trade. Zambia has borders with eight countries and is the start, destination or transit country for five of the 18 major transit corridors in Sub-Saharan Africa (World Bank 2008).9 However, the poor competitiveness of Zambian firms, among other factors, has prevented Zambia from exploiting the potential of its strategic geographical location to further its own development. RECENT ECONOMIC DEVELOPMENTS AND PROSPECTS Economic Developments

24. Zambia's rich natural endowments offer opportunities for growth from diverse economic activities such as agriculture (including livestock and fisheries), tourism, and hydro-energy. However, even with some exceptional natural tourism resources, such as Victoria Falls, Luangwa

Table 5. Zambia: Key Economic Indicators and Prospects

2011 2012 2013 2014 2015

prelim proj proj proj

GDP growth (%) 5.7 6.4 7.6 6.8 7.3 7.8 8.0 7.7

GDP per capita growth (%) 3.1 3.8 5.0 4.0 .. .. .. ..

Inflation Rate (end of period) 16.6 9.9 7.9 7.2 7.2 6.0 5.0 5.0

T-Bill Yield (91 days, annual average) 12.2 13.4 4.6 6.7 .. .. .. ..

Nominal Exchange Rate (K/US$ period average) 3,746 5,046 4,797 4,861 5,234 5,424 .. ..

Real Effective Exchange Rate (depreciation -) -15.2 14.2 -5.8 -2.6 .. .. .. ..

Copper Export Price (US$/tonne, average) 6,275 4,716 6,951 8,828 7,900 8,500 8,000 7,000

Total Revenues and Grants 23.0 18.9 19.6 21.7 21.5 22.0 22.5 22.6

Domestic revenue 18.9 16.0 17.8 20.9 19.9 20.7 20.9 21.1

o/w Mining revenue 1.9 1.0 1.9 5.5 3.8 4.5 4.6 4.8

Grants 4.1 2.9 1.8 0.8 1.6 1.3 1.6 1.4

Total Expenditure 23.9 21.3 22.6 23.9 25.8 26.9 26.4 26.9

Current 20.4 17.9 19.4 19.7 19.7 19.6 18.4 17.4

o/w wages & salaries 8.2 8.2 8.1 7.9 8.9 9.2 9.1 8.8

Capital 3.5 3.4 3.2 4.2 6.1 7.3 8.0 9.6

Overall Balance after grants (cash basis)a -1.5 -2.4 -3.1 -3.9 -4.3 -4.9 -3.9 -4.3

Trade Balance 404 906 2,704 2,276 1,351 1,564 2,163 2,724

Merchandise Exports 4,959 4,319 7,414 8,731 9,445 10,608 11,942 13,614

Copper Exports 3,684 3,179 5,768 6,663 6,461 7,205 8,112 9,319

Merchandise Imports 4,554 3,413 4,710 6454 8,094 9,044 9,779 10,891

Current Account Balance, after grants (% of GDP)

-7.2 4.2 7.1 1.5 -3.4 -3.1 -1.4 -0.2

International Reserves (months of imports) 2.1 3.7 3.0 2.8 3.0 3.2 3.2 3.3

Nominal GDP (billions ZMK) 54,839 64,616 77,667 93,345 105,255 120,138 136,514 153,908

Nominal GDP (US$ Millions) 14,641 12,805 16,190 19,204 20,112 22,148 24,590 27,196

Net public debt 19.9 22.0 22.1 20.1 23.8 25.8 25.2 24.7

External 9.4 10.0 9.1 10.2 13.3 14.0 13.8 13.6

Domestic 10.5 12.1 12.9 9.9 10.5 11.8 11.4 11.1

a. Reflects carryover budget releases not included in expenditures

Central Government Accounts (% GDP)

External Sector (in US$ millions)

National accounts

Public debt (% GDP)

Source: Zambia Authorities and IMF Estimates

Prices, Interest Rate, and Exchange Rates

2008 2009 2010

Real Output

7

National Park and the Lower Zambezi, tourism today contributes less than 3 percent to GDP. With the favorable land and water resources both food and cash crop production could be significantly increased and agro-processing developed to create jobs. Similarly, Zambia's outstanding natural grazing areas and water resources in rivers, lakes and swamps could support a much larger livestock and fisheries population and provide for substantially increased animal food production. Zambia could also better exploit its strategic position within the Zambezi River Basin and improve energy production and irrigation to contribute to diversification and growth. 25. A combination of prudent macroeconomic management, market liberalization and privatization efforts have enabled Zambia to accelerate growth. Substantially increased copper production in response to privatization and steep increase in world copper prices contributed to this achievement. The Government consolidated macroeconomic stability under the International Monetary Fund (IMF) programs (the last of which concluded in June 2011) and successfully navigated the shocks connected with the 2008 global economic and financial crises. Annual inflation declined from about 30 percent in 2000 to 7.2 percent in 2011 (Table 5). The completion of the Heavily Indebted Poor Countries (HIPC) and Multilateral Debt Relieve Initiative (MDRI) provided Zambia with about US$6.5 billion in debt relief, which provided the much-needed fiscal space by reducing debt service obligations. In addition, debt relief improved Zambia's external position and enabled building up of foreign-exchange reserves. This, in turn, has strengthened the country's ability to manage volatility in its exchange rate and bolstered the financial system. This enduring stability has supported robust growth, a marked turnaround from a decade ago. 26. With declining aid, the Government has escalated domestic resource mobilization efforts. The level of aid to Zambia has sharply declined in the past five years. In 2012, grants, including both budget support and project grants, amounted to about 6 percent of Government expenditure (1.6 percent of GDP) compared to 22 percent in 2004 and a peak of 27 percent in 2002. The decline in aid highlighted the importance of domestic resource mobilization and the Government is making attempts to increase domestic revenues. Several changes were made to the mining fiscal regime in 2009. During the period 2008-11, mining revenues averaged around 2.6 percent of GDP, a sharp increase from the previous range of 1-1.4 percent of GDP. In 2012 revenues are expected to come in at 3.8 percent of GDP despite a decline in mining output, partly due to an increase in royalty rates. The 2013 budget proposes further rationalization of the mining fiscal regime and measures to improve tax compliance while keeping the regime predictable. A comprehensive review of tax policy is also proposed in 2013 focusing on rationalizing of tax incentives and simplification of the tax system for small and medium enterprises (SMEs). 27. To meet its needs for development finance, the Government has also accelerated borrowing on non-concessional terms. Between July 2011 and September 2012, the Government borrowed about $1.25 billion from non-concessional sources alone including the recent issue of a sovereign bond for US $750 million. The Government is also relying on public-private partnerships in infrastructure to meet the demands for infrastructure finance.

Table 6: Proposed Use of the Sovereign Bond Proceeds ZMK billions US$ millions % GDP Energy (Generation and Transmission)

1,275 255 1.2

Transport (Road and Rail)

2,150 430 2.0

Rehabilitation of Central Hospitals

145 29 0.1

Access to Finance (DBZ-SME Credit line)

100 20 0.1

Fee and Transaction Cost (Actual)

7 1.4 0.0

Discount Premium (Actual)

73 14.6 0.1

3,750 750 3.6 Source: World Bank 2012d drawing on Government’s 2013 budget speech

8

28. Zambia is using its growing central budget resources mostly to provide for ramping up of public investments in infrastructure but the capacity to appraise and implement projects is weak. The capital budget has risen from 3.2 percent of GDP in 2010 to 6.0 percent of GDP in 2012. The 2013 budget proposes a capital budget of a similar magnitude with bulk of the resources planned to be spent on transport and energy infrastructure. Most of the proceeds of the sovereign bond are also proposed to be used to finance infrastructure projects (Table 6). The Finance Minister’s 2013 budget speech also acknowledged that project appraisal is weak and promises to “institutionalize a rigorous appraisal system for screening investment projects in order to ensure that borrowed funds are only applied to infrastructure projects that directly and demonstrably contribute to the nation’s economic growth.” 29. Foreign Direct Investment (FDI) is complementing public investment in a significant manner but could be at risk. Zambia's FDI regime is one of the most open in Africa (see for example OECD, 2012 Investment Policy Review Zambia 2012). Political stability is one of the major factors explaining the country’s attractiveness for investments (para 9). FDI rose from approximately US$164.9 million in 2003 to US$1.73 billion in 2010 with most investments going to mining, manufacturing, wholesale and retail trade10. However, the signals emanating from several policy actions by the Government, such as abrupt reversals of Zamtel privatization and the railway concession, are perceived by some stakeholders as creating an incoherent policy environment for private investment. The mining companies have also complained about changes to the fiscal regime such as the doubling of royalty in 2012 and treatment of capital expenditure for tax purposes. The adoption of Statutory Instrument (SI) 33 which prohibits domestic transactions in any currency other than Kwachas is also seen by some stakeholders to have increased uncertainty among investors. MEDIUM TERM PROSPECTS AND DEBT SUSTAINABILITY 30. Overall, Zambia’s medium-term economic outlook remains steady but vulnerable to downside risks from a global economic slowdown. Real GDP growth is projected to stay above 7 percent in the medium-term based on continued growth in the mining, construction, and tourism sectors, and expansion in the manufacturing, transportation, and communications industries (Table 5). In 2013 and 2014, mining and quarrying are projected to grow at 14.3 and 18 percent respectively (World Bank 2012d). These projections however, face downside risks because of global economic slowdown, particularly in China. An unexpectedly large drop in copper prices resulting from slowdown in emerging economies could weaken the country’s prospects for growth and affect its fiscal and external balances severely. In addition, the tourism sector is especially susceptible to adverse changes in the external environment. 31. The macroeconomic framework will be put to test should the risks materialize but can withstand the shocks with some adjustment. If risks materialize, Zambia will have some maneuverability on the monetary side. The foreign reserve position covering three months of imports should allow absorption of shocks to the overall balance of payments to some extent, beyond which, the flexible exchange rate regime should keep external balance from swinging too far. However, unlike the 2008-09 crises, the Government does not have a fiscal cushion and adjustment will be needed. It is expected that the Government should be willing to cut spending pro-cyclically, if needed given that most of the recent increase in spending is on discretionary capital budget.

32. There are also perceived concerns emanating from recent policy actions. Several policy actions such as the rebasing of the currency, adoption of Statutory Instrument (SI) 33, increase in capital requirements for foreign banks and interest rate caps on lending by commercial banks have been taken by the Government to strengthen economic management. However, a range of stakeholders have been concerned about economic policy priorities of the Government and the process by which they are

9

arrived at. Unbudgeted fuel subsidies, significant overruns in the cost of maize marketing, and pension arrears have also led to the weakening of fiscal discipline. 33. Zambia’s stock of external and public debt remains relatively low but needs careful management. The Joint Fund-Bank Debt Sustainability Analysis for Low Income Countries (LIC DSA) conducted in April 2012 suggests that Zambia’s risk of debt distress remains low.11 The external debt indicators remain well below their thresholds in the baseline scenario and bound tests. The public debt DSA also suggests that Zambia’s overall public sector debt dynamics are sustainable in light of the current size and the evolution of the domestic debt stock in the baseline scenario. The non-concessional borrowing in 2011-12 is unlikely to worsen Zambia’ debt outlook if debt is managed carefully.12 Besides sound macroeconomic policies, both strong debt management and project appraisal capacity are needed to maintain debt sustainability in the face of increasing dependence on non-concessional borrowing. An exception to IDA’s Non-concessional Borrowing Policy is being considered by Bank’s Management and the country team is discussing non-zero limits on non-concessional borrowing for 2013 with the Government. D. Key Development Challenges

34. Development challenges in four broad areas are discussed in this section —reducing poverty, related vulnerabilities and accelerating human development; promoting agricultural growth and diversification; improving competitiveness; and improving governance and strengthening economic management. Chapter 3—paragraph 96 then notes what contribution the WBG will make in each area. REDUCING POVERTY, RELATED VULNERABILITIES AND ACCELERATING HUMAN DEVELOPMENT 35. Reducing poverty is the greatest development challenge for Zambia. The country’s low rank on the HDI (para 11), indicates the vulnerabilities faced by the majority of Zambians: malnourishment, limited education opportunities to improve their conditions, health and water supply and sanitation services. According to 2010 LCMS, 46.7 percent of children under-five years are stunted, close to the high levels of the early 1990s. There are two main reasons for under-nutrition in children: inadequate dietary intake resulting from suboptimal maternal and infant feeding practices and the heavy burden of malaria, diarrheal diseases, and acute respiratory infections (World Bank 2012m)—both factors associated with poverty. Chronic malnutrition in childhood has also negatively influenced learning abilities among children from the poorest households. 36. There are several on-going safety net programs in Zambia that directly transfer either in-kind resources or cash to poor households, but have limited effectiveness (World Bank 2012m). Government is committed to addressing chronic under-nutrition and strengthening the country's capacity for service delivery for vulnerable and at-risk populations. It requested the World Bank to undertake a comprehensive review of existing safety nets that is expected to inform the policy makers' work in this area. The Bank's analysis found that current Government transfers and safety net programs are not targeted to the poor and that almost none of the very poor are currently benefitting from public transfer programs. In addition, benefits from education and health spending have also not been progressive. 37. For close to two decades, successive Zambian governments have supported health sector reforms, to provide cost-effective and quality health services to the population. The reforms have generally centered on the delivery of primary health care through a decentralized health system. Multilateral and bilateral CPs, faith-based and for-profit private health providers have also provided significant support to the health sector over the years.

10

38. But achieving the health-related MDGs by 2015 remains a key development challenge. At the current pace, (1990-2011 level), Zambia will only be able to meet the MDG targets for under-5 mortality and maternal mortality after the year 2040.13 Zambia is also one of the reproductive health priority countries because of both high maternal mortality and high fertility rate of 6.26 (World Bank 2010b). The recent WDR 2012 on Gender notes that average fertility among women in the poorest quintile in Zambia is 8.5 children (the highest in the world) but for women in the richest fifth it is just over 3.

39. External aid has contributed to increased access to essential services but most of it has been targeted for specific diseases. Malaria control has been impressive (Table 7). The TB treatment success rate increased from 79 percent in 2005 to 86 percent in 2010, slightly above the WHO target of 85 percent. HIV/TB collaborative activities are being implemented in all the provinces and districts and this increased the rate of HIV testing among TB patients from 23 percent in 2006 to 72 percent in 2009. The number of centers administering services to prevent mother to child transmission of HIV increased to 1,100 in 2010 from 936 in 2009. However, Zambia continues to have a very high HIV prevalence of about 14.3 percent for the 15-49 year-old cohort. Most of the external assistance has been targeted for HIV/AIDS, malaria, and tuberculosis and not for overall health system strengthening. As highlighted in the 2009 Zambia health public expenditure review, much of the donor funding is off-budget while the priorities of the global vertical sponsors often supersede national priorities and needs. 40. The joint work by the Government, Bank and other partners identifies severe shortages in human resources for health, weak drug and medical supplies logistic management, poor health infrastructure, among others14,15,16 There is a 59 percent gap in the total number of staff positions for clinical health workers (doctors, clinical officers, nurses, midwives and other paramedics). Severe understaffing and low morale among health workers, as highlighted in the 2007 Public Expenditure Tracking Survey (PETS), adds to the challenge. Weak drug and medical supplies logistic systems, poor health infrastructure, low quality monitoring and evaluation systems, cultural and community barriers, and the overall mixed record of the country on service delivery are other critical constraints to improving health and nutrition outcomes.

41. Inadequate access to clean and safe water and sanitation also increases the risks of diseases. Despite improvements over time, Zambia is behind schedule in meeting the clean water and sanitation MDG targets (Table 8). In addition, the quality of service is poor, particularly in the rural and peri-urban areas. The lack of adequate water supply and sanitation result in annual outbreaks of cholera and dysentery and overall poor environmental conditions. The economic burden of poor sanitation falls disproportionally on the poor.17 There has been significant progress on many of the reforms laid down in the 1994 National Water Policy, such as the separation of water resources management from water supply and sanitation, the separation of regulatory and executive functions and the devolution of authorities from central to local governments. However, much more needs to be done to strengthen local capacity to deliver on these services.

Table 7. Improvements in Malaria Control (%) 2006 2010 Malaria parasitemia in children aged 0-59 months 22 16 Households owning at least one insecticide-treated net 38 64 Source: Zambia Malaria Indicator Survey, 2010

Table 8: Access to Clean Water and Sanitation

1990 2008 MDG 2015

Target Population with access to an improved drinking source (%)

49 60 75

Population with access to improved sanitation facilities (%)

46 49 73

Source: AMCOW: CSO2 2012

11

42. With the new Government there is renewed commitment to decentralization and the Government is reviewing the decentralization policy to take into account latest developments on the ground. Devolution has been articulated as formal Government policy since 2005, and the Decentralization Implementation Plan (DIP) was adopted in 2009, and implementation is at different stages in the various sectors. The functional and fiscal devolution of responsibility is so far limited with local government expenditures constituting about 1.5 percent of total budgetary expenditure. Inter-governmental transfers represent less than 1 percent of the national budget. Some progress has been made on the decentralization agenda over the past year: total allocation of inter-governmental transfers to local governments increased by 98 percent between 2011 and 2012, however, intergovernmental transfers remain low; the draft Constitution provides a broad framework for decentralization; a consensus has been reached in the Government on implementing a phased approach, i.e., devolving a limited number of sectors; and the Government has progressed with the design and costing of the new organizational structures for the devolved functions. However, in order to implement a program of this magnitude, strong leadership and technical capacity will be needed. PROMOTING AGRICULTURAL GROWTH AND DIVERSIFICATION 43. The vast majority of the very poor derive their livelihoods from subsistence smallholder agriculture, whose productivity remains low. The SNDP recognizes agriculture as a principle sector for poverty reduction and for promoting economic diversification. Increased agricultural productivity will not only improve the income of women as the majority (68 percent) of those who are economically active work in that sector, but also increase the nutritional intake of children as women have consistently been found to be more likely than men to invest in their children’s health and well-being (World Bank 2008b) when they have the means to do so. 44. Farmers face numerous constraints that keep productivity low. Inadequate rural infrastructure, particularly feeder roads and irrigation systems, poor access to markets, inadequate research and access to improved inputs, limited advice on their proper use are examples of constraints faced. Women farmers tend to have even lower access than men to agricultural inputs. Government expenditure on agriculture has risen consistently since 2000 but two main subsidy programs, Farmer Input Support Program (FISP) and the Food Reserve Agency (FRA), have absorbed more than 60 percent of the sector's budget and have distorted incentives in favor of maize, and created unpredictability that has hindered private investment in agriculture. Political economy constraints have made reforms of these subsidy programs difficult, but they are critical for ensuring optimum development benefits accrue from public expenditure. Recently the Government has proposed scaling down and reforming FRA purchase activities and reforming the FISP and undertaking a reform of land tenure system. The challenge, however, will be in defining the size of the strategic food reserve and employing transparent and competitive processes for procuring the reserve stock and bringing closure to land tenure reform issues in a timely manner. The 2013 Budget also increased allocations to non-maize investment components, signaling steps towards diversification. 45. Since 2002 the Government has supported the development of farm blocks-one per province, whose development has been limited by resource constraints and infrastructure deficits. The Government proposes to provide the infrastructure (roads, electricity and irrigation) on a farm block to attract investors who develop a core venture and/or any of the commercial farms into centers of excellence for production, processing and management under an out-grower arrangement. So far development is in an advanced stage in only Nansanga farm block. The Government faces resource constraints for developing infrastructure and inadequate irrigation, the high cost of borrowing and high production costs have kept away potential investors. There is a need to conduct a careful analysis of the existing farm blocks to better understand the costs and benefits of use of public resources to create jobs and improve agricultural production through this program.

12

46. The value chains for both crops and animal products are inefficient and weak. Weaknesses are there at every link-from shortage of inputs, inadequate research, limited access to technology, inadequate storage infrastructure and transport, agro-processing and marketing and distribution. Livestock and aquaculture sector development is also hampered by animal diseases, inadequate extension, poor animal husbandry and chronic shortages of quality fish seed and fingerlings. Recently, the Government announced measures to increase forward (by promoting local value addition to crop and livestock products) and backward (through local production of key agriculture inputs) linkages with agriculture.

IMPROVING COMPETITIVENESS

47. Despite progress on investment climate reform, Zambia still lags behind neighbors on the World Bank’s Doing Business 2013 (Figure 2). Zambia's ranking on Doing Business 2013 dropped from 90 in 2012 to 94.Three issues stand out in the 2013 report: (i) Dealing with construction permits (rank 151), (ii) Getting electricity (rank 151); and (iii) Trading across borders (rank 156). The latter is a matter of concern since Zambia is landlocked and depends on smooth border crossings to promote all trade. The Government is taking steps, such as creating one-stop border posts, to improve trade facilitation. 48. Zambia's businesses face serious constraints in improving competitiveness. Labor costs are high while productivity is low. Both hard and soft infrastructure is poor including energy, transport, telecom, water and also insurance, marketing and professional services—particularly outside the urban areas.

49. Transportation, both road and rail, is seriously limited outside the main provincial towns and major regional transit routes. Since 2003, the Government has been implementing a ten-year road development program, known as ROADSIP II, partially financed by the World Bank and other CPs. In addition, Government recently announced a further paved road construction program, Link 8000, planned for implementation over the next 5-10 years in which it is investing a significant amount of its own resources. The sector has faced several governance challenges that the CPs have raised as a concern. Connecting remote rural areas also still remains a challenge. Performance-based road contracting could remove the road infrastructure gap and allow meaningful agricultural development to take place. The rail and road network asset condition also needs attention.18 The rail network condition and service has continued to deteriorate. The concession was cancelled in September 2012, with a commitment from Government to recapitalize the railway service.

50. Access to electricity is limited. The mining industry accounts for about 50 percent of national electricity consumption. The overall national electrification rate is about 23 percent, with 47 percent of the population in urban and peri-urban areas and only 3 percent in rural areas having access to electricity.

Figure 2: Zambia and comparator economies on ease of doing business

Source: Doing Business 2013

13

51. The inadequate electricity supply is a binding constraint to growth. Zambia has a strategic position within the Zambezi River Basin that affords it significant potential to develop new hydropower generation, and improve existing energy production through cooperation. Inefficiencies in the sector have however, deterred new investments and the country has not made major investments in generation capacity since the development of the major hydro-power stations in the mid-1960s and early 1970s. The poor financial condition and weak operational performance of ZESCO, the state-owned power company, had been an obstacle to new investments needed to build power-generating capacity. Investment needs in generation alone are estimated at about US$6 billion in the next 10 years and transmission and distribution networks also need to be rehabilitated. 52. The Government’s strategy addresses short-, medium-, and long-term issues in the energy sector. The strategy’s focus is on opening the transmission network to private electricity providers in addition to the state-owned ZESCO; improving the operational and financial performance of ZESCO, while gradually phasing out the need to subsidize new capital investments; and raising electricity tariffs to total cost recovery levels in order to attract private investors to the market. 53. Access to information and communication technology (ICT) is limited in Zambia (Table 9) and costs are high, constraining private sector development. Zambia has yet to fully exploit the transformational opportunities provided by ICT. 54. Access to finance remains a serious constraint, as is availability of skilled workers. Limited access to financial services for both large corporations and small enterprises, but particularly for the latter, is a major factor in poor productivity in Zambia. The generally poor financial literacy level in the country also increases the vulnerability of the borrowers. A major input of concern is labor, the cost of which is high and the productivity of which is well below international standards. There is a significant gap between the vocational skills demanded by the private sector and those produced by the educational system. The cost of other inputs, such as equipment, spares, fuel and other consumables is also high as most items need to be imported.

55. Factors that hinder private sector development have also constrained tourism development. If the infrastructure and the business climate in Zambia were as in South Africa, Zambia's tourist flows would be 51 percent higher than existing levels (Mattoo and Payton 2007). In addition, policies that help improve the regulatory and marketing aspects of the tourism industry are also needed.

56. Improving Zambia’s infrastructure requires reforms (for example in ZESCO) and also substantial capacity to implement. While Zambia’s debut US$750 million Euro bond is largely earmarked to fund infrastructure (Table 6) selecting projects that contribute to high growth, and capacity to spend effectively needs to be enhanced.

57. The Government’s capacity for undertaking public-private partnerships (PPPs) also needs to be enhanced. The Government has supported PPPs to leverage the strengths of both the private and public sectors to deliver and maintain infrastructure investments in the country. Following the approval and adoption of the Public-Private Partnership Policy in 2008 and the enactment of the PPP Act by Parliament in August 2009, the Government has continued to firm up institutional

Table 9: Benchmarking ICT Indicators Zambia Middle-income

countries GSM coverage % population 53 85.1 Internet subscribers/100 people 0.2 3.0 Landline subscribers/100 people 8.5 34.8 Mobile phone subscribers/100 people 20.9 30.0 Quality of service Faults/100 mainlines

90.8 50.8

Source: World Bank 2010a

14

arrangements to implement PPP financed infrastructure projects. In September 2012, the Government announced the merger of the Zambia Development Agency and the Public-Private Partnership Unit in the MOF to establish an Industrial Development Commission to enhance capacity for implementation of PPPs. An adequate institutional framework, however, to spearhead project identification, appraisal and implementation still remains a constraint.

58. Concerns remain among civil society, media and the general public about the generally low level of participation by Zambians in the mining industry. Effective strategies for broad-based development anchored in mining will be needed to deal with these concerns. Planned infrastructure, value-addition and small business development can help turn “enclave” mining projects into sustainable mining districts. Capacity gaps in the Government’s ability to monitor mining operations, ensure full tax compliance, and maintain a smooth-functioning cadaster19 and license-award processes also need to be addressed. 59. Zambia’s regulatory regime for mining has not kept pace with the structure and size of the industry. The current regulatory structure and capacity was designed to oversee a single state-owned copper and cobalt mining company. But today Zambia has a private sector-led industry, comprising many large and small mining operations and ever-growing exploration activity, including by some of the largest global mining companies. New minerals are also being discovered. Continued clean-up on legacy environmental contamination in now-closed mining sites is also needed. The regulatory framework for mining-related environmental protection also needs to be solidified.

60. Integration into a dynamic and more open Southern African region will contribute to further growth and poverty reduction in Zambia. With eight neighbors, Zambia is favorably positioned to take advantage of increased regional demand. World Bank analytical work has demonstrated the scope for increased exports of animal products to other countries in the region, provided that non-tariff barriers to imports are eliminated or at least reduced (World Bank 2011). The Common Market for Eastern and Southern Africa (COMESA) and the South African Development Community (SADC)20, the two regional trade blocs of which Zambia is a member, have supported liberalization of market access for road freight and harmonization of rules to ensure interoperability in member states (MCA 2010). In this regard Zambia could exploit further the presence of COMESA headquarters in Lusaka to source financing for trade and commerce related developmental matters. Recently, Zambia has initiated dialogue with four other like-minded countries in Southern Africa to accelerate trade integration. This has the potential to expand regional trade to the mutual benefit of all participating countries. 61. As a member of the Southern African Power Pool, Zambia could be a supplier and transmitter of energy regionally by increasing its power generation capacity and transmission infrastructure including regional interconnectors. The growing demand for electricity at both domestic and regional levels, and the regional power shortages in the foreseeable future provide a solid market for any additional electricity supply that can be offered. Regional interconnectors such as the Zimbabwe-Zambia-Botswana-Namibia and the Zambia-Tanzania-Kenya interconnectors could help Zambia become a regional hub for power trade in southern and eastern Africa. IMPROVING GOVERNANCE AND STRENGTHENING ECONOMIC MANAGEMENT 62. Improving governance and strengthening economic management is critical to making good policy and effective and efficient use of public resources. Good governance and sound economic management also provide the enabling environment for private sector development and for improving service delivery. While Zambia has reached low MIC status, its economic management capacity remains weak, similar to that in several LICs. Policy coordination within the Government is

15

also poor. Efficiency and effectiveness gaps in public spending as well as transparency and accountability challenges in public service delivery continue to pose a serious threat to continued growth, competitiveness and service-delivery. The statistical base to provide accurate information for policy making also remains feeble. The main constraints are less the availability of resources, but the knowledge, capacity and incentives to improve government performance. As the Government increasingly approaches international capital markets for meeting its needs for development finance, its systems for managing public finances, debt, and expenditure will come under greater scrutiny. 63. Public sector management (PSM) reforms have been implemented by the Government in the last ten years. Progress has been made on civil service reforms (e.g. payroll policy), and service-delivery measures such as service-delivery charters, and process re-engineering which have resulted in steady improvements in the six WGI indicators.21 There is renewed momentum to accelerate reforms and the Government has over the last six months approached the Bank with a number of different requests for support such as: civil service reform, including pay policy, performance management system for senior government officials, public pension reform, design of a system for assets disclosure, and creating a public sector credit union; and strengthening decentralization.

64. Since early 2000, PFM reforms with support from CPs through the Public Expenditure Management and Financial Accountability (PEMFA) program have also been undertaken. A number of diagnostic studies (CFAA of 2003, Public Expenditure and Financial Accountability (PEFA) assessments of 2005, 2008 and 2012 (draft)) found that Zambia’s PFM system exhibits several weaknesses. A comparison of the draft 2012 and 2008 PEFA assessments reveals that scores for eight indicators have improved while the remaining ones show a stagnant or downward trend (see Annex 17). Some of the achievements to date are: the change in the Government budget cycle in 2009, which the 2008 PEFA assessment identified as the biggest impediment to improved PFM in Zambia, improved infrastructure and logistics for internal and external audits, parliamentary committees and Zambia Institute of Chartered Accountants (ZICA); and a significant amount of training across all components including for the Integrated Financial Management Information Systems (IFMIS). The GRZ has committed to implementing the new PFM strategy (recently approved by Cabinet) and has made specific commitments to implementing public procurement reforms. Since January 2013, the Zambia Public Procurement Authority (ZPPA) has been transformed into an oversight and regulatory body and public procurement has been decentralized to ministries, provinces and spending agencies.

65. GRZ has been attempting to also strengthen capacity in other areas that would improve economic management. These include a monitoring and evaluation (M&E) system including strengthening statistical capacity, project appraisal and investment management, debt management, and the ability of the MOF to influence sector expenditure policies. The Ministry has also recently developed a strategic plan to address these areas over the next five years. The Government has approached CPs for support in building a government-wide M&E system and for supporting e-government, including a review of existing ICT systems to get efficiency gains, expand inter-operability, and strengthen fiduciary controls and transparency. The World Bank has also recently proposed an action plan for strengthening Government’s debt management.