Project on study of vehicle loan financing process

-

Upload

nitesh-vazekar -

Category

Documents

-

view

423 -

download

0

description

Transcript of Project on study of vehicle loan financing process

ON THE TOPIC

“STUDY OF VEHICLE FINANCING PROCESS’’

SUMMER INTERNSHIP PROJECT AT

JAIKA MOTORS LTD.

STERLING INSTITUTE OF MANAGEMENT STUDIES

Faculty Guide:RAKHI SHRIVSTAVAFaculty: Finance

Presented By:NITESH VAZEKARROLL NO. B-71FINANCE

JAIKA MOTORS LTD

The Jaika Group began its journey on 2 November, 1954, with the founding of Jaika Motors Ltd., in association with Tata Motors

Today, the Group has completed over 5 decades of mutual trust with Tata Motors. It has diversified and grown into a conglomerate of 10 companies with a combined annual turnover of over Rs.750 cr

In the process, the group has also established tie-ups with a number of world class companies such as Hyundai, TVS, Bharat Petroleum, Whirlpool, TCL, ILFS etc

TATA MOTORS FINANCE LTD.

Tata Motors Ltd pioneered commercial vehicle financing in 1957 in the name of BHPC (Bureau for Hire Purchase and Credit)

Tata Motors Finance Ltd (TMFL), came into existence in June 2003

This was a common front-end, jointly formed by BHPC of Tata Motors and the asset financing arm of erstwhile Tata Finance Ltd

Subsequently Tata Finance was merged with Tata Motors and in April 2005 TMF became a division of Tata Motors

STEPS FOR FINANCING THE VEHICLE

Jaika Motors Sales Team

Jaika Motors Finance Department

TATA Motors Finance

Jaika Motors File disbursement (TATA Invoice + Jaika Invoice +

Insurance)

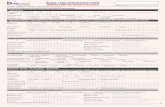

Minimum Rates for BHPC March 2012

Sr.No. Vehicle Model IRR% 1 2 3 4 5

CARS ADV NIL ADV NIL ADV NIL ADV NIL ADV NIL

1 INDICA DLS 16 6.76 8.18 7.63 8.38 8.05 8.6 8.05 8.06 8.64 9.02

2 INDICA XETA 16 6.76 8.18 7.63 8.38 8.05 8.6 8.37 8.82 8.64 9.02

3 INDICA VISTA 14 5.91 7.14 6.64 7.30 7 7.48 7.24 7.63 7.46 7.78

4 INDIGO CS 14 5.91 7.14 6.64 7.3 7 7.48 7.24 7.63 7.46 7.78

5 TATA SAFARI 16 6.76 8.18 7.63 7.63 8.05 8.6 8.37 8.82 8.64 9.02

Format of Rate of Interest of Finance

CIBIL

CIBIL – Credit Information Bureau (India) Limited

India's first credit information bureau- which contains the credit history of commercial and consumer borrowers. CIBIL provides this information to its Members in the form of credit information reports

Banks, Financial Institutions, State Financial Corporations, Non-Banking Financial Companies, Housing Finance Companies and Credit Card Companies are Members of CIBIL

Specimen o

f CIB

IL

TATA DEDUPE

Dedupe is a database created of all the customers of TATA group

It contains the financial data of individuals as well as corporate customers of TATA Group for all products

Specimen of DEDUPE

FIELD INVESTIGATION

Field Investigation is done to get following details:

Applicant’s personal information

Residence verification (RVR)

Work place details (OVR)

Finance requirement

Guarantor details (if there is Guarantor in the case)

CALCULATION OF DOWN PAYMENT AND EMI

The Jaika Motors Finance department calculates the expected amount that can be finance and the EMI

RISK SCORING PRICING MODULE

This is a questionnaire designed such that it helps the company to know their customers financial condition to avail the finance

Total Income and assets held by customer

RSPM gives 3 decisions for forward processing Yes – Approval for finance (Telephone bill is necessary or its waiver) Refer to credit – the case is refer to the Credit Processing Agency

to clarifies the deviations and reduce the risk No – Mandatory rejection

RISK CONTAINMENT UNIT

It sample the doubtful documents and verify with original It minimize the risk of financing by carefully observing

the documents of customers

If any report found negative , it return the case to Jaika for clarification

RELEASE ORDER

After getting the approval from all the departments, a Releasing Order is passed for final processing to Sales Team of Jaika Motors

Sales Team prepares the following documents:TATA InvoiceJaika InvoiceInsurance

The customer is handed over the Vehicle and photocopies of above three documents

Conclusion