PAN-AO-Non-International-Taxation-29032011

-

Upload

supratimsahu -

Category

Documents

-

view

198 -

download

4

Transcript of PAN-AO-Non-International-Taxation-29032011

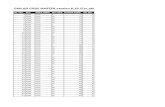

PAN AO CODE MASTER version 5.5 (For other than Mumbai Locations)

SR. NO. RCC AREA CODE AO TYPE RANGE CODE AO NO.1 AGR KNP C 75 12 AGR KNP W 75 13 AGR KNP W 75 24 AGR KNP W 75 35 AGR KNP W 75 56 AGR KNP C 76 17 AGR KNP W 76 18 AGR KNP W 76 29 AGR KNP W 76 3

10 AGR KNP W 76 411 AGR KNP C 77 112 AGR KNP W 77 113 AGR KNP W 77 214 AGR KNP W 77 315 AGR KNP W 77 416 AGR KNP C 80 117 AGR KNP W 80 118 AGR KNP W 80 219 AGR KNP W 80 320 AGR KNP W 80 421 AGR KNP C 81 122 AGR KNP W 81 123 AGR KNP W 81 224 AGR KNP W 81 325 AGR KNP W 81 526 AGR KNP C 82 127 AGR KNP W 82 128 AGR KNP W 82 229 AGR KNP W 82 330 AGR KNP W 82 431 AGR KNP C 85 132 AGR KNP W 85 133 AGR KNP W 85 234 AGR KNP W 85 335 AGR KNP W 85 436 AGR KNP C 86 137 AGR KNP W 86 138 AGR KNP W 86 239 AGR KNP W 86 340 AGR KNP W 86 441 AGR KNP W 87 1

42 AGR KNP C 87 143 AGR KNP W 87 244 AGR KNP W 87 345 AGR KNP W 87 446 AHM DLC CC 61 147 AHM DLC CC 61 248 AHM DLC CC 61 349 AHM DLC CC 61 450 AHM DLC CC 62 151 AHM DLC CC 62 252 AHM DLC CC 62 353 AHM DLC CC 62 454 AHM DLC CC 62 655 AHM DLC CA 107 156 AHM DLC CA 107 257 AHM DLC CA 109 158 AHM DLC WX 109 259 AHM DLC CA 109 360 AHM DLC CA 109 461 AHM DLC CA 109 562 AHM DLC CA 109 663 AHM GUJ C 101 164 AHM GUJ W 101 165 AHM GUJ C 101 266 AHM GUJ W 101 267 AHM GUJ W 101 368 AHM GUJ W 101 469 AHM GUJ W 102 170 AHM GUJ C 102 171 AHM GUJ W 102 272 AHM GUJ W 102 373 AHM GUJ W 102 474 AHM GUJ W 103 175 AHM GUJ C 103 176 AHM GUJ W 103 277 AHM GUJ W 103 378 AHM GUJ W 103 479 AHM GUJ W 104 180 AHM GUJ C 104 181 AHM GUJ C 104 282 AHM GUJ W 104 283 AHM GUJ W 104 384 AHM GUJ W 104 485 AHM GUJ W 105 1

86 AHM GUJ C 105 187 AHM GUJ W 105 288 AHM GUJ W 105 389 AHM GUJ W 105 490 AHM GUJ W 105 591 AHM GUJ W 106 192 AHM GUJ C 106 193 AHM GUJ W 106 294 AHM GUJ W 106 395 AHM GUJ W 106 496 AHM GUJ W 106 597 AHM GUJ W 107 198 AHM GUJ C 107 199 AHM GUJ W 107 2

100 AHM GUJ W 107 3101 AHM GUJ W 107 4102 AHM GUJ W 108 1103 AHM GUJ C 108 1104 AHM GUJ W 108 2105 AHM GUJ C 108 2106 AHM GUJ W 108 3107 AHM GUJ W 108 4108 AHM GUJ W 108 5109 AHM GUJ W 109 1110 AHM GUJ C 109 1111 AHM GUJ W 109 2112 AHM GUJ C 109 2113 AHM GUJ W 109 3114 AHM GUJ W 109 4115 AHM GUJ W 110 1116 AHM GUJ C 110 1117 AHM GUJ C 110 2118 AHM GUJ W 110 2119 AHM GUJ W 110 3120 AHM GUJ W 110 4121 AHM GUJ W 111 1122 AHM GUJ C 111 1123 AHM GUJ W 111 2124 AHM GUJ W 111 3125 AHM GUJ W 111 4126 AHM GUJ C 112 1127 AHM GUJ W 112 1128 AHM GUJ W 112 2129 AHM GUJ W 112 3130 AHM GUJ W 112 4

131 AHM GUJ W 113 1132 AHM GUJ C 113 1133 AHM GUJ W 113 2134 AHM GUJ W 113 3135 AHM GUJ W 113 4136 AHM GUJ C 114 1137 AHM GUJ W 114 1138 AHM GUJ W 114 2139 AHM GUJ W 114 3140 AHM GUJ W 114 4141 AHM GUJ W 115 1142 AHM GUJ C 115 1143 AHM GUJ W 115 2144 AHM GUJ W 115 3145 AHM GUJ W 115 4146 AHM GUJ C 116 1147 AHM GUJ W 116 1148 AHM GUJ W 116 2149 AHM GUJ W 116 3150 AHM GUJ W 116 5151 AHM GUJ W 118 1152 AHM GUJ C 118 1153 AHM GUJ W 118 2154 AHM GUJ W 118 3155 AHM GUJ W 118 4156 AHM GUJ C 119 1157 AHM GUJ W 119 1158 AHM GUJ W 119 2159 AHM GUJ W 119 3160 AHM GUJ W 119 4161 AHM GUJ W 120 1162 AHM GUJ C 120 1163 AHM GUJ W 120 2164 AHM GUJ W 120 3165 AHM GUJ W 120 4166 AHM GUJ W 121 1167 AHM GUJ C 121 1168 AHM GUJ W 121 2169 AHM GUJ W 121 3170 AHM GUJ W 121 4171 AHM GUJ C 122 1172 AHM GUJ W 122 1173 AHM GUJ W 122 2174 AHM GUJ W 122 3175 AHM GUJ W 122 4

176 AHM GUJ C 123 1177 AHM GUJ W 123 1178 AHM GUJ W 123 2179 AHM GUJ C 123 2180 AHM GUJ W 123 3181 AHM GUJ W 123 4182 AHM GUJ C 124 1183 AHM GUJ W 124 1184 AHM GUJ W 124 2185 AHM GUJ W 124 3186 AHM GUJ W 124 4187 AHM GUJ W 125 1188 AHM GUJ C 125 1189 AHM GUJ C 991 99190 ALD DLC CC 120 1191 ALD DLC CC 120 2192 ALD DLC CC 120 3193 ALD LKN C 20 1194 ALD LKN W 20 1195 ALD LKN C 20 2196 ALD LKN W 20 2197 ALD LKN W 20 3198 ALD LKN W 20 4199 ALD LKN W 21 1200 ALD LKN C 21 1201 ALD LKN W 21 2202 ALD LKN C 21 2203 ALD LKN W 21 3204 ALD LKN W 21 4205 ALD LKN C 22 1206 ALD LKN W 22 1207 ALD LKN C 22 2208 ALD LKN W 22 2209 ALD LKN W 22 3210 ALD LKN W 22 4211 ALD LKN C 23 1212 ALD LKN W 23 1213 ALD LKN W 23 2214 ALD LKN C 23 2215 ALD LKN W 23 3216 ALD LKN W 23 4217 ALD LKN C 24 1218 ALD LKN W 24 1219 ALD LKN W 24 2220 ALD LKN C 24 2

221 ALD LKN W 24 3222 ALD LKN W 24 4223 ALD LKN C 25 1224 ALD LKN W 25 1225 ALD LKN W 25 2226 ALD LKN C 25 2227 ALD LKN W 25 3228 ALD LKN W 25 4229 ALD LKN C 26 1230 ALD LKN W 26 1231 ALD LKN C 26 2232 ALD LKN W 26 2233 ALD LKN W 26 3234 ALD LKN W 26 4235 ALD LKN C 27 1236 ALD LKN W 27 1237 ALD LKN C 27 2238 ALD LKN W 27 2239 ALD LKN W 27 3240 ALD LKN W 27 4241 ALD LKN C 28 1242 ALD LKN W 28 1243 ALD LKN W 28 2244 ALD LKN C 28 2245 ALD LKN W 28 3246 ALD LKN W 28 4247 ALD LKN C 992 99

248 AMR NWR C 80 1

249 AMR NWR W 80 1

250 AMR NWR W 80 2

251 AMR NWR W 80 3

252 AMR NWR W 80 4

253 AMR NWR C 81 1

254 AMR NWR W 81 1

255 AMR NWR W 81 2

256 AMR NWR W 81 3

257 AMR NWR W 81 4

258 AMR NWR C 82 1

259 AMR NWR W 82 1

260 AMR NWR W 82 2

261 AMR NWR W 82 3

262 AMR NWR W 82 4

263 AMR NWR C 83 1

264 AMR NWR W 83 1

265 AMR NWR W 83 2

266 AMR NWR W 83 3

267 AMR NWR W 83 4

268 AMR NWR W 84 1269 AMR NWR C 84 1

270 AMR NWR W 84 2

271 AMR NWR W 84 3

272 AMR NWR W 84 4

273 AMR NWR W 85 1274 AMR NWR C 85 1

275 AMR NWR W 85 2

276 AMR NWR W 85 3

277 AMR NWR W 85 4

278 AMR NWR W 86 1279 AMR NWR C 86 1

280 AMR NWR W 86 2

281 AMR NWR W 86 3282 AMR NWR W 86 4

283 AMR NWR W 87 1284 AMR NWR C 87 1

285 AMR NWR W 87 2

286 AMR NWR W 87 3287 AMR NWR W 87 4

288 AMR NWR W 88 1289 AMR NWR C 88 1

290 AMR NWR W 88 2

291 AMR NWR W 88 3

292 AMR NWR W 88 4

293 AMR NWR W 89 1294 AMR NWR C 89 1

295 AMR NWR W 89 2

296 AMR NWR W 89 3297 AMR NWR W 89 4

298 AMR NWR W 90 1299 AMR NWR C 90 1300 AMR NWR W 90 2

301 AMR NWR W 90 3

302 AMR NWR W 90 4

303 AMR NWR W 91 1304 AMR NWR C 91 1

305 AMR NWR W 91 2

306 AMR NWR W 91 3

307 AMR NWR W 91 4308 AMR NWR C 994 99309 BBN BBN W 1 1310 BBN BBN W 1 2311 BBN BBN W 1 3312 BBN BBN W 1 4313 BBN BBN W 1 5314 BBN BBN W 1 6315 BBN BBN C 1 8316 BBN BBN C 1 9317 BBN BBN W 2 1318 BBN BBN W 2 2319 BBN BBN W 2 3320 BBN BBN W 2 4321 BBN BBN W 2 5322 BBN BBN W 2 6323 BBN BBN C 2 8324 BBN BBN C 2 9325 BBN BBN C 2 10326 BBN BBN W 3 1327 BBN BBN W 3 2328 BBN BBN W 3 3329 BBN BBN W 3 4330 BBN BBN W 3 5331 BBN BBN W 3 6332 BBN BBN W 3 7333 BBN BBN C 3 8334 BBN BBN W 4 1335 BBN BBN W 4 2336 BBN BBN W 4 6337 BBN BBN W 4 7338 BBN BBN C 4 8339 BBN BBN C 4 10340 BBN BBN W 5 1341 BBN BBN W 5 2342 BBN BBN W 5 5343 BBN BBN W 5 6344 BBN BBN C 5 8345 BBN BBN C 5 10346 BBN BBN W 6 3347 BBN BBN W 6 4348 BBN BBN W 6 5349 BBN BBN W 6 6350 BBN BBN W 6 7

351 BBN BBN C 6 8352 BBN BBN W 7 1353 BBN BBN W 7 2354 BBN BBN W 7 3355 BBN BBN W 7 4356 BBN BBN C 7 7357 BBN BBN C 7 8358 BBN BBN W 8 1359 BBN BBN W 8 2360 BBN BBN W 8 3361 BBN BBN W 8 4362 BBN BBN C 8 8363 BBN BBN W 9 1364 BBN BBN W 9 2365 BBN BBN W 9 3366 BBN BBN W 9 4367 BBN BBN W 9 5368 BBN BBN C 9 8369 BBN BBN C 991 99370 BLR DLC CC 68 1371 BLR DLC CC 68 2372 BLR DLC CC 68 3373 BLR DLC CC 68 4374 BLR DLC CC 69 1375 BLR DLC CC 69 2376 BLR DLC CC 69 3377 BLR DLC CC 69 4378 BLR DLC CC 70 1379 BLR DLC CC 70 2380 BLR DLC CC 70 3381 BLR DLC CC 70 4

382 BLR DLC CA 502 1383 BLR DLC WX 502 1

384 BLR DLC CA 502 2385 BLR DLC WX 502 2

386 BLR DLC WX 502 3387 BLR KAR W 1 1

388 BLR KAR C 111 1

389 BLR KAR W 111 1

390 BLR KAR W 111 2

391 BLR KAR W 111 3

392 BLR KAR W 111 4

393 BLR KAR C 112 1

394 BLR KAR W 112 1

395 BLR KAR W 112 2

396 BLR KAR W 112 3

397 BLR KAR W 112 4

398 BLR KAR C 113 1

399 BLR KAR W 113 1

400 BLR KAR C 113 2

401 BLR KAR W 113 2

402 BLR KAR C 113 3

403 BLR KAR C 113 4

404 BLR KAR C 113 5

405 BLR KAR C 121 1

406 BLR KAR W 121 1

407 BLR KAR W 121 2

408 BLR KAR W 121 3

409 BLR KAR W 121 4

410 BLR KAR W 122 1

411 BLR KAR C 122 1

412 BLR KAR W 122 2

413 BLR KAR W 122 3

414 BLR KAR W 122 4

415 BLR KAR W 123 1

416 BLR KAR C 123 1

417 BLR KAR W 123 2

418 BLR KAR W 123 3

419 BLR KAR W 123 4

420 BLR KAR C 127 1

421 BLR KAR W 127 1

422 BLR KAR W 127 2423 BLR KAR W 127 3424 BLR KAR W 127 4425 BLR KAR W 127 5

426 BLR KAR W 211 1

427 BLR KAR C 211 1

428 BLR KAR W 211 2

429 BLR KAR W 211 3

430 BLR KAR W 211 4

431 BLR KAR C 212 1

432 BLR KAR W 212 1

433 BLR KAR W 212 2434 BLR KAR C 212 2

435 BLR KAR W 212 3

436 BLR KAR W 212 4

437 BLR KAR C 213 1

438 BLR KAR W 213 1

439 BLR KAR C 213 2

440 BLR KAR W 213 2

441 BLR KAR C 213 3

442 BLR KAR C 213 4

443 BLR KAR C 213 5

444 BLR KAR W 221 1

445 BLR KAR C 221 1

446 BLR KAR W 221 2

447 BLR KAR W 221 3

448 BLR KAR W 221 4

449 BLR KAR W 222 1

450 BLR KAR C 222 1

451 BLR KAR W 222 2

452 BLR KAR W 222 3

453 BLR KAR W 222 4

454 BLR KAR W 223 1

455 BLR KAR C 223 1

456 BLR KAR W 223 2

457 BLR KAR W 223 5

458 BLR KAR W 223 6

459 BLR KAR W 311 1

460 BLR KAR C 311 1

461 BLR KAR W 311 2

462 BLR KAR W 311 3

463 BLR KAR W 311 4

464 BLR KAR W 312 1

465 BLR KAR C 312 1

466 BLR KAR W 312 2

467 BLR KAR W 312 3

468 BLR KAR W 312 4

469 BLR KAR W 312 5

470 BLR KAR W 313 1

471 BLR KAR C 313 1

472 BLR KAR W 313 2

473 BLR KAR W 313 3

474 BLR KAR W 313 4

475 BLR KAR W 321 1

476 BLR KAR C 321 1

477 BLR KAR W 321 2

478 BLR KAR C 321 2

479 BLR KAR W 321 3

480 BLR KAR W 321 4481 BLR KAR W 321 5

482 BLR KAR W 321 7

483 BLR KAR W 322 1

484 BLR KAR C 322 1

485 BLR KAR W 322 2

486 BLR KAR W 322 3

487 BLR KAR W 322 7

488 BLR KAR W 322 8

489 BLR KAR W 322 9

490 BLR KAR W 323 1

491 BLR KAR C 323 1

492 BLR KAR W 323 2

493 BLR KAR W 323 5

494 BLR KAR W 323 7

495 BLR KAR W 411 1

496 BLR KAR C 411 1

497 BLR KAR W 411 2

498 BLR KAR W 411 3

499 BLR KAR W 411 6

500 BLR KAR W 412 1

501 BLR KAR C 412 1

502 BLR KAR W 412 2

503 BLR KAR W 412 5

504 BLR KAR W 412 6

505 BLR KAR W 413 1

506 BLR KAR C 413 1

507 BLR KAR W 413 2

508 BLR KAR W 413 3

509 BLR KAR W 413 4

510 BLR KAR W 421 1

511 BLR KAR C 421 1

512 BLR KAR W 421 2

513 BLR KAR W 421 3

514 BLR KAR W 421 4

515 BLR KAR W 422 1

516 BLR KAR C 422 1

517 BLR KAR W 422 2

518 BLR KAR W 422 3

519 BLR KAR W 423 1

520 BLR KAR C 423 1

521 BLR KAR W 423 2

522 BLR KAR W 423 5

523 BLR KAR W 423 6

524 BLR KAR C 431 1

525 BLR KAR W 431 1

526 BLR KAR W 431 2

527 BLR KAR W 431 3528 BLR KAR W 431 4

529 BLR KAR W 431 7530 BLR KAR W 431 8

531 BLR KAR W 433 1

532 BLR KAR C 433 1

533 BLR KAR W 433 2

534 BLR KAR W 433 3

535 BLR KAR C 511 1

536 BLR KAR W 511 1

537 BLR KAR W 511 2

538 BLR KAR W 511 3

539 BLR KAR W 511 4

540 BLR KAR C 512 1

541 BLR KAR W 512 1

542 BLR KAR W 512 2

543 BLR KAR W 512 3544 BLR KAR W 512 4

545 BLR KAR W 513 1

546 BLR KAR C 513 1

547 BLR KAR C 513 2

548 BLR KAR W 513 2

549 BLR KAR W 513 3

550 BLR KAR W 513 4

551 BLR KAR W 513 5

552 BLR KAR W 521 1

553 BLR KAR C 521 1

554 BLR KAR W 521 2

555 BLR KAR W 521 3556 BLR KAR W 521 5557 BLR KAR W 521 7

558 BLR KAR W 522 1

559 BLR KAR C 522 1

560 BLR KAR W 522 2

561 BLR KAR W 522 5

562 BLR KAR W 522 7

563 BLR KAR W 523 1

564 BLR KAR C 523 1

565 BLR KAR W 523 2

566 BLR KAR W 523 5

567 BLR KAR W 531 1

568 BLR KAR C 531 1

569 BLR KAR W 531 2

570 BLR KAR W 531 3571 BLR KAR W 531 4

572 BLR KAR W 531 7

573 BLR KAR W 532 1

574 BLR KAR C 532 1

575 BLR KAR W 532 2

576 BLR KAR W 532 3

577 BLR KAR W 532 4

578 BLR KAR W 533 1

579 BLR KAR C 533 1

580 BLR KAR W 533 2

581 BLR KAR W 533 5

582 BLR KAR W 533 6583 BLR KAR C 612 1584 BLR KAR W 612 1585 BLR KAR C 991 99586 BPL BPL C 31 1587 BPL BPL W 31 1588 BPL BPL C 31 2589 BPL BPL W 31 2590 BPL BPL W 31 11591 BPL BPL W 31 12592 BPL BPL C 32 1593 BPL BPL W 32 1594 BPL BPL C 32 2595 BPL BPL W 32 2596 BPL BPL W 32 3597 BPL BPL W 32 11598 BPL BPL W 32 12599 BPL BPL C 33 1600 BPL BPL W 33 1601 BPL BPL C 33 2602 BPL BPL W 33 2603 BPL BPL W 33 3

604 BPL BPL W 33 11605 BPL BPL W 33 12606 BPL BPL C 41 1607 BPL BPL W 41 1608 BPL BPL C 41 2609 BPL BPL W 41 2610 BPL BPL W 41 11611 BPL BPL C 42 1612 BPL BPL W 42 1613 BPL BPL W 42 2614 BPL BPL W 42 3615 BPL BPL C 43 1616 BPL BPL W 43 1617 BPL BPL W 43 2618 BPL BPL W 43 11619 BPL BPL W 43 12620 BPL BPL C 51 1621 BPL BPL W 51 1622 BPL BPL C 51 2623 BPL BPL W 51 2624 BPL BPL W 51 3625 BPL BPL W 51 11626 BPL BPL C 52 1627 BPL BPL W 52 1628 BPL BPL W 52 2629 BPL BPL W 52 3630 BPL BPL C 53 1631 BPL BPL W 53 1632 BPL BPL W 53 2633 BPL BPL W 53 3634 BPL BPL W 61 1635 BPL BPL C 61 1636 BPL BPL W 61 2637 BPL BPL C 61 2638 BPL BPL W 61 3639 BPL BPL W 61 4640 BPL BPL C 62 1641 BPL BPL W 62 1642 BPL BPL W 62 2643 BPL BPL W 62 3644 BPL BPL C 63 1645 BPL BPL W 63 1646 BPL BPL W 63 2647 BPL BPL W 63 3648 BPL BPL C 91 1

649 BPL BPL W 91 1650 BPL BPL W 91 2651 BPL BPL W 91 11652 BPL BPL C 92 1653 BPL BPL W 92 1654 BPL BPL W 92 2655 BPL BPL W 92 11656 BPL BPL C 93 1657 BPL BPL W 93 1658 BPL BPL W 93 2659 BPL BPL W 93 11660 BPL BPL W 93 12661 BPL BPL C 991 99662 BRD DLC CC 97 1663 BRD DLC W 97 1664 BRD DLC CC 97 2

665 BRD GUJ W 301 1

666 BRD GUJ C 301 1

667 BRD GUJ W 301 2

668 BRD GUJ C 301 2

669 BRD GUJ W 301 3

670 BRD GUJ W 301 4

671 BRD GUJ C 302 1

672 BRD GUJ W 302 1

673 BRD GUJ C 302 2

674 BRD GUJ W 302 2

675 BRD GUJ W 302 3

676 BRD GUJ W 302 4

677 BRD GUJ W 302 5

678 BRD GUJ W 302 6

679 BRD GUJ W 303 1

680 BRD GUJ C 303 1

681 BRD GUJ W 303 2

682 BRD GUJ W 303 3

683 BRD GUJ W 303 4

684 BRD GUJ C 304 1685 BRD GUJ W 304 1686 BRD GUJ W 304 2687 BRD GUJ W 304 3688 BRD GUJ W 304 4689 BRD GUJ C 305 1690 BRD GUJ W 305 1691 BRD GUJ W 305 2692 BRD GUJ W 305 3693 BRD GUJ W 305 4694 BRD GUJ C 306 1695 BRD GUJ W 306 1696 BRD GUJ W 306 2697 BRD GUJ W 306 3698 BRD GUJ W 306 4699 BRD GUJ C 307 1700 BRD GUJ W 307 1701 BRD GUJ W 307 2702 BRD GUJ W 307 3703 BRD GUJ W 307 4

704 BRD GUJ C 308 1

705 BRD GUJ W 308 1

706 BRD GUJ W 308 2

707 BRD GUJ W 308 3

708 BRD GUJ W 308 4

709 BRD GUJ W 309 1

710 BRD GUJ C 309 1

711 BRD GUJ W 309 2

712 BRD GUJ W 309 3

713 BRD GUJ W 309 4

714 BRD GUJ W 309 5715 BRD GUJ W 310 1716 BRD GUJ C 310 1717 BRD GUJ W 310 2718 BRD GUJ W 310 3719 BRD GUJ W 310 4720 BRD GUJ C 311 1721 BRD GUJ W 311 1722 BRD GUJ W 311 2723 BRD GUJ W 311 3724 BRD GUJ W 311 4725 BRD GUJ C 312 1726 BRD GUJ W 312 1727 BRD GUJ W 312 2728 BRD GUJ W 312 3729 BRD GUJ W 312 4730 BRD GUJ C 994 99731 CAL DLC CC 71 3732 CAL DLC CC 71 4733 CAL DLC CC 71 5734 CAL DLC CC 71 11735 CAL DLC CC 71 14736 CAL DLC CC 71 17737 CAL DLC CC 72 6738 CAL DLC CC 72 7739 CAL DLC CC 72 8740 CAL DLC CC 72 28741 CAL DLC CC 73 10742 CAL DLC CC 73 12743 CAL DLC CC 73 13744 CAL DLC CC 73 15745 CAL DLC CC 73 16746 CAL DLC CC 74 18747 CAL DLC CC 74 19748 CAL DLC CC 74 21749 CAL DLC CC 74 27750 CAL DLC CC 74 35

751 CAL DLC CC 75 20752 CAL DLC CC 75 23753 CAL DLC CC 75 24754 CAL DLC CC 75 25755 CAL DLC CC 75 29756 CAL DLC CC 75 30757 CAL DLC CC 75 31758 CAL DLC CC 76 1759 CAL DLC CC 76 2760 CAL DLC CC 76 22761 CAL DLC CC 76 24762 CAL DLC CC 76 36

763 CAL DLC CA 112 1

764 CAL DLC WX 112 1

765 CAL DLC CA 112 2

766 CAL DLC WX 112 2767 CAL DLC C 517 1

768 CAL WBG C 101 1

769 CAL WBG W 101 1

770 CAL WBG W 101 2

771 CAL WBG W 101 3

772 CAL WBG W 101 4

773 CAL WBG W 102 1

774 CAL WBG C 102 1

775 CAL WBG W 102 2776 CAL WBG C 102 2

777 CAL WBG W 102 3

778 CAL WBG W 102 4

779 CAL WBG C 103 1780 CAL WBG W 103 1

781 CAL WBG C 103 2

782 CAL WBG W 103 2

783 CAL WBG W 103 3

784 CAL WBG W 103 4

785 CAL WBG W 104 1

786 CAL WBG C 104 1

787 CAL WBG W 104 2

788 CAL WBG W 104 3

789 CAL WBG W 104 4

790 CAL WBG W 105 1

791 CAL WBG C 105 1

792 CAL WBG W 105 2

793 CAL WBG W 105 3

794 CAL WBG W 105 4

795 CAL WBG W 106 1

796 CAL WBG C 106 1

797 CAL WBG W 106 2

798 CAL WBG W 106 3

799 CAL WBG W 106 4

800 CAL WBG W 107 1

801 CAL WBG C 107 1

802 CAL WBG W 107 2

803 CAL WBG W 107 3

804 CAL WBG W 107 4

805 CAL WBG W 108 1

806 CAL WBG C 108 1

807 CAL WBG W 108 2

808 CAL WBG W 108 3

809 CAL WBG W 108 4

810 CAL WBG W 109 1

811 CAL WBG C 109 1

812 CAL WBG W 109 2

813 CAL WBG W 109 3

814 CAL WBG W 109 4

815 CAL WBG C 110 1

816 CAL WBG W 110 1

817 CAL WBG W 110 2

818 CAL WBG W 110 3

819 CAL WBG W 110 4

820 CAL WBG C 111 1

821 CAL WBG W 111 1

822 CAL WBG W 111 2

823 CAL WBG W 111 3

824 CAL WBG W 111 4

825 CAL WBG C 112 1

826 CAL WBG W 112 1

827 CAL WBG W 112 2

828 CAL WBG W 112 3

829 CAL WBG W 112 4

830 CAL WBG W 113 1

831 CAL WBG C 113 1

832 CAL WBG W 113 2

833 CAL WBG W 113 3

834 CAL WBG W 113 4

835 CAL WBG C 114 1

836 CAL WBG W 114 1

837 CAL WBG W 114 2

838 CAL WBG W 114 3

839 CAL WBG W 114 4

840 CAL WBG W 115 1

841 CAL WBG C 115 1

842 CAL WBG W 115 2

843 CAL WBG W 115 3

844 CAL WBG W 115 4845 CAL WBG W 116 1

846 CAL WBG C 116 1

847 CAL WBG W 116 2

848 CAL WBG W 116 3

849 CAL WBG W 116 4

850 CAL WBG W 117 1

851 CAL WBG C 117 1

852 CAL WBG W 117 2

853 CAL WBG W 117 3

854 CAL WBG W 117 4

855 CAL WBG C 118 1

856 CAL WBG W 118 1

857 CAL WBG W 118 2

858 CAL WBG W 118 3

859 CAL WBG W 118 4

860 CAL WBG C 119 1

861 CAL WBG W 119 1

862 CAL WBG W 119 2

863 CAL WBG W 119 3

864 CAL WBG W 119 4

865 CAL WBG C 120 1

866 CAL WBG W 120 1

867 CAL WBG W 120 2

868 CAL WBG W 120 3

869 CAL WBG W 120 4

870 CAL WBG W 121 1

871 CAL WBG C 121 1

872 CAL WBG W 121 2

873 CAL WBG W 121 3

874 CAL WBG W 121 4875 CAL WBG W 122 1876 CAL WBG C 122 1

877 CAL WBG W 122 2

878 CAL WBG W 122 3

879 CAL WBG W 122 4

880 CAL WBG C 123 1

881 CAL WBG W 123 1

882 CAL WBG W 123 2

883 CAL WBG W 123 3

884 CAL WBG W 123 4

885 CAL WBG W 124 1

886 CAL WBG C 124 1

887 CAL WBG W 124 2

888 CAL WBG W 124 3

889 CAL WBG W 124 4890 CAL WBG C 125 1

891 CAL WBG W 125 1

892 CAL WBG W 125 2

893 CAL WBG W 125 3

894 CAL WBG W 125 4

895 CAL WBG W 126 1

896 CAL WBG C 126 1

897 CAL WBG W 126 2

898 CAL WBG W 126 3

899 CAL WBG W 126 4

900 CAL WBG C 127 1

901 CAL WBG W 127 1

902 CAL WBG W 127 2

903 CAL WBG W 127 3

904 CAL WBG W 127 4

905 CAL WBG W 128 1906 CAL WBG C 128 1

907 CAL WBG W 128 2

908 CAL WBG W 128 3

909 CAL WBG W 128 4

910 CAL WBG W 129 1911 CAL WBG C 129 1

912 CAL WBG W 129 2

913 CAL WBG W 129 3

914 CAL WBG W 129 4

915 CAL WBG W 130 1916 CAL WBG C 130 1

917 CAL WBG W 130 2

918 CAL WBG W 130 3

919 CAL WBG W 130 4

920 CAL WBG C 131 1

921 CAL WBG W 131 1

922 CAL WBG W 131 2

923 CAL WBG W 131 3

924 CAL WBG W 131 4

925 CAL WBG C 132 1

926 CAL WBG W 132 1

927 CAL WBG W 132 2

928 CAL WBG W 132 3

929 CAL WBG W 132 4

930 CAL WBG W 133 1

931 CAL WBG C 133 1

932 CAL WBG W 133 2

933 CAL WBG W 133 3

934 CAL WBG W 133 4

935 CAL WBG C 134 1

936 CAL WBG W 134 1

937 CAL WBG W 134 2

938 CAL WBG W 134 3

939 CAL WBG W 134 4

940 CAL WBG C 135 1

941 CAL WBG W 135 1

942 CAL WBG W 135 2

943 CAL WBG W 135 3

944 CAL WBG W 135 4

945 CAL WBG W 136 1

946 CAL WBG C 136 1

947 CAL WBG W 136 2

948 CAL WBG W 136 3

949 CAL WBG W 136 4

950 CAL WBG C 137 1

951 CAL WBG W 137 1

952 CAL WBG W 137 2

953 CAL WBG W 137 3

954 CAL WBG W 137 4

955 CAL WBG W 138 1

956 CAL WBG C 138 1

957 CAL WBG W 138 2

958 CAL WBG W 138 3

959 CAL WBG W 138 4

960 CAL WBG W 139 1

961 CAL WBG C 139 1

962 CAL WBG W 139 2

963 CAL WBG W 139 3

964 CAL WBG W 139 4

965 CAL WBG W 140 1966 CAL WBG C 140 1

967 CAL WBG W 140 2

968 CAL WBG W 140 3

969 CAL WBG W 140 4970 CAL WBG C 141 1971 CAL WBG W 141 1

972 CAL WBG W 141 2

973 CAL WBG W 141 3

974 CAL WBG W 141 4

975 CAL WBG W 142 1976 CAL WBG C 142 1

977 CAL WBG W 142 2

978 CAL WBG W 142 3

979 CAL WBG W 142 4

980 CAL WBG W 143 1981 CAL WBG C 143 1

982 CAL WBG W 143 2

983 CAL WBG W 143 3

984 CAL WBG W 143 4

985 CAL WBG C 144 1

986 CAL WBG W 144 1

987 CAL WBG W 144 2

988 CAL WBG W 144 3

989 CAL WBG W 144 4

990 CAL WBG W 145 1991 CAL WBG C 145 1

992 CAL WBG W 145 2

993 CAL WBG W 145 3

994 CAL WBG W 145 4

995 CAL WBG W 146 1

996 CAL WBG C 146 1

997 CAL WBG W 146 2

998 CAL WBG W 146 3

999 CAL WBG W 146 4

1000 CAL WBG C 147 1

1001 CAL WBG W 147 1

1002 CAL WBG W 147 2

1003 CAL WBG W 147 3

1004 CAL WBG W 147 4

1005 CAL WBG C 148 1

1006 CAL WBG W 148 1

1007 CAL WBG W 148 2

1008 CAL WBG W 148 3

1009 CAL WBG W 148 4

1010 CAL WBG W 149 11011 CAL WBG C 149 1

1012 CAL WBG W 149 2

1013 CAL WBG W 149 3

1014 CAL WBG W 149 4

1015 CAL WBG W 150 11016 CAL WBG C 150 1

1017 CAL WBG W 150 2

1018 CAL WBG W 150 3

1019 CAL WBG W 150 4

1020 CAL WBG W 151 11021 CAL WBG C 151 1

1022 CAL WBG W 151 2

1023 CAL WBG W 151 3

1024 CAL WBG W 151 4

1025 CAL WBG W 152 11026 CAL WBG C 152 1

1027 CAL WBG W 152 2

1028 CAL WBG W 152 3

1029 CAL WBG W 152 4

1030 CAL WBG W 153 11031 CAL WBG C 153 1

1032 CAL WBG W 153 2

1033 CAL WBG W 153 3

1034 CAL WBG W 153 4

1035 CAL WBG W 154 1

1036 CAL WBG C 154 1

1037 CAL WBG W 154 2

1038 CAL WBG W 154 31039 CAL WBG W 154 4

1040 CAL WBG W 155 1

1041 CAL WBG C 155 1

1042 CAL WBG W 155 2

1043 CAL WBG W 155 3

1044 CAL WBG W 155 4

1045 CAL WBG C 156 1

1046 CAL WBG W 156 1

1047 CAL WBG W 156 21048 CAL WBG C 156 2

1049 CAL WBG W 156 3

1050 CAL WBG W 156 41051 CAL WBG C 160 11052 CAL WBG W 160 11053 CAL WBG W 160 2

1054 CAL WBG W 176 1

1055 CAL WBG C 176 1

1056 CAL WBG W 176 2

1057 CAL WBG W 176 3

1058 CAL WBG W 176 4

1059 CAL WBG W 178 1

1060 CAL WBG C 178 1

1061 CAL WBG W 178 2

1062 CAL WBG W 178 3

1063 CAL WBG W 178 4

1064 CAL WBG W 179 1

1065 CAL WBG C 179 1

1066 CAL WBG W 179 2

1067 CAL WBG W 179 3

1068 CAL WBG W 179 4

1069 CAL WBG C 182 1

1070 CAL WBG W 182 1

1071 CAL WBG W 182 2

1072 CAL WBG W 182 3

1073 CAL WBG W 182 4

1074 CAL WBG C 183 1

1075 CAL WBG W 183 1

1076 CAL WBG W 183 2

1077 CAL WBG W 183 3

1078 CAL WBG W 183 4

1079 CAL WBG W 186 1

1080 CAL WBG C 186 1

1081 CAL WBG W 186 2

1082 CAL WBG W 186 3

1083 CAL WBG W 186 4

1084 CAL WBG W 188 1

1085 CAL WBG C 188 1

1086 CAL WBG W 188 2

1087 CAL WBG W 188 3

1088 CAL WBG W 188 4

1089 CAL WBG W 188 5

1090 CAL WBG W 190 1

1091 CAL WBG C 190 1

1092 CAL WBG W 190 2

1093 CAL WBG W 190 3

1094 CAL WBG W 190 4

1095 CAL WBG W 191 1

1096 CAL WBG C 191 1

1097 CAL WBG W 191 2

1098 CAL WBG W 191 3

1099 CAL WBG W 191 4

1100 CAL WBG C 194 1

1101 CAL WBG W 194 1

1102 CAL WBG W 194 2

1103 CAL WBG W 194 3

1104 CAL WBG W 194 4

1105 CAL WBG C 196 1

1106 CAL WBG W 196 1

1107 CAL WBG W 196 2

1108 CAL WBG W 196 3

1109 CAL WBG W 196 4

1110 CAL WBG C 197 1

1111 CAL WBG W 197 1

1112 CAL WBG W 197 2

1113 CAL WBG W 197 3

1114 CAL WBG W 197 4

1115 CAL WBG C 198 1

1116 CAL WBG W 198 1

1117 CAL WBG W 198 2

1118 CAL WBG W 198 3

1119 CAL WBG W 198 4

1120 CAL WBG C 201 1

1121 CAL WBG W 201 1

1122 CAL WBG W 201 2

1123 CAL WBG W 201 3

1124 CAL WBG W 201 4

1125 CAL WBG W 202 1

1126 CAL WBG C 202 1

1127 CAL WBG W 202 2

1128 CAL WBG W 202 3

1129 CAL WBG W 202 4

1130 CAL WBG C 205 1

1131 CAL WBG W 205 1

1132 CAL WBG W 205 2

1133 CAL WBG W 205 3

1134 CAL WBG W 205 41135 CAL WBG C 207 11136 CAL WBG W 207 11137 CAL WBG W 207 21138 CAL WBG W 207 31139 CAL WBG W 207 41140 CAL WBG C 208 11141 CAL WBG W 208 11142 CAL WBG C 208 21143 CAL WBG W 208 21144 CAL WBG W 208 31145 CAL WBG W 208 41146 CAL WBG C 209 11147 CAL WBG W 209 11148 CAL WBG W 209 21149 CAL WBG W 209 31150 CAL WBG W 209 41151 CAL WBG C 212 11152 CAL WBG W 212 11153 CAL WBG W 212 2

1154 CAL WBG W 212 31155 CAL WBG W 212 41156 CAL WBG C 213 11157 CAL WBG W 213 11158 CAL WBG W 213 21159 CAL WBG W 213 31160 CAL WBG W 213 4

1161 CAL WBG C 216 1

1162 CAL WBG W 216 1

1163 CAL WBG W 216 2

1164 CAL WBG W 216 3

1165 CAL WBG W 216 41166 CAL WBG P 888 1

1167 CHE CHE C 103 1

1168 CHE CHE W 103 1

1169 CHE CHE W 103 2

1170 CHE CHE W 103 3

1171 CHE CHE W 103 4

1172 CHE CHE C 104 1

1173 CHE CHE W 104 1

1174 CHE CHE W 104 2

1175 CHE CHE W 104 3

1176 CHE CHE W 104 4

1177 CHE CHE W 105 1

1178 CHE CHE C 105 1

1179 CHE CHE W 105 2

1180 CHE CHE W 105 3

1181 CHE CHE W 105 4

1182 CHE CHE W 106 1

1183 CHE CHE C 106 1

1184 CHE CHE W 106 2

1185 CHE CHE W 106 3

1186 CHE CHE W 106 4

1187 CHE CHE W 107 1

1188 CHE CHE C 107 1

1189 CHE CHE W 107 2

1190 CHE CHE W 107 3

1191 CHE CHE W 107 4

1192 CHE CHE W 108 1

1193 CHE CHE C 108 1

1194 CHE CHE W 108 2

1195 CHE CHE W 108 3

1196 CHE CHE W 108 4

1197 CHE CHE C 109 1

1198 CHE CHE W 109 1

1199 CHE CHE W 109 2

1200 CHE CHE W 109 3

1201 CHE CHE W 109 41202 CHE CHE C 110 11203 CHE CHE W 110 11204 CHE CHE W 110 21205 CHE CHE W 110 31206 CHE CHE W 110 41207 CHE CHE C 111 1

1208 CHE CHE W 111 1

1209 CHE CHE W 111 21210 CHE CHE W 111 3

1211 CHE CHE W 111 4

1212 CHE CHE C 112 1

1213 CHE CHE W 112 1

1214 CHE CHE W 112 2

1215 CHE CHE W 112 3

1216 CHE CHE W 112 4

1217 CHE CHE W 113 1

1218 CHE CHE C 113 1

1219 CHE CHE W 113 2

1220 CHE CHE W 113 3

1221 CHE CHE W 113 4

1222 CHE CHE C 114 1

1223 CHE CHE W 114 1

1224 CHE CHE W 114 2

1225 CHE CHE W 114 3

1226 CHE CHE W 114 4

1227 CHE CHE C 115 1

1228 CHE CHE W 115 1

1229 CHE CHE W 115 2

1230 CHE CHE W 115 3

1231 CHE CHE W 115 4

1232 CHE CHE C 116 1

1233 CHE CHE W 116 1

1234 CHE CHE W 116 2

1235 CHE CHE W 116 3

1236 CHE CHE W 116 41237 CHE CHE C 117 1

1238 CHE CHE W 117 11239 CHE CHE W 117 21240 CHE CHE W 117 31241 CHE CHE W 117 4

1242 CHE CHE C 141 1

1243 CHE CHE W 141 1

1244 CHE CHE W 141 2

1245 CHE CHE W 141 3

1246 CHE CHE W 141 4

1247 CHE CHE W 141 5

1248 CHE CHE W 141 6

1249 CHE CHE W 141 71250 CHE CHE C 142 11251 CHE CHE W 142 11252 CHE CHE W 142 21253 CHE CHE W 142 31254 CHE CHE W 142 4

1255 CHE CHE C 146 1

1256 CHE CHE W 146 1

1257 CHE CHE W 146 2

1258 CHE CHE W 146 3

1259 CHE CHE W 146 4

1260 CHE CHE W 146 51261 CHE CHE W 146 6

1262 CHE CHE W 146 111263 CHE CHE W 146 121264 CHE CHE W 146 13

1265 CHE CHE W 171 1

1266 CHE CHE C 171 1

1267 CHE CHE W 171 2

1268 CHE CHE W 171 3

1269 CHE CHE C 181 1

1270 CHE CHE W 181 1

1271 CHE CHE W 181 2

1272 CHE CHE W 181 3

1273 CHE CHE W 181 4

1274 CHE CHE C 182 1

1275 CHE CHE W 182 1

1276 CHE CHE W 182 2

1277 CHE CHE C 191 1

1278 CHE CHE W 191 1

1279 CHE CHE C 191 2

1280 CHE CHE W 191 2

1281 CHE CHE W 191 3

1282 CHE CHE W 191 4

1283 CHE CHE C 192 1

1284 CHE CHE W 192 1

1285 CHE CHE W 192 2

1286 CHE CHE W 192 11

1287 CHE CHE W 192 12

1288 CHE CHE C 193 1

1289 CHE CHE W 193 1

1290 CHE CHE W 193 2

1291 CHE CHE W 193 11

1292 CHE CHE W 193 12

1293 CHE CHE W 193 21

1294 CHE CHE C 194 1

1295 CHE CHE W 194 1

1296 CHE CHE W 194 2

1297 CHE CHE W 194 3

1298 CHE CHE C 206 1

1299 CHE CHE W 206 1

1300 CHE CHE W 206 2

1301 CHE CHE W 206 3

1302 CHE CHE W 206 11

1303 CHE CHE W 206 12

1304 CHE CHE C 216 1

1305 CHE CHE W 216 1

1306 CHE CHE W 216 2

1307 CHE CHE W 216 3

1308 CHE CHE C 231 1

1309 CHE CHE W 231 1

1310 CHE CHE C 231 2

1311 CHE CHE W 231 2

1312 CHE CHE W 231 3

1313 CHE CHE W 231 4

1314 CHE CHE W 231 5

1315 CHE CHE C 232 1

1316 CHE CHE W 232 1

1317 CHE CHE W 232 2

1318 CHE CHE W 232 3

1319 CHE CHE W 232 4

1320 CHE CHE W 232 11

1321 CHE CHE W 232 12

1322 CHE CHE C 233 1

1323 CHE CHE W 233 1

1324 CHE CHE W 233 11

1325 CHE CHE W 233 12

1326 CHE CHE W 233 131327 CHE CHE C 251 1

1328 CHE CHE W 251 11329 CHE CHE C 251 21330 CHE CHE C 251 31331 CHE CHE C 251 41332 CHE CHE C 251 11

1333 CHE CHE W 251 111334 CHE CHE C 252 1

1335 CHE CHE W 252 11336 CHE CHE C 252 21337 CHE CHE C 252 31338 CHE CHE C 252 41339 CHE CHE C 253 1

1340 CHE CHE W 253 1

1341 CHE CHE C 253 2

1342 CHE CHE C 253 31343 CHE CHE C 253 4

1344 CHE CHE C 254 1

1345 CHE CHE W 254 1

1346 CHE CHE C 254 2

1347 CHE CHE C 254 31348 CHE CHE C 254 41349 CHE CHE C 255 1

1350 CHE CHE W 255 1

1351 CHE CHE C 255 21352 CHE CHE C 255 31353 CHE CHE C 255 41354 CHE CHE C 256 1

1355 CHE CHE W 256 1

1356 CHE CHE C 256 21357 CHE CHE C 256 31358 CHE CHE C 256 4

1359 CHE CHE C 271 1

1360 CHE CHE W 271 1

1361 CHE CHE W 271 2

1362 CHE CHE W 271 3

1363 CHE CHE W 271 4

1364 CHE CHE C 272 1

1365 CHE CHE W 272 1

1366 CHE CHE W 272 2

1367 CHE CHE W 272 3

1368 CHE CHE W 272 4

1369 CHE CHE C 273 1

1370 CHE CHE W 273 1

1371 CHE CHE W 273 2

1372 CHE CHE W 273 3

1373 CHE CHE W 273 4

1374 CHE CHE C 274 1

1375 CHE CHE W 274 1

1376 CHE CHE W 274 21377 CHE CHE W 274 3

1378 CHE CHE W 274 4

1379 CHE CHE C 275 1

1380 CHE CHE W 275 1

1381 CHE CHE W 275 2

1382 CHE CHE W 275 3

1383 CHE CHE W 275 4

1384 CHE CHE C 276 1

1385 CHE CHE W 276 1

1386 CHE CHE W 276 2

1387 CHE CHE W 276 3

1388 CHE CHE W 276 41389 CHE CHE W 291 11390 CHE CHE C 291 11391 CHE CHE W 291 21392 CHE CHE C 291 21393 CHE CHE W 291 31394 CHE CHE C 801 11395 CHE CHE C 991 991396 CHE DLC CC 51 11397 CHE DLC CC 51 21398 CHE DLC CC 51 31399 CHE DLC CC 51 41400 CHE DLC CC 51 51401 CHE DLC CC 52 11402 CHE DLC CC 52 21403 CHE DLC CC 52 31404 CHE DLC CC 52 41405 CHE DLC CC 52 51406 CHE DLC CC 53 1

1407 CHE DLC CC 53 21408 CHE DLC CC 53 31409 CHE DLC CC 53 41410 CHE DLC CC 54 11411 CHE DLC CC 54 21412 CHE DLC CC 54 31413 CHE DLC CC 54 41414 CHE DLC CC 55 11415 CHE DLC CC 55 21416 CHE DLC CC 55 31417 CHE DLC CC 55 41418 CHE DLC CC 55 51419 CHE DLC CC 56 11420 CHE DLC CC 56 21421 CHE DLC CC 56 31422 CHE DLC CC 56 41423 CHE DLC CC 56 51424 CHE DLC CC 56 6

1425 CHE DLC CA 201 11426 CHE DLC CA 201 2

1427 CHE DLC CA 201 3

1428 CHE DLC CA 201 41429 CHN DLC CC 113 11430 CHN DLC CC 113 21431 CHN DLC CC 113 31432 CHN DLC CC 113 4

1433 CHN DLC CC 114 2

1434 CHN DLC CC 114 31435 CHN DLC CC 114 41436 CHN DLC CC 114 51437 CHN DLC CC 114 6

1438 CHN KRL C 10 1

1439 CHN KRL W 10 1

1440 CHN KRL C 10 2

1441 CHN KRL W 11 1

1442 CHN KRL C 11 1

1443 CHN KRL C 11 21444 CHN KRL W 11 2

1445 CHN KRL C 11 3

1446 CHN KRL W 11 11

1447 CHN KRL W 11 12

1448 CHN KRL W 12 1

1449 CHN KRL C 12 1

1450 CHN KRL W 12 2

1451 CHN KRL C 12 2

1452 CHN KRL W 12 3

1453 CHN KRL W 13 1

1454 CHN KRL W 13 2

1455 CHN KRL W 13 3

1456 CHN KRL W 13 11

1457 CHN KRL C 13 11

1458 CHN KRL W 13 12

1459 CHN KRL C 15 1

1460 CHN KRL W 15 1

1461 CHN KRL W 15 2

1462 CHN KRL W 15 3

1463 CHN KRL W 15 4

1464 CHN KRL W 15 5

1465 CHN KRL W 15 6

1466 CHN KRL C 18 1

1467 CHN KRL W 18 1

1468 CHN KRL CA 18 1

1469 CHN KRL C 18 2

1470 CHN KRL CA 19 1

1471 CHN KRL W 21 1

1472 CHN KRL C 21 1

1473 CHN KRL W 21 2

1474 CHN KRL W 21 31475 CHN KRL W 21 4

1476 CHN KRL W 22 11477 CHN KRL C 22 1

1478 CHN KRL W 22 2

1479 CHN KRL W 22 3

1480 CHN KRL W 22 4

1481 CHN KRL C 25 1

1482 CHN KRL W 25 1

1483 CHN KRL W 25 21484 CHN KRL W 25 31485 CHN KRL W 31 11486 CHN KRL C 31 11487 CHN KRL W 31 21488 CHN KRL W 31 31489 CHN KRL W 31 41490 CHN KRL W 31 51491 CHN KRL W 32 11492 CHN KRL C 32 11493 CHN KRL W 32 21494 CHN KRL C 32 21495 CHN KRL W 32 31496 CHN KRL W 32 41497 CHN KRL W 32 51498 CHN KRL W 32 61499 CHN KRL C 35 11500 CHN KRL W 35 11501 CHN KRL W 35 21502 CHN KRL W 35 31503 CHN KRL W 35 41504 CHN KRL W 35 51505 CHN KRL W 35 6

1506 CHN KRL C 991 99

1507 CMB CHE C 61 1

1508 CMB CHE C 61 2

1509 CMB CHE C 61 3

1510 CMB CHE W 61 11

1511 CMB CHE C 62 1

1512 CMB CHE W 62 11

1513 CMB CHE W 62 12

1514 CMB CHE W 62 131515 CMB CHE W 62 14

1516 CMB CHE W 62 15

1517 CMB CHE C 63 1

1518 CMB CHE W 63 11

1519 CMB CHE W 63 12

1520 CMB CHE W 63 131521 CMB CHE W 63 14

1522 CMB CHE C 64 1

1523 CMB CHE C 64 2

1524 CMB CHE C 64 3

1525 CMB CHE W 64 14

1526 CMB CHE W 64 15

1527 CMB CHE C 65 1

1528 CMB CHE W 65 11

1529 CMB CHE W 65 12

1530 CMB CHE W 65 13

1531 CMB CHE W 65 14

1532 CMB CHE C 66 1

1533 CMB CHE W 66 11

1534 CMB CHE W 66 12

1535 CMB CHE W 66 13

1536 CMB CHE W 66 14

1537 CMB CHE C 67 11538 CMB CHE W 67 111539 CMB CHE W 67 121540 CMB CHE W 67 131541 CMB CHE W 67 141542 CMB CHE W 67 15

1543 CMB CHE W 67 16

1544 CMB CHE W 67 171545 CMB CHE W 67 18

1546 CMB CHE C 68 11547 CMB CHE C 68 2

1548 CMB CHE W 68 11

1549 CMB CHE W 68 12

1550 CMB CHE W 68 131551 CMB CHE W 68 141552 CMB CHE W 68 151553 CMB CHE W 68 16

1554 CMB CHE C 992 991555 DEL DEL C 31 11556 DEL DEL W 31 11557 DEL DEL W 31 21558 DEL DEL W 31 31559 DEL DEL W 31 41560 DEL DEL W 32 11561 DEL DEL C 32 11562 DEL DEL W 32 21563 DEL DEL W 32 31564 DEL DEL W 32 41565 DEL DEL C 33 11566 DEL DEL W 33 11567 DEL DEL W 33 21568 DEL DEL W 33 31569 DEL DEL W 33 41570 DEL DEL W 34 11571 DEL DEL C 34 11572 DEL DEL W 34 21573 DEL DEL W 34 31574 DEL DEL W 34 41575 DEL DEL W 35 1

1576 DEL DEL C 35 11577 DEL DEL W 35 21578 DEL DEL W 35 31579 DEL DEL W 35 41580 DEL DEL W 36 11581 DEL DEL C 36 11582 DEL DEL W 36 21583 DEL DEL W 36 31584 DEL DEL W 36 41585 DEL DEL W 37 11586 DEL DEL C 37 11587 DEL DEL W 37 21588 DEL DEL W 37 31589 DEL DEL W 37 41590 DEL DEL C 38 11591 DEL DEL W 38 11592 DEL DEL W 38 21593 DEL DEL W 38 31594 DEL DEL W 38 41595 DEL DEL C 39 11596 DEL DEL W 39 11597 DEL DEL W 39 21598 DEL DEL W 39 31599 DEL DEL W 39 41600 DEL DEL W 40 11601 DEL DEL C 40 11602 DEL DEL W 40 21603 DEL DEL W 40 31604 DEL DEL W 40 41605 DEL DEL W 41 11606 DEL DEL C 41 11607 DEL DEL W 41 21608 DEL DEL W 41 31609 DEL DEL W 41 41610 DEL DEL C 42 11611 DEL DEL W 42 11612 DEL DEL W 42 21613 DEL DEL W 42 31614 DEL DEL W 42 41615 DEL DEL W 43 11616 DEL DEL C 43 11617 DEL DEL W 43 21618 DEL DEL W 43 31619 DEL DEL W 43 41620 DEL DEL W 44 1

1621 DEL DEL C 44 11622 DEL DEL W 44 21623 DEL DEL W 44 31624 DEL DEL W 44 41625 DEL DEL W 45 11626 DEL DEL C 45 11627 DEL DEL W 45 21628 DEL DEL W 45 31629 DEL DEL W 45 41630 DEL DEL W 46 11631 DEL DEL C 46 11632 DEL DEL W 46 21633 DEL DEL W 46 31634 DEL DEL W 46 41635 DEL DEL W 47 11636 DEL DEL C 47 11637 DEL DEL W 47 21638 DEL DEL W 47 31639 DEL DEL W 47 41640 DEL DEL W 48 11641 DEL DEL C 48 11642 DEL DEL W 48 21643 DEL DEL W 48 31644 DEL DEL W 48 41645 DEL DEL W 49 11646 DEL DEL C 49 11647 DEL DEL W 49 21648 DEL DEL W 49 31649 DEL DEL W 49 41650 DEL DEL W 50 11651 DEL DEL C 50 11652 DEL DEL W 50 21653 DEL DEL W 50 31654 DEL DEL W 50 41655 DEL DEL W 51 11656 DEL DEL C 51 11657 DEL DEL W 51 21658 DEL DEL W 51 31659 DEL DEL W 51 41660 DEL DEL W 52 11661 DEL DEL C 52 11662 DEL DEL W 52 21663 DEL DEL W 52 31664 DEL DEL W 52 41665 DEL DEL W 53 1

1666 DEL DEL C 53 11667 DEL DEL W 53 21668 DEL DEL W 53 31669 DEL DEL W 53 41670 DEL DEL W 54 11671 DEL DEL C 54 11672 DEL DEL W 54 21673 DEL DEL W 54 31674 DEL DEL W 54 41675 DEL DEL W 55 11676 DEL DEL C 55 11677 DEL DEL W 55 21678 DEL DEL W 55 31679 DEL DEL W 55 41680 DEL DEL W 56 11681 DEL DEL C 56 11682 DEL DEL W 56 21683 DEL DEL W 56 31684 DEL DEL W 56 41685 DEL DEL W 57 11686 DEL DEL C 57 11687 DEL DEL W 57 21688 DEL DEL W 57 31689 DEL DEL W 57 41690 DEL DEL W 58 11691 DEL DEL C 58 11692 DEL DEL W 58 21693 DEL DEL W 58 31694 DEL DEL W 58 41695 DEL DEL W 59 11696 DEL DEL C 59 11697 DEL DEL W 59 21698 DEL DEL W 59 31699 DEL DEL W 59 41700 DEL DEL W 60 11701 DEL DEL C 60 11702 DEL DEL W 60 21703 DEL DEL W 60 31704 DEL DEL W 60 41705 DEL DEL W 61 11706 DEL DEL C 61 11707 DEL DEL W 61 21708 DEL DEL W 61 31709 DEL DEL W 61 41710 DEL DEL W 62 1

1711 DEL DEL C 62 11712 DEL DEL W 62 21713 DEL DEL W 62 31714 DEL DEL W 62 41715 DEL DEL C 63 11716 DEL DEL W 63 11717 DEL DEL W 63 21718 DEL DEL W 63 31719 DEL DEL W 63 41720 DEL DEL W 64 11721 DEL DEL C 64 11722 DEL DEL W 64 21723 DEL DEL W 64 31724 DEL DEL W 64 41725 DEL DEL W 65 11726 DEL DEL C 65 11727 DEL DEL W 65 21728 DEL DEL W 65 31729 DEL DEL W 65 41730 DEL DEL W 66 11731 DEL DEL C 66 11732 DEL DEL W 66 21733 DEL DEL W 66 31734 DEL DEL W 66 41735 DEL DEL W 67 11736 DEL DEL C 67 11737 DEL DEL W 67 21738 DEL DEL W 67 31739 DEL DEL W 67 41740 DEL DEL W 68 11741 DEL DEL C 68 11742 DEL DEL W 68 21743 DEL DEL W 68 31744 DEL DEL W 68 41745 DEL DEL W 69 11746 DEL DEL C 69 11747 DEL DEL W 69 21748 DEL DEL W 69 31749 DEL DEL W 69 41750 DEL DEL W 70 11751 DEL DEL C 70 11752 DEL DEL W 70 21753 DEL DEL W 70 31754 DEL DEL W 70 41755 DEL DEL C 71 1

1756 DEL DEL W 71 11757 DEL DEL W 71 21758 DEL DEL W 71 31759 DEL DEL W 71 41760 DEL DEL C 72 11761 DEL DEL W 72 11762 DEL DEL W 72 31763 DEL DEL W 72 41764 DEL DEL C 73 11765 DEL DEL W 73 11766 DEL DEL W 73 21767 DEL DEL W 73 31768 DEL DEL W 73 41769 DEL DEL C 74 11770 DEL DEL W 74 11771 DEL DEL W 74 21772 DEL DEL W 74 31773 DEL DEL W 74 41774 DEL DEL C 75 11775 DEL DEL W 75 11776 DEL DEL W 75 21777 DEL DEL W 75 31778 DEL DEL W 75 41779 DEL DEL C 76 11780 DEL DEL W 76 11781 DEL DEL W 76 21782 DEL DEL W 76 31783 DEL DEL W 76 41784 DEL DEL C 77 11785 DEL DEL W 77 11786 DEL DEL W 77 21787 DEL DEL W 77 31788 DEL DEL W 77 41789 DEL DEL C 78 11790 DEL DEL W 78 11791 DEL DEL W 78 21792 DEL DEL W 78 31793 DEL DEL W 78 4

1794 DEL DEL C 991 991795 DEL DLC CC 1 61796 DEL DLC CC 1 71797 DEL DLC CC 1 131798 DEL DLC CC 1 251799 DEL DLC CC 2 3

1800 DEL DLC CC 2 151801 DEL DLC CC 2 171802 DEL DLC CC 2 211803 DEL DLC CC 3 51804 DEL DLC CC 3 111805 DEL DLC CC 3 121806 DEL DLC CC 3 201807 DEL DLC CC 4 81808 DEL DLC CC 4 91809 DEL DLC CC 4 101810 DEL DLC CC 4 161811 DEL DLC CC 45 11812 DEL DLC CC 45 21813 DEL DLC CC 45 181814 DEL DLC CC 45 221815 DEL DLC CC 46 41816 DEL DLC CC 46 141817 DEL DLC CC 46 191818 DEL DLC CC 46 231819 DEL DLC CA 47 11820 DEL DLC CA 47 21821 DEL DLC WX 48 11822 DEL DLC CA 48 21823 DEL DLC WX 48 21824 DEL DLC CA 48 41825 HYD APR C 50 11826 HYD APR W 50 11827 HYD APR C 50 21828 HYD APR W 50 21829 HYD APR C 50 31830 HYD APR C 52 11831 HYD APR W 52 11832 HYD APR C 52 21833 HYD APR W 52 21834 HYD APR C 52 31835 HYD APR C 53 11836 HYD APR W 53 11837 HYD APR C 53 21838 HYD APR W 53 21839 HYD APR C 53 31840 HYD APR C 54 11841 HYD APR W 54 11842 HYD APR W 54 21843 HYD APR W 54 31844 HYD APR W 54 4

1845 HYD APR C 55 11846 HYD APR W 55 11847 HYD APR W 55 21848 HYD APR W 55 31849 HYD APR W 55 41850 HYD APR W 55 51851 HYD APR C 56 11852 HYD APR W 56 11853 HYD APR W 56 21854 HYD APR W 56 31855 HYD APR W 56 41856 HYD APR W 56 51857 HYD APR C 57 11858 HYD APR W 57 11859 HYD APR W 57 21860 HYD APR W 57 31861 HYD APR W 57 41862 HYD APR C 58 11863 HYD APR W 58 11864 HYD APR W 58 21865 HYD APR W 58 31866 HYD APR W 58 41867 HYD APR W 58 51868 HYD APR W 58 61869 HYD APR C 59 11870 HYD APR W 59 11871 HYD APR W 59 21872 HYD APR W 59 31873 HYD APR W 59 41874 HYD APR W 59 61875 HYD APR W 60 11876 HYD APR C 60 11877 HYD APR W 60 21878 HYD APR W 60 31879 HYD APR W 60 41880 HYD APR C 61 11881 HYD APR W 61 11882 HYD APR W 61 21883 HYD APR W 61 31884 HYD APR W 61 41885 HYD APR C 66 11886 HYD APR W 66 11887 HYD APR C 66 21888 HYD APR W 66 21889 HYD APR C 66 3

1890 HYD APR C 71 11891 HYD APR W 71 11892 HYD APR W 71 21893 HYD APR W 71 31894 HYD APR W 71 41895 HYD APR W 71 51896 HYD APR C 72 11897 HYD APR W 72 11898 HYD APR W 72 21899 HYD APR W 72 31900 HYD APR W 72 41901 HYD APR C 73 11902 HYD APR W 73 11903 HYD APR W 73 21904 HYD APR W 73 31905 HYD APR C 74 11906 HYD APR W 74 11907 HYD APR W 74 21908 HYD APR W 74 31909 HYD APR W 74 41910 HYD APR W 74 51911 HYD APR W 74 61912 HYD APR C 75 11913 HYD APR W 75 11914 HYD APR W 75 21915 HYD APR W 75 31916 HYD APR W 75 41917 HYD APR W 75 61918 HYD APR C 76 11919 HYD APR W 76 11920 HYD APR W 76 21921 HYD APR W 76 31922 HYD APR W 76 41923 HYD APR C 77 11924 HYD APR W 77 11925 HYD APR W 77 21926 HYD APR W 77 31927 HYD APR W 77 41928 HYD APR W 77 51929 HYD APR C 78 11930 HYD APR W 78 11931 HYD APR W 78 21932 HYD APR W 78 31933 HYD APR W 78 41934 HYD APR W 78 6

1935 HYD APR W 78 71936 HYD APR C 79 11937 HYD APR W 79 11938 HYD APR W 79 21939 HYD APR W 79 31940 HYD APR W 79 41941 HYD APR W 79 51942 HYD APR C 80 11943 HYD APR W 80 11944 HYD APR W 80 21945 HYD APR W 80 31946 HYD APR W 80 41947 HYD APR W 80 51948 HYD APR C 81 11949 HYD APR W 81 11950 HYD APR W 81 21951 HYD APR W 81 31952 HYD APR W 81 41953 HYD APR W 81 51954 HYD APR C 82 11955 HYD APR W 82 11956 HYD APR W 82 21957 HYD APR W 82 31958 HYD APR W 82 41959 HYD APR W 82 51960 HYD APR W 82 61961 HYD APR C 83 11962 HYD APR W 83 11963 HYD APR W 83 21964 HYD APR W 83 31965 HYD APR W 83 41966 HYD APR W 83 51967 HYD APR W 83 61968 HYD APR P 92 11969 HYD APR P 93 1

1970 HYD APR C 991 991971 HYD DLC CC 57 11972 HYD DLC CC 57 21973 HYD DLC W 99 21974 HYD DLC W 99 31975 HYD DLC W 99 41976 HYD DLC W 99 51977 HYD DLC W 99 61978 HYD DLC W 99 7

1979 HYD DLC W 99 81980 JBP BPL C 71 11981 JBP BPL W 71 11982 JBP BPL W 71 21983 JBP BPL W 71 31984 JBP BPL C 72 11985 JBP BPL W 72 11986 JBP BPL W 72 21987 JBP BPL W 72 31988 JBP BPL W 81 11989 JBP BPL C 81 11990 JBP BPL W 81 21991 JBP BPL W 81 31992 JBP BPL W 81 41993 JBP BPL W 82 11994 JBP BPL C 82 11995 JBP BPL W 82 21996 JBP BPL W 82 31997 JBP BPL C 83 11998 JBP BPL W 83 11999 JBP BPL W 83 22000 JBP BPL W 83 32001 JBP BPL W 84 12002 JBP BPL C 84 12003 JBP BPL W 84 22004 JBP BPL W 85 12005 JBP BPL C 85 12006 JBP BPL W 85 22007 JBP BPL C 85 22008 JBP BPL W 85 32009 JBP BPL W 85 42010 JBP BPL W 85 112011 JBP BPL W 85 122012 JBP BPL W 86 12013 JBP BPL C 86 12014 JBP BPL W 86 22015 JBP BPL W 86 32016 JBP BPL W 86 42017 JBP BPL W 86 52018 JBP BPL W 86 62019 JBP BPL C 87 12020 JBP BPL W 87 12021 JBP BPL C 87 22022 JBP BPL W 87 22023 JBP BPL W 87 3

2024 JBP BPL W 87 42025 JBP BPL C 88 12026 JBP BPL W 88 12027 JBP BPL W 88 22028 JBP BPL W 89 12029 JBP BPL C 89 12030 JBP BPL W 89 22031 JBP BPL W 89 32032 JBP BPL W 89 42033 JBP BPL W 89 52034 JBP BPL W 89 62035 JBP BPL W 89 72036 JBP BPL W 90 12037 JBP BPL C 90 12038 JBP BPL W 90 22039 JBP BPL W 90 32040 JBP BPL C 992 992041 JDH DLC CC 66 12042 JDH DLC CC 66 22043 JDH DLC CC 66 32044 JDH DLC CC 66 42045 JDH DLC CC 67 12046 JDH DLC CC 67 22047 JDH DLC CC 67 32048 JDH RJN W 510 12049 JDH RJN C 510 12050 JDH RJN W 510 22051 JDH RJN W 510 32052 JDH RJN W 510 42053 JDH RJN W 520 12054 JDH RJN C 520 12055 JDH RJN W 520 22056 JDH RJN W 520 42057 JDH RJN W 520 52058 JDH RJN W 530 12059 JDH RJN C 530 12060 JDH RJN W 530 22061 JDH RJN W 530 32062 JDH RJN W 530 42063 JDH RJN W 540 12064 JDH RJN C 540 12065 JDH RJN W 540 22066 JDH RJN W 540 32067 JDH RJN W 540 52068 JDH RJN W 550 1

2069 JDH RJN C 550 12070 JDH RJN W 550 22071 JDH RJN W 550 32072 JDH RJN W 550 42073 JDH RJN W 560 12074 JDH RJN C 560 12075 JDH RJN W 560 32076 JDH RJN W 560 42077 JDH RJN W 560 52078 JDH RJN C 570 12079 JDH RJN W 570 12080 JDH RJN W 570 22081 JDH RJN W 570 32082 JDH RJN W 570 42083 JDH RJN C 580 12084 JDH RJN W 580 12085 JDH RJN W 580 22086 JDH RJN W 580 32087 JDH RJN W 580 42088 JDH RJN C 590 12089 JDH RJN W 590 12090 JDH RJN W 590 22091 JDH RJN W 590 32092 JDH RJN W 590 52093 JDH RJN W 710 12094 JDH RJN C 710 12095 JDH RJN W 710 22096 JDH RJN W 710 32097 JDH RJN W 710 42098 JDH RJN W 720 12099 JDH RJN C 720 12100 JDH RJN W 720 22101 JDH RJN W 720 32102 JDH RJN W 720 42103 JDH RJN W 730 12104 JDH RJN C 730 12105 JDH RJN W 730 22106 JDH RJN W 730 32107 JDH RJN W 730 42108 JDH RJN C 740 12109 JDH RJN W 740 12110 JDH RJN W 740 22111 JDH RJN W 740 32112 JDH RJN W 740 42113 JDH RJN C 750 1

2114 JDH RJN W 750 12115 JDH RJN W 750 22116 JDH RJN W 750 32117 JDH RJN W 750 42118 JDH RJN C 760 12119 JDH RJN W 760 12120 JDH RJN W 760 22121 JDH RJN W 760 32122 JDH RJN W 760 42123 JDH RJN W 770 12124 JDH RJN C 770 12125 JDH RJN W 770 22126 JDH RJN W 770 32127 JDH RJN W 770 42128 JDH RJN W 780 12129 JDH RJN C 780 12130 JDH RJN W 780 22131 JDH RJN W 780 32132 JDH RJN W 780 42133 JDH RJN W 790 12134 JDH RJN C 790 12135 JDH RJN W 790 22136 JDH RJN W 790 3

2137 JDH RJN C 992 992138 JLD DLC CC 27 12139 JLD DLC CC 27 22140 JLD DLC CC 27 32141 JLD DLC CC 27 42142 JLD DLC CC 27 52143 JLD DLC CC 38 12144 JLD DLC CC 38 22145 JLD DLC CC 38 112146 JLD DLC CC 39 32147 JLD DLC CC 39 42148 JLD DLC CC 39 52149 JLD NWR C 101 12150 JLD NWR W 101 12151 JLD NWR W 101 22152 JLD NWR W 101 32153 JLD NWR W 101 42154 JLD NWR C 102 12155 JLD NWR W 102 12156 JLD NWR W 102 22157 JLD NWR W 102 3

2158 JLD NWR W 102 42159 JLD NWR C 103 12160 JLD NWR W 103 12161 JLD NWR W 103 22162 JLD NWR W 103 32163 JLD NWR W 103 42164 JLD NWR C 104 12165 JLD NWR W 104 12166 JLD NWR W 104 22167 JLD NWR W 104 32168 JLD NWR W 104 4

2169 JLD NWR C 105 1

2170 JLD NWR W 105 1

2171 JLD NWR W 105 22172 JLD NWR W 105 32173 JLD NWR W 105 42174 JLD NWR C 106 12175 JLD NWR W 106 12176 JLD NWR W 106 22177 JLD NWR W 106 32178 JLD NWR W 106 42179 JLD NWR C 110 12180 JLD NWR W 110 12181 JLD NWR W 110 22182 JLD NWR W 110 32183 JLD NWR W 110 42184 JLD NWR C 111 12185 JLD NWR W 111 12186 JLD NWR W 111 22187 JLD NWR W 111 32188 JLD NWR W 111 42189 JLD NWR C 112 12190 JLD NWR W 112 12191 JLD NWR W 112 22192 JLD NWR W 112 32193 JLD NWR W 112 42194 JLD NWR C 113 12195 JLD NWR W 113 12196 JLD NWR W 113 22197 JLD NWR W 113 32198 JLD NWR W 113 42199 JLD NWR C 114 1

2200 JLD NWR W 114 12201 JLD NWR W 114 22202 JLD NWR W 114 32203 JLD NWR W 114 42204 JLD NWR C 115 12205 JLD NWR W 115 12206 JLD NWR W 115 22207 JLD NWR W 115 32208 JLD NWR W 115 42209 JLD NWR C 116 12210 JLD NWR W 116 12211 JLD NWR W 116 22212 JLD NWR W 116 32213 JLD NWR W 116 42214 JLD NWR C 117 12215 JLD NWR W 117 12216 JLD NWR W 117 22217 JLD NWR W 117 32218 JLD NWR C 118 12219 JLD NWR W 118 12220 JLD NWR W 118 22221 JLD NWR W 118 32222 JLD NWR P 201 12223 JLD NWR P 202 12224 JLD NWR P 203 12225 JLD NWR P 204 12226 JLD NWR P 205 12227 JLD NWR P 206 12228 JLD NWR P 207 12229 JLD NWR P 208 12230 JLD NWR P 209 12231 JLD NWR P 210 12232 JLD NWR P 301 12233 JLD NWR P 302 12234 JLD NWR P 303 12235 JLD NWR P 304 12236 JLD NWR P 305 12237 JLD NWR P 306 12238 JLD NWR P 307 12239 JLD NWR P 308 12240 JLD NWR P 309 12241 JLD NWR C 991 992242 JPR DLC CC 65 12243 JPR DLC CC 65 22244 JPR DLC CC 65 3

2245 JPR DLC CC 65 4

2246 JPR RJN W 101 1

2247 JPR RJN C 101 1

2248 JPR RJN W 101 2

2249 JPR RJN W 101 3

2250 JPR RJN W 101 4

2251 JPR RJN C 102 1

2252 JPR RJN W 102 1

2253 JPR RJN W 102 2

2254 JPR RJN W 102 3

2255 JPR RJN W 102 4

2256 JPR RJN C 103 1

2257 JPR RJN W 103 1

2258 JPR RJN W 103 2

2259 JPR RJN W 103 3

2260 JPR RJN W 103 4

2261 JPR RJN C 104 1

2262 JPR RJN W 104 1

2263 JPR RJN W 104 2

2264 JPR RJN W 104 32265 JPR RJN W 104 4

2266 JPR RJN C 105 1

2267 JPR RJN W 105 1

2268 JPR RJN W 105 2

2269 JPR RJN W 105 3

2270 JPR RJN W 105 4

2271 JPR RJN C 106 1

2272 JPR RJN W 106 1

2273 JPR RJN W 106 2

2274 JPR RJN W 106 3

2275 JPR RJN W 106 4

2276 JPR RJN C 107 1

2277 JPR RJN W 107 1

2278 JPR RJN W 107 2

2279 JPR RJN W 107 3

2280 JPR RJN W 107 42281 JPR RJN W 107 52282 JPR RJN W 108 12283 JPR RJN C 108 12284 JPR RJN W 108 22285 JPR RJN W 108 32286 JPR RJN W 108 5

2287 JPR RJN W 109 12288 JPR RJN C 109 12289 JPR RJN W 109 22290 JPR RJN W 109 32291 JPR RJN W 109 42292 JPR RJN W 109 5

2293 JPR RJN W 110 12294 JPR RJN C 110 1

2295 JPR RJN W 110 2

2296 JPR RJN W 110 3

2297 JPR RJN W 110 4

2298 JPR RJN W 111 1

2299 JPR RJN C 111 1

2300 JPR RJN W 111 2

2301 JPR RJN W 111 32302 JPR RJN W 111 4

2303 JPR RJN W 112 1

2304 JPR RJN C 112 1

2305 JPR RJN W 112 2

2306 JPR RJN W 112 32307 JPR RJN W 112 4

2308 JPR RJN C 991 992309 KLP DLC CC 119 12310 KLP DLC W 119 22311 KLP PNE C 93 12312 KLP PNE W 93 12313 KLP PNE W 93 22314 KLP PNE W 93 32315 KLP PNE W 93 42316 KLP PNE C 94 12317 KLP PNE W 94 12318 KLP PNE W 94 22319 KLP PNE W 94 3

2320 KLP PNE W 94 42321 KLP PNE W 95 12322 KLP PNE C 95 12323 KLP PNE W 95 22324 KLP PNE W 95 32325 KLP PNE W 95 42326 KLP PNE C 96 12327 KLP PNE W 96 12328 KLP PNE W 96 22329 KLP PNE W 96 32330 KLP PNE W 96 42331 KLP PNE C 97 12332 KLP PNE W 97 12333 KLP PNE W 97 22334 KLP PNE W 97 32335 KLP PNE W 97 42336 KLP PNE C 98 12337 KLP PNE W 98 12338 KLP PNE W 98 22339 KLP PNE W 98 32340 KLP PNE W 98 42341 KLP PNE C 995 992342 KNP DLC CC 28 12343 KNP DLC CC 28 22344 KNP DLC CC 28 32345 KNP DLC CC 28 42346 KNP DLC CC 28 52347 KNP DLC CC 28 112348 KNP DLC CC 29 12349 KNP DLC CC 29 22350 KNP DLC CC 29 32351 KNP DLC CC 29 42352 KNP DLC CC 29 52353 KNP DLC CC 29 62354 KNP DLC CC 29 112355 KNP DLC CC 34 12356 KNP DLC CC 34 112357 KNP DLC CC 34 212358 KNP DLC CC 34 22

2359 KNP KNP W 51 12360 KNP KNP C 51 1

2361 KNP KNP W 51 2

2362 KNP KNP W 51 3

2363 KNP KNP W 51 4

2364 KNP KNP W 52 12365 KNP KNP C 52 1

2366 KNP KNP W 52 2

2367 KNP KNP W 52 3

2368 KNP KNP W 52 42369 KNP KNP C 53 12370 KNP KNP W 53 12371 KNP KNP W 53 22372 KNP KNP W 53 32373 KNP KNP W 53 42374 KNP KNP W 54 12375 KNP KNP C 54 12376 KNP KNP W 54 22377 KNP KNP W 54 32378 KNP KNP W 54 42379 KNP KNP W 55 12380 KNP KNP C 55 1

2381 KNP KNP W 55 22382 KNP KNP W 55 32383 KNP KNP W 55 42384 KNP KNP C 56 12385 KNP KNP W 56 12386 KNP KNP W 56 22387 KNP KNP W 56 32388 KNP KNP W 56 42389 KNP KNP W 56 62390 LKN DLC CC 591 12391 LKN DLC CC 591 22392 LKN DLC CC 591 32393 LKN LKN C 41 112394 LKN LKN W 41 112395 LKN LKN W 41 122396 LKN LKN W 41 132397 LKN LKN W 41 142398 LKN LKN W 42 12399 LKN LKN W 42 22400 LKN LKN W 42 32401 LKN LKN W 42 42402 LKN LKN C 42 112403 LKN LKN W 43 12404 LKN LKN W 43 22405 LKN LKN W 43 32406 LKN LKN W 43 42407 LKN LKN C 43 11

2408 LKN LKN W 51 12409 LKN LKN C 51 1

2410 LKN LKN W 51 2

2411 LKN LKN W 51 3

2412 LKN LKN W 51 4

2413 LKN LKN C 51 11

2414 LKN LKN W 52 1

2415 LKN LKN C 52 1

2416 LKN LKN W 52 2

2417 LKN LKN W 52 3

2418 LKN LKN W 52 4

2419 LKN LKN C 52 11

2420 LKN LKN W 53 12421 LKN LKN C 53 1

2422 LKN LKN W 53 2

2423 LKN LKN W 53 3

2424 LKN LKN W 53 4

2425 LKN LKN C 53 112426 LKN LKN W 61 12427 LKN LKN W 61 22428 LKN LKN W 61 32429 LKN LKN W 61 42430 LKN LKN C 61 112431 LKN LKN W 62 12432 LKN LKN W 62 22433 LKN LKN W 62 32434 LKN LKN W 62 42435 LKN LKN C 62 112436 LKN LKN W 63 12437 LKN LKN W 63 22438 LKN LKN W 63 32439 LKN LKN W 63 42440 LKN LKN C 63 112441 LKN LKN W 71 12442 LKN LKN W 71 22443 LKN LKN W 71 3

2444 LKN LKN W 71 42445 LKN LKN C 71 112446 LKN LKN W 72 12447 LKN LKN W 72 22448 LKN LKN W 72 32449 LKN LKN W 72 42450 LKN LKN C 72 112451 LKN LKN W 73 12452 LKN LKN W 73 22453 LKN LKN W 73 32454 LKN LKN W 73 42455 LKN LKN C 73 112456 LKN LKN C 91 1

2457 LKN LKN W 91 1

2458 LKN LKN W 91 2

2459 LKN LKN W 91 3

2460 LKN LKN W 91 4

2461 LKN LKN C 91 11

2462 LKN LKN W 92 1

2463 LKN LKN C 92 1

2464 LKN LKN W 92 22465 LKN LKN C 92 2

2466 LKN LKN W 92 3

2467 LKN LKN W 92 4

2468 LKN LKN W 93 12469 LKN LKN C 93 1

2470 LKN LKN W 93 2

2471 LKN LKN W 93 3

2472 LKN LKN W 93 4

2473 LKN LKN C 93 11

2474 LKN LKN C 991 912475 MRI CHE W 501 112476 MRI CHE W 501 122477 MRI CHE W 501 212478 MRI CHE W 501 22

2479 MRI CHE C 501 51

2480 MRI CHE C 501 522481 MRI CHE W 502 112482 MRI CHE W 502 122483 MRI CHE W 502 132484 MRI CHE W 502 142485 MRI CHE W 502 152486 MRI CHE W 502 212487 MRI CHE W 502 222488 MRI CHE W 502 23

2489 MRI CHE C 502 512490 MRI CHE W 503 112491 MRI CHE W 503 122492 MRI CHE W 503 132493 MRI CHE W 503 142494 MRI CHE W 503 212495 MRI CHE W 503 22

2496 MRI CHE C 503 512497 MRI CHE W 511 11

2498 MRI CHE W 511 16

2499 MRI CHE W 511 17

2500 MRI CHE W 511 182501 MRI CHE W 511 212502 MRI CHE W 511 22

2503 MRI CHE C 511 512504 MRI CHE W 512 112505 MRI CHE W 512 12

2506 MRI CHE W 512 132507 MRI CHE W 512 14

2508 MRI CHE W 512 21

2509 MRI CHE W 512 22

2510 MRI CHE C 512 512511 MRI CHE W 513 112512 MRI CHE W 513 122513 MRI CHE W 513 132514 MRI CHE W 513 14

2515 MRI CHE C 513 512516 MRT DLC CC 202 12517 MRT DLC CC 202 22518 MRT DLC CC 202 32519 MRT DLC CC 202 42520 MRT KNP W 14 12521 MRT KNP C 14 12522 MRT KNP W 14 22523 MRT KNP W 14 32524 MRT KNP W 14 42525 MRT KNP C 15 12526 MRT KNP W 15 12527 MRT KNP W 15 22528 MRT KNP W 15 32529 MRT KNP W 15 42530 MRT KNP W 15 52531 MRT KNP C 16 12532 MRT KNP W 16 12533 MRT KNP W 16 22534 MRT KNP W 16 52535 MRT KNP W 16 62536 MRT KNP C 17 12537 MRT KNP CC 17 12538 MRT KNP W 17 12539 MRT KNP W 17 22540 MRT KNP W 17 32541 MRT KNP W 17 42542 MRT KNP W 17 72543 MRT KNP C 18 12544 MRT KNP W 18 1

2545 MRT KNP W 18 22546 MRT KNP W 18 32547 MRT KNP W 18 52548 MRT KNP W 18 62549 MRT KNP C 19 12550 MRT KNP W 19 12551 MRT KNP W 19 22552 MRT KNP W 19 32553 MRT KNP W 19 42554 MRT KNP C 23 12555 MRT KNP W 23 12556 MRT KNP W 23 22557 MRT KNP W 23 42558 MRT KNP W 23 52559 MRT KNP C 24 12560 MRT KNP W 24 12561 MRT KNP W 24 22562 MRT KNP W 24 42563 MRT KNP W 24 72564 MRT KNP C 25 12565 MRT KNP W 25 12566 MRT KNP W 25 22567 MRT KNP W 25 32568 MRT KNP W 25 42569 MRT KNP W 25 52570 MRT KNP CC 26 12571 MRT KNP W 26 12572 MRT KNP C 26 12573 MRT KNP W 26 22574 MRT KNP W 26 32575 MRT KNP W 26 42576 MRT KNP W 27 12577 MRT KNP C 27 12578 MRT KNP W 27 22579 MRT KNP W 27 32580 MRT KNP W 27 42581 MRT KNP C 28 12582 MRT KNP W 28 12583 MRT KNP W 28 22584 MRT KNP W 28 32585 MRT KNP W 28 42586 MRT KNP W 28 62587 MRT KNP W 28 72588 MRT KNP W 28 82589 MRT KNP W 28 9

2590 MRT KNP W 28 102591 MRT KNP W 88 12592 MRT KNP C 88 12593 MRT KNP W 88 22594 MRT KNP W 88 32595 MRT KNP W 88 42596 MRT KNP C 89 12597 MRT KNP W 89 12598 MRT KNP W 89 52599 MRT KNP W 89 62600 MRT KNP W 89 72601 MRT KNP W 90 12602 MRT KNP C 90 12603 MRT KNP W 90 22604 MRT KNP W 90 32605 MRT KNP W 90 42606 NGP DLC CC 91 12607 NGP DLC CC 91 22608 NGP DLC CC 91 32609 NGP DLC CC 91 42610 NGP DLC CC 92 12611 NGP DLC CC 92 22612 NGP DLC CC 92 32613 NGP DLC CC 92 52614 NGP NGP C 1 12615 NGP NGP W 1 12616 NGP NGP W 1 22617 NGP NGP W 1 32618 NGP NGP W 1 42619 NGP NGP C 2 12620 NGP NGP W 2 12621 NGP NGP W 2 22622 NGP NGP W 2 42623 NGP NGP C 3 12624 NGP NGP W 3 12625 NGP NGP W 3 22626 NGP NGP W 3 32627 NGP NGP W 3 42628 NGP NGP C 4 12629 NGP NGP W 4 12630 NGP NGP W 4 22631 NGP NGP W 4 32632 NGP NGP W 4 42633 NGP NGP C 5 12634 NGP NGP W 5 1

2635 NGP NGP W 5 22636 NGP NGP W 5 32637 NGP NGP W 5 42638 NGP NGP C 6 12639 NGP NGP W 6 12640 NGP NGP W 6 22641 NGP NGP W 6 32642 NGP NGP C 7 12643 NGP NGP W 7 12644 NGP NGP W 7 22645 NGP NGP W 7 32646 NGP NGP W 7 122647 NGP NGP C 8 12648 NGP NGP W 8 12649 NGP NGP W 8 112650 NGP NGP W 8 122651 NGP NGP C 101 12652 NGP NGP W 101 12653 NGP NGP W 101 22654 NGP NGP W 101 32655 NGP NGP W 101 42656 NGP NGP C 201 12657 NGP NGP W 201 12658 NGP NGP W 201 22659 NGP NGP W 201 32660 NGP NGP W 201 42661 NGP NGP C 301 12662 NGP NGP W 301 12663 NGP NGP W 301 22664 NGP NGP W 301 32665 NGP NGP W 301 42666 NGP NGP C 401 12667 NGP NGP W 401 12668 NGP NGP W 401 22669 NGP NGP W 401 32670 NGP NGP W 401 42671 NGP NGP C 993 992672 NSK DLC W 94 12673 NSK DLC CC 94 12674 NSK DLC CC 94 22675 NSK DLC W 94 22676 NSK DLC W 94 32677 NSK DLC CC 94 32678 NSK DLC CC 94 42679 NSK PNE C 21 1

2680 NSK PNE W 21 12681 NSK PNE W 21 22682 NSK PNE W 21 32683 NSK PNE W 21 42684 NSK PNE W 22 12685 NSK PNE C 22 22686 NSK PNE W 22 22687 NSK PNE W 22 32688 NSK PNE W 22 42689 NSK PNE C 23 12690 NSK PNE W 23 12691 NSK PNE W 23 22692 NSK PNE W 23 32693 NSK PNE W 23 42694 NSK PNE W 24 12695 NSK PNE W 24 22696 NSK PNE C 24 32697 NSK PNE W 24 32698 NSK PNE W 24 42699 NSK PNE W 25 12700 NSK PNE C 25 12701 NSK PNE W 25 22702 NSK PNE W 25 32703 NSK PNE W 25 42704 NSK PNE W 26 12705 NSK PNE C 26 22706 NSK PNE W 26 22707 NSK PNE W 26 32708 NSK PNE W 26 42709 NSK PNE C 27 12710 NSK PNE W 27 12711 NSK PNE W 27 22712 NSK PNE W 27 32713 NSK PNE W 27 42714 NSK PNE W 28 12715 NSK PNE C 28 22716 NSK PNE W 28 22717 NSK PNE W 28 32718 NSK PNE W 28 42719 NSK PNE C 29 12720 NSK PNE W 29 12721 NSK PNE W 29 22722 NSK PNE W 29 32723 NSK PNE W 29 42724 NSK PNE C 996 99

2725 PNE DLC W 87 12726 PNE DLC CC 87 12727 PNE DLC CC 87 22728 PNE DLC W 88 12729 PNE DLC CC 88 12730 PNE DLC CC 88 22731 PNE DLC CC 88 32732 PNE DLC W 89 12733 PNE DLC CC 89 12734 PNE DLC CC 89 22735 PNE DLC CC 89 32736 PNE PNE C 50 12737 PNE PNE W 50 12738 PNE PNE W 50 22739 PNE PNE W 50 32740 PNE PNE W 50 42741 PNE PNE C 52 12742 PNE PNE W 52 12743 PNE PNE C 52 22744 PNE PNE W 52 22745 PNE PNE W 52 32746 PNE PNE W 52 42747 PNE PNE C 53 12748 PNE PNE W 53 12749 PNE PNE W 53 22750 PNE PNE W 53 32751 PNE PNE C 54 12752 PNE PNE W 54 12753 PNE PNE W 54 22754 PNE PNE W 54 42755 PNE PNE C 55 12756 PNE PNE W 55 12757 PNE PNE W 55 22758 PNE PNE W 55 42759 PNE PNE W 55 52760 PNE PNE W 55 62761 PNE PNE C 56 12762 PNE PNE W 56 12763 PNE PNE W 56 22764 PNE PNE W 56 32765 PNE PNE W 56 42766 PNE PNE C 57 12767 PNE PNE W 57 12768 PNE PNE W 57 22769 PNE PNE W 57 3

2770 PNE PNE W 57 42771 PNE PNE C 58 12772 PNE PNE W 58 12773 PNE PNE W 58 22774 PNE PNE W 58 32775 PNE PNE W 58 42776 PNE PNE C 59 12777 PNE PNE W 59 12778 PNE PNE W 59 22779 PNE PNE W 59 32780 PNE PNE W 59 42781 PNE PNE C 60 12782 PNE PNE W 60 12783 PNE PNE W 60 22784 PNE PNE W 60 32785 PNE PNE W 60 42786 PNE PNE C 61 12787 PNE PNE W 61 12788 PNE PNE W 61 22789 PNE PNE W 61 32790 PNE PNE W 61 42791 PNE PNE C 62 12792 PNE PNE W 62 12793 PNE PNE W 62 22794 PNE PNE W 62 32795 PNE PNE W 62 42796 PNE PNE C 63 12797 PNE PNE W 63 12798 PNE PNE W 63 22799 PNE PNE W 63 32800 PNE PNE W 63 42801 PNE PNE C 64 12802 PNE PNE W 64 12803 PNE PNE W 64 22804 PNE PNE W 64 32805 PNE PNE W 64 42806 PNE PNE C 70 12807 PNE PNE W 70 12808 PNE PNE W 70 22809 PNE PNE W 70 32810 PNE PNE W 70 42811 PNE PNE C 71 12812 PNE PNE W 71 12813 PNE PNE W 71 22814 PNE PNE W 71 3

2815 PNE PNE W 71 42816 PNE PNE C 72 12817 PNE PNE W 72 12818 PNE PNE W 72 22819 PNE PNE W 72 32820 PNE PNE W 72 42821 PNE PNE C 73 12822 PNE PNE W 73 12823 PNE PNE W 73 22824 PNE PNE W 73 32825 PNE PNE W 73 42826 PNE PNE C 75 12827 PNE PNE W 75 12828 PNE PNE W 75 22829 PNE PNE W 75 32830 PNE PNE W 75 42831 PNE PNE C 76 12832 PNE PNE W 76 12833 PNE PNE W 76 22834 PNE PNE W 76 32835 PNE PNE W 76 42836 PNE PNE C 77 12837 PNE PNE W 77 12838 PNE PNE W 77 22839 PNE PNE W 77 32840 PNE PNE W 77 42841 PNE PNE C 80 12842 PNE PNE W 80 12843 PNE PNE W 80 22844 PNE PNE W 80 32845 PNE PNE W 80 42846 PNE PNE C 81 12847 PNE PNE W 81 12848 PNE PNE W 81 22849 PNE PNE W 81 32850 PNE PNE W 81 42851 PTL NWR C 37 12852 PTL NWR W 37 12853 PTL NWR W 37 22854 PTL NWR W 37 32855 PTL NWR W 37 42856 PTL NWR C 38 12857 PTL NWR W 38 12858 PTL NWR W 38 22859 PTL NWR W 38 3

2860 PTL NWR W 38 42861 PTL NWR W 38 62862 PTL NWR C 39 12863 PTL NWR W 39 12864 PTL NWR W 39 22865 PTL NWR W 39 32866 PTL NWR W 39 42867 PTL NWR W 39 62868 PTL NWR W 39 72869 PTL NWR C 40 12870 PTL NWR W 40 12871 PTL NWR W 40 22872 PTL NWR W 40 32873 PTL NWR W 40 42874 PTL NWR W 40 62875 PTL NWR C 41 12876 PTL NWR W 41 12877 PTL NWR W 41 22878 PTL NWR W 41 32879 PTL NWR W 41 42880 PTL NWR C 42 12881 PTL NWR W 42 12882 PTL NWR W 42 22883 PTL NWR W 42 32884 PTL NWR W 42 42885 PTL NWR C 43 12886 PTL NWR W 43 12887 PTL NWR W 43 22888 PTL NWR W 43 32889 PTL NWR W 43 42890 PTL NWR W 44 12891 PTL NWR C 44 12892 PTL NWR W 44 22893 PTL NWR W 44 32894 PTL NWR W 44 42895 PTL NWR C 45 12896 PTL NWR W 45 12897 PTL NWR W 45 22898 PTL NWR W 45 32899 PTL NWR W 45 42900 PTL NWR C 46 12901 PTL NWR W 46 12902 PTL NWR W 46 22903 PTL NWR W 46 32904 PTL NWR W 46 4

2905 PTL NWR C 47 12906 PTL NWR W 47 12907 PTL NWR W 47 22908 PTL NWR W 47 32909 PTL NWR W 47 42910 PTL NWR W 48 12911 PTL NWR C 48 12912 PTL NWR W 48 22913 PTL NWR W 48 32914 PTL NWR W 48 42915 PTL NWR C 49 12916 PTL NWR W 49 12917 PTL NWR W 49 22918 PTL NWR W 49 32919 PTL NWR W 49 42920 PTL NWR CC 700 12921 PTL NWR CC 700 22922 PTL NWR CC 700 32923 PTN DLC CC 83 12924 PTN DLC CC 83 22925 PTN DLC CC 83 52926 PTN DLC CC 83 62927 PTN DLC CC 83 7

2928 PTN PTN C 21 1

2929 PTN PTN W 21 1

2930 PTN PTN W 21 4

2931 PTN PTN W 21 5

2932 PTN PTN W 21 6

2933 PTN PTN C 22 1

2934 PTN PTN W 22 4

2935 PTN PTN W 22 52936 PTN PTN W 22 8

2937 PTN PTN W 23 1

2938 PTN PTN C 23 1

2939 PTN PTN W 23 2

2940 PTN PTN W 23 3

2941 PTN PTN W 23 4

2942 PTN PTN W 23 5

2943 PTN PTN W 24 1

2944 PTN PTN C 24 1

2945 PTN PTN W 24 2

2946 PTN PTN W 24 3

2947 PTN PTN W 24 4

2948 PTN PTN W 25 1

2949 PTN PTN C 25 1

2950 PTN PTN W 25 2

2951 PTN PTN W 25 5

2952 PTN PTN W 25 6

2953 PTN PTN C 26 1

2954 PTN PTN W 26 1

2955 PTN PTN W 26 2

2956 PTN PTN W 26 5

2957 PTN PTN W 26 6

2958 PTN PTN W 27 1

2959 PTN PTN C 27 1

2960 PTN PTN W 27 2

2961 PTN PTN W 27 3

2962 PTN PTN W 27 4

2963 PTN PTN W 28 1

2964 PTN PTN C 28 1

2965 PTN PTN W 28 2

2966 PTN PTN W 28 3

2967 PTN PTN W 28 4

2968 PTN PTN W 29 1

2969 PTN PTN C 29 1

2970 PTN PTN W 29 2

2971 PTN PTN W 29 4

2972 PTN PTN W 29 5

2973 PTN PTN W 30 1

2974 PTN PTN C 30 1

2975 PTN PTN W 30 2

2976 PTN PTN W 30 5

2977 PTN PTN W 30 6

2978 PTN PTN C 31 12979 PTN PTN W 31 1

2980 PTN PTN W 31 5

2981 PTN PTN W 31 6

2982 PTN PTN W 31 7

2983 PTN PTN W 31 8

2984 PTN PTN C 32 1

2985 PTN PTN W 32 1

2986 PTN PTN W 32 2

2987 PTN PTN W 32 5

2988 PTN PTN W 32 62989 RCH DLC CC 801 962990 RCH DLC CC 801 972991 RCH DLC CC 801 982992 RCH DLC CC 801 992993 RCH PTN W 51 12994 RCH PTN C 51 12995 RCH PTN W 51 22996 RCH PTN W 51 32997 RCH PTN W 51 4

2998 RCH PTN C 52 12999 RCH PTN W 52 1

3000 RCH PTN W 52 23001 RCH PTN W 52 33002 RCH PTN W 52 43003 RCH PTN W 53 1

3004 RCH PTN C 53 13005 RCH PTN W 53 23006 RCH PTN W 53 33007 RCH PTN W 53 4

3008 RCH PTN C 54 1

3009 RCH PTN W 54 1

3010 RCH PTN W 54 2

3011 RCH PTN W 54 3

3012 RCH PTN W 54 4

3013 RCH PTN C 55 1

3014 RCH PTN W 55 1

3015 RCH PTN W 55 2

3016 RCH PTN W 55 3

3017 RCH PTN W 55 4

3018 RCH PTN C 56 1

3019 RCH PTN W 56 1

3020 RCH PTN W 56 2

3021 RCH PTN W 56 3

3022 RCH PTN W 56 4

3023 RCH PTN C 57 1

3024 RCH PTN W 57 1

3025 RCH PTN W 57 2

3026 RCH PTN W 57 3

3027 RCH PTN W 57 4

3028 RCH PTN C 58 1

3029 RCH PTN W 58 1

3030 RCH PTN W 58 2

3031 RCH PTN W 58 3

3032 RCH PTN W 58 4

3033 RCH PTN C 59 13034 RCH PTN W 59 13035 RCH PTN W 59 23036 RCH PTN W 59 33037 RCH PTN W 59 43038 RCH PTN W 60 1

3039 RCH PTN C 60 1

3040 RCH PTN W 60 23041 RCH PTN W 60 33042 RCH PTN W 60 43043 RCH PTN C 61 13044 RCH PTN W 61 13045 RCH PTN W 61 23046 RCH PTN W 61 33047 RCH PTN W 61 43048 RCH PTN W 62 13049 RCH PTN C 62 1

3050 RCH PTN W 62 23051 RCH PTN W 62 33052 RCH PTN W 62 43053 RCH PTN C 992 993054 RKT DLC CC 96 13055 RKT DLC CC 96 23056 RKT GUJ W 201 13057 RKT GUJ C 201 13058 RKT GUJ W 201 23059 RKT GUJ W 201 33060 RKT GUJ W 201 43061 RKT GUJ C 202 13062 RKT GUJ W 202 13063 RKT GUJ W 202 23064 RKT GUJ W 202 33065 RKT GUJ W 202 43066 RKT GUJ C 203 13067 RKT GUJ W 203 13068 RKT GUJ W 203 23069 RKT GUJ W 203 33070 RKT GUJ W 203 43071 RKT GUJ C 204 13072 RKT GUJ W 204 13073 RKT GUJ W 204 23074 RKT GUJ W 204 33075 RKT GUJ W 204 43076 RKT GUJ C 205 13077 RKT GUJ W 205 13078 RKT GUJ W 205 23079 RKT GUJ W 205 33080 RKT GUJ W 205 43081 RKT GUJ C 211 13082 RKT GUJ W 211 13083 RKT GUJ W 211 2

3084 RKT GUJ W 211 33085 RKT GUJ W 211 43086 RKT GUJ C 212 13087 RKT GUJ W 212 13088 RKT GUJ W 212 23089 RKT GUJ W 212 33090 RKT GUJ W 212 43091 RKT GUJ C 221 13092 RKT GUJ W 221 13093 RKT GUJ W 221 23094 RKT GUJ W 221 33095 RKT GUJ W 221 43096 RKT GUJ W 222 13097 RKT GUJ C 222 13098 RKT GUJ W 222 23099 RKT GUJ W 222 33100 RKT GUJ W 222 43101 RKT GUJ C 223 13102 RKT GUJ W 223 13103 RKT GUJ W 223 23104 RKT GUJ W 223 33105 RKT GUJ W 223 43106 RKT GUJ C 233 13107 RKT GUJ W 233 13108 RKT GUJ W 233 23109 RKT GUJ W 233 33110 RKT GUJ W 233 4

3111 RKT GUJ C 992 993112 RTK DLC CC 118 13113 RTK DLC CC 118 23114 RTK DLC CC 118 33115 RTK NWR W 51 13116 RTK NWR C 51 13117 RTK NWR W 51 23118 RTK NWR W 51 33119 RTK NWR W 51 43120 RTK NWR W 51 53121 RTK NWR W 52 13122 RTK NWR C 52 13123 RTK NWR W 52 23124 RTK NWR W 52 33125 RTK NWR W 52 43126 RTK NWR C 53 13127 RTK NWR W 53 1

3128 RTK NWR C 53 23129 RTK NWR W 53 23130 RTK NWR W 53 33131 RTK NWR W 53 43132 RTK NWR W 53 53133 RTK NWR W 53 63134 RTK NWR C 54 13135 RTK NWR W 54 13136 RTK NWR W 54 23137 RTK NWR W 54 33138 RTK NWR W 54 43139 RTK NWR C 55 13140 RTK NWR W 55 13141 RTK NWR W 55 23142 RTK NWR W 55 33143 RTK NWR W 55 43144 RTK NWR C 56 13145 RTK NWR W 56 13146 RTK NWR W 56 23147 RTK NWR W 56 33148 RTK NWR W 56 43149 RTK NWR C 57 13150 RTK NWR W 57 13151 RTK NWR W 57 23152 RTK NWR W 57 33153 RTK NWR W 57 43154 RTK NWR C 58 13155 RTK NWR W 58 13156 RTK NWR W 58 23157 RTK NWR W 58 33158 RTK NWR W 58 43159 RTK NWR C 59 13160 RTK NWR W 59 13161 RTK NWR W 59 23162 RTK NWR W 59 33163 RTK NWR W 59 43164 RTK NWR C 60 13165 RTK NWR W 60 13166 RTK NWR W 60 23167 RTK NWR W 60 33168 RTK NWR W 60 43169 RTK NWR C 61 13170 RTK NWR W 61 13171 RTK NWR W 61 23172 RTK NWR W 61 3

3173 RTK NWR W 61 43174 RTK NWR C 62 13175 RTK NWR W 62 13176 RTK NWR W 62 23177 RTK NWR W 62 33178 RTK NWR W 62 43179 RTK NWR C 63 13180 RTK NWR W 63 13181 RTK NWR W 63 23182 RTK NWR W 63 33183 RTK NWR W 63 43184 RTK NWR C 64 13185 RTK NWR W 64 13186 RTK NWR W 64 23187 RTK NWR W 64 33188 RTK NWR W 64 43189 RTK NWR W 65 13190 RTK NWR C 65 13191 RTK NWR W 65 23192 RTK NWR W 65 33193 RTK NWR W 65 43194 RTK NWR C 70 13195 RTK NWR W 70 13196 RTK NWR W 70 23197 RTK NWR W 70 33198 RTK NWR C 993 993199 SHL SHL C 1 13200 SHL SHL W 1 13201 SHL SHL W 1 23202 SHL SHL W 1 33203 SHL SHL W 1 43204 SHL SHL W 1 53205 SHL SHL C 2 13206 SHL SHL W 2 13207 SHL SHL W 2 23208 SHL SHL W 2 113209 SHL SHL W 2 123210 SHL SHL C 3 13211 SHL SHL W 3 13212 SHL SHL W 3 23213 SHL SHL W 3 33214 SHL SHL W 3 43215 SHL SHL W 3 53216 SHL SHL C 4 13217 SHL SHL W 4 1

3218 SHL SHL W 4 23219 SHL SHL W 4 33220 SHL SHL W 4 113221 SHL SHL W 4 213222 SHL SHL C 5 13223 SHL SHL W 5 13224 SHL SHL W 5 23225 SHL SHL W 5 33226 SHL SHL W 5 113227 SHL SHL C 6 13228 SHL SHL W 6 13229 SHL SHL W 6 23230 SHL SHL W 6 113231 SHL SHL W 6 123232 SHL SHL C 7 13233 SHL SHL W 7 13234 SHL SHL W 7 23235 SHL SHL W 7 33236 SHL SHL W 7 113237 SHL SHL C 8 13238 SHL SHL W 8 13239 SHL SHL W 8 23240 SHL SHL W 8 113241 SHL SHL W 8 123242 SHL SHL C 9 13243 SHL SHL W 9 13244 SHL SHL W 9 23245 SHL SHL W 9 33246 SHL SHL C 14 13247 SHL SHL W 14 13248 SHL SHL W 14 23249 SHL SHL W 14 33250 SHL SHL W 14 113251 SHL SHL W 14 123252 SHL SHL W 15 13253 SHL SHL CI 15 13254 SHL SHL W 15 23255 SHL SHL W 15 33256 SHL SHL C 16 13257 SHL SHL W 16 13258 SHL SHL W 16 23259 SHL SHL W 16 33260 SHL SHL W 16 213261 SHL SHL W 16 313262 SHL SHL W 20 1

3263 SHL SHL C 20 13264 SHL SHL W 20 23265 SHL SHL W 20 33266 SHL SHL W 20 43267 SHL SHL C 25 13268 SHL SHL W 25 13269 SHL SHL W 25 23270 SHL SHL W 25 33271 SHL SHL W 26 13272 SHL SHL C 26 13273 SHL SHL W 26 23274 SHL SHL W 26 113275 SHL SHL W 26 123276 SHL SHL C 991 993277 SRT DLC CC 98 13278 SRT DLC CC 98 23279 SRT DLC CC 98 33280 SRT DLC CC 98 4

3281 SRT GUJ W 401 13282 SRT GUJ C 401 1

3283 SRT GUJ W 401 2

3284 SRT GUJ W 401 3

3285 SRT GUJ W 401 43286 SRT GUJ C 402 13287 SRT GUJ W 402 13288 SRT GUJ W 402 23289 SRT GUJ W 402 33290 SRT GUJ W 402 43291 SRT GUJ C 403 13292 SRT GUJ W 403 13293 SRT GUJ W 403 23294 SRT GUJ W 403 33295 SRT GUJ W 403 43296 SRT GUJ C 404 13297 SRT GUJ W 404 13298 SRT GUJ W 404 23299 SRT GUJ W 404 3

3300 SRT GUJ W 404 43301 SRT GUJ C 405 13302 SRT GUJ W 405 13303 SRT GUJ W 405 23304 SRT GUJ W 405 33305 SRT GUJ W 405 43306 SRT GUJ C 406 13307 SRT GUJ W 406 13308 SRT GUJ W 406 23309 SRT GUJ W 406 33310 SRT GUJ W 406 43311 SRT GUJ C 407 13312 SRT GUJ W 407 13313 SRT GUJ W 407 23314 SRT GUJ W 407 33315 SRT GUJ W 407 43316 SRT GUJ C 408 13317 SRT GUJ W 408 13318 SRT GUJ W 408 23319 SRT GUJ W 408 33320 SRT GUJ W 408 43321 SRT GUJ C 409 13322 SRT GUJ W 409 13323 SRT GUJ W 409 23324 SRT GUJ W 409 33325 SRT GUJ W 409 43326 SRT GUJ C 410 13327 SRT GUJ W 410 13328 SRT GUJ W 410 23329 SRT GUJ W 410 33330 SRT GUJ W 410 43331 SRT GUJ C 411 13332 SRT GUJ W 411 13333 SRT GUJ W 411 23334 SRT GUJ W 411 33335 SRT GUJ W 411 43336 SRT GUJ C 412 13337 SRT GUJ W 412 13338 SRT GUJ W 412 23339 SRT GUJ W 412 33340 SRT GUJ W 412 43341 SRT GUJ C 993 99

3342 TVD KRL C 51 1

3343 TVD KRL W 51 1

3344 TVD KRL C 51 2

3345 TVD KRL W 51 2

3346 TVD KRL C 51 3

3347 TVD KRL W 51 3

3348 TVD KRL W 51 43349 TVD KRL C 51 4

3350 TVD KRL C 52 1

3351 TVD KRL W 52 1

3352 TVD KRL W 52 2

3353 TVD KRL W 52 3

3354 TVD KRL W 52 4

3355 TVD KRL W 53 1

3356 TVD KRL C 53 1

3357 TVD KRL W 53 2

3358 TVD KRL W 53 3

3359 TVD KRL W 53 4

3360 TVD KRL C 61 1

3361 TVD KRL W 61 1

3362 TVD KRL W 61 2

3363 TVD KRL W 61 3

3364 TVD KRL W 61 4

3365 TVD KRL C 62 1

3366 TVD KRL W 62 1

3367 TVD KRL W 62 2

3368 TVD KRL W 62 3

3369 TVD KRL W 62 4

3370 TVD KRL C 63 1

3371 TVD KRL W 63 1

3372 TVD KRL W 63 2

3373 TVD KRL W 63 3

3374 TVD KRL W 63 4

3375 TVD KRL C 992 993376 VPN APR C 84 13377 VPN APR W 84 13378 VPN APR W 84 23379 VPN APR W 84 33380 VPN APR W 84 43381 VPN APR C 85 13382 VPN APR W 85 13383 VPN APR W 85 23384 VPN APR W 85 33385 VPN APR C 86 13386 VPN APR W 86 13387 VPN APR W 86 23388 VPN APR W 86 33389 VPN APR W 86 43390 VPN APR C 87 13391 VPN APR W 87 13392 VPN APR W 87 23393 VPN APR W 87 33394 VPN APR W 87 43395 VPN APR C 88 13396 VPN APR W 88 13397 VPN APR W 88 23398 VPN APR W 88 33399 VPN APR C 89 13400 VPN APR W 89 13401 VPN APR W 89 23402 VPN APR W 89 33403 VPN APR W 89 43404 VPN APR W 89 53405 VPN APR W 89 63406 VPN APR W 89 73407 VPN APR C 90 13408 VPN APR W 90 13409 VPN APR W 90 23410 VPN APR W 90 33411 VPN APR W 90 43412 VPN APR W 90 53413 VPN APR C 91 13414 VPN APR W 91 13415 VPN APR W 91 23416 VPN APR W 91 33417 VPN APR W 91 43418 VPN APR W 91 53419 VPN APR C 992 99

3420 VPN DLC CC 49 13421 VPN DLC CC 49 23422 VPN DLC CC 49 21

PAN AO CODE MASTER version 5.5 (For other than Mumbai Locations)

DESCRIPTIONACIT CIRCLE-1(1), AGRAINCOME TAX OFFICER 1(1), AGRAINCOME TAX OFFICER 1(2), AGRAINCOME TAX OFFICER 1(3), AGRAINCOME TAX OFFICER, AURAIYAACIT CIRCLE 2(1), AGRAINCOME TAX OFFICER 2(1), AGRAINCOME TAX OFFICER 2(2), AGRAINCOME TAX OFFICER 2(3), AGRAINCOME TAX OFFICER 2(4), AGRAACIT CIRCLE 3(1), MATHURAINCOME TAX OFFICER 3(1), MATHURAINCOME TAX OFFICER 3(2), MATHURAINCOME TAX OFFICER 3(3), MATHURAINCOME TAX OFFICER 3(4), MATHURAACIT CIRCLE 4(1), AGRAINCOME TAX OFFICER 4(1), AGRAINCOME TAX OFFICER 4(2), AGRAINCOME TAX OFFICER 4(3), AGRAINCOME TAX OFFICER 4(4), AGRAACIT CIRCLE-5(1), FIROZABADINCOME TAX OFFICER 5(1), FIROZABADINCOME TAX OFFICER 5(2), FIROZABADINCOME TAX OFFICER 5(3), FIROZABADINCOME TAX OFFICER, ETAWAHACIT CIRCLE 6(1), JHANSIINCOME TAX OFFICER 6(1), JHANSIINCOME TAX OFFICER 6(2), JHANSIINCOME TAX OFFICER 6(3), JHANSIINCOME TAX OFFICER 6(4), LALITPURACIT CIRCLE 1(1), ALIGARHINCOME TAX OFFICER 1(1), ALIGARHINCOME TAX OFFICER 1(2), ALIGARHINCOME TAX OFFICER 1(3), ALIGARHINCOME TAX OFFICER 1(4), ALIGARHACIT CIRCLE 2(1), FATEHGARHINCOME TAX OFFICER -1, FATEHGARHINCOME TAX OFFICER -2, FATEHGARHINCOME TAX OFFICER -1, KANNAUJINCOME TAX OFFICER -1, MAINPURIINCOME TAX OFFICER - 1, ETAH

ACIT CIRCLE, ETAHINCOME TAX OFFICER -1, KASGANJINCOME TAX OFFICER, WARD-3(3), HATHRASINCOME TAX OFFICER, WARD-3(4), HATHRASDCIT CENTRAL CIRCLE 1(1), AHMEDABADDCIT CENTRAL CIRCLE 1(2), AHMEDABADDCIT CENTRAL CIRCLE 1(3), AHMEDABADDCIT CENTRAL CIRCLE 1(4), AHMEDABADDCIT CENTRAL CIRCLE 2(1), AHMEDABADDCIT CENTRAL CIRCLE 2(2), AHMEDABADDCIT CENTRAL CIRCLE 2(3), AHMEDABADDCIT CENTRAL CIRCLE 2(4), AHMEDABADITO WARD 2(1) CENTRAL RANGE 2, AHMEDABADADIT EXEMPTION 1, AHMEDABADADIT EXEMPTION 2, AHMEDABADDDIT(EXEMPTION), AHMEDABADITO(EXEMPTION), AHMEDABADADIT(EXEMP), BHAVNAGARDDIT(EXEMP), SURENDRANAGARDDIT(EXEMP), HIMMATNAGARADIT(EXEMP), PALANPURDCIT CIRCLE-1, AHMEDABADITO WARD 1(1), AHMEDABADDCIT/ACIT (OSD) CIRCLE-1, AHMEDABADITO WARD 1(2), AHMEDABADITO WARD 1(3), AHMEDABADITO WARD 1(4), AHMEDABADITO WARD 2(1) AHMEDABADDCIT CIRCLE 2, AHMEDABADITO WARD 2(2) AHMEDABADITO WARD 2(3) AHMEDABADITO WARD 2(4) AHMEDABADITO WARD 3(1) AHMEDABADACIT CIRCLE 3, AHMEDABADITO WARD 3(2) AHMEDABADITO WARD 3(3) AHMEDABADITO WARD 3(4) AHMEDABADITO WARD 4(1) AHMEDABADDCIT CIRCLE 4, AHMEDABADACIT CIRCLE 4 AHMEDABADITO WARD 4(2) AHMEDABADITO WARD 4(3) AHMEDABADITO WARD 4(4) AHMEDABADITO WARD 5(1) AHMEDABAD

DCIT/ACIT CIRCLE 5, AHMEDABADITO WARD 5(2) AHMEDABADITO WARD 5(3) AHMEDABADITO WARD 5(4) AHMEDABADITO (OSD) 5(1) AHMEDABADITO WARD 6(1) AHMEDABADDCIT/ACIT CIRCLE 6, AHMEDABADITO WARD 6(2) AHMEDABADITO WARD 6(3) AHMEDABADITO WARD 6(4) AHMEDABADITO WARD 6(5) AHMEDABADITO WARD 7(1) AHMEDABADDCIT/ACIT CIRCLE 7, AHMEDABADITO WARD 7(2) AHMEDABADITO WARD 7(3) AHMEDABADITO WARD 7(4) AHMEDABADITO WARD 8(1) AHMEDABADDCIT/ACIT CIRCLE 8, AHMEDABADITO WARD 8(2) AHMEDABADDCIT/ACIT (OSD) CIRCLE 8, AHMEDABADITO WARD 8(3) AHMEDABADITO WARD 8(4) AHMEDABADITO WARD 8(5) AHMEDABADITO WARD 9(1) AHMEDABADDCIT/ACIT CIRCLE 9, AHMEDABADITO WARD 9(2) AHMEDABADDCIT/ACIT (OSD) CIRCLE-9, AHMEDABADITO WARD 9(3) AHMEDABADITO WARD 9(4) AHMEDABADITO WARD 10(1) AHMEDABADDCIT/ACIT CIRCLE 10, AHMEDABADDCIT/ACIT (OSD) CIRCLE 10 AHMEDABADITO WARD 10(2) AHMEDABADITO WARD 10(3) AHMEDABADITO WARD 10(4) AHMEDABADITO WARD 11(1) AHMEDABADDCIT/ACIT CIRCLE 11, AHMEDABADITO WARD 11(2) AHMEDABADITO WARD 11(3) AHMEDABADITO WARD 11(4) AHMEDABADDCIT/ACIT CIRCLE-12, AHMEDABADITO WARD 12(1), AHMEDABADITO WARD 12(2), AHMEDABADITO WARD 12(3), AHMEDABADITO WARD 12(4), AHMEDABAD

ITO WARD 13(1) AHMEDABADDCIT CIRCLE 13, AHMEDABADITO WARD 13(2) AHMEDABADITO WARD 13(3) AHMEDABADITO WARD 13(4) AHMEDABADDCIT/ACIT CIRCLE 14, AHMEDABADITO WARD 14(1) AHMEDABADITO WARD 14(2) AHMEDABADITO WARD 14(3) AHMEDABADITO WARD 14(4) AHMEDABADITO WARD 15(1) AHMEDABADDCIT/ACIT CIRCLE 15, AHMEDABADITO WARD 15(2) AHMEDABADITO WARD 15(3) AHMEDABADITO WARD 15(4) AHMEDABADDCIT/ACIT CIRCLE, SABARKANTHAITO WARD 1, HIMMATNAGARITO WARD 2, HIMMATNAGARITO WARD 3, HIMMATNAGARITO, MODASAITO WARD 1 PALANPURDCIT/ACIT CIRCLE, PALANPURITO WARD 2 PALANPURITO WARD 3 PALANPURITO WARD 4 PALANPURDCIT/ACIT CIRCLE, SURENDRANAGARITO WARD 1, SURENDRANAGARITO WARD 2, SURENDRANAGARITO WARD 3, SURENDRANAGARITO WARD 4, SURENDRANAGARITO WARD 1(1) BHAVNAGARDCIT/JCIT CIRCLE-1, BHAVNAGARITO WARD 1(2) BHAVNAGARITO WARD 1(3) BHAVNAGARITO WARD 1(4) BHAVNAGARITO WARD 2(1) BHAVNAGARDCIT/JCIT CIRCLE-2, BHAVNAGARITO WARD 2(2) BHAVNAGARITO WARD 2(3) BHAVNAGARITO WARD 2(4) BHAVNAGARDCIT/ACIT CIRCLE PATANITO WARD 1 PATANITO WARD 2 PATANITO WARD 3 PATANITO WARD 4 PATAN