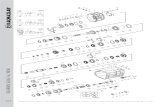

Presentazione di PowerPoint - Marcolin · Adjustments to other non-cash items 1,0 1,1 -2,1 CF from...

Transcript of Presentazione di PowerPoint - Marcolin · Adjustments to other non-cash items 1,0 1,1 -2,1 CF from...

Q1 Report March 31, 2014

Investors presentation

May 28, 2014

Confidentiality This presentation has been prepared by Marcolin S.p.A. and its affiliates. The information contained herein is confidential and has been prepared solely for the needs of the adressee and is not to be relied upon by any other person or entity. Hence, if you wish to disclose copies of this report to any other person or entity, you must inform they that they may not use these reports for any purpose without Marcolin written consent. No representation, warranty or undertaking, express or implied, is made as to, and no reliance shoud be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein.

2

3

At a glance

Key consolidated financials

Viva Integration Project

Agenda

Appendix

At a glance Key facts 2014

> Early June new licence announcement

> Current Business: so far sound and strong

> Viva: sales force re-organization

4

Key financials combined

> INTRODUCTORY NOTE: * EBITDA is affected by a number of extraordinary items. For this reason it has been adjusted to restate the one-off effects deriving from the re-organization as represented in “Adjusted EBITDA” page.

Sales Consolidated Net sales increased +1,4%, thanks to a significant upside from TF. In

terms of Markets 2014 Q1 has confirmed the expectations of sales improvement in

Europe and in particular Italy (+23%)

At constant FX sales increased +3,8% vs. PY

98.7 Million EUR

EBITDA 2014 Q1 EBITDA Reported is € 9.8m (€ 8.4m previous year)

2014 Q1 Adjusted EBITDA* (excluding one-offs) is

€ 11.4m vs. € 11.3m and in line with 2013 in terms of % on Net Sales.

LTM Adjusted Run-Rate EBITDA for 2014 is € 47.4m, substantially in line in respect of LTM Dec 2013 of €47.8m.

Q1 11.4 11.5% On Net

sales

Net Debt

101.0 2014 Constant FX

5

Consolidated Net Debt as of March 2014 is € 180.2m (€ 166,2m end of

December 2013); the 2014 Q1 , with a cash absorption of € 14m due to the

recurring seasonality of the business

The ratio Net financial position to LTM Adjusted run-rate EBITDA is 3.80

Million EUR in 2013

97.3

3.80 NFP /

Adj LTM RR Ebitda

LTM 47.4 13.7% On Net

sales

180.2 Million EUR

Consolidated Sales 98.7 million EUR

2014 Q1

@ const FOREX

+1.4% vs PY

Global sales By market destination

101.0 mill EUR

6

North America

Europe Asia

RoW

36.6 Mill. EUR

38.0 Mill. EUR

7.4 Mill. EUR

16.7 Mill. EUR

38,5%

37,1%

7,5%

16,9%

LTM Revenues by market destination

Europe million eur Row – rest of the world ASIA North america million eur million eur

million eur

7

1,3696 1,3206 Ex rate EUR/USD

125,2

124,1

2014 LTM

2013

135,7

136,6

2014 LTM

2013

27,2

27,2

2014 LTM

2013

58,2

57,0

2014 LTM

2013

As of March, 31st Full Year

2014 % 2013 % 2014 LTM % 2013 %

in € Mln, except percentages in $ Mln, except percentages

Europe 38,0 38,5% 36,9 37,9% 125,2 36,2% 124,1 36,0%

North America 36,6 37,1% 37,5 38,5% 135,7 39,2% 136,6 39,6%

Asia 7,4 7,5% 7,4 7,6% 27,2 7,8% 27,2 7,9%

Rest of World 16,7 16,9% 15,5 16,0% 58,2 16,8% 57,0 16,5%

Total 98,7 100,0% 97,3 100,0% 346,3 100,0% 344,9 100,0%

Total @ constant FX (€ Mln) 101,0

change vs. PY 3,8%

LTM Ebitda performance (million eur)

EBITDA REPORTED EBITDA ADJUSTED *

8.1%

ADJ RUN-RATE EBITDA **

% 2014 LTM on net sales

11.2% % 2014 LTM on net sales

7,8% in 2013 13.7%

% 2014 LTM on net sales

11,4% in 2013 13,9% in 2013

EBITDA consolidated

8

* excluding one-offs * including synergies

28,1

26,8

2014

LTM

FY

2013

38,9

39,3

2014

LTM

FY

2013

47,4

47,8

2014

LTM

FY

2013

CONSOLIDATED

2014 LTM FY 2013 2014 LTM FY 2013 2014 LTM FY 20132013 JUNE

LTM

in € Mln, except percentages in € Mln, except percentages in € Mln, except percentages

NET SALES 206,6 204,2 139,7 140,7 346,3 344,9 348,2

% vs. PY 1,2% -0,8% 0,4%

EBITDA 15,9 16,6 12,3 10,2 28,1 26,8 18,0Adjustment 8,3 10,4 0,8 0,0 9,1 10,4 16,8

24,2 26,9 13,0 10,2 37,2 37,1 34,8

Management Fees 1,3 1,8 1,3 1,8 1,8

Germany J/V 0,4 0,4 0,4 0,4 0,8

EBITDA ADJUSTED 24,2 26,9 14,7 12,4 38,9 39,3 37,4Synergies 8,5 8,5 8,5

ADJ RUN-RATE EBITDA 47,4 47,8 45,9

EBITDA ADJ % on Net sales 11,69% 13,20% 10,53% 8,80% 11,22% 11,41% 10,74%

EBITDA ADJ RR % on Net sales 13,68% 13,87% 13,18%

MARCOLIN VIVA

Financial reports

> Year 2013 is affected by a number of non recurring events: • Cristallo mandatory tender offer (OPA) on Marcolin shares (Feb. 2013) • reverse merger of Marcolin Parent Company Cristallo (Oct. 2013) • refinancing on existing indebtedness through HY Bond on Nov. 2013 • VIVA acquisition on Dec. 2013 Due to the scale of the non recurring events, comparison with the previous period in not always immediate, particularly as regards to the Group cash flows. To enhance period-on-period comparability and whereas possible, financial information has been represented as “Pro-Forma” (including Cristallo and Viva results).

9

> Financial information presentation In a departure from the previous financial report issued, this report focuses on the consolidated result for the Group. The results of operations of the Group, which includes Marcolin, Cristallo and Viva are discussed as one entity (whereas previously the result of Marcolin and Viva were discussed separately). This is consistent with the strategy to fully integrate Viva, its operations and its brands into the Marcolin Group. Stand-alone income statement information for both Marcolin and Viva can be found in appendix.

Introductory note on Consolidated Financial Report

> Profit & Loss Operating Income improvement of 100bps compared to the same period of 2013. Interested paid impacted by Bond interests for approximately €4.3 m.

10

> Balance Sheet and Cash Flow Cash and Cash Liquidity are decreasing €15.1 m strongly affected by a material increase on trade receivables due to seasonality and the decrease on payables due to non recurring payments. Intangible assets include approximately €6.8 m as renewal fees for two existing brands.

Consolidated Profit & Loss

11

P & L consolidated

11

YTD March

(EURm)Actual 14

Reported

Actual 14

Reported % NS

Actual 13

Pro-Forma

Actual 13

Pro-Forma % NS

Net sales 98,7 100,0% 97,3 100,0%

Cost of Goods (39,2) -39,7% (37,3) -38,4%

-- Gross Margin 59,5 60,3% 60,0 61,6%

Selling and Marekting costs (38,9) -39,5% (40,1) -41,2%

Distributon costs (4,0) -4,0% (3,8) -3,9%

G&A costs (6,8) -6,9% (7,6) -7,8%

Depreciation and Amortization (2,3) -2,4% (2,0) -2,1%

-- OPERATING PROFIT (EBIT) 7,5 7,6% 6,4 6,6%

Financial (5,1) -5,2% (2,8) -2,9%

-- Pre tax 2,3 2,4% 3,5 3,6%

Tax (2,1) -2,1% (2,4) -2,5%

-- Net Result 0,3 0,3% 1,1 1,1%

-- EBITDA 9,8 9,9% 8,4 8,7%

2014 Reported and 2013 pro-forma: considering Marcolin, Cristallo and Viva

Consolidated Balance sheet

12

Balance sheet consolidated

∆ 2014 vs. 2013

Balance Sheet (EURm) Actual 14 ReportedMarch-13

Pro-FormaDec-13 Reported vs Mar vs Dec

Inventory 68,4 67,3 72,9 1,0 (4,5)

Trade receivables 85,4 92,7 72,5 (7,4) 12,9

Other current assets 14,3 12,4 14,0 1,9 0,3

Other current financial 25,2 42,8 40,3 (17,6) (15,1)

CURRENT ASSETS 193,2 215,3 199,7 (22,0) (6,4)

Intangible assets - Net 298,0 299,9 291,6 (1,9) 6,5

Tangible assets - Net 22,7 24,5 23,5 (1,8) (0,8)

Others 26,6 29,0 27,2 (2,4) (0,6)

Other non current financial 6,3 7,9 7,1 (1,5) (0,8)

FIXED ASSETS 353,7 361,3 349,4 (7,6) 4,3

TOTAL ASSETS 546,9 576,5 549,1 (29,6) (2,2)

Payables to suppliers 65,9 74,4 64,7 (8,6) 1,2

Current financial liabilities 15,6 6,4 17,7 9,2 (2,1)

Funds and other current liabilities 28,3 34,4 30,6 (6,1) (2,3)

CURRENT LIABILITIES 109,8 115,3 113,0 (5,5) (3,2)

Payables due to banks 196,1 196,7 195,9 (0,6) 0,2

Funds and other non current liabilities 25,6 27,0 25,2 (1,5) 0,3

BANKS and FUNDS 221,7 223,7 221,1 (2,1) 0,5

SHAREHOLDERS' EQUITY 215,5 237,5 215,0 (22,0) 0,5

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 546,9 576,5 549,1 (29,6) (2,2)

NET FINANCIAL POSITION 180,2 152,5 166,2 27,7 14,0

2014 Reported, Dec 2013 pro-forma and Dec 2013 Reported: considering Marcolin, Cristallo and Viva

Consolidated Cash Flow statement

13

Cash Flow consolidated

(EURm) Dec 2013 Reported Dec 2013 Pro-Forma 2014 March

Operating activities

Profit before income tax expense -11,8 -10,0 2,3

Depreciation, amortization and impairments 5,4 5,2 2,1

Accruals to provisions other accruals 17,1 17,2 7,0

Adjustments to other non-cash items 1,0 1,1 -2,1

CF from operating activities before changes in WC, tax and int. 11,7 13,4 9,4

Movements in working capital -9,3 -12,5 -16,9

Income taxes paid -1,9 -1,9 -0,7

Interest paid -17,5 -17,5 -0,6

Net cash flows provided by operating activities -17,0 -18,5 -8,8

Investing activities

(Purchase) of property, plant and equipment -2,6 -2,6 -0,5

Proceeds from the sale of property, plant and equipment 0,0 0,2 0,0

(Purchase) of intangible assets -1,5 -1,6 -0,5

(Acquisition) of investment - Marcolin e Viva -127,7 -53,6 0,0

Net cash (used in) investing activities -131,9 -57,7 -1,0

Financing activities

Net proceeds from/(repayments of) borrowings 91,6 88,0 -5,4

Other cash flows from financing activities 51,3 51,2 0,0

Net cash from/(used in) financing activities 142,9 139,2 -5,4

Net increase/(decrease) in cash and cash equivalents -6,0 63,1 -15,1

Effect of foreign exchange rate changes -0,7 -0,7 0,1

Cash and cash equivalents at beginning of period 45,2 45,2 38,5

Cash and cash equivalents at end of period 38,5 107,6 23,5

Dec 2013 Reported: Marcolin, Cristallo and Viva (Viva for the month from the acquisition date to the annual closing date)

Dec 2013 pro-forma: only Marcolin and Cristallo (excluding Viva for the month from the acquisition date to the annual closing date)

2014 March: considering Marcolin, Cristallo and Viva

Net Financial Position

14

Net Financial Position

(EURm) March 2014 December 2013

Short Term borrowings 15,6 17,7

Medium Long Term borrowings 196,1 195,9

Gross borrowings 211,7 213,6

Cash and cash equivalents 23,5 38,5

Financial receivables current 1,6 1,8

Financial receivables non current 6,4 7,1

Reported Net indebtedness 180,2 166,2

Revolving Credit Facility €25mn 3,0 0,0

Short term borrowings from Banks 3,5 8,6

Receivable Factoring 0,0 1,1

Vendor Loan (HVHC) - Short Term 1,4 4,6

Bond accrued interests 6,5 2,3

Ministry of productive activities 0,1 0,1

Financial leasing VIVA 0,7 0,7

Other 0,4 0,3

Short Term gross borrowing 15,6 17,7

Senior Secured bonds €200mn 200,0 200,0

Bond issue amortized fees -8,9 -9,3

Vendor Loan (HVHC) - Long Term 3,0 3,0

Financial leasing VIVA 1,8 2,0

Ministry of productive activities 0,2 0,2

Other 0,0 0,0

Medium Long Term gross borrowing 196,1 195,9

Reasons for restatements

15

Marcolin is still involved in new projects, in consolidation and in development activities, which in fact brought about a global

reorganization at all levels:

• Reorganization process with changes in top and middle management

• Reposition of collections, expanding the “vision” segment and integrating new lines or new models and relaunch of domestic

brand WEB

• Rationalization of the distribution networks both internationally and at domestic level

• In-depth review of the brand portfolio with the addition of new prestigious licensing agreements that will start in January

2015, and discountinuation of non performing licences

For the above reasons the EBITDA is also reported net of the impact of the one-off effects in order to provide comparability.

• Integration process of Viva Group

Adjusted Ebitda

16

in € Mln, except percentages Q1 2014 Q1 2013

EBITDA pre-adjustment 9,8 8,4

Cost related to Cristallo impact 0,0 1,2

EBITDA Reported 9,8 9,6

Exceptional termination of licenses 0,0 0,5

Cost related to PAI Acquisition 0,0 0,1

Cost related to VIVA Acquisition 0,0 0,0

Senior management changes 0,6 0,2

Restructuring of sales force 0,0 0,1

Cost related to VIVA Integration 1,1 0,0

Other 0,0 0,8

Total adlustments 1,6 1,7

EBITDA ADJUSTED 11,4 11,3

Net Sales 98,7 97,3

% on Net Sales 11,55% 11,64%

in € Mln, except percentages LTM 2014 FY 2013

EBITDA pre-adjustment 28,1 26,8

Cost related to Cristallo impact 0,2 1,4

EBITDA Reported 28,3 28,1

Exceptional termination of licenses 1,8 2,3

Cost related to PAI Acquisition 0,4 0,5

Cost related to VIVA Acquisition 1,0 1,0

Senior management changes 3,2 2,8

Restructuring of sales force 1,3 1,4

Cost related to VIVA Integration 1,1 0,0

Other 0,1 0,9

Total adlustments 8,9 9,0

EBITDA ADJUSTED 37,2 37,1

Net Sales 346,3 344,9

% on Net Sales 10,74% 10,76%

Consolidated

Appendix

17

18

Stand alone

18

Key financials

Sales Sales driven by EUROPE, in particular, as expected Italy improve thanks to the

reorganization of selling distribution implemented at the end of 2013.

North America still positive despite to the negative exchange rate effect

59.4 mill. EUR

+5.1% vs PY

EBITDA EBITDA reported € 5,7m (9.6%); EBITDA Adjusted* € 6,5m, 11.0% on

Net Sales.

5.7

9.6% on Net sales

mill. EUR

19

Stand alone

-2.9% constant FX

> INTRODUCTORY NOTE: * EBITDA is affected by a number of extraordinary items. For this reason it has been adjusted to restate the one-off effects deriving from the re-organization as represented in “Adjusted EBITDA” page.

Revenues 2014 Q1 By market of destination, product type and segment

by product type North America

Asia

Rest of W.

Europe

By market destination

Europe

Asia

North America

Rest of the World

+5.1% +2.0%

Revenues in EUR/000 and % changes vs 2013

-2.3% +13.7%

Sunglasses

Prescription

frames

+7.3%

+3.3%

by product segment

Luxury

Diffusion

+5.1%

+6.8%

20

Stand alone

46%

25%

10%

19%

71%

29%

16.534

17.652

2013

2014

40.779

42.875

2013

2014

26.031

27.354

2013

2014

14.611

14.905

2013

2014

5.873

5.738

2013

2014

10.039

11.416

2013

2014

58%

42%

32.752

35.150

2013

2014

24.561

25.377

2013

2014

21

Stand alone

21

22

Sales SALES: at $ 54,4m (vs. 53,8m of Q1 2013), increase of 1,0% vs. PY

54.4 mill. USD

1.0% vs PY

EBITDA EBITDA reported $ 5,6m (10.4% on Net Sales) ; EBITDA Adjusted* $ 6,7m, 12.3% on

Net Sales.

5.6 10.4%

on Net sales

mill. USD

Stand alone

Key financials

22

> INTRODUCTORY NOTE: * EBITDA is affected by a number of extraordinary items. For this reason it has been adjusted to restate the one-off effects deriving from the re-organization as represented in “Adjusted EBITDA” page.

by market of destination

Europe

Asia

Americas

Rest of the World

Revenues in USD/000 and % changes vs 2013

by product segment

Diffusion +1.0%

by product type

Americas

Asia

Rest of W.

Europe

Revenues 2014 Q1 - Viva By market of destination, product type and segment

+5.5%

Sunglasses

Prescription

frames -0.1%

+2.8%

+7.5% -6.2%

+0.2%

23

100%

53.802

54.352

2013

2014

39%

61%

33.085

33.050

2013

2014

20.718

21.302

2013

2014

28%

56%

4%

12%

14.308

15.096

2013

2014

30.185

30.241

2013

2014

7.242

6.792

2013

2014

2.067

2.222

2013

2014

Investor relation

Marcolin Contacts:

Massimo Stefanello

CFO and COO

+39 0437 777111

Alessandra Sartor

+39 0437 777204

Francesca Pellegrini

+39 0437 777152

24

![Jährlinge 2014 - Stall M.S. Diamanten · Yankee Bambi [US] 0:00,0 Photo Maker [US] SJ'S Photo [US] 1:11,7 1:10,2 Sassy Jane [US] 1:16,6 Flak Bait [US] 1:11,7 Coccola Diamant [DE]](https://static.fdocuments.in/doc/165x107/605ab01b91467a20820a358c/jhrlinge-2014-stall-ms-yankee-bambi-us-0000-photo-maker-us-sjs-photo.jpg)