Presentation for Investor Conference Call - Borets:...

Transcript of Presentation for Investor Conference Call - Borets:...

Contents

2

2016: Facts & Figures 4

Borets ESP Global Market Share 2015-2016 5

Borets Technologies and Solutions 6

Borets Manufacturing Facilities Worldwide 7

Borets Service Capabilities 8

Borets Service Company Worldwide Locations 9

Borets’ Global Share of Installed ESPs 10

ESP System Design and Configuration 11

Financial Results 12

Rouble Devaluation May Be Reversing 13

Sales declined by 7.5% vs 10.6% Rouble fall 14

Services are a growing share of revenues 15

“Real” revenues kept growing while “nominal” revenues are effected by exchange rate 16

Russian Revenues grew by 11% in 2016 17

Record Oil Production Continues in Russia in 2016 18

Non Russian Revenues hit by collapse in North America and slow down in Latin America 19

International Revenues vs Oil Price 20

Contents

3

Growing Gross Profit Margin 21

9% drop in Cost of Sales 22

Operating Costs down by 22% 23

Operating Profit Margin recovered strongly in 2016 24

Decline in Net Income due to Rouble depreciation and higher tax burden 25

EBITDA Reconciliations (2) 26-27

Record EBITDA margin 28

Positive Free Cash Flow 29

Leverage ratios are compliant with Leverage Policy 30

Consolidated Net Leverage Ratio calculation 31

Guarantors test 32

Capex 33

Cash holdings (3) 34-36

Balance Sheet Items (2) 37-38

Сash Analyses (4) 39-43

Tight Control Over Net Working Capital 44

Changes in PP&E in 2014-2016 45

Risk Management 46-48

2016: Facts & Figures

No. 1 ESP manufacturer worldwide

(c13,000 ESPs manufactured annually)

No. 3 ESP global sales position

$482 MM annual revenue in 2016

No. 1 ESP service company worldwide

c46,700 ESPs installed base

7,000+ PMMs in operation worldwide

22,000+ serviced wells

500+ clients worldwide

Borets traces its history back to 1897.

In 2016:

– с9,000 employees worldwide, including

– 3,500 dedicated field personnel

– 11 Manufacturing Facilities

– 25 Service Centers in 10 countries 4

Borets ESP Global Market Share

Despite continued Rouble depreciation, Borets maintains 11% of global ESP sales in 2016

Borets leads in the Russian ESP market with 29% share in 2016

5

Baker Hughes, 24%

Schlumberger, 21%

Borets, 11%

GE, 8%

Novomet, 5%

Alkhoraef, 5%

Other, 26%

Global ESP Market by Competitors in 2016, %100% c. $4.2 Billion

Baker Hughes, 25%

Schlumberger, 20%

Borets, 11%

GE, 9%

Novomet, 5%

Alkhoraef, 4%

Other, 26%

Global ESP Market by Competitors in 2015, %100% c. $5 Billion

Borets Technologies and Solutions

Borets is the world’s only vertically integrated ESP provider, supplying complete ESP systems

6

Borets Service Capabilities

Borets is the largest ESP service provider worldwide

More than 22,000 wells under service worldwide

Capable of servicing and repairing equipment

manufactured by all global ESP manufacturers

Capable of providing turnkey ESP solutions to clients

Maintained stock of equipment and components for

repair and equipment maintenance

Knowledgeable, fully-trained professionals to meet the

needs of our clients 24 hours per day

High level repairing process

Unique centers to provide services for more than 7,000

wells in each region

Unmatched experience which allows Borets to create

service centers “from zero” in any part of the world

8

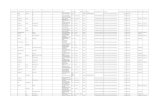

Borets’ Global Share of Installed ESPs

10

Total ESP Wells of which Rental ESP Wells

Total

(‘000s)

Borets

(‘000s)%

Total

(‘000s)

Borets

(‘000s)%

Russia 97.0 44.0 45% 21.0 6.1 29%

Rest of the World 64.0 2.7 4% 19.0 0.6 3%

TOTAL 161.0 46.7 29% 40.0 6.7 17%

Rouble Devaluation May Be Reversing

Impact on Borets (Rb per $)

Average Rate

(Income

Statement)

Yearend Rate

(Balance Sheet)

2011 29.3 32.2

2012 31.1 30.4

2013 31.8 32.7

2014 37.6 56.3

2015 60.3 72.9

2016 66.7 60.7

2017* 59.5 N/A

0

0,5

1

1,5

2

2,5

3

3,5

4

2011 2012 2013 2014 2015 2016 2017

$ per 100 roubles

Rouble Fell 56% since 2011 / 1

* 14.3.2017

13

Revenues ($ mm)

Sales declined by only 7.5% as Rouble fell by

10.6%

742,7766,9

720,1

521,6482,4

566,0 579,1

510,1

367,4 368,8

176,7 187,8210,0

154,2113,6

0

100

200

300

400

500

600

700

800

900

2012 2013 2014 2015 2016

Consolidated

Russia

International

14

US $1 = RUB 31.1 RUB 31.8 RUB 37.6 RUB 60.3 RUB 66.7

68,1% 65,9% 62,1%54,2%

31,9% 34,1% 37,9%45,8%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2013 2014 2015 2016

Product Sales Services (including rental)

Revenues ($ mm and %)

Services are a growing share of revenues

766,9 720,1 521,6 482,4

15

707743

767

720

522

482

707

778817

872910

953

400

450

500

550

600

650

700

750

800

850

900

950

1000

2011 2012 2013 2014 2015 2016

Based on actual rate Using rate of 29.3 RUB/USD (2011 average rate)

“Real” revenues kept growing while “nominal” revenues

are effected by exchange rate

Total revenue 2011-2016 ($ mm)

16

Actual Rate

US $1 = RUB 29.3 RUB 31.0 RUB 31.8 RUB 37.6 RUB 60.3 RUB 66.7

Russian Revenues grew by 11% in 2016

Russia Revenues (roubles bn)

17

14,8

17,1 17,618,4

19,2

22,2

24,6

7,18,3 8,9 9,1 9,1

10,811,9

0,0

5,0

10,0

15,0

20,0

25,0

30,0

2010 2011 2012 2013 2014 2015 2016

Year H1

Record Oil Production continues in Russia in 2016

Source: East office of Finnish Industries, Minenergo, Company Data.

85

90

95

100

105

110

Jan Feb March April May June July Aug Sep Oct Nov Dec

%

Russian Extraction of oil (incl. gas condensate)Physical output % of Dec 2011 level (Dec11=100%)

2013 2014 2015 2016 (forecast)

18

Non Russian Revenues hit by collapse in North America

and slow down in Latin America

International Revenues breakdown ($ mm)

124 177 188 210 154 114

19

70

7971

64 46 34

130

31

38 3318

1012

19

21

22

19

67 19

3517

7

17 17 14 16 10

8

20 32 34 36 2628

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011 2012 2013 2014 2015 2016

USA Colombia Egypt Venezuela Canada Other

International Revenues (USDm) vs. Oil Price (USD) 2012 - 2016

20

112 10999

5244

177

188

210

154

114

$0

$50

$100

$150

$200

$250

2012 2013 2014 2015 2016

Average oil price (Brent), $/bbl International Revenues (USDm)

Growing Gross Profit Margin

Gross Profit ($ mm) and Gross Profit Margin (%)

26.7%

28.3% 28.4%

21

205,1 203,7

148,0143,2

99,0105,5

76,864,0

26,7%28,3% 28,4%

29,7%

2%

12%

22%

32%

$0

$50

$100

$150

$200

$250

$300

2013 2014 2015 2016

Year-Gross profit 1H-Gross profit Year-Gross profit margin

While Revenues drop by 7.5% Cost of

Sales declined by 9%

2013 2014 2015 2016

Materials 338.7 327.2 213.7 210.4

Labour 155.1 147.5 101.8 94.6

D&A 49.3 45.8 55.7 64.7

Prod. Overheads 30.5 27.8 23.9 24.8

Transport 21 16.9 12.2 11.4

Rental tools sold 5.1 4.3 5.6 1.8

External services used 3.8 4.5 4.9 4.0

Decrease \ (increase) in stock and capitalised goods (41.7) (57.7) (44.3) (72.6)

TOTAL 561.8 516.3 373.5 339.1

Cost of sales ($ mm)

22

Operating Costs down by 22%

2013 2014 2015 2016

Sales & Marketing 8.4 7.5 4.8 3.8

G & A 111.1 111.1 94.6 83.3

Other 24.6 16.3 11.6 (1.0)

TOTAL 144.1 134.9 111.0 86.1

Operating costs ($ mm)

23

Operating Profit Margin recovered strongly in

2016

Operating Profit ($ mm) and Operating Profit Margin (%)

24

61,068,7

37,0

57,1

37,9

43,9

23,1 24,7

8,0%

9,5%

7,1%

11,8%

9,9%

12,4%

8,6%

11,0%

0%

5%

10%

15%

0

10

20

30

40

50

60

70

80

90

100

2013 2014 2015 2016

Year-operating profit 1H-operating profit Year-operating profit margin 1H-operating profit margin

47,145,3

23,1 22,6

58,0

44,8

12,3

6,4

0,0

10,0

20,0

30,0

40,0

50,0

60,0

70,0

2013 2014 2015 2016

PBT Net profit

Decline in Net Income due to

Rouble depreciation and higher tax burden

Profits before income tax and net profits ($ mm)

* Includes $11 mm one-off tax benefit

*

25

EBITDA Reconciliation (1/2)

2015 2016

EBITDA Management Accounts 134.9 143.4

Adjustments & Provisions for:

Impairment and write-off of doubtful trade and other receivables -12.2 -1.3

Impairment of inventory -3.7 -1.8

Forex 8.5 -5.3

Other 3.1 6.6

EBITDA 130.6 141.6

EBITDA ($ mm)

26

2013 2014 2015 2016

Net Profit 58.0 44.8 12.3 6.4

Adjustments for:

Income Tax (11.0) 0.5 10.8 16.2

Interest Expense (net) 13.8 33.1 34.8 35.6

Service Agreement 11.3 15.0 15.3 15.3

D&A 52.5 50.8 57.4 66.7

Extraordinary item 6.7 - - 1.4

EBITDA 131.3 144.2 130.6 141.6

EBITDA Reconciliation (2/2)

EBITDA ($ mm)

27

Record EBITDA margin

EBITDA EBITDA margin

Consolidated EBITDA ($mm) and EBITDA margin (%)

28

101,0 107,8

148,4131,3

144,2130,6

141,6

0

40

80

120

160

200

2010 2011 2012 2013 2014 2015 2016

17%

15%

20%

17%

20%

25%

29%

5%

10%

15%

20%

25%

30%

Positive Free Cash Flow

Capital Expenditure and Rental Investment (USDm) Free Cash Flow4 (USDm)

Operating Cash Flow1 (USDm)

Notes:

1. EBITDA – Non-cash Adjustments – Management Fees – Interest – Taxes – Change in NWC

2. OCF / FCF cash conversion is defined as OCF / CFC divided by EBITDA

3. Rental business is high margin and spending is discretionary

4. Operating Cash Flow – Capex – Rental investment – R&D – Other

5. The figures presented on this slide are based on the management accounts

Comments

Stable cash flow generation, remaining steady through 2013-

15 despite a 68% fall in Nominal Revenues:

In 2016 OCF and FCF cash conversion increased to 75% and

20% respectively

– Tight cost control increasing margins, helping to preserve

EBITDA despite fall in top-line growth

– Strong track record of adjusting capex to manage cash

flows given strong pipeline visibility, shown through a 66%

reduction between 2013 - 2016

36

56

3220 2

27

34%37%

24%

14%

1%

20%

0%

20%

40%

$0

$40

$80

2011 2012 2013 2014 2015 2016

Free Cash Flow FCF Cash Conversion (%)

83106 103 95

62

101

77%71% 78%

66%

47%

75%

0%

20%

40%

60%

80%

100%

$0

$40

$80

$120

2011 2012 2013 2014 2015 2016

Operating Cash Flow OCF Cash Conversion (%)

18 2131

2314 1120 18 24

4932

60

$0

$20

$40

$60

$80

2011 2012 2013 2014 2015 2016

Capex Rental Investment3

2

2

29

Leverage ratios are compliant with Leverage Policy

According to the conditions of the Notes the Consolidated Net Leverage Ratio should not exceed 3 to 1 on an incurrence basis

For 2016 the Consolidated Net Leverage Ratio equals 2,6 with headroom of 13,3% to the covenant restriction value

Net Debt ($ mm) and Net Debt /EBITDA multiple

Net debt / EBITDA

Net debt

30

116,284,8

32,8

339,2 341,5385,6 367,8

0

100

200

300

400

500

2010 2011 2012 2013 2014 2015 2016

1,1

0,8

0,2

2,6

2,4

2,95

2,6

2013 2014 2015 2016

Total Debt ($ mm) 426.5 416.9 448.6* 400.6

Cash ($ mm) 87.4 75.5 63 32.8

Net Debt ($ mm) 339.1 341.4 385.6 367.8

EBITDA ($ mm) 131.3 144.2 130.6 141.6

Ratio (<3.0x) 2.58 2.37 2.95 2.60

Headroom (%) 13.9 21.1 1.6 13.3

Consolidated Net Leverage Ratio calculation

Debt ($ mm), Ratios / multiples & percentages

31

* Including NGML

Guarantors test

Net Assets and EBITDA (previous 12 months) of the Guarantors ($ mm)

According to the bond issuance documentation after the publication of the annual or interim financial statements the Guarantors undergo Guarantors Test, which implies compliance with the following:

- aggregate consolidated net assets after intragroup eliminations of the Guarantors comprises 80 % or more of the consolidated net assets of the Group

- EBITDA of the Guarantors comprises 80 % or more of the EBITDA of the Group

Guarantors Test2015 2016

Net Assets EBITDA Net Assets EBITDA

PK Borets 167.8 118.0 216.7 101.9

Borets US 61.9 -18.7 57.2 -5.6

OOO Lemaz 13.1 2.6 39.9 3.6

SK Borets 15.7 0.3 13.4 -2.3

Neftegazmash 6.8 16.0 40.2 28.7

Borets Canada 10.7 - 3.1 12.1 -1.5

ZTS-Kabel 9.1 3.1 18.3 0.9

Borets International Ltd Sucursal Colombia Branch - 2.2 - -

Borets International Ltd. (HQ) 137.8 - 3.2 121.9 -3.6

Consolidated 75.9 130.6 225.5 141.6

% of Consolidated 557% 90% 230% 86%

32

Capex

Capex calculation ($ mm)

Cash flows from investing activities 2013 2014 2015 2016

Purchase of PPE and IA 33.5 20.2 14.6 9.5

Development costs 8.0 7.5 4.8 5.3

Acquisition of subsidiaries 17.4 0.0 10.8 0.0

Divestments -9.5 -5.2 -1.2 -1.5

Total investing activities 49.4 22.5 29.0 13.3

33

Rental Capex presented in Operational activities

Period 2013 2014 2015 2016

Amount, $ mm29.5 45.9 33.4 70.9

Cash Holdings (1/3)

International vs. Russia Holdings ($ mm)

22,531,2

22,031,6

23,516,0

28,4

11,8

54,7

56,2

39,5

43,9

39,947,0

27,0

21,0

0

20

40

60

80

100

30-06-13 31-12-13 30-06-14 31-12-14 30-06-15 31-12-15 30-06-16 31-12-16

International Russia

32,8

34

77,2

87,4

61,5

75,5

63,4 63,0

55,4

Cash Holdings (2/3)

By Currency (US$ or RUB)

$63.0 mm $32.8 mm$75.5 mm$87.4 mm

4,2%10,5%

18,1%

6,4%

33,8%

36,3%

10,3%

47,0%

62,0%

53,2%

71,6%

46,6%

0%

20%

40%

60%

80%

100%

31-12-13 31-12-14 31-12-15 31-12-16

Other RUB USD

35

Cash Holdings (3/3)

by banks 31.12.2014* 31.12.2015* 31.12.2016* 31.12.2014 31.12.2015 31.12.2016

TOTAL 75.5 63.0 32.8 100% 100% 100%

Alef 35.8 10.1 6.3 47% 16% 19%

Nordea 7.9 5.3 - 10% 8% -

ING Group 20.5 36.4 18.5 27% 58% 57%

JPMorgan (USA) 3.2 1.0 1.1 4% 2% 3%

Banco Mercantil (VEN) 2.9 7.5 - 4% 12% -

HSBC 2.5 2.2 4.2 3% 3% 13%

Other 2.7 0.5 2.7 4% 1% 8%

* US $ millions

36

2013 2014 2015 2016

Trade Receivables ($ mm) 124.5 126.5 115.3 121.5

Impairment ($ mm) (2.2) (4.9) (14.7) (13.7)

Net ($ mm) 122.3 121.6 100.6 107.8

Others (net, $ mm) 7.9 8.2 1.5 1.5

Total ($ mm) 130.2 129.8 102.1 109.3

Days Receivable* (days) 62 66 71 83

Balance Sheet Items (1/2)

* Total Receivables ÷ (Sales Revenues/365)

Trade & Other Receivables

37

2013 2014 2015 2016

Inventories:

• Raw Materials ($ mm) 91.9 72.1 54.9 41.2

• W.I.P ($ mm) 20.2 16.0 6.3 10.7

• Goods for Sale ($ mm) 67.2 62.9 70.1 68.4

179.3 151.0 131.3 120.3

• Impairment ($ mm) (14.7) (13.9) (13.7) (14.2)

Total (net, $ mm) 164.6 137.2 117.6 106.1

Days Inventory* (days): 78 70 82 80

Balance Sheet Items (2/2)

* Total Inventory ÷ (Sales/365)

Inventories

38

Inventory + A/C Receivable - A/C Payable x 365 days

Cost of sales* Sales* Cost of Sales*

Сash Analyses (1/5)

a. Evolution of Cash Conversion Cycle (Days)

112

133

98

130 136 138 138

0

50

100

150

200

2013 / 12 2014 / 6 2014 / 12 2015 / 6 2015 / 12 2016 / 6 2016 / 12

Cash cycle

39

( * Last 12 months )

Сash Analyses (2/5)

b. Evolution of Operating Cycle (Days)

169

205

163

201186

213197

0

50

100

150

200

250

300

2013 / 12 2014 / 6 2014 / 12 2015 / 6 2015 / 12 2016 / 6 2016 / 12

Operating cycle

Inventory + A/C Receivable

Cost of sales* Sales*

40

( * Last 12 months )

End of Period Cash Balance

(Total Operating Expenses – D & A) *

x 365 days

Сash Analyses (3/5)

c. Days of Cash

49

36

4643

54 54

33

0

20

40

60

80

2013 / 12 2014 / 6 2014 / 12 2015 / 6 2015 / 12 2016 / 6 2016 / 12

Days of Cash

41

( * Last 12 months )

Сash Analyses (4/5)

d. Current Ratio

3,08 3,082,84

3,012,7

2,14

2,56

0

1,5

3

4,5

2013 / 12 2014 / 6 2014 / 12 2015 / 6 2015 / 12 2016 / 6 2016 /12

Current Assets / Current Liabilities

42

Сash Analyses (5/5)

e. Acid Test

1,84 1,79 1,74 1,791,62

1,31,52

0

1,5

3

2013 / 12 2014 / 6 2014 / 12 2015 / 6 2015 / 12 2016 / 6 2016 / 12

(Current Assets - Inventory) / Current Liabilities

43

Tight Control Over Net Working Capital (USDm)

172 165137

118 106

151 157

143

114122

-119 -119 -116

-78-92

-$150

-$100

-$50

$0

$50

$100

$150

$200

$250

$300

$350

2012 2013 2014 2015 2016

Inventories Accounts Receivables and Other current assets

Accounts payable and Other current liabilities Working Capital

44

Net W.C. $204m $203m $164m $154m $136m

Changes in PP&E 2014-2016

$396.9 mm

59.9%

$316.2 mm

55.1%

$314.7 mm

59.5%

$483.9 mm

73.5% Non-current Assets

% of Non-current Assets

Non-current Assets

% of Non-current Assets

Non-current Assets

% of Non-current Assets 45

Property, Plant & Equipment ($ mm)

237.7

174.2

31/12/13 31/12/14

Addi-

tionsDispo-

sals

Trans-

lation

Depre-

ciation

&other

95.1

30.9

82.6

45.1

2014

187.2

31/12/15

144.9

36.9

44.6

50.4

2015

30/06/16

131.7

53.3 44.9

106.3

Addi-

tionsDispo-

sals

Trans-

lation

Depre-

ciation

&other

355.6

Addi-

tionsDispo-

sals

Trans-

lation

Depre-

ciation

&other

Reval

uation

61.2

2016

Five largest balances of accounts receivable of the

major counterparties:

2016 ($ mm) % of total AR Days Sales

Outstanding*

Rosneft group 42.5 39% 69

PDVSA group 6.9 6% n/a

Surgutneftegaz group 5.2 5% 57

Lukoil group 5.1 5% 55

Ecopetrol S.A. 4.1 4% 84

TOTAL 63.8 59%

Risk Management (1/3)

46

* Days Sales Outstanding (DSO) = (Accounts Receivable / Revenue) * 365

Contractual currency analysis of monetary assets and liabilities is as follows:

47

Currency Exchange Risk Analysis

31 December 2016

RUB USD EUR Other Total

USD’000 USD’000 USD’000 USD’000 USD’000

Financial assets

Trade and other receivables less prepayments 68,595 36,372 79 4,260 109,307

Cash and cash equivalents 15,402 15,976 (1,579) 2,994 32,793

Total financial assets 83,997 52,348 (1,500) 7,254 142,099

Financial liabilities

Loans and borrowings (3) (400,562) - - (400,565)

Trade and other payables less advances received (33,676) (15,090) (1,129) (4,597) (54,492)

Total financial liabilities (33,679) (415,652) (1,129) (4,597) (455,058)

Net position 50,318 (363,304) (2,629) 2,657 (312,958)

If the USD strengthened against the RUB, Euro and other currencies by 10%

then this would have the following impact:

30 Jun 2016 31 Dec 2015

USD’000 USD’000

Foreign currency

RUB (5,032) (230)

EUR 263 4

Other (266) (1,178)

Had the USD weakened against the RUB, Euro

and other currencies by 10% then this would

have the equal but opposite effect on the

amounts shown above given that all other

variables remained constant.

Risk Management (2/3)

48

Interest Rate Risk Analysis ($ mm)

Fixed rate instruments 2013 2014 2015 2016

Term deposits 32.9 24.6 41.4 5.3

Loans received (426.5) (416.9) (417.4) (400.6)

Total (393.6) (392.3) (376.0) (395.3)

Variable rate instruments

Loans received 0.0 0.0 (31.2) 0.0

Overdraft (3.0) (3.4) (3.4) (2.0)

TOTAL (3.0) (3.4) (34.6) (2.0)

Risk Management (3/3)

At the reporting date the interest rate profile of the Group’s interest bearing financial instruments was: