PFS IM Series 1 Infra Bonds 7 Feb 2011 - rrfinance.com IM.pdf · Capital Structure of the Company...

Transcript of PFS IM Series 1 Infra Bonds 7 Feb 2011 - rrfinance.com IM.pdf · Capital Structure of the Company...

Private & Confidential- Not for Circulation (This is a Disclosure Document prepared in conformity with

Securities and Exchange Board of India (Issue and Listing of Debt

Securities) Regulations, 2008 issued vide circular no. LAD-

NRO/GN/2008/13/127878 dated June 06, 2008)

PRIVATE PLACEMENT OF PFS SECURED LONG TERM INFRASTRUCTURE

BONDS - SERIES 1 OF Rs.5,000/- EACH FOR CASH AT PAR WITH BENEFITS UNDER

SECTION 80CCF OF THE INCOME TAX ACT, 1961

Registered Office: 2nd Floor, NBCC Tower, 15, Bhikaji Cama Place, New Delhi 110 066

Corporate Office: 2nd Floor, NBCC Tower, 15, Bhikaji Cama Place, New Delhi 110 066 Tel: 011 41595122 Fax: 011 41595155, website: www.ptcfinancial.com

PRIVATE PLACEMENT OF PFS LONG TERM INFRASTUCTURE NON-

CONVERTIBLE BONDS OF Rs. 5,000/- (RUPEES FIVE THOUSAND ONLY) EACH

FOR CASH AT PAR WITH BENEFITS UNDER SECTION 80 CCF OF THE INCOME

TAX ACT, 1961 FOR Rs. 30 CRORES (RUPEES THIRTY CRORE ONLY) WITH AN

OPTION TO RETAIN OVER-SUBSCRIPTION UP TO AN ADDITIONAL AMOUNT OF

Rs. 70 CRORES (RUPEES SEVENTY CRORE ONLY), THUS AGGREGRATING TO

Rs. 100 CRORES (RUPEES ONE HUNDRED CRORE ONLY)

Credit Rating

‘Brickwork’ has assigned “BWR AA” (Pronounced Double A) (Outlook: Stable) rating. Instrument with this rating are considered to offer High Credit quality in terms of timely payment of debt obligations.

‘ICRA’ has assigned “LA+” (pronounced L A plus) positive outlook rating. This rating is considered to offer adequate credit quality for timely servicing of debt obligations.

The above ratings are not recommendation to buy, sell or hold securities and investors should take their own decision. The ratings may be subject to revision or withdrawal at any time by the assigning rating agencies and each rating should be evaluated independently of any other rating. The ratings obtained are subject to revision at any point of time in the future.

Listing

The Secured Redeemable Taxable Non-Convertible Bond are proposed to be listed on the WDM segment of National Stock Exchange of India Limited (NSE).

REGISTRAR TO THE ISSUE

Karvy Computershare Private Limited

Plot No. 17 to 24, Vithalrao Nagar Madhapur, Hyderabad 500 086 Telephone: +91 40 2342 0815 Fax +91 40 2342 0814

TRUSTEE FOR THE BONDHOLDERS

IDBI Trusteeship Services Limited

Asian Building, Ground Floor 17, R. Kamani Marg Ballard Estate, Mumbai – 400 021 Tel No. 022 – 66311771/2/3 Fax No. 022 – 66311776

* An Investor may invest any amount but the maximum tax benefit under section 80 CCF of Income Tax Act 1961, would be available

on the maximum investment of up to Rs. 20,000 only

Note: This information memorandum is neither a prospectus nor a statement in lieu of prospectus. This is only an information

brochure intended for private use and should not be construed to be prospectus and/or an invitation to the public for subscription to

Bonds. PFS can at its sole and absolute discretion change the terms of the offer. The investors are advised to check the terms and

conditions including rate of interest prevailing at the time of applying for the Bonds. The issuer also reserves the right to close the

issue earlier/extend from the @aforesaid date or change the issue time table including the Deemed Date of Allotment at its sole

discretion, without giving any reasons or prior notice.

INFORMATION MEMORANDUM

Minimum Application Size: Rs. 5000/- Maximum Application Size: No Limit*

ISSUE OPEN ON: February 09, 2011 @ISSUE CLOSES ON : March 15, 2011

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

ARRANGERS TO THE ISSUE

Almondz Global Securities Limited

2nd Floor, 3 Scindia House

Janpath, New Delhi 110001

Tel No. 011-41514666-669

Fax No. 011-41514665

Bajaj Capital Limited

Bajaj House, 5th Floor

97 Nehru Place , New Delhi 110019

Tel No. 011-66161111 Fax No. 011-66608888

Edelweiss Capital Limited

14th Floor, Express Towers

Nariman Point

Mumbai 400021

Tel No. 022 – 6623 3405

Fax No. 022 – 4342 8029

JM Financial Service Pvt Limited

2,3 & 4, Kamanwala Chambers

Sir P. M. Road Fort

Mumbai 400001

Tel No. 022- 22665577 to 80

Fax No. 022-22665902

R R Investors Capital Services Pvt Limited

47, M M Road

Rani Jhansi Marg, Jhandelwalan

New Delhi 110055

Tel No. 011-23508908

Fax No. 011-23636745

SPA Merchant Bankers Limited

25 ‘C’ Block Community Centre

Janak Puri

New Delhi 110058

Tel No. 011- 45675536

Fax No. 011-25532644

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

TABLE OF CONTENT

Title Page No.

Definitions/ Abbreviations 4

Disclaimer 6

Issue Structure 8

Risk Factors 11

General Information 16

Terms of the Issue 18

Statement of Tax Benefit 26

Procedure of Application 28

Brief Profile of Directors of the Company 31

Company Profile 33

PTC India Limited (Promoter) 34

Shareholding Pattern of Company 34

Financial Performance 35

Product & Services 36

Investments In Energy Value Chain 37

Industry Outlook 38

Capital Structure of the Company

(A) Details of Share Capital 49

(B) Details of other borrowings 50

Material Contracts & Agreements Involving Financial Obligations of the Issuer 56

Declaration 57

ANNEXURES

A Credit rating letter from ICRA LTD

B Credit rating letter from BRICKWORK RATINGS INDIA PVT LTD

C Consent letter from Karvy Computershare Private Limited

D Consent letter from IDBI Trusteeship Services Ltd

E RBI Certificate for conferring Infrastructure Finance Company status to PFS

F List of Collecting Banks

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

DEFINITIONS/ ABBREVIATIONS

Board/ Board of Directors The Board of Directors of PTC India Financial Services Limited

or Committee thereof

Bonds Secured, Redeemable, Non-Convertible Bonds Series 1 having

benefits under section 80 CCF of the Income Tax, 1961 for Long

Term Infrastructure Bonds

Book Closure/ Record Date The date of closure of register of Bonds for payment of interest

and repayment of principal

CAR Capital Adequacy Ratio

CDSL Central Depository Services (India) Ltd.

Depository A Depository registered with SEBI under the SEBI (Depositories

and Participant) Regulations, 1996, as amended from time to time

Depositories Act The Depositories Act, 1996, as amended from time to time

Depository Participant A Depository participant as defined under Depositories Act

Designated Stock Exchange National Stock Exchange of India Ltd.

DER Debt Equity Ratio

Director(s) Director(s) of PTC India Financial Services Limited unless

otherwise mentioned

DP Depository Participant

EPS Earnings Per Share

FIs Financial Institutions

FIIs Foreign Institutional Investors

Financial Year/ FY Period of twelve months period ending March 31, of that

particular year

GoI Government of India/ Central Government

HUF Hindu Undivided Family

Issuer/ PFS/ Company PTC India Financial Services Ltd

Disclosure Document Disclosure Document dated February 07, 2011 for Private

Placement of Secured, Redeemable, Non-Convertible Bonds

Series 1 having benefits under section 80 CCF of the Income Tax,

1961 for long term Infrastructure Bonds

I.T. Act The Income Tax Act, 1961, as amended from time to time

Arrangers Almondz Global Securities Ltd, Bajaj Capital Ltd, Edelweiss

Capital Limited, JM Financial Service Pvt Limited, R R Investors

Capital Services Pvt Ltd & SPA Merchant Bankers Ltd

Listing Agreement Listing Agreement for Debt Securities issued by Securities and

Exchange Board of India vide circular no.

SEBI/IMD/BOND/1/2009/11/05 dated May 11, 2009 and

Amendments to Simplified Debt Listing Agreement for Debt

Securities issued by Securities and Exchange Board of India vide

circular no. SEBI/IMD/DOF-1/BOND/Cir-5/2009 dated

November 26, 2009 and Amendments to Simplified Debt Listing

Agreement for Debt Securities issued by Securities and Exchange

Board of India vide circular no. SEBI/IMD/DOF-1/BOND/Cir-

1/2010 dated January 07, 2010

MoF Ministry of Finance

NPAs Non Performing Assets

NSDL National Securities Depository Ltd.

PAN Permanent Account Number

Rs. Indian National Rupee

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

RBI Reserve Bank of India

RTGS Real Time Gross Settlement

Registrar Registrar to the Issue, in this case being IDBI Trusteeship

Services Limited

SEBI The Securities and Exchange Board of India, constituted under the

SEBI Act, 1992

SEBI Act Securities and Exchange Board of India Act, 1992, as amended

from time to time

SEBI Regulations Securities and Exchange Board of India (Issue and Listing of Debt

Securities) Regulations, 2008 issued vide Circular No. LAD-

NRO/GN/2008/13/127878 dated June 06, 2008

TDS Tax Deducted at Source

The Companies Act/ The Act The Companies Act, 1956 as amended from time to time

The Issue/ The Offer/ Private

Placement

Issue through Private Placement of 60,000 Secured, Redeemable,

Non-Convertible Bonds Series 1 having benefits under section 80

CCF of the Income Tax, 1961

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

DISCLAIMER

GENERAL DISCLAIMER

This Information Memorandum (“document”/”IM”) is neither a Prospectus nor a Statement in Lieu of

Prospectus or an invitation to the Public to subscribe to the Infrastructure Bonds issued by PTC India

Financial Services Limited (PFS) (the “Issuer”/ “the Company”) and is prepared in accordance with

Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued

vide Circular No. LAD-NRO/GN/2008/13/127878 dated June 06, 2008. This IM is not intended for

distribution and is for the consideration of the person to whom it is addressed and should not be

reproduced / redistributed by the recipient. It cannot be acted upon by any person other than to whom it

has been specifically addressed. Multiple copies hereof given to the same entity shall be deemed to be

offered to the same person. The securities mentioned herein are being issued strictly on a private

placement basis and this offer does not constitute a public offer/invitation.

This Information Memorandum is not intended to form the basis of evaluation for the potential investors

to whom it is addressed and who are willing and eligible to subscribe to these Infrastructure Bonds issued

by PFS. This IM has been prepared to give general information regarding PFS to parties proposing to

invest in this issue of Infrastructure Bonds and it does not purport to contain all the information that any

such party may require. PFS and the Arrangers do not undertake to update this Information Memorandum

to reflect subsequent events and thus it should not be relied upon without first confirming its accuracy

with PFS.

Potential investors are required to make their own independent valuation and judgment before making the

investment and are believed to be experienced in investing in debt markets and are able to bear the

economic risk of investing in the Bonds. It is the responsibility of potential investors to have obtained all

consents, approvals or authorizations required by them to make an offer to subscribe for, and purchase the

Bonds. Potential investors should not rely solely on information in the Information Memorandum or by

the Arrangers nor would providing of such information by the Arrangers be construed as advice or

recommendation by the Issuer or by the Arrangers to subscribe to and purchase the Bonds. Potential

investors also acknowledge that the Arrangers do not owe them any duty of care in respect of their offer to

subscribe for and purchase of the Bonds. It is the responsibility of potential investors to also ensure that

they will sell these Bonds in strict accordance with this IM and other applicable laws, and that the sale

does not constitute an offer to the public within the meaning of the Companies Act, 1956. Potential

investors should also consult their own tax advisors on the tax implications of the acquisitions, ownership,

sale and redemption of Bonds and income arising thereon.

DISCLAIMER OF THE SECURITIES & EXCHANGE BOARD OF INDIA

This Disclosure Document has not been filed with Securities & Exchange Board of India (SEBI). The

Securities have not been recommended or approved by SEBI nor does SEBI guarantee the accuracy or

adequacy of this document. It is to be distinctly understood that this document should not, in any way, be

deemed or construed to have been cleared or vetted by SEBI. SEBI does not take any responsibility either

for the financial soundness of any scheme or the project for which the Issue is proposed to be made, or for

the correctness of the statements made or opinions expressed in this document. The issue of Bonds being

made on private placement basis, filing of this document is not required with SEBI. However, SEBI

reserves the right to take up at any point of time, with PFS, any irregularities or lapses in this document.

DISCLAIMER OF THE ISSUER

The Issuer confirms that the information contained in this Disclosure Document is true and correct in all material respects and is not misleading in any material respect. All information considered adequate and relevant about the Issue and the company has been made available in this Disclosure Document for the use and perusal of the potential investors and no selective or additional information would be available for a section of investors in any manner whatsoever. The company accepts no responsibility for statements made otherwise than in this Disclosure Document or any other material issued by or at the instance of the

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

company and anyone placing reliance on any other source of information would be doing so at his/her/their own risk. Neither the Company nor the arrangers take any responsibility for any future changes in the Income Tax Rules by the Government of India, which may affect the status of these Bonds. PTC India Financial Services Limited proposes, subject to receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its equity shares and has filed a draft red herring prospectus (“DRHP”) with the Securities and Exchange Board of India (“SEBI”). The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1993, as amended (“U.S. Securities Act”) or any state securities laws in the United States and may not be offered or sold within the United States or to, or for the account or benefit of, “U.S. persons” (as defined in Regulation S), except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. Accordingly, the Equity Shares are being offered and sold only outside the United States in offshore transactions in reliance on Regulation S under the U.S. Securities Act and the applicable laws of the jurisdiction where those offers and sales occur. The DRHP is available on SEBI website at www.sebi.gov.in as well as on the websites of the Book Running Lead Managers at (“BRLMs”) associated with the Issue (i.e. the website of SBI Capital Markets Limited- www.sbicaps.com , JM Financial Consultants Private Limited- www.jmfinancial.in , ICICI Securities Limited- www.icicisecurities.com , Almondz Global Securities Limited- www.almondzglobal.com ) and the Co-Book Running Lead Manager (“Co- BRLM”) associated with the Issue ( i.e. website of Avendus Capital Private Limited- www.avendus.com).

DISCLAIMER OF THE ARRANGERS

It is advised that company has exercised self due-diligence to ensure complete compliance of prescribed

disclosure norms in this Disclosure Document. The role of the Arrangers in the assignment is confined to

marketing and placement of the Bonds on the basis of this Disclosure Document as prepared by the

Company. The Arrangers have neither scrutinized/ vetted nor have they done any due-diligence for

verification of the contents of this Disclosure Document. The Arrangers shall use this document for the

purpose of soliciting subscription from qualified institutional investors in the Bonds to be issued by the

company on private placement basis. It is to be distinctly understood that the aforesaid use of this

document by the Arrangers should not in any way be deemed or construed that the document has been

prepared, cleared, approved or vetted by the Arrangers; nor do they in any manner warrant, certify or

endorse the correctness or completeness of any of the contents of this document; nor do they take

responsibility for the financial or other soundness of this Issuer, its promoters, its management or any

scheme or project of the company. The Arrangers or any of its directors, employees, affiliates or

representatives do not accept any responsibility and/or liability for any loss or damage arising of whatever

nature and extent in connection with the use of any of the information contained in this document.

DISCLAIMER OF THE STOCK EXCHANGE

As required, a copy of this Disclosure Document has been submitted to the National Stock Exchange of

India Ltd. (hereinafter referred to as “NSE”) for hosting the same on its website. It is to be distinctly

understood that such submission of the document with NSE or hosting the same on its website should not

in any way be deemed or construed that the document has been cleared or approved by NSE; nor does it in

any manner warrant, certify or endorse the correctness or completeness of any of the contents of this

document; nor does it warrant that this Issuer’s securities will be listed or continue to be listed on the

Exchange; nor does it take responsibility for the financial or other soundness of this Issuer, its promoters,

its management or any scheme or project of the company. Every person who desires to apply for or

otherwise acquire any securities of this Issuer may do so pursuant to independent inquiry, investigation

and analysis and shall not have any claim against the Exchange whatsoever by reason of any loss which

may be suffered by such person consequent to or in connection with such subscription/ acquisition

whether by reason of anything stated or omitted to be stated herein or any other reason whatsoever.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

ISSUE STRUCTURE

PRIVATE PLACEMENT - LONG TERM INFRASTRUCTURE BONDS

SUMMARY TERM SHEET

Issuer PTC India Financial Services Limited (the “Issuer”)

Offering 60,000 Secured, Redeemable, Non-Convertible Long Term Infrastructure Bonds of Series 1 of Rs. 5,000/- each aggregating to Rs. 30,00,00,000 (Rupees Thirty Crore only) with a green-shoe option to retain over-subscription for issuance of additional Infrastructure Bonds up to Rs. 70,00,00,000 (Rupees Seventy Crore only) resulting the cumulative amount up to of Rs. 100,00,00,000/- (Rupees One Hundred Crore Only) to be raised through issuance of Non-Convertible Long Term Infrastructure Bonds Series 1

Objects of the Issue The proceeds shall be utilized towards infrastructure lending as defined by the

Reserve Bank of India in the Guidelines issued by it time to time.

Type of Issue Private Placement Basis

Instrument Secured, Redeemable, Non-Convertible Long Term Infrastructure Bonds with

benefits under section 80CCF of the Income Tax, 1961, Series 1

Credit Rating “BWR AA” by Brickwork Ratings &“LA+” (positive outlook) by ICRA

Eligible Investors Resident Indian Individual (Major) and HUF through Karta of the HUF

Security First charge on the receivables of the assets created from the proceeds of current

Bond issue and other unencumbered receivables of the Company to provide the

100% security coverage

Face Value Rs. 5,000/- per Bond

Issue Price At par i.e. Rs. 5,000/- per Bond

Minimum Application 1 Bond and in multiples of 1 Bond thereafter

Lock-in For first 5 years from date of allotment

Tenure 10 years, with or without buyback option after five years

Options for Subscription

The Bonds are proposed to provide the following options-

Option I - Annual Coupon and Buyback after 5 years

Option II- Cumulative Coupon and Buyback after 5 years

Option III - Annual Coupon and No Buyback (maturity at the end of 10 years)

Option IV- Cumulative Coupon and No Buyback (maturity at the end of 10 years)

Redemption/ Maturity For Option I and III: At par at the end of 10th year from the deemed date of

allotment.

For Option II and IV: At par with cumulated interest thereon.

Coupon Rate Option I (Annual Coupon and Buyback after 5 years) –8.25% p.a.

Option III (Annual Coupon and No Buyback) – 8.30 % p.a.

Option II and IV will have cumulative payment at the end of the Buyback period or 10 years, as per the option opted by the Investor (Refer Table on Page 10)

Registrar & Transfer

Agent

Karvy Computershare Private Limited

Trustees IDBI Trusteeship Services Ltd

Listing Proposed on the Wholesale Debt Market (WDM) Segment of National Stock

Exchange of India Limited (NSE)

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

Compliance All provisions/ clauses/ regulations specified by GoI/ SEBI/ RoC with respect to

issue of Secured Redeemable Non Convertible Bonds shall be complied with by

the PFS.

Form of Issuance Physical and Dematerialized form

Depository National Securities Depository Ltd. and Central Depository Services (India) Ltd

Mode of Payment ECS/ At par Cheques/ Demand Drafts or any other mode as may be permissible

at time of such payment/s

Issuance Demat and Physical Form

Trading Demat mode only following expiry of lock-in period

Record Date 3 days prior to each interest payment and/ or principal repayment date.

Issue Opening Date February 9, 2011

Issue Closing Date * March 15, 2011. The issuer would have an option to pre-close/extend the issue by

giving notice to the Arrangers without giving any reason to any third party

Deemed Date of

Allotment

March 25, 2011

Buy Back Dates March 25, 2011 every year commencing from year 2016 to year 2020

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

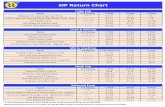

AVAILABLE OPTIONS FOR INVESTMENT IN INFRASTRUTURE BONDS OF PFS

Options I II III IV

Buyback/

Non

Cumulative

Option

Buyback/

Cumulative

Option

Non Buyback/

Non Cumulative

Option

No Buyback/

Cumulative Options

Face Value (Rs.) 5,000/- 5,000/- 5,000/- 5,000/-

Minimum

Application

1 Bond 1 Bond 1 Bond 1 Bond

In Multiples of 5,000/- 5,000/- 5,000/ 5,000/-

Buy Back Option Yes Yes No No

Interest Payment Yearly NA Yearly NA

Coupon 8.25% per annum

8.25% per annum to be compounded annually

8.30% per annum 8.30% per annum to be compounded annually

Yield on Redemption 8.25% 8.25% 8.30% 8.30%

Coupon Payment

Date

March 25 every year

NA March 25 every year NA

Maturity Date March 25, 2021 March 25, 2021 March 25, 2021 March 25, 2021

Buy Back

Intimation Period Every Year Between January 1 to January 31, starting from Year 2016 till Year 2020

Every Year Between January 1 to January 31, starting from Year 2016 till Year 2020

NA NA

Buy Back After 5/6/7/8/9 Years 5/6/7/8/9 Years NA NA

Redemption Amount (Rs.)

5,000/- 11,047/- 5,000/- 11,098/-

Annual Interest Payment and Interest on application money

The First Annual Interest shall be paid on March 25, 2012. Interest on application money at the above rate from the date of credit in PFS bank account to the previous date of allotment shall be paid with the first annual Interest Payment.

Redemption Amount in case ‘Buy Back’ option is exercised (in Rs.)

Year 5 5,000 7,432 -- --

Year 6 5,000 8,045 -- --

Year 7 5,000 8,709 -- --

Year 8 5,000 9,427 -- --

Year 9 5,000 10,205 -- --

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

RISK FACTORS

(A) FORWARD-LOOKING STATEMENTS While no forecasts or projections relating to the Company’s financial performance are included in this Information Memorandum, this document contains certain “forward-looking statements” like intends/believes/expects and other similar expressions or variations of such expressions. These statements are primarily meant to give Investors an overview of the Company’s future plans, as they currently stand. The Company operates in a highly competitive, regulated and ever-changing business environment, and a change in any of these variables may necessitate an alteration of the Company’s plans. Further, these plans are not static, but are subject to continuous internal review, and may be altered if the altered plans are perceived to suit the Company’s needs better. Further, many of the plans may be based on one or more underlying assumptions (all of which may not be contained in this Information Memorandum) which may not come to fruition. Thus, actual results may differ materially from those suggested by the forward-looking statement. The Company cannot be held liable by estoppel or otherwise for any forward-looking statement contained herein. The Company and all intermediaries associated with this Information Memorandum do not undertake to inform Investors of any changes in any matter in respect of which any forward-looking statements are made. All statements contained in this Information Memorandum that are not statements of historical fact constitute “forward-looking statements” and are not forecasts or projections relating to the Company’s financial performance. All forward-looking statements are subject to risks, uncertainties and assumptions that may cause actual results to differ materially from those contemplated by the relevant forward-looking statement. Important factors that may cause actual results to differ materially from the Company’s expectations include, among others:

• General economic and business conditions in India;

• The Company’s ability to successfully implement its strategy and growth plans;

• The Company’s ability to compete effectively and access funds at competitive cost;

• Changes in Indian or international interest rates;

• The level of non-performing assets in its portfolio;

• Rate of growth of its loan assets;

• Potential mergers, acquisitions or restructurings and increased competition;

• Changes in tax benefits and incentives and other applicable regulations, including various tax laws;

• The Company’s ability to retain its management team and skilled personnel;

• Changes in laws and regulations that apply to NBFCs in India, including laws that impact its lending rates and its ability to enforce its collateral; and

• Changes in political conditions in India. (These are only illustrative and not exhaustive)

By their nature, certain market risk disclosures are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains or losses could materially differ from those that have been estimated. Neither the Company nor any of its Directors nor any of their respective affiliates have any obligation, or intent to update or otherwise revise any statements reflecting circumstances arising after the date hereof or to reflect the occurrence of underlying events, even if the underlying assumptions do not come to fruition.

(B) PRESENTATION OF FINANCIALS AND USE OF MARKET DATA Unless stated otherwise, the financial information used in this Information Memorandum is derived from the Company’s financial statements for the period April 1, 2009 to March 31, 2010, being the statutory year ended March 31, 2010 and prepared in accordance with Indian GAAP and the Companies Act, 1956 as stated in the report of the Company’s Statutory Auditors, Price Waterhouse, Chartered Accountants (statutory auditors of the company for financial year 2008-09), included in this Information Memorandum. In addition to the financial information for the financial year 2009-10, the financial information related to audited accounts for the half year ended on September’10 is also used and the same has been audited by Company’s Statutory

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

Auditor for FY 2010-11, M/s Deloitte Haskins & Sells. The Issuer’s fiscal year commences on April 01 and ends on March 31 of a particular year. Unless stated otherwise, references herein to a Fiscal Year are to the Fiscal Year ended March 31 of the reference year. “Fiscal 2010” for instance, refers to the Fiscal year ended March 31, 2010. In this Information Memorandum, any discrepancies in any table between the total and the sum of the amounts listed are due to rounding-off.

Unless stated otherwise, macroeconomic and industry data used throughout this Information Memorandum has been obtained from publications prepared by providers of industry information, Government sources and multilateral institutions. Such publications generally state that the information contained therein has been obtained from sources believed to be reliable but that their accuracy and completeness are not guaranteed and their reliability cannot be assured. Although the Issuer believes that industry data used in this Information Memorandum is reliable, it has not been independently verified.

(C) INTERNAL/EXTERNAL RISK FACTORS The following are the risks envisaged by the management, and Investors should consider the following risk factors carefully for evaluating the Company and its business before making any investment decision. Unless the context requires otherwise, the risk factors described below apply to PTC India Financial Services Limited only. The risks have been quantified wherever possible. If any one of the following stated risks actually occur, the Company’s business, financial conditions and results of operations could suffer and therefore the value of the Company’s debt securities could decline.

Note: Unless specified or quantified in the relevant risk factors, the Company is not in a position to quantify the financial or other implications of any risk mentioned herein below:

INTERNAL RISK FACTORS

(a) Bond Redemption Reserve

No Bond Redemption Reserve is being created for issue of BONDs in pursuance of this Information Memorandum.

Management Perception: Creation of Bond Redemption Reserve is not required for the propose issue of Bonds. The MCA vide General Circular No.9/2002; No. 6/3/2001-CL.V dated April 18, 2002 has clarified that NBFCs need not create a Bond Redemption Reserve as specified under section 117C of the Companies Act, 1956, in respect of privately placed Bonds.

(b) Credit Risk

The Company carries the risk of default by borrowers and other counterparties.

Management Perception: Any lending and investment activity is exposed to credit risk arising from the risk of repayment default by the borrowers and counterparties. The Company has institutionalized a systematic credit evaluation process monitoring the performance of its asset portfolio on a regular and continual basis to detect any material development, and also constantly evaluates the changes and developments in sectors to which it has substantial exposure. The Company also undertakes a periodic review of its entire asset portfolio with a view to determine the portfolio valuation, identify potential areas of action and devise appropriate strategies thereon. The Company follows a conservative provisioning and write-off policy, which is in line with what is prescribed by the RBI.

(c) Contingent Liabilities

The Company’s contingent liabilities could adversely affect its financial condition.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

Management Perception: As on September 30, 2010, PFS had no contingent liabilities on account of income-tax/interest-tax/sales-tax liabilities in respect of matters in appeal and bond executed in respect of legal matters.

(d) Non-Performing Assets (NPA)

If the level of NPAs in the Company’s portfolio were to increase, its business would suffer.

Management Perception: The Gross and Net NPAs of PFS as on September 30, 2010, were zero respectively. PFS is fully complying with the RBI Guidelines/Directives in connection with the same. The Company believes that its overall financial profile, capitalization levels and risk management systems, provide significant risk mitigation.

(e) Interest Rate Risk

The Company’s business is largely dependent on interest income from its operations.

Management Perception: The Company is exposed to interest rate risk principally as a result of lending to customers at interest rates and in amounts and for periods, which may differ from its funding sources (institutional/bank borrowings and debt offerings). The Company seeks to match its interest rate positions to minimize interest rate risk. Despite these efforts, there can be no assurance that significant interest rate movements will not have an effect on its results of operations. Interest rates are highly sensitive to many factors beyond its control, including the monetary policies of the RBI, deregulation of the financial sector in India, domestic and international economic and political conditions, inflation and other factors. Due to these factors, interest rates in India have historically experienced a relatively high degree of volatility. Nevertheless the endeavor of the Company will be to keep the interest rate risk at minimum levels by proactively synchronizing resource raising and lending activities on an ongoing basis.

(f) Access to Capital Markets and Commercial Borrowings

The Company’s growth will depend on its continued ability to access funds at competitive rates.

Management Perception: With the growth of its business, the Company is increasingly reliant on funding from the debt capital markets and commercial borrowings. The market for such funds is competitive and its ability to obtain funds at competitive rates will depend on various factors, including its ability to maintain its credit ratings. While its borrowing costs have been competitive in the past due to its credit rating and the quality of its asset portfolio, if the Company is unable to access funds at an effective cost that is comparable to or lower than its competitors, the Company may not be able to offer competitive interest rates for its loans. This may adversely impact its business, its future financial performance. The value of its collateral may decrease or the Company may experience delays in enforcing its collateral when its customers default on their obligations, which may result in failure to recover the expected value of collateral and adversely affect its financial performance. The Company has also filed its Draft Red Herring Prospectus with market regulator i.e. SEBI on December 22, 2010, for its proposed fund raising exercise through Initial Public Offering (“IPO”).

(g) Availment of foreign currency borrowings in the future, which will expose Company to

fluctuations in currency exchange rates, which could adversely affect its business, financial

condition and results of operations.

While PFS currently do not have any foreign currency borrowings, it may avail foreign currency borrowings in the future. As an IFC, PFS is eligible to raise external commercial borrowings without prior RBI approval up to 50.00% of its Owned Funds and are likely to avail significant external commercial borrowings in the future. In October 2010, the Company has also entered into a loan agreement with Deutsche Investitions - und Entwicklungsgesellschaft mbH ("DEG") for an aggregate amount of U.S.$26 million for on-lending to renewable energy projects and therefore may be exposed to fluctuations in currency exchange rates in the future. Although PFS may enter

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

into hedging transactions with respect to its foreign currency borrowings, there can be no assurance that any such measure will be effective or that PFS will enter into effective hedging with respect to any new foreign currency borrowings. Volatility in currency exchange rates could adversely affect Company’s business, financial condition and results of operations and the price of its Equity Shares.

(h) Failure to recover the expected value of collateral when borrowers default on their

obligations to Company may adversely affect its financial performance.

As of September 30, 2010, all loans were secured by project assets. For debt provided on a senior basis, PFS generally seek a first ranking pari passu charge on the project assets. For loans provided on a subordinated basis, PFS generally seek to have a pari passu charge on the project assets. Although we seek to maintain a collateral value to loan ratio of at least 1.25:1 for our secured loans, an economic downturn or other project risks could result in a fall in collateral values. Moreover, foreclosure of such collateral may require court or tribunal intervention that may involve protracted proceedings and the process of enforcing security interests against collateral can be difficult. Additionally, the realizable value of all collateral in liquidation may be lower than its book value.

PFS cannot guarantee that it will be able to realize the full value of its collateral, due to, among other things, defects in the perfection of collateral, delays on its part in taking immediate action in bankruptcy foreclosure proceedings, stock market downturns, claims of other lenders, legal or judicial restraint and fraudulent transfers by borrowers. In the event a specialized regulatory agency gains jurisdiction over the borrower, creditor actions can be further delayed. In addition, to put in place an institutional mechanism for the timely and transparent restructuring of corporate debt, the RBI has devised a corporate debt restructuring system. Any failure to recover the expected value of collateral security could expose PFS to a potential loss. Apart from the RBI guidelines, PFS may be a part of a syndicate of lenders the majority of whom elect to pursue a different course of action than the Company would have chosen. Any such unexpected loss could adversely affect business, prospects, results of operations and financial condition.

EXTERNAL RISK FACTORS

(a) Material changes in Regulations to which the Company is subject could cause the

Company’s business to suffer

Management Perception: NBFCs in India are subject to detailed supervision and regulation by the RBI. NBFCs not accepting public deposits are exempt from most such provisions. The Company is subject generally to changes in Indian law, as well as to changes in Government regulations and policies and accounting principles. The RBI also requires the Company to make provisions in respect of NPAs. The provision made is equal to or higher than that prescribed under the prudential norms. Any changes in the regulatory framework affecting NBFCs including the provisioning for NPAs or capital adequacy requirements could adversely affect the profitability of the Company or its future financial performance, by requiring a restructuring of its activities, increasing costs or otherwise.

(b) Risk of competition in lending and resource raising could cause the Company’s business to

suffer

Management Perception: PFS offers a financial products and services, such as Term Loans and Bridge Loans, catering to varied cross section of customers. The management believes that the Company’s brand equity, reach and strategic alliances along with its resource base would provide the necessary strength to perform well in a competitive market.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

(c) A slowdown in economic growth in India could cause the Company’s business to suffer

Management Perception: The Company’s performance and the quality and growth of its assets are necessarily dependent on the health of the overall Indian economy. A slowdown in the Indian economy could adversely affect its business, including its ability to grow its asset portfolio, the quality of its assets, and its ability to implement its strategy. India’s economy could be adversely affected by a general rise in interest rates, or various other factors affecting the growth of industrial, manufacturing and services sector or general down trend in the economy.

Notes to Risk Factors:

Save, as stated elsewhere in this Information Memorandum, since the date of publishing audited financial accounts contained in this Information Memorandum:

(a) no material developments have taken place that are likely to materially affect the performance or prospects of the Company; and

(b) no developments have taken place in the last nine months which materially and adversely affect the profitability of the Company or the value of its assets, or its ability to pay its liabilities within the next 12 months.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

GENERAL INFORMATION

PTC India Financial Services Ltd (“PFS” or “Issuer” or “Company”) is offering for subscription, on private placement basis, secured, redeemable, non-convertible Long Term Infrastructure Bonds of the face value of Rs. 5,000/- each for cash at par with benefits under Section 80CCF of the Income Tax Act, 1961 termed as PFS LONG TERM INFRASTRUCTURE NON- CONVERTIBLE BONDS (“INFRASTRUCTURE BONDs”). The minimum application shall be for 1 Bond of Rs. 5,000/- each and in multiples of 1 Bond thereafter.

AUTHORITY FOR THE ISSUE

This issue is being made pursuant to the Resolution of the Board of Directors of the Company passed at its meeting held on March 22, 2010 and the Committee of Directors for Bond Issuance of the Company, passed at its Meeting held on January 27, 2011 and is made under appropriate provisions of the Income Tax Act, 1961.

ISSUE SIZE

PFS (the “Issuer” or the “Company”) proposes to raise Rs. 30 Crore, with a green-shoe option, to retain over-subscription by issuance of additional Infrastructure Bonds up to Rs. 70 Crore, in that case the total issue size may be up to Rs. 100 Crore, through issue of Secured, Redeemable, Non-Convertible Long Term Infrastructure Bonds face value of Rs.5,000 each for cash at par with benefits under section 80CCF of the Income Tax Act, 1961 termed as PFS LONG TERM INFRASTRUCTURE BONDS - SERIES 1 (“Infrastructure Bonds”) by way of private placement (‘the Issue”). The allotment of Bonds will be made on First-cum-first serve basis (as per records of Company) and Company will monitor the Issue collection on daily basis. In case of over subscription of the issue, the applications received over and above of the Issue size may be rejected or the Company may allot the entire application/s received on Closing date through pro-rata basis or draw of lot or the Company may adopt any other mode as may be deemed fit by the Company at its sole discretion so that the total Issue size could not exceed Rs. 100 Crore.

OBJECTS OF THE ISSUE

The proceeds shall be utilized towards infrastructure lending as defined by the Reserve Bank of India in the Guidelines issued by it from time to time, after meeting the expenditures of, and raised through this issue.

CREDIT RATING

‘Brickwork’ has assigned “BWR AA” (Pronounced Double A with Stable outlook) rating to the Bonds of

the Company aggregating to Rs. 100 Crores letter Ref No. BWR/BLR/RA/2010-11/0274 on January 31,

2011. A copy of rating letter from Brickwork is enclosed elsewhere in this Disclosure Document

Instrument with this rating are considered to offer High Credit quality in terms of timely payment of debt

obligations. A copy of rating letter from Brickwork is enclosed elsewhere in this Disclosure Document

‘ICRA’ has assigned “LA+” (pronounced L A plus) rating to the Bonds of the Company aggregating to

Rs.100 crores letter Ref no. D/RAT/2010-11/P48/9 on February 3, 2011. This rating is considered to offer

adequate credit quality for timely servicing of debt obligations. A copy of rating letter from ICRA is

enclosed elsewhere in this Disclosure Document.

Other than rating mentioned hereinabove, the Company has not sought any other credit rating from any

other credit rating agency (ies) for the Bonds offered for subscription under the terms of this Disclosure

Document.

The above ratings are not a recommendation to buy, sell or hold securities and investors should take their

own decision. The ratings may be subject to revision or withdrawal at any time by the assigning rating

agencies and each rating should be evaluated independently of any other rating. The ratings obtained are

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

subject to revision at any point of time in the future. The rating agencies have the right to suspend,

withdraw the rating at any time on the basis of new information etc.

LISTING

The Secured Redeemable Long Term Infrastructure Non-Convertible Bonds Series 1 of PFS is proposed

to be listed on the Wholesale Debt Market (WDM) Segment of the National Stock Exchange of India Ltd.

(“NSE”). The Company has obtained an in-principle approval from the NSE for listing of said Bonds on

its Wholesale Debt Market (WDM) Segment. The Company shall make an application to the NSE to list

the Bonds to be issued and allotted under this Disclosure Document and complete all the formalities

relating to listing of the Bonds within 70 days from the date of closure of the Issue. If such permission is

not granted within 70 days from the date of closure of the Issue or where such permission is refused

before the expiry of the 70 days from the closure of the Issue, the Company shall forthwith repay without

interest, all monies received from the applicants in pursuance of the Disclosure Document, and if such

money is not repaid within 8 days after the Company becomes liable to repay it (i.e. from the date of

refusal or 70 days from the date of closing of the subscription list, whichever is earlier), then the Company

and every director of the Company who is an officer in default shall, on and from expiry of 8 days, will be

jointly and severally liable to repay the money, with interest at the rate of 15 per cent per annum on

application money, as prescribed under Section 73 of the Companies Act, 1956.

REGISTRAR

M/s Karvy Computershare Pvt Limited has been appointed as Registrar to the Issue. The Registrar will monitor the applications while the private placement is open and will coordinate the post private placement activities of allotment, dispatch of interest warrants etc. Investors can contact the Registrar in case of any post-issue problems such as non receipt of letters of allotment; demat credit, refund orders, interest on application money.

TRUSTEES

IDBI Trusteeship Services Limited has given its consent to act as the Trustee to the proposed Issue and for its name to be included in this Information Memorandum. All remedies of the Bond holder(s) for the amount due on the Bond will be vested with the Trustees on behalf of the Bond holders. The holders of the Bond shall without any further act or deed be deemed to have irrevocably given their consent to and authorised the trustees to do inter-alia, all acts, deeds, and things necessary for servicing the Bond being offered including any payment by the Company to the Bond holders / Bond Trustee, as the case may be, shall, from the time of making such payment, completely and irrevocably discharge the Company pro tanto from any liability to the Bond holders..

FUTURE RESOURCE RAISING

PFS will be entitled to borrow/raise loans or avail financial assistance both from domestic and international market as also issue Bonds/Equity Shares/Preference Shares/other securities in any manner having such ranking pari passu or otherwise and on terms and conditions as PFS may think fit without the consent of or intimation to Bond holders or Trustees in this connection.

PERMISSION/ CONSENT FROM PRIOR CREDITORS

The Company hereby confirms that it is entitled to raise money through current issue of Infrastructure Bonds without the consent/permission/approval from the Bond holders/Trustees/ Lenders/other creditors of PFS. Further the Bonds proposed to be issued under the terms of this Information Memorandum being secured there is no requirement for obtaining permission/consent from the prior creditors.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

TERMS OF THE ISSUE

The following are the terms and conditions of Bonds being offered under this Information Memorandum for an aggregate amount of up to Rs. 100 Crore for the financial year 2010-2011.

1. STATUS OF THE BOND

The Infrastructure Bonds shall be non-convertible and secured. These bonds carry tax benefit under section 80CCF of Income Tax Act, 1961 (up to a maximum of Rs.20,000/- per applicant) and these Long Term Infrastructure Bonds are being issued in terms of Notification No. [48/2010/F No 149/84/2010-SO (TPL)] dated 09th July, 2010 issued by Central Board of Direct Taxes, Department of Revenue, Ministry of Finance, Government of India, and RBI certificate no. N-14.03116, dated 23rd August 2010; a copy of the RBI certificate is annexed to this Memorandum.

In accordance with Section 80CCF of the Income Tax Act, 1961 the amount, not exceeding Rs. 20,000 per annum, paid or deposited as subscription to Long-Term Infrastructure Bonds during the previous year relevant to the assessment year beginning April 01, 2011 shall be deducted in computing the taxable income of a resident individual or HUF. In the event that any Applicant subscribes to the Bonds in excess of Rs. 20,000, the aforestated tax benefit shall be available to such Applicant only to the extent of Rs. 20,000.

Eligible investors can apply for up to any amount of the Bonds across any of the Series(s) or a combination thereof. The investors will be allotted the total number of Bonds applied for in accordance with the Basis of Allotment.

2. FORM

a) The allotment of the Bonds shall be made in physical and dematerialized form both. The Company has made depository arrangements with National Securities Depository Limited ("NSDL") and Central Depository Services (India) Limited ("CDSL", and together with NSDL, the "Depositories") for issue of the Bonds in a dematerialized form. The Company shall take necessary steps to credit the Depository Participant account of the Applicants with the number of Bonds allotted.

b) In case of Bonds that are rematerialized and held in physical form, the Company will issue one certificate to the Bond holder for the aggregate amount of the Bonds that are rematerialized and held by such Bond holder (each such certificate a "Consolidated Bond Certificate"). In respect of the Consolidated Bond Certificate(s), the Company will, upon receipt of a request from the Bond holder within 30 days of such request, split such Consolidated Bond Certificates into smaller denominations, subject to a minimum denomination of one Bond. No fees will be charged for splitting any Consolidated Bond Certificates but, stamp duty, if payable, will be paid by the Bond holder. The request to split a Consolidated Bond Certificate shall be accompanied by the original Consolidated Bond Certificate which will, upon issuance of the split Consolidated Bond Certificates, be cancelled by the Company.

3. FACE VALUE

The face value of each Bond is Rs. 5,000/-.

4. TITLE

In case of:

1. Bonds held in the dematerialized form, the person for the time being appearing in the register

of beneficial owners maintained by the Depository; and

2. the Bond held in physical form, the person for the time being appearing in the Register of

bondholders (as defined below) as Bond holder,

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

shall be treated for all purposes by the Company, the Bond Trustee, the Depositories and all other

persons dealing with such person as the holder thereof and its absolute owner for all purposes

whether or not it is overdue and regardless of any notice of ownership, trust or any interest in it or

any writing on, theft or loss of the Consolidated Bond Certificate issued in respect of the Bonds

and no person will be liable for so treating the Bond holder.

No transfer of title of a Bond will be valid unless and until entered on the Register of Bond holders

or the register of beneficial owners maintained by the Depository prior to the Record Date. In the

absence of transfer being registered, interest, Buyback Amount and/or Maturity Amount, as the

case may be, will be paid to the person, whose name appears first in the Register of Bond holders

maintained by the Depositories and/or the Company and/or the Registrar, as the case may be. In

such cases, claims, if any, by the purchasers of the Bonds will need to be settled with the seller of

the Bonds and not with the Company or the Registrar. The provisions relating to transfer and

transmission and other related matters in respect of the Company's shares contained in the Articles

of Association of the Company and the Companies Act shall apply, mutatis mutandis (to the

extent applicable) to the Bond (s) as well.

5. LISTING

The Bonds are proposed to be listed on NSE.

6. NOMINATION

In accordance with Section 109A of Companies Act, 1956, the sole Bond holder or first bondholder, along with other joint bondholders [being individual(s)] may nominate any one person (being an individual) who, in the event of death of sole holder or all the joint holders, as the case may be, shall become entitled to the Bond(s). Nominee shall be entitled to the same rights to which he will be entitled if he were the registered holder of the Bond(s). Where nominee is a minor, the Bondholders may make a nomination to appoint any person to become entitled to the Bond(s), in the event of their death, during the minority. A buyer will be entitled to make a fresh nomination in the manner prescribed. When the Bond is held by two or more person, the nominee shall become entitled to receive the amount only on the demise of all the Bond holders. The Bond holders are advised to provide the specimen signature of the nominee to the company to expedite the transmission of Bond(s) to the nominee in the event of demise of Bond holders. In dematerialized mode, there is no need to make a separate nomination with the Company.

7. TRANSFER OF BONDs

a) Register of Bondholders: The Company shall maintain at its registered office or such other place as permitted by law a register of Bondholders (the "Register of Bondholders") containing such particulars as required by Section 152 of the Companies Act. In terms of Section 152A of the Companies Act, the Register of Bondholders maintained by a Depository for any Bond in dematerialized form under Section 11 of the Depositories Act shall be deemed to be a Register of Bondholders for this purpose.

b) Lock in Period: In accordance with the Notification, the Bondholders shall not sell or transfer the Bonds in any manner for a period of 5 years from the Deemed Date of Allotment (the "Lock-in Period"). The Bondholders may sell or transfer the Bonds after the expiry of the Lock-in Period on the stock exchange where the Bonds are listed. These Bonds can also be pledged, hypothecated or given on lien for obtaining loans from Scheduled Commercial Banks after the lock-in period of five years.

c) Transmission of Bonds: However, transmission of the Bonds to the legal heirs in case of death of the Bondholder / Beneficiary to the Bonds is allowed.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

d) Transfer of Bonds held in dematerialized form: In respect of Bonds held in the dematerialized form, transfers of the Bonds may be effected only through the Depository(ies) where such Bonds are held, in accordance with the provisions of the Depositories Act, 1996 and/or rules as notified by the Depositories from time to time. The Bondholder shall give delivery instructions containing details of the prospective purchaser's Depository Participant's account to his Depository Participant. If a prospective purchaser does not have a Depository Participant account, the Bondholder may rematerialize his or her Bonds and transfer them in a manner as specified below.

The transferee(s) should ensure that the transfer formalities are completed prior to the Record Date. If a request for transfer of the Bond is not received by the Registrar before the Record Date for maturity, the Maturity Amount for the Bonds shall be paid to the person whose name appears as a Bondholder in the Register of Bondholders. In such cases, any claims shall be settled inter se between the parties and no claim or action shall be brought against the Company.

e) Succession: In the event of demise of the holder(s) of the Bonds, PFS will recognise the executor or administrator of deceased bondholder, being an individual / HUF, or the holder of the succession certificate or other legal representative, being an individual / HUF as having title to the Bonds. PFS shall not be bound to recognise such executor, administrator, or holder of succession certificate, unless such executor or administrators obtains probate or letter of administration or such holder is the holder of succession certificate or other legal representation, as the case may be, from a Court of India having jurisdiction over the matter. PFS may at its absolute discretion, where it thinks fit, dispense with production of probate or letter of administration or succession certificate or other legal representation, in order to recognise such holder, being an individual / HUF as being entitled to the Bonds standing in the name of the deceased bond holder(s) on production of documentary proof or indemnity. All requests for registration of transmission along with requisite documents should be sent to the Registrars.

8. DEEMED DATE OF ALLOTMENT

The Deemed Date of Allotment shall be March 25, 2011. All benefits under the Bond including

payment of interest will accrue to the Bondholders from the Deemed Date of Allotment.

9. SUBSCRIPTION

Issue opens on February 09, 2011

Issue closes on *March 15, 2011

* Issue date may be change at sole discretion of Company.

10. INTEREST

a) Annual Payment of Interest: For Option I (subject to buyback, as applicable) & Option

III Bonds, interest will be paid annually commencing from the Deemed Date of Allotment

and on the equivalent date falling every year thereafter.

b) Cumulative Payment of Interest: Interest on Option II & IV Bonds shall be

compounded annually commencing from the Deemed Date of Allotment and shall be

payable on the Maturity Date or the Buyback Date, as the case may be.

c) Day Count Convention: Interest shall be computed on a 365 days-a-year basis on the

principal outstanding on the Bonds. However, where the interest period (start date to end

date) includes February 29, interest shall be computed on 366 days-a-year basis, on the

principal outstanding on the Bonds.

d) Interest on Application and Refund Money: The Company shall not pay any interest on

refund of Application Amount, in whole or part. However, interest on Application Money,

to the extent of allotment of bonds, shall be paid on first interest payment date (i.e. 25

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

March 2012 for all options), from the date of credit of this money to the bank account of

PFS to the date immediately preceding the deemed date of allotment at the respective

coupon rates.

11. REFUND

In case of rejection of the application on account of technical grounds or receipt of application

after the closure of the issue, refund without interest will be made within a period of 30 days from

the deemed date of allotment of the bonds.

12. REDEMPTION

Unless previously redeemed as per the terms of the Bond, the Company shall redeem the Bonds

on the Maturity Date i.e. March 25, 2021 PFS’s liability to Bondholder(s) towards all their rights

including payment of face value shall cease and stand extinguished up on redemption of the

Bonds Series 1 in all events. Further PFS will not be liable to pay any interest, income or

compensation of any kind after the date of such Redemption of the Bonds(s).

Bonds held in electronic form: No action is required on the part of Bondholders at the time of maturity of the Bonds. On the redemption date, redemption proceeds would be paid by NECS/At Par Cheque/Demand Drafts to those Bondholders, whose names appear on the list of beneficial owners given by the depository to PFS. These names would be as per the depository’s record on the record date/book closure date fixed for the purpose of redemption. These Bonds will be simultaneously extinguished.

Bonds held in physical form: No action will ordinarily be required on the part of the Bondholder at the time of redemption and the maturity amount will be paid to those Bondholders whose names appear in the Register of Bondholders maintained by the Company or Registrar on the Record Date fixed for the purpose of redemption. However, the Company may require that the Consolidated Bond Certificate(s), duly discharged by the sole holder or all the joint-holders (signed on the reverse of the Consolidated Bond Certificate(s) to be surrendered for redemption on Maturity Date and sent by registered post with acknowledgment due or by hand delivery to the Registrar or Company or to such persons at such addresses as may be notified by the Company from time to time. Bondholders shall have to surrender the Consolidated Bond Certificate(s) in the manner as stated above, not more than three months and not less than two months prior to the Maturity Date so as to facilitate timely payment. In case of transmission applications pending on the record date, the redemption proceeds will be issued to the legal heirs after the confirmation of the adequacy and correctness of the documentation submitted with such application till such time, the redemption proceeds will be kept in abeyance.

13. INTERIM EXIT ROUTES

These Bonds shall be listed at NSE. The investors shall have the right to exit through the secondary market, but only after completion of the lock-in period of five years from the date of allotment. In respect of the Bonds having buyback facility, the investors can exit either through secondary market or through buyback route.

14. BUYBACK OF BONDS

In respect of Bonds with buyback option, exit facility shall be available at the end of 5th, 6th,7th, 8th and 9th year. The investors, who opt and are allotted Bonds with buyback facility and wish to exit

through this facility shall have to apply for buy back by writing to the Company (‘Early

Redemption Notice for PFS Long Term Infrastructure Bond Series 1”) of his/her intention to redeem all the Bonds held by him/her under the buyback option. Such early Redemption Notice from the Bondholder should reach the Registrar or the Company between January 1 to January 31, starting from year 2016 to year 2020 (‘Early Redemption Date’) for redeeming the Bonds in that particular financial year. The Bonds will be redeemed on March 25 of the same financial year. Partial buyback of the bonds held under the buyback option shall not be permissible.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

Bonds held in dematerialized form

The Company or the Registrar upon receipt of the notice from the Bondholders would undertake appropriate corporate action to effect the buyback. The bank details will be obtained from the Depositories for payments. Investors who have applied or who are holding the Bonds in electronic form, are advised to immediately update their bank account details as appearing on the records of Depository Participant. Failure to do so could result in delays in credit of the payments to investors at their sole risk and neither the Arrangers nor the Company shall have any responsibility and undertake any liability for such delays on part of the investors

Bonds held in physical form

On receipt of the notice from the investor for exercise of buy back option, no action would ordinarily be required on the part of the Bondholder on the Buyback Date and the Buyback Amount would be paid to those Bondholders whose names appear first in the Register of Bondholders. However, the Company may require the Bondholder to duly surrender the Consolidated Bond Certificate to the Company/Registrar for the buyback. While exercising the buyback option, Bondholder are required to furnish any change of address or bank details etc. Upon payment of the Buyback Amounts, the Bonds shall be deemed to have been repaid to the Bondholders and all other rights of the Bondholders shall terminate and no interest shall accrue on such Bonds thereafter. Subject to the provisions of the Companies Act, where the Company has bought back any Bond(s) under the Buyback Facility, the Company shall have and shall be deemed always to have had the right to keep such Bonds alive without extinguishment for the purpose of resale and in exercising such right, the Company shall have and be deemed always to have had the power to resell such Bonds.

15. PAYMENT OF INTEREST/ REDEMPTION/BUYBACK AMOUNT

Payment of Interest Payment of interest on the Bonds will be made to those holders of the Bonds, whose name appears first in the Register of Bondholders maintained by the Depositories and/or the Company and/or the Registrar, as the case may be, as on the Record Date.

Record Date The record date for the payment of interest or the Buyback Amount or the Maturity Amount shall be 3 days prior to the date on which such amount is due and payable ("Record date").

Effect of holidays on payment

If the date of payment of interest or principal or any date specified does not fall on a Working Day, then the succeeding Working Day will be considered as the effective date. Interest and principal or other amounts, if any, will be paid on the succeeding Working Day. Payment of interest will be subject to the deduction of tax as per Income Tax Act or any statutory modification or re-enactment thereof for the time being in force. In case the Maturity Date falls on a holiday, the payment will be made on the next Working Day, without any interest for the period overdue.

Payment on Redemption or Buyback

Bonds held in electronic form On the Maturity Date or the Buyback Date as the case may be, the Maturity Amount or the Buyback Amount as the case may be, will be paid as per the Depositories' records on the Record Date fixed for this purpose. No action is required on the part of Bondholders. The bank details will be obtained from the Depositories for payments. Investors who have applied or who are holding the Bond in electronic form are advised to immediately update their bank account details as appearing on the records of Depository Participant. Failure to do so could result in delays in

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

credit of the payments to investors at their sole risk and neither the Lead Arrangers nor the Company shall have any responsibility and undertake any liability for such delays on part of the investors.

Bonds held in physical form Payments with respect to maturity or buyback of Bonds will be made by way of cheques or pay orders or electronically. The bank details will be obtained from the Registrar for effecting payments. However, if the Company so requires, payments on maturity may be made on surrender of the Consolidated Bond Certificate(s). Dispatch of cheques or pay orders in respect of payments with respect to redemptions will be made on the Maturity Date or Buyback Date within a period of 30 days from the date of receipt of the duly discharged Consolidated Bond Certificate, if required by the Company.

The Company's liability to the Bondholders including for payment or otherwise shall stand extinguished from the Maturity Date or upon dispatch of the Maturity Amounts to the Bondholders.

Further, the Company will not be liable to pay any interest, income or compensation of any kind from the Maturity Date.

Mode of Payment All payments to be made by the Company to the Bondholders shall be by cheques or demand drafts or through National Electronic Clearing System ("NECS")

16. TAXATION

The interest on Bonds will be subject to deduction of tax at source at the rates prevailing from time to time under the provisions of the Income Tax Act or any statutory modification or re-enactment thereof. As per the current provisions of the Income Tax Act, on payment to all categories of resident Bondholders, tax will not be deducted at source from interest on Bonds, if such interest does not exceed Rs. 2,500 in a financial year.

As per clause (ix) of Section 193 of the Income Tax Act, no income tax is required to be withheld on any interest payable on any security issued by a company, where such security is in dematerialized form and is listed on a recognized stock exchange in India in accordance with the Securities Contracts Regulation Act, 1956, as amended, and the rules notified there under. Accordingly, no income tax will be deducted at source from the interest on Bonds held in dematerialized form. In case of Bonds held in a physical form no tax may be withheld in case the interest does not exceed Rs. 2,500. However, such interest is taxable income in the hands of resident Bondholders.

If interest on Bonds exceeds the prescribed limit of Rs. 2,500 in case of resident individual Bondholders, to ensure non-deduction or lower deduction of tax at source, as the case may be, the Bondholders are required to furnish either (a) a declaration (in duplicate) in the prescribed form i.e. Form 15G which may be given by all Bondholders other than companies, firms and non-residents subject to provisions of section 197A of the Income Tax Act; or (b) a certificate, from the assessing officer of the Bondholder, in the prescribed form under section 197 of the Income Tax Act which may be obtained by the Bondholders. Senior citizens, who are 65 or more years of age at any time during the financial year, can submit a self-declaration in the prescribed Form 15H for non-deduction of tax at source in accordance with the provisions of section 197A even if the aggregate income credited or paid or likely to be credited or paid exceeds the maximum limit for the financial year. These certificates may be submitted to the Company or to such person at such address as may be notified by us from time to time, quoting the name of the sole or first Bondholder, Bondholder number and the distinctive number(s) of the Bond(s) held, at least one month prior to the interest payment date.

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

Tax exemption certificate or document, if any, must be lodged at the office of the Registrar prior to the Record Date or as specifically required. Tax applicable on coupon will be deducted at source on accrual thereof in the Company's books and / or on payment thereof, in accordance with the provisions of the Income Tax Act and / or any other statutory modification, re-enactment or notification as the case may be. A tax deduction certificate will be issued for the amount of tax so deducted on annual basis.

17. RIGHTS OF BONDHOLDERS The Bonds shall not confer upon the holders thereof any rights or privileges including the right to receive notices or annual reports of, or to attend and/or vote, at a General Meeting of PFS. If any proposal affecting the rights attached to the Bonds is considered by PFS, the said proposal will first be placed before the registered Bondholders or Trustees for their consideration. The Bonds comprising the present Private Placement shall rank pari passu inter se without any preference to or priority of one over the other or others over them and shall also be subject to the other terms and conditions to be incorporated in the Agreement / Trust Deed(s) to be entered into by PFS with the Trustees and the Letters of Allotment/Bond Certificates that will be issued. A register of Bondholders will be maintained and sums becoming due and payable in respect of the Bonds will be paid to the Registered Holder thereof. The Bonds are subject to the provisions of the Act and the terms of this Information Memorandum. Over and above such terms and conditions, the Bonds shall also be subject to other terms and conditions as may be incorporated in the Agreement/Bond Trust Deed/Letters of Allotments/Bond Certificates, guidelines, notifications and regulations relating to the issue of capital and listing of securities issued from time to time by the Government of India and/or other authorities and other documents that may be executed in respect of the Bonds.

18. MODIFICATION OF RIGHTS The rights, privileges and conditions attached to the Bonds may be varied, modified and / or abrogated with the consent in writing of the holders of at least three-fourths of the outstanding amount of the Bonds or with the sanction of the Trustees, provided that nothing in such consent or sanction shall be operative against PFS, where such consent or sanction modifies or varies the terms and conditions governing the Bonds, if the same are not acceptable to PFS.

19. NOTICES

The communications to the Bondholder(s) required to be sent by PFS or the Trustees shall be deemed to have been given if sent by an ordinary post to the registered holder of the Bonds. All communications to be given by the Bondholder(s) shall be sent by registered post or by hand delivery to the Registrar and Transfer Agents or to PFS or to such person, at such addresses as may be notified by PFS from time to time.

20. MISCELLANEOUS

Loan against Bonds

The Bonds cannot be pledged or hypothecated for obtaining loans from scheduled commercial banks during the Lock-in Period of five years.

Lien

The Company shall have the right of set-off and lien, present as well as future on the moneys due and payable to the Bondholder, whether in single name or joint name, to the extent of all outstanding dues by the Bondholder to the Company.

Lien on Pledge of Bonds

The Company, at its discretion, may note a lien on pledge of Bonds if such pledge of Bond is accepted by any bank or institution for any loan provided to the Bondholder against pledge of

PFS Tax Saving Long Term Infrastructure Bonds Series 1: Information Memorandum

such Bonds as part of the funding after completion of lock-in period of five years as notified time to time.

Right to Reissue Bond(s)

Subject to the provisions of the Act, where the Company has redeemed or repurchased any Bond(s), the Company shall have and shall be deemed always to have had the right to keep such Bonds alive without extinguishment for the purpose of resale or reissue and in exercising such right, the Company shall have and be deemed always to have had the power to resell or reissue such Bonds either by reselling or reissuing the same Bonds or by issuing other Bonds in their place. This includes the right to reissue original Bonds.

Joint-holders

Where two or more persons are holders of any Bond (s), they shall be deemed to hold the same as joint holders with benefits of survivorship subject to Articles and applicable law.

Sharing of Information

The Company may, at its option, use its own, as well as exchange, share or part with any financial or other information about the Bondholders available with the Company, its subsidiaries and affiliates and other banks, financial institutions, credit bureaus, agencies, statutory bodies, as may be required and neither the Company nor its subsidiaries and affiliates nor their agents shall be liable for use of the aforesaid information.

Issue of Duplicate Consolidated Bond Certificate(s)

If any Consolidated Bond Certificate is mutilated or defaced it may be replaced by the Company against the surrender of such Consolidated Bond Certificates, provided that where the Consolidated Bond Certificates are mutilated or defaced, they will be replaced only if the certificate numbers and the distinctive numbers are legible.

If any Consolidated Bond Certificate is destroyed, stolen or lost then upon production of proof thereof to the RTA/Company’s satisfaction and upon furnishing such indemnity/security and/or documents as we may deem adequate, duplicate Consolidated Bond Certificate(s) shall be issued.

Jurisdiction