Profits and Gains of Business or Profession in MBA

-

Upload

lakhan-chhapru -

Category

Documents

-

view

220 -

download

0

Transcript of Profits and Gains of Business or Profession in MBA

-

7/25/2019 Profits and Gains of Business or Profession in MBA

1/24

Profits and Gains of Businessor Profession

Lecture Notes

-

7/25/2019 Profits and Gains of Business or Profession in MBA

2/24

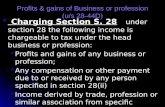

Basis of Charge (Section 28)

Following Incomes shall e charged to ta! under thishead

"# Profit and Gains of an$ usiness or Profession carriedon $ the assessee

2# %n$ Com&ensation or other &a$ments due or recei'ed$ assessee for loss of agenc$ due to termination ormodification in terms and conditions of such agenc$

# Income deri'ed $ a trade &rofessional or similarassociation for s&ecific ser'ices &erformed* for itsmemers#

+# ,!&ort Incenti'es recei'ed $ ,!&orter such as Saleof licenses Cash %ssistance -ut$ -rawac.

-

7/25/2019 Profits and Gains of Business or Profession in MBA

3/24

Basis of Charge (contd#)

/# 0alue of an$ enefit or &er1uisite whethercon'ertile into mone$ or not arising fromusiness or the e!ercise of a &rofession

# Interest Salar$ Bonus Commission orremuneration due or recei'ed $ a &artner of afirm from such firm#

3# Sum 4ecei'ed or recei'ale in cash or .ind for

a) not carr$ing out an$ acti'it$

) not sharing an$ .nowhows &atent etc#

8# Sum 4ecei'ed under 5e$man Insurance Polic$

6# Income from S&eculati'e Business#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

4/24

Business 7 Profession

Business

includes an$ rade Commerce or 9anufacture oran$ ad'enture in the nature of rade Commerce or9anufacture#

Profession:

means an occu&ation re1uiring s&ecialised5nowledge and S.ill#

0ocation:

is an acti'it$ in which an assessee has s&ecialiseds.ill for earning Income#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

5/24

-eduction %llowale

"# 4ent 4ates a!es and Insurance of Building( u;s

-

7/25/2019 Profits and Gains of Business or Profession in MBA

6/24

-e&reciation (u;s 2)

Following conditions are to e fulfilled#

a) %ssessee must e owner of the %sset#

) %sset must e used for the &ur&ose of

usiness or Profession#

c) Such use must e in the rele'ant &re'ious

$ear#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

7/24

-e&reciation

-e&recation is allowed in res&ect of

a) Building

) Plant 7 9achiner$ c) Furniture

d) 9otor 0ehicles

e) Com&uters f) Intangiles

-

7/25/2019 Profits and Gains of Business or Profession in MBA

8/24

-e&reciation

-e&reciation is allowed on the =ritten -own0alue of Bloc. of %ssets

>&ening =-0 ??

%dd : Purchases during the $ear ?? Less : Sales during the $ear ??

Closing =-0 ??

Note : If the %sset is &ut to use for less than"8< -a$s in the $ear de&reciation will eallowed at /< @ of the eligile rate#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

9/24

%dditional -e&reciation

%dditional -e&recation A 2< @ of %ctual Costof 9achiner$ ac1uired after "#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

10/24

,!&enditure of Scientific 4esearch ;s /

%n$ ,!&enditure (other than Cost of Land) e!&ended onscientific research related to the usiness#

Contriution to i) %ssociation uni'ersit$ college for the &ur&ose of

Scientific 4esearch ii) National Laorator$ eligile for "3/ @ -eduction

iii) %ssociation uni'ersit$ college for the &ur&ose ofresearch in social sciences or statistical research

eligile for "2/ @ -eduction

In ouse 4esearch in s&ecified industries eligile for 2

-

7/25/2019 Profits and Gains of Business or Profession in MBA

11/24

,!&enditure for >taining License to o&erateelecommunication Ser'ices ;s /%BB

%llowed as -eduction e1uall$ o'er thenumer of $ears of 0alidit$ ofLicenses

-

7/25/2019 Profits and Gains of Business or Profession in MBA

12/24

>ther ,!&enditures

/%C : ,!&enditure on ,ligile ProDects

/CC% : ,!&enditure for carr$ing out rural

de'elo&ment &rogrammes

/ CCB : ,!&enditure for carr$ing out&rogrammes of conser'ation of natural

resources#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

13/24

%mortisation of

Preliminar$ ,!& deduction is allowed in /Eears ( Section /-)

%mortisation of %malgamation or -emergerin / Eears (Section /--)

%mortisation of 04S ,!&enses in / Eears

( Section /--%)

,!&enditure on 9inerals Pros&ecting in "ther -eduction u;s

i) Insurance &remium &aid to co'er the ris.of damage or destruction of Stoc.

Ii) Bonus or Commission &aid to ,m&lo$ees

Iii) Interest on Borrowed Ca&ital iii) Contriution to 4ecognised Pro'ident

Fund i') Contriution to %&&ro'ed Gratuit$ Fund

0) =rite off of useless or -ead %nimals 0i) Bad -ets 0ii) ,!&enditure on &romotion of Famil$

Planning among em&lo$ees

-

7/25/2019 Profits and Gains of Business or Profession in MBA

15/24

General ,!&enses u;s 3

Conditions to e fulfilled

i) ,!&enditure should not e in the

nature &rescried u;s < to ii) Not a Ca&ital ,!&enditure

iii) Not Personal ,!&enditure

i') for the &ur&ose of Business

-

7/25/2019 Profits and Gains of Business or Profession in MBA

16/24

%d'ertisement ,!&enses( Section 3(2B)

-eduction is not allowed in res&ect ofe!&enditure incurred $ an assesseeon ad'ertisement in an$ sou'enirrochure tract &am&let or li.e&ulished $ a &olitical &art$#

-

7/25/2019 Profits and Gains of Business or Profession in MBA

17/24

-isallowance u;s +

-

7/25/2019 Profits and Gains of Business or Profession in MBA

18/24

-isallowance us;s +< a

Pa$ment to 4esident without deducting -s

Following &a$ments are co'ered

I) Interest

II) commission or Bro.erage III) 4ent

I') Fees for echnical or Professional Ser'ices

0) ro$alt$

0I) Pa$ment to Contractor

-

7/25/2019 Profits and Gains of Business or Profession in MBA

19/24

-isallowance us;s +< a

Securities ransaction a!

Fringe Benefit a!

Income a!

=ealth a!

Salar$ &aid outside India without deducting-S

Pro'ident Fund &a$ment without deducting-S

a! on Pre1uisites &aid $ the em&lo$er

-

7/25/2019 Profits and Gains of Business or Profession in MBA

20/24

-isallowance u#;s +< ()

%mount not -eductile in case ofPartnershi& Firm

I) Interest e!ceeding the rates&ecified in the Partnershi& -eed or"2 @ whiche'er is lower

II) 4emuneration to Partner

-

7/25/2019 Profits and Gains of Business or Profession in MBA

21/24

4emuneration to Partner

Is allowed u&to the following limits

First 4s

-

7/25/2019 Profits and Gains of Business or Profession in MBA

22/24

-isallowance u;s +< %

,!cessi'e Pa$ment to 4elati'es

Pa$ment e!ceeding 4s 2

-

7/25/2019 Profits and Gains of Business or Profession in MBA

23/24

Contriution to Non Statutor$ Funds

Pro'ision for na&&ro'ed Gratuit$Fund

-

7/25/2019 Profits and Gains of Business or Profession in MBA

24/24

Section + B : -eduction onPa$ment Basis

Following will e allowed as -eduction on actual &aidasis#

>utstanding amount has to e &aid efore -ue -ateof Filing of 4eturn of Income#

i) %n$ a! -ut$ &aid to go'ernment ii) Contriution to PF

iii) Bonus or Commission

i') Interest on Loans from financial

institution 0) Interest on Loans from Scheduled Ban.

0i) Lea'e Salar$ to ,m&lo$ees

![INDIAN INCOME TAX RETURN rules/2020/itr2... · ITR-2 INDIAN INCOME TAX RETURN [For Individuals and HUFs not having income from profits and gains of business or profession] (Please](https://static.fdocuments.in/doc/165x107/5f4e9fcaaf112f01225b695d/indian-income-tax-return-rules2020itr2-itr-2-indian-income-tax-return-for.jpg)

![INDIAN INCOME TAX RETURN · INDIAN INCOME TAX RETURN [For Individuals and HUFs not having income from profits and gains of business or profession] (Please see Rule 12 of the Income-tax](https://static.fdocuments.in/doc/165x107/5fbd84db67d212512e64efc7/indian-income-tax-return-indian-income-tax-return-for-individuals-and-hufs-not.jpg)