Project “Zoo” presentation€¦ · (British Business Bank Business Finance Survey: SMEs 2016)...

Transcript of Project “Zoo” presentation€¦ · (British Business Bank Business Finance Survey: SMEs 2016)...

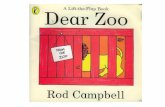

Project “Zoo” presentationApril 2017

1

This presentation ("Presentation") has been prepared by 1pm plc (the "Company") and is confidential and is only directed at persons who fall within theexemptions contained in Articles 19 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (such as persons who areauthorised or exempt persons within the meaning of the Financial Services and Markets Act 2000 and certain other investment professionals, high networth companies, unincorporated associations or partnerships and the trustees of high value trusts) and persons who are otherwise permitted by law toreceive it.

This Presentation is directed only at persons having professional experience in matters relating to investments and any investment or investment activityto which this Presentation relates is only available to such persons. Persons of any other description, including those who do not have professionalexperience in matters relating to investments, should not rely on this Presentation or act upon its contents. This Presentation does not constitute or formpart of any offer for sale or subscription or any solicitation for any offer to buy or subscribe for any securities nor shall it or any part of it form the basis of orbe relied upon in connection with any contract or commitment whatsoever. Any decision in connection with any proposed purchase of shares in the

Company must be made solely on the basis of the information contained in the admission document to be published by the Company. While allreasonable care has been taken to ensure that the facts stated in this Presentation are accurate and that any forecasts, opinions and expectationscontained herein are fair and reasonable, this Presentation has not been verified and no reliance whatsoever should be placed on them. Accordingly,no representation or warranty express or implied is made to the fairness, accuracy, completeness or correctness of this Presentation or the opinionscontained herein and each recipient of this Presentation must make its own investigation and assessment of the matters contained herein. In particular,but without prejudice to the generality of the foregoing, no representation or warranty is given, and no responsibility or liability is accepted, as to theachievement or reasonableness of any future projections or the assumptions underlying them, or any forecasts, estimates, or statements as to prospectscontained or referred to in this Presentation. Save in the case of fraud, no responsibility or liability whatsoever is accepted by any person for any losshowsoever arising from any use of, or in connection with, this Presentation or its contents or otherwise arising in connection therewith. In issuing thisPresentation, the Company does not undertake any obligation to update or to correct any inaccuracies which may become apparent in thisPresentation.

This Presentation is being supplied to you for your own information and may not be distributed, published, reproduced or otherwise made available toany other person, in whole or in part, for any purposes whatsoever. In particular, this Presentation should not be distributed to or otherwise madeavailable to persons with addresses in Canada, Australia, Japan, the Republic of Ireland, South Africa or the United States, its territories or possessions or

in any other country outside the United Kingdom where such distribution or availability may lead to a breach of any law or regulatory requirements.

2

Disclaimer

Ed Rimmer, MD designate, Commercial Finance Division

• Currently engaged by 1pm in a consulting capacity with view to full-time role and plc directorship (terms agreed)

• 17 years with leading independent player, Bibby Financial Services, including 5 years as UK CEO

• Extensive experience at growing businesses, both organically and through acquisitions

• Whilst UK CEO of Bibby, increased new business and market share by 50% and doubled profitability

• Will lead 1pm’s drive to consolidate niche, high-quality, under-exploited businesses in Invoice Finance

3

Presentation team

Ian Smith, CEO

• 15 months in full-time CEO role

• Previous 2 years in Non-exec Chairman role

• Instigated the current strategic plan, leading on the previous Placing and recent acquisitions

• 23 years in listed and privately-owned, PE/VC - backed entities, leading strategic transformations

and in attendance, James Roberts, CFO; joining 2 May 2017

4

£12m - £15m fundraising

Sound track record in ASSET FINANCE

Successful extension to BUSINESS LOANS

Now adding INVOICE FINANCE

Take advantage of a market opportunity to consolidate niche,

small-ticket invoice finance providers.

First target – sign upon Placing announcement

Second target in diligence.

Will increase group returns on net assets

Strategic objective to introduce “adjacent” products to provide a full suite of business finance choices for SMEs

0

500

1000

1500

2000

2500

3000

3500

4000

2011 2012 2013 2014 2015 2016 2016Group

0

2000

4000

6000

8000

10000

12000

14000

PB

T £

k

Rev

enu

e £

k

5

Financial performance – 31 May y/e

• Top line CAGR 33% over 5 years to 2016

• 10 x growth in PBT from 2011 to 2016

6

The SME finance market

• 5.5m SMEs in the UK – employing 15.6m people (BEIS Business Population Estimates 2016)

• Circa 70% are current or potential borrowers (British Business Bank Business Finance Survey: SMEs 2016)

• Over 50% of these still go to their main bank when first identifying a financing need (British Business Bank Business Finance Survey: SMEs 2016)

• Their challenge is immediate day-to-day cash flow

• High-street banks no longer structured to meet this immediate need

• In 2016 only 6% actually applied to their bank for a new loan or overdraft (BDRC Continental (2016) SME Finance Monitor)

• So, where do SME borrowers go?

7

Alternative Finance

• As a specialist provider, we have:

• greater flexibility

• faster service

• more personal approach

• 13 days from proposal to pay-out(HSBs up to 60 days)

• Provide or arrange commercial leases,loans and vehicle finance

• Business-critical equipment for SMEs

• Finance from £1,000 to £250,000; 3 to 60months

• Across a broad range of sectors

• 22% of SMEs still use credit cards forfinance (British Business Bank Business FinanceSurvey: SMEs 2016)

• at a blended interest rate of circa 17%we are a cost-competitive alternative

8

Deals

“1pm had agreed and paid out a

£42,000 loan which allowed us to

begin repair work faster than

planned and reopen our gym

before substantial losses to our

memberships.”

Mark – Space Premier Fitness

“Within two weeks 1pm had

secured, agreed and paid out over

£50,000 to allow us fund the

equipment we needed for our

newest venture.”

John Ennis/Matt Farrell – Graffiti Group

“As I’m not a homeowner it was

hard to find funding for my new

start business, 1pm managed to

source £20,000. Our gym has been

open 6 weeks and already has over

250 members.”

Chris Kirkby – Kirkby Gyms

9

Why we succeed

• Underwriting decision within 4 hours

• Every customer circumstance is a ‘story’requiring a ‘pair of eyes’ on the deal andpotentially a site visit – we areoperationally set up to do this

• Strict underwriting and credit control –aim to be “brilliant at the basics”

• PGs on all advances

• Write-off rate less than 1% of portfolio

• Typically dealing with owner-managers forwhom their business is their life – often alower credit risk than may be apparentfrom their trading results

• Receivables now total c. £75m.

• £15m of unearned income

• Carrying an impairment provision of c.£1m (1.67% of capital outstanding)

• Cautious, prudent approach to growth

10

Breadth of portfolio

23%

11%

11%

9%5%

5%

5%

4%

28%

Restaurants / Cafes

Beauty and Hairdressing

Garage

Retail

Health and Fitness

Pubs and Bars

Takeaway

Scaffolds

Other

13%

12%

11%

9%

9%8%

7%

5%

27%

Telephone systems

Survey equipment

Garage

Data collection units

Catering

Energy management

Laundry

Office

Other

8.62%

7.06%

4.96%

3.70%

3.29%

2.9%

2.48%

2.38%

2.33%

2.09%

2.06%2.03%

Freight transport by road

Remediation activities andother waste managementservices

Renting and leasing ofconstruction and civilengineering machinery andequipmentOther transportation supportactivities

Demolition

Specialised constructionactivities (other than scaffolderection) n.e.c.

Private companiesQuantum Finance

(Investec);Armada Leasing;Kingsway; GAM;

...multiple small brokers with their own book

11

Competition

Banks9 consecutive quarters

of positive net bank lending to SMEs, but no

longer structured to support smaller

businesses

Challenger BanksAlthough lessors

themselves, they do not

operate in the smaller end of the market and

instead lend to us to lend-on – 11.5% NIM

Alternative finance platforms

P2P lending up 30% in 2016 (AltFi Data 2016).

The FinTech trend needs to be deployed better in lending to business

Quoted companiesPrivate and Commercial Finance Group (PCFG), although the business

lending part of PCFG is mostly vehicles

Three divisions: Asset Finance (long-established); Loans (recently formed) and now Commercial Finance.

Theoretically widespread, but in practice there are few businesses of scale in small-ticket lending.

Banks Challenger Banks Alternative finance platforms Quoted companies Private companies

Flexibility X X

Speed of service X

Personal approach X X X X

Broad range of financial products X X

Investment in resources

2014

Acquisition:

Academy 2015

Adjacent products

iLoans

2017

‘Fintech’ platform

Acquisition:

Bradgate2016

Bell Finance

2017

Further M&A?

Market Cap May 2015 £25m

Market Cap target £100m

Goal

• £100m market cap

Objectives

• Building scale through a model of distributed separate entities

• Having a multi-channel, multi-product offering to SMEs

• Maintaining risk mitigation through funding and broking

• Strict underwriting and credit control policies

• Being appropriately geared with cost-effective funding

• Being digitally capable (e.g. Fintech)

12

Strategic growth plan

Currently £33m

The Invoice Finance Process

Client sells product / service on credit terms

Invoice raised and sent electronically

to Lender

Lender performs risk checks i.e. verify invoice /

credit check customers

Lender advances between 75-90%

of the value of invoices

Customers pay the Lender directly

As Lender collects customer payments,

balance paid to client less fees

Further sales and invoices

generated and continues through

the cycle

13

£16.0bn

£17.3bn

£18.9bn£19.3bn

£20.3bn

£22.2bn

£10

£12

£14

£16

£18

£20

£22

£24

2011 2012 2013 2014 2015 2016

Bill

ion

s

The UK Invoice Finance market

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

Q109

Q3 Q110

Q3 Q111

Q3 Q112

Q3 Q113

Q3 Q114

Q3 Q115

Q3 Q116

£m

Domestic factoring Domestic Invoice Discounting

Export factoring Export Invoice Discounting

Non recourse

• Debtors financed per quarter • Advances

14

Onepm CF

2017 Competitive landscapeR

isk Q

ualit

y

Small-ticket Mid-marketFull service Asset

Based Lending

Ashley

I G F

Calverton

Gener8

Factor 21

Bibby

Group

Aldermore

Close

Shawbrook

RBS IF

Clydesdale

HSBC IFSantander

Barclays

LTSB CFS

ABN

Amro

Leumi

ABL

Positive

Ultimate

Regency

Amicus

Pulse

Secure

Trust

Metro

Bank

Skipton

15

Hitachi

16

First target – Gener8 Finance

The business and reasons to acquire:

• Good quality client portfolio; 145 clients and 4.5 years average client life

• Very low levels of historic bad debts

• Excellent reputation for client service

• 2016 Revenue £2.6m; PBT £0.9m (34%); Lending £12m on £30m receivables

• Strong relationship with debt provider (Lloyds) who have funded the business since start up in 2008

• Robust back office processes and procedures – 15 staff

• Oxford based and predominately targets clients south of Birmingham

• Strong relationship between exiting CEO and Ed Rimmer

• Excellent platform from which to implement a controlled expansion strategy

• Significant cross selling opportunities

Consideration:

• £5.25m in cash on Completion (from Placing proceeds)

• Represents circa 6.5x normalised current PBT.

Note: Gener8’s exiting CEO has indicated he will reinvest circa £150k in the proposed placing.

Status of the acquisition:

• Due Diligence completed with no “Red Flags”

• Meeting held with Lloyds who are supportive of change in control and future plans

• 6 month handover agreed with exiting CEO

• Legal documentation drafted

• Target date for signing SPA (exchange of contracts) and announcement: 10th May 2017.

17

Second target & acquisition status

The business and reasons to acquire:

• Steady business, conservatively run with clear opportunities for growth

• Well respected management team, well known to Ed Rimmer

• Management wish to continue in their roles and have strong buy-in to being part of the 1pm group

• Excellent reputation for client service

• Low levels of historic bad debt

• 2016 Revenue £4.1m; PBT £1.1m (27%). Lending £23m on £46m receivables

• Very good relationship with debt provider (RBS), great opportunity for more attractive terms to be negotiated

• Based in Manchester with sub office in Birmingham (total 24 staff), therefore providing excellent complementary regional fit with Gener8 Finance.

Status of the acquisition:

• Letter of Intent signed, with exclusivity period

• Internal Due Diligence conducted with no “Red Flags”

• External Due Diligence in progress

• Meeting to be held with debt provider

• Proposed timing: Completion late May/early June 2017

Proposed consideration:

• £4.5m cash on Completion (from Placing proceeds)

• £2.0m deferred cash over 3 years

• £2.5m share-based earn-out over 3 years

• £9.0m total. Circa 6x current year PBT excluding earn-out

Short Term

• Complete organised handover with exiting CEO

• Focus on solidifying key client relationships

• Appoint Sales Director and build internal sales team to boost new business

• Invest in marketing

• Complete second acquisition

Longer Term

• Drive cross selling opportunities within the 1pm group, including improved use of technology

• Deliver economies of scale from enlarged operation where possible

• Pursue other suitable acquisition opportunities

• Development of other commercial finance products

• Position Onepm Commercial Finance as a challenger to mid-market players

18

Organic growth plan post-acquisitions

On completion of acquisitions, Commercial Finance Division will be comparable in size to the Asset Finance and Loans Divisions with circa £75m of receivables and yielding 20%+ on funds advanced.

The strategic proposition:

• 1pm to be a consolidator of niche, high-quality, well-run, small-ticket invoice discounting and factoring businesses – butwhich are under-exploited in terms of growth potential;

• 1pm to be a provider of a range of relevant finance solutions to the SME sector;

• Increase shareholder returns, targeting 15%+ return on net assets in the short-term

Transaction outline:

• £12 - £15m fundraise – a Placing and £1m Open Offer

• To finance £5.25m of cash consideration for the acquisition of Gener8

• To finance the £4.5m cash element of the proposed consideration for the second target

• To provide funds for initial post-acquisition growth – industry norm is 5:1 leverage with bank facilities – high ROE – 30%+

• To meet transaction expenses

19

Proposed transaction

20

Summary

• The 1pm group has a clear strategic growth plan and is successfully implementing it;

• There is a clear and present opportunity now to introduce complementary adjacent SME

lending products such as Invoice Discounting and Factoring;

• The plan is compelling – a consolidator of independent, high-quality, well-run, but under-

exploited players in the small-ticket segment of the market – a space we know well;

• Seeking shareholder and new investor support to raise £12 - £15m to acquire identified

target businesses;

• The acquisitions will be earnings-enhancing and will increase shareholder returns;

• This will position 1pm as a balanced, established, risk-mitigated finance provider to a

broad range of SMEs;

• Board is optimistic and confident of further organic growth.

Appendices

21

Example once equity is being utilised:

Equity £2m

5:1 leverage with bank facilities £10m

Total to lend £12m

Contribution based on historic margins £600k

Return on Equity 30%

22

Initial post-acquisition growth utilisation

Client numbers

-

5,000

10,000

15,000

20,000

25,000

Q109

Q3 Q110

Q3 Q111

Q3 Q112

Q3 Q113

Q3 Q114

Q3 Q115

Q3 Q116

Domestic FactoringDomestic Invoice DiscountingExportABL facilities

£0 - £500k

£500k - £1m

£1m- £5m

£5m - £10m

£10m - £50m

£50m+

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

Q109

Q3 Q110

Q3 Q111

Q3 Q112

Q3 Q113

Q3 Q114

Q3 Q115

Q3 Q116

• driven by £0 - £500k and £1m - £5m segments • driven by domestic factoring and invoice discounting

23

Onepm market positioning

Equality:

Operate in ‘partnership’

with customer to meet their

needs

Authority:

Dictate the way the

product and service works

24

Competitor Performance – client numbers

Company 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

CLIENT NUMBERS

2015 OVER 2014 +/-

% CHANGE,

2015 OVER

2014

MARKET

SHARE

2015 %

1 RBSIF 7436 10654 10529 9779 9906 8745 9792 8950 9945 9967 9934 -33 0% 20.10%

2 Lloyds CF 8115 8467 9604 9837 9974 9539 9656 10059 10299 9611 9299 -1312 -14% 18.90%

3 HSBC 6320 6263 6392 6159 5699 5714 6045 6382 6749 7428 7649 220 3% 17.40%

4 Bibby Financial Services 2737 2980 3160 3385 3530 3790 4008 4227 2877 3755 3969 214 6% 9%

5 Barclays 4815 5061 5117 4967 3723 3297 3235 3149 3003 2999 2912 -77 -3% 6.40%

6 Close 1016 1087 1097 1025 999 1079 1029 1017 1026 1075 1105 30 3% 2.50%

7 Aldermore 677 741 813 819 729 892 1009 1114 1196 1194 1096 -108 -9% 2.50%

8 ABN AMRO 768 778 837 998 922 964 979 998 878 857 795 -62 -7% 1.80%

9 Hitachi Capital 378 377 360 366 433 530 647 641 -6 -1% 1.50%

10 Ultimate 223 222 299 311 279 275 308 400 583 193 46% 1.30%

11 Skipton Business Finance 205 246 274 312 358 409 492 553 61 12% 1.30%

12 BNP Parisbas (formerly Fortis) 116 492 590 361 313 369 404 467 532 539 7 1% 1.20%

13 Santander (Liquidity) 104 125 129 117 127 212 276 403 459 56 14% 1%

14 Factor 21 114 138 154 162 170 179 221 284 340 56 20% 0.90%

15 Ashley 204 245 265 256 235 260 292 284 311 27 10% 0.70%

16 IGF 521 566 515 405 414 399 392 223 221 223 231 8 4% 0.50%

17 Calverton 117 103 123 151 165 173 202 226 24 12% 0.50%

18 Shawbrook (Formerly Centric) 220 201 194 204 214 229 217 224 7 3% 0.50%

19 Leumi ABL 51 80 103 114 130 140 153 177 199 199 0 0% 0.50%

20 Positive 75 105 117 127 151 154 182 190 8 4% 0.40%

25

Non Execs:John Newman (Chair),

Julian Telling, Ron Russell

James RobertsCFO

Mike NolanMD Asset Finance

Ed RimmerMD Commercial

Finance

Statutory Board

Operating Board

Junior Board

26

Management

GM Onepm

GMLoans

GMBradgate

GMAcademy

Ian SmithCEO

Group HR

Academy Vehicles

Compliance

Bradgate

Group FC

iLoans

Projects

tba: GMInvoice Finance

tba: Gener8

Funding Structure

Bank facility

Block lines £62m

£1m Over-draft

SLN £7.5m

Equity Placing

Back-2-back

Onepm Treasury Ltd

1pm (UK) Ltd t/a Onepm Finance

Academy Leasing Ltd

Bradgate Business Finance Ltd (including Bell Finance)

1pm plc

Intelligent Loans

Onepm Commercial Finance Ltd

First charge

First charge

First charge

Second charge

First chargeNotes: In addition to First and Second charges, security also taken by funders through assignment of underlying lease, loan and invoice finance contracts

Cross guarantees including 1pm plc

Asset Finance

InvoiceFinance

Loan Finance

First charge

27

Current funding

28

1pm plc ownership – top 10 holders

Now LombardOdier

29

H1 2017 Origination and P&L

• Approx 50% of lease business originated by Academy and

Bradgate is ‘broked-on’ for commission (24% as a Group).

Vehicles all broked-on; no funding risk taken

• Pro-rata lease figures reflect a competitive market over past 12

months and a policy decision to not relax credit criteria

• Loans figures reflect the level of designated funding for loans and

management of the proportion of loans to leases in accordance

with our business model

H1:2016 H2:2016 H1:2017

LEASES£m: Onepm 5.5 5.8 5.0

Academy 4.4 8.5 10.8

Bradgate 2.2 6.4

9.9 16.5 22.2

LOANS£m: Onepm 6.1 4.0 4.4

VEHICLES£m: Academy 4.0 6.9 9.8

20.0 27.4 36.4

37% 33%

ACTUAL

H1: 2016 H2: 2016 H1: 2017

REVENUE £m: Onepm 3.79 4.21 4.23

Academy 1.46 2.85 3.14

Bradgate 0 0.24 0.62

5.25 7.30 7.99

PBT £m: Onepm 1.26 0.94 1.06

Academy 0.50 1.00 0.96

Bradgate 0 0.02 0.03

1.76 1.96 2.05

Exceptional items £m -0.10 -0.27 0

PBT £m: 1.66 1.69 2.05

Basic earnings per share (p): 2.91 2.96 3.08

ACTUAL

30

H1 2017 KPIs & Funding

• Funding is in the form of Block Discount facilities from 12 banks, plus HNW loans in the form

of a £7.5m Secured Loan Note and (in Onepm’s case) 7 individuals and 1 corporate lender

• Block Discount lenders include: Siemens; Lombard; Investec; Aldermore; Hitachi; Close;

Hampshire Trust; Shawbrook; Conister

H1: 2016 H2: 2016 H1: 2017

Gross margin %: Onepm 57.8 53.4 53.7

Academy 82.4 79.3 76.5

Bradgate 0 70.8 63.4

Blended 64.6 64.1 63.4

Net Interest Margin %:

Blended average price 17.2 16.0 16.7

Blended cost of funds 5.7 5.2 5.2

Net Interest Margin: 11.5 10.8 11.5

Block funding: Facilities £m 42.8 62.2 62.0

Utili l ised £m 29.3 37.6 43.8

Utilised % 68.5% 60.5% 70.6%

Headroom £m 13.5 24.6 18.2

ACTUAL