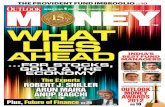

Outlook Money

description

Transcript of Outlook Money

www.outlookmoney.com`30

27 December 2012-9 january 2013

anoop bhaskar

maneesh Dangi

chirag Setalvad

Sachin Padwal-Desai

r.j. Shiller

9 January 2013 Volume 12

Issue 1

www.outlookmoney.com l 9 January 2013 l ouTlooK money 1

Contents

Head Office AB-10, S.J. Enclave, New Delhi 110 029; Tel: (011) 33505500, Fax: (011) 26191420 OtHer Offices Bangalore: (080) 33236100, Fax: (080) 25582810; Kolkata: (033) 33545400, Fax: (033) 22823593; Chennai: (044) 33506300, Fax: 28582250; Hyde rabad: (040) 23371144, Fax: (040) 23375676; Mumbai: (022) 33545000, Fax: (022) 33545100. Printed and published by Vinayak Aggarwal on behalf of Outlook Publishing (India) Pvt. Ltd. Editor: Udayan Ray. Printed at IPP Limited, C4-C 11, Phase-II, Noida and published from AB-10 Safdarjung Enclave, New Delhi 110029For Subscription queries, please call: 011-33505653, or email: [email protected]

Published for the fortnight of Dec 27, 2012 - Jan 9, 2013; Release date: Dec 26, 2012. Total no. of pages 88 + Covers

Outlook Money does not accept responsibility for any investment decision taken by readers on the basis of information provided herein. The objective is to keep readers better informed and help them decide for themselves.

Cover Design: MaNOJit datta

48 india’s top fund managersThe best in managing your money: Anoop Bhaskar; Chirag Setalvad; Maneesh Dangi; and Sachin Padwal-Desai

Global thought leader Robert J. Shiller brainstorms about the course of stocks, gold and the economy in a televised panel discussion with Arun Maira and Anup Bagchi 26 Plus His views on the future of finance

The road ahead

pg 18

neXt issue

DateD 23 Jan 2013

ON StaNDS 9 Jan2013

CoVer sTory

WorldMags.netWorldMags.net

WorldMags.net

2 ouTlooK money l 9 January 2013 l www.outlookmoney.com

4 Internet Contents Action in our Web world6 Editor’s note8 Letters85 Fortnight Figures88 Sunny’s Money Bad Than Worst?

update10 newsroll EPFO’s controversial circular has been put on hold, till further orders; RBI puts rate cut on hold, despite easing inflation; Sun Pharma shares rise

following news of US acquisition; M&M to buy out US partner’s stakes in joint ventures 16 Queries Your queries on matters affecting your personal finance answered

regulars

Contentsstart56 House saleA house sale doesn’t end with handing over the keys to the buyer. Here’s why

58 decoderBajaj Allianz Life Assure

59 insurance made easyTax benefits of life insurance policies

60 stock pickLIC Housing Finance

62 Banking stocks New bank licenses are up for grabs. How should you play the sector?

66 my planA roadmap for the Jasuds

68 Head start Take care of your child in your absence by having a hassle-free succession plan

manage76 commodities The Fiscal Cliff is posing a threat to the commodities market, but all’s not lost

77 diy money Build a strong stock portfolio

spend 80 interiors Your home decor this new year

84 your space Share personal finance thoughts

pg

10

30 and tHe award goes to... The Outlook Money Awards were presented in Mumbai on 13 December to companies that provided the best customer value in banking, home and educational loans, life and health insurance, e-broking and mutual funds. A report on the event and the profile of the winners in their respective categories

34 Best BankBest loan Providers36 education loan37 Home loanBest Insurers 38 life insurers39 HealtH insurers

40 Best e-BrokerageWealth Creators41 Best fund House42 Best fund House—equity43 Best fund House—debt46 Hall of fame K.V. Kamath, Chairman, ICICI Bank

ouTlooK money aWards 2012

WorldMags.netWorldMags.net

WorldMags.net

Join us on FacebookVisit www.facebook.com/olmindia. Get links to our articles and access to Outlook Money Digital, personal finance calculators and polls.

Have a query?Join our individual groups: click on the DISCUSSION tab, start a NEW TOPIC and post queries to members.

Sukhvinder Sidhu: As per a global study, Indians are living longer than they did 40 years ago. How far is it good news? Is there any abnormality associated with the rise in life expec-tancy? What’s the message for citi-zens for improving their life quality? 16 December

L. Krishnamurthy: My car was pur-chased in 2004. How do I determine the premium at the time of renewal?

OLM Replies: Premium depends on factors, such as age of the car, type of engine, renewal year, etc. Most insur-ers have a facility to renew the cover online, where you get the idea of the premium amount by filling the details.19 December

Follow us on TwitterLog in to Twitter and search for us or visit http://twitter.com/OutlookMoney. Follow us for updates and articles.

Tweet! Tweet!Naveen Kumar: RBI keeps rates un-changed. No respite of lower interest in the near term for borrowers. Exist-ing rate on FDs to continue 18 December

Outlook Money ONLINEI n d I a ’ s n o 1 p e r s o n a l f I n a n c e m a g a z I n e o n t h e w e b

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

LasT week on

CHeCk ouTDon’t forget to surf our easy-to-navigate website www.outlookmoney.com

IndIa’s FirsT personal fInance

eweekly

to stay on the ball visit http://digital.outlookmoney.com

4 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

IPO Financing Risks IPO financing may look attractive in terms of the profit you could make from it. But does it really pay?Which Way? Inflation is not showing any signs of abating even as our cost of living is going up steadilyEased KYC Norms rBI revises know your customer (KyC) process for con-venience of new accountholders FDI in Insurance Proposal to allow foreign institutional investors (FIIs) to enter insurance sector in India

http://digital.outlookmoney.com

www.outlook

mon

ey.com

14 december 2012

Cover Design: MANOJIT DATTA

Subscribe to Outlook Money’s weekly newsletter at eletter@ outlookmoney.com to stay updated about the contents of forthcoming issues of Outlook Money and Outlook Money Digital, subscription offers and other hot deals.

now also available on iPad

http://digital.outlookmoney.com/apps/ipad/261/Outlook-Money-Digital

WorldMags.netWorldMags.net

WorldMags.net

The parliamentary approval of the Banking Laws (Amendment) Bill, 2011, was, perhaps, last fortnight’s most important economic event and set the scene for entrants in the sector. In this issue, we analyse its impact on the stocks of compa-nies most likely to apply for banking licences (page 62). New banks, it has been argued, are needed for the huge credit disbursal required to fund India’s growth over the next decade, but, at the same time, the size of Indian banks will also be critical for them to be globally competitive. So, we may see banks, old and new, tak-ing over others. The proliferation of new banks will also dovetail with the effort towards greater financial inclusion through the use of Aadhar. This had taken centrestage lately with the Centre’s decision to undertake direct cash transfers using this route to plug leakages from subsidies to the poor and control the subsidy bill. Going forward, apart from subsidy payments into new bank accounts—many of them in new banks—microinsurance, micropensions and microinvestments, such as small-ticket systematic investment plans of mutual funds and gold, will make the make these accounts viable.

No wonder then that in a televised panel dis-cussion on Bloomberg Television India organised by Outlook Money and featuring emi-nent panellists Arun Maira, member, Planning Commission, and Anup Bagchi, managing director and CEO, ICICI Securities, Robert J. Shiller, one of world’s foremost econo-mists and thought leaders called Aadhar the biggest recent reform measure in India, far ahead of others such as FDI in retail (page 18). Shiller, in India at the invitation of Outlook Money and the guest of honour at the Outlook Money Awards 2012 held in Mumbai on 13 December, however, remains wary of the course of the world economy in the immediate future and argues that global financial crisis is still not behind us. In his awards address, he gave the audience a fascinating peek into the future of our financial world. Don’t miss the excerpts (page 26).

Lastly, like every year, the best in personal finance, who create value for you, be it through loans, banking, life insurance, health insurance, mutual funds, or e-brok-ing, were felicitated at the prestigious Outlook Money Awards in a glittering ceremo-ny attended by the who’s who of India’s financial world. Of particular interest to you would be the award winning fund managers who have made your money grow and taken you closer to your dreams. We profile them in our second cover story (page 48), a must-read for you. r

A Long View

6 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

shiller speakTop: Thought leader robert j. Shiller speaks at the Outlook Money Awards

Above: at the Bloomberg TV panel discussion on the Future of Finance

Editor’s Note

(Udayan Ray)[email protected]

http://twitter.com/udayanray

www.udayanray.blogspot.in

1. anoop Bhaskar 2. Chirag Setalvad 3. Maneesh Dangi

4. Sachin Padwal-Desai

1

3

2

4

ACE fund mAnAgErs

WorldMags.netWorldMags.net

WorldMags.net

EDITOR Udayan RayDEPUTY EDITORs Abhijit Mitra, Clifford AlvaressENIOR EDITORs Pankaj Anup Toppo, Sunil DhawanCONsULTING EDITORs Mohit Satyanand, Swami Saran SharmasENIOR AssIsTANT EDITOR Samarpan DuttasPECIAL CORREsPONDENTs Anagh Pal, Kundan Kishore, Teena Jain KaushalPRINCIPAL CORREsPONDENT Kavya Balaji sENIOR CORREsPONDENTs Ashwini Kumar Sharma, Naveen Kumar, Pheji Phalghunan CORREsPONDENT Deepali PenkarCOPY DEsk Lakshmi Krishnakumar, Sutirtha Sanyal (Dy. Copy Editors), Shinjini Ganguli (Assistant Copy Editor)ART Manojit Datta (Art Editor), Anil Panwar (Assistant Art Director) Saji C.S. (Principal Designer), Bhoomesh Dutt Sharma (Sr. Designer), Varun Vashishtha (Chief of Graphics) PhOTOGRAPhY Soumik Kar (Photo Editor), Bhupinder Singh (Chief Photographer), R.A. Chandroo (Principal Photographer), Nilotpal Baruah, Vishal Koul, Tushar Mane (Sr. Photographers) TECh TEAm Anwar Ahmed Khan, Hasan Kazmi, Manav Mishra, Raman Awasthi, Suraj Wadhwa EDITORIAL ChAIRmAN ViNoD MEHTA

Business Office PREsIDENT indranil RoyAssOCIATE PUbLIshER Johnson D’silvaCFO Vinodkumar PanickerAdvertisements GENERAL mANAGER Kabir Khattar (Corp) AssIsTANT GENERAL mANAGER Manoj Nair (West) REGIONAL mANAGERs Kailash Lohani (North), Taroon Kumar (South) sENIOR mANAGER James V Jose (East) mANAGERs Suchitra Vaidya (West), Suneel Raju (South), Ankur Srivastava (North) AssIsTANT mANAGER Devesh S Shetty (West)circulAtiOn NATIONAL hEADs L Arokia Raj (Circulation), Himanshu Pandey (Subs & Biz Dev) GENERAL mANAGER B.S. Johar (Subs) AssIsTANT GENERAL mANAGERs Anindya Banerjee (West), G Ramesh (South) ZONAL sALEs mANAGER Vinod Kumar (North) mANAGER Vinod Joshi DEPUTY mANAGER Shekhar SuvarnaPrOductiOn ChIEF mANAGER Shashank Dixit sENIOR mANAGERs Deshraj Jaswal, Shekhar Kumar PandeyAccOunts sENIOR GENERAL mANAGER (F&A) Satish Raghavan mANAGER Diwan Singh BishtAdministrAtiOn AssIsTANT GENERAL mANAGER Rajendra Kurup

mENTOR MAHESHWER PERi

x http://twitter.com/outlookMoney; http://www.facebook.com/olmindia

insurance Plans M. Rao Gopidalai, emailThis is regarding the article Invest Early For Your Child (14 November). I didn’t get the meaning of reduction in yield (RIY) mentioned in the table, Children’s Plan: What’s On Offer. Is this the policy charge which exists in the life insurance plans or something else? How can I compare the performance of unit-linked insurance plans (Ulips) across companies? Is there any methodology to do it?

OLM RepliesFor unit-linked plans we have calculated returns at an assumed annual growth rate of 10 per cent as they do not offer any guaranteed returns. Reduction in yield shows the net return after deducting policy charges from the assumed annual rate of 10 per cent. For instance, if the stockmarket rises by 10 per cent then your invest-ments will grow by 7 per cent (assuming charges are 3 per cent), as companies invest your premium money after deducting various policy charges. There is no website where you can compare their performance.

loan realities Rajeev Srivastava, emailI have been a regular reader of Outlook Money. I took a home loan from LIC Housing Finance (LICHFL) in March 2010, which is on a fixed interest rate up to March 2013. I want to transfer the loan to State Bank of India, which has a floating interest rate of 10.15 per cent up to 31 December 2012. LICHFL is charging 2 per cent of the outstanding amount as acco-unt closure charges and a fur-ther `22,000 as broken peri-od interest. Is LICHFL justified in doing so? I understand that the Reserve Bank of India (RBI) has banned prepayment penalty on housing loans.

OLM RepliesWaiver of prepayment penalty is only applicable to float-ing rate home loans. For the dual rate (fixed for initial few years and then floating) home loans, this penalty waiver works only after the loan has completed the fixed rate ten-ure and entered into the float-ing rate regime. In your case, since the rate is applicable till March 2013, till that time your loan will be considered as a fixed rate loan and, hence,

the waiver will not be applica-ble. It will be better for you to wait till your loan enters the floating rate regime and then go for the refinancing.

sunny’s moneyB. Bandyopadhyay, emailI have been a regular sub-scriber of Outlook Money since the very first issue and I eagerly wait for the forthcom-ing issues as I like the differ-ent type of informative and serious topics you bring out in your issue every time.That said, I like the one par-ticular illustration feature in the Sunny’s Money series (The Idiot Box Story, 12 December). I thought of sending my appreciation to the editor for the concept and the illustra-tor for the sketch. I had a hearty laugh while going through the story and shared the same with many of my friends, who also liked it very much. I hope you will bring out some well-conceptualised illustrated feature in the forth-coming issues too.

Sachin Agarwal, emailApropos The High Price Of Low Risk (12 December), traditional plans, though relatively less risky, are not rewarding, while term plans don’t pay anything. Unit-linked insurance plans (Ulips) provide a mix of insurance and investment, but can never be as rewarding as equity mutual funds (MFs) or stocks. In my opinion, it’s better to invest in stocks or equity MFs and partly in debt instruments, such as Public Provident Fund (PPF) and gradually shift the equity investments to debt as one nears his goals. One should buy a term plan only to offset a liability such as a home loan or to provide for the family’s expenses in the event of his demise. Otherwise there’s no need to make the insurers rich if one doesn’t have any liability. A health plan is advisable unless one is adequately covered for medical expenses for his entire life.

www.outlookmoney.com

12 DECEMBER 2012

`30

Rajiv Bose (L), 39, is using Ulips to

save for retirement and Manish Dak, 33,

took a pure term plan to get a high risk cover. Both gave traditional

plans a miss

12 December 2012

Letters

Letters must be addressed to: The Editor, Outlook Money, AB-5, 3rd floor, Safdarjung Enclave, New Delhi [email protected] Please mention your full name and residential address.

8 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.comWorldMags.netWorldMags.net

WorldMags.net

Update

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

x Newsroll 10 x Queries 16

The new Central Provident Fund commissioner, Ravi Mathur, has put the controversial Employees’

Provident Fund Organisation (EPFO) circular on hold. It, experts say, would have otherwise increased the cost of hiring and decreased the take-home salary for employees.

The 30 November circular issued by the former PF commissioner R.C. Mishra, stated that all allowances which are uniformly paid to employees should be included in the definition of basic salary. At present, employees and employers contribute 12 per cent of the basic salary each. So, going forward, if the circular gets implemented, even regularly paid allowances, such as spe-cial and transport allowance would be added to the salary while calculating PF contribution, which would leave employees with reduced take-home sal-ary (see The Impact).

With increased cost to company (because of higher matching PF contri-bution), employers may also restruc-ture the salary of employees to mini-mise the impact of the cost to company.

Manish Sabharwal, CEO, TeamLease,

a staffing company said: “If the circular gets implemented the gross salary of employees would go up, but, at the same time, their take-home will come down. Moreover, this will give rise to informal employment as people won’t trust EPFO with their money.” Further, you wouldn’t have enough money left to make your own investments in funds

offering higher returns. EPFO currently offers 8.25 per cent to its members.

Mukul Asher, a social security expert and professor at National University of Singapore, said: “The proposed mea-sure can be interpreted as being designed to fetch additional revenue in the short term to the EPFO at a time when its finances are constrained.”

The circular goes on to add: “Confusion in definition of wages pri-marily arises from the expression ‘com-mission or any other similar allowance payable to the employee’ as ‘commis-sion’ and ‘any other similar allowance’ are read as two separate expressions. The expression ‘commission or any other similar allowance payable to the employee’ is one continuous term meaning commission or any other “commission” like allowance by what-ever nomenclature referred.” Asher further said: “The EPFO circular is unfortunately, not well-drafted and throws light on the outdated nature of the 1952 Act under which it contin-ues to operate.”

The circular stops EPFO officials from acting against companies that default-ed on employees’ dues unless it can be proved that the worker is cheated. It also says that no inquiry should go beyond seven years. This was to stop open-ended assessment investigations which have gone beyond seven years as EPFO insisted it only harasses employ-ers. “If an organisation can’t ensure recovery of dues after seven years it is EPFO’s gross failure and calls for a dras-tic restructuring,” said Asher r

TEENA JAIN KAUSHAL

NewsRollA sigh of Relief foR employeesEPFO’s controversial circular has been put on hold with immediate effect till further orders

10 OUTLOOK MONEY l 9 jaNuary 2013 l www.outlookmoney.com

Salary Structure

exiSting (`)

ProPoSed (`)

Basic salary (BS) 40,000 40,000Dearness allowance (DA) 10,000 10,000

House rent allowance* (HRA) 10,000 10,000

Special allowance (SA) 10,000 10,000

Transport allowance (TA) 800 800

Total salary 70,800 70,800

Provident fund contribution 6,000

8,496 (BS + DA + HRA + SA + TA)

Take home 64,800 62,304Employer’s contribution 6,000 8,496

THE IMPACT

*Inclusion will depend on the interpretation of the circular

WorldMags.netWorldMags.net

WorldMags.net

NewsRoll

small Change by VArUN VASHISHTHA

12 OUTLOOK MONEY l 9 jaNuary 2013 l www.outlookmoney.com

the wAit goes oN

In the recent past, though inflation went down from the earlier double

digits it is still a factor for the Reserve Bank of India (RBI) while considering rate cuts. The central bank has yet again put policy rate cut on hold in its mid-quarter monetary policy review on 18 December. We tell you how the ‘no policy rate cut’ decision will affect you.What lies ahead? Inflation has been a major concern for the RBI and it has hinted that going forward the inflation situation may improve, which might lead to a rate cut. RBI in its review says: “Headline inflation has been below the Reserve Bank’s projected lev-

els over the past two months. The decline in core inflation has also been comforting. These emerging patterns reinforce the likelihood of steady mod-eration in inflation going into 2013-14, though inflation may edge higher over the next two months. In view of infla-tion pressures ebbing, monetary policy has to increasingly shift focus and respond to the threats to growth from this point onwards.” Industry experts feel that an opportunity has been lost. However, they hope that in its next review the RBI would bring down the interest rate. Naina Lal Kidwai, presi-dent of Federation of Indian Chambers of Commerce and Industry, says: “With the inflation numbers showing a decline and the global economy still in a difficult situation, industry is crying out for an impetus for investment and growth and lower interest rates would

With RBI putting rate cut on hold despite easing inflation, borrowers wait for respite

be oxygen to the sentiment which is beginning to look positive.” So, if you are waiting for rates to come down you would have to wait a little longer.impact on borrowers. If you are an existing borrower with a floating rate loan or are planning to take one with the expectation of interest rate cuts, then you will have to wait a while. In all likelihood, RBI may cut rates in the January review as it is set to focus on growth. So, if you have done all your groundwork for a home loan or an auto loan and are comfortable with the downpayment charges and equated monthly instalment servicing, go ahead with your loan. However, if you are still in the initial stages of exploring loan options, then it would make more sense to wait for the rates to come down.impact on depositors. The interest rate on deposits, after reaching its peak of around 10 per cent, has started coming down. Most banks are now offering their highest interest rates on deposits typically around 9-9.5 per cent. If you are a senior citizen you would be able get an additional 0.5 per cent interest above the normal rate.

Now, with no rate cut in the picture, the only way to benefit from the exist-ing rates is through deposits, at least till the next rate cut is announced. So, if you have surpluses or funds matur-ing it would be a good idea to park your funds in fixed deposits as the rates are still attractive. debt funds. The return of debt funds depends on the movement of interest. Therefore, as the key policy rate remains unchanged there was no impact on such funds. Experts suggest that investors with investment horizons of less than a year can stick to short-term debt funds. r NAVEEN KUMAr

gold ANd glitteRThe government is planning a number of schemes to unlock some of the huge domestic savings held in gold. The schemes may redirect demand from gold to gold-backed products

gettiNg the NodThe Banking Laws (amendment) Bill, 2011, and the Enforcement of Security Interest and Recovery of Debts Laws (amendment) Bill, 2011, gets Parlia-mentary approval in its winter session

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

Time for another squeeze, guys?

WorldMags.netWorldMags.net

WorldMags.net

NewsRoll

14 OUTLOOK MONEY l 9 JANUARY 2013 l www.outlookmoney.com

wait it outThe Insurance Laws (amendment) Bill will not be taken up for passage in the ongoing winter session of the Rajya Sabha. The Bill has been passed in the Lower House of the Parliament

probe onThe Securities and Exchange Board of India is investigating the share price movement of Karnataka Bank driven by speculation about its possible merger with a leading bank

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

After Sun Pharma’s US subsidiary Caraco

Pharmaceutical Laboratories announced it will buy the generic drugs business of Philadelphia-based URL Pharma from Japan’s Takeda Pharmaceutical Company, its stock rose. On 18 December its shares went up 2.33 per cent to `736.3 from `719.55 on the BSE.

URL Pharma’s leading prod-uct Colcrys’ net sales in 2011 was more than $430 million and revenue was nearly $600 million. This is Sun Pharma’s second acqui-sition in the US within two months. In November it had bought US-based DUSA Pharmaceuticals for `1,251 crore. More than 60 per cent of its revenue comes from international markets. Sarabjit Kaur Nangra, vice-president, research, Angel Broking, says: “URL’s acqui-sition will strengthen Sun Pharma’s foothold in US.” r

dEEpaLi pENKar

Sun Pharma shares rose after it announced US acquisition

On hopes of rising demand Shree Cement

rose as much as 0.25 per cent to `4,496.65 from `4,485.35 on 17 December. In three consecutive trading sessions its stock rose 4.35 per cent from `4,309.45 to 4,496.65 (13-17 Decem-ber). Post monsoon, things have turned positive for

cement stocks. Improving supply-demand dynamics and government measures to boost infrastructure proj-ects are driving the cement stocks upwards.

The company improved its capacity utilisation to meet the rising demand. Demand surged as construction activities in both the hous-ing and infrastructure seg-ments picked up. Analysts and broking firms are posi-tive about the stock and believe that location advan-tage, strong management team and strong earnings growth will support the stock in the future. r

d.p

Followed by reports of Mahindra & Mahindra’s

(M&M) plan to buy out its US partner Navistar Group for `175 crore its shares shot up 0.89 per cent to `967.68 from `959.13 on the BSE on 18 December. In the utility vehicle making joint venture (JV), M&M will acquire the 49 per cent stake held in both JVs by the Navi-star Group and make them wholly-owned subsidiaries. The JVs for trucks and engi-nes were formed in 2005 and 2007, respectively.

In the quarter that ended September, Navistar’s num-bers were disappointing struggling to stay afloat in the US business environ-ment. It reported a loss of $100 million in Q3 2012. Its revenues in the Q3 were $3.3 billion, down 6 per cent from Q3 2011. It will thus, be difficult for Navistar to invest in the joint venture. Navistar will, however, con-tinue to supply technology to M&M on the basis of its indefinite licence. r

d.p.

buying spreesebi alert

sebi Has revised the base minimum capital (BMC) requirement for stockbrokers to a maxi-mum of `50 lakh. Earlier, a flat BMC of `10 lakh was levied on members of stock exchanges. It is man-datory for all the mem-bers to maintain a mini-mum capital deposit with the regulator

on the Curve

The stockmarket dipped substantially and gained slightly during the fort-night. The BSE Auto surged well above the Sensex

Shree Cement stock hit a high on demand and positive measures

M&M to buy out US partner’s stakes in joint venture

05 Dec 2012 08 Dec 2012

BSE Sensex

05 Dec 2012 08 Dec 2012

Nifty

Auto Index

5,900.5

99.86100.00

104.55

5,896.8

5,850

5,875

5,900

5,925

5,950

99

101

103

105

HIgH on dEMAnd

uTILITy dRIvE

street talk

WorldMags.netWorldMags.net

WorldMags.net

harsh sinha, email My father is retired and has no pension. His only source of income is rent from property, which is about `2.10 lakh per annum, and bank interest of `50,000 a year. Does he need to file his income tax returns? Is there any way he could be exempted from taxes?OLM replies As you have stated, the income of your father falls under two heads, namely ‘income from house property’ and ‘income from other sources’ (bank interest). The income from rent is subject to a standard deduction of 30 per cent and, therefore, his taxable income under this head will be only `1.47 lakh. Income from bank interest being fully taxable, the gross total income of your father will work out to `1.97 lakh. A gross income of under `2 lakh is exempted from tax. Therefore, your father need not file his income tax return in case he does not

wish to do so. However, in case tax has been deducted at source by either the tenants or the

bank, your father must file his return to claim the refund of tax deducted. In case your father is aged 60 or above, he will not be required to pay any tax up to `2.50 lakh per annum. r

General insurancegaurav thapar, email If I purchase two insurance poli-cies on my house, can I make a claim under both policies in case of any loss incurred?

OLM replies You can have two insurance poli-cies on your property covering different types of risk, such as a fire insurance and a burglary insurance for the contents of your home. In that case, any loss will be classified under one policy or the other. However, if you have two policies covering the same risk, say both policies cover the risk of fire, the loss shall be shared by both the policies in the ratio of the sum insured under each policy. One basic premise of a gener-al insurance contract is that no insured can make profit out of an insurance policy. Therefore, the insured only has to be indemni-fied for the loss incurred. In case there is more than one company covering the loss, the loss will be shared between the companies. r

LOkesh singh, email I have recently bought a second-hand car, which has a no-claim bonus attached with the insurance taken by the previous owner. Will this benefit be transferred to me when I take a fresh insurance for the car?OLM replies No-claim bonus (NCB) is a reward which is given to the owner of the vehi-cle for safe driving. It is not attached with the vehicle. Therefore, as soon as the vehicle chang-es hands, the insurance companies withdraw the no-claim bonus. The original owner, howev-er, can retain the bonus and transfer it to his next buy (vehicle). A purchaser of a second-hand vehicle will not get the benefit of NCB when he or she renews the policy. r

life insuranceshiLpi gupta, email What is the legal status of a life insurance policy during the grace period for payment of premium?

Life insurance generaL insurance MutuaL funds taxatiOn banking reaL estate retireMent stOcks nri

16 OutLOOk MOneY l 9 january 2013 l www.outlookmoney.com

vijaY singh askedPlease advise me about tax rebate on purchase of a new property?

OLM replies Per se, there is no provision under the Income Tax Act, 1961, for rebate on property purchase. However, there are certain benefits which are ancillary to the purchase of property. For example, if you buy a property for a business purpose, you can claim a pre-scribed percentage of its cost as depreciation, which will be treated as a business expense. If you buy a property by raising a loan and generate rental income from it, you can claim the payment of interest as an expense for earning that income. If you buy property in the form of a house for self occupation, you can claim rebate for repayment of the principal amount of the home loan subject to limits under Section 80C of the I-T Act, 1961, as well as on the interest paid on that loan, up to `1.5 lakh per annum. r

taxation

Queries

WorldMags.netWorldMags.net

WorldMags.net

Life insurance generaL insurance MutuaL funds taxatiOn banking reaL estate retireMent stOcks nri

OLM replies Life insurance companies usually give a grace period of 30 days for depositing a premium of a life insurance policy after the due date of payment, without any charge or interest. During this grace period, the policy remains in force. In case a death occurs during this grace period, the insurance company would, typically, deduct the outstanding premium and the inter-est thereupon from the death claim proceeds and pay the balance proceeds to the beneficia-ries. This provision has been made to avoid the unintentional lapse in an insurance policy. The grace days are normally one month, but not less than 30 days for all modes of payment except in a monthly mode where only 15 days are allowed as grace days. r

aMit pathak, emailI earn `2.1 lakh annually and wish to save and invest on a regular basis. Apart from some fixed deposits I do not have any investments. I would like to take a life insurance policy. Please advise. I am 30 years old. OLM replies Considering your age and income you should go for a term insurance plan for yourself. This is a pure risk cover that takes care of the risk to your life. In simple words, if any-thing happens to the policyholder his or her nominee would receive the sum assured. Term insurance is more economical than other insur-ance plans because it has lower premiums. Often, the idea is to go with a cheaper term insurance and invest the difference in regular savings and investment plans. The main benefit of taking a term plan is that it provides more insurance coverage at lower premiums and also there is no-lock in period. Thus, the policyholder has nothing to lose if he or she wishes to switch to some other insurance plan. r

naveen bhaskar jha, email With so much of controversy around unit-linked insurance plans (Ulips), is it advisable to buy Ulips? What factors one should know before investing in unit-linked schemes?OLM replies The choice of investing in unit-linked investment schemes will depend on your investment requirements and your insurance needs. A Ulip provides both insurance and investment benefits. So, if you are looking for insurance as well as appreciation of your money and are willing to take risks, you can consider investing in Ulips. In a Ulip, the insurance com-pany invests the amount you pay as premium in different funds after deducting administration and other charges. So, the policyholder’s money is invested in different funds which invest in equities, debt instruments, money market instruments, government securities and so on. Also, the policyholder determines the appropri-ate ratio of investments into these funds. r

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindiahttp://digital.outlookmoney.com l 9 january 2013 l OutLOOk MOneY 17

Log on to www.outlookmoney.

com and post your queries at the Expert Advice

box or mail at letters@outlookmoney.

com

OutlOOk MOney phOtOs

WorldMags.netWorldMags.net

WorldMags.net

What lies aheadCover Story

Anup Bagchi, Managing Director & CEO, ICICI Securities

Robert J. Shiller, Arthur M. Okun Professor Of Economics, Yale University

WorldMags.netWorldMags.net

WorldMags.net

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindiahttp://digital.outlookmoney.com l 9 january 2013 l OUTLOOK MONEY 19

for stocks, gold and the economy

What lies ahead

As 2012 heads towards an end and you wonder what 2013 has in store for you, Outlook Money, in association with Bloomberg Television India got three eminent experts to brainstorm on the likely

course of the economy, stocks and gold in a televised discussion last fortnight. Participating in the discussion moderated by Vivek Law, editor, Bloomberg Television India, were Robert J. Shiller, one of the world’s foremost economists and thinkers, who correctly predicted the current finan-cial crisis and the dotcom bust of 2000. Besides Shiller, the other participants were Arun Maira, member, Planning Commission and Anup Bagchi, managing director and CEO, ICICI Securities. Here are excerpts from their discussion.

Arun Maira, Member, Planning Commission

WorldMags.netWorldMags.net

WorldMags.net

Real Estate

20 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

Cover Story

Economy x Vivek Law: Is it still a long way from feeling a little more comfortable about the global economy?Shiller: Well, one thing we know about financial markets is that there is uncertainty, but we still see the overhang from the crisis. We still see damaged financial institutions with balance sheet problems, households who are under water and have negative net worth. We have long-term unem-ployment and we have people who are giving up on finding jobs. All these are weighing on confidence and that damage in confidence might last a long time.

x Vivek Law: You recently said you were hopeful that the US will go over the ‘fiscal cliff’. What’s your view now?Shiller: I am hopeful that some kind of compromise will be reached. The problem is that there is such a polarisation in US politics, it would be tough. We have the Republican Party, which has a low tax priority. It’s very difficult for them to give in and President Obama has said that he won’t compromise on raising taxes on the rich. Therefore, we surely have a battle and we have no idea how it is going to come up. If it drags on, it can hurt confidence and hurt the economy as a whole. There are so many scenarios that

could unfold. We can just go over the cliff, but only for a short time and then there could be some corrections. That wouldn’t be so bad. It’s so hard to predict right now, but I think it does reflect a deeper mood of austerity that is driv-ing the US and the economy of other countries in the world. This austerity is dragging the economies back and it is affecting the whole world.

x Vivek Law: What about Europe? How bad is the situa-tion there?Shiller: Well, I have seen recent reports that have described the financial sector as very fragile. We have banks that are in trouble. They have been encouraged to hold the debt of governments whose debt is not entirely viable. We have a possible break-up of the eurozone area and the important psychological consequences in that. It is very unpredictable and it has the potential to develop into a serious crisis that would drag down the world economy.

x Vivek Law: Do you believe that there is a bigger chance of things going wrong from here on? Shiller: I think the most likely course for the world econo-my is that it will be steady and at lower growth. There is a

(R-L): Shiller, Bagchi, Maira, (video link from Delhi) and Law at the televised discussion

WorldMags.netWorldMags.net

WorldMags.net

22 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

substantial chance of a world recession, but I am not pre-dicting it as of now.

x Vivek Law: Mr. Maira, what is your reading on what’s really happening in the global world?Maira: We foresee three scenarios for India. One of the sce-narios is that we keep muddling along because of the log-jam in the system caused by lack of trust in institutions, which, in turn, disables the policy-making machinery from getting things done. The other scenario which can emerge—a worse one at that—is, if this logjam continues for much longer, then the condition of the system deterio-rates much further, both in the financial and economic conditions, as well as the lack of trust in institutions. We could then witness the falling apart of India’s growth story. There is another scenario that is possible, and there are forces which suggest that if they are taken advantage of, a flotilla advancing, the flotilla of various states, various interest and various stakeholders lining around strategies, would produce benefit for the whole system.

We have calculated gross domestic product (GDP) growth numbers within these three scenarios. And we do foresee that if we get the flotilla aligned and moving, for which we determine what needs to be done, we could see in the next five years growth of over 8 per cent. This means, going from where we are at 5-6 per cent, towards 9-10 per cent by the end of the five years. The second scenario—the fall-ing apart scenario—where the growth would be around 5-5.5 per cent on an average, in the next five years. And, the in-between scenario, where we just keep muddling along and don’t fall apart entirely, it could be 6-6.5 per cent GDP growth in the five-year period.

x Vivek Law: Anup, over $20 billion have been invested in the country this year. How would you explain that in the context of what’s going on globally?Anup Bagchi: In the Indian context, there has been four

times, where there was a massive upsurge in the index. All the four times, it has been driven by liquidity—(quatitative easing) QE1, QE2, Japanese Tsunami and then QE3. We must keep that in mind that liquidity is driving a lot of this upsurge that is coming in. Second, I think the whole mar-ket moves in expectation, not what happens in the real economy, but the expectations on the real economy. So, I think, the last 3-4 years, the index hasn’t gone anywhere, but the earnings have increased. And, to that extent, I think there is a decompression, so monies have started to come in, but I would say that it is largely driven by liquidity.

The bulk of the money that is coming in the country is of an ETF (exchange traded fund) variety, which is essentially allocation money and it is not so much India-dedicated active investing money. So, we have to keep in mind that these are the two factors for the inflows. In the Indian con-text, FIIs (foreign institutional investors) are looking at rea-sons and places to invest.

x Vivek Law: Dr. Shiller, you are visiting India at a time when the government has announced big bang reforms in the last 2-3 months. How does India look to you?Shiller: Well, I am impressed with some of the new reforms, one of them being this new unique identity num-ber, Aadhar, which I think is revolutionary (in terms of the very concept and the intended application). We don’t have that, by the way, in the United States, not a biometric sys-tem connected with an identification system that allows and, eventually, connects with databases across the coun-try. This is powerful and, I think, it will help lead India to a new and better future. So, in order to keep the economy advancing and to keep preventing the loss of trust and con-fidence that Mr. Maira was talking about, it would help.

Cover Story

arun maira “We have not been able to get a large flow of foreign investments because the money gets stuck and doesn't produce results. Aadhar and other administrative reforms will enable people to see benefits of growth”

robert j. shiller “Stockmarkets can still give 3-5 per cent real returns. From a value per-spective, it is still a good investment”

WorldMags.netWorldMags.net

WorldMags.net

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindiahttp://digital.outlookmoney.com l 9 january 2013 l OUTLOOK MONEY 23

x Vivek Law: What you are really saying is that this is perhaps something which could change India in the next 5-10 years. It’s a far bigger reform than throwing open an odd sector to foreign direct investment.

Shiller: It’s fundamental because it changes the informa-tion structure. It brings people into the financial system who are now anonymous and unidentified. Now they have got an account, they have the ability to act as an economic agent on their own. That is fundamental, and it works at benefitting all levels of the Indian society.

x Vivek Law: Mr Maira, with the kind of decisions gov-ernment has taken recently, do you think that the govern-ment has created a better opportunity to not fall in the worst case scenario?Arun Maira: There has been a lot of focus on opening up the country’s markets to outside investments previously. And, the truth is that most of our sectors are already opened to outside investments and only a few remain, and we are talking about opening those up. But, we haven’t been able to get a big flow of investments into the country except under conditions where everywhere else is depressed so short-term money would come here for a while perhaps. And, why it has not happened though India is a large mar-ket with a lot of potential is because when money comes in things don’t get done here. The money is sort of stuck. It doesn’t repay and produce results. So, people have been saying “why don’t you concentrate on getting things done

anup bagchi “Improved ‘feel good’ and liquidity have driven up the market. If there is time gap between the real economy moving and this enthusiasm, there will be a correction”

WorldMags.netWorldMags.net

WorldMags.net

Real Estate

24 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

Cover Story

within the country?” Therefore, Aadhar and other adminis-trative reforms, which will enable people to see the benefits of growth, are very important. If you do these reforms, people will not only directly benefit, but even the projects will get implemented (on time), money will produce returns faster and you would be able to draw in more money from investors both in India and from elsewhere in the world.

x Vivek Law: Will the recent (reform) announcements take us to next level of high in the market? Anup Bagchi: If you look at the markets construct as of now, it is tripolar. You have cash-rich companies and com-panies which are generating cash. Then, you have very asset-heavy and investment-heavy companies, such as those in infrastructure. Then, you have companies which are very exposed to global factors like the IT sector. If you see, massive underperformance has happened on the investment side and on the capital-heavy sectors. And, if you look at that sector, it hasn’t moved much because the real stuff has to get done. I think, so far what has happened is that the feel good factor has improved. So, (recent market upmove) is a factor of two things: a general feel good and liquidity which drives the market. The second one is the critical factor. But, the real economy has to catch up.

When you speak to corporates and when you look at pro-moters, I don’t think much has changed. But, I think confi-dence is coming back. Now it’s a very good start for the market always, because, when confidence comes back, expectation of returns on investment comes back (with it) and things start to move. Cash-rich companies are sitting on cash, but not investing. If they see that there is less poli-cy volatility, they will start to invest.

While on the ground nothing much has improved, I think sentiment has improved a great deal. People are waiting with bated breath that things might move, going ahead. And, trust me, if it moves, I think we will have a big jump,

as the two sectors, as you know, haven’t participated much in the overall rally. So, I think, we can see a good run up if real economy starts to move. If there is time gap between real economy moving and this enthusiasm, there will be a correction for sure.

Gold x Vivek Law: Dr. Shiller, do you think gold is where the next bubble is?Shiller: Well, gold has already been in the bubble and I have to admit I missed this one. I didn’t predict it. But, I have a lot of company. There are lot of other people who didn’t predict it, including some very successful money managers. You can’t get everything (right). The problem with gold is it has very little intrinsic use. It has a stored value, but it doesn’t generate earnings. So, I would like to compute a price-to-earnings ratio for gold, but we don’t have that. I study behavioural economics and human psy-chology, but I find it inscrutable. So, if you ask me to predict when this gold bubble will end I can’t do it.

StockS x Vivek Law: What about equities?Shiller: I have my ‘CAPE’, Cyclically Adjusted Price Earnings ratio, which is little over 20 in the US. It varies by countries and, in the UK, it is lower. But, it is high and it’s a sign that we don’t probably expect as good returns as we have got historically. It is just suggesting something like 3-4-5 per cent a year real returns, which is pretty good in this environment. And, moreover, you can go into lower price sectors of any economy and, maybe, do even better than that. So, I think the stockmarket, if you take it from a value perspective, is still a good investment. r

arun maira “If we have a flotilla of various states, interests and stakeholders aligned with strategies that would produce benefit for the whole system, we could see a growth rate of 8 per cent in the next five years.”

robert j. shiller “I think the most likely course for the world economy is that it will be steady and at lower growth. There is a sub-stantial chance of a world recession”

WorldMags.netWorldMags.net

WorldMags.net

26 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.comWorldMags.netWorldMags.net

WorldMags.net

In the future, I think, that the next course of action should be to continue the expansion of our use of modern financial theory including behavioural finance, and a better understanding of how people actually think and behave. One thing that’s happening is we are entering the age of big data, where we have

expanding databases that allow better risk management. In order to make these work better we also need—and this is something that I know you are very much aware of here in India—better individual identification systems, biometrics, identification cards and numbers and ways of interacting financially with these numbers. So, I think that the new identification system being developed in India is extremely important. I talked about this in one of my earlier books, New Financial Order, and I think it’s very important because it allows people to link to data and automatic processing of data that allows systems to manage their risks and to incentivise people better. It is absolutely fundamental.

At the same time, I believe there is a trend in the world today that we will see evolving over the next half century, of a decline of the underground or par-allel economy. More things would be above ground and quantifiable and identifiable, which would mean better risk management and better incentivi-sation. Another thing you hear talked about now is that we have more com-plex contracts because with computers and databases and identification we

can do it. We can enforce the contracts, we can see it actu-ally fulfilling its plan. And we will see more use of electron-ic money; the paper money that we have is gradually disap-pearing. We will see more, I am hopeful, of what I call 'index units of account'. I have talked about this in my vari-ous books. I think that we will see the decline of conven-tional money and we will have more different kinds of money indexed to economic variables, better than anything we have seen so far.

The next few years are possibly difficult. ...Unemployment rate can stay up for a decade or more in the time of eco-nomic slowdown. It is irregular and you see ups and downs within that, but I think the slowdown that we see in the

Indian economy is just one example of the kinds of slowdown that may still be ahead of us because of this crisis (which started in 2008), which is not over yet. We are still in the aftermath of a bubble and the effect depends on confidence, on animal spirits, on how people are thinking. Fortunately, the G-20 nations responded very well to the crisis that developed in 2008. They did expansionary fiscal and monetary policy. The problem has been that since then there has been a tendency towards austerity because when you do get into a crisis like this and you use expansionary fiscal policy, it tends to put governments greater in debt. And there has been an absolute panic about that leading to austerity campaigns around much of the world.

In his address at the Outlook Money Awards 2012, the economic visionary mentioned how our financial future will pan out and what we should prepare for. Excerpts

‘The economic crisis is not quite over yet’

http://digital.outlookmoney.com l 9 january 2013 l OUTLOOK MONEY 27x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

RobeRT j. shIlleR Professor of Economics, Yale University

in motionThe future depends on improving and extending use of financial theoryn Expanding databases allow better risk managementn Individual identification (as ongoing in India) will allow databases to be linked bettern Decline of underground economy will continuen Much more complex con-tracts will be drawn upn Electronic money and indexed units of account will become more common

Cover Story

WorldMags.netWorldMags.net

WorldMags.net

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

I have been arguing in various news-paper articles and in my books that governments shouldn’t be afraid of stimulus anymore and that the bal-anced budget stimulus can still be applied. That means raising taxes and raising expenditures to invest in infra-structure and other important activi-ties that are neglected in a time of eco-nomic austerity. It doesn’t look like we have the political will to do this. So, it is not a forecast to say that we would not be using economic stimulus to put us out of this slow period and I am wor-ried that this slow period will continue. But I wanted to just say finally and conclude that it is important also to think about the longer term and not lose sight of the exciting, truly exciting revolution that’s going on in finance around the world. The little downturn that we are going through—little, maybe not so little—but the downturn we are going through now will be forgotten. There will be new bubble and busts like the one that we have now.

The important thing to keep in sight is to keep the revolu-tion, the financial revolution going. And this means that we need to be positive about the development of new finan-cial derivatives to deal with important risks. The important risks tend to be long-term risks to the income streams. I tell my students that the next half century is going to be an adventure for the next century. It’s a serious uncertainty about what’s coming up. The horizon, as I tell my students, that one should have is about a hundred years. My students will live the better part of the century themselves and we care about our chil-dren. So, we have a 100-year horizon. What is going to happen in the next 100 years nobody knows. The last cen-tury had enormous uncertainty revealed. This coming century will as well. We have to think about our finan-cial system as a system that insures against risks that are important to us and allows us also to incentivise people to move ahead in a risky world.

So, some examples of the kinds of things that we are to be thinking about that are even more important than the current economic slowdown is how we can insure against the major risks com-ing up. One of these is environmental risk. It looks like global warming is not being solved, this is just one example, by international treaties. It’s getting worse. Maybe there will be some treaty. We don’t know, but it’s a major uncer-

tainty. I don’t know how we can get international agreement to prevent this worsening, but I do know how we can ensure people against suffering from it. Now the environmental risk affects the whole planet, but it doesn’t affect the whole planet equally. So there are many risk management contracts that ought to be made, long-term risk man-agement contracts.

Another one is when you think about the distant future there is a worry about war and terrorism. I have NBCR, that’s nuclear, biological, chemical and radiological risks. These are risks that we need to talk about and develop long-term risk management contracts against them.

There is also a risk going forward about increasing economic inequality. With the informa-tion revolution going at the a pace that it is going at, there is uncertainty of people as to whether they would be able to earn a decent income. I am not saying that I know that inequality will increase, there is a risk that will increase. And this is something again that we can help devise finan-cial or insurance products (to mitigate the risk of). And if we develop finance further with advanced risk manage-ment and incentivisation methods, it will create a very positive future for ourselves and for our children. Because ultimately what finance releases is human achievement so that their activities are not diminished by excessive or unnecessary fears.

When you have a financial system that is attentive to peo-ple and makes complex contracts to protect them and to incentivise them, it will create amazing new things. One thing that is being happening during this immediate financial crisis is we have seen our communications tech-nology move ahead amazingly. If you compare our telephones, our mobile phones from five or 10 years ago with today's, they have just advanced so much in spite of the financial crisis. What this means is that the financial system, I believe, incentivises human behaviour and incentivises people to work better in groups. This is some-thing that is amazing, it’s the story of our times, we have to see it continue.

But the important lesson is that finan-cial innovation, which is discredited and doubted by so many people, is alive and well and has to be promoted for the future.” r

28 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

FAR vision Financial predictions for the next centuryn Increased speculative acti-vity will bring about more bubbles and bustsn Financial derivatives required to deal with long-term risks to income streamsn Protections against nuclear, biological, chemical and radio-logical risks to evolven Insurance against environ-mental risksn Insurance against rising inequalityn Advanced risk management will make for better achieve-ment of personal goals

Cover Story

nEAR HoRiZonThe next few years to depend on consistent application of economic stimulus because ofn Fundamental instability of capitalist economyn The G-20 nations responded well to this crisis (after 2008)n The tendency towards austerity in aftermath of bud-get crises is major threat (to the global economy)n Balanced-budget stimulus can still be applied today

WorldMags.netWorldMags.net

WorldMags.net

a different tea Party It was a high-powered high tea at Mumbai’s ITC Grand Central on 13 December 2012, in honour of

global thought leader Prof. Robert J.Shiller from the prestigious Yale University, who was visiting India at our invitation. The country’s best finance brains came to spend some quality time with Prof. Shiller

to discuss emerging trends in world finance. Among them were Subir Gokarn, deputy governor, Reserve Bank of India; O.P. Bhatt, former chairman, State Bank of India; K.V. Kamath, chairman, ICICI Bank; Y.H. Malegam, noted tax and financial regulation expert; and Anup Bagchi, managing director

and CEO, ICICI Securities. They were joined by Vinod Mehta, editorial chairman of the Outlook Group and Akshay Raheja, vice-chairman of the Outlook Group. Before the eminent gathering left after a

stimulating conversation, they posed for our shutterbug. r

From left: O.P. Bhatt, former chairman, SBI; Y.H. Malegam, financial expert; Subir Gokarn, deputy governor, RBI; Robert J. Shiller, noted economist; Akshay Raheja, vice-chairman, Outlook Group; K.V. Kamath, chairman ICICI Bank; Vinod Mehta, editorial chairman, Outlook Group; and Anup Bagchi, MD & CEO ICICI Securities

Conversations

http://digital.outlookmoney.com l 9 JAnUARY 2013 l OUTLOOK MONEY 29x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

tushar Mane

WorldMags.netWorldMags.net

WorldMags.net

By Pheji Phalghunan

Ayear of volatile markets, stub-bornly high inflation and poor investor sentiment: that’s how many of us would describe 2012. But even this bleak back-

drop threw up its set of shining stars. The Outlook Money Awards 2012 was held to honour those who had delivered excep-tional service to the man on the street.

The evening began with Outlook Money editor Udayan Ray welcoming the stal-warts of Indian finance. That was fol-lowed by a talk by Robert J. Shiller, one of the foremost economic thinkers of our time and the only person to have predict-ed both the dotcom bust as well as the 2008 crash, on the future of the financial world. A Q&A session moderated by jour-nalist Govindraj Ethiraj was next.

The Outlook Money Children’s Special Collector’s Issue 2 was launched at the ceremony by Vinod Mehta, editorial chairman, Outlook Group, Harshendu Bindal, president, Franklin Templeton Investments (India), and Shiller. This was the second of the Collector’s Issues, with the first being the successful Women’s Special and more to follow.

The Awards evening was rounded off by the induction into the Outlook Money Hall of Fame of K.V. Kamath, a legend of Indian finance, who, with his foresight and acumen built up the country’s sec-ond-largest commercial bank, ICICI Bank, of which he is now the chairman. That was, indeed, a rare privilege.

The Constellation

The winners with their trophies at the Outlook Money awards 2012 ceremony at the iTC grand Central, Mumbai, on 13 December 2012

30 OuTlOOK MOney l 9 JANUARY 2013 l www.outlookmoney.comWorldMags.netWorldMags.net

WorldMags.net

The ConstellationThe Ceremony

t Update Awards Start Manage Spend

http://digital.outlookmoney.com l 9 JANUARY 2013 l OuTlOOK MOney 31x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

WorldMags.netWorldMags.net

WorldMags.net

1 K.V. Kamath, chairman, iCiCi Bank (l), who was inducted into the Outlook Money hall of Fame in 2012, with the 2011 hall of Fame awardee and tax and financial regulation expert y.h. Malegam. 2 Robert j. Shiller, arthur M. Okun professor of economics, Cowles Foundation for Research and economics, yale university, delivers his address. 3 (l-R) harshendu Bindal, president, Franklin Templeton investments (india); Vinod Mehta, editorial chairman, Outlook group, and Shiller launch the Outlook Money Children's Special Collectors' issue 2. 4 udayan Ray, editor, Outlook Money, delivers the welcome address. 7 (l-R) O.P. Bhatt, chairman, awards jury, and former chairman, State Bank of india; Mehta; akshay Raheja, vice-chairman, Outlook group; and Ray on the dais. The Outlook Money awards 2012 winners: 5 Keki Mistry, vice-chairman and CeO, housing Development Finance Corp.; 6 hemant Bhargava, executive director (marketing & product development), life insurance Corporation of india; 8 M.V. Tanksale, chairman & managing director, Central Bank of india; 9 antony jacob, CeO, apollo Munich health insurance Co.; 10 V. Philip, managing director & CeO, Bajaj allianz life insurance Co.; 11 Vibha Padalkar, executive director and CFO, hDFC life insurance; 12 R.K. Bammi, executive director (retail banking), axis Bank; 13 g. Srinivasan, chairman cum managing director, new india assurance Co.; 14 anup Bagchi, managing director & CeO, iCiCi Securities; 15 aseem Dhru, managing director & CeO, hDFC Securities; 16 amandeep S. Chopra, president & head (fixed income), uTi aMC, (l) and imtaiyazur Rahman, acting CeO, uTi aMC (R); 18 nimesh Shah, managing director & CeO, iCiCi Prudential aMC; 19 n. Seshadri, executive director, Bank of india; 20 (l-R) lakshmi iyer, senior vice-president & head (fixed income & products), Kotak Mahindra aMC, and Sandesh Kirkire, CeO, Kotak Mahindra aMC; and 21 Prashant jain, executive director & CiO, hDFC MF. 17 johnson D'silva, vice-president, Outlook group, & associate publisher, Outlook Money, delivers the vote of thanks. 22 (l) indranil Roy, president, Outlook group, and Manoj nair, assistant general manager, Outlook Money

1

65

11 12

17 18

32 OuTlOOK MOney l 9 JANUARY 2013 l www.outlookmoney.com

Photos: sOuMik kar; tushar Mane; aPOOrva salkade; aMit haralkar; Pravin utturkar

WorldMags.netWorldMags.net

WorldMags.net

2 3 4

108 97

13 14 1615

19 20 21 22

http://digital.outlookmoney.com l 9 JANUARY 2013 l OuTlOOK MOney 33x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

WorldMags.netWorldMags.net

WorldMags.net

Winner’s edge n Consistent performancen It topped the tables in the financial performance category by a big marginn Good reach

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

34 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

IndIan Bank

Competition was tough and Indian Bank performed well across all parameters, topping the list on ‘reach’. Axis Bank

and ICICI Bank also scored similar points, but Indian Bank won the award on the ground that it provides services such as phone banking, mobile banking and Netbanking along with the fact that it opened a large number of no-frill accounts. That is what worked in its favour. Indian Bank also boasted of a healthy increase in its savings bank accounts in FY12 compared to FY11 and a large number of new customers in the last three years. The bank also scored on the cost and convenience criterion. The bank has the minimum average quarterly balance requirement for a savings account with cheque book facility, the lowest charge for non-maintenance of the average quarter-ly balance and the lowest annual charges for debit cards. Where it lost a little ground was in the financial performance. Not that it did not perform well in this parameter, only it fell below its performance in other parameters. r

bank IndIan bank

t.m. bhasin Chairman &

Managing Director

Winner’s edge n Services such as phone, mobile and Netbankingn Their no-frill accountsn Minimum average quar-terly balance requirement

axIs Bank

this bank has been on the winner’s podi-um for a second year in a row, only that it was the topper last year. In the reach

parameter its performance was on a par with Indian Bank’s, but it faltered in ‘cost and convenience’. The average quarterly balance needed to maintain a savings account is high compared to Indian Bank as are the charges for not maintaining the average quarterly balance. Even the annual debit card fee and the interest in rollover credit charged by Axis Bank is high com-pared to Indian Bank. But where it made up for lost ground was in the financial perfor-mance parameter. In fact, it topped the tables in the financial performance category by a big margin. One of the major reasons for this was healthy fee-based income, CASA and low NPA among others. r

RUNNER-UPbank

aXIS bankshikha sharma

Managing Director & CEO

bankBestWINNER

Bankt

Update Awards Start Manage Spend

Up next x OLM Awards: Best Education Loan Provider pg 36

WorldMags.netWorldMags.net

WorldMags.net

winner’s edge n High loan disbursementn Low default raten Low cost of interestn Quick loan disbursaln Higher repayment options

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

36 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

Bank of IndIa

Bank of India (BOI) has driven ahead of the competition and won the best educa-tion loan provider award by proving its

worth across parameters. So, what is it that BOI did and others could not? For starters, the bank’s extensive network worked in its favour. The number of loans disbursed by the bank further strengthened its cause. While BOI registered a positive growth rate with regard to the number of loans disbursed in FY12 over FY11, many of the competing institutions struggled to even maintain the levels of FY11. Not only that, it left the com-petition way behind in the value of the loans disbursed. It more than doubled the value of loans disbursed in FY12 compared to FY11. On the ‘cost and convenience’ parameter, the bank fared well, thanks to its low interest rate and fleet-footedness in disbursing loans. It also earned points on the disclosures and good governance parameters for its openness about providing quality information to edu-cation loan seekers, both on its website and in the product brochure. r

education loan

Bank of india

n. sesHadri Executive Director

winner’s edge n Extensive networkn High loan disbursementn Value of loans disbursed better than peersn Good governance

Central Bank of IndIa

central Bank of India’s performance was only second to that Bank of India. It disbursed higher number and value

of education loans in FY12 as against FY11 compared to its competitors. The bank has a low default rate compared to institutions competing in the same category. It scored the highest on the cost and convenience parameter. The low cost of interest and quick loan disbursal were the major reasons for Central Bank of India topping the tables in this category.

Further, higher number of repayment options of the education loan for custom-ers’ convinience also worked in the bank’s favour. It, however, faltered a bit in the dis-closures and good governance criterion. r

RUNNER-UPeducation loan CEnTRaL Bank of indiaM.V. tanKsale

Chairman & Managing Director

education loan ProViderBest ider

WINNER

Education Loant

Update Awards Start Manage Spend

WorldMags.netWorldMags.net

WorldMags.net

winner’s edge n Year-on-year increase in the number of loans disbursedn Table-topper in disclosures and good governancen Lowest cost

HDFC

HDFC made it to the top for the second consecutive year. This year, however, the competition was really tough with

the runner-up, Central Bank of India, breathing down the neck. Yet, at the finish-line, HDFC was the undisputed king with its sound performance and reach. The value of loans disbursed by the private sector player was far higher than its peers—even beating that of State Bank of India, which has the largest branch network in the country. The average number of loans disbursed per branch by HDFC was also the highest among competing institutions.

HDFC also topped the table in terms of cost and convenience, but the margin between the runner-up and the winner was very thin. What worked in HDFC’s favour in this cate-gory, though, was the fact that it provided greater convenience to loan applicants. In the disclosures and good governance front, HDFC did fairly well, but was not good enough to beat Central Bank of India, which kept its nose ahead. r

Home loan

provider HDFC

KeKi misTrY Vice-chairman & CEO

winner’s edge n Highest loan disbursed in value termsn Table-topper in cost and conveniencen Gives more convenience to loan applicants

RUNNER-UPHome loan provider

CENTRAL BANK OF INDIAm.v. TanKsale

Chairman & Managing Director

Home loan providerBestWINNER

Home Loan Providert

Update Awards Start Manage Spend

Central Bank oF InDIa

The bank has been a steady performer at the Outlook Money Awards in this space. Though the value of loans disbursed by

the Central Bank of India was on a par with its peers, the increase in the number of loans disbursed in FY12 over FY11 exceed-ed expectations. It did reasonably well in the performance and reach parameter and gave a run for the money to HDFC in the cost and convenience category. Central Bank not only charged the least, but was fleet-footed—something that is not associat-ed with PSU banks. The disclosures and good governance parameter—where it topped—helped it make up for lost ground elsewhere. The bank’s good show across parameters helped it get the second spot. r

Up next x Life Insurer pg 38

www.outlookmoney.com l 9 January 2013 l OUTLOOK MONEY 37x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

WorldMags.netWorldMags.net

WorldMags.net

LIFE INSURER HDFC lIFE InsuranCE CompanyAMITABH CHAUDHRYManaging Director & CEO

RUNNER-UP

HDFC LiFe insuranCe

It’s a joint venture between Housing Development Finance Corporation (HDFC) and Standard Life. Its reach, cus-

tomer education programmes, persistence and product innovation makes it our next best in the business. In terms of premiums collected (excluding renewals), the insurer has fared better than most peers. r

LIFE INSURER baJaJ allIanZ lIFE InsuranCE Company

V. PHILIP Managing Director & CEO

RUNNER-UP

Bajaj aLLianz LiFe

Bajaj Allianz is a joint venture between Bajaj Auto and Allianz AG, a German company. It has also offered good

returns to its policyholders with high bonus rates and good fund performance. On the basis of improved customer service, the decline in the number of awards against the insurer from the ombudsman also makes Bajaj Allianz Life the frontrunner. r

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

38 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

LiFe insuranCe Corporation oF inDia

Life Insurance Corporation of India contin-ues to be the market leader in the life insurance industry in India. In FY12 it

sold over 35.7 million individual policies with total premium collection at `2,02,889 crore. Add to that its extensive reach with 2,048 branches, 109 divisional offices, eight zonal offices, 992 satellite offices and the corporate office in Mumbai. It also has the strong agen-cy force of 1.28 million during 2011-12, of which 1.21 million are the active agents. To its credit, the company manages to deliver good returns to the majority of its policyhold-ers, for both unit-linked and traditional plans. Few surrenders and low percentage rise of complaints to Ombudsmen also gives it an edge. In terms of reach, disclosures and prod-uct innovation the company scores well. Despite a fall in its total agent count and even on the active agent front the company has managed to pull off a win. r

LIFE INSURER lIC

D.k. MEHRoTRAChairman

wINNER’S EDgE n Consistent performancen Gives good returns to policyholdersn Few surren-ders and low percentage rise in complaints to ombudsmen

LIFE INSURERBestWINNER

Life Insurert

Update Awards Start Manage Spend

WorldMags.netWorldMags.net

WorldMags.net

winner’s edge n Extensive networkn High customer responsivenessn Varied product portfolion Promoted cashless servicesn Underwriting practices

The New INdIa assuraNce

The New India Assurance, a leading global insurance group with 1,068 offices, bagged the first prize in the inaugural

edition of best health insurance award. With approximately 21,000 employees, it has the largest number of technically-qualified per-sonnel at all levels of management. It is also the only Indian insurance company to have an ‘A-’ (excellent) rating by A.M. Best, an international rating agency.

Health continues to drive the insurance company’s growth story, significantly sup-ported by the motor and the fire segments. The healthy top-line growth for two consecu-tive years has helped the company continue as the market leader with a global premium of `8,225.51 crore.

In terms of reach, it is way ahead of its peers, not only in terms of its network, but also in terms of number of lives covered. It also maintains high standards of customer service and regulatory compliance. r

healTh insurer the new IndIa

assurance company

g. sriniVasan Chairman cum Manag-

ing Director

winner’s edge n High number of technically qualified employeesn High number of lives coveredn High stan-dard of cus-tomer service

apollo muNIch

apollo Munich Health Insurance is the runner-up in this category. A joint ven-ture between the Apollo Hospitals

Group and Munich Health, a company of the Munich Re Group, Apollo Munich oper-ates as a standalone health insurer and offers innovative health, accident and travel insurance solutions.

The company scored well across all the four parameters—reach, product portfolio, customer service and complying with regu-latory norms. It, in fact, showed remarkable determination in extending its cashless ser-vices across the entire country. The compa-ny’s underwriting practices, bouquet of innovative products and features, and prompt customer responsiveness helped it tally up its score. r

RUNNER-UP

healTh insurer apollo munIch health Insurance

companyanTOnY JaCOB

Chief Executive Officer

healTh insurerBestWINNER

Health Insurert

Update Awards Start Manage Spend

www.outlookmoney.com l 9 January 2013 l OUTLOOK MONEY 39x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

Up next x e-brokerage pg 40

WorldMags.netWorldMags.net

WorldMags.net

winner’s edge n Extensive networkn Strong retail customer acquisi-tion strategyn Diversified product suiten Reduced costs and overheads

x http://twitter.com/OutlookMoney; http://www.facebook.com/olmindia

40 OUTLOOK MONEY l 9 january 2013 l www.outlookmoney.com

ICICI DIreCt

For the fifth consecutive time, ICICI Direct has bagged the best e-Brokerage Award. It is one of the fastest-growing e-broking

companies, serving 2.4 million retail custom-ers across the country. Of course, being backed by a strong parent, ICICI Bank, helps, with the bank offering services across invest-ment transactions.

But that’s not all. ICICI Direct, which was the first to introduce a mobile trading plat-form, has been taking giant strides in inves-tor outreach by tapping a growing list of cus-tomers. Besides offering equity and deriva-tives in the local market, it facilitates trading on major US exchanges, including the New York Stock Exchange. The bank rationalised its brokerage costs last year and rolled out a stream of products and incentives to facili-tate more trading for retail investors. It also offers special incentives such as no deposito-ry sell charges and interest on idle money in a trading account.

Little surprise then that ICICI Direct won our coveted award. r

e-brokerage ICICIdirect.com

anUP bagCHi Managing Director

& CEO

winner’s edge n Investor out-reachn Trading on US exchangesn No depository sell chargesn No interest on idle money

HDFC seCurItIes

The runner-up in the e-brokerage catego-ry, with a strong banking parent (HDFC Bank) is HDFC Securities. Incorporated

in April 2000, the firm expanded from being a single-product broking house to a full-service financial intermediary.

HDFC Securities has more than 180 branches and over 1.4 million customers. It is a fast-growing brokerage with a healthy retail customer acquisition strategy. Its diversified product suite aims at reducing costs and overheads for investors. The firm has been among the top eight distributors of IPOs and FPOs across India and pio-neered NCD applications online. This is one securities firm we would be watching in the ensuing years. r

RUNNER-UPe-brokerage

HDFC SeCurItIeSaseeM dHrU

Managing Director & CEO

e-brokerageBestWINNER

e-brokeraget

Update Awards Start Manage Spend

WorldMags.netWorldMags.net

WorldMags.net

winner’s edge n Strong performancen Extensive reachn Star-rated schemes