P 0 BOX 2886 ( 205) 326-5382 - Foundation...

Transcript of P 0 BOX 2886 ( 205) 326-5382 - Foundation...

0

9

0CV

LLIZZ

0

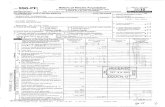

990 -990 Return of Private Foundation OMBNo.1545-0052

or Section 4947(a)(1) Nonexempt Charitable Trust ^O 0W-ppoli ment of the Treasury Treated as a Private Foundation

nal Revenue Service Note . The foundation may be able to use a co py of this return to satisfy state re portin g uirements.F,or, calendar year 2010 , or tax year beg inning , 2010 , and ending , 20G,_Check all that apply

H

Initial return Initial return of a former public charity Final returnAmended return Address change 171 Name change

Nape of foundation A Employer identification number

LUCILLE S. BEESON CHARITABLE TRUST CIOJ

REGIONS BANK (M00521) 1055001761 77-r77AQ11jder and street (or P O box number if mail is not deliveredto street address) Room/suite B Telephone number ( see page 10 of the instructions)

J CC

P 0 BOX 2886 ( 205 ) 326-5382Cq town, state, and ZIP code C If exemption application is ,d pending , check here . . .

a-

MOBILE AL 36652-2886D I Foreign organizations , check here

, 2 Foreign organizations meeting the

H Check type of organization X Section 501(c)(3) exempt private foundation m t, check here end attach ►aand

Section 4947(a((1) nonexem pt charitable trust Other taxable p rivate foundation

co putcomputation . . . . ..

I Fair market value of all assets at end Accounting method. Cash AccrualE If private foundation status was terminated

11" 1:1of year (from Part 11, col. (C), line [::] Other (specify)

under section 507(b)(1 )(A), check here .

16) $ 177 963 563.__ _ ___________________

(Part 1, column (d) must be on cash basis)F

if

the foundation is in a 60-month termination

under section 507(b)(1)(B), check here . 1110- F-1Analysis of Revenue and Expenses (The

(a) Revenue and(d) Disbursements

total of amounts in columns (b), (c), and (d) (b) Net investment (c) Adjusted net for charitablemay not necessarily equal the amounts in expenses per

booksincome income purposes

column (a) (see page 11 of the instructions)) ( cash basis onl y)1 Contributions efts, grants, etc , received (attach schedule) t

k 10-if the foundation is not required to

2 Ch ec attach Sch B . . . . . . . . 1

3 Interest on savingsand temporarycash investments 7 , 269. 7 , 269. STMT 14 Dividends and interest from securities . . . 5 , 824 , 074. 5 , 824 , 074. STMT 25a Gross rents . . . . . . . . . . . . . . . .

b Net rental income or (loss) `

, 6 a Net gain or (loss) from sale of assets not on line 10 -794 , 875 .b Gross sales price for all 36,881,477.assets on line 6a

7 Capital gain net income (from Part IV, line 2)r

8 Net short-term capital gain . . . . . . . . '

9 Income modlfl ns-•--^10 a prosssal fs.(ess returnjv

and allowances Ic r_D

b L C ld'd -t -----1 01ess ost o goo s so -1 IG 'c ros profit or (loss) tto cti scheduf e)/

11 Other mcgyne ^attch scfleNdule) to -31 , 975. -50 , 422. STMT 312 ToaI Add lines 1 throu g h-1-1- 5 004 493.1 5 , 780 , 921. 1113 Cqlmpensapo otofficer dueAotrustees(etc

^ si

903 033. 722 , 427. 180 , 6074 Oth ) W t "^-^ers p.1 oyee.selanesimp and wages . ... NON NONE

y 15 Pension plans, employee benefits . NON NON

a 16a Legal fees (attach schedule) • . STMT 4 1 , 027. NON NON 1 , 027X b Accounting fees (attach schedule)STMT. 5 1 , 500. NON NON 1 , 500a c Other professional fees (attach schedule). .

17 Interest . . . . . . . . . . . . . . . . . .

T18 Taxes (attach schedule) (see page 14 of t1£',-Tnc5) 13 , 365 . 13 , 365 .

E 19 Depreciation (attach schedule) and depletion .

i 20 Occupancy . . . . . . . . . . . . . . . .

21 Travel, conferences, and meetings . . . . NON NONEm 22 Printing and publications . . . . . . . . NON NONE

23 Other expenses (attach schedule) UK. 7 • 45 , 015 . 45 , 015.So 24 Total operating and administrative expenses.

CL Add lines 13 through 23 ......... 963 940. 780 807. NONE 183 , 1348 320 7125 Contributions, gifts, grants paid . . .. . , , 8 . $ 320 , 718

26 Totalex nses anddislwrsements Add lines 24 and 25 9 , 284 , 658. 780 807. NONE 8 503 , 85227 Subtract line 26 from line 12

a Excess of revenue over expenses and disbursements _ -4 , 2 80 , 165.

b Net investment income (if negative, enter -0-) 5 , 000 , 114.c Adjusted net income (if neg ative, enter -0 )

I-or Paperwork Reduction Act Notice , see page 30 of the instructions. JSAOE1410 1 000APE691 9155 05/09/2011 16:11:47 1055001761

Form 990-PF (2010)

4 -

0

•

Attached schedules and amounts in theBalance Sheets description column should be for end-of-year

Beginning of year

rage c

End of year

amounts only (See i nstructions ) ( a) Book Value ( b) Book Value (c) Fair Market Value1 Cash - non-interest -bearing . . . . . . . . . . . . . . . . -15.

2 Savings and temporary cash investments ......... , 1 133 777. 1 , 048 , 158 . 1 , 048 , 1583 Accounts receivable ►

Less. allowance for doubtful accounts ►--------------

4 Pledges receivable ►-------------------------

Less allowance for doubtful accounts ►--------------

5 Grants receivable . . . . . . . . . . . . . . . . . . . .

6 Receivables due from officers , directors , trustees , and other

disqualified persons ( attach schedule ) ( see page 15 of the instruct i ons)

7 Other notes and loans receivable ( attach schedule) ►Less• allowance for doubtful accounts ► NONE

--------------8 Inventories for sale or use

9 Prepaid expenses and deferred charges . . . . . . . . . . . .

Q 10a Investments - US and state government obligations ( attach schedule ). 18 381 841. 19 209 024. 20 , 177 , 509b Investments - corporate stock ( attach schedule ) . . . . . . . . 69 956 572. 55 705 518. 58 , 983 , 028c Investments - corporate bonds ( attach schedule ). . . . . . 56 436 293. 67 427 339. 77 , 869 , 750

11 Investments - land, buildings, ►and equipment basis ____ ________________Less accumulated depreciation ►(attach schedule ) ____________________

12 Investments - mortgage loans . . . . . . . . . . . . .

13 Investments - other ( attach schedule ) .. STMT 8 18 496 095. 16 , 816 , 851. 19 , 885 , 11814 Land, buildings, and ►

equipment basis--------------------Less accumulated depreciation ►

(attach schedule ) _____________________

15 Other assets ( describe ► )

16 Total assets (to be completed by all filers - see theinstructions. Also, see page 1 , item 1 ) . , 164 404 563. 160 206 890. 177 , 963 , 563

17 Accounts payable and accrued expenses , , , , , , , , , ,

18 Grants payable ,,,,,,,,,,

19 Deferred revenue . . . . . . . . . . . . . . . . . . . . .

*-' 20 Loans from officers , directors , trustees , and other disqualified persons

m 21 Mortgages and other notes payable (attach schedule) '

22 Other liabilities (describe ► --------------------

23 Total liabilities ( add lines 17 through 22) . .

Foundations that follow SFAS 117 , check here ►and complete lines 24 through 26 and lines 30 and 31.

4)V 24 Unrestricted . . . . . . . . . . . . . . . .

25 Temporarily restricted . . . . . . . . . . . . . . . . . . .

op 26 Permanently restricted . . . . . . . . . . . . . . . . . . .

°c Foundations that do not follow SFAS 117,,i check here and complete lines 27 through 31. 0- 1X

8 27 Capital stock , trust principal , orcurrent funds , , , , , , , , , . 164 , 404 , 563 . 160 , 206 , 890.28 Paid-in or capital surplus,or land, bldg and equipmentfund

2 29 Retained earnings , accumulated income, endowment , or other funds

30 Total net t f d b lasse s or un a ances ( see page 17 of the

z instructions),,,,,,,,,,,,,,,,,,,,,,,,, 164,404,563. 160 206 890.31 Total liabilities and net assets /fund balances ( see page 17

.

of the instructions ) .. 164 404 563. 160 206 890.WMe Analysis of Changes in Net Assets or Fund Balances1 Total net assets or fund balances at beginning of year - Part II, column ( a), line 30 ( must agree with

end-of-year figure reported on prior year ' s return) , , ....... 1 164 , 404 , 563.2 Enter amount from Part I, line 27a . . . ... ........... 2 -4 , 280 , 165.3 Other increases not included in line 2 (Itemize ) ►-SEE STATEMENT 9

---------------------------- - 3 105 , 955.4 Add lines 1, 2 , and 3 ............................................. 4 160 , 230, 353.5 Decreases not included in line 2 ( itemize ) ► SEE STATEMENT 10 ________________ 5 23 , 463.6

__Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column ( b), line 30 . 6 160 , 206 , 890.

Form 990-PF (2010)

JSA

OE 1420 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 5 -

72-6278911

•

0

Form 990-PF ( 2010) Page 3

Capital Gains and Losses for Tax on Investment Income

( a) List and describe the kind ( s) of property sold (e g , real estate ,

2-story brick warehouse , or common stock , 200 shs. MLC Co. )

"o-acqu i red

P nazi n

(c) Dateacquired

(mo ,day, yr .)( d) Date soldImo ,day, yr.)

la SEE PART IV DETAILb

c

d

e

( e) Gross sales price ( f) Depreciation allowed(or allowable )

( g) Cost or other basisplus expense of sale

(h) Gain or (loss)( e) plus ( f) minus (g)

a

b

c

d

eComplete only for assets showing gain in column (h) and owned by the foundation on 12/31 /69 (I) Gains ( Col. (h) gain minus

(i) F M.V. as of 12/31/69 (j) Adjusted basisas of 12 / 31/69

( k) Excess of col. (I)over col . ( j), if any

cot (k), but not less than -0-) orLosses (from col (h))

a

b

c

d

e

2 Capital gain net income or (net capital loss )If gain, also enter in Part I, line 7

{ If (loss), enter -0- in Part I, line 7 } 2 -794 , 875.3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6).

If gain , also enter in Part I , line 8, column ( c) (see pages 13 and 17 of the instructions).

If (loss ), enter -0- in Part I , line 8. 3Qualification Under Section 4940(e ) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Base period yearsCalendar year ( or tax year beginning in ) Adj usted qualifying distributions Net value of noncharitablewse assets

Distribution(d )

ratioratio( col (b) divided by col. (c))

2009 7 , 658 , 458. 158 529 136. 0.048309466602008 6 , 814 , 611. 176 256 287. 0.038663080432007

2006

2005

2 Total of line 1 , column (d) , , , , , , , , , , , , , , , , , , , , 2 0.086972547033 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5 , or by the

number of years the foundation has been in existence if less than 5 years . .. . . ... . 3 0.04348627352

4 Enter the net value of noncharitable-use assets for 2010 from Part X, line 5 4 171 , 012 , 472.

5 Multiply line 4 by line 3 , , , , , , , , , , , , , , , , , , , , , , ,,, , ,, , ,, , , , ,, , , 5 7 , 436 , 695.

6 Enter 1 % of net investment income ( 1%of Part I, line 27b ) . . . . . . . . . . . .. . . . ... . 6 50 , 001.

7 Addlines 5and6 , , , , , , , , , , , , , , , , , , , , , , , , , , , , , ,, ,,, , ,, , , , 7 7,486,696.

8 Enter qualifying distributions from Part XII , line 4 8 8 , 503 , 852.If line 8 is equal to or greater than line 7 . check the box in Part VI . line 1b. and complete t hat Dart uslna a 1% tax rate. See the

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period ? E]Yes ©NoIf "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.

I Enter the a pprop riate amount in each column for each year , see page 18 of the instructions before making any entries.

Part VI instructions on page 18.

JSA Form 990-PF (2010)OE 1430 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 6 -

Form990-PF 120 10) 72-6278911 Page 4

FMPM Excise Tax Based on Investment Income ( Section 4940 ( a), 4940 (b), 4940(e), or 4948 - see page 18 of the instructions)

1a Exempt operating foundations described in section 4940(d)(2), check here ► and enter "N/A" on line 1 . . .

Date of ruling or determination letter ------------- (attach copy of ruling letter if necessary - see instructions)

b Domestic foundations that meet the section 4940(e) requirements in Part V, check 1 50 , 001.

here ► 1A I and enter 1% of Part I, line 27b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% of ____ _ --Part I , line 12, col. (b).

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) . . . 2

3 Add lines 1 and 2 ............................................. 3 50 , 001.

4 Subtitle A (income) tax (domestic section 4947(a)(1( trusts and taxable foundations only Others enter -0-) . . . 4 NONE

5 Tax based on investment income . Subtract line 4 from line 3. If zero or less, enter -0. . . . . . . . . . . . . 5 50 , 001.

6 Credits/Payments

a 2010 estimated tax payments and 2009 overpayment credited to 2010 , , , , 6a 52 , 580.

b Exempt foreign organizations-tax withheld at source . . . . . . . . . . . . 6b NONE

c Tax paid with application for extension of time to file (Form 8868) , , , , , , , 6c NONE

d Backup withholding erroneously withheld . . . . . . . . . . . . . . . . . 6d _

7 Total credits and payments Add lines 6a through 6d . . . . . . . . . . . . . . . . . . . . . . . . . 7 52 , 580.

8 Enter any penalty for underpayment of estimated tax. Check here q if Form 2220 is attached . . . . . . . 8

9 Tax due . If the total of lines 5 and 8 is more than line 7, enter amount owed . . . . . . . . . . . . . . . ► 9

10 Overpayment . If line 7 is more than the total of lines 5 and 8, enter the amount overpaid , , , , , , ► 10 2 , 579.11 Enter the amount of line 10 to be Credited to 2011 estimated tax ► 2 , 579. Refunded No. 11

Statements Regarding Activities

la During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it Yes No

participate or intervene in any political campaign? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a X•

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page 19

of the instructions for definition)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b X

If the answer is "Yes" to la or 1b, attach a detailed description of the activities and copies of any materials

published or distributed by the foundation in connection with the activities

c Did the foundation file Form 1120-POL for this year? , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , 1c X

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year

(1) On the foundation. (2) On foundation managers. ► $

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers. ► $ _

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? . . . . . . . . . . . . . . . 2 X

If "Yes," attach a detailed description of the activities

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of

incorporation, or bylaws, or other similar instruments? If "Yes,"attach a conformed copy of the changes . . . . . . . . . . . , 3 X

4a Did the foundation have unrelated business gross income of $1,000 or more during the year? . . . . . . . . . . . . . . . . 4a X

. . . . . . . . . . . . . . . . . . . .b If "Yes," has it filed a tax return on Form 990-T for this year? . . . . . . . . . . 4b. .

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year? . . . . . . . . . . . . . . . . . 5 X

If "Yes," attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions that

conflict with the state law remain in the governing instrument? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 X

7 Did the foundation have at least $5,000 in assets at any time during the year? If "Yes," complete Part Il, col. (c), and Part XV 7 X

8a Enter the states to which the foundation reports or with which it is registered (see page 19 of the

instructions) ► -------------------------------------------------STMT 11 ---

b If the answer is "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General

(or designate) of each state as required by General Instruction G? if "No,"attach explanation . . . . . . . . . . . . . . . . . 8b X

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3( or

4942(j((5) for calendar year 2010 or the taxable year beginning in 2010 (see instructions for Part XIV on page

27)? If 'Yes,"complete Part XIV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 X

10 Did any persons become substantial contributors during the tax year? If "Yes," attach a schedule listing their

names and addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 X

JSA

OE 1440 1 000

APE691 9155 05/09/2011 16:11:47 1055001761

Form 990-PF (2010)

7 -

Form 990-PF ( 2010) 72 - 6278911 Page 5

OF.IM"T Statements Regardin g Activities (continued)

11 At any time during the year, did the foundation , directly or indirectly , own a controlled entity within the

meaning of section 512 ( b))13)? If "Yes," attach schedule (see page 20 of the instructions ) . . . . . . . . . . . . . . . . . . 11 X

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract before

August 17, 2008? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 X

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application? . . . . . 13 X

• Website address NJ^---------------------------- --- --------- --------

14 The books are in care of REGIONS BANK______ __________---- _ Telephone no . ( Q 326 _ 5382- --------V E NORTH, BIRMINGHAML _AL____________- ZIP+4 35203_-___TH ENU190 ILocated at ► -____

15

_ _ -__ _ __ _ _ ____

Section 4947 ( a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here . . . . . . . . . . . . . ► q

and enter the amount of tax-exempt interest received or accrued during the year . . . . . . . . . . . . . . . . . . ► 15

16 At any time during calendar year 2010, did the foundation have an interest in or a signature or other authority Yes No

over a bank , securities , or other financial account in a foreign country? . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 X

See page 20 of the instructions for exceptions and filing requirements for Form TD F 90- 22 1. If "Yes," enter

the name of the forei g n count ry ►Statements Regardin g Activities for Which Form 4720 May Be Required

unless an exception applies.File Form 4720 if any item is checked in the "Yes" column Yes No,

la During the year did the foundation ( either directly or indirectly)

q Yes No? . . . . . . . .(1) Engage in the sale or exchange , or leasing of property with a disqualified person

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a

disqualified person? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes X No

(3) Furnish goods , services, or facilities to ( or accept them from) a disqualified person? . . . . . . . Yes X No

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . . . . . . . . X Yes No

• (5) Transfer any income or assets to a disqualified person (or make any of either available for

q Yes a No? . .the benefit or use of a disqualified person )

(6) Agree to pay money or property to a government official? ( Exception . Check " No" if the

foundation agreed to make a grant to or to employ the official for a period after

q Yes X Nohi 90 df ays ) . . . . . . . . . . . . . . . .terminating wit ntermination of government service, i

b If any answer is "Yes" to la(1)-(6 ), did any of the acts fail to qualify under the exceptions described in Regulations

4941 (d)-3 or in a current notice regarding disaster assistance ( see page 22 of the instructions ) ? • •section 53 1b X.

► qOrganizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . . . . .

c Did the foundation engage in a prior year in any of the acts described in la, other than excepted acts, that

were not corrected before the first day of the tax year beginning in 2010? . . . . . . . . . . . . . . tc X. . . . . . . . . . . . .

2 Taxes on failure to distribute income ( section 4942 ) ( does not apply for years the foundation was a private

operating foundation defined in section 4942(j)(3) or 4942 ())( 5))

a At the end of tax year 2010, did the foundation have any undistributed income ( lines 6d and

q Yes No7 . . . . . . . . . . . . . . . . . . . . . . . . .Be, Part XIII ) for tax year ( s) beginning before 2010

If "Yes,' list the years ►

b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year ' s undistributed income? ( If applying section 4942 ( a((2) to

answer "No " and attach statement - see page 22 of the instructions .) . . . . . . . . . . . . . . . . . . . . . .all years listed 213 X,

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise

q qYes EA No? • . • . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .at any time during the year

b If "Yes," did it have excess business holdings in 2010 as a result of (1) any purchase by the foundation or

disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved by the

Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest , or (3) the lapse of

the 10 -, 15-, or 20 -year first phase holding period ? (Use Schedule C, Form 4720, to determine if the

. . . . . . .foundation had excess business holdings in 2010) . . . . . . . . . . . . . . . . . 3b. . . . . . . . . . . . . .

4a Did the foundation invest during the year any amount in a manner that would j eopardize its charitable purposes? 4a X. . . . . . .

b Did the foundation make any investment in a prior year ( but after December 31, 1969) that could jeopardize its

charitable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 20107. . 4b J X

Form 990-PF (2010)

JSA

0E 1450 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 8

Form 990-PF (201 6Statements Regarding Activities for Which Form 4720 May Be Required (continued)

is

•

5a During the year did the foundation pay or incur any amount to.(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? . . . . . . Yes No

(2) Influence the outcome of any specific public election (see section 4955), or to carry on,

directly or indirectly, any voter registration drive? . , . . . . . . Yes

H

BX No

(3) Provide a grant to an individual for travel, study, or other similar purposes?. . . . . . Yes X No

(4) Provide a grant to an organization other than a charitable, etc., organization described in

section 509(a))1), (2), or (3), or section 4940(d)(2)? (see page 22 of the instructions) . . . . . . . Yes F-X] No

(5) Provide for any purpose other than religious, charitable, scientific, literary, or educational

purposes, or for the prevention of cruelty to children or animals? . . . . . . . . . . . . . . . . . El Yes No

b If any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described inRegulations section 53 4945 or in a current notice regarding disaster assistance (see page 22 of the instructions)? . . . 5b

Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . . . . . . ► Elc If the answer is "Yes" to question 5a(4), does the foundation claim exemption from the tax

because it maintained expenditure responsibility for the grant? . . . . . . . . . . . . . . . . . . . El Yes F] No

If "Yes,"attach the statement required by Regulations section 53 4945-5(d).

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums

on a personal benefit contract? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? , , . _ , , , , . . 6b XIf "Yes" to 6b, file Form 8870

-7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? 1 Yes1 F Nob If "Yes," did the foundation receive any proceeds or have any net income attributable to the transaction? 7b

Information About Officers, Directors , Trustees, Foundation Managers, Highly Paid Employees,and Contractors

1 List all officers , directors . trustees . foundation manaaers and their comnensatinn (Sep nano 99 of tho inctrw'tinnet

(a) Name and address(b) Title, and average

hours per weekdevoted to position

( Cl Compensation( if not paid, enter

-0-)

(d) Contributions toemployee benef i t plans

and deferred com pensation

( e) Expense account,other allowa nces

---------------------------------------SEE STATEMENT 12 903 033. -0- -0-

---------------------------------------

---------------------------------------

c .,umpensduun of rive mgnesx-pate emproyees Cotner Tnan tnose mctuaea on line 1 - see page Z3 of the instructions).If none, enter "NONE."

(a) Name and address of each employee paid more than $50,000( b) Title, and average

hours per weekdevoted to position

( c) Compensation( d) Contributionstoemployee benefitplans and deferredcompensation

( e) Expense account,other allowances

---------------------------------------NONE NONE NONE NONE

---------------------------------------

---------------------------------------

---------------------------------------

---------------------------------------

i oiai numoer or orner employees paia over o*u ,uuu ......................... ............ . . ► I NONEForm 990-PF (2010)

JSA

OE 1460 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 9 -

72-6278911

0

Form 990-F (2010) Page 7

Information About Officers , Directors, Trustees , Foundation Managers , Highly Paid Employees,and Contractors (continued)

s rive mgnesi-pala maepenuent contractors Tor protessionai services (see page cs or me mstrucaons it none, enter rvumt.

(a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation

----------------------------------------------------------NONE NONE

----------------------------------------------------------

----------------------------------------------------------

----------------------------------------------------------

----------------------------------------------------------

Total number of others receivin g over $50,000 for p rofessional services . . ► NONE

Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year Include relevant statistical information such as the number of IExpenses

organizations and other beneficiaries served, conferences convened, research papers produced, etc

1NONE--------------------------------------------------------------------------

0 2

3-----------------------------------------------------------------------------

4-----------------------------------------------------------------------------

ORR U Summary of Program-Related Investments (see nacre 94 of the instructions)

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2 Amount

1 NONE-------------------------------------------------------------------------------------------------------------------------------------------------------

2-----------------------------------------------------------------------------

-----------------------------------------------------------------------------

All other program-related investments See page 24 of the instructions.

3NONE----------------------------------------------------------------------------------------------------------------------------------------------------------

Total . Add lines 1 throu g h 3 . ►Form 990-PF (2010)

JSA

OE1465 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 10 -

Form 990-PF ( 2010 ) 72-6278911 Page 8

Minimum Investment Return ( All domestic foundations must complete this part. Foreign foundations,see page 24 of the instructions.)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc.,

purposes:

a Average monthly fair market value of securities .. . . . . . ... . . . .

b Average of monthly cash balances . . . . . . . .... . . . . . . . . . . . . .. . . .

c Fair market value of all other assets (see page 25 of the instructions) . . . . . .. . .

d Total (add lines 1 a, b, and c) , , , , , , , , , , , , , , , , , , ,

e Reduction claimed for blockage or other factors reported on lines 1a and

1c (attach detailed explanation) . . .. . . .. . . . . .. . le

2 Acquisition indebtedness applicable to line 1 assets ............................3 Subtract line 2 from line 1d .................................4 Cash deemed held for charitable activities. Enter 1 1/2%of line 3 (for greater amount, see page 25 of

the instructions) ................................................5 Net value of noncharitable-use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4

la 173,616,723.lb NONEI c NONE1d 173 616 723.

2 NONE3 173 616 723.

4 2 r;f14 2cl

6 Minimum investment return . Enter 5% of line 5 r6-r- 8.550,624.[gym] Distributable Amount (see page 25 of the instructions) (Section 4942(j)(3) and (j)(5) private operating

foundations and certain foreign organizations check here ► n and do not comp l ete this part.)

1 Minimum investment return from Part X, line 6 . . . . . . . ... . . . . . . . . .. ... . . . .

2a Tax on investment income for 2010 from Part VI, line 5 , , , , , , , , 12a 50 , 001b Income tax for 2010. (This does not include the tax from Part VI.) 2b

c Add lines 2a and 2b .............................................3 Distributable amount before adjustments. Subtract line 2c from line 1 . . . . . ..: .. .. . . . .

0Recoveries of amounts treated as qualifying distributions

5 Add lines 3 and 4

6 Deduction from distributable amount (see page 25 of the instructions) . , . . . . , . .

7 Distributable amount as adjusted Subtract line 6 from line 5. Enter here and on Part XIII,

1 5 1 8,500,623.

8.500.62

Qualifying Distributions (see page 25 of the instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:

a Expenses, contributions, gifts, etc. -total from Part I, column (d), line 26 . . . . . . . ..... . . . la 8 , 503 , 852.b Program-related investments -total from Part IX-B 1b.............................

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc.,

purposes .. 2 NONE.......................................... , . _ , . ,

3 Amounts set aside for specific charitable projects that satisfy the

a Suitability test (prior IRS approval required) . .. ... . .. 3a NONE

b Cash distribution test (attach the required schedule) . . . ... . . . . . . . . . . 3b NONE

4 Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8, and Part XIII, line 4 , , , , 4 8 , 503 , 852.

5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment income.

Enter 1%of Part I, line 27b (see page 26 of the instructions) , , , , , , , , , , , , , , , , , , , 5 50 , 001.6 Adjusted qualifying distributions . Subtract line 5 from line 4. . . . _ 6 8 , 453 , 851.

Note : The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundationqualifies for the section 4940(e) reduction of tax in those years

Form 990-PF (2010)

JSA

0E 1470 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 11 -

72-6278911

•

•

Form 990-PF 9 __Undistributed Income (see page 26 of the instructions)

( a) (b) (c) (d)

1 Distributable amount for 2010 from Part XI, Corpus Years prior to 2009 2009 2010

line 7 , , , , , , , , , , , , , , , , , , , , , 8,500,623.2 Undistributed income, if any, as of the end of 2010

a Enter amount for 2009 only , , , , , , , , 2 , 047 , 086.

b Total for prior years 20 08 , 20

-

120 NONE

3 Excess distributions carryover, if any, to 2010

a From 2005 NONE

b From 2006 NONE

c From 2007 NONEd From 2008 NONE

e From 2009 , , , , NONE

f Total of lines 3a through e , , , , , , , , , , NON

4 Qualifying distributions for 2010 from Part XII,

line4 ► $ 8,503,852.a Applied to 2009, but not more than line 2a . . 2 , 047 , 086.

b Applied to undistributed income of prior years (Election

required- see page 26 of the instructions) , , , , NON

c Treated as distributions out of corpus (Electionrequired - see page 26 of the instructions) . . NON

d Applied to 2010 distributable amount , , , , , 6 , 456 , 766.

e Remaining amount distributed out of corpus . . NON

5 Excess distributions carryover applied to 2010 NON NONE(If an amount appears in column (d), the sameamount must be shown in column (a) )

6 Enter the net total of each column asindicated below:

a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5 NON

b Prior years' undistributed income. Subtractline 4b from line 2b NON

c Enter the amount of prior years' undistributedincome for which a notice of deficiency has beenissued, or on which the section 4942(a) tax hasbeen previously assessed . . . . . . . . . . NON

d Subtract line 6c from line 6b. Taxableamount - see page 27 of the instructions NON

e Undistributed income for 2009. Subtract line4a from line 2a. Taxable amount - see page27 of the instructions . . . . . . . . . . . .

f Undistributed income for 2010 Subtract lines4d and 5 from line 1. This amount must bedistributed in 2011, , , , , , , , , , , , , , , 2 , 043 , 857.

7 Amounts treated as distributions out of corpusto satisfy requirements imposed by section170(b)(1)(F) or 4942(g)(3) (see page 27 of theinstructions) .. ... . . NON

8 Excess distributions carryover from 2005 notapplied on line 5 or line 7 (see page 27 of the

NONinstructions) . . . . . . . . . . . . . . . . .

9 Excess distributions carryover to 2011.

Subtract lines 7 and 8 from line 6a , , , , NON

10 Analysis of line 9

a Excess from 2006 , , , NONE g

b Excess from 2007 - . . NONE

c Excess from 2008 , . NONE

d Excess from 2009 . . . NONE

e Excess from 2010 . . . NONE

Form 990-PF (2010)

JSA

OE 1480 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 12 -

Form 990-PF ( 20 10 ) 72-6278

1a

b

Private Operating Foundations (see page 27 of the instructions and Part VII-

If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2010, enter the date of the ruling . . . " . . . ►

Check box to indicate whether the foundation is a to foundation described inpnvaoperating ton section 494 2111 1s) or 4a4ztJll51

T lota(e)2a Enter the lesser of the ad-justed net income from Part

I or the minimum investment•return from Part X for eachyear listed , . . . . , ,

b 85% of line 2a . . . . .

C Qualifying distributions from Part

XII, line 4 for each year listed

d Amounts included to line 2c not

used directly for active conduct

of exempt activities . . . . .

e Qualifying distributions made

directly for active conduct of

exempt activities Subtract line

2d from line 2c . . . . . .

3 Complete 3a, b, or c for the

alternative test relied upon

a "Assets" alternative test - enter

(1) Value of all assets .

(2) Value of assets qualifying

under section

4942111(3)(B)(i). . . " .

b "Endowment" alternative test-

enter 2/3 of minimum invest-

ment return shown in Part X,

•

C

line 6 for each year listed " ,

'Support' alternative test - enter

(1) Total support other than

gross investment income

(interest, dividends, rents,

payments on securities

loans (section 512(a)(5)),

or royalties). . . . .

(2) Support from general

public and 5 or more

exempt organizations as

provided in section 4942

(J)(3)(B)l11n) . . . . .

(3) Largest amount of sup-

port from an exempt

organization . . . .

Tax year Prior 3 years

(a) 2010 (b) 2009 (c) 2008 (d) 2007

-

(4) Gross investment income ,

ONU Supplementary Information (Complete this part only if the foundation had $5 ,000 or more in assetsat any time during the year - see page 28 of the instructions.)

1 Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundationbefore the close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

N/A

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of theownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

N/A2 Information Regarding Contribution , Grant, Gift, Loan , Scholarship , etc., Programs:

Check here ► q if the foundation only makes contributions to preselected charitable organizations and does not acceptunsolicited requests for funds. If the foundation makes gifts, grants, etc. (see page 28 of the instructions) to individuals ororganizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or otherfactors

estionPage 10

NOT APPLICABLE

I0A0E1490 1000 Form 990-PF (2010)

APE691 9155 05/09/2011 16:11:47 1055001761 13 -

72-6278911

•

Form 990-PF (2010) Page 11

OW&NM. Supplementary Information (continued)3 Grants and Contributions Paid During the Year or Approved for Future Payment

Reci p ient It recipient is an indiv idual,show any relat i onship to

Foundationf Purpose of grant or Amount

Name and address (home or business )any foundation manageror substantial contributor

status orecipient

contribution

a Paid during the year

SEE STATEMENT 18

.................................................Total ► 3a 8 , 320 , 718.b Approved for future payment

Total 3bIForm 990-PF (2010)

JSA

0E1491 1.000

APE691 9155 05/09/2011 16:11:47 1055001761 14

72-6278911Form 990-PF (2010) Page 12

Analysis of Income-Producing Activities

Enter g

1 Pro

a

b•

c

d

e

f

9

2 Me

3 Inte

4 Div

5 Net

a

b

6 Net

7 Ot

8 Gai

9 Net

10 Gr

11 0t

b

c

d

e

12 Su

ross amounts unless otherwise indicated . Unrelated business income Excluded b section 512 513, or 514 R l d (

gram service revenue:

(a)susnesscode

(b)Amount

(c)

Exdusioncode

(d)

Amount

ateor

exempti^unction income

thee^st9uctlonsf

Fees and contracts from government agencies

mbership dues and assessments , , , ,

rest on savings and temporary cash investments 14 7 2 6 9 .idends and interest from securities , , , 14 5 824 074 .rental income or (loss ) from real estate

Debt-financed property , , , , , , , , ,

Not debt-financed property . . . . . . ,

rental income or (loss ) from personal property .

er investment income . . . . . . . . ,

n or (loss ) from sales of assets other than inventory 18 - 7 94 8 7 5 .

income or ( loss) from special events , ,

ss profit or (loss ) from sales of inventory .

er revenue a

OTHER INCOME 14 -50 , 422.FEDERAL TAX REFUND 14 18 , 447.

btotal . Add columns ( b), (d), and (e) . . . = 5 004 493 .

t

h

t

o

h

13 Total . Add line 12, columns (b), (d), and (e) . . . . . . . . , . . . . . . . . . 13 5,004,493.

(See worksheet in line 13 instructions on page 29 to verify calculations.)

Relationship of Activities to the Accomplishment of Exempt Purposes

Line No . Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to the

Vaccomplishment of the foundation's exempt purposes (other than by providing funds for such purposes). (See page 29 of theInstructions.)

NOT APP

Form 990-PF (2010)JSA

OE 1492 1 000

APE691 9155 05/09/2011 16:11:47 1055001761 15 -

Form 990-PF (2010) 72-6278911 Page 13Information Regarding Transfers To and Transactions and Relationships With NoncharitableExempt Organizations

1 Did the organization directly or indirectly engage in any of the following with any other organization described Yes No

in section 501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political

organizations?

a Transfers from the reporting foundation to a noncharitable exempt organization of.

• (1) Cash ........................................................ a(1)

.

X

(2) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a(2) X

b Other transactions

(1) Sales of assets to a nonchantable exempt organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(1) X

(2) Purchases of assets from a noncharitable exempt organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(2) X

(3) Rental of facilities, equipment, or other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(3) X

(4) Reimbursement arrangements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(4) X

(5) Loans or loan guarantees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(5) X

(6) Performance of services or membership or fundraising solicitations . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(6) X

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees . . . . . . . . . . . . . . . . . . . . . . . . 1c X

d If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market

value of the goods, other assets, or services given by the reporting foundation If the foundation received less than fair market

is

(a) Name of organization ( b) Type of organization ( c) Description of relationship

Under penalties of perdu , Idn=d this return , including accompanying schedules and statements, and to the best of my knowledge and

Signb e t is true cgrrect, co rer ( otherthan taxpayer or fiduciary) is based on all information of which preparer has any knowledge.

Here 'l'ip'+Jl'J/LI.

' S n ure of officer or trustee REGIONS BANK TRUSTEE

1 1111 /Type preparer ' s name Preparer ' s signat

Paid

Use Only

OE 1493 1 000

APE691

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations

described in section 501(c) of the Code ( other than section 501(c)(3) ) or in section 5277 . . . . . . . . . . . . . . . . . . . F]Yes © No

h If "Yes -" complete the fnllowina schedule-

4797Sales of Business Property OMB No 1545-0184

Form (Also Involuntary Conversions and Recapture Amounts2010Under Sections 179 and 280F(b)(2))

Department of the Treasury AttachmentInternal Revenue service (99) ► Attach to your tax return. ► See separate instructions . Sequence No. 27

•

Name ( s) shown on return Identifying number

LUCILLE S. BEESON CHARITABLE TRUST C/OREGIONS BANK (M00521) 1055001761 72-6278911

1 Enter the gross proceeds from sales or exchanges reported to you for 2010 on Form(s) 1099-B or 1099-S (or

substitute statement) that you are including on line 2, 10, or 20 (see instructions) . 1

1121711 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From OtherThan Casualty or Theft - Most Property Held More Than 1 Year (see instructions)

2 (a) Descriptionof property

(b) Date acquired

( mo., day , yr( c) Date sold(mo., day, yr)

(d) Grosssales price

(e) Depreciationallowed or

allowable sinceacquisition

(f) Cost or otherbasis, plus

improvementsandexpense of sale

( g) Gain or (loss)Subtract (f) from thesum of (d) and (e)

SEE STATEMENT 1 80 , 129

3 Gain, if any, from Form 4684 , line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Section 1231 gain from installment sales from Form 6252 , line 26 or 37 . . . . . . . . . 4

5 Section 1231 gain or (loss) from like-kind exchanges from Form 8824 5

6 Gain , if any, from line 32 , from other than casualty or theft 6

7 Combine lines 2 through 6. Enter the gain or (loss) here and on the appropriate line as follows . 7 80 , 129

Partnerships ( except electing large partnerships) and S corporations . Report the gain or ( loss) following theinstructions for Form 1065, Schedule K, line 10 , or Form 1120S, Schedule K, line 9 Skip lines 8 , 9, 11, and 12 below.

Individuals , partners, S corporation shareholders, and all others . If line 7 is zero or a loss, enter the amount fromline 7 on line 11 below and skip lines 8 and 9. If line 7 is a gain and you did not have any prior year section 1231losses, or they were recaptured in an earlier year, enter the gain from line 7 as a long-term capital gain on theSchedule D filed with your return and skip lines 8, 9, 11, and 12 below.

8 Nonrecaptured net section 1231 losses from prior years ( see instructions ) . . . . . . . . . . . . . 8

9 Subtract line 8 from line 7 If zero or less, enter -0-. If line 9 is zero, enter the gain from line 7 on line 12 below. If line

9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from line 9 as a long-term

capital g ain on the Schedule D filed with your return (see instructions) 9 80 , 129JjM Ordinary Gains and Losses (see instructions)10 Ordinary, gains and losses not included on lines 11 through 16 (include DroDertv held 1 year or less)

11 Loss, if any, from line 7 , , , , , , . . . . . . . . . . . . . . . . . 11 ( J

12 Gain, if any, from line 7 or amount from line 8, if applicable , , , , , , , , , , , , , , , , , , , , , , , , , , , 12

13 Gain, if any, from line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Net gain or (loss) from Form 4684, lines 34 and 41a , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , 14

15 Ordinary gain from installment sales from Form 6252, line 25 or 36 , , , , , , , , , , , , , , , , , , , , , , , 15

16 Ordinary gain or (loss) from like-kind exchanges from Form 8824 , , , , , , , , , , , , , , , , , , , , , , , , , 16

17 Combine lines 10 through 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 For all except individual returns, enter the amount from line 17 on the appropriate line of your return and skip lines a

and b below. For individual returns, complete lines a and b below.

a If the loss on line 11 includes a loss from Form 4684, line 38, column (b)(u), enter that part of the loss here. Enter the

part of the loss from income-producing property on Schedule A (Form 1040), line 28, and the part of the loss fromline 23 line 18aee on Schedule A (Form 1040) Identify as from "Form 4797 "used as an em loro ert , . , .yp p y p

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18a

b Redetermine the g ain or ( loss) on line 17 excludin g the loss , if any, on line 18a Enter here and on Form 1040 , line 14 18b

For Paperwork Reduction Act Notice, see separate instructions.

JSA

0F0933 2 000

APE691 9155 05/09/2011 16:11:47 1055001761

Form 4797 (2010)

114 -

Form 4797 (20 10) 72-6278911 Page 2

Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255(see instructions)

0

19 (a) Description of section 1245, 1250, 1252, 1254, or 1255 property, (btmDate acquiredo., da , r

(c) Date sold(mo, da r

A

B

C

D

These columns relate to the properties on lines 19A through 19D 10,Property A Property B Property C Property D

20 Gross sales price (Note: See line I before completing) 20

21 Cost or other basis plus expense of sale . . . . . 21

22 Depreciation (or depletion) allowed or allowable . 22

23 Adjusted basis Subtract line 22 from line 21 . . 23

24 Total gain. Subtract line 23 from line 20 . 24

25 If section 1245 property:

a Depreciation allowed or allowable from line 22 . . , 25a

b Enter the smaller of line 24 or 25a . 25b26 If section 1250 property If straight line depreciation was

used, enter-0- on line 26g, except for a corporation subject

to section 291

a Additional depreciation after 1975 (see instructions), 6a

b Applicable percentage multiplied by the smaller of

line 24 or line 26a (see Instructions). . . . . . . . . 26b

c Subtract line 26a from line 24. If residential rental property

or line 24 is not more than line 26a, skip lines 26d and 26e , 26c

d Additional depreciation after 1969 and before 1976 26d

e Enter the smaller of line 26c or 26d . . . . . . . . . 26e

f Section 291 amount (corporations only). . . . . . . 26f

g Add lines 26b, 26e, and 26f . 26

27 If section 1252 property Skip this section if you did notdispose of farmland or if this form is being completed for apartnership (other than an electing large partnership)

a Soil, water, and land clearing expenses , , , , , 7a

b Line 27a multiplied by applicable percentage Isee instructions). 27b

c Enter the smaller of line 24 or 27b . 27c

28 If section 1254 property:a Intangible drilling and development costs, expendituresfor

development of mines and other natural deposits, miningexploration costs, and depletion (see instructions) , , , 8a

b Enter the smaller of line 24 or 28a . 281b

29 If section 1255 property:

a Applicable percentage of payments excluded from

income under section 126 (see instructions) , , , , 29a

b Enter the smaller of line 24 or 29a (see instructions) . 29b

Summary of Part III Gains . Complete property columns A through D through line 29b before going to line 30.

30 Total gains for all properties. Add property columns A through D, line 24 . . . . . . . . . . . . . . . . . . . . . . 30

31 Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b Enter here and on line 13 . . . . . . . . . . 31

32 Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, line 36. Enter the portion from

other than casualty or theft on Form 4797, line 6 32

Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to 50% or Less(see instructions)

(a) Section ( b) Section

179 280F(b)(2)

33 Section 179 expense deduction or depreciation allowable in prior years , . , , , . , , , , , ,

34 Recomputed depreciation (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

35 Recapture amount. Subtract line 34 from line 33. See the instructions for where to report . . . .

Form 4797 (2010)

JSA

OF0934 2 000

APE691 9155 05/09/2011 16:11:47 1055001761 115 -

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

is CUSIP/ Description Units Tax Cost Market Value

Cash

CASH

Total For Cash 0

Short Term Investments

999990146 REGIONS TRUST MONEY MARKET DE POSIT ACCOUNT 1,048,157.51 1,048,157.51 1,048,158

Total For Short Term Investments 1,048,157.51 1,048,157.51 1,048,158

U S Government Obligations

17313YAJO CITIGROUP INC FDIC GUARANTEED DTD 08/06/2009 2.25%

12/10/2012 1,400,000 1,418,170.30 1,440,05424424DAA7 JOHN DEERE CAPITAL CORP INSD: FDIC DTD 12/19/08 2.875%

06/19/2012 1,000,000 1,003,537.35 1,033,240880591DT6 TENNESSEE VALLEY AUTHORITY SER A PUTABLE 6.79%

• 05/23/2012 4,000,000 4,092,599.17 4,341,480912810EQ7 UNITED STATES TREASURY 6.25% 08/15/2023 2,375,000 2,868,425.55 2,985,090

912810FP8 UNITED STATES TREASURY 5.375% 02/15/2031 675,000 782,050.78 787,955

912828DV9 UNITED STATES TREASURY 4.125% 05/15/2015 2,300,000 2,134,688.83 2,532,691

912828JE1 UNITED STATES TREASURY IN FLATION INDEX BOND DTD

07/15/08 1.375% 07/15/2018 OFV 3725000 3,777,895 3,841,914.27 3,981,259

912828KE9 UNITED STATES TREASURY N/B DTD 2/28/09.875% 02/28/2011 750,000 752,010.00 750,788

912828MM9 UNITED STATES TREASURY N/B DTD 11/30/09.75%

11/30/2011 1,500,000 1,498,040.27 1,505,910912828PC8 UNITED STATES TREASURY N/B DTD 11/15/2010 2.625%

11/15/2020 780,000 737,587.50 735,758

Total For U S Government Obligations 18,557,895 19,129,024.02 20,094,224

Mortgage Backed Securities

31283HXM2 FEDE RAL HOME LOAN MORTGAGE CORP POOL #G01584 DTD

07/01/03 5% 08/01/2033 OFV 990000 281,183.88 278,372 05 296,83731283K6E3 FEDE RAL HOME LOAN MORTGAGE CORP POOL #G11769 DTD

09/01/05 5% 10/01/2020 OFV 3734550 1,209,829.00 1,256,264.72 1,288,6613128JRP75 FED HOME LN MTG CORP PARTN CTF POOL #847646 5.821%

11/01/2036 OFV 1115000 346,368.67 345,611.01 369,7693128LXUK4 FEDE RAL HOME LOAN MTG CORP POOL #G02386 6%

11/01/2036 OFV 3538440 1,061,594.89 1,044,675.72 1,153,741

3128M1CK3 FEDE RAL HOME LOAN MTG CORP POOL #G11974 DTD

04/01/06 5.5% 05/01/2021 OFV 1160000 350,128.16 352,972.95 375,6773128M1DN6 FEDERAL HOME LOAN MTG CORP POOL#G12009DTD

05/01/06 5.5% 07/01/2020 OFV 2459149 778,582.62 788,558.20 835,8793128M1N47 FEDE RAL HOME LOAN MTG CORP POOL #G12311 DTD

08/01/06 5% 12/01/2020 OFV 1300000 502,645.77 498,561.76 536,0263128M43N1 FEDE RAL HOME LOAN MTG CORP POOL G03205 5.5%

07/01/2035 OFV 3371759 1,739,058.34 1,775,802.18 1,867,383

Page 1 of 8

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

CUSIP/ Description

3128M5GR5 FEDE RAL HOME LOAN MORTGAGE CORP POOL #G03508 DTD

10/01/07 6% 07/01/2037 OFV 1500000

3128PFEH4 FED H M LN MTG CORP PARTN CTFS POOL #J03736 5.5%

11/01/2021 OFV 1307341

312966VL5 FEDE RAL HOME LOAN MTG CORP GOLD POOL #B14219 15-YR

5% 05/01/2019 OFV 790000

31296MWX3 FEDE RAL HOME LOAN MTG CORP GOLD POOL #A13362 30-YR

5.5% 11/01/2033 OFV 1150000

31296S5T9 FEDE RAL HOME LOAN MTG CORP POOL #A18058 30-YR 6%

01/01/2034 OFV 1131364

31349UB56 FEDERAL HOME LOAN MORTGAGE CORP POOL #782760 VAR

RT DTD 11/01/06 6.013% 11/01/2036 OFV 670000

31371MCGO FEDE RAL NATIONAL MORTGAGE ASSN POOL #255771 6%

07/01/2035 OFV 4543941

• 31371NU86 FEDE RAL NATIONAL MORTGAGE ASSN POOL #257207 DTD

04/01/08 6% 05/01/2038 OFV 800000

31391PVE3 FEDERAL NATIONAL MTG ASSN POOL #673013 15-YR 5%

11/01/2017 OFV 1125000

31402C4H2 FEDE RAL NATL MTGE ASSN POOL #725424 DTD 04/01/04 5.5%

04/01/2034 OFV 7220000

31402DDB3 FEDE RAL NATIONAL MORTGAGE ASSN POOL #725598 DTD

06/01/2004 5.5% 07/01/2034 O FV 3500000

31402GYW7 FEDE RAL NAIL MTGE ASSN POOL #728925 30-YR 6%

08/01/2033 OFV 1181192

31403TUQ5 FEDE RAL NATL MTG ASSN POOL # 7575914.5% 12/01/2018

OFV 2000000

31405VQR1 FEDE RAL NATL MORTGAGE ASSN POOL #800664 30-YR 5 5%

10/01/2034 OFV 1000000

31410F3H6 FEDE RAL NATIONAL MORTGAGE ASSN POOL #888300 5 462%

02/01/2036 OFV 2851146

3141OGG72 FEDE RAL NATIONAL MORTGAGE ASSN POOL #888622 5.654%

07/01/2037 OFV 1000000

31410GHD8 FEDERAL NATIONAL MORTGAGE ASSN POOL #888628 5.525%

07/01/2037 OFV 1000000

31412DUA4 FEDE RAL NATIONAL MORTGAGE ASSOC POOL # 922277 6%

12/01/2036 OFV 3932000

Total For Mortgage Backed Securities

Collateralized Mortgage Obligations

31393BL29 FEDERAL NATIONAL MORTGAGE ASSN SERIES. 2003-35 CLASS:

MD DTD 04/01/03 5% 11/25/2016 OFV 1000000

31394NGQ5 FREDDIE MAC SERIES 2739 CLASS PE DTD 01/01/04 5%

03/15/2032 OFV 1000000

31396EYS9 FREDDIE MAC SERIES: 3062 CLASS: LC 5.5% 11/15/2028 OFV

3000000

Units

787,115.62

625,218.90

218,403.51

345,748.56

85,866.23

194,581.65

1,537,520.74

467,785 97

205,637.11

1,864,967.37

1,103,168.26

91,531 39

573,821.24

313,369.78

949,823.14

Tax Cost Market Value

794,740.80

625,609.63

220,485.19

349,854.32

89,247.23

195,676.17

1,548,331.46

467,639.78

859,869

676,699

233,181

371,479

93,963

207,726

1,677,881

508,881

207,532.84

1,852,346.25

1,091,274.72

95,206.92

545,309.50

316,503.47

945,667.66

376,242.80 373,538.56

444,880.55 446,270.79

1, 670,999.34 1, 685, 944.61

18,126,073.49 18,191,998.49

605,613.19

1,000,000.00

3,000,000.00

604,477.66

985,312.50

2,970,937.50

219,935

2,010,248

1,187,384

100,831

607,895

337,292

1,011,191

400,774

473,455

1,827,722

19,530,382

615,731

1,062,072

3,077,123

Page 2 of 8

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

0 CUSIP/ Description Units Tax Cost Market Value

31396HXBO FEDERAL HOME LOAN MTG CORP SERIES: 3116 CLASS: AC DTD

02/01/06 5.5% 12/15/2032 OFV 500000 500,000.00 497,812.50 535,677

3837H02A0 GOVERNMENT NATL MORTGAGE ASSN SERIES 1997-13 CLASS F

FLT RT DTD 09/16/1997.75% 09/16/2027 OFV 75000000 850,026.00 851,885.42 850,852466247AB9 JP MORGAN MORTGAGE TRUST SERIES: 2003-Al CLASS: 2A1

2.7215% 10/25/2033 OFV 2500000 414,282.77 402,242.67 410,457

Total For Collateralized Mortgage Obligations 6,369,921.96 6,312,668.25 6,551,912

Municipal Obligations

091059W43 BIR MINGHAM AL NEW P UBLIC HOUSING AUTHORITY

REVENUE BOND CALLABLE; US GOVT GTD 5.25% 11/01/2011-2011 35,000 35,000.00 35,980091059W68 BIRMINGHAM AL NEW P UBLIC HOUSING AUTHORITY

REVENUE BOND CALLABLE, US GOVT GTD 5.25% 11/01/2013-2011 45,000 45,000 00 47,305

Total For Municipal Obligations 80,000 80,000.00 83,285

• Corporate Bonds

00206RAM4 AT&T INC DTD 05/13/08 5.6% 05/15/2018 750,000 792,280.75 836,80500209AAG1 AT&T WIRELESS SVCS IN C CALLABLE 8.125% 05/01/2012 500,000 516,522.11 546,190

010392EYO ALABAMA POWER CO SERIES: 07-D DTD 12/12/07 4.85%

12/15/2012 750,000 753,158.43 804,43505531FAC7 BB& T CORPORATION DTD 7/27/09 3.85% 07/27/2012 750,000 778,307.51 780,218

06739GBB4 BARCLAYS BANK PLC DTD 04/07/2010 3 9% 04/07/2015 750,000 751,123.41 773,370

126408GN7 CSX CORP DTD 3/27/08 6.25% 04/01/2015 750,000 830,102.22 852,323126650BRO CVS/CAREMARK CORPORATION DTD 9/11/09 6.125%

09/15/2039 750,000 762,258.95 801,34512673PAC9 CA INC DTD 11/13/09 5.375% 12/01/2019 750,000 765,980.98 775,418149123BH3 CATERPILLAR INC 6.55% 05/01/2011 1,000,000 996,510.27 1,020,730

149123BQ3 CATERPILLAR INC DTD 12/05/08 7.9% 12/15/2018 750,000 748,800.86 965,295172967FE6 CITIGROUP INC DTD 06/15/2010 6% 12/13/2013 700,000 763,707.00 764,911

20030NAZ4 COMCAST CORP DTD 06/18/09 5.7% 07/01/2019 750,000 772,261.28 819,94520825CAQ7 CONOCOPH ILLIPS DTD 2/3/09 6.5% 02/01/2039 750,000 732,835.69 891,82522546QAA5 CREDIT SUISSE NEW YORK DTD 5/4/09 5.5% 05/01/2014 1,500,000 1,642,703.28 1,644,975

25459HAN5 DIRECTV HOLDGS/FING DTD 03/11/2010 3 55% 03/15/2015 690,000 715,100.88 700,985

264399DW3 DUKE ENERGY CORP CALLABLE 6.25% 01/15/2012 1,000,000 1,023,361.78 1,055,690368710AG4 GENENTECH INC CALLABLE 4.75% 07/15/2015 750,000 747,975 00 825,818369604AY9 GENERAL ELECTRIC CO 5% 02/01/2013 680,000 728,450.74 726,900

38141EA25 GOLDMAN SACHS GROUP INC DTD 2/5/09 7.5% 02/15/2019 725,000 794,595.84 845,343

38141EA33 GOLDMAN SACHS GROUP INC DTD 5/6/09 6% 05/01/2014 450,000 486,761.72 495,738

38141GCG7 GOLDMAN SACHS GROUP INC DTD 08/27/02 5.7% 09/01/2012 250,000 251,680.47 266,84040429CAAO H SBC FINANCE CORP 6.75% 05/15/2011 1,000,000 983,779 05 1,021,73042809HAB3 HESS CORPORATION DTD 2/3/09 8.125% 02/15/2019 630,000 742,126.87 795,923

Page 3 of 8

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

• CUSIP/ Description Units Tax Cost Market Value

428236BE2 HEWLETT-PACKARD CO DTD 12/02/2010 2.2% 12/01/2015 750,000 749,323.76 738,645

46625HHL7 J P MORGAN CHASE & CO DTD 04/23/09 6.3% 04/23/2019 750,000 744,299.05 853,69550075NBB9 KRAFT FOODS IN C DTD 02/08/2010 4 125% 02/09/2016 750,000 751,741.23 787,29059018YN64 MERRI LL LYNCH & CO INC SERIES: MTN DTD 04/25/08 6.875%

04/25/2018 750,000 747,270.00 820,77059022CAJ2 MERRI LL LYNCH & CO 6.11% 01/29/2037 825,000 775,005.00 744,711

59217EBD5 MET LIFE GLOB FUNDING I SERIES: 144A DTD 11/09/06 5.125%

11/09/2011 750,000 754,265.22 776,79061747YCJ2 MORGAN STANLEY SERIES: MTN DTD 9/23/09 5.625%

09/23/2019 750,000 752,334.05 764,760

68389XAC9 ORACLE CORPORATION DTD 04/09/08 5.75% 04/15/2018 825,000 824,612.25 943,759

• 71645WAP6 PETROBRAS INTL FIN CO DTD 10/30/09 5.75% 01/20/2020 750,000 749,332.50 778,178

717081DB6 PFIZER INC DTD 3/24/09 6.2% 03/15/2019 675,000 753,371.09 790,668

74834LAL4 QUEST DIAGNOSTICS INC CALLABLE 5.45% 11/01/2015 750,000 726,682.50 807,068

87425EAL7 TALISMAN ENERGY INC DTD 6/1/09 7.75% 06/01/2019 650,000 752,065.52 802,458

87612EAH9 TARGET CORP CALLABLE 5.875% 03/01/2012 250,000 254,932.20 263,25587612EAP1 TARGET CORP CALLABLE 5.375% 05/01/2017 450,000 484,802.29 504,306

88732JAL2 TIME WARNER CABLE 6.75% 07/01/2018 700,000 762,387.39 815,976

89417EAD1 TRAVELERS COMPANIES INC. CALLABLE SERIES: MTN 6.25%

06/15/2037 750,000 797,663.80 833,49892343VAC8 VERIZON COMMUNICATIONS 5.55% 02/15/2016 450,000 488,398.33 504,414

92344WAA9 VERIZON MARYLAND INC CALLABLE 6.125% 03/01/2012 500,000 495,397.04 527,465

929903DT6 WACHOVIA CORP DTD 06/08/07 5.75% 06/15/2017 750,000 756,583.16 830,280Total For Corporate Bonds 30,200,000 31,200,851.47 32,900,733

Common Stock

001055102 AFLAC INC 10,000 402,066.00 564,300002068102 AT&T IN C 33,300 1,124,368.00 978,354002824100 ABBOTT LABS 26,125 1,163,141.68 1,251,649

00817Y108 AETNA INC 11,100 483,408.33 338,661009158106 AIR PRODS & CH EMS INC 6,575 650,827.57 597,996011311107 ALAMO GROUP INC 4,840 100,869.47 134,649

018490102 ALLERGAN INC 12,300 592,674.91 844,641

025676206 AMERICAN EQUITY INVT LIF E 10,330 62,505.09 129,642

025816109 AMERICAN EXPRESS CO 6,300 322,304.97 270,39603232P405 AMSURG CORP 6,200 108,742.47 129,890037598109 APOGEE ENTERPRISES IN C 11,000 116,055.05 148,170

046220109ASTAFUNDING INC 13,000 102,202.10 105,300053015103 AUTOMATIC DATA PROCESSING INC 21,800 880,214.93 1,008,904054937107 BB&TCORP 33,500 1,264,259.19 880,715

064058100 BANK OF NEW YORK MELLON CORP 32,400 1,019,170.60 978,480

Page 4 of 8

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

0 CUSIP/ Description Units Tax Cost Market Value092533108 BLACK ROCK KELSO CAPITAL CORP 9,050 87,489.97 100,09309746Y105 BOISE INC BOISE 16,395 88,019.84 130,01209776J 101 THE BON-TON STORES IN C. 10,525 100,367.24 133,247

110122108 BRISTOL MYERS SQUIBB CO 31,400 856,939.46 831,472126650100 CVS/CAREMARK CORPORATION 17,000 682,710.00 591,09012811R104 CALAM OS ASSET MANAGEMENT 9,510 90,659.93 133,140

166764100 CHEVRON CORP 17,400 966,240.88 1,587,75017275R102 CISCO SYSTEMS INC 32,500 437,845.21 657,475

177376100 CITRIX SYSTEM INC 12,000 359,888.40 820,92018538R103 CLEARWATER PAPER CORP 1,375 74,837.19 107,663

189054109 CLOROX CO 14,800 865,683.08 936,544191216100 COCA COLA CO 16,425 668,422.78 1,080,272205887102 CONAG RA FOODS INC 40,125 942,523.73 906,023208242107 CONN'S IN C 22,000 111,122.00 102,960209115104 CONSOLIDATED EDISON INC 15,000 663,067.39 743,550

244199105 DE ERE & COMPANY 5,400 483,410.16 448,470

247131105 DELPHI FINANCIAL GROUP-CL A 4,200 117,826.66 121,128

247368103 DE LTA APPAREL INC 6,500 100,379.50 87,750

25179M103 DEVON ENERGY CORP 6,100 672,265.68 478,911

254687106 WALT DISNEY CO 20,000 514,457.74 750,200

25659P402 THE DOLAN COMPANY 9,720 106,984.96 135,302

25746U109 DOMIN ION RES INC VA NEW 20,400 678,353.50 871,488

26441C105 DUKE ENERGY CORPORATION 51,000 940,983.20 908,310

268648102 E M C CORP MASS 42,500 556,970.62 973,250278058102 EATON CORP 18,700 1,674,931.84 1,898,237291011104 EMERSON ELECTRIC CO 12,750 695,418.68 728,918

293306106 ENGLOBAL CORP 41,055 135,554.07 152,725

30161N101 EXELON CORP 16,500 1,083,792.59 687,06030231G102 EXXON MOBIL CORP 24,378 1,472,842.93 1,782,519

30239F106 FBL FINANCIAL GROUP INC CL A 4,185 25,315.07 119,984

320239106 FI RST FI NANCIAL HOLDING IN C 10,000 111,522.00 115,100

320771108 FI RST MARB LEHEAD CORP 45,450 131,444.12 98,627

320841109 FI RST MERC URY FINANCIAL CORP 10,560 149,317.39 173,184

33646W100 FIRST SOUTH BANCORP INC 10,650 110,323.35 68,906

337932107 FI RSTENERGY CORP 8,350 639,879.71 309,11735906A108 FRONTIER COMMUNICATIONS CORP 2,400 23,592 90 23,352363576109 GALLAGHER ARTHUR J & CO 37,200 1,030,439.40 1,081,776369550108 GENERAL DYNAMICS CORP 7,950 705,225.53 564,132369604103 GENERAL ELECTRIC CO 26,000 706,321.21 475,540370334104 GENERAL M ILLS IN C 24,000 663,310.80 854,160372460105 GENUINE PARTS CO 21,400 781,755.09 1,098,676374689107 GIBRALTAR INDUSTRIES IN C 12,390 119,591.75 168,132

376535100 GLADSTONE CAPITAL CORP 9,500 103,155.75 109,440

377316104 GLATFELTER 9,500 100,137.60 116,565406216101 HALLIBURTON CO 13,100 620,881.02 534,873410495105 HAN MI FINANCIAL CORP 84,725 113,612.34 97,434

Page 5 of 8

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

0 CUSIP/ Description Units Tax Cost Market Value44044K101 HORIZON LINES IN C CL A 26,090 143,287.42 114,013

440543106 HORN BECK OFFSHORE SERVICES 5,600 109,937.64 116,928447462102 H URON CONSULTING GROUP INC 5,525 105,617.07 146,136

452308109 ILLINOIS TOOL WORKS IN C 31,225 1,460,769.45 1,667,415

458140100 INTEL CORP 78,225 1,580,795.51 1,645,072

46625H100 J P MORGAN CHASE & CO 35,300 1,269,089.39 1,497,42646626E205 J2 GLOBAL COMMUNICATIONS INC 4,325 109,924.63 125,209

478160104 JOHNSON & JOHNSON 22,000 1,284,990.51 1,360,70048203R104 JUNIPER NETWORKS INC 27,900 721,611.30 1,030,068

494368103 KIMBERLY CLARK CORP 14,000 975,258.49 882,560

50077B207 KRATOS DEFENSE & SECURITY 9,925 108,102.11 130,712

505447102 LABRAN CHE & CO INC 28,000 111,008.80 100,800505597104 LACLEDE GRO UP IN C 2,990 102,030.16 109,255

532457108 ELI LILLY & CO 13,000 695,332.90 455,520

548661107 LOWE 'S COMPANIES IN C 19,800 461,993.15 496,584571157106 MARLIN BUSINESS SERVICES IN C 9,000 114,831.00 113,850

577081102 MATTEL INC 30,000 324,172.00 762,900580135101 MCDONALDS CORP 12,900 417,315.00 990,20458047P107 MCG CAPITAL CORP 17,950 85,777.66 125,112

580645109 MCGRAW HILL INC 10,000 332,243 00 364,10058319P108 MEADOWBROOK INSURANCE GRP 12,480 84,187.55 127,920

585055106 MEDTRONIC INC 13,000 599,637.25 482,170

58933Y105 MERCK & CO. INC. NEW 25,000 877,810.00 901,000

594918104 MI CROSOFT CORP 57,750 1,503,180 77 1,611,803

595017104 MICROCHIP TECHNOLOGY INC 15,000 479,689.50 513,150

62912R107 NG P CAPITAL RESOURCES 11,535 91,638.31 106,122

629579103 NACCO INDS IN C - CL A 1,215 95,899 62 131,670653391`101 NEXTERA ENERGY INC. 10,000 505,077.85 519,900

655844108 NORFOLK SOUTHERN CORP 22,500 1,087,863.86 1,413,450

66986W207 NOVAMED INC 10,288 121,223.72 118,621

670346105 N UCOR CORP 15,000 532,985.70 657,300674599105 OCCIDENTAL PETE CORP 10,300 152,844.79 1,010,430

68389X105 ORACLE CORPORATION 30,950 353,356.29 968,735704326107 PAYCHEX IN C 27,300 1,019,596.22 843,843709600100 PE NSON WORLDWIDE INC. 20,600 115,073.26 100,734713448108 PE PSICO INC 22,200 1,170,657.99 1,450,326718172109 PHI LIP MORRIS INTERNATIONAL INC 9,000 408,770.90 526,770

72346Q104 PINNACLE FINL PARTNERS INC 11,425 109,443.50 155,152

74005P104 PRAXAIR INC 10,000 478,936.00 954,700742718109 PROCTER & GAMBLE CO 10,000 500,104.12 643,300743263105 PROGRESS ENERGY INC 12,100 525,982.90 526,108744320102 PRUDENTIAL FINANCIAL INC 5,100 432,638.59 299,421

747525103 QUALCOMM INC 14,250 509,717.32 705,233

790849103 STJUDE MED INC 12,135 457,817.76 518,771

806857108 SCHLUMBERGER LTD 8,000 188,292.12 668,000807863105 SCHOOL SPECIALTY INC 8,000 105,980.00 111,440

Page 6 of 8

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

• CUSIP/ Description Units Tax Cost Market Value

811656107 SEABRIGHT HOLDI NGS IN C 13,560 186,108.79 125,023

842587107 SOUTHERN CO 25,000 735,293.70 955,750847560109 SPECTRA ENERGY CORP 34,900 822,181.18 872,151859241101 STERLING CONSTRUCTION CO 8,650 135,229.08 112,796863667101 STRYKER CORP 12,100 431,641.84 649,770871829107 SYSCO CORP 22,200 629,818.20 652,68087929/103 TELECOMMUNICATION SYSTEMS-A TELECOMMUNICATION

SYSTEMS-A 29,425 117,902.68 137,415

88162F105 TETRA TECHNOLOGIES IN C 11,000 97,001.30 130,57088579Y101 3M CO 18,800 1,388,044.81 1,622,440891027104 TORCHMARK CORP 25,000 861,506.47 1,493,50089417E109 TRAVELERS COMPAN IES INC. 14,925 720,742.11 831,472901476101 TWIN DISC INC 7,825 89,300.46 233,655902973304 USBANCORP DEL 28,575 835,333 66 770,668

• 90984P105 UNITED COMM BK BLAIRSVILLE 94 330 88 183911268100 UNITED ONLINE INC 18,000 102,972.60 118,800913017109 UNITED TECHNOLOGIES CORP 11,100 477,488.20 873,792918204108 VF CORP 4,300 331,898.08 370,57492343V104 VERIZON COMMUNICATIONS 33,000 1,261,410.27 1,180,740929160109 VULCAN MATERIALS CO 5,000 317,190.50 221,800

931142103 WAL MART STORES INC 10,800 542,175.17 582,444931422109 WALGREEN CO 18,600 641,051 64 724,65694106L109 WASTE MANAGEMENTINC 20,500 594,779 65 755,835949746101 WELLS FARGO & CO 23,825 699,389 82 738,337G01291(104 AIRCASTLE LTD 11,725 99,007.07 122,526G02995101 AMERICAN SAFETY INS HOLDI NGS 6,430 82,045.09 137,473Total For Common Stock 2,345,055 65,980,960.95 75,972,901

Foreign Stock

881624209 TEVA PHARMACEUTICAL INDS SPONS ADR ONE ADR REPRS ONE

ORD SHARE 31,900 1,257,286.11 1,662,947G05384105 ASPEN INSURANCE HOLDINGS LTD 3,550 84,555.47 101,601L3466T104 FLAGSTONE REINSURANCE HOLDING SEDOL: B4LPW38

I NSN.LU0490650438 10,500 104,536.95 132,300Total For Foreign Stock 45,950 1,446,378.53 1,896,848

Mutual Funds - Equity

464287598 ISHARES R USSELL 1000 VALUE 10,000.000 697,561.00 648,700

723709507 PIONEER INTERNATIONAL VALUE FUND INTL VALUE FUND - Y 59,492 305 1,152,228.83 1,181,517Total For Mutual Funds - Equity 69,492.305 1,849,789.83 1,830,217

Mutual Funds -International

29875E100 AMERICAN EUROPACIFIC GRTH-F2 34,398.415 1,278,410.00 1,421,686552983470 MFS RESH INTL FD CL I 209,178 607 2,363,810.00 3,282,012885215566 THORNBURG INTL VALUE FD CL I #209 52,865.127 1,309,050.00 1,514,057

Page 7 of 8

C

u

Assets as of 12/31/2010

M00521

AS TRUSTEE OF THE LUCILLE S BEESON CHARITABLE TRUST UNDER

ITEM 17 OF WILL DATED 6/11/93 AMENDED 5/27/94 AS AMENDED

CUSIP/ Description Units Tax Cost Market ValueTotalForMutualFunds - International 296,442.149 4,951,270.00 6,217,756

Partnerships

031999998 AMSOUTH TIMBER COMPANY TE LLC 30,000 2,612,010.00 3,062,400032171993 AMSOUTH OPPORTUNITY F UND 10,000 946,719.00 1,267,500411457997 HAR BERT PRIVATE EQUITY F UND II LLC 1,770,910 2,457,062.00 1,770,910482725991 K2 OVERSEAS INVESTORS I LTD HEDGE FUND CL H 4,000 4,000,000.00 5,736,336SM5588001 HAR BERT EQUITY COMMITTED 4,000,000

Total F or Partnerships 5,814,910 10,015,791.00 11,837,146

Total 12/31/2010 Assets 160, 206,890.05 177,963,563

Page 8 of 8

FORM 990-PF - PART IVCAPITAL GAINS AND LOSSES FOR TAX ON INVESTMENT IN(_OMF

•

Kind of Property Description

P

pDate

acquiredDate sold

Gross sa l e Depreciation Cost or FMV Adj. basis Excess of Gainprice less allowed / other as of as of FMV over or

expenses of sale allowable ad basis ( loss )

TOTAL LONG-TERM CAPITAL GAIN DIVIDENDS 80.

TOTAL GAIN FROM FORM 4797 80,129.

500000. AT&T WIRELESS SVCS INC CALLABLE 06/12/2006 04/05/2010PROPERTY TYPE: SECURITIES

562,365.00 522,480.00 39,885.00

353000. ABBOTT LABS DTD 3/3/09 5.125°-1 04 02/26/2009 03/22/2010PROPERTY TYPE: SECURITIES

374,819.00 352,271.00 22,548.00

234000. ABBOTT LABS DTD 3/3/09 5.125% 04 02/27/2009 03/26/2010PROPERTY TYPE: SECURITIES

245,045.00 232,935.00 12,110.00

163000. ABBOTT LABS DTD 3/3/09 5.125% 04 02/27/2009 04/15/2010PROPERTY TYPE: SECURITIES

172,314.00 162,193.00 10,121.00

3525. AGILYSYS INC 10/01/2009 01/04/2010PROPERTY TYPE: SECURITIES

34,131.00 23,071.00 11,060.00

1430. AGILYSYS INC 10/02/2009 04/05/2010PROPERTY TYPE: SECURITIES

16,189.00 9,277.00 6,912.00

4100. AGILYSYS INC 07/01/2010 10/05/2010PROPERTY TYPE: SECURITIES

28,065.00 27,934.00 131.00

10585. AGILYSYS INC 10/02/2009 10/05/2010PROPERTY TYPE: SECURITIES

72,456.00 65,865.00 6,591.00

5300. ALAMO GROUP INC 01/04/2010 04/05/2010PROPERTY TYPE: SECURITIES

105,306.00 93,954.00 11,352.00

1000000. ALCOA INC 6.500 DTD 5/23/01 DUE 05/29/2001 08/03/2010PROPERTY TYPE: SECURITIES

1048750.00 995,846.00 52,904.00

JSA

OE 1730 2 000

APE691 9155 05/09/2011 16:11:47 1055001761 17

FORM 990-PF - PART IV(APITAI (AINS ANn I nSSFS FOR TAX nN INVFSTMFNT IN('_nMF

0

Kind of Property DescriptionP01 Date

acquiredDate sold

Gross sa l e Depreciation Cost or FMV Add. basis Excess of Gainprice less allowed / other

1as of as of FMV over or

ex penses of sale allowable hnzig 32/31/69 12/31/6 ad i basis ( loss )-

15730. ALON USA ENERGY INC 04/05/2010 07/01/2010PROPERTY TYPE: SECURITIES

94,636.00 118,385.00 -23,749.00

1100. AMERICAN EQUITY INVT LIFE 10/06/2008 01/04/2010PROPERTY TYPE: SECURITIES

8,325.00 6,812.00 1,513.00

3800. AMERICAN EQUITY INVT LIFE 10/06/2008 04/05/2010PROPERTY TYPE: SECURITIES

41,003.00 23,533.00 17,470.00

1320. AMERICAN EQUITY INVT LIFE 10/06/2008 07/01/2010PROPERTY TYPE: SECURITIES

13,464.00 8,175.00 5,289.00

15610. AMERICAN REPROGRAPHICS CO 01/04/2010 04/05/2010PROPERTY TYPE: SECURITIES

141,448.00 129,118.00 12,330.00

710. THE ANDERSONS INC 04/01/2009 04/05/2010PROPERTY TYPE: SECURITIES

23,619.00 9,912.00 13,707.00

1270. THE ANDERSONS INC 01/04/2010 07/01/2010PROPERTY TYPE: SECURITIES

41,167.00 36,102.00 5,065.00

2270. THE ANDERSONS INC 04/28/2009 07/01/2010PROPERTY TYPE: SECURITIES