Prospects for public sector finances: the squeeze on spending continues … · 2014. 11. 28. ·...

Transcript of Prospects for public sector finances: the squeeze on spending continues … · 2014. 11. 28. ·...

Prospects for public sector finances: the squeeze on spending continues Gemma Tetlow

Presentation to the CIPFA Pensions Network CFO Briefing

24 November 2014, London

© Institute for Fiscal Studies

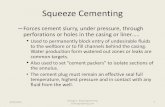

Overview of the public finance situation

• Financial crisis and recession revealed large structural deficit

– Necessitated active policy response to reduce borrowing from a post-World War II high of 10.2% of GDP

• Roughly halfway through a large fiscal consolidation

– Budget plans imply deep spending cuts through to 2018–19 in order to eliminate the deficit in that year

– Spending cuts and tax rises have largely been implemented as planned so far but weak growth has meant deficit has not fallen as forecast in 2010

• Parties differ somewhat in their objectives for reducing borrowing

– None have given much detail about how this will be achieved

• Potential developments in the Autumn Statement

– Tax revenues have been weaker than forecast so far this year, despite growth turning out largely as expected

– Is this a temporary or permanent phenomenon? © Institute for Fiscal Studies

Spending and revenues, without action

30

35

40

45

50

55

1997–98

1998–99

1999–00

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

© Institute for Fiscal Studies

Public sector receipts and total managed expenditure, 1997 to 2018

Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Spending and revenues, without action

30

35

40

45

50

55

1997–98

1998–99

1999–00

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

Revenues - without action Spending - without action

© Institute for Fiscal Studies Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Public sector receipts and total managed expenditure, 1997 to 2018

The policy response

-2

0

2

4

6

8

10

12 2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

Other current spend

Debt interest

Benefit spend

Investment spend

Tax

© Institute for Fiscal Studies Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

March 2014: 8.8% national income (£152bn) hole in public finances,

offset by 10.3% national income (£178bn) consolidation over 9 years

12% from tax rises

8% from investment spending cuts

14% from welfare spending cuts

52% from other current spending

Spending and revenues, with action

30

35

40

45

50

55

1997–98

1998–99

1999–00

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

Revenues - without action Spending - without action

Revenues - with action Spending - with action

© Institute for Fiscal Studies

Now aiming for tighter

fiscal position than

planned pre-crisis

Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Public sector receipts and total managed expenditure, 1997 to 2018

Spending and revenues, with action

30

35

40

45

50

55

1997–98

1998–99

1999–00

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

Revenues - without action Spending - without action

Revenues - with action Spending - with action

© Institute for Fiscal Studies Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Implies tax burden

slightly above pre-crisis

level and at 30 year high

Public sector receipts and total managed expenditure, 1997 to 2018

Spending and revenues, with action

30

35

40

45

50

55

1997–98

1998–99

1999–00

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

Revenues - without action Spending - without action

Revenues - with action Spending - with action

© Institute for Fiscal Studies Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Implies total spending

back to 2002 levels,

but….

Public sector receipts and total managed expenditure, 1997 to 2018

… high spending on social security and debt interest implies relatively little for public services

• Public service spending reduced to the share of national income seen at the end of the 1990s (technically: lowest since at least 1948)

0

5

10

15

20

25

30

35

40

1948–49

1951–52

1954–55

1957–58

1960–61

1963–64

1966–67

1969–70

1972–73

1975–76

1978–79

1981–82

1984–85

1987–88

1990–91

1993–94

1996–97

1999–00

2002–03

2005–06

2008–09

2011–12

2014–15

2017–18 %

of

nati

on

al in

co

me

© Institute for Fiscal Studies

Note: Figure shows total public spending less spending on social security benefits

and debt interest.

Deficit reduction: have they stuck to the plan?

-20

0

20

40

60

80

100

120

140

160

180

Pu

bli

c s

ecto

r n

et

bo

rro

win

g

(£ b

illi

on

)

Financial year

March 2014 Budget (old basis)

March 2014 Budget (new basis)

June 2010 Budget (old basis)

© Institute for Fiscal Studies Source: Office for National Statistics and Office for Budget Responsibility.

-2

0

2

4

6

8

10

12 2010–11

2011–12

2012–13

2013–14

2014–15

2015–16

2016–17

2017–18

2018–19

% o

f n

ati

on

al in

co

me

Budget 2014 Budget June 2010

© Institute for Fiscal Studies

Originally planned tax increases and spending cuts delivered but more announced...

Planned cuts to public spending

Based on current plans from Budget 2014:

Between 2010–11 and 2018–19 and after economy-wide inflation

• Total spending cuts of 5%

• But

– debt interest spending rising

– social security spending, particularly on pensioners, rising

– other non-departmental spending such as on PAYG spending on public service pensions and UK contribution to the EU budget rising

• Departmental spending on public services to be cut by 20%

© Institute for Fiscal Studies

Whitehall departments: ‘winners’

-11.0

-10.4

-8.2

-7.4

4.3

9.4

35.3

-80 -60 -40 -20 0 20 40

Total DEL

Defence

Education

Transport

NHS (Health)

Energy and Climate Change

International Development

Real budget increase 2010–11 to 2015–16

© Institute for Fiscal Studies

Departmental budget in 2015–16 compared to 2010–11, after economy-wide inflation

Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Whitehall departments: ‘losers’

-11.0

-35.4

-35.3

-33.4

-30.3

-28.8

-28.4

-19.1

-59.5

-80 -60 -40 -20 0 20 40

CLG Communities

Work and Pensions

Justice

Culture, Media and Sport

Environment, Food and Rural …

Home Office

CLG Local Government

Business, Innovation and Skills

Total DEL

Real budget increase 2010–11 to 2015–16

© Institute for Fiscal Studies

Departmental budget in 2015–16 compared to 2010–11, after economy-wide inflation

Source: Emmerson and Tetlow (2014), http://www.ifs.org.uk/publications/7238

Departmental spending cuts not set in stone (1)

• Detailed plans for spending in 2015–16 set out in Spending Review 2013

– Conservatives, Labour and Liberal Democrats have all said they would stick to these levels of (current) spending

• Departmental spending beyond 2015–16 not explicitly planned

– Equals planned total spending less OBR forecasts for social security and other non-departmental spending

Changes in these will have implications for departmental spending

© Institute for Fiscal Studies

Departmental spending cuts not set in stone (2)

• Could choose to cut social security further

– £12 billion would reduce departmental spending cuts between 2015–16 and 2018–19 to the same rate as over 2010–11 to 2015–16

– Cut to DEL of 17% between 2010–11 and 2018–19

– If NHS, schools and aid remain protected from cuts then ‘unprotected’ areas would face cuts averaging 31%

– £12 billion equivalent to 6% of all social security spending, 11% of non-pension spending, or 13% of spending on non-pensioners

• Could choose to have a higher level of total spending

– Labour and Liberal Democrats have suggested they would be happy with a higher level of borrowing than currently planned for

– Could spend around £26 billion a year more by 2018–19 and still achieve their suggested deficit targets

– Cut to DEL of 13% between 2010–11 and 2018–19 © Institute for Fiscal Studies

Are these cuts deliverable? A reason to think yes...

• Government departments have (more than) delivered the budget cuts required in 2010–11, 2011–12, 2012–13 and 2013–14

– likely that political cost of over-spending means that departments treat their budgets as a cap rather than a target

Suggests mechanism is there: departments look like they can deliver the spending cuts if they are required to...

– (though this will get harder!)

© Institute for Fiscal Studies

Are these cuts deliverable? A reason to think no...

© Institute for Fiscal Studies

• But would a future government want to stick to these plans once the associated fall in service provision and/or quality becomes more apparent?

• Large cuts to public service spending still to come

– these are likely to get harder/more painful to deliver

• The above figures also understate the squeeze on spending

– additional spending commitments

– demographic pressures

Additional spending commitments with no, or only temporary, additional funding

• Budget 2013

– Ending contracting out into DB pensions increases public sector employer NICs (£3.3 billion a year)

– Dilnot reform to social care funding (£1.0 billion)

– Tax-free childcare scheme (£0.8 billion)

• Autumn Statement 2013

– Extension of free school meals (£0.8 billion)

– Scrapping cap on HE student numbers (£0.7 billion)

– Energy prices and efficiency measures (£0.4 billion)

• Budget 2014

– Higher contributions to public service pensions (£1 billion)

• Adds up to £8 billion (around 2% of departmental spending) to be found from within departmental spending

© Institute for Fiscal Studies

Demographic pressures

• Population increasing which increases demand for public services

– ONS projects population will grow by 5.6% (3.5 million) between 2010 and 2018

• Public service spending forecast to fall by average 1.7% per year 2010–11 to 2018–19 but spending per person to fall by 2.4%

• Population also ageing which puts particular pressure on public services used more by older people

– ONS projects population aged 65 and over will grow by 20.0% (2.0 million) between 2010 and 2018

• For example: real freeze in NHS spending between 2010–11 and 2018–19 would actually be a 9.1% cut in real age-adjusted NHS spending per person

– NHS may be ‘protected’ but still considerable squeeze

© Institute for Fiscal Studies

Demographic pressure on the NHS budget

© Institute for Fiscal Studies

86

88

90

92

94

96

98

100

102

20

10–

11

20

11–

12

20

12

–1

3

20

13

–1

4

20

14

–1

5

20

15

–1

6

2016–17

20

17

–1

8

20

18

–1

9

Indexed r

eal te

rms s

pendin

g

20

10

–11 =

100

NHS spending

...per person

...per age-adjusted person

5.6% drop in

per-capita real

spending 9.1% drop in

per-capita age

adjusted real

spending

Summary

• Financial crisis and recession revealed large structural deficit

– Necessitated active policy response to reduce borrowing from a post-World War II high of 10.2% of GDP

• Roughly halfway through a large fiscal consolidation

– Budget plans imply deep spending cuts through to 2018–19 in order to eliminate the deficit in that year

– Spending cuts and tax rises have largely been implemented as planned so far but weak growth has meant deficit has not fallen as forecast in 2010

• Parties differ somewhat in their objectives for reducing borrowing

– None have given much detail about how this will be achieved

• Potential developments in the Autumn Statement

– Tax revenues have been weaker than forecast so far this year, despite growth turning out largely as expected

– Is this a temporary or permanent phenomenon? © Institute for Fiscal Studies

Prospects for public sector finances: the squeeze on spending continues Gemma Tetlow

Presentation to the CIPFA Pensions Network CFO Briefing

24 November 2014, London

© Institute for Fiscal Studies