Proposed 2015 Budget Presentation Bristol Township Budget...GENERAL FUND REVENUES Highlights •...

Transcript of Proposed 2015 Budget Presentation Bristol Township Budget...GENERAL FUND REVENUES Highlights •...

Proposed 2018 Budget Presentation

Bristol Township

Council President - Craig BowenCouncil Vice-President – Cynthia Murphy

Councilman Howard AllenCouncilman - Patrick Antonello

Councilman - Joe GlassonCouncilman - John Monahan

Councilwoman – Maryann WagnerTownship Manager -William J. McCauley, III

December 7, 2017

2018 BUDGET SCHEDULE• 2018 budget request forms

distributed to department heads on September 14. Dept. heads submit expenditure estimates (October 7).

• 2018 Budget Distributed to Council and public on November 14

• 2018 Budget Public Hearings:

November 14 (first reading)

December 7 (presentation)

• Adoption of proposed 2018 budget: December 7 or December 21

BUDGET HIGHLIGHTS

• No fund balance being proposed as revenue inthe balanced General Fund operating budget forthe sixth consecutive year=BALANCED BUDGET.

• NO REAL ESTATE TAX INCREASE (Real estate taxdecrease in 2012, 2015 and no increase in 2013,2014, 2016, 2017, and 2018)

• Proposed budget reflects a 13% increase (allfunds) over the 2017 adopted budget.

• Continue to invest in infrastructure. $2 millionfor gateway beautification projects, $1 million forblight removal, and $4 million for expansion ofmunicipal complex park.

• $76,475,204 million in unfunded liabilities2

despite having gone to Act 111 Arbitration.

2: Total = $76,475,204 includes post employment benefit plan, Police Pension Trust Fund, and accrued leaves . Breakdown is as follows: Post employment benefit plan ($66,464,278), Police Pension Trust Fund ($6,538,930), Accrued Leave ($3,471,996)

COMPARISON BETWEEN 2017 ADOPTED &

2018 PROPOSED BUDGET

Township Fund 2017 Adopted 2018 Proposed Increase/Decrease% Change

from

Budget Budget from Previous Year Previous Year

General Fund $ 23,888,500.00 $ 21,186,000.00 $ (2,702,500.00) (11%)

Education Service Agency $ 170,900.00 $ 183,300.00 $ 12,400.00 7%

Street Lights $ 805,000.00 $ 728,500.00 $ (76,500.00) (10%)

Fire $ 1,177,800.00 $ 1,146,400.00 $ (31,400.00) (3%)

Rescue $ 227,300.00 $ 230,400.00 $ 3,100.00 1%

Parks $ 793,100.00 $ 469,800.00 $ 323,300.00 (41%)

Grants $ 820,000.00 $ 1,074,800.00 $ 254,800.00 31%

Capital Projects $ 5,364,000.00 $ 12,730,000.00 $ 7,366,000.00 137%

Debt $ 2,138,000.00 $ 2,756,400.00 $ 618,400.00 29%

Refuse $ 5,281,400.00 $ 7,198,700.00 $ 1,917,300.00 36%

Liquid Fuels $ 1,915,000.00 $ 2,750,000.00 $ 835,000.00 44%

Community Development $ 944,200.00 $ 1,042,600.00 $ 98,400.00 10%

Sewer $ 11,749,180.00 $ 11,079,500.00 $ (669,680.00) (6%)

Total Budgets $ 55,274,380.00 $ 62,576,400.00 $ 7,302,020.00 13%

GENERAL FUND OPERATING RESULTS (Revenues-Expenses)/Revenues

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

2012 2013 2014 2015 2016 2017 2018

OperatingResults

BalancedFund(Trigger)

Year Surplus/(deficit)Balanced Fund

(Trigger)

2012 $1,544,910.00 3.30%

2013 $2,123,021.00 7.50%

2014 $3,390,999.00 9.39%

2015 $(4,251,452.00) 15.61%

2016 $ 252,650.00 1.12%

2017 - 0 - 0.00%

2018 -0- 0.00%

GENERAL FUND REVENUES Highlights

• General Fund revenues will be $21,186,000 and expenditureswill be $21,186,000 (11% decrease from 2017 budget).1

• 2018 General Fund budget proposes to balance the budgetwithout using any fund balance as operating revenue.

• Net revenues are slightly more than 2017 levels. 2

1: No significant transfers of general fund revenue to capital fund proposed in 2018.

2: Largely due to efficient collection of EIT, LST,R/E transfer taxes and various fees.

GENERAL FUND REVENUES

2013 ACTUAL 2014 ACTUAL 2015 ACTUAL 2016 ACTUAL 2017 ADOPTED 2018 PROPOSED

TOTAL REVENUES $22,610,670 $21,720,179 $21,946,394 $22,489,671 $23,888,500 $21,186,000

INTERFUND TRANSFERS $1,060,069 $300,000 $400,000 $460,000 $3,735,000 $535,000

NET REVENUES $21,550,601 $21,420,179 $21,546,394 $22,029,671 $20,153,500 $20,651,000

INCREASE(DECREASE) $1,148,725 ($130,422) $126,215 $483,277 ($1,876,171) $497,500

PERCENTAGE 5.63% (.6%) .58% 2.24% (8.52%) 2.47%

Bristol Township Net General Fund Revenues 2013 to 2018

GENERAL FUND REVENUES 2018

General Fund Revenue Source

2017 Adopted 2018 Proposed % of TotalSurplus/Deficit from Previous

Year

% Change from

Previous Year

Total Revenue 23,888,500.00 21,186,000.00 N/A (2,702,500.00) (11.31%)

Real Property Taxes 7,558,000.00 7,611,000.00 35.92% 53,000.00 0.70%

Local Enabling Taxes 2,191,000.00 2,331,000.00 11.00% 140,000.00 6.39%

Earned Income Taxes 6,100,000.00 6,250,000.00 29.50% 150,000.00 2.46%

Business License & Permits 2,662,200.00 2,756,200.00 13.01% 94,000.00 3.53%

State Shared Revenue 646,700.00 671,700.00 3.17% 25,000.00 3.87%

Capital & Operating Grants 0.00 0.00 0.00% - -

Miscellaneous 328,100.00 354,600.00 1.67% 26,500.00 8.08%

Charges for Services 190,500.00 190,500.00 0.90% - -

Fines & Forfeits 477,000.00 486,000.00 2.29% 9,000.00 1.89%

Debt Proceeds 0.00 0.00 0.00% - 0.00%

Interfund Transfer 3,735,000.00 535,000.00 2.53% (3,200,000) (85.68%)

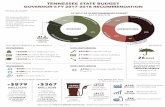

GENERAL FUND REVENUES 2018

35.92%

11.00%

29.50%

13.01%

3.17%

0.00%

1.67%

0.90%

2.29%

0.00% 2.53%

Real Property Taxes

Local Enabling Taxes

Earned Income Taxes

Business Licenses & Permits

State Shared Revenue

Capital & Operating Grants

Miscellaneous

Charges for Services

Fines & Forfeits

Debt Proceeds

Interfund Transfers

GENERAL FUND EXPENDITURESHighlights

• Investment in public safety: Hire two full-time police officers

• Continued investment in technology to improve productivity

GENERAL FUND EXPENDITURES

2013 ACTUAL 2014 ACTUAL 2015 ACTUAL 2016 ACTUAL 2017 ADOPTED 2018 PROPOSED

TOTAL EXPENDITURES$20,487,649 $18,329,180 $26,197,846 $22,237,021 $23,888,500 $21,186,000

INTERFUND TRANSFERS$2,828,290. $890,816 $7,832,078 $3,423,850 $3,777,200 $221,900

NET EXPENDITURES $17,659,359 $17,438,364 $18,365,768 $18,813,171 $20,111,300 $20,964,100

INCREASE(DECREASE) ($1,219,977) ($220,995) $927,404 $447,403 $1,298,129 $852,800

PERCENTAGE (6.46%) (1.25%) 5.32% 2.43% 6.90% 4.24%

Bristol Township Net General Fund Expenditures (2013 to 2018)

GENERAL FUND EXPENDITURES

(2018)

General Fund Expenditures

2017 Adopted 2018 Proposed% of Total GF Expenditures

Surplus/Deficit from Previous

Year

% Change from

Previous Year

Salaries $9,100,700.00 $9,744,700.00 46.48% $644,000.00 7.00%

FICA $303,500.00 $317,500.00 1.51% $14,000.00 5.00%

Benefits $7,142,300.00 $7,350,200.00 35.06% $207,900.00 3.00%

Total Personnel Related Costs

$16,546,500.00 $17,412,400.00 83.06% $865,900.00 5.00%

Operating Expenditures

$3,564,800.00 $3,551,700.00 16.94% $(13,100.00) (.37%)

Total Expenditures $20,111,300.00 $20,964,100.00 N/A $852,800.00 4.24%

GENERAL FUND EXPENDITURES

(2018)

46.49%

1.51%

35.06%

16.94%

Salaries

FICA

Benefits

Operating Expenses

CAPITAL FUND Highlights

• 2018 total proposed budgetfor the Capital Fund is$12,730,000 an increase of$7,366,00 over the 2017budget of $5,364,000

• Borrowed $10 million fromDelaware Valley RegionalFinance Authority in July2017

• Transferred $3 million todebt fund to pay off loans

CAPITAL FUNDHighlights

• Development of municipal complex parkland ($4 million)

CAPITAL FUNDHighlights

• Development of municipal complex parkland ($4 million)

CAPITAL FUNDHighlights

Cedar Avenue Park

CAPITAL FUND Highlights

CAPITAL FUND Highlights

• Township Gateway Beautification Project –$2 million

• Blight Elimination ($1 million)

• Upgrade of five intersections/traffic signals

• Spray Park at Policeman’s Park ($700,000)

• Wistar Avenue Bridge ($850,000)

• Other capital projects computer upgrades ($60,000) document scanning technology ($150,000), and new police cars ($165,000) provide “Glasson Grants” ($100,000) to volunteer fire companies and public works bucket truck ($100,000)

BRISTOL TOWNSHIP MILLING & PAVING

Program Summary

*The Public Works Department has also paved approximately 2 miles of Township highways between 2012 and 2014.

ROADS MILES COST

2012 36 8.4 $1,259,940

2013 162 35.8 $4,255,722

2014 99 25.0 $3,529,988

2015 130 32.3 $4,421,213

2016 50 14.6 $1,979,952

2017 11 3.36 $368,132

Total 488 119.46 $15,814,947

2018 15 10 $1,500,000

GRAND TOTAL 503 129.46 $17,314,947

CAPITAL PROJECTS Highlights

RECREATION FUND

2014 Actual 2015 Actual 2016 Actual 2017 (Adopted) 2018(Proposed)5 Year

Aggregate

Total Revenues $430,255.00 $427,929.00 $445,211.00 $793,100.00 $469,800.00 $2,566,295.00

Total Expenses $385,625.00 $359,484.00 $312,373.00 $793,100.00 $469,800.00 $2,320,382.00

Surplus/(Deficit) $44,630.00 $68,445.00 $132,838.00 - - ____$245,913.00

REFUSE FUND

2014 Actual 2015 Actual 2016 Actual 2017 Adopted 2018 Proposed5 Year

Aggregate

TOTAL REVENUES $5,430,451.00 $5,311,461.00 $5,557,006.00 $5,281,400.00 $7,198,700.00 $28,779,018.00

TOTAL EXPENSES $4,274,562.00 $4,520,637.00 $4,837,488.00 $5,281,400.00 $7,198,700.00 $26,112,787.00

SURPLUS/(DEFICIT) $1,155,889.00 $790,824.00 $719,518.00 - - $2,666,231.00

REFUSE FUND Highlights

• 2018 total proposed budget for the Refuse Fund is $7,198,700an increase of $1,917,300 over the 2017 budget of $5,281,400

• 2018 is the final year of a five-year trash contract with WasteManagement to expire on December 31, 2018.

• No Rate Increase proposed for Residential trash in 2018.

• $20 rate reduction in 2014 for residential refuse collectionsdecreased the annual residential trash fee from $337 a year in2013 to $317 in 2014 ($317 fee proposed again in 2018).

• Free Spring Cleanup Weekend/Fall Cleanup Day to dispose ofextra trash.

• Free electronics recycling program for township residents.Only municipality in Bucks County with free electronicsrecycling program!

SEWER FUND

2014 Actual 2015 Actual 2016 Actual 2017 Adopted 2018 Proposed5 Year

Aggregate

Total Revenues $5,258,090.00 $5,217,852.00 $5,381,058.00 $11,749,180.00 $11,079,500.00 $38,685,680.00

Total Expenses $4,436,644.00 $5,777,128.00 $5,020,549.00 $11,749,180.00 $11,079,500.00 $38,063,001.00

Surplus/(Deficit) $ 821,446.00 $(559,276.00) $360,509.00 - - $622,679.00

SEWER FUND Overview

• 65 Miles of Sewer Lines

• 18 pumping stations

• 2.25 million permitted gallons of sewage treated daily at treatment plant.

• 2018 total proposed budget for the Sewer Fund revenues is $11,079,500 a decrease of $669,680 over the 2017 budget of $11,749,180.*

*Reflects $5.7 million in capital upgrades

SEWER FUND Highlights

• No rate increase proposed for sewer fund.

• $5.7 million to invest in a secondary clarifier and endmoratorium on sewer connections to collectionsystem and increase capacity at sewage treatmentplant.

• Expenditures include continuing repairs ($789,378)for capital upgrades to the sewer pumping stations,Inflow and Infiltration program (I&I) work($400,000), and treatment plant generator $830,000

SEWER FUND Highlights

• Contract with M&B Environmentalexpires end of 2017

• Solicited proposals from Aqua,Severn Trent, BCWSA, and M&B toassume plant operations andmanagement

• New Five-Year contract ($1.5 million)with Severn Trent (Inframark) toassume management and operationsof wastewater treatment plant.

• Severn Trent (Inframark) has 35+years experience in wastewaterindustry

2017 LIQUID FUELS FUND FINANCIAL RESULTS (Projected)

Funds from the Commonwealth of PA used for maintenance & reconstruction of Township Roads

January 1, 2017 Beginning Fund Balance $3,079,649

Revenue 1,562,179

Expense 1,661,644

Annual Deficit 99,465

December 31, 2017 Cumulative Fund Balance $2,980,184

TOWNSHIP MILLAGE & REFUSE FEE

Average Assessed Value 17,877 Mils

Average

Resident's

Township Real Estate RE Taxes &

Year Millage Tax Refuse Fee Trash Fee

2008 19.6125 $351.00 $332.00 $683.00

2009 20.9875 $375.00 $337.00 $712.00

2010 23.9875 $429.00 $337.00 $766.00

2011 23.9875 $429.00 $337.00 $766.00

2012 23.9875 $429.00 $337.00 $766.00

2013 23.9875 $429.00 $337.00 $766.00

2014 23.9875 $429.00 $317.00 $746.00

2015 23.98 $429.00 $317.00 $746.00

2016 23.98 $429.00 $317.00 $746.00

2017 23.98 $429.00 $317.00 $746.00

2018 23.98 $429.00 $317.00 $746.00

Bristol Township Taxes 2008-2018

REAL ESTATE TAX MILLAGE HISTORY

(2007 – 2018)TOWNSHIP AMOUNT PERCENTAGE

YEAR MILLAGE INCREASE INCREASE

2007 19.6125 - 0.00%

2008 19.6125 - 0.00%

2009 20.9875 1.3750 7.01%

2010 23.9875 3.0000 14.29%

2011 23.9875 - 0.00%

2012 23.9875 - 0.00%

2013 23.9875 - 0.00%

2014 23.9875 - 0.00%

2015 23.98 (0.0075) -0.03%

2016 23.98 - 0.00%

2017 23.98 - 0.00%

2018 23.98 - 0.00%

TOTALS 4.3675 21.27%

AVERAGE 0.3644 1.77%

VALUE OF ONE MILL (2008-2018)

Year Assessed Valuation Value of One Mill Net Value of One Mill

2018 $418,976,610 $418,976.61 $397,932.78

2017 $416,156,390 $416,156.39 $395,348.75

2016 $416,798,170 $416,798.17 $395,958.26

2015 $417,462,470 $417,462.47 $396,589.35

2014 $416,837,500 $416,837.50 $391,827.25

2013 $418,976,000 $418,976.39 $393,837.81

2012 $416,024,630 $416,024.63 $391,063.15

2011 $417,440,720 $417,440.72 $392,394.28

2010 420,204,750 $420,204.75 $394,992.47

2009 420,688,490 $420,688.49 $395,447.18

2008 420,774,370 $420,774.37 $395,527.91

215.82 , 82%

23.98 , 9%

23.20 , 9%

Bristol Township S.D 215.82 mills

Bristol Township 23.98 mills

Bucks County 23.20 mills

WHERE YOUR TAX DOLLARS GO!!!

215.82

23.98 23.20

-

50.00

100.00

150.00

200.00

250.00

Bristol Township S.D. Bristol Township Bucks County

Mill

age

Ass

ess

ed

Governmental Entity

BRISTOL TOWNSHIP MILLAGE DISTRIBUTION

(2018)

TOTAL AND AVERAGE COST OF

HEALTH INSURANCE (2018)(Employee/Retiree)

CLASSIFICATION NUMBER ANNUAL COST AVERAGE COST

Non-Uniform 44 $882,552 $20,058

Police (Active) 62 $1,736,516 $28,008

Retirees 76 $1,429,300 $18,807

TOTALS 182 $4,048,368 $22,244

AVERAGE HEALTH INSURANCE COST (Per Employee)

Classification 2014 2015 2016 2017 2018

ACTUAL ACTUAL ACTUAL (ADOPTED) (PROPOSED)

NON-UNIFORM $16,635.00 $23,302.00 $19,299.00 $22,965.00 $20,058.00

POLICE ACTIVE $21,593.00 $22,960.00 $24,132.00 $27,167.00 $28,008.00

RETIREES $14,898.00 $14,815.00 $16,917.00 $17,232.00 $18,807.00

HEALTH, RX, VISION AND DENTAL INSURANCE RATES

FOR NON-UNIFORM EMPLOYEES (2018)(TWU)

TOTAL TOTAL

PPO/1000/3000 RX5/20/35 VISION DENTAL PER MONTH ANNUAL

Single $611.51 $281.37 $3.27 $23.58 $919.73 $11,036.76

Parent/Child $1,090.17 $518.30 $9.10 $82.91 $1,700.48 $20,405.76

Parent/Children $1,090.17 $518.30 $9.10 $82.91 $1,700.48 $20,405.76

Couple $1,406.42 $691.10 $9.10 $82.91 $2,189.53 $26,274.36

Family $1,793.93 $753.91 $9.10 $82.91 $2,639.85 $31,678.20

HEALH, RX, VISION AND DENTAL INSURANCE RATES

FOR POLICE EMPLOYEES (UNIFORM) 2018(Police)

TOTAL TOTAL

$10 HMO RX $5/$10 VISION DENTAL PER MONTH ANNUAL

Single $672.54 $263.16 $3.27 $23.58 $962.55 $11,550.60

Parent/Child $1,202.89 $434.23 $9.10 $82.91 $1,729.13 $20,749.56

Parent/Children $1,202.89 $434.23 $9.10 $82.91 $1,729.13 $20,749.56

Couple $1,548.59 $578.98 $9.10 $82.91 $2,219.58 $26,634.96

Family $1,972.26 $631.62 $9.10 $82.91 $2,695.89 $32,350.68

HEALTH, RX, VISION AND DENTAL INSURANCE RATES

FOR NON-UNIFORM EMPLOYEES (2018)(SEIU)

TOTAL TOTALKEYSTONE15 RX $10/$20 VISION DENTAL PER MONTH ANNUAL

Single $1,233.03 $249.46 $3.48 $23.58 $1,509.55 $18,114.60

Parent/Child $2,198.74 $411.59 $9.68 $82.91 $2,702.92 $32,435.04

Parent/Children $2,198.74 $411.59 $9.68 $89.38 $2,702.92 $32,435.04

Couple $2,837.83 $548.79 $9.68 $89.38 $3,485.68 $41,828.16

Family $3,618.52 $598.68 $9.68 $89.38 $4,316.26 $51,795.12

TOTAL COST OF HEALTH INSURANCE (Employees/Retirees)

Classification 2014 Actual 2015 Actual 2016 Actual 2017 (Adopted) 2018 (Proposed)

NON-UNIFORM $781,846.00 $838,800.00 $851,839.00 $941,565.00 $882,552.00

POLICE-ACTIVE 1,230,795.00 1,285,786.00 1,496,154.00 1,629,984.00 1,736,516.00

RETIREES 1,147,104.00 1,170,419.00 1,285,740.00 1,292,322.00 1,429,300.00

TOTAL $3,159,745.00 $3,295,005.00 $3,633,733.00 $3,863,871.00 $4,048,368.00

HEALTH INSURANCE OPT-OUT PROGRAM

Health Ins RX Dental

$ 23,667.12 -0- $ 994.92

23,667.12 -0- 994.92

7,338.12 $ 3,376.44 282.96

21,527.16 9,046.92 994.92

16,877.04 8,293.20 994.92

21,527.16 9,046.92 282.96

21,527.16 9,046.92 994.92

21,527.16 8,293.20 994.92

16,877.04 3,376.44 282.96

$174,535.08 $ 50,480.04 $ 7,530.16 $232,545.48

Opt Out $36,300.21

FICA $ 2,497.97

Total Cost 38,798.18

Savings $193,747.30

BRISTOL TOWNSHIP UNFUNDED LIABILITIES 2016-2018

2016 2017 2018 INCREASE/ (DECREASE)

POST EMPLOYMENT BENEFIT PLAN $73,094,112 $66,464,278 $66,464,278 -0-

POLICE PENSION TRUST FUND $ 6,538,930 $ 6,538,930 $ 6,538,930 -0-

ACCRUED LEAVES $ 3,050,895 $ 3,170,376 $ 3,471,996 $ 23,314

TOTAL UNFUNDED LIABILITIES $82,683,937 $76,173,584 $76,475,204 $ 23,314

*Police Pension Trust figures based on January 1, 2015 actuarial report (with smoothing)1

POST EMPLOYMENT BENEFITS STATUSUnfunded Liabilities- Post Retirement Benefits

60,000,000

65,000,000

70,000,000

75,000,000

80,000,000

85,000,000

2010 2011 2012 2013 2014 2015 2016 2017 2018

Unfunded Actuarial Increase/(Decrease)

Liability Year on Year

2010 $66,917,267.00 -

2011 $77,074,400.00 $ 10,157,133.00

2012 $80,718,771.00 $ 3,644,371.00 2013 $70,420,090.00 $(10,298,681.00)

2014 $72,943,694.00 $ 2,523,604.00 2015 $75,284,033.00 $ 2,340,339.00

2016 $73,094,112.00 $ (2,189,921.00)

2017 $66,464,278.00 $ (6,629,834.00)

2018 $66,464,278.00 -0-

POLICE PENSION EXPENDITURES (2014-2018)

MMO BondDeferred

Compensation Total

2014 $1,739,662.00 $581,322.00 $101,548.00 $2,422,532.00

2015 $2,219,238.00 $270,820.00 $108,912.00 $2,598,970.00

2016 $1,616,617.00 $884,200.00 $109,283.00 $2,610,100.00

2017 $1,511,398.00 $935,000.00 $114,236.00 $2,560,634.00

2018 $1,505,029.00 $935,000.00 $119,634.00 $2,559,663.00