p r o C E T Z s ' a n i h C f o e u c s e r p m u r T t s ... · world markets stock markets 0d\...

Transcript of p r o C E T Z s ' a n i h C f o e u c s e r p m u r T t s ... · world markets stock markets 0d\...

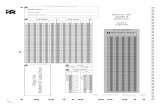

World Markets

STOCK MARKETS

May 22 prev %chg

S&P 500 2737.48 2733.01 0.16

Nasdaq Composite 7402.57 7394.04 0.12

Dow Jones Ind 24992.25 25013.29 -0.08

FTSEurofirst 300 1557.00 1552.54 0.29

Euro Stoxx 50 3594.95 3572.57 0.63

FTSE 100 7877.45 7859.17 0.23

FTSE All-Share 4324.41 4314.70 0.23

CAC 40 5640.10 5637.50 0.05

Xetra Dax 13169.92 13077.72 0.71

Nikkei 22960.34 23002.37 -0.18

Hang Seng 31234.35 31047.91 0.60

MSCI World $ 2130.72 2120.80 0.47

MSCI EM $ 1136.49 1137.75 -0.11

MSCI ACWI $ 517.72 515.66 0.40

CURRENCIES

May 22 prev

$ per € 1.177 1.175

$ per £ 1.342 1.341

£ per € 0.877 0.877

¥ per $ 111.020 111.220

¥ per £ 148.988 149.107

€ index 94.468 94.458

SFr per € 1.169 1.173

May 22 prev

€ per $ 0.849 0.851

£ per $ 0.745 0.746

€ per £ 1.140 1.141

¥ per € 130.709 130.689

£ index 78.845 79.134

$ index 100.120 99.948

SFr per £ 1.333 1.338

COMMODITIES

May 22 prev %chg

Oil WTI $ 72.48 72.35 0.18

Oil Brent $ 79.72 79.22 0.63

Gold $ 1288.35 1288.30 0.00

INTEREST RATES

price yield chg

US Gov 10 yr 93.21 3.08 0.01

UK Gov 10 yr 97.76 1.52 0.05

Ger Gov 10 yr 100.29 0.56 0.04

Jpn Gov 10 yr 100.54 0.04 -0.01

US Gov 30 yr 91.30 3.22 0.01

Ger Gov 2 yr 101.89 -0.61 0.02

price prev chg

Fed Funds Eff 1.70 1.69 0.01

US 3m Bills 1.93 1.91 0.02

Euro Libor 3m -0.35 -0.35 0.00

UK 3m 0.62 0.62 0.00Prices are latest for edition Data provided by Morningstar

CHRIS GILES — ECONOMICS EDITOR

Britain’s economy is likely to be on therebound in the current quarter afterthree months of near stagnation tostart the year, Bank of England leaderstold MPs yesterday, signalling that theyare still planning on raising interestratesgraduallythisyear.

Mark Carney, the BoE governor, told theTreasury select committee that house-holds were right to think “interest ratesare more likely to go up than not, but ata gentle rate”, comments that helped liftthe pound nearly 0.5 per cent to $1.35before itparedgains in late trading.

Sterling has fallen sharply since mid-April, when it approached highs notseen since before the Brexit referen-dum, amid a softening inflation picturethat had analysts questioning whetherthe central bank would stay on its rate-

raising course. Earlier this month, theBoE left rates on hold and gave littleguidanceonhowitwouldproceed.

Mr Carney said despite the MonetaryPolicy Committee’s view that the under-lying economy had not weakened, thepoor first-quarter statistics gave rate-setters some pause for thought. “I felt itwasright togetmoredata,”hesaid.

Part of Mr Carney’s optimism is a dis-pute with the Office for National Statis-tics over whether heavy snow early intheyearhurteconomicperformance.

The ONS has ruled out the weather asa factor in the poor start, while Mr Car-ney said the BoE’s regional agents con-tacts had suggested that the snow hadcut between 0.1 to 0.2 percentage pointsfromthefirst-quartergrowthrate.

Even after the BoE took account ofsnow, “there was a bit of residual soft-ness”, the governor acknowledged,

“which is why it made sense to seemomentum was reestablished [beforeraisingrates],whichIexpect”.

Other MPC members shared the gov-ernor’s view that first-quarter weaknesswas likely to be temporary, and growthwas expected to rebound to 0.4 per centinthesecondquarterwithoutanysnow.

Dave Ramsden, deputy governor formarkets, who voted against the Novem-berrise, said therewasarisk thathouse-holds were spending less than the BoEhad expected, which might be showingupinrecentpoorconsumercreditdata.

The committee members were askedwhether they agreed with GertjanVlieghe, an external MPC member, thatthe BoE could communicate its inten-tions more effectively if the rate setterspublished an expected path of interestrates in future.Borrowing hits decade low page 2

Carney expects economic reboundand ‘gentle’ interest rate increases

Debate has sharpened in Ireland asFriday’s referendum on repealing aconstitutional ban on abortion nears.‘One of our canvassers had a man getright in her face and poke her andshout “baby killer”,’ said one pro-abortion campaigner. Surveys suggestthe repeal campaign has a large butdiminishing lead in a vote seen as amodernising step for a country oncedominated by the Catholic Church.Report i PAGE 5

Clair Wills i PAGE 11

Polls narrow ahead of Irishvote to end abortion ban

WEDNESDAY 23 MAY 2018 UK £2.70 Channel Islands £3.00; Republic of Ireland €3.00

© THE FINANCIAL TIMES LTD 2018No: 39,788 ★

Printed in London, Liverpool, Glasgow, Dublin,Frankfurt, Milan, Madrid, New York, Chicago, SanFrancisco, Orlando, Tokyo, Hong Kong, Singapore,Seoul, Dubai, Doha

Subscribe In print and onlinewww.ft.com/subscribenowTel: 0800 298 4708

For the latest news go towww.ft.com

WORLD BUSINESS NEWSPAPER

Briefing

i M&S to speed up store closuresMarks and Spencer plans to step up its store-closureplans after finding that many customers shop atalternative branches rather than abandoning thebrand when their local store shuts.— PAGE 13

I BT switch-off to hit cash machinesOpenreach, theBTunit thatrunsthegroup’svoicetelephonenetwork,saystraffic lights, cashmachinesandsecurityalarmswillhavetobechangedafter thenetworkisswitchedoff in2025.— PAGE 2

I China success spurs Entertainment OneDespitebeingbannedonsomeofChina’splatforms, thesuccessofPeppa Pighashelpedincreaseprofits forEntertainmentOne,theUKmediagroupbehindthetelevisioncartoon.— PAGE 14

I Court hints at Puigdemont extraditionAGermancourtrejectedacall forex-Catalan leaderCarlesPuigdemonttobeextraditedtoSpaintofacerebellionchargesbutsuggestedhemightbehandedoverto facemisuseofpublic fundsclaims.— PAGE 7

i Italy’s leaders lock horns with presidentItaly’sFiveStarMovementandtheLeagueare inastand-offwiththecountry’spresident,afterpushingforaEuroscepticeconomist tobethenewfinanceminister.— PAGE 7; MARTIN WOLF, PAGE 11; LEX, PAGE 12

I Sony shifts mode to take control of EMIJapanesetechnologyandentertainmentgroupSonyis tospend$2.3bntotakecontrolofEMIMusicandgainaccess to2msongsas it shifts intospendingmodeafteradecadeofrestructuring.— PAGE 13

I Altice up 60% as watchdog eases stanceShares inAlticesoaredmorethan60percentaftertheFrenchtelecomsregulatoropenedthedoortoaconsolidation,amovethatcouldallowthe indebtedcompanytosell itsbusiness.— PAGE 14; LEX, PAGE 12

Datawatch

The EU has beguntrade talks withAustralia andNew Zealandin a push forbilateral tradedeals with bigeconomies. TheEU excluding theUK is Australia’ssecond-largesttrading partnerafter China.

Australia’s tradeExports and imports of goodsand services (A$bn) FY 2017

Source: Australia’s department of trade

ChinaEU (excl. UK)

JapanUS

South KoreaUK

New ZealandIndia

0 50 100 150 200

SHAWN DONNAN — WASHINGTON

Congressional Republicans are mount-ing a rebellion over Donald Trump’smove to patch up trade relations withBeijing, drawing up legislation thatwould block the White House’s attemptto rescue a Chinese telecoms grouppushedtothebrinkbyUSsanctions.

The revolt, led by Florida SenatorMarco Rubio, is a sign of mounting scep-ticism inside the Republican party overthe president’s handling of his tradebrinkmanshipwithChina.

Mr Trump’s aides are negotiating adeal that would lift US sanctions againstZTE Corp, the Shenzhen-based tele-coms group accused of selling sensitivetechnologies to Iran and North Korea, inexchange for wholesale senior manage-

ment changes and another large fine.Mr Trump said yesterday that oneoptionwasfiningZTE$1.3bn.

The group was fined $1.2bn by the USlastyear.

Xi Jinping, the Chinese president, hasmade a reprieve for ZTE, which wasforced to halt operations after the UScommerce department announced aseven-year ban on sourcing chips andother parts from the US, a condition forabroadertradedeal.

Beijing yesterday announced that itwould cut tariffs on car imports from 25per cent to 15 per cent on July 1, a moveseen by some analysts as a concession toMrTrumpfollowinghisU-turnonZTE.

Mr Rubio, who has been leadingRepublican opposition to a ZTE dealsince Mr Trump first ordered a reversal

inpolicy lastweek, saidchanges inman-agement, fines and other ideas floatedaspartofadealwerenotenough.

“Sadly China is out-negotiating theadministration [and] winning the tradetalks right now,” Mr Rubio wrote onTwitter.

“They have avoided tariffs [and] got aZTE deal without giving up anythingmeaningful inreturn.”

Mr Rubio is not alone in his concern.Congressional committees last weekpassed bipartisan measures tying theZTE punishment to funding bills, andthe Senate’s powerful banking commit-tee yesterday passed a measure thatwould prevent Mr Trump from modify-ingZTE’spunishment forat leastayear.

MrTrumpsaidhehadnotyetreacheda deal over ZTE and acknowledged he

was re-examining the punishment onlybecause Mr Xi had asked him to. US offi-cials liken Mr Xi’s ZTE request to inter-ventions Mr Trump makes on behalf ofUSgroupswithother foreign leaders.

“Theobjective[of theoriginalpunish-ment] was not to put ZTE out of busi-ness; theobjectivewastomakesurethatthey abide by our sanctions pro-grammes,” Steven Mnuchin, US Treas-urysecretary, toldCongressyesterday.

The dispute comes as Republicans inCongress are hardening their lineagainst Beijing’s efforts to acquire UStechnology, advancing legislation thatwould give the Committee on ForeignInvestment in the US greater power toreview inbound Chinese investment foritsnationalsecurity implications.China faces tighter curbs page 4

Republicans launch revolt againstTrump rescue of China’s ZTE Corp3 White House brinkmanship criticised 3 Beijing urges reprieve for ailing telecoms group

Zuckerbergapology tourhits EuropeMark Zuckerberg, founder and chiefexecutive of Facebook, arrives yester-day at the European Parliament, wherehe made his latest attempt to draw a lineunder a data leak scandal that hasshakenthesocialmedianetwork.

Mr Zuckerberg echoed his apologylast month to the US Congress, saying ithad “become clear over the last coupleof years that we haven’t done enough toprevent the tools we’ve built from beingusedforharmaswell”.

Manfred Weber, leader of the centre-right in the parliament and an ally ofAngela Merkel, Germany’s chancellor,asked why Facebook should not bebroken up. Mr Zuckerberg replied: “Weexist inaverycompetitivespace.”Reuters Yves Herman/Reuters

Marco Rubio,the senator forFlorida, saidChina has‘avoided tariffs[and] got a ZTEdeal withoutgiving upanythingmeaningfulin return’

Fear and loathingAnger at corruption and alarm overcrime stalk Brazil’s election — PAGE 9

Merger effectGig workers need regulators toprotect them — SARAH O’CONNOR, PAGE 11

Smart MoneyEurope’s banks still pose a threat tothe eurozone — JOHN AUTHERS, PAGE 13

MAY 23 2018 Section:FrontBack Time: 22/5/2018 - 20:12 User: nick.miller Page Name: 1FRONT, Part,Page,Edition: LON, 1, 1

Newspaper of the Year

Wednesday 23 May 2018 ★ FINANCIAL TIMES 9

FT BIG READ. BRAZIL

October’s poll is set to be the most unpredictable in 30 years. The result could hinge on the votes of thosein the lower middle class whose standard of living has risen and fallen with the boom and bust cycle.

By Joe Leahy and Andres Schipani

finance case. “This thing in which some-one [a politician] says he ‘steals but getsthings done’. Hang on, they earn a verygoodsalarynot tosteal, right?”shesays.

BanditcountryThousands of kilometres away inCampo Verde, a farming town in Brazil’scentral grain-growing state of MatoGrosso, voters are turning towards thefar-right’s Mr Bolsonaro. Infamous foronce telling a PT congresswoman thatshe was too ugly to “deserve” beingraped, Mr Bolsonaro speaks fondly ofthe former military dictatorship andwants to arm the citizenry againstcrime. He is also courting the powerfulfarmers’ lobby in Congress and the giantevangelical movement, having recentlyrebaptisedhimself intheJordanRiver.

His message on crime appeals to ruralpopulations, which have begun to sufferthe kind of armed assaults oncereservedfor thebigcities.

“The bandido [criminal] enters yourhouse, robs you, beats up your wife andchild, and nothing happens,” complainsEdson Campos, a farmer with 1,700 hec-tares of crops and 5,000 cattle. Hebelieves many people would support amilitary intervention, saying: “Thepolice do not have the conditions to pro-videsecurity.Weneedthearmy.”

Mr Bolsonaro is tapping into the “fear

factor”, says Datafolha’s Mr Paulino. Ofhis supporters, 60 per cent were rela-tively affluent middle-class voters agedunder 34 — the group hardest hit by therecession,analystssay.

There are signs that Mr Bolsonaro isalso attracting some of the lower middleclass male youth vote too. “He’s anextremist,he’s for thedeathpenalty,butat themomenthe’s thebestoption,”saysLucas de Lima Pereira Santos, 22, theson of Ms de Lima. He too is unem-ployed after being dismissed as alabourer. If a robber “kills, he shouldpayinthesamecurrency”,hesays.

Analysts caution that the electoralmap in Brazil is very fluid. Official cam-paigning will only start in late August. InBrazil, parties traditionally form grandcoalitions to campaign together in orderto gain the right to more time on televi-sion under electoral rules. This wouldbenefit mainstream candidates, such asMr Alckmin, or Mr Gomes, looking totakevotes fromthe left.

Mr Bolsonaro’s small Social Liberalparty, or PSL, might struggle to buildcoalitions. While social media — one ofits key campaigning tools — is becomingmore important, many Brazilians stilldo not have smartphones or easy accessto the internet. And more than 60 percent of the electorate remain unde-cided,accordingtoDatafolha.

“This is a moment of transition, inwhich the old electoral parameters haveyet to be completely dismantled and thenew [ones] yet to fully emerge. That’swhy it is so difficult to read,” saysRicardo Sennes a director of Prospec-tiva,aconsultancy.

More than anything else, this electionwill be a battle for the hearts and mindsof the lowermiddleclasses,analystssay.

Even the left cannot be completelywritten off. Although some stillbelieve Lula da Silva, who is appealingagainst his conviction, could make acomeback, the prospect seems increas-ingly unlikely. Whoever he gives hisbacking to could draw about 20 per centof the vote. After all, some Braziliansstill see him as a hero, particularly in thepoverty-strickennorth-east.

“I really want him to go free. If hereturned to the presidential race, Iwouldvoteforhim,wewouldallvote forLula here,” says Rosangela da Silva dosSantos, a small farmer and shop-ownerand mother of four in Belo Jardim inPernambuco. “If he does not come back,we will vote for someone else he sup-ports, that is thetruth.”

In the Complexo da Maré, a sprawlingfavela in Rio de Janeiro, a city whereinfighting between drug gangs andpolice killings are commonplace,violence is souring the political mood.Some Brazilian states, such as Rio,have seen a deterioration in publicsecurity, and with roughly 60,000people murdered in Brazil last year,there is a growing sense that theviolence is spinning out of control.

Opinion polls show that security is amajor priority ahead of October’selection. This is playing into the handsof far-right presidential candidate JairBolsonaro, the only candidate puttingsecurity at the heart of his campaign.

The former army captain-turned-congressman from Rio (left), has been

gaining ground in the polls withhis pledge to declare openseason on criminals.

“With Brazil in the handsof a military man, the

murder rate will certainly drop, manythings will improve,” says AdrianoRibeiro, a 23-year-old newspaperdelivery man, who voted for theWorker’s party in 2014.

But André Soares, a local sociologist,says some favela residents should becareful what they wish for. MrBolsonaro, he says, “is speaking ofprotecting them, but in a violent citywhen he says that ‘every citizen has tohave a weapon’, he is not talking to me,the guy from Maré . . . He is talking toanother guy, from another socialclass”.

The Brazilian Public Security Forumand the Igarapé Institute, two think-tanks, paired up to gauge the “fear” ofhomicide: 52 per cent of Brazilians saidthey knew someone who had been avictim of a homicide or a fatal robbery.

“Unsurprisingly, over 80 per cent ofthem fear they could be a victim ofhomicide in the next 12 months,” saysRobert Muggah, a director at theIgarapé Institute. He adds that thesepeople are more easily seduced bypopulists promising “tough on crime”responses, such as Mr Bolsonaro.

Crime rateBolsonaro playson security fears

A ruined wattle-and-daubhut sits outside of Caetés,Brazil’s northeastern stateof Pernambuco, sur-rounded by small farms.

The bucolic scene belies the area’shistoryofharshdroughts.

It was here that former president LuizInácioLuladaSilvagrewupuntil theageof seven, when he left for São Paulothousands of kilometres away with hisfamily on the back of a truck. Decadeslater, he rose through Brazil’s unionmovement to become the first labourpresident of Latin America’s largestcountry, presiding over a period of rapideconomic growth between 2003 and2010 fuelled by a China-led commodi-tiesboom.

“The situation before Lula becamepresident was difficult, no one had a car,no one had any land, no one had any-thing,” says Gilberto Ferreira, a farmerwho is a cousin of the former presidentand lives nearby. He points to his grand-daughter, Jacqueline Ferreira, who tookpart in a government-funded exchangestudy programme in Canada and nowteaches English, something that wouldhavebeenhighlyunusualbefore.

Eight years on Lula da Silva is inprison on graft charges, his leftist Work-ers’ party (PT) in tatters amid corrup-tion scandals, and the economy, despitea recent bounce, is still struggling. Thatis the backdrop against which electionsin October will be fought, with ana-lysts predicting that the vote will be

decided by the Ferreiras and millionslike them in Brazil’s huge new lowermiddleclass.

During Lula da Silva’s eight years inpower and under his successor, formerpresident Dilma Rousseff, whowas impeached in 2016, Brazil’s lowermiddle class grew dramatically. Higherminimum wages, monthly stipends andcheappublichousinghelped,by itspeakin 2014, pull 67m people into the middleand upper classes — roughly the equiva-lent of the population of France, accord-ing to figures from Marcelo Neri, econo-mist with the Getúlio Vargas Founda-tion, and a former minister of strategicaffairsunderMsRousseff.

But today this legacy is in danger ofcrumbling. Battered by the country’sworst recession in history over the pastfew years, which many believe waslargely self-inflicted by the PT-led gov-ernment, many in the lower middleclass, known as the “C-class”, are fight-ingtoholdontowhattheyhavegained.

“These voters have become more crit-ical of politics including the PT and theDilma government especially becausethey started to lose their recent gainsfollowing the end of the Lula govern-ment,” says Mauro Paulino, director-generalofpollsterDatafolha.

Confluence of crises

It is this traumatic change in fortunesthat lies behind the turbulent politicalenvironment. While some remain sym-pathetic to the former president, sup-port for thePTis fragmenting.

At the same time, all the mainstreamparties, including the PT, the BrazilianDemocratic Movement, or MDB, of cur-rent President Michel Temer and theBrazilian Social Democracy party, orPSDB, led by presidential con-tender Geraldo Alckmin, have beendevastated by Lava Jato (Car Wash), avast investigation originally centred onbribery at state-owned oil com-pany Petrobras. Lula da Silva — who wasexpected to stand — was sentenced to 12years last month under Car Wash, leav-ing the path open to more unconven-tional figures.

Far-right, populist politician Jair Bol-sonaro is leading in the polls followed bycentre-left environmentalist MarinaSilva, and leftist Ciro Gomes. In a pollreleased on May 14, Mr Bolsonaro had18.3 per cent of voters’ intentions, MsSilva 11.2 per cent, Mr Gomes 9 per centandMrAlckmin5.3percent.

This year promised to be an electionof fear and loathing, saysMr Paulino. “Fear” becauseof a crime wave sweepingthe country, and “loath-ing”becauseof thedisgustvoters felt for a politicalclass they believe stole atthe expense of publicservices, par-t icular lyhealth andeducation.

At stake isthe future ofLatin Amer-

dates — the PSDB’s Mr Alckmin and MrGomes of the Democratic Labour partyor PDT. Mr Pedrozo has been seekingwork for five months, he says, a victimof Brazil’s severe recession in whichgross domestic product shrank by morethan 7 per cent in 2015-16. While a weakrecovery is under way now, Mr Pedrozosays jobsremainscarce.

“If you go back eight years, it was eas-ier to leave a job because you’d getanother straight away, today you havetothinkhardabout it,”hesays.

Formerly earning R$1,800 ($486) amonthasasecurityguard,whilehiswifemade another R$800 as a baker, MrPedrozo’s household used to fall intowhat many Brazilian economists defineas the lower middle class. FGV’s Mr Nerisays that at its peak in 2014 theC-class earned between R$2,005 andR$8,640 per family and grew from66.5m people in 2003 to 116.7m people

in 2015 — the most recent figure availa-ble—inacountryofmorethan200m.

Since then, median real income hasfallen a net 14.3 per cent. Despite thatthere are indications the population ofthe lower middle class remained rela-tively stable, partly because of peoplefrom the higher income bracket los-ing their jobs and slipping downthesocial ladder.

“Just in the first year of the crisis in2015, 6m fell into poverty, there was astrong downward adjustment,” he says.Adding that the recession has notentirely wiped out the gains from thepreceding decade of prosperity, withmany of those who lost jobs startingtheirownbusinesses.

“The crisis was big but the previousgainswereevengreater,”saysMrNeri.

Threats tothebig ‘C’The question now is whether the nextgovernment will be able to undertakethe reforms necessary to create last-ing growth, including an overhaul ofBrazil’s costly pension system, andreduce unsustainable budget deficits,say analysts. “Brazil has a very delicatefiscal situation,” says Alejandro Werner,director, western hemisphere depart-ment,of theIMF.

Despite his poor performance in earlypolls, markets regard Mr Alckmin as themost likely candidate to be able topush through reform. With his record asformer governor of São Paulo state, Bra-zil’s economic powerhouse, they seehim as having the negotiating skills todeal with the pork-loving Congress,which ispopulatedbynearly30parties.

Espedita de Lima, a single mother inher fifties living in the Pindamonhang-abahousingproject, saysshewouldvotefor Mr Alckmin. Having only recentlymoved in, she is surviving with two plas-tic chairs and a television that blares outdaytime celebrity programmes. Pinda-monhangaba, she says, is suffering fromviolenceanddrugs.

But like many Brazilians, Ms de Limais disgusted with Brazil’s political classand would dump Mr Alckmin if he wasconvicted of corruption. He is underinvestigation in an illegal campaign

Brazil is lagging behindits neighbours

Sources: IMF; Getúlio Vargas Foundation

Annual growth in GDP (%)

Class DE (lower income)Class C (lower middle class)Class AB (upper middle class)

0

20

40

60

80

100

2003 2011 2014 2015

Brazil’s lower middle classholds on, for nowPopulation (m)

-2

0

2

4

2012 2015 2020 2023

Forecast

BrazilArgentina, Chile,Colombia, Peru

ica's largest economy. Brazil has pulledout of the freefall of 2015-16, but it is stillfragile. Many economists believe that ifthenextpresident isunwillingorunableto take steps to rein in public spending,the country could slip into anotherperiod of low growth and internecinepoliticalconflict.

“This election will be especially inter-esting, occurring in an environment inwhich there are various crises all com-ing together — the economic crisis andthe crisis affecting public security andservices — which is very dramatic,” MrPaulinosays.

In a new low-income housing projectin Pindamonhangaba, in the interior ofBrazil's richest state, São Paulo, JúlioCésar Pedrozo, an unemployed securityguard, prints off more résumés. Thisindustrial town on the highway betweenRiodeJaneiroandSãoPaulo is thebirth-place of two of the 2018 election candi-

A youngster flies akite at the Vidigalfavela in Rio deJaneiro — Carl deSouza/AFP/Getty Images

Legacy of ‘Lulismo’ About 67m peoplehad been helped into the middle andupper classes by 2014 by PT policies

Brasília shake-up? In a poll last weekfar-right, populist Jair Bolsonaro ledwith 18.3 per cent of voters’ intentions

Overhaul likely Markets see the PSDB’sGeraldo Alckmin as the politician mostlikely to be able to push reform

Fear and political loathing

‘In the first year of thecrisis in 2015, 6m fell intopoverty. The crisis wasbig but the previous gainswere even greater’

‘When someone says “[apolitician] steals but getsthings done”. Hang on,they earn a very goodsalary not to steal, right?’

Online videoWhy Brazil’s hard pressed lowermiddle class holds the key to theOctober election

ft.com/video

MAY 23 2018 Section:Features Time: 22/5/2018 - 17:34 User: sarah.provan Page Name: BIG PAGE, Part,Page,Edition: LON, 9, 1