Payback Time Spreadsheet ANS

-

Upload

jay-galvan -

Category

Documents

-

view

18 -

download

0

description

Transcript of Payback Time Spreadsheet ANS

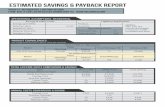

I.

Calculating Growth RatesCalculate Compounded Annual Growth Rate for EPS, OCPS, Sales, and Book Value per Share

Earnings Per Share (EPS) = Found on the Income Statement, EPS is the amount of the company's earnings allocated to each share of common stock.

Operating Cash Flow Per Share (OCPS) = Found on the Cash Flow Statement, OCPS is the amount of cash from operations allocated to each share of common stock.

Sales = Found on the Income Statement, Sales is simply the company's total annual sales.

Book Value Per Share = Found on the Balance Sheet Book, Value Per Share is the value of Common Shareholder's Equity / Total Outstanding Shares .

Item Age Initial Value Current Value Rate

EPS 4 0.21$ 0.74$ 37%

OCPS 4 964.40$ 266.00$ -28%

Sales 4 1,225.00$ 2,808.00$ 23%

BVPS 4 4.85$ 8.69$ 16%

II.

Calculating Return on Equity (ROE) and Return on Invested Capital (ROIC)

Return on Invested Capital (ROIC) = ROIC is NOPAT / Debt + Equity and the return achieved on all invested capital.

Return on Equity (ROE) = ROE is Net Income / Shareholder's Equity and the return achieved on sharholder's ownership.

NOPAT 996$ Net Operating Profit After Taxes is on the Income Statement.

Long Term Debt 119$ Long Term Debt is found on the Balance Sheet.

Equity 11,292$ Shareholder's Equity is found on the Balance Sheet.

ROIC 9%

Net Income $995 Net Income is found on the Income Statement.

Equity $11,292 Shareholder's Equity is found on the Balance Sheet.

ROE 9%

III.

Long Term Debt $119 Long Term Debt is found on the Balance Sheet.

Net Income $995 Net Income is found on the Income Statement.

Debt to Earnings (Yrs) 0.12

IV.

Sticker and MOS PriceCalculating the Sticker and Margin of Safety (MOS) Price

EPSTTM $1.03 EPSTTM is found on the Income Statement and is the EPS for the last 12 months.

Earnings Growth Rate 16% Determine at what rate you think earnings for this company will grow year after year.

Future P/E Multiplier 10 Enter an estimate of the future (P/E) using one of the appropriate methods.

MARR 15% Determine your Minimum Acceptable Rate of Return.

MOS % 25% Determine your Margin of Safety. Novice investors use 50%.

EPSTTM Future EPS Future Retail Value Sticker Price MOS Price

$1.03 $4.54 $45.44 $11.23 $8.42

V.

Calculating the PayBack Time Price

PBT Years PBT Price

Default 8 $17.01

User Defined 5 $8.22

PayBack Time Analysis

Return on Invested Capital (ROIC)

Return on Equity (ROE)

Debt Analysis

Debt to Earnings Ratio

Pay Back Time

Moat Analysis

Management Analysis

ROE and ROIC

PBT Analysis

Business Valuation

Companies that have been able to sustain compounded annual growth rates of over 10% per year in EPS, OCPS, Sales, and BVPS are considered to have a durable moat. The competitive Moat keeps competition at bay and allows these companies to grow at above average rates. Looking at the Growth Rates you have calculated, does this company have a Moat? Are all these growth rates similar? Reliable companies are ones where EPS, OPS, Sales, and BVPS, all grow at a similar rate.

Companies that have high a high ROIC are one's that efficiently use the capital that they have raised in order to grow the business. Look at the ROIC of a company over time. Is it stable or increasing? If ROIC is greater than 10% over time it demonstrates the effectiveness of the management team and their ability to run and grow the firm.

ROE is the return that shareholders are recieving on their invested capital. (Shareholder's Equity). Shareholders expect ROE to be stable or increasing. Companies that have a ROE of greater than 10% over time, demonstrate the effectiveness of management in increasing the value of shareholders equity. Be aware of companies that have a high ROE but low growth rates. This can mean that management is artificially supporting ROE, which is commonly used as a measure of management quality .

The Debt to Earnings Ratio demonstrates the amount of years it would take the company to pay off its current Long Term Debt if it used the current level of earnings. Companies that have a Debt to Earnings Ratio of less than 3 years are considered stable because they do not have a large amount of interest expense or debt to service. Companies with Zero debt are considered less risky because they have the ability to raise debt capital should it be necessary to avoid unforseen market or business issues. Analysts should look at both the Debt to Earnings Ratio and the level of Debt over time to see if it has increased or decreased .

The parameters that are used for calculating the Sticker and MOS price comes from your analysis of MOAT and Management and are a function of your expectations of future growth. Determine the EPSTTM by loking at the most current EPS or to be more conservative, use an average for the past few years. The earnings growth rate should be in line with the Compounded Annual Growth Rates that were calculated for EPS, OCPS, Sales, and BVPS. Since BVPS is the hardest to manipulate, start with the ten-year growth rate in Book Value. For comparison, look at the analyst's forecast. Make sure your future P/E multiplier is in line with what this particular business has sold for in the past.

Using Earnings pe Share (EPS) growing at the Earnings Growth Rate (EGR), the PayBack Time Price (PBT Price) is the amount one can pay for a particular business to potentially recoup their initial investment within 8 years using the earnings of the company.

At left you can see both the PBT price for 8 years and the PBT Price for a user defined number of years. Change the number of years in the box labeled user defined to see the PayBack Time Price for holding periods from 1 to 10 years.