P R E S E N T S DESIGN / SUPERVISION / PROJECT MANAGEMENT / AVIATION SERVICES TRUE BLUE AIRLINES...

-

Upload

allison-lang -

Category

Documents

-

view

214 -

download

0

Transcript of P R E S E N T S DESIGN / SUPERVISION / PROJECT MANAGEMENT / AVIATION SERVICES TRUE BLUE AIRLINES...

P R E S E N T S

DESIGN / SUPERVISION / PROJECT MANAGEMENT / AVIATION SERVICESDESIGN / SUPERVISION / PROJECT MANAGEMENT / AVIATION SERVICES

TRUE BLUE AIRLINES YEAR TWO EXPANSION

The Parties

•TRUE BLUE - Author, Project Management

& Operations

•GFLI – Proposed General Equipment Provider ,

(Aircraft, Engines & Spare Parts)

•Investor – Seed Capital Provider

•Inter Island – General Sales Agent and

Curent AOC Partner in Philippines

•NAS- Proposed GSA & code share partner in KSA

Market Analysis

SaudiMarket

High Cost of Air Fares and excess baggage charges

2 Million Filipinos

Travel Agency’s Difficulty

Huge Passenger Volume

50,000 Ave. YearlyOFW Deployment

PALS’s Route Withdrawal

Why are we here?

Carrier Shortage

Lack of Filipino Carrier

Alternative Fare

Business Enterprise

In the service to OFWs

Carrier Shortage

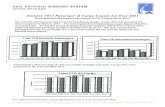

Max. Weekly Passenger Output

8,000+ Passengers per Week

ACTUAL PASSENGER VOLUME

6,3006,300

SR 4,365

CATHAY

Alternative Fare

SR 3,950

SAUDIA

SR 4,250

GULF AIR

SR 3,800

TRUE BLUE

Price Benchmarking for Y-Class TicketRUH – CLRK Route

Start-up Strategy

Marketing

Personnel Training

Aircraft & System Acquisition

Management Formation

Continuous

2 Months

15 Days

1 Month

Full OperationsFull Operations

$ 5,559,151$ 463,262 $ 1,389,787

Revenue Relative to Flight Frequency

1 Trip 1 Trip CycleCycle

CLRK-RUH-CLRKCLRK-RUH-CLRK 4wks4wksMonthlyMonthly

3X3XWeeklyWeekly

Monthly Financial Statement@ 100% Load Factor

Gross Revenue Details

Passenger Service: J – Class

$ 0.

Passenger Service: Y – Class$ 4,959,151

Cargo Services$ 0.6 M

$ 5,559,151 $ 5,559,151

Monthly Financial Statement@ 100% Load Factor

Forecast on Expenses

Per Flight 2-Way Monthly

Staff: Salaries, Allow. Etc

12,500 25,000 300,000

Route: Ground Handling,Landing & Radio Fee, etc.

10,000

20,000

240,000

Fuel 81,512 171,194 2,054,328

Operating Lease 13,054 26,109 313,312

Catering 11,300 22,600 271,200

Insurance 2,050 4,100 49,200

Others 5,000 10,000 120,000

TOTAL 135,416 279,003 3,348,040

Financial Forecast

ONE MONTH OPERATION (@100% Load Factor)

Sales (Riyadh and Clark Flights) 5,559,151

Less (5.5% Gross ) TAX 305,753

Less Royalty (3%Gross) NAS 166,774

Less EXPENSES (1 Month Operations) 3,348,040

Net Monthly Profit USD 1,738,584

$ 1,738,584 NET PROFIT

INVESTOR@ 60% of Monthly Net

$1,043,150

TRUE BLUE@ 40% of Monthly Net

$695,433

5% ROI

Profit Sharing before ROI full recovery

Profit Sharing after ROI full recovery

$ 1,738,584NET PROFIT

TRUE BLUE@ 60% of Monthly Net

$1,043,150

INVESTOR@ 40% of Monthly Net

$695,433

Initial Capitalization

Figure Estimate as of: August 2011 in US Dollars

Aircraft Security Deposit (1 months) 313,312

Initial Inspection Team 76,995

Aircraft Test Flight Operation Expense 73,000

Flight Crew Training B747-400 type rating 500,000

Airline Purchase (Inter Island Airways 100% company equity including AOC & facility)

2,500,000

Aircraft repositioning (fuel AZ, USA – MNL) crew allowance and livery

200,000

Start-up Expenses 216,000

Four Months Full Operations Expenses 13,258,896

Riyadh Office & Equipment 12,064

Aircraft Maintenance Reserve 4,049,733

Total Initial Capitalization (with unforeseens) USD 20,000,000