Presentation to FDIC Advisory Committee on Economic Inclusion October 24, 2007 Washington, D.C.

description

Transcript of Presentation to FDIC Advisory Committee on Economic Inclusion October 24, 2007 Washington, D.C.

Presentation toFDIC Advisory Committee on Economic Inclusion

October 24, 2007Washington, D.C.

Economic Inclusion:Meeting the Financial Needs of Consumers

Through Financial Service Centers

Introduction

Joseph Coleman

Chairman, FiSCA

Revolution

• Revolution

• Engage in meaningful dialogue to lead to actions that will vastly improve the delivery of financial services to consumers

• Who is the enemy?

• 13,000 outlets serving 30 million low to moderate income consumers

Financial Services Centers of America

• FiSCA represents the Financial Service Center Industry - an economically significant force in the lives of millions of households.

• Formidable Player in the Financial Service Industry:– Has evolved and thrived for over 70 years

– Comprises 13,000 FSC’s throughout the nation

– Serves 30 million customers.

– Conducts 350 million transactions each year, with transactions worth an estimated $106 billion

– 95% of our customers rated our service as good to excellent.

• At the end? 10 Calls to Action

The Bank Business Model• Account Relationship Based• Prefers Low Transaction, High

balance Accounts• Fiduciary – Requires overhead to

mange safety and soundness of funds on deposit

FSC Business Model• Fee for service, pay as you go,

transaction based• Seeks high transaction

volumes.• Non Fiduciary – We transact

primarily with our own funds

A Tale of Two Business Models

How the Bank Business Model Fares in this Space

• Our Customers – Are engaged in high-volume / low-balance transactions.– It is arguable that they pay less, overall, using an FSC

than they would at a bank

• Bank Errors– It is not “lack of branches” that alienates LMIs– What goes on in a bank branch is not what LMIs need.– The most successful FSCs are those surrounded by the

most bank branches– The account-based model is not the best model for entry

level access to financial services– Bank fees, unless subsidized, are too great a burden for

many LMIs– As long as bankers are asked to serve LMIs at rates

below cost, the cry of “bank the unbanked!” will not gain traction

– We must do better than the simplistic temptation to trot out, over and over, the same old repudiated perennial panacea -- the low cost bank account

• The FSC Business Model– Provides a the best cost benefit equation

for serving LMIs at reasonable prices– Attracts entrepreneurs– Ensures sustainability– Ensures the widespread delivery of

needed services

• FSCs Have Evolved To Satisfy The Genuine Needs Of LMIs– Liquidity– Access– Service– Transparency

How the FSC Business Model Fares in this Space

The Real Financial Needs of LMI Consumers

1. Liquidity: The Single Most Urgent Need of LMI Consumers

– Banks expect you to not to draw your account down to zero.

– Many LMI individuals cannot afford to leave funds lying in an account – from time to time, they need all their money for necessities.

– FSCs make 100 % of funds, less the fee, available immediately. We hold no funds

2. Access– LMI consumers require access due to

demanding life styles,• Multiple jobs• Variable work hours• Family and childcare issues.

– FSCs provide an environment where customers feel comfortable and respected.

– FSCs maintain locations where customers live and work

– FSCs are open extended hours including many 24 / 7 locations

3. Service– FSCs provide “financial oxygen” in

the communities we serve– Our hardworking customers need

fast service– We provide most of the economic

necessities our customers demand– Our cashiers know most of their

customers by name, anticipate their needs; and speak the languages of the community

The Real Financial Needs of LMI Consumers

The Real Financial Needs of LMI Consumers

4. Fee Transparency– LMI consumers must manage a tight budget. Events such as surprise fees,

incomprehensible fees, and unknown charges can be catastrophic– FSC Fees

• Fees are posted and known up front – there are no surprises

• Fees are paid at the time of the transaction, at the point of sale

• Fees are clearly listed on the customer’s receipt

Prepaid Debit Card / “Credit Card” / Stored Value Card

• Provides a branded Visa or MasterCard

• Acts as a virtual account to hold funds.

• Enables consumers to access electronic commerce such as the internet.

• Tens of thousands of customers

What’s New in the FSC World

FSC Driven, Entrepreneurial Innovations(What will succeed in this space are transactional versions of traditional products)

Credit Union/Bank and FSC Alliances• NY PayNet Deposit Program

– Credit Union Members can use the Point of Banking Program to

• Make deposits and get immediate availability.

• Make Transfers.

• Make Withdrawals.

• Get Balances.

– In some locations, customers can open accounts.

– Participation is growing: 6 Credit Unions and 7 FSC Companies, comprising 150 locations

– Approximately 24,000 deposits a year.

• NYC PayNet Payroll Program– Check Cashers pioneered the PayNet Payroll Network.

– Employees cash their checks free and the fees are borne by the bank.

What’s New in the FSC World

Innovations in Consumer Empowerment

FiSCA Consumer Empowerment Program:The “Three Legged Stool”

1. Savings

2. Credit Building

3. Education

Innovations in Consumer Empowerment

1. Savings Every NetSpend card distributed by a

FiSCA member comes with a totally liquid savings option.

No fee, no minimum balance, FDIC Insured

5% interest Approximately $44 million put into

savings. The program has been expanded to

other businesses, such as convenience stores.

2. Need Based Financial Education– Current Programs

• Do not address the day-to-day financial needs and realities of LMI consumers

• Focus on products and services that LMIs don’t use

– FiSCA’s Program• Will reflect the demonstrated needs,

preferences and behaviors of LMIs• Will provide educational materials to help

consumers transition to traditional financial services

• Will be delivered through the 6,500 FiSCA member locations across the country

• Will be designed for delivery through wider channels, such as cable television

Innovations in Consumer Empowerment

3. Credit Building– The Need – Credit scoring for

those with no history– The Solution

• FiSCA’s partnership with PRBC (“Payment Reporting Builds Credit”)

• PRBC enables consumers to build a credit file and score based on their history of making rent and other recurring bill payments

• PRBC has been qualified as a “Community Development Service” for Financial Institutions

Innovations in Consumer Empowerment

The Compliance Myth

• The MSB industry suffers from the misperception that it is “high risk”

• This conclusion ignores the actual compliance record of the industry

• FSCs have an exemplary record

The Myth Results in “Bank Discontinuance”

• Bank Regulators have put pressure on the banks that serve our industry.• We have experienced an epidemic of bank account closures• A small number of banks serve an enormous MSB industry. This places us

in precarious position of risk• The trend endangers the very existence of MSBs and the essential financial

services they deliver• Efforts by FinCEN and the federal bank regulatory agencies have had little

or no success in reversing the trend of blanket bank discontinuance

What’s to Be Done About “Bank Discontinuance”

• FiSCA led the effort to bring key constituents together to attack this destructive trend:– FiSCA– American Bankers Association– Other key MSB and banking organizations

• Solution: a federal bill to provide regulatory relief

• Desired Result: reduce the regulatory burden on banks by relieving them of a duty to act as the “functional regulator” of their MSB customers

Small Dollar, Short-Term Loans

• The Need: There is a definite need for small dollar short-term credit – $47.65 billion a year is transacted. Last year 150 million loans were transacted; 20% of this number were transacted by FSCs

• Problems and Substantive issues raised by consumer advocates and others:– Cost?– Entrapment?– Areas to reform?– Changes that meet consumer needs yet remain a

sustainable product for providers– Public and media discourse has been incendiary

and contentious– Facts are replaced by anecdote

• Solutions– Instrument for constructive dialogue– Leadership is required– Create a task force

Consumers, FSCs and Satisfied Customers

Patricia J. Cirillo, Ph.D

Cypress Research Group

A Brief Look at the FSC Industry

The FSC Industry:• It is specialized and perfectly aligned with

specific segment of the consumer market• It is large• It has an existing infrastructure, built on a

commitment to high levels of services. – If you want to reach this consumer market, look

inside FSCs

FSCs: Take Home Messages

Product/Service Offerings

% of FSCs operating companies

25%

4%

58%

88%

96%

96%

96%

96%

0% 20% 40% 60% 80% 100%

Installment Loans

Travelers Checks

Payday Advances

Prepaid Debit Cards

Bill Payments

Money Transfers

Money Orders

Check Cashing

FSCs: Specialized

• FSCs are fairly homogeneous in the products/services they offer.

• Because these are the products/ services that consumers need.

Products & Services Ratings How would you rate [current outlet] on…?

Convenient Locations

Convenient Hours of Operations

Treat Customers With Respect & Courtesy

Helpful Employees

In & Out Of Store Quickly

Has Products & Services Needed

Charges Reasonable Fees For Products/Services

Offers A Safe Environment

Clearly Communicates All Costs Of Products & Services

FSCs: Specialization=High Customer Satisfaction

53%

51%

56%

37%

35%

55%

58%

60%

54%

62%

57%

64%

60%

55%

49%

64%

55%

22%

24%

33%

22%

40%

24%

32%

21%

31%

20%

32%

20%

30%

25%

39%

20%

34%

0% 20% 40% 60% 80% 100%

2006

2000

2006

2000

2006

2000

2006

2000

2006

2000

2006

2000

2006

2000

2006

2000

2006

2000

%'Excellent' % 'Very Good'

84%89%

88%80%

84%90%

89%82%

85%81%

90%79%

75%59%

89%75%

75%

% of Customers

Overall Service Ratings

1%

1%

5%

14%

36%

45%

1%

1%

2%

19%

28%

50%

0% 20% 40% 60% 80% 100%

Not Sure

Poor

Fair

Good

Very Good

Excellent

2006 Study

2000 Study

% of Customers

• 95% customers rate the service as either “good,” “very good” or “excellent.”

FSCs: High Customer Satisfaction

This industry knows and understands its customer……

Fairly Targeted Demographic Group

Distinctive based on their demographic characteristics. As a group, they are:• Employed, either full- or part-time (85%)

• Young. 70% are under age 45

• Even male/female split

• Median income of $27,000 per year, but include significant representation from all income groups

• More likely to be never-married than the general population (47%)

• Educated (at about the same level as the general population)

2%

2%

28%

29%

39%

4%

1%

3%

21%

31%

41%

0% 20% 40% 60% 80% 100%

Other

Native American

Asian

Caucasian

Hispanic

African American

2006 Study

2000 Study

% of Customers

More Insight Into The Customer

They Are of Diverse Race/Ethnicity

2%

2%

4%

4%

4%

7%

8%

9%

10%

11%

24%

5%

3%

2%

6%

6%

8%

8%

7%

12%

12%

25%

0% 20% 40% 60% 80% 100%

Self-Employed

Educational

Transportation

Professional

Medical/Professional

Sales/Marketing

Clerical

Managerial/Administrative

Skilled Craftsman

Unskilled Craftsman

Service

2006 Study

2000 Study

% of Customers

• Customers are employed within a large array of industries and have a large variety of job categories.

• No job category dominates this list.

They Are In A Variety Of Professions

More Insight Into The Customer

Some Have/Had Checking & Savings Accounts

42%

35%

9%

14%

42%

33%

4%

21%

0% 20% 40% 60% 80% 100%

NEITHER aChecking Nor

Savings Account

BOTH Checkingand Savings Account

Savings Account

Checking Account2006 Study

2000 Study

% of Customers

• FSC customers do not lack access to bank accounts. In fact, over half (58%) have either a checking account, a savings account, or both.

• Those without accounts choose not to.

Even More Insight Into The Customer

The Most Important Thing To Understand…..

…The Unique Needs Met By FSC Outlets• Convenient locations

• Convenient operating hours

• Relatively small number of products/services– Which can be delivered in fast, efficient manner by experienced,

well-trained, representatives

• Respectful, rapid service, regardless of financial status of customer

• Access to cash, without the requirement of an account

• Services are provided on an a la carte basis– No monthly fees (which these customers eschew)

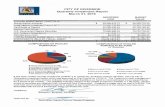

The FSC sub-industry is large

FSCs: Large Segment Of The Industry

57,136,952

2,802,699

32,443,313

20,982,881

107,645,244

$22.5B

$8.3B

$13.2B$5.4B $58M

$56.3B

137,402,509

Wire Remittances Payday Advances Pre-paid Value Cards Bill PaymentsMoney OrdersCheck Cashing

358 Million Transactions/$106 Billion

U.S. Consumer Financial Services MarketTotal of 229M Adults

• FSCs serve a significant portion of this market (33M adults), yet share that service with banks for about 15M customers.

• The unserved market is also of considerable size – almost 10% of American adults (22M).

Brief Look at the Consumer

Unserved Served by FSCs Served by Banks/Credit Unions

Mature infrastructure which has evolved to meet specific needs….

Traditional Outlets• Calculate profit-per-customer

• Heavy reliance on formal customer relationships (accounts)

• Numerous product offerings, highly segmented based on customers’ net-worth

• Strong investment in technologies to provide access to services out of branches

• In-branch services are extremely expensive to provide; therefore, only high-profit services are encouraged in branches

FSCs• Calculate profit-per-transaction

• No reliance on formal customer relationships; instead, service levels.

• Relatively few product offerings, no segmentation based on customers’ status. Completely financial democracy.

• No access to services out of stores; instead, extensive operating hours

• In-store services are also expensive to provide, but high volumes keep costs down. High volumes are possible, while still maintaining high service, because of specialization.

FSC Service Provision Evolved Out of Unmet Needs By the Traditional Provider Industry

Contrasting Business Models

The FSC Industry:• Offers a small subset of financial

services/products, with a focus on superior, convenient service

• The number of consumers it serves is large (14% of the consumer financial services retail market)

• FSCs serve their consumers in-person, by definition. Presents an efficient communication channel

FSCs: Take Home Messages, Put Another Way

Calls to Action

Joseph Coleman

Chairman, FiSCA

Calls to Action

1. To include the Financial Service Center Industry, represented by FiSCA, as a partner on the Advisory Committee, as a first step toward a productive dialogue addressing services to low- and moderate-income consumers;

2. To encourage the use of the Financial Service Center network as a ready-made delivery channel to reach low- and moderate-income consumers;

3. To provide banks the direction, incentive and motivation to make banking services available to Financial Service Centers;

4. To actively support the Bank Discontinuance Bill when it is introduced and to otherwise work to end bank discontinuance;

5. To dispel the myths about the compliance burdens and risks posed by MSB's and replace them with the facts;

6. To expand access to credit by endorsing and, by all available means, encouraging the use by banks of alternative credit scores such as those developed by PRBC;

7. To promote and encourage the expansion of savings programs such as the FiSCA / NetSpend National Savings Program, in order to encourage low- and moderate- income consumers to take advantage of these savings opportunities;

8. To promote and encourage the expansion of partnerships and alliances between banks, credit unions and Financial Service Centers;

9. To promote, encourage and support financial education programs that reflect demonstrated needs and preferences and are designed for low- and moderate-income consumers who use Financial Service Centers; and

10. To form a “Small Loan Task Force” comprised of regulators, consumer advocates and providers from within the Financial Service Center industry in order to foster constructive dialogue about the best ways to ensure the availability of small dollar, short-term loans and other forms of credit, while still ensuring that consumers have protections from lending abuses.

Calls to Action

Carpe Diem!

Take up the challenge: 13,000 outlets serving 30 million Consumers.

Revolution