Outlook 2012

-

Upload

the-institute-for-healthcare-consumerism -

Category

Documents

-

view

214 -

download

0

description

Transcript of Outlook 2012

www.theihcc.com

ISSUE || Annual 2012

The Official Magazine of

The Institute for HealthCare Consumerism

Our 2012 Experts Share Insights

Ronald E. Bachman

Bonnie BrazzellGilbert W. Lowerre

Mike La Penna

Leah Binder

Grace-Marie Turner

Mark Merritt

Melissa Van Dyke

Doug Bulleit

Karen Ignagni

Larry Boress

Dr. Wendy Lynch

Frederick D. Hunt

Jon Comola

William R. Boyles

Kevin McKechnie

Wolf Kirsten

Laura Carabello

Affordablewith a partner who doesn’t just talk lower costs, but guarantees them. Healthstat offers healthcare solutions that drive better employee health while reducing healthcare costs. Our experience, advanced technology, scalability and predictive modeling system can create an environment of wellness that works. As the leading provider of on-site primary care, health risk intervention, chronic care management and occupational medicine, Healthstat is here to change healthcare for the better. Inspire a healthy change today, by visiting healthstatinc.com.

Generated a 2:1 ROI in year 1.

Implemented Healthstat for his company last year.

Used only 2 sick days. Increased her sales by 5%.

Healthcare is

wellness that works. As the leading provider of on-site primary care, healthrisk intervention, chronic care management and occupational medicine,Healthstat is here to change healthcare for the better. Inspire a healthychange today, by visiting healthstatinc.com.

010463.6_CDHCSolutions.indd 1 2/16/12 10:26 AM

I n s I d e

www.TheIHCC.com I CDHC Solutions™ I IHC Annual Outlook 2012 3

(From the publishers of CDHC Solutions, the official magazine of The Institute for HealthCare Consumerism)

The Institute for HealthCare Consumerism www.theihcc.com

8 Health Care ConsumerismThe Journey to Health Care Consumerism: The Fifth Generation Revealed

If you are a policyholder, a covered plan member, a patient, or a stakeholder in any part of the vast “health care industrial complex” you may have had the

opportunity to participate in the growing evolution of consumerism. But, have you been offered, engaged or are you benefiting from it?

By Ronald E. Bachman, Chairman, Editorial Advisory Board, The Institute for Health Care Consumerism

17 Health Care Outlook on Policy & Legislation2012: The Pivotal Year for Consumer-directed Health Care

Businesses are in a quandary. Major deadlines are approaching to comply with the federal health law. At the same time, many businesses are hoping they will be

rescued by the Supreme Court or by Congress to repeal or significantly amend the health care law.

By Grace-Marie Turner, President, Galen Institute

18 Health PlansImproving Health Care Quality and Bringing Costs Down: Encouraging Signs but Clouds on Horizon

Health care costs are crushing the economy, eating up state budgets, frustrating employers and causing consumers to make difficult kitchen table tradeoffs.

By Karen Ignagni, President, CEO, American Health Insurance Plans (AHIP)

22 Health Plans – Self-fundingBright Future for Self-funding Health Plans

After initial concern about the impact of the 2010 health reform law, it is easy to see that the opportunities and market for self-funded plans administered by TPAs is very bright.

By Frederick D. Hunt, Active Past President, Society of Professional Benefit Administrators (SPBA)

26 Account-based PlansMaelstrom: How Markets, Regulation and Litigation Affect the Outlook for HSAs

If you’ve been watching the health care debate closely, you can be forgiven for thinking that the Cold War, and all of its attendant sacrifices, was for nothing..

By Kevin McKechnie, Executive Director, American Bankers Association’s HSA Council

34 Supplemental Health BenefitsAs Employers’ Attitudes Change, Voluntary Benefits Become a Necessity in a Health Plan

The role of voluntary in employers’ benefits programs is changing, and employers’

attitudes toward voluntary have been changing along with it. Voluntary has continued to grow in sales and in account penetration, even during the recent recession.

By Gilbert W. Lowerre, CEBS, CLU, ChFC, President and Bonnie Brazzell, Vice President, Eastbridge Consulting Group

40 Pharmacy Benefit ManagementPBMs in 2012 and Beyond: Fighting for Consumers and Payers

Pharmacy benefit management (PBMs) is the one industry in America to have met the three-fold challenge posed by a generation of policymakers and consumer

advocates: to simultaneously reduce costs, expand access, and improve the quality of health benefits for the 215 million Americans with prescription drug coverage.

By Mark Merritt, President, CEO, Pharmaceutical Care Management Association (PCMA)

42 Population Health ManagementDriving Employee Engagement in Today’s Global Economy

To remain competitive in today’s global marketplace, employers are finding it necessary to invest substantial resources to improve the health—and ultimately

productivity—of their employees by offering a combination of health benefits, workplace health programs and external health management resources.

By Larry Boress, President, CEO, Midwest Business Group on Health (MBGH)

48 Health Care Consumerism Collaborative StrategiesLinking Enterprises With the Community to Enable Health and Well-being

Health is shaped by more than individual choices and medical care. There are two types of risk factors influencing individual health; those under the direct control of the individual and factors beyond the individual’s control.

By Jon Comola, Founder, WRGH.org, GKEN.org and Wolf Kirsten, President, Founder,

International Health Consulting

51 Health Care AccessCDHPs put the Consumer in the Driver’s Seat, but Employers ‘Take the Wheel’ With Workplace On-site Clinics

Employers have always been participants in the health care system as indirect purchasers of health care

benefits for their workforce and as direct beneficiaries of a healthy and productive workforce.

By Mike La Penna, National Worksite Health Center Association

57 Health Rewards & IncentivesEnergizing Workplace Wellness Programs; The Role of Incentives, Rewards and Recognition

The use of worksite wellness programs among large companies have surged in recent years, despite the economic downturn.

By Melissa Van Dyke, President, Incentive Research Foundation

I n s I d e & O n l I n e learn.COnneCt.share.

61 Health Care Consumerism Decision Support Tools

Ready, Willing, but not Quite Able: The Status of Consumer Involvement in Health Care

No longer in its infancy, health care consumerism is emerging into a stand-alone industry. We can see its expanding influence. It has its own advocacy groups

and publications, such as this one; it takes a prominent position at human resources conferences. In a sure sign of its growing presence, the medical establishment also has noticed, prompting a mix of welcoming and concerned responses.

By Dr. Wendy Lynch, Health as Human Capital Foundation

64 Consumer-designed Health TechCDH Tech Vision: Big Waves Will Drive

Health Consumers

As early as 1998 the “consumer-driven” health care movement was about new technology. Early adopters like HealthMarket, Definity and Lumenos knew having

a spending account was only one feature of the new payment and benefits model. Employees with a combined health savings account (HSA) or health reimbursement arrangement (HRA) plus advanced market information and support tools were transformed into the ultimate consumer.

By William R. Boyles, Publisher, Interpro Publications Inc.

67 Medical Tourism2012: The Rise of a Global Health Care System

In the past few years, medical travel has drawn interest from the self-funded employer community and the nation’s health plans, sparking growth and, in the wake of health care reforms, promising to transform

medical travel into a global and integrated health care system. By Laura Carabello, Chief Creative Officer, CPR Strategic

Marketing Communications

70 Health Data AnalyticsThe Importance of Reducing Early Elective Newborn Deliveries

Of the many attention-grabbing topics in health care today, maternity care remains among the most critical issues for employers and employees alike.

By Leah Binder, CEO, The Leapfrog Group

72 Consumerism Care NetworksOn Careful Networks and Support of Long-term Care

Case in point: Care. Some folks take care to provide for their future care, while others couldn’t care less—about how much, or how little, care they’ll eventually need, or who will provide it—until they need it.

By Doug Bulleit, Founder, DCS Health

PROVIDER FORECASTS

12 ConnectYourCarePutting the Consumer Truly in the Driver’s Seat

By Jamie Spriggs

14 FIS Healthcare SolutionsDriving Increased CDHC Adoption in 2012 and Beyond

By Dr. John Reynolds

20 AetnaAetna HealthFund Plans Reduce Costs and Employees Get the Care They Need

By Chris Riedl

24 UMR Healthcare ServicesDeclining Health of Workforce Top Concern for Employers

By Bart Halling

28 U.S. BankWhy the New Health Exchanges Matter: Realizing Greater Value from HDHPs and HSAs.

By Ralph L. Bernstein

30 TSYSPowering the Model: A Deep Dive into TSYS Healthcare’s Interchange Sharing Model

By Trey Jinks

32 DataPathThe Pros and Cons of Consolidation

38 TransitionsSetting Your Sights on the Aging Workforce

By Pat Huot

46 MasterCardIncentive Programs: Key to Promoting Employee Health and Lowering Health Care Costs

By Beth Griffin

54 HealthstatEmployers Hold the Key to Solving the Health Care Crisis

By John Kaegi

69 Medserv GlobalMedical Travel Options Important Addition to Cost-effective Benefit Design

By John Linss

Departments

6 From the Editor & Publisher as Consumerism transforms health Care, so does our annual Outlook Issue

75 Who’s Who Profiles

78 Resource Guide/Ad Index

4 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

It is hard to believe this is the sixth year we have produced our annual Outlook issue. Six years ago we debuted our “Outlook 2007: A Look at the Year Ahead in Benefits &

Compensation.” The publication was much smaller and only a handful of the articles focused on health care or health care consumerism.

Fast forward to 2012, and the landscape of health and benefit management has changed, and our organization and the publication also has changed with the times.

Formerly known as CDHC Solutions, we, along with many thought leaders in the industry, have discovered health care consumerism, which has gone from a buzzword to a national megatrend, is much more than just about account-based plans.

While flexible spending accounts (FSA)s, health reimbursement arrangements (HRA)s and health savings accounts (HSA)s, paired with a high-deductible health plan (HDHP), is the engine to the health care consumerism locomotive, consumerism is so much more. Like the Nile River, health care consumerism runs wide and deep.

The same can be said for this publication, which is our largest edition to date. This year’s “HealthCare Consumerism Outlook 2012” features new categories and an all-star cast of contributors, who are considered the top thought leaders from eclectic backgrounds. However, they all have one common belief and that is the power of consumerism and empowering individuals to take charge of their health and well-being.

This year we feature 16 articles on topics such as health care consumerism, policy & legislation, health plans, self-funding, account-based plans, supplemental benefits, pharmacy benefit management, population health management, collaborative strategies in consumerism, health care access alternatives, health rewards & incentives; health decision support tools, consumer-design health technology, medical tourism, health data analytics and the emergence of care networks.

In our first year we showcased our contributors on the cover of the magazine. This year we are doing the same.

We hope you enjoy this issue and find it useful as a guide for the upcoming year, as the landscape of health care continues to shift. We also welcome you to become a member of The Institute for HealthCare Consumerism by going to www.theihcc.com. Much like the ever-changing face of health care, The Institute website also changes and is a one-stop shop for education and collaboration between your peers.

We also would like to thank our contributors for this publication. We are honored by your participation not only in this magazine but also for supporting the health care consumerism movement.

Thanks again to: Ron Bachman, Grace-Marie Turner, Karen Ignagni, Fred Hunt, Kevin McKechnie, Bonnie Brazzell, Gil Lowerre, Mark Merritt, Larry Boress, Jon Comola, Wolf Kirsten, Mike La Penna, Melissa Van Dyke, Dr. Wendy Lynch, William R. Boyles, Laura Carabello, Leah Binder and Doug Bulleit.

Sincerely,

As Consumerism Transforms Health Care, so Does our Annual Outlook Issue

todd CallahanEditorial [email protected] Field

l e t t e r eDitor & publisher

6 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

www.theihcc.comVOLUME 9 NO. 3 ANNUAL OUtLOOk 2012

Published by FieldMedia LLC292 South Main Street, Suite 400

Alpharetta, GA 30009 Tel: 404.671.9551 • Fax: 770.663.4409

CEO/ PUbLIShEr/EdItOr-IN-ChIEFDoug Field

404.671.9551 ext. 101 · [email protected]

ASSOCIAtE PUbLIShEr Brent Macy

404.671.9551 ext. 103 · [email protected]

EdItOrIAL dIrECtOrTodd Callahan

404.671.9551 ext. 105 · [email protected]

SENIOr EdItOrMavian Arocha-Rowe

404.671.9551 ext. 104 · [email protected]

ASSOCIAtE EdItOr/SOCIAL MEdIA MANAGErJonathan Field

ASSOCIAtE EdItOrMatt Macy

404.671.9551 • [email protected]

SALES ASSOCIAtESNAtIONAL ACCOUNt MANAGEr

Brent Macy 404.671.9551 ext. 103 · [email protected]

VICE PrESIdENt OF bUSINESS dEVELOPMENt Susan Yakots

404.671.9551 ext. 102 · [email protected]

bUSINESS dEVELOPMENt ASSOCIAtESDavid Cerri

404.671.9551 ext. 106 · [email protected]

ACCOUNt MANAGErJoni Lipson

800.546.3750 · [email protected]

Rogers Beasley 404.671.9551 · [email protected]

Art dIrECtOrKellie Frissell

404.671.9551 ext. 107 · [email protected]

ChAIrMAN OF CdhC SOLUtIONS EdItOrIAL AdVISOry bOArd

Ronald E. Bachman, CEO, Healthcare Visions

EdItOrIAL AdVISOry bOArd

Kim Adler, Allstate; Diana Andersen, Zions Bancorporation;

Bill Bennett; Doug Bulleit, DCS Health; Jon Comola, Wye River

Group; John Hickman, Alston+Bird LLP; Tony Holmes, Mercer

Health & Benefits; Marc Kutter, PilotHSA; Sanders McConnell,

My HSA Rewards; Roy Ramthun, HSA Consulting Services LLC;

John Young, CIGNA

WEBMASTER Kevin Carnegie

COPY WRITER + PRLana Perry

770.298.1959 · [email protected]

rEPrINtSSusan Yakots

404.671.9551 ext. 102 · [email protected]

bUSINESS MANAGErKaren Raudabaugh

404.671.9551 ext. 108 · [email protected]

CDHC Solutions™ Volume 8 Issue 2Copyright ©2012 by FieldMedia LLC. All rights reserved.

CDHC Solutions™ is a trademark of FieldMedia LLC. CDHC Solutions™ is published eight times yearly by FieldMedia LLC., 292 South Main Street, Suite 400, Alpharetta, GA 30009. Periodical postage paid at Alpharetta, GA and additional mailing offices.

TO SUBSCRIBE: Make checks and money orders payable to CDHC Solutions™ magazine 292 S. Main Street, Suite 400, Alpharetta, GA 30009 or visit www.cdhcsolutionsmag.com. Non-qualified persons may subscribe at the following rates: single copy $7.50; $75.00/yr in the U.S., $105/yr in Canada and $170/yr international. Please contact FieldMedia at 404.671.9551 or [email protected] for name/address changes.

PrINtEd IN thE U.S.A.

CDHC Solutions™ is designed to provide both accurate and authoritative information with regard to the understanding that the publisher is not engaged in rendering legal, financial or other professional service. If legal advice is required, the services of a professional adviser should be sought.

The magazine is not responsible for unsolicited manuscripts or photographs. Send letters to the editor and editorial inquiries to the above address or to [email protected]. Permission to reuse content should be sent to, [email protected].

Defined Contributions & Consumer-Driven Health Plans

Attract and Retain Better TalentEmployees are more apt to stay with a company that off ers an extensive selection of benefi ts. Don’t let rising health costs and shrinking budgets keep you from acquiring a quality work force.

Defi ned Contributions Deliver Choice and SavingsYou can determine the amount to contribute to employees’ benefi t accounts. Off er a limited number of benefi t plans for employees to choose from, or release them into the local insurance marketplace. Employees can use their “benefi t allowance” to choose the plans that best meet their needs. The balance is calculated in real time, making it easy for employees to see how their selections aff ect their paycheck.

We’re Committed to Participant EducationOur downloadable guides and online videos help participants understand their options and make the best elections for their situation.

Convenient Online & Mobile ManagementWhether you’re an employer enrolling a new hire or a participant fi ling a claim, our online portal and smartphone apps make it easy.

Call 1-800-946-6342 to get a quote today!

800-946-6342WorkableSolutions.com7120 Lake Ellenor Drive, Orlando, FL 32809

Medical FSADependent Care FSAHealth Reimbursement Arrangement (HRA)Health Savings Account (HSA)Commuter Benefi ts

Health Exchange TechnologyDefi ned ContributionBenefi t Administration OutsourcingWellness ProgramCOBRA Administration

your employee benefi ts package has never looked healthier

With Workable Solutions’

Flexible Solutions to your HR Challenges

YOUR SATISFACTION IS GUARANTEED OR WE’LL GIVE YOU A 100% REFUND.

WorkablePERFORMANCEGUARANTEE

2012 HR GOALS:

Reduce expenses

Provide quality employee benefits

Attract & retain better talent

Spend less time administering benefits

8 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

HealtH Care Consumerism

By Ronald E. Bachman FSa, maaa » Chairman Editorial advisory Board » ThE InSTITuTE oF hEalThcaRE conSumERISmprEsidEnt & CEo » hEalThcaRE vISIonS, Inc.

The fifth generation? Many of you are probably thinking, “Wow, I missed the first four generations.” If you are a policyholder, a covered plan

member, a patient, or a stakeholder in any part of the vast “health care industrial complex” you may have had the opportunity to participate in the growing evolution of consumerism. But, have you been offered, engaged or are you benefiting from it?

The most recognized forms of early generation health care consumerism are account-based plans. These are plans such as health savings accounts (HSA)s and health reimbursement arrangements (HRA)s.

A Kaiser study showed 23 percent of employers offer a plan with an HRA or an HSA. Enrollment of covered workers in account-based plans increased from 13 percent in 2010 to 17 percent in 2011, or about 1 in every 6 plan members.

But health care consumerism is more than account-based plans. Health care consumerism is about engaging employees with information and incentives

to change behaviors and improve health and health care purchasing decisions, regardless of plan design. As plans evolve, the emphasis is less on the plan design and more on how to promote, encourage, incent, and reinforce healthy behaviors and increase healthy lifestyle choices.

Health care consumerism is a market megatrend, evolving with or without government mandated health reforms. Health care consumerism is an extension of individuals taking control of their lives with personal needs and preferences.

It is a part of the same cultural movement of individuals who buy and sell goods on eBay, purchase cars on Craigslist, manage their music on iTunes, manage their stock portfolios on the Internet, pump their own gas, and bank with an ATM.

Overview of the First Four Generations of Health Care Consumerism

1. Plan Design. A high-deductible plan or an account-based plan is an example of first generation health care consumerism that focus mainly on lowering discretionary expenses (e.g. emergency room, prescription drugs).

A recent Rand study found that when people shifted into health insurance plans with deductibles of at least $1,000 per person, their health spending dropped an average of 14 percent. Health care spending also was lower among families enrolled in high-deductible plans that had health savings accounts.

The Journey to Health Care Consumerismthe Fifth Generation revealed

Health care consumerism is about

engaging employees with information and incentives to change

behaviors and improve health and health care purchasing decisions,

regardless of plan design.

BEHAVIORAL CHANGE AND COST MANAGMENT POTENTIALLow Impact High Impact

1st Generation 2nd Generation 3rd Generation 4th Generation Consumerism Consumerism Consumerism Consumerism

Focus on Focus on Integrated Personalized Discretionary Behavior Health & Health &Spending Changes Performance Health Care

Traditional Traditional Plans Plans with Consumer Information

The Evolution of Health CareFuture Generations of Health Care Consumerism

www.TheIHCC.com I CDHC Solutions™ I IHC Annual Outlook 2012 9

Account-based plans are a good start. However, if the goal is to change member behaviors and to engage them to make better-informed health and health care decisions, more than a new plan design is needed.

2. Behavioral Change. Many plans have evolved into second generation designs with financial incentives focusing on wellness, disease management, and health literacy. Most employers implementing second generation programs are seeking to produce measurable results of employee engagement and healthy outcomes.

A Quest Diagnostic report showed 60 percent of employees who participate in wellness programs report that the incentive is a deciding factor in their choice to participate. Incentives have been so successful in increasing participation that approximately two-thirds of the employers who invest in employee wellness use an incentive to drive employee participation. Bio-metrics (e.g. blood pressure, cholesterol, body mass index, waist size, and A1(c)) are popular as measuring standards for improved outcomes.

3. Health & Performance. Industry leaders have been promoting third generation plans that recognize healthy employees impact the corporate bottom line. Companies moving to third generation concepts recognize that health plans are the “maintenance contracts” for their human capital—their most valuable asset. These efforts add a focus on workplace health, safety and stress management. Studies show that stress impacts a company in many ways:

1. Health care – 21.5 percent of total health care costs

2. Turnover – 40 percent of the primary reasons that employees leave a company

3. Presenteeism – 50 percent of presenteeism is a function of stress

4. Disability – 33 percent of all disability and workers’ compensation costs

5. Unscheduled Sickness – 50 percent of the primary reasons that employees take unscheduled absence days

4. Personalized Health – Fourth gen-

eration health care consumerism moves from broad-based population manage-ment to very personalized health care based on genomics, predictive model-ing, wireless wellness monitoring, cul-turally sensitive disease management, outcomes, and health status. Fourth generation also expands health literacy to include personalized information therapy that is consistent and compat-ible with provider clinical therapies.

In summary, more and more benefit managers are implementing effective second generation plans. But, many also are including new products and services from third and fourth generation health care consumerism.

Creative vendors are already working with early adopters developing, testing, and imple-menting various aspects of future generation programs. Forward-thinking human resource vice presidents are becoming a more critical part of senior management by taking advantage of these new developments for increasing per-sonalized health programs, improving corpo-rate productivity, growing revenues and profits, supporting strategic workforce initiatives and lowering health care costs.

The “promises” of health care consumerism

are expanding with the continued evolution of new generation products and services. Each new generation builds on the previous ones and produces a new dimension and meaning of health care consumerism. Each evolution can be analyzed by understanding the change produced in the five building blocks. I have previously written about these first four generations. The market has continued to change. We can now begin to see the start of the newest evolution of health care consumerism.

Fifth Generation Health Care Consumerism

The fifth generation of health care consumerism is beginning to reveal itself.

Thought leaders are identifying the concepts, and creative solution providers are developing the newest generation of products and services.

An important insight to the future and fifth generation health care consumerism comes from a book called ”Blue Zones” by Dan Buettner. In “Blue Zones,” he studied cultures around the world where people are living longer (high percentage older than 100) and more productive lives (by 10 or more years). By relating the book’s findings to the evolution of health care consumerism, we can see a fifth

Major Building blocks of Consumerism

Personal Care Accounts

Wellness/Prevention Early Intervention

Disease and Case Management

Information Decision Support

Incentives & Rewards

The Promise of Demand Control & Savings

The Promise of Wellness

The Promise of Health

The Promise of Transparency

The Promise of Shared Savings

The Promises of Consumerism

It is the creative development,

efficient delivery of these elements that

will prove the success or failure of

consumerism.

10 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

HealtH Care Consumerism

Ronald E. Bachman FSa, maaa » ContinuEd from pagE 9

generation that differs from the first four by moving consumerism from:

1. Personalized (self) to Community (others)

2. Health to Productive Longevity 3. Self-help to Helping Others4. Being Served to Sharing5. Taking to Giving6. Secular to Spiritual7. Monetary to Emotional8. Head (logic) to Heart (feelings)

Community Health Care. Fifth gen-eration health care consumerism can be called Community Health Care. It is about socially engaging community, family and friends in a meaningful connected healthy lifestyle.

Social networking is growing as a driving force in many parts of our lives. A PricewaterhouseCoopers study found that near-ly a third (32 percent) of consumers have used some form of social media for health care pur-poses. The self-absorbed “Me” generation is giv-ing way to sharing communities on Facebook, LinkedIn, Plaxo and YouTube.

Personal Care Accounts: A fifth generation world moves us from financial incentives to intrinsic emotional and charitable rewards. Unlike HSAs or HRAs, fifth generation personal care accounts will not be about accumulating money. They will include accumulating credits for charitable giving, “paying it forward” accounts, and volunteer support.

Wellness: The goal of wellness or health management programs will no longer be stated as getting healthy, but to having a long and productive life. For employers, it may mean increasing support for walking compacts, group activities, and worksite yoga and meditation.

Corporate health events will include family and friends, not just employees. To promote teaming, and group support corporate health clubs will be open to dependents, friends, and neighbors. For solution providers, stress measurements will become as critical as biometric testing. Health treatments will

recognize the interaction between mind and body. New brain science discoveries will support psycho-physical initiatives in wellness and disease management programs.

Disease Management: For disease or condition management programs, the emphasis will shift from recovery to functionality. It will no longer be acceptable to simply eliminate symptoms or use traditional medical treatments to deal with chronic conditions. The ultimate measurement will be functionality.

Effective treatments will include genomic testing and interventions, predictive modeling, and proteomics. The goal will be for individuals to return to doing their jobs effectively, adequately perform the activities of daily living, continue social contacts, and participate in desired lifestyle activities.

Plans will encourage the development of disease specific teams and support groups working towards common health goals. Key personal relationships will develop as “friendship pods.”

Information: Information and decision support programs will expand to include concepts such as “sharing circles”, “mentoring groups”, and “wise-men councils.”

“Cyber-health aides” will use push tech-nology to expand and link information thera-

Personal Care Accounts

Wellness/Prevention Early Prevention

Disease and Case Management

Information Decision Support

Incentives & Rewards

The Consumerism

Grid

Initial Account Only

100% Basic Preventive Care

Information, Health Coach

Passive InfoDiscretionary

Expenses

Cash, Tickets, Trinkets

Activity & Compliance Rewards

Web-based behavior change support

programs

Compliance Awards, disease specific

allowances

Personal health mgmt, info with incentives to

access

Zero balance account activity, outcome-based

incentives

Indiv & Group Corporate Metric Rewards

Worksite wellness, clinics, safety, stress/error

reduction

Population Mgmt, Integrated Health Mgmt, Integrated Back-to-Work

Health & performance info, integrated health

work data

Non-health corporate metric driven incentives

Specialized Accts, Matching HRAs, Expanded QME

Genomics, predictive modeling push

technology

Wireless cyber support, cultural DM, Holistic

care

Arrive in time info, information therapy,

social networks

Personal development plan incentives, health

status related

1st Generation 2nd Generation 3rd Generation 4th Generation 5th Generation Consumerism Consumerism Consumerism Consumerism Consumerism

Focus on Focus on Integrated Personalized Community Discretionary Behavior Health & Health & Health &Spending Changes Performance Health Care Health Care

“Volunteer” Vessels, Pay Forward, Charitable

Giving

Natural Resource Flows, Longevity more than

Health

Functionality, Community, Faith &

Spirituality

Friendship Pools, Wisemen Sharing Circles

Psychological rewards, Recognition, Honor,

Respect, Love

In general, the theme of the fifth generation health care consumerism will be “LEARN, CONNECT

and SHARE.”

www.TheIHCC.com I CDHC Solutions™ I IHC Annual Outlook 2012 11

pies with clinical therapies. We will learn both from those who have experience and those cre-ative individuals who are experimenting with new ideas.

Clinical and lifestyle information will be shared across generations. Physicians and other care providers will be supplemented with not just paraprofessionals, but with practical lifestyle insights from an informed experienced trusted circle of personal advisors and mentors.

Incentives: Incentives will shift from financial to psychic rewards of recognition, honor, respect and love for others. Faith, hope and spirituality will become an important feature of these recovery, functional improvement programs, incentives and support.

Believing in something bigger than one’s self can have a strong healing and behavioral impact. Regardless of one’s personal health, assisting, helping, or teaching someone less fortunate is a powerful health producing psychic positive.

In general, the theme of the fifth genera-tion health care consumerism will be “LEARN, CONNECT and SHARE.”

It will provide collaboration between others who have ideas and knowledge of ideas,

experiences of what works, what doesn’t work, lifestyle support, along with the industry’s helpful solution providers. It is about serving others, not just helping one’s self.

A fifth generation mindset is less individually competitive and materialistic. Fifth generation participants want to be engaged in meaningful work but enjoy life, family, and contribute to the community. For older individuals it is about moving from career success to community significance. There will be more volunteering, giving, sharing of wisdom and support to others.

The above consumerism grid is the “crystal ball”—a visual framework—for understanding the future generations of health care consumerism and the five major building blocks. The overall goal of health care consumerism is to assist individuals in making more informed health and health care decisions, which will favorably impact clinical outcomes and lower the cost of health care.

Expected SavingsExpected savings will vary based upon the

effectiveness of programs supporting the health care consumerism concepts. Consumerism with

proper plan design, supported by information and incentives, has proven itself over recent years to lower costs and improve the quality of care. The American Academy of Actuaries reports that health care consumerism lowers costs in the first year by 12 to 20 percent and reduces future trend increases by 3 to 5 percent.

Other experience studies and actuarial modeling indicate that a plan can expect to save at least 5 to 8 percent annually over the next five years and enjoy a 2 percent reduction in trend each year. Actual annual savings have topped 10 percent in many cases. Savings of up to 30 percent or more are possible.

At its best, health care consumerism empowers individuals with tools that allow them to know more about their health and health care decisions. Health care consumerism puts the power of access and the selection of quality providers into the hands of individuals.

Health care consumerism may not be the silver bullet for all health care and health care problems facing the country, but it is a darn good start with great promise and with the new evolutions advancing effective solutions.

If you haven’t found your path forward, it’s time to find your place on the road of this dynamic “Journey to Health Care Consumerism.”

The American Academy of Actuaries reports that health care consumerism lowers costs in the first year by 12 to 20 percent and reduces future trend increases by 3 to 5 percent.

EffectivePrograms

Implemented

Basic

Expanded

Complete

Comprehensive(Future)

Passive

2%

3.4%

4%

5%

1st Generation

3%

5.8%

7%

10%

2nd Generation

7%

12-15.0%

17%

20%

3rd Gen & Future

10%

20.0+%

25%

30%

Potential Savings fromFull Implementation of Consumerism

Achievement of savings and improved outcomes is dependent upon both the Type and Effectiveness of

the programs implemented.

Gross* Savings as % of Total Plan Costs(Programs Applicable to All Members)

Traditional PlansConsumerism Plans

*Excludes Carry-over HRAs/HSAs and any added Administrative Costs of Specialized Programs

hEalTh caRE conSumERISm

12 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

By JamIE SpRIggS

Founder and PresidentconnEcTyouRcaRE

The app for healthcare.actually there are several apps for healthcare. there

are apps to help you live a healthy life including apps to help you eat better, exercise more and quit smoking. Companies associated with healthy products like nike and Weight Watchers are increasingly providing free apps to enhance the consumer experience with their products and services. there are also apps that help you manage your financial interactions with the healthcare system. increasingly, consumers can look to mobile apps to help them manage their health and their healthcare.

Healthcare consumerism is a quietly growing movement within the us healthcare system. employers recognize that a significant amount of money spent on healthcare in the us is due to preventable behavioral decisions. Healthcare consumerism, or consumer directed healthcare, is based on the premise that if americans have more financial stake in the healthcare system then they will make better healthcare decisions. as a result, more employers and employees are selecting higher deductible health plans paired with a health account—often a Health savings account (Hsa) or a Healthcare reimbursement arrangement (Hra). While the inner workings of the accounts are different the fundamental idea of encouraging healthcare saving and consumerism via a health account is the same.

Consumerism today means mobile and apps. today’s healthcare user is more sophisticated, more

technologically savvy and a better consumer. in order to compete successfully, healthcare organizations need to provide the same level of access and convenience as retailers.

CYC mobile from ConnectYourCare is a five-star rated smartphone app that helps consumers manage their healthcare budgets and helps simplify the healthcare experience. the app enables users to view balances, claim details and upload receipts using the phone’s camera.

receiving five star reviews for this type of app is particularly significant because while most americans are happy with their primary care physician and their medical care in general, they are typically not happy with their interactions with the financial

aspect of healthcare. Filing claims is often cumbersome and frustrating. it is eye opening to see finicky customers download a healthcare app, use it on a regular basis, and report a 5-star experience.

Is this the future of healthcare? many employers and benefits providers think so. advanced

benefits providers have applications that allow customers to refill prescriptions and find pharmacies via their mobile devices. Companies that are able to effectively offer valuable, user

friendly health apps become more desirable as a healthcare partner by creating benefit solutions that fit into a busy lifestyle. the 2012 consumer demands on-the-go access to their benefits from anywhere.

the consumer market has effectively delivered apps that promote healthy living. the nike + GPs app allows users to track their runs, play ‘Power songs’ during critical moments in their workouts and even passes along words of encouragement from their Facebook friends. this popular 4+ star app is one of many apps encouraging healthy lifestyle choices.

many current and future healthcare apps promise conveniences already available in the consumer market. Consumers can already review restaurants and make reservations with apps from urban spoon, Yelp and open table. Healthcare apps promise the ability to compare healthcare providers and make an appointment with the selected provider. similarly, just as current apps help consumers track financial health, there are more and more apps promised to help track physical health.

Government regulation and market forces are driving americans to be better consumers of healthcare. the healthcare market is responding with more consumer tools including increased use of apps. Consumers can take comfort in the early apps and look forward to many innovations to come.

Jamie Spriggs is founder and president of ConnectYourCare. In 2002, Jamie set out to radically change the face of consumer-directed healthcare by providing a CDH platform that empowers businesses and employees to benefit from tax-advantaged health accounts and consumer choice. For more information about ConnectYourCare, see www.connectyourcare.com

Putting the Consumer Truly in the Driver’s Seat

Today’s healthcare user is more sophisticated, more

technologically savvy and a better consumer. In order to compete successfully, healthcare organizations

need to provide the same level of access and convenience as retailers.

ConnectYourCare has the expertise to simplify account administration, drive account enrollment and deliver greater employee satisfaction.

Don’t just wish for better service. Partner with a company that delivers it.

Account Administration Excellence

• HSA, HRA, FSA, VEBA, Retirement and Commuter benefit accounts

• Multi-account healthcare payment card

• Online participant portal and employer dashboard

• Participant communications designed to drive enrollment using proven Consumerology® principles

Service Excellence

• Industry leading customer service performance metrics

• 24x7 customer service center

• Tiered account management structure for optimal account service

• Fast and accurate claims processing

• Award-winning technology

www.connectyourcare.com

hEalTh caRE conSumERISm

patients are not accustomed to feeling empowered—but they should get used to it. the trend toward consumer-driven health care (CDHC) is placing

more information, more choices and more power in the hands of consumers than ever before. Because the benefits of CDHC require greater consumer responsibility and accountability, access to hands-on information is key. Consumers want easy-to-find answers to questions like:

• WhatplanshouldIenrollin?• What’sthedifferencebetweenahealthsavings

account (Hsa) and a health reimbursement account(HRA)?

• Havemyclaimsbeenpaid?• What’smybalance?• Whatservicesdoesmyaccountcover?• WhatincentivesdoIhavethatIshouldbeaware

of?• HowcanIsavemoneyonhealthcare?• Howmuchismyhealthcaregoingtocostme?

tools must be developed to provide answers to these and other customer queries. in response, Fis™ offers a fully integrated WealthCare Portal that gives consumers control over their wealth and health care information using a computer or mobile device.

Consumers can use the portal’s built-in decision engine, complete with worksheets, to determine which type of CDHC account is best for their circumstances. among the variables factored into the decision: the person’s anticipated health care costs, expected annual contributions from the employer and consumer, health status of all covered family members, current income and tax status and other forecasting tools.

the WealthCare Portal also contains the information needed to manage health such as lifestyle tips for managing or avoiding high blood pressure, cholesterol and other chronic conditions, interactive health risk assessments, medical appointment reminders that automatically sync to existing online calendars, prescription refill reminders and more. in addition, there is a section of the WealthCare Portal that displays investment performance for the unused funds currently held in the account.

using the same technology currently in use with financial management programs like Quicken®, the consumer can migrate this data painlessly and automatically, manage investments and pay health care bills using online bill payment.

When government-mandated administrative simplification and unified coding are in place, entering personal health records (PHrs) using the WealthCare Portal could be accomplished as easily as exporting a contact list today. mobile device-based barcode scanners will let consumers pay for and record health care purchases at retailers using CDHC account funds. account details could be displayed prominently on the WealthCare Portal Web site, so each visit to the site alerts the consumer to balance information, recent payments and other financial information.

integrating all this functionality seamlessly and making it easy to use is critically important. that’s why Fis has ensured that the WealthCare Portal is technologically sound and consumer focused. the following components are critical to the solution:

• Technologythatisreal-time,dependableandintegrated

• Respectforthedifferentcommunicationchannelsdemanded by consumers

• Capabilitythatallowsuserstomanagetheircommunication preferences

• Anadministrative and social media engine for driving the CDHC messages

nearly all the elements for a mature CDHC market are in place – including such factors as the necessary technology, regulatory incentives, consumer demand, potential cost savings and efficiencies. all that’s been missing is the ability to pull it all together—until now. With Fis’ WealthCare Portal, a solution finally exists to drive increased CDHC plan adoption and usage.

Driving Increased CDHC Adoption in 2012 and Beyond

By John REynoldS

PresidentFIS hEalThcaRE

14 Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

The increasingly consumer-directed U.S. healthcare system is marked by rising costs, regulatory changes and chronic ineffi ciencies that plague all parties involved. FIS™ Healthcare Solutions is helping to transform the healthcare industry by facilitating the fl ow of information and funds among patients, payers, providers and fi nancial institutions.

Thanks to deep industry expertise, proven technology and extensive relationships across the fi nancial and healthcare payments spectrum, FIS can deliver a complete healthcare solution suite that seamlessly connects thousands of individuals and organizations.

As a result, healthcare providers get a single interface for streamlining HIPAA and fi nancial transactions. Payers gain a consumer-directed healthcare (CDH) administration platform to improve relationships with members and employee groups. Patients have a more seamless healthcare experience – from saving and paying for care, to making treatment decisions. And fi nancial institutions are well positioned to strengthen and grow their healthcare customer relationships.

To learn more about our complete healthcare solution suite, visit www.fi sglobal.com/healthcare.

We’re forging new connectionsamong patients, payers, providersand fi nancial institutions.

© 2012 FIS and/or its subsidiaries. All rights reserved.

fi sglobal.com

HEALTHCARE

FINANCIAL SOLUTIONS • PAYMENT SOLUTIONS • BUSINESS CONSULTING • TECHNOLOGY SERVICES

Learn more about ourhealthcare payment solutions atwww.fi sglobal.com/healthcare

FIS_Healthcare ad_OP1.indd 1 3/16/12 10:49 AM

Content and Design AHIP—All Rights Reserved: © AHIP 2012

It’s been proven over and over again that healthy employees tend to be happier and more productive. That’s why wellness programs have become so prevalent. And, that’s why we developed two convenient online courses providing you with everything you need to know to create and maintain a culture of wealth in your organization.

Wellness, Part One: Wellness, Prevention, and Value-Based CareThis course takes a practical approach to worksite wellness, guiding you through the stages of program development.

Wellness, Part Two: Combating Chronic Diseases through Workplace Wellness ProgramsThis course offers an in-depth look at chronic diseases along with the unhealthy behaviors that often precipitate illness, positioning the workplace as a venue for combating disease.

Learn. Achieve. Succeed.www.ahip.org/[email protected]

How Much Do You Know About Wellness Programs?

For details, visit www.ahip.org/courses or call the Support Team at 800.509.4422.

www.TheIHCC.com I CDHC Solutions™ I IHC Annual Outlook 2012 17

PoliCY & leGislation

By gRacE-maRIE TuRnER » prEsidEnt » galEn InSTITuTE

At a recent conference about the new health overhaul law in the state of Washington, one exasperated business owner asked the speaker, “Will someone please just tell me how much

this is going to cost me?”Unfortunately, like so much about the Affordable Care

Act, that question is just not answerable.Dennis Lockhart, president of the Federal Reserve

Bank of Atlanta, also reports about his conversations with business owners: “We’ve frequently heard strong comments

to the effect of ‘my company won’t hire a single additional worker until we know what health insur-ance costs are going to be.’”

Businesses are in a quandary. Major deadlines are approaching to comply with the federal health law. At the same time, many businesses are hoping they will be rescued by the Supreme Court or by Congress to repeal or significantly amend the health care law.

The U.S. Supreme Court heard an unprecedented 5 1/2 hours of argument about key

provisions of the law in late March and a decision is expected in June. But few court watchers expect the entire law to be struck down. Even if the controversial mandate that individuals must purchase government-sanctioned insurance were to be declared unconstitutional, then 90 percent of the law still would stand, including the mandate that businesses must provide expensive health insurance or pay a fine, and a plethora of new taxes on businesses, individuals and health insurance.

The future and fate of the health overhaul law likely will be a major issue in the 2012 presidential and congressional elections, with virtually every Republican pledging to repeal the law. If President Obama is re-elected, it will be almost impossible for Congress to get enough votes to repeal all or even parts of it.

So businesses wait in uncertainty and frustration. Employers are holding off on hiring new employees because of their uncertainty about the costs of the mandatory insurance or the extent of the federal fines they would have

to pay if they drop or don’t offer health coverage. This is depressing job creation and the economic recovery.

One restaurant owner said that he couldn’t afford to provide the expensive health insurance the health law requires, but even paying the annual fine of $2,000 to $3,000 per worker would consume more than the entire profit margin of his business. His business plans are paralyzed by ObamaCare.

The cost and complexity of the law may very well lead to delay in getting it implemented. The Obama administration’s problems with the law build by the day. For example, a majority of states are resisting the creation of the required health insurance exchanges. The main role of the exchanges will be to allocate federal subsidies for health insurance to eligible individuals and families, and states also must approve and regulate the health plans offering coverage in the exchanges.

If the states aren’t ready by January 2013, the federal government is required to get federal exchanges up and running by the end of next year. But there is no money to do that, and the Republican leadership in the House of Representatives will resist any efforts to provide the funding. So there is, for now, a stalemate on setting up these key agencies tasked with implementing ObamaCare.

Congress will be keeping a close watch on the expected cost of the subsidies. As they soar, Congress will have an even greater incentive to revisit and possibly delay startup of the law.

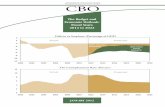

Former Director of the Congressional Budget Office Douglas Holtz-Eakin estimates that as many as 35 million more people than Congress expected will seek taxpayer-subsidized health insurance, adding $1 trillion to the $2.6 trillion 10-year cost.

One of the reasons many in the business community supported passage of the health law was because of promises it would finally get their health costs under control.

Mr. Obama repeatedly promised the American people he would reduce a typical family’s premium $2,500 a year before the end of his first term.

But costs are rising now even faster than before the law was enacted in March 2010. A Kaiser Family Foundation sur-vey found that premiums for a family policy topped $15,000 a year in 2011, increasing an average of $1,300 in the last year—three times faster than the year before. The Kaiser survey

2012: The Pivotal Year for Consumer-directed Health Care

“The cost of [account-based health plan]

coverage is considerably more affordable than either PPO/POS plan

or HMO plan coverage in 2011,” the NBGH

survey found.

continued on page 74

18 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

By KaREn IgnagnI » prEsidEnt, CEo » amERIcan hEalTh InSuRancE planS

HealtH Plans

Health care costs are crushing the economy, eating up state budgets, frustrating employers and causing consumers to make difficult kitchen table tradeoffs.

In the past 50 years, health care expenditures have risen five times faster than the economy has grown.

At the federal level, health costs are the major driver of our long-term deficits. At the state level, the rising cost of Medicaid is consuming a greater portion of state budgets and causing funding for K-12 education, higher education and transportation to remain flat or decline.

The story is similar for employers. Health expenditures are driving up the costs of benefits. For employees, they are consuming an ever-larger share of tight family budgets.

The policy question is, “Has the country come to the proverbial fork in the road?” And, to paraphrase Yogi Berra, “Are we prepared to take it?”

Looking back gives us some answers, as well as cause for encouragement and caution. In recent decades, the only interruption in the cost-rising cycle occurred in the

1990s with the development of health maintenance organizations (HMOs). For a short period of time, the health cost curve trended down and purchasers and consumers saw real relief. However, with cost reduction came pushback.

The lesson we should take away from this experience should not be that managed care didn’t succeed. The key takeaway—that also needs to be confronted today—is that consumer and purchaser cost reduction was (and still is) provider revenue reduction.

It’s Not the ’90s AnymoreThe managed care backlash came, in part, from

clinicians that saw a shift in payment to structures that relied on primary care with internists and family physicians directing referrals to specialists. Many clinicians also resisted

having the need for tests and procedures reviewed by managed care plans. In addition, hospitals and physicians opposed the narrowing of networks, with calls for legislation that restricted or prevented their usage whatsoever.

As pushback grew, legislative campaigns were launched. There were accusations that prepayment created incentives to deny care and the review of tests and procedures was characterized as second-guessing. Tools needed to better coordinate care and ensure value were shelved and, predictably, costs exploded.

Skip ahead. Today, there is consensus finally that the rate of increase in health care costs and long-standing gaps in quality and safety cannot be sustained. Purchasers, consumers and government payers are rightfully demanding value for their health care investments and there are promising signs new solutions are working. While the challenges may be similar, the most promising innovations are fundamentally different than they were in years past.

Achieving Value for Consumers and Purchasers

Awareness of the scope of the problem has accelerated efforts to enable the provision of care that is safe, effective and affordable. Across the country, new payment models are being implemented. What’s different from the tools used in the ’90s is that cost and quality goals are being set and health plans, hospitals and clinicians are working together to align incentives to reward the provision of care that is high quality and cost effective.

Health plans are working with primary care physicians to offer a “medical home” to patients. The concept is to support physicians’ efforts to provide preventive care, coordination of care for multiple conditions, and services designed to maintain health and to coordinate care for those with chronic conditions.

New accountable care models span a broad spectrum of care and involve health plans and providers working together to move away from paying for each service rendered toward financial arrangements that reward performance.

A third approach involves health plans partnering with physician groups to pay for episodes of care, identify

Improving Health Care Quality and Bringing Costs Down:encouraging signs but Clouds on Horizon

Purchasers, consumers and government payers are rightfully demanding

value for their health care investments and

there are promising signs new solutions

are working.

www.TheIHCC.com I CDHC Solutions™ I IHC Annual Outlook 2012 19

and promote best practices, reduce treatment variation, and provide better results and value to patients.

What is strikingly different from past efforts is that these designs are emerging from partnerships among health plans, hospitals and physicians, who are working together to reform payment systems based on a shared recognition of the urgent need for practice transformation.

Improved measurement tools developed by credible, objective third parties have enabled health plans and providers to agree on best practices and steps that will demonstrate tangible improvements. Goals now relate both to the quality and cost of care; neither are reviewed in isolation. These new models empower purchasers and patients to assess value and make informed choices.

Plan and provider partnerships also are becoming longer term, creating incentives to invest in both health prevention and health improvement.

Putting Technology to WorkThe ability to set performance goals is

supported by an enhanced ability to measure, collect, aggregate and analyze information on provider performance to pinpoint gaps in care and help drive quality improvement.

Increasingly, health plans’ HIT infrastruc-ture is enabling information exchange to support doctor and patient decision-making—in real time—thereby providing access to needed infor-mation at the point of care. Whether through electronic health records, patient registries, or an alternative HIT infrastructure, better use of secure, confidential data helps identify gaps in care, supports case management of chronic conditions and creates more patient awareness.

Spurring Patient EngagementEngagement in treatment choices helps

patients make informed decisions and adhere to treatment plans and wellness programs designed for their specific conditions, such as heart disease, hypertension, obesity, asthma and diabetes.

Incentives can include waiving or reducing cost sharing for high-performing providers, particular settings of care (e.g., centers of

excellence), or certain types of medical treatments, tests or screenings that have been proven to improve health outcomes. Incentives also are available for reaching health goals, such as adherence to prescription drug regimens, completing health risk assessments, or meeting physical activity and healthy eating goals.

Other strategies we are seeing in the mar-ket include: waiving copayments for particular prescription drugs for patients who have had a myocardial infarction or for patients with asthma or diabetes to follow physician-recom-mended prescription therapies; and encourag-ing patients with diabetes to better manage their hemoglobin levels by providing blood glucose monitors.

Challenges on the Policy FrontEvery year, the U.S. Department of Health

and Human Services provides an analysis of the year-to-year drivers of health care costs.

From 2000-2006, about half the growth in health care spending was attributable to increases in the prices being charged for health care services, such as hospital care, nursing home services and prescription drugs - the other half was attributable to utilization of health care services.

Now, according to government analysts, the annual growth in health expenditures is fueled primarily by price increases. Acknowledging the role of medical prices is critically important because there is nothing that clears a crowded Washington conference room faster than a discussion about how much is being charged for medical care. When it comes to health care costs, there is no upside for politicians to even frame this challenge – unless consumers and purchasers demand action.

Indeed, very few observers have connected the dots about the effects of larger hospital systems purchasing lower cost community hospitals, hospitals buying physician practices, which is increasing the cost of procedures previously done in physician offices, and the costly boom in buildings and construction.

The policy discussion has not focused enough on how these trends are baking in revenue expectations that cannot be sustained. But these are issues that will be of growing

concern to consumers and purchasers and the role of regulation should be to ensure that markets can function effectively and that the new tools that are showing promising results are allowed to work.

Transforming our health care system is not going to be easy, but it is necessary. We know what must be done to implement a sustainable, modernized health care system that engages patients and rewards value over volume.

However the challenge for this decade is whether there will be the political will to address structural barriers to progress, fend off poten-

tial legislative campaigns to resist change and maintain the status quo and continued support of consumers and purchasers being empow-ered with great transparency, more choice and more effective care. That’s our mission in the health plan community and that’s what our new suite of products and resources are designed to achieve. As President and Chief Executive Officer of America’s Health Insurance Plans (AHIP), Karen Ignagni is the voice of health insurance plans, representing members that provide health care, long-term care, dental and disability benefits to more than 200 million Americans. Ignagni joined the organization as its chief executive in 1993. From there she led two mergers with other organizations to form AHIP in 2003, making AHIP the leading voice for the health plan community in America.

When it comes to health care costs, there is no upside for politicians to even frame this challenge—unless consumers and purchasers demand action.

Transforming our health care system is not going to be easy, but it is necessary

20 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

hEalTh planS

By chRIS RIEdl

hEad of ConsumErism and produCt innovation

aETna

Many employers are currently performing a “balancing act” as they search for the right health benefits for their organization. While

organizations are looking for health benefits plans that will help them reduce their health care costs, they also want to continue offering plans that allow their employees to access the health care services they need. although these may appear to be opposing needs, aetna HealthFund plans have a proven history of achieving both of these goals.

aetna recently announced results from the eighth annual aetna HealthFund study, which is the longest-running review of consumer-directed health plans in the industry. the results showed employers who completely replaced their traditional health benefits plans with aetna HealthFund consumer-directed plans saved more than $400 per member per year.

employers that completely transitioned to aetna HealthFund plans saw the most dramatic cost savings, but employers who simply offered aetna HealthFund plans as an option still saw significant reductions in their health care costs. the employers offering an aetna HealthFund plan option experienced savings of more than $150 per member per year for members enrolled in all health plan options, even though the other plan options offered had a similar overall plan value.

Aetna HealthFund Members Receiving Recommended Care at the Right Time

in addition to reducing health care costs, the study showed members with aetna HealthFund plans received more preventive care from their primary care physicians than members with traditional Preferred Provider organization (PPo) plans. the study also found aetna HealthFund members:

• receive screenings for cervical cancer, colorectal cancer, and prostate cancer, as well as mammograms and immunizations, at a higher rate compared to members in PPo plans.

• use the prescription drugs necessary to treat chronic conditions such as diabetes, congestive heart failure, high blood pressure and high cholesterol at similar rates as PPo members.

• select generic drugs at a higher rate than members in PPo plans, allowing members to reduce their prescription drug costs and generating up to four percent pharmacy cost savings for employers.

even though aetna HealthFund members access as much or more care than members with traditional PPo plans in many instances, the study found members with aetna HealthFund plans spent seven percent less on overall health care costs. By receiving recommended care earlier, members with aetna HealthFund plans are better able to avoid more significant and costly health care issues in the future.

Online Tools Give Employees the Information They Need

employees with aetna HealthFund plans also were more engaged health care consumers, using online tools more than twice as often as members with PPos. aetna is committed to providing members with the resources they need to better understand the quality and cost of the health care services they receive.

one popular tool is the member Payment estimator, which provides real-time out-of-pocket cost estimates for in-network and out-of-network care for more than 500 commonly used, non-emergency health care services. this level of detail—a first for health plan members—gives members a more complete picture of the costs involved and helps people better plan for and budget for health care.

the member Payment estimator received more than 67,000 hits per month in 2011, and that number jumped to more than 92,000 in January 2012. aetna members are not the only ones taking notice—the u.s. Government accountability office recently recognized the member Payment estimator as the only tool from a private health insurance company that “provides estimates of a consumer’s complete cost.”

With these types of industry-leading tools and the innovative aetna HealthFund plan designs, aetna can partner with employers to maintain their “balancing act” of controlling health care costs and encouraging employees to take a more active role in their health care.

Aetna HealthFund Plans Reduce Costs and Employees Get the Care They Need

Job # Prev. Users

Art Director Copy Writer

Acct Mgr.Proj. Manager

Studio Artist

Filename Last Modified

DeadlineClientBleedTrimLive

Cont

ent

Location Fonts & Placed Graphics

AETCORP1134A_CDHP_PS AETCORP1134A_CDHP_PS.indd 2-3-2012 2:56 PM ffernandez/ffernandez

12/20/11 Sig Gross

Aetna Betsy Guerro

8.625” x 11.125” Caroline Paik

7.875” x 10.5” Eibhin McLoughlin

7” x 9.4375” Frank Fernandez

Family StyleFoco Regular, Bold

Name Color Space Eff. Res.aetna_orange_cmyk_c.eps 42-20967427_RF_r2.psd CMYK 347 ppi PlanSponsorCDHP-orange.tif CMYK 749 ppi

Cyan Magenta Yellow Black

ffernandez (quad core)

Setu

p

110 Fith Avenue New York, N.Y. 10011

No

tes

Per

sonn

el

at

None

212-463-1036

Any questions regarding this material please call Print Production Manager Kristen Walsh

Document Path: NYC-Creative:Volumes:NYC-Creative:Studio:MECHANICALS:AETNA:2012:AETCORP1134:Plan Sponsor:A size:AETCORP1134A_CDHP_PS.indd

Inks

Quality health plans & benefitsHealthier livingFinancial well-beingIntelligent solutions

Smarter is when your employees are 2x more likely to take charge of their health.

More involved employees and savings.

1Aetna HealthFund® Eighth Annual Study Results, released December 2011. © 2012 Aetna Inc. Plans offered by Aetna Life Insurance Company and its affiliates. Health benefits and health insurance plans contain exclusions and limitations. 2012002

See the proof at smarteris.aetna.com/cdhp

• Decrease overall medical costs by 7% and prescription costs by 16%. • Proven savings of more than $400 per member per year.• 9% fewer non-routine physician visits.1

S:7”

S:9.4375”T:7.875”

T:10.5”B:8.625”

B:11.125”

22 IHC Annual Outlook 2012 I CDHC Solutions™ I www.TheIHCC.com

selF-FunDinG

By FREdERIcK d. hunT » aCtivE past prEsidEnt » SocIETy oF pRoFESSIonal BEnEFIT admInISTRaToRS (SpBa)

I started in employee benefits in the designing discussions of the U. S. Department of Labor’s Employee Retirement Income Security Act (ERISA). Today, ERISA is a hallowed word, but during drafting

and passage, insurers, employers, unions and every one else gave it the nickname Every Ridiculous Idea Since Adam.

ERISA was designed to be, and remains, the ultimate consumer protection law. The level of disclosure and fiduciary duty were considered excessive, and it was considered the sure death of employee benefits. Of course, to the contrary, ERISA sparked phenomenal growth in employee benefit plans and the number of Americans receiving stable coverage.

The largest ERISA growth has been in self-funded health plans, and self-funding is the giant player. It is estimated nearly three-fourths of workers in health employee benefits is self-funded. Even most health coverage business of many health insurance companies and Blues is self-funded plans, with the insurer using the marketing term ASO (Administrative Services Only) to describe their self-funding services. The most important players in self-funding are third

party administrator (TPA) firms.I mention this story for two reasons. First to show

that every major law impacting employee health plans is greeted with moans for health plans. I have heard the premature death announcement dozens of times, but each time employee benefits grow and bloom.

After initial concern about the impact of the 2010 health reform law, it is easy to see that the opportunities and market for self-funded plans administered by TPAs is very bright.

How does it work? Self-funding is when an employer or benefit plan writes a customized plan of coverage, like an insurance policy, and arranges a trust or funding system for paying the claims. The next move is getting stop-loss coverage, which acts like reinsurance to protect the employer/plan from high claims from either one person or

the whole. That is a simplistic description, but it also takes precise administration and intense understanding of the various laws and regulations.

Nearly all self-funded plans use a TPA from the start. The reason is that the processing requirements and government compliance is so complex that, as judges often warn in legal matters, ”Only a fool represents himself.”

TPAs also are known for year-round service and assistance as new laws, regulations and opportunities arise. As noted earlier, some insurance companies call their administration work TPA and some call it ASO. Legally both are subject to the same requirements. (See compliance concern below.)

Why a Bright Future for Self-funding and TPAs?

(1). Insurance companies have become the whipping boy of PPACA, with fines, limitations, restrictions and other disincentives throughout the law. I predicted two years ago that insurers will depart the U.S. fully-insured market, and people thought I was crazy. However, I had the advantage of some inside information, but now, even The New York Times is writing that health insurance companies will soon be “extinct.”

Many of the punitive measures on insurers also will make life unpleasant or uncertain for employers with insured plans. There are already signs of insurers shifting from employer group customers to individual coverage.

So, self-funding is the remaining strong source of employee benefits. Also, most of the factors and new rules, which the insurance companies will find unlivable, have been the law (mostly ERISA) for self-funding for almost 30 years. So TPAs and self-funded clients flourish in the consumer-friendly environment.

(2). Employers are becoming more dedicated than ever to having their own employee benefits health plan. In the old days, employee benefits were just a bothersome “fringe benefit.” However, employers have quickly figured out that sponsoring an employee benefit plan is a business survival tool.

Why? As employers read and hear all the delays and limited

or rationed services that are a problem for all government-overseen health plans around the world, they realize that vital

Bright Future for Self-funded Health Plans

“After initial concern about the impact of the 2010 health reform law,

it is easy to see that the opportunities and

market for self-funded plans administered by

TPAs are very bright.”

www.TheIHCC.com I CDHC Solutions™ I IHC Annual Outlook 2012 23

employees could be off work for long periods waiting for diagnosis and care, and maybe not the best care. That is lost productivity. So, just as employers pay for instant-repair and service plans for their vital equipment and computers, they realize they need a good plan which they can customize to serve the needs of their particular workforce. This gives them more bang for the buck, and provides services quickly to get the workers back into productivity.

As employers have streamlined staffing, it makes quickly returning employees to work all the more important. The moral of the story is having a custom-designed employee health plan is a business survival tool.

An employer steering workers to individual coverage does not achieve the new needs for quick care and coverage for things that this particular workforce wants and needs most, and will probably not be reliable as a source of coverage.

(3). The government alternatives are not attractive and are apt to be shaky. There is big question whether state exchanges will function as envisioned. States are skittish and fearful exchanges could become a financial black hole for which they have the actual or political liability. Also, the exchanges depend on having insurance companies willing to offer policies in a market with expected high claims and low premiums and other micro-managing review by the states. So, states may find they have exchanges, but no insurer offering coverage to buy. To add to the problem, Congress is already diverting part of the intended subsidies to make exchanges more affordable for states, to other uses. As a result, the exchanges may be stripped-down or be rationed.

Similarly, Medicare will be going through upheaval for several years, and Medicaid will probably face big cuts in many states, which simply cannot afford such a loss in their budget. So, health reform has painted itself into what is looking like a dead end.

So, for employers, more than ever before, a self-funded health plan and good TPA firm are the best and perhaps only choice.

In the marketplace, we also are seeing first signs, and have been told to brace for a major shift over the next couple of years

as large, previously-insured employers and employers smaller than previously normal—under 100 lives—seek self-funding and solicit TPAs to create custom-designed self-funded benefit plans for them. We’re ready, including coordinating with stop-loss firms to assure that the smaller firms have the security and stability they need.

(4). Government compliance is potentially the biggest “risk” for employers and employee benefit plans, and PPACA simply expands the compliance responsibilities. I am proud to brag that SPBA member TPAs are on the cutting edge.

In fact, we play an active role as a non-partisan, non-political candid resource for government officials who seek advice and ideas from SPBA and our member TPAs about how laws and regulatory issues would work “in the real world.” Also, self-funding TPAs have long lived and are experienced on dealing with fiduciary duty, disclosure and tightly-monitored administrative cost oversight that is choking insurers.

However, there are compliance issues, which self-funding will need to face and solve. Insurance companies who do TPA duties for their self-funded clients under the term ASO, have traditionally been more closely connected to the insurance company, and tend to get their compliance information and policies from the insurance company’s legal department from lawyers trained in insurance law, which is very different from ERISA and other self-funding laws.

Not only is that like getting advice from a lawyer in France for U.S. business, but some things allowed in insurance or general business law can be prosecuted as a federal crime under ERISA, the ultimate consumer protection law. So, ASO will need to merge into the TPA world smoothly and be sure they are up to speed so inaccurate advice does not cause problems that embarrass the whole private employee benefits and health coverage system.

Variables and Probable Outcomes

Does my forecast have any variables, unknowns, or possible bumps in the road? Yes,

but they are not insurmountable, especially considering the many advantages and support the private health benefits system provides for the government and people.