Pitch3 AA

-

Upload

usittech -

Category

Economy & Finance

-

view

2.271 -

download

0

Transcript of Pitch3 AA

Alcoa – AA (NYSE) 80% upsideYash Samat, Brian Minkus, Clayton Kurpiewski, Reese Davis – AnalystsMark Albin - Director

Alcoa – AA (NYSE) 80% upsideYash Samant, Brian Minkus, Clayton Kurpiewski, Reese Davis – AnalystsMark Albin - Director

AlcoaThesis

Alcoa is splitting its value chain into two distinct sections. This will allow management

to focus on higher-margin projects

Alcoa sells products not easily commoditized

Long-term contracts are not recognized by a commodity-panicked market

Industry Overview

Jan-10Mar-

10May-

10Jul

-10Oct-

10Dec-

10Feb

-11May-

11Jul

-11Se

p-11

Dec-11Feb

-12Ap

r-12Jun

-12Se

p-12

Nov-12Jan

-13Ap

r-13Jun

-13Au

g-13

Nov-13Jan

-14Mar-

14May-

14Au

g-14Oct-

14Dec-

140

500

1000

1500

2000

2500

3000

Aluminum Price

Date

Alum

inum

Pric

e (U

SD/t)

Favorable Market ConditionsCommodity Price of Aluminum

Stable

Growth From Specialized Industries

Volatility Protection

Company Partnerships Well Positioned Aluminum Worldwide

China risk minimal

Strong demand in NA and Europe drive sales.

Use overcomes priceAluminum in the U.S.

YOY use of aluminum increases in U.S automobiles.

U.S vehicles must become lighter to meet new emissions standards

Company Overview

Existing Alcoa shareholders will receive stock in both

Delivering Shareholder Value

Value-Add Co. Upstream Co.Premier supplier of high-performance multi-material products and solutions

Positioned to grow in diversified set of growth markets

Robust margins and investment opportunities above cost of capital

Expanded multi-material, technology and process expertise

Robust demand growth of 6.5% in 2015 and 2x between 2010 and 2020

World’s largest, low cost bauxite miner at the 19th percentile on cost curve

Operational flexibility to profit from market cyclicality

Collaborate to produce next-gen automotive aluminum alloys with key

manufacturers

Positioned for growth from horizontal monopolistic structure

Competitive Advantage

Turn Into Aluminum Based Products

Sell to Manufactures

Company 1:Upstream

Company 2: Value-Added

Distribution of Revenue Now

51%27%

15%

7%% Sales - Location

United StatesEuropePacificOther Amer-icas

29%

26%

23%

14%8%

% Sales - Segment

Global Rolled Products

Primarty Metals

Engineered Products and Solutions

Alumina

Other

Valued-Added Co. Strong Top +Bottom Line Growth Insulated from Market

Dow Jones U.S. Aluminum Index

Isolated from highly volatile market conditions--long term manufacturing contracts and control over cost of raw materials.

Company Overview: Value-Add Co: Key Businesses

Highly Diversified

Value-Added Co: Increase in Demand for Parts from Key Industries

Company Overview: Upstream Co: Continued Drive for ProfitabilityStrong Growth Despite Falling Commodities Prices

Strengths: Impeding division of the company Diversified set of customers for aluminum products Insulated from volatile commodity prices Horizontal integration of mining and production operations

Weakness: Division execution risk

Threats: Rising energy prices(i.e. natural gas) Global market weakens

Opportunities Automotive Lightening Micro mill alloy produced in conjunction with Ford Increase in demand for aluminum parts from aerospace manufacturers

SWOT Analysis Indicated Opportunities in Emerging Industries

Company Overview

In the NewsCatalysts – 3yr time horizon

Alcoa signed a $1 billion contract with Airbus

Alcoa’s quarterly earnings release on Thursday

10/3/

2005

2/20/2

006

7/10/2

006

11/27

/2006

4/16/2

007

9/3/20

07

1/21/2

008

6/9/20

08

10/27

/2008

3/16/2

009

8/3/20

09

12/21

/2009

5/10/2

010

9/27/2

010

2/14/2

011

7/4/20

11

11/21

/2011

4/9/20

12

8/27/2

012

1/14/2

013

6/3/20

13

10/21

/2013

3/10/2

014

7/28/2

014

12/15

/2014

5/4/20

15

9/21/2

015

05

10152025303540

Price

Valuation

Comps

Company Comps

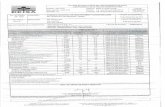

Ticker Name P/E Total Debt (in mm) Total Equity (in mm) Debt/Equity P/BV NTMTEV/EBITDA NTM 2015 Total Revenue (in mm)

NYSE:AA Alcoa Inc.16.4 8,846.0 14,794.0 0.60 1.80 6.3 24,332.0

NasdaqGS:KALU Kaiser Aluminum Corporation16.3 225.2 758.8 0.30 2.00 9.5 1,415.8

NasdaqGS:CENX Century Aluminum Co.4.4 254.7 1,091.2 0.23 0.40 1.8 2,163.3

NYSE:CSTM Constellium 13.49 1,205.0 (41.4) -29.11 NM 9.1 5,193.7

Nucor16.0 4,360.6 8,075.0 0.54 2.70 7.9 21,105.1

Average 13.3 0.42 1.725 6.9

DCF 2010A 2011A 2012A 2013A 2014A 2015LTM 2015P 2016E 2017E 2018E 2019E

Sales $ 21,013 $ 24,951 $ 23,700 $ 23,032 $ 23,906 $ 24,332 $ 23,062 $ 24,135 $ 25,100 $ 26,819 $ 27,423

% change 19% -5% -3% 4% 4% 5% 4% 2% 2%

Cost of Goods Sold $ (17,116) $ (20,474) $ (20,401) $ (19,277) $ (19,070) $ (18,946) $ (17,988) $ (18,825) $ (19,578) $ (20,918) $ (21,390)

Gross Profit $ 3,897 $ 4,477 $ 3,299 $ 3,755 $ 4,836 $ 5,386 $ 5,074 $ 5,310 $ 5,522 $ 5,900 $ 6,033

Sales, general, and administrative $ (961) $ (1,027) $ (997) $ (1,008) $ (953) $ (928) $ (922) $ (965) $ (1,004) $ (1,073) $ (1,097)

Other operating charges $ (174) $ (184) $ (197) $ (192) $ (218) $ (240) $ (231) $ (241) $ (251) $ (268) $ (274)

EBITDA $ 2,762 $ 3,266 $ 2,105 $ 2,555 $ 3,665 $ 4,218 $ 3,921 $ 4,103 $ 4,267 $ 4,559 $ 4,662

Depreciation and Amortization $ (1,450) $ (1,479) $ (1,460) $ (1,421) $ (1,371) $ (1,322) $ (1,384) $ (1,448) $ (1,506) $ (1,609) $ (1,645)

EBIT $ 1,312 $ 1,787 $ 645 $ 1,134 $ 2,294 $ 2,896 $ 2,537 $ 2,655 $ 2,761 $ 2,950 $ 3,017

Taxes $ (148) $ (255) $ (162) $ (428) $ (320) $ (620) $ (761) $ (796) $ (828) $ (885) $ (905)

NOPAT $ 1,164 $ 1,532 $ 483 $ 706 $ 1,974 $ 2,276 $ 1,776 $ 1,858 $ 1,933 $ 2,065 $ 2,112

Depreciation and Amortization $ 1,450 $ 1,479 $ 1,460 $ 1,421 $ 1,371 $ 1,322 $ 1,384 $ 1,448 $ 1,506 $ 1,609 $ 1,645

Change in Net Working Capital $ 528 $ (63) $ 77 $ 276 $ (795) $ (592) $ (165) $ 10 $ (208) $ (45) $ 78

CAPEX $ (1,015) $ (1,287) $ (1,261) $ (1,193) $ (1,219) $ (1,266) $ (1,153) $ (1,207) $ (1,255) $ (1,341) $ (1,371)

Unlevered Free Cash Flow $ 2,127 $ 1,661 $ 759 $ 1,210 $ 1,331 $ 1,740 $ 1,841 $ 2,110 $ 1,976 $ 2,288 $ 2,464

AV:

COGS/Sales -81.5% -82.1% -86.1% -83.7% -79.8% -77.9% -83% 78% 78% 78% 78% 78%

SG&A/Sales -4.6% -4.1% -4.2% -4.4% -4.0% -3.8% -4.3% 4% 4% 4% 4% 4%

Other/Sales -0.8% -0.7% -0.8% -0.8% -0.9% -1.0% -0.8% 1% 1% 1% 1% 1%

D/A Sales -7% -6% -6% -6% -6% -5% -6.2% 6% 6% 6% 6% 6%

Tax Rate -11% -14% -25% -38% -14% -21% -20.5% 21% 21% 21% 21% 21%

CAPEX/Sales -5% -5% -5% -5% -5% -5% -5.1% 5% 5% 5% 5% 5%

DCF and Implied Discount

Beta: 1.11Equity Risk Premium: 6%Risk Free Rate: 2%Cost of Equity: 6.44%Cost of Debt: 4%Cost of Preferred Equity: 5%Dividend: $ 3.75 Preferred Share Price: $ 81.02 Market Value of Debt: $ 8,789.00 Market Value of Equity: $ 12,256.00 Market Value of Preferred Equity: $ 58.00 WACC: 5.42%

WACC: 5.4% Growth Rate: 2% 2010A 2011A 2012A 2013A 2014A 2015LTM 2015P 2016E 2017E 2018E 2019EUnlevered Free Cash Flow: $ 2,127.00 $ 1,661.00 $ 759.00 $ 1,210.00 $ 1,331.00 $ 1,740.00 $ 1,841.39 $ 2,109.73 $ 1,975.72 $ 2,288.21 $ 2,463.80 PV of FCF: $ 9,076.78

Multiple 6.31 PV of Terminal Value (Multiple): $ 22,594.50 % of Enterprise Value: 0.76805928 Enterprise Value $ 31,671.28 Enterprise Value $ 31,671.28 Implied Equity Value: $ 21,811.28 Implied Share Price: $ 18.79

Implied Discount: 80%

Risks and Mitigants

Not Just a Mining CompanyRisks and Mitigants

Demand RiskEmission Standards

Aluminum Prices

Energy RequirementsEnergy Prices

Decreased Reliance

Split Execution RiskMulti-year Process

No loss of coverage

Conclusion

Appendix

Why DCF for mining company? Why not Net Asset Value? Alcoa has so much aluminum in house that it doesn’t even bother

figuring out how much it has in reserves. Most of the company literature is based in EBITDA and their operating performance metrics are on a cash-flow basis

Your Implied Discount is Pretty High....why? The company has been adversely hit by a commodity bust that doesn’t

really affect it’s ability to price Can you tell me more about this split?

The details have yet to be released....the process has yet to be cleared by the Feds, but the project has been years in the making and management has assured equity holders they will get equal rights in both companies

Your comparables don’t seem like they reflect Alcoa Not many companies own their entire value chain....we considered doing

a sum-of-parts analysis, but figured it wouldn’t be appropriate if we didn’t have synergy information from the company yet

We Know You Have Questions...