Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

-

Upload

ifc-sustainability -

Category

Documents

-

view

217 -

download

0

Transcript of Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

1/44

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

2/44

FUTURE PROOF?Embedding environmental, social and

governance issues in investment markets

Outcomes o the Who Cares Wins Initiative20042008

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

3/44

Foreword by the sponsoring institutions

Who Cares Wins was launched in early 2004 as a joint initiative o the inancial industry and

the UN Global Compact, International Finance Corporation (IFC) and the Swiss Government.

The aim was to support the inancial industrys eorts to integrate environmental, social and

governance (ESG) issues into mainstream investment decision-making and ownership practicesthrough a series o high-level meetings with investment proessionals.

At the heart o the Initiative lay the conviction that increased consideration o environmental,

social and governance issues will ultimately lead to better investment decisions, create stronger

and more resilient inancial markets, and contribute to the sustainable development o societies.

The recent economic downturn has revealed the devastating eects o miscalculations. It has

reinorced the necessity or the inancial industry to more diligently manage their risks, including

those related to environmental, social and governance issues. Among those is climate change,

considered one o the most serious threats the global economy will have to ace in the next

century. A inancial system that is too short-sighted and unaware o the dynamics o climate im-pacts will ail to avoid or reduce the risks posed by a climate-induced economic crisis that could

easily be ar greater than the credit-related crash o 20072008.

The positive message rom the inal report o this Initiative is that the industry has come a long

way since 2004 in understanding the issues and developing the methodologies and tools or ESG

integration. However it is clear that widespread implementation o these methodologies and

tools has yet to occur throughout the inancial industry, and will only be possible with the col-

laboration o all inancial market actors.

Going orward, the engagement o asset owners and regulators is particularly sought to help

create much-needed enabling rameworks and market demand or ESG-inclusive investments.Intelligent regulation is a necessary component o the growth o sustainable capital lows,

which implies regulation that requires greater transparency on ESG integration rom companies

and investors and relies on markets to apply the most appropriate ESG integration strategies.

Implementation should also be driven by strong public-private partnerships, voluntary initiatives

and principles-based approaches. Principles can oer both investors and companies guidance

where legislation is lacking, and the chance to beneit rom virtuous circles o ESG leadership.

The Who Cares Wins Initiative is drawing to a close, but our dialogue and engagement with

the inancial industry continues unabated through other orums. We believe that this continued

engagement will be particularly important or investments in emerging markets, where ESG

integration is still an exception.

We strongly believe that better integration o ESG issues into investment markets is within

reach, leading to more resilient and eicient markets and contributing to a more sustainable de-

velopment o societies. IFC, the Swiss Government and the UN Global Compact urge all actors

3

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

4/44

involved in investment markets to consider and implement the recommendations set out at the

end of the report.

Though the current turbulence in financial markets may tempt investors and companies to

think of ESG issues as tomorrows problem, we believe that urgent and wholehearted action

is warranted not in spite of, but precisely because of the market dynamics observed in the pastmonths.

ESG integration is about investors and companies taking a longer-term view, acknowledging

the full spectrum of future risks and opportunities, and allocating capital as if they themselves

were the beneficial owner. There can be no better way to restore public confidence in the mar-

kets and build a prosperous economic future.

Georg Kell

Executive Director

United Nations

Global Compact

Rachel Kyte

Vice President,

Business Advisory Services

International Finance

Corporation

Ambassador Thomas Greminger

Head of Political Affairs Division IV,

Human Security

Federal Department of Foreign Affairs

(Switzerland)

4

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

5/44

5

Contents

Executive summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

1. Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

2. Progress in ESG integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Observations relating to the investment system as a whole . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Asset owners and investment consultants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Asset managers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Investment researchers, data providers and rating agencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Regulators, exchanges, proessional bodies, etc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

3. A focus on emerging markets investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27

4. Ten recommendations to accelerate ESG integration . . . . . . . . . . . . . . . . . . . . . . 30Enabling change in a complex system . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Recommendations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Appendices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .35

B a c k g r o u n d , e x p e r t c o n s u l t a t i o n . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

Goals and chronology o the WCW Initiative. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Selected organisations and initiatives addressing ESG integration or investors . . . . . . . . . . . . . . . 38

Assessment o progress by investment actors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Institutions that participated in Who Cares Wins 20042008. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Report authors:

Ivo Knoepel, Gordon Hagart

onValues Ltd.

Zurich, January 2009

Commonly-used terms

EM Emerging market(s)

ESG Environmental, social and governance (issues)

WCW Who Cares Wins Initiative

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

6/44

Executive summary

This report summarises the strategic outcomes o the Who Cares Wins Initiative a series o working con-

erences and inancial industry consultations that took place between 2004 and 2008. The Initiative aimed

to increase the industrys understanding o the risks and opportunities presented by

environmental, social and governance (ESG) issues, and to improve their consider-

ation in investment decision-making. In concluding our years o discussion with the

industry, the report proposes a number o actions to urther ESG integration and,

ultimately, to set the investment system on a more sustainable, long-term ooting.

The past years can be described as a period o intense experimentation and learn-

ing regarding the relevance o ESG issues or investments and their integration into

investment decisions. The industry has considerably progressed since 2004: it is

today a commonly-accepted act that ESG issues can have a inancial impact on

single companies or entire sectors. The industry has also become more sophisticated

in understanding when and where this impact is relevant. Leading analysts have

developed the necessary techniques to integrate ESG issues into inancial analysis

proving that ESG integration is absolutely within the reach o the analyst proession.

However, this know-how is not yet widely applied in the industry. Given the role o

investors in assessing uture economic developments, and the potential or many

ESG issues to change signiicantly the course o our economies1 , this lack o uptake is

surprising.

To understand better the impediments to a wider uptake o ESG inormation by the i-

nancial industry a systemic view is needed. The Who Cares Wins consultations looked

in-depth at the relationships o key actors, including asset owners (pension unds and

other institutional investors), asset managers, investment researchers and regula-

tors. This report oers a set o key recommendations or each o the actors in order to

improve and scale up ESG integration considerably.

The dynamic nature o the inancial industry means that each actor is highly depen-

dent on other actors. It also means that changes in the behaviour o key actors, such

as the asset owners at the top o the chain, can rapidly unblock stalled situations and move the system to a

new equilibrium.

In the coming years the inancial industry has the opportunity to reap the gains o the good work done so ar

by applying it more widely to mainstream investment processes. I the industry does not seize this opportu-

nity, it risks ailing to account or important developments that are shaping the uture o our economies. This

in turn could create systemic risks or the inancial industry and the economy at large. The positive message

is that ESG integration currently represents an important source o competitive dierentiation and value

creation or inancial institutions that make it part o their strategy.

However, the next phase o ESG integration will require the leadership o the CEOs and CIOs o inancial in-

stitutions and implementation at all levels o their organisations, or it will not happen. Employees working on

1 Climate change and its policy response being but one example

Who Cares Wins was initi-

ated by the UN Secretary-

Generals Global Com-

pact Oice in 2004 and

endorsed by an alliance

o inancial institutions

that collectively represent

more than USD 6 tril-

lion in assets. Who Cares

Wins provided a platorm

or asset managers andinvestment researchers to

engage with institutional

asset owners, companies

and other private and

public actors on ESG is-

sues. The principal setting

or this engagement was

a series o annual closed-

door, invitation-only events

or investment proession-

als. In-depth consultations

with a number o leading

industry practitioners pre-

ceded the drating o this,

the Initiatives inal report.

7

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

7/44

ESG integration must be given appropriate incentives, dierent actors must agree on ways to share the costs

and beneits o developing new ESG-inclusive services, and institutions strategies need to be communicated

better to the market at large.

Progress in ESG integration

As mentioned, the level o awareness o ESG issues among mainstream proessionals has greatly improved

since the launch o Who Cares Wins, with new collaborative initiatives such as the Principles or Responsible

Investment (PRI) acilitating the adoption o best practice. The development phase, characterised by experi-

mentation and innovation in many areas, is now drawing to a close, leaving those institutions that have made

a irm institutional commitment to the space with a springboard or scaling up ESG integration.

However, progress has not been uniorm environmental, social and governance issues have not

been taken up by investors to equal extents. Nor have the various actors in the investment system

moved orward in unison.

Asset owners (e.g. pension unds, insurance companies), at the head o the chain, have certainly improvedtheir awareness o ESG issues, but their implementation eorts investing in an ESG-inclusive manner

have been disappointing. In contrast, active ownership activities, including the

exercise o voting rights and engagement with companies, have made good progress

since 2004.

Likewise the leading consultants have invested in researching what ESG issues mean

or their clients, and have begun to show how ESG issues are built in to standard services

such as investment strategy, asset allocation and manager selection. But the majority o

the consultancy world is well behind the pace set by the ew leaders.

The clearest progress made by asset managers has been in terms o sourcing ESG-inclusive investment research rom service providers. On the other hand, it is much

less clear how the research is actually being used by asset managers. Indeed, asset

managers are candid about the challenge o integrating ESG inormation into their

traditional rameworks.

In uture, asset managers must provide a greater degree o transparency towards

research providers and company management on the use o ESG data, and towards

asset owners and consultants in terms o the objectives o their ESG-inclusive invest-

ment products and services. Further progress in asset management will also require

clearer incentives or employees involved in ESG integration.

A big step orward has been made in the past years by academics and investment re-

searchers in developing the analytical rameworks and demonstrating the rationale

or ESG integration in investment research. Although the actual coverage o ESG by

mainstream investment research has improved (rom a low base), coverage remains

patchy and is generally driven by specialist teams rather than by mainstream ana-

lysts. The key challenges ahead or researchers are insuicient incentive systems, the

high cost o building up teams and tools, and the lack o comparable company data on

ESG issues.

Having been involved

in the investment indus-

try or over 35 years, it

is clear to me that ESG

analysis is set to play an

ever more important role

in stock selection because

it addresses key strategic

issues or companies and

economies. It is simply

not possible to make good

investment decisions in

a world where corporate

proitability increasingly

depends on thriving in a

world o growing scar-

city o energy, water and

skilled labour and eective

and eicient corporate

governance systems. ESGanalysis can only become

more important.

Jean-Pierre Hellebuyck

Director and Vice

Chairman, AXA

Investment Managers

8

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

8/44

The emergence o new specialist ESG data providers is also a positive trend, but

the leading credit rating agencies a crucial actor in investment markets are

conspicuous by their absence rom the debate on the materiality o ESG issues. The

positive role played by a number o stock exchanges in improving the ESG disclosure

o listed companies is a notable development.

Leading companies have advanced greatly in making ESG issues part o their strat-

egy (arguably more rapidly than investors), and have shown that they are willing to

engage in a sophisticated dialogue with investors on inancially-material ESG issues.

Nonetheless, the production o ESG data that are robust and comparable, and the

integration o the most material issues into investor relations communications,

remain areas o concern2 .

Who Cares Wins also looked at the role o regulators and governments. The

message rom WCW participants is that, given the complex and technical nature o

ESG integration, governments should not play an active role at the micro level but

should ocus on deining the right boundary conditions or the system as a whole.This includes requiring greater transparency on ESG integration rom companies

and investors, supporting eorts to give a price to public environmental and social

goods, and relying on markets to apply the most appropriate ESG integration strate-

gies. Regulators can also support ESG integration by stating explicitly that they see

no contradiction between a thoughtul consideration o material ESG issues and

iduciary responsibilities.

The role o proessional bodies and qualiications in increasing the industrys aware-

ness and knowledge and in better training young proessionals in the ield o ESG

was repeatedly stressed throughout the WCW consultations. The more active role

undertaken by the CFA Institute in this area provides an encouraging signal or thewhole investment industry.

Enabling change in a complex system: 10 recommendations

to kick-start the next phase in ESG integration in financial markets

To rame the recommendations that complete this report, a model or the interactions between dierent

actors on ESG integration was developed. The concept o a simple, one-way chain, with requests issued by

upstream clients to downstream providers, was considered an unsatisactory description o the investment

system.

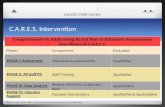

The ramework shown in the chart below takes a more dynamic, systems-orientated view o the interactions.When upstream participants request disruptive changes to the way the system works, they must accompa-

ny their requests with assurance (counter-requests) that their own actions will be transparent, and that risks

taken will be reciprocated. This system o requests and counter-requests is set out below, and explained in

more detail in the recommendations section that begins on page 30.

2 These subjects were the ocus o the 2006 Who Cares Wins event, Communicating ESG Value Drivers at the

Company-Investor Interace

9

The CalPERS Board and

Investment Oice are

committed to integrating

ESG issues into our asset

management, consistent

with our iduciary duty tomaximise risk-adjusted

returns or our members.

We have been a long-time

corporate governance ad-

vocate or transparency in

reporting, including report-

ing on environmental issues.

Further, CalPERS is consid-

ering new opportunities to

invest with managers who

are targeting investments

in publicly-held companies

that have an advantage in

adapting to, or mitigating,

climate change and other

environmental issues, in

addition to managers whose

processes involve screening

out companies.

Anne Stausboll

Chief Executive Officer,CalPERS

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

9/44

10

Regulatorsa

ndgovernments,exchanges

Academia,thinktanks,supportinginitiatives(e.g.PRI,ICGN)

Beneficiaries

Assetowners

Companies

Investment

researchers

Assetmanagers

Investment

consultants

Requirementsforgreatertransparency

InternalisationofESGcosts

Assuran

ceoncompatibility

withfiduciaryresponsibilities

Innovativeinvestmentstrategies

Research

Mandates;appropriate

performancemeasurement

F l h t

t i d E S G

i l i h f

i i d t h t h t h t t h h

Thoughtleadership

Groundworkresear

ch

Lowercoststoen

trythroughcollaboration,

disseminationofbestpractice

Transparen

t

use;

willingnessto

payforresearch

EvidencethatESG

drivesinvestmentdecisions

Reliabledata;

managment

engagement

Data

providers

Rating

agencies

REQU

EST

COUNTER

-REQUEST

E

nablingchangeinacomp

lexsystem

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

10/44

11

The strength o the discussions and consultations with industry proessionals that took place

during the WCW Initiative has been this ocus on the dynamics o the investment system and

on what is needed to unblock stalled situations.

Who Cares Wins aimed to support the inancial industrys eorts to integrate ESG issues

into mainstream investment decision-making and ownership practices. In the light o the20072008 inancial crisis the need to reocus the investment system on the long term and

on a more holistic assessment o risk is more important than ever. The conclusions o the Who

Cares Wins initiative a roadmap to markets that are more uture proo are captured by

the ollowing set o ten recommendations or dierent investment market actors:

1. All investment actors: mobilise top management. CEO / CIO leadership is needed to

unblock stalled situations between dierent actors and agree on how to share the costs o

urther market-building eorts

2. Regulators and governments: require greater transparency on ESG perormance / integration

rom companies and investors. Engage in an open dialogue with the nancial industry on this

issue, and support neutral platorms aimed at ostering that dialogue. Walk the talk in termso the way you invest your own capital. Help the industrys integration eorts by giving a price

to public goods, thereby internalising external environmental and social costs

3. Asset owners: make ESG inclusion a specic criterion in new asset management man-

dates. Commit to evaluating ESG capabilities systematically when ormulating mandates

and selecting managers. Proessional sta: increase the awareness and knowledge o

trustees in this area

4. Investment consultants: develop and communicate a house view on the integration o ESG

issues. Be explicit about how that position is refected in your services (e.g. investment strategy,

asset-liability management / asset allocation and manager selection)

5. Asset managers (senior management): lead ESG integration by communicating clear goals

and providing appropriate incentives or employees and service providers (e.g. sell-side re-search). Involve human resources / compensation managers in your planning

6. Asset managers: pro-actively develop and distribute investment strategies and services

that ocus on ESG as a tool or improving risk-adjusted return. Design integrated method-

ologies3 or ESG that go beyond simple screening approaches

7. Asset owners, asset managers and research providers: enter a dialogue with compa-

nies to explain how ESG issues drive investment decision-making and to request improved

reporting on ESG perormance

8. Asset owners, asset managers and research providers: improve the quality and cover-

age o country-specic ESG research in emerging markets. Include ESG issues in regular

company meetings and engagement activities. Consider collaborating with other investors

in requiring minimum ESG disclosure standards rom emerging markets legislators andexchanges

9. Research providers: leverage the knowledge o analysts covering industries with a high

degree o ESG integration, and expand the quality and scope o ESG inclusive research to

include other sectors, regions (including emerging and rontier markets) and asset classes

10. Rating agencies: improve and communicate your eorts to integrate ESG issues into rat-

ing methodologies

3 Methodologies that integrate ESG into the traditional undamental analysis (proit and loss / cash low modelling,

cost o capital, multiples-based valuations, etc.) and into established investment processes

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

11/44

12

In order to plot a course that could be ollowed by institutions looking to scale up their ESG integra-

tion eorts, we present composites o the characteristics o asset owners and asset managers at

early and advanced phases o integration. These composites can be ound on pages 33 to 34.

To improve ESG integation in emerging markets investment (a special ocus area o the WCW Initia-

tive), the ollowing key recommendations were ormulated:

IncludeESGissuesinregularcompanymeetingsandengagementactivities

PerformasystematicreviewoftheESGexposureofinvestmentsinemergingmarkets

ConsidercollaboratingwithotherinvestorsinrequiringminimumESGdisclosurestandardsfrom

local legislators and exchanges

Considerthepotentialforsmallallocationstofrontiermarketsnotonlytodeliverattractive

returns but also to establish basic investability conditions (such as custody, ecient settlement

services, etc.) and management awareness o material ESG issues

Acknowledgements

The Who Cares Wins sponsors are indebted to the ollowing individuals, who gave invaluable input

to this report, and to the large number o institutions and individuals who supported the Initiative

between 2004 and 2008 (see the appendices on pages 43 and 44 or a list o the institutions that

endorsed and participated in the Initiative).

Publications of the Who Cares Wins Initiative

WhoCaresWins:ConnectingFinancialMarketstoaChangingWorld(2004)

InvestingforLong-TermValue(2005)

CommunicatingESGValueDriversattheCompany-InvestorInterface(2006)

NewFrontiersinEmergingMarketsInvestment(2007)

Futureproof?Embeddingenvironmental,socialandgovernanceissuesininvestmentmarkets(2009)

David Blood

Generation InvestmentManagement

Melissa Brown

ASrIA

George Dallas

F&C Asset Management

Sarah Forrest

Goldman Sachs

David Gait

First State Investments

James Gifford

UN Secretariat or the Principlesor Responsible Investment

Subir Gokarn

CRISIL

Jane Goodland

Watson Wyatt

Malcolm Gray

Investec Asset Management

Gordon Hagart

onValues

Klaus Kmpf

Bank Sarasin

Matthew KiernanInnovest Strategic Value Advisors

Ivo Knoepfel

onValues

Rob Lake

APG Investments

Berit Lindholdt Lauridsen

International Finance Corporation(IFC)

Amanda McCluskey

Colonial First State GlobalAsset Management

Bill Page

State Street Global Advisors(SSgA)

Gavin Power

UN Global Compact

Nils Rosemann

Federal Department o ForeignAairs (Switzerland)

David Russell

Universities SuperannuationScheme (USS)

Dan Siddy

DELSUS

Raj Thamotheram

AXA Investment Managers

Roger Urwin

Watson Wyatt

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

12/44

13

1. Introduction

The goal o the Who Cares Wins Initiative was to catalyse the integration o environmental,

social and governance (ESG) issues into mainstream investment decision-making.

At the time o the Initiatives launch in 2004, 20 inancial institutions with combined assets o overUSD 6 trillion4 published a report entitled Who Cares Wins: Connecting Financial Markets to a

Changing World. The report contained a series o general recommendations, targeting dierent

inancial industry actors, that aimed to acilitate ESG uptake throughout the investment system.

4 Who Cares Wins endorsing institutions: ABN AMRO, Aviva, AXA Group, Banco do Brasil, Bank Sarasin,

BNP Paribas, Calvert Group, China Minsheng Bank, CNP Assurances, Credit Suisse, Deutsche Bank, F&C Asset

Management, Goldman Sachs, Henderson Global Investors, HSBC, Innovest, IFC, KLP, Mitsui Sumitomo Insurance,

Morgan Stanley, RCM, UBS and Westpac

Environmental, social and governance (ESG) issues

ESG issues relevant to investment decisions dier across companies, sectors and re-

gions. The ollowing are examples o issues with a broad range o impacts on companies

and other issuers o securities:

Environmental issues:

Climatechange,waterscarcityrelatedrisksandopportunities

Localenvironmentalpollutionandwastemanagement

Newregulationexpandingtheboundariesofenvironmental

product liability

Newmarketsforenvironmentalservicesandenvironmentally-friendlyproducts

Social issues:

Workplacehealthandsafety

Knowledgeandhumancapitalmanagement

Labourandhumanrightsissueswithincompaniesandtheirsupplychains Governmentandcommunityrelations(notablywherethereareoperationsindevel-

oping countries)

Governance issues:

Boardstructureandaccountability

Accountinganddisclosurepractices,transparency

Executivecompensation

Managementofcorruptionandbriberyissues

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

13/44

14

The ESG landscape has evolved greatly since that time. Substantial progress has been made

through initiatives such as the Principles or Responsible Investment (PRI) and UNEP Finance

Initiative, industry collaborations such as the Carbon Disclosure Project, the Enhanced Ana-

lytics Initiative (EAI) and the Marathon Club, and the innumerable eorts o institutions and

individuals at all stages in the investment chain.

For their part, the sponsors o Who Cares Wins the International Fi-

nance Corporation, the Federal Department o Foreign Aairs

(Switzerland) and the UN Global Compact hosted our closed-door

events or investment proessionals5. Each event considered a particular

element o ESG mainstreaming, rom the interace between investors

and companies to the particular role o ESG issues in emerging markets

investment. The events brought together asset owners, investment con-

sultants, asset managers, service providers and policy makers, and were

characterised by the rank, challenging dialogue between participants.

In concluding the Initiative in 2008 the sponsors aim to provide a platormor the next phase o ESG integration scaling up current know-how in order

to attain widespread integration o ESG issues into inancial markets. As such,

this report attempts to answer two questions:

1. What progress has there been on mainstreaming ESG issues since the

launch of Who Cares Wins in 2004?

2. Which actions will enable the next phase of ESG mainstreaming?

Progress since 2004 was assessed against the ramework set out at the

launch o Who Cares Wins. In doing so we have not only summarised the

outcomes o the our years o Who Cares Wins discussions, but also built on the excellent workalready done in this space by various industry, academic, public sector and civil society initiatives 6 .

An instrumental component o the concluding phase was the consultation held with senior

industry proessionals in the summer o 2008. The experts consulted, who are listed on page

36, gave strategic insight into both the assessment o progress and uture priorities or the

industry. However, the conclusions and recommendations presented in this report are those o

the authors alone.

5 The our events were: Who Cares Wins: Connecting Financial Markets to a Changing World (Zurich, 2004),

Investing or Long-Term Value (Zurich, 2005), Communicating ESG Value Drivers at the Company-Investor Interace

(Zurich, 2006) and New Frontiers in Emerging Markets Investment (Geneva, 2007)

6 Additional research sources included, inter alia, work by Ceres, the CFA Institute, The Conerence Board, the

European Centre or Corporate Engagement (ECCE), IFC, the International Corporate Governance Network (ICGN),

the PRI, UNEP FI, and the World Economic Forum / AccountAbility

ESG integration is chal-

lenging and not many asset

owners have the resources

to deal with it. However, I

am impressed by a grow-

ing group who understand

how delicately balanced

and connected our inancial

system is, and how ESG will

critically inluence uture

outcomes. I think consul-

tant research on ESG issues

is a key enabler or more

unds to see the tangible

beneits o ESG integration.

Roger Urwin

Global Head of Investment

Consulting, Watson Wyatt

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

14/44

15

2. Progress in ESG integration

The irst Who Cares Wins report, published in 2004, recommended action areas or each o

the major actors in the investment chain. These recommendations were examined in depth in

the course o the our Who Cares Wins events between 2004 and 2007. In 2008 we revisited

these recommendations (in consultation with a number o industry experts) to test their valid-ity and to measure the industrys progress against them.

In the expert consultation and this report we use a ive-point scale to assess progress. The lowest

grade used weak indicates the existence o some knowledge sharing and commitments in

principle, but that no practical implementation steps have been taken since the baseline was set in

2004. The upper limit o the scale strong means that there has been widespread implemen-

tation by a majority o institutions, including clearly deined strategies, targets and implementation

programmes. We also take strong to mean that no urther ocus on ESG integration is required

rom industry initiatives or other investment industry actors ESG has become generally accepted

as part o investment best practice in the area concerned.

By assessing the progress made by each actor relative to the original recommendations, we

hope to plot the position o ESG integration on along the course shown below.

Weak Weak / moderate Moderate Moderate / strong Strong

Some knowledge sharing and

commitments in principle but no

practical implementation steps

Widespread implementation by a

majority o institutions, includ-

ing clearly deined strategies,

targets and implementation

programmes

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

15/44

16

The phases of ESG integration towards mainstream acceptance are characterised by differ-

ent activities and actors

Observations relating to the investment system as a whole

ESG integration has come a long way in the last our years. The level o consciousness o

ESG issues among mainstream proessionals has greatly improved the majority o industry

proessionals that participated in Who Cares Wins consultations believe that the investment

system is well on track or ESG issues becoming mainstream.

In terms o the phases o evolution mapped in the chart above, the investment system seems

to be in the early stages o phase 3 institutional commitment and scaling up. That is to say

in developed markets that the learning phase is drawing to a close, leaving those institutions

that have made a irm institutional commitment to the space with a springboard or scaling up

ESG integration.

However, progress has not been uniorm environmental, social and governance issues

have not been taken up by investors to equal extents. In general, corporate governance is the

concept that most easily captures mainstream minds. The understanding and integration o

inancially-material environmental issues has also advanced greatly in recent years, with a

particular emphasis on the opportunities presented by responses to environmental challenges.

Degreeofprogress

Strong

Moderate

Weak

Phase 1. Experimentation 2. Industry-wide

innovation and

learning

3. Institutional com-

mitment

and scaling up

4. Full

Integration

Key actors Pioneers, lone rangers Experts and leaderswith varying degrees oinstitutional backing

CEOs, CIOs All levels

Activities

and

symptoms

Ad hoc initiatives byindividuals

Specialist teams, ocuson high ESG-exposurebusiness and oncertain product andclient segments, learn-ing through in-houseand industry-wideplatorms

ESG integrationbecomes part o thecore strategy, scope oESG integration rapidlyexpands to all typeso relevant businessactivities, regions, assetclasses and client types

ESG ocus is integralpart o core invest-ment strategy andprocesses gener-ally accepted as bestpractice

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

16/44

17

However, the response o investors to social issues, such as workplace health and saety, hu-

man rights and companies stewardship o intellectual capital, has lagged.

As described in the ollowing sections o this progress report, the actors have also progressed

at dierent rates. In act, there has been something o a transormation:

In2004anumberofassetownersexpressedastrongbeliefinESGasavalueadd,and

challenged asset managers and research providers to take up these issues. Investment

research was oten seen as a blockage between increasingly enlightened ESG practices at

the corporate level and uptake by investors

By2008researchersandotherserviceprovidershadmadesomeofthebiggeststrides

orward, begging dicult questions in terms o how asset managers are integrating ESG

issues and whether asset owners were really writing ESG-inclusive mandates

As the innovation and learning phase comes to a close we stand at the brink o more system-

atic and proound changes to the role o ESG issues in investment. We cannot, however, expect

this to happen without the sincere commitment o the industrys senior executives. Indeed,industry proessionals repeatedly stressed the importance o the human resources aspects o

mainstreaming, including:

Leadershipatthetop(CEOsupport)

Institutionalcommitmentthroughoutafullmarketcycleave-yearplan,notjustafair

weather approach

Theneedforeducationandincentivesystemsatalllevels

Asupportivecorporateculture,coupledwithself-condenceandtheconvictionthatthe

ESG bet will pay out over the long term

ESG mainstreaming requires both substance and intelligent communications. The pioneers ophases 1 and 2 should be conscious o the perceptions that they create in the investment com-

munity. For example, experts should check whether by constantly emphasising ESG as some-

thing special they have contributed to pigeonholing the issues. Likewise, gaining traction with

ESG sceptics will also involve being honest about situations when ESG issues are not material

relative to other considerations.

The industry and its stakeholders should also be realistic in their time expectations, and acknowl-

edge that large organisations have dierent speeds o change. ESG is, ater all, unlikely to have a

near-term, disruptive eect on the inancial industrys business model in the way that, or example,

hedge unds have. Rather it is about doing traditional investments better. ESG integration is there-

ore necessarily long term and adds value at the margin, making it understandable that change hassometimes been slow.

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

17/44

18

Asset owners and investment consultants

Asset owners

Industry proessionals that participated in the Who Cares Wins consultations commented that

the awareness o asset owners o ESG issues has improved more than expected7 , but that

the level o implementation investing in an ESG-inclusive manner was underwhelming.

Given asset owners position at the top o the investment chain, a move to a higher level o

implementation o ESG commitments will be a major boost to ESG integration throughout the

system.

In contrast, individual and collaborative active ownership activities (engagement with com-

panies, other issuers and regulators on ESG issues, exercise o voting rights, etc.) have made

good progress since 2004.

Although a number o large asset owners, such as the Environment Agency (England and

Wales) Pension Fund and the Fonds de rserve pour les retraites (FRR) in France, have issued

asset management mandates that explicitly require ESG integration, these have been the

exception, rather than the rule. Moreover, action in this area has been dominated by institu-

tional asset owners whose beneiciaries are either public sector employees or broad groups o

citizens / tax payers (e.g. pension reserve unds). Despite theoretical work on long-term, ESG-

inclusive mandates carried out by Hewitt / the Universities Superannuation Scheme (USS), the

Marathon Club, and others, most o the signals sent out by owners are not asset backed.

Asset managers that participated in WCW consultations noted that they:

DonotseetheESG-inclusivemandates

DoubtwhetherESGcapabilitiesgenuinelyhaveaninuenceintheselectionofexternal

managers

Findithardtogetconstructivefeedbackfromassetownersonwhatmanagersaredoing

on integration, reporting, etc.

The lack o concrete action does not necessarily indicate a lack o sincerity on the part o as-

set owners. It may rather be that many simply lack the governance and human resources to

implement their commitments to ESG. It is perhaps no coincidence that many o the most

7 It less clear what is happening outside the group o PRI signatories. In addition, corporate pension unds are con-

spicuously absent rom the debate, with the exception o a ew large company deined-beneit schemes (which have

been active in the PRI)

Action areas* Assessment of progress 20042008**

1. Consider ESG issues in ormulation o mandates / selec-tion o managers / in-house management

Weak

2. Implement active ownership strategies inclusive o ESGissues

Moderate

* As deined by the original Who Cares Wins report in 2004** For an explanation o the scale please see the beginning o the section on progress on ESG integration

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

18/44

19

robust ESG actions have come rom large asset owners such as ABP (and their manager APG

Investments), the BT Pension Scheme and FRR, where strong governance systems and experi-

enced teams are present.

Asset managers urged owners to make real their commitments to ESG by explicitly mandating

managers to integrate the issues, and by ormalising the role o ESG capabilities in the managerselection process.

More positively, the use o active ownership approaches to ESG has increased notably among

asset owners. Initiatives such as the PRI Clearinghouse8 and specialist engagement service

providers have allowed asset owners (and asset managers) to pool resources, ampliy their

voice and reduce costs9. ESG-speciic engagements through the PRI, the CDP, etc., are just a

component o a larger trend o asset owners making greater use o their ormal and inormal

ownership rights.

According to industry proessionals the obstacles that asset owners most requently encounter are

entrenched belies and misconceptions about ESG, and limited empirical evidence around ESG as avalue-adding strategy. However, the number o asset owners that believe there is a conlict be-

tween ESG integration and iduciary (or equivalent) duties has reduced considerably in number.

Another obstacle to more decisive action by asset owners is the ability o their own resources

and governance structures to support ESG integration. Any discussion o an asset owner taking

on ESG needs to be accompanied by an evaluation o the governance and time budgets avail-

able in-house. i.e. is the owner apt to manage ESG issues himsel, or should it be outsourced to

service providers?

Smaller asset owners oten have inadequate governance to deal with the complexity o ESG. More-

over, the incentives or the iduciaries o asset owners o all sizes to adopt apparently risky, newapproaches are low. Industry proessionals pointed to the importance o investment consultants

guiding their clients through ESG integration (a role that is rarely actively played).

However, an enabling environment will not be created solely by improved owner governance and

leadership rom consultants. In some cases asset owners require stronger statements by beneicia-

ries and regulators conirming that ESG integration is entirely consistent with their responsibilities.

The Who Cares Wins consultations also reminded us o the need to consider the role o asset

owners other than pension unds. Pension unds are oten seen as the panacea or all market

ills, whereas in reality other large asset owners such as insurance companies, sovereign unds

and private wealth must also be part o the discussion. These other owners may have at leastas great an interest in long-term, ESG-inclusive strategies as pension unds.

8 Other important collaborative initiatives in this space include the Carbon Disclosure Project (CDP), the

International Corporate Governance Network (ICGN) and the Institutional Investors Group on Climate Change

(IIGCC). Please also reer to page 38 o the appendices or a more complete list o initiatives

9 It should, however, be noted that the advantages o outsourced engagement services can sometimes be accom-

panied by the disadvantage that the signal sent to companies may be weaker than i the asset owner or manager was

dealing with the company directly

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

19/44

20

The clear message let by the Who Cares Wins Initiative is that without the sincere engage-

ment o asset owners o all descriptions the scaling up phase o ESG integration will not

happen. The time has come or asset owners to turn their stated commitments to ESG into

concrete interactions with their service providers. This report proposes such a step in the rec-

ommendations on page 32.

Investment consultants

A discussion o the importance o asset owners to ESG integration should clearly also acknowledge

the gate-keeping role o consultants. However, many investment consultants have made little e-

ort to understand how ESG issues can enhance the services they oer asset owners 10.

There are, however, exceptions investment consultants such as Mercer and Watson Wyatt

have allocated signiicant resources to ESG issues.

The journey or consultants begins by developing and communicating a house view on the inte-

gration o ESG issues. Once the policy has been established, the challenge is to how systema-

tise the inclusion o ESG in standard services such as ormulating investment strategies and

selecting managers to implement those strategies.

As part o the latter, industry proessionals invited consultants to put lower weights on manag-

ers recent track records, and greater weights on the ability o managers to deal with emerging

issues, including ESG.

The leading consultants have begun to rate managers in their databases in terms o ESG ca-

pabilities (not only or the beneit o clients with an expressed interest in ESG). However, much

like investment research, until such time as ESG becomes a ixed component o the standard

manager evaluation model, claims that ESG issues can be material to all investors will appear

incongruous.

Consultants should also lead smaller asset owners through these diicult issues, proactively pro-

posing solutions that are appropriate or the owners governance budget and in-house capacity.

10 Standard investment consultancy tasks include investment strategy, asset allocation / asset-liability modelling

and manager selection / monitoring

Action areas Assessment of progress 20042008

1. Consider ESG issues in ormulation o mandates /selection o managers / in-house management

Weak

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

20/44

21

Asset managers

Some o the strongest progress in the asset management community has been in terms o sourcing

ESG-inclusive investment research rom service providers. On the other hand, other actors in the

investment system have doubts about how that research is used within asset managers, and about

the robustness some o the current range o ESG-inclusive asset management strategies. Asset

managers themselves also cautioned that incentive systems within their organisations were oten

not aligned with the long-term goals o ESG integration.

The Enhanced Analytics Initiative (EAI) has been an important orce in signalling the desire

o asset managers to see investment research on the ull range o risks and opportunities to

which they are exposed. The call rom the asset manager members o the EAI has been unam-

biguous, and backed by commercial incentives or their service providers. The response to this

call by research providers is discussed on page 23.

However, the absolute levels o progress in the broader asset manage-

ment community are still low. Few asset managers are requesting and

rewarding ESG research (even among PRI signatories), and sometimes

even those who are making requests send contradictory signals to

research providers. The market or ESG-inclusive research requires bothbroader international reach and greater liquidity. The responsibility is

with the buyers to send appropriate signals.

A common complaint rom the sell side o this market is that it is unclear

how the research is actually being used by asset managers. Managers

ask or integrated research, but is there evidence or reciprocal integra-

tion eorts on the buy side, beyond high-level commitments and sel-

assessment o progress? Market participants suspect that there is a large

gap between policy and implementation at asset managers. It may be that

asset management CEOs make public commitments (such as signing the

PRI) without consulting the CIO and other key personnel on the structures that need to be putin place to implement the commitment.

The message sent by research providers is that requests or enhanced research must be ac-

companied not only by commercial incentives, but also by clarity on how managers use the

research, and more broadly how ESG policies translate into integration into asset management

products and services (in all asset classes).

Once again we see that the concept o a simple, one-way chain, with requests issued by up-

Taking into account

inancially-material ESG

issues improves the quality

o investment decisions. Italso makes the investment

system as a whole more

uture proo and ultimately

may help to avoid heavy-

handed regulatory interven-

tions.

Burkhard Varnholt

Chief Investment Officer,

Bank Sarasin

Action areas Assessment of progress 20042008

1. Request and reward ESG research rom sell-side /independent research

Weak / moderate

2. Integrate material ESG issues into investment

processes

Weak / moderate

3. Incentivise employees in charge o ESG integration Weak

4. Proactively oer ESG inclusive investment products andservices

Weak / moderate

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

21/44

22

stream clients to downstream providers, provides an unsatisactory description o the invest-

ment system. When upstream participants request disruptive changes to the way the system

works, they must accompany their requests with assurance that their own actions will be

transparent, and that risks taken will be reciprocated.

This requirement or an enabling environment applies equally to the direct interaction be-tween asset managers and company management. In order to enable the disclosure by

companies on key ESG issues, and management engagement at the highest levels o investee

companies, asset managers must be clear about the inluence that ESG inormation has on

their investment decision-making.

However, integration o ESG into orthodox investment rameworks is a real challenge or many

asset managers, as is shown in the chart below.

PRI signatories find integration of ESG into investment decision-making the hardest part of

their commitment

Ranking o principles rom most diiicult to implement to least diicult to implement (Q117)

Source: Principles for Responsible Investment, PRI Report on Progress 2008

The lack o consistency in ESG data and research may explain some o these diiculties.

However, asset managers in countries such as Australia have advanced their ESG integration

eorts, despite the paucity o research on that market.

0

20

40

60

80

100

120

140

160

Principle 6:

reporting

Principle 5:

collaboration

Principle 4:

PRI promotion

Principle 3:

seek disclosure

Principle 2:

active ownership

Principle 1:

integration

Hardest

2nd hardest

3rd hardest

3rd easiest

2nd easiest

Easiest

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

22/44

23

In contrast to integration, engagement with companies, other issuers and regulators on behal

o asset owners can be a powerul way or managers to embrace ESG, and is oten the least

threatening change or mainstream proessionals to make. However, in the long term this could

be counterproductive, i engagement creates a smokescreen that obscures less impressive e-

orts on the integration ront.

From the point o view o asset owners and their consultants, the transparency o asset

management products is currently a problem. There is oten a gap between how a product is

marketed and what it actually does. Many asset managers also try to serve traditional SRI in-

vestors and inancially-driven investors with the same strategy. Owners eel that this bundling

o clients is unlikely to deliver satisactory outcomes over the long term.

Finally, the gap between policy and implementation also maniests itsel in terms o the incentives

or rank and ile buy-side researchers and portolio managers to embrace ESG. The onus is clearly

on senior management to communicate clear goals and provide strong incentives or employees.

For asset managers that give clear guidance to companies and research providers on how ESGinormation is used, that develop ESG-inclusive strategies that are transparent about their

objectives, and that align the incentives or employees and service providers with their policies,

ESG provides a great business opportunity.

Indeed, industry proessionals were surprised that ew large asset management houses were

using ESG as a dierentiator. So ar this role has been let to niche asset managers.

Investment researchers, data providers and rating agencies

A big step orward has been made in the past years by academics and

investment researchers in developing the analytical rameworks and

demonstrating the rationale or ESG integration in investment research.

Leading sell-side research institutions have published comprehensive

methodologies or ESG integration and have demonstrated that quantiy-ing inancial impacts o ESG issues, in spite o their oten uncertain and

long-term character, is absolutely within the reach o the analysts pro-

ession. This is one o the most important legacies o the innovation and

learning phase and an important basis on which the next phase (institu-

tional commitment and scaling up) can build.

Likewise, in terms o the actual coverage o ESG issues in mainstream

investment research, the industry has made important strides rom a low

Action areas Assessment of progress 20042008

1. Develop the investment ramework and rationale orESG integration

Moderate / strong

2. Integrate ESG issues into mainstream research, widensector coverage

Weak / moderate

3. Widen coverage o emerging markets Weak / moderate

There is an increasing

recognition o the need to

include the analysis o ESG

actors in order to more

completely ulil this duty

[to act in the best interests

o clients and ultimate

beneiciaries].

CFA Institute

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

23/44

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

24/44

25

the leader in quick succession. Participants also suggested that gaps in the research agenda

present ideal opportunities or academics and investment researchers to collaborate12. For

example:

Moreworkneedstobedonenotjustonmicroissuesforcompaniesbutalsoontheimpact

o ESG issues on long-term macro drivers and asset allocation Fixedincome/creditresearchwasalsoseenasacrucialgap.Thereisalotoffocusonsell-

side equity research, but it has been very hard to engage sell-side xed income researchers and

the big three rating agencies, even on the most widely-accepted corporate governance issues

The main obstacles or better ESG integration mentioned during WCW consultations were

insuicient incentive systems or analysts13, the high cost o building up the new research oer

(versus relatively low demand rom clients), and the lack o comparable company data on ESG

issues.

The irst point calls or more leadership by senior management, the second or a air split o

costs and beneits between users and producers o the research.

In terms o better data availability, voluntary standards such as the Global Reporting Initiative

and the services o specialist data providers have led to certain improvements. However, sev-

eral participants in WCW consultations were convinced that this is not enough and that govern-

ments should mandate minimum ESG disclosure standards or companies in order to improve

data availability.

Regulators, exchanges, professional bodies, etc.

The 2004 Who Cares Wins report mentions that regulatory rameworks should require a

minimum degree o disclosure and accountability on ESG issues rom companies, as this will

support [ESG integration into] inancial analysis. The ormulation o speciic standards should,

on the other hand, rely on market-driven voluntary initiatives.. Since then, through the eorts

undertaken by several exchanges14

and voluntary initiatives (such as the Global Reporting Ini-tiative and the Carbon Disclosure Project), disclosure levels and the comparability o ESG data

have improved. But the battle on ESG perormance disclosure is not yet won, and some invest-

12 Platorms or collaborations between academics and industry practitioners already exist, such as the Mistra

Sustainable Investment Research Platorm and the new PRI / ECCE Academic Network

13 The bundled commissions model by which most research is remunerated is an important component o this

obstacle

14 A number o exchanges have introduced minimal ESG disclosure standards as part o their listing particulars. The

World Federation o Exchanges has been active in this space

Action areas Assessment of progress 20042008

1. Require minimum degree o disclosure / accountability

rom companies

Moderate

2. Establish that ESG integration and iduciary obligationsare compatible

Moderate

3. Incorporate ESG issues in proessional curricula andsupport knowledge and awareness building in theindustry

Weak / moderate

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

25/44

26

ment proessionals called or regulators to maintain the pressure on companies and consider

mandating minimum disclosure standards.

In the coming years, not only companies but also inancial institutions, especially pivotal players

such as the large credit rating agencies, should improve disclosure o their ESG integration eorts15.

Regulators can play an important role here by supporting voluntary initiatives and neutral platorms

through which the inancial sector can report on ESG integration eorts.

Overall, the message rom the WCW consultations is that, given the complex and technical

nature o ESG integration, governments should not play an active role at the micro level but

should ocus more on deining the right boundary conditions or the system as a whole. E.g.

sending price signals to companies and the inancial sector by putting a price on public goods

such as clean air and water.

When Who Cares Wins started, many investors were uncertain as to whether ESG integration

was compatible with their iduciary responsibilities. The publication o a Freshields Bruckhaus

Deringer / UNEP FI study on this issue

16

, and the debate that has taken place within the indus-try since then, have made it clear that integration o material ESG issues is not only compatible

with but may be a requirement o iduciary responsibility.

In practice, however, many iduciaries are still conused on this point. Regulators could sup-

port ESG integration by communicating explicitly to the industry that they see no contradiction

between a thoughtul consideration o material ESG issues and iduciary responsibilities.

It should also be remembered that governments also own large pools o inancial and other

assets. Participants at WCW consultations stressed that government investors and multi-

lateral agencies should walk the talk when it comes to investing their own capital in a more

ESG-inclusive way. This would not only add to the pool o ESG-inclusive assets, but also sendimportant signals in terms o governments long-term support o the industrys ESG integration

eorts.

The role o proessional bodies and curricula in increasing the industrys awareness and knowl-

edge and in better training young proessionals in the ield o ESG was repeatedly stressed

throughout the WCW Initiative. Several initiatives by proessional bodies have been undertaken

in the course o the past years but a lot still remains to be done to counter the prevailing scepti-

cism. The recent more active role undertaken by the CFA Institute in this area is very encourag-

ing in this respect.

15 While respecting the proprietary nature o the rating agencies methodologies

16 Freshields Bruckhaus Deringer / UNEP Finance Initiative: A legal ramework or the integration o environmental,

social and governance issues into institutional investment, October 2005

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

26/44

27

3. A ocus on emerging markets investment

The role o ESG issues in emerging markets investment was a particular area o ocus or Who

Cares Wins17. This section summarises key indings and speciic recommendations in this area.

Industry proessionals that participated in WCW consultations noted thatthe investment case or considering ESG issues in EM investments is on

average stronger than in the case o developed market investments.

Departures rom ESG best-practice tend to be larger in the worst-case

EM companies (compared with worst-case developed market companies)

and a relative lack o oversight by regulators and gatekeepers such as

analysts and institutional investors results in weaker investor protection

and ultimately higher agency costs.

Participants also remarked that ESG issues in EM can have a proound

impact not only at the micro but also at the macro level (including theimpact on long-term growth rates o issues such as political stability,

governance, corruption, education levels and public health).

An important insight is that emerging markets should not be viewed

monolithically by investors country speciicity and contextualisation are

crucial. In addition, international investors have a tendency o ocussing on downside mitigation

when considering ESG issues, without spending time on the upside potential o ESG integration.

Interestingly, perceptions about which ESG issues are most inancially material oten dier be-

tween international and local emerging markets investors. Local investors oten point to social and

governance issues as being most relevant, at least in the short term, whereas the ocus o interna-tional investors tends to be on environmental issues18. Governance issues are generally o high rel-

evance in the EM context. This is particularly true in the case o the many EM companies controlled

by governments and amilies.

WCW participants highlighted the act that there has not been much progress in the past years

in terms o asset owners19 allocating more capital to ESG-inclusive EM investment strate-

gies. This was seen as a major impediment or better ESG integration throughout the industry.

Participants also stressed the act that international investors should be more aware o their

central role in establishing high standards o disclosure and ESG practice and should consider

investing capital not only to established EM but also to rontier markets20.

17 The Who Cares Wins event in Geneva in July 2007 was dedicated to this subject

18 The chart on page 29 illustrates that the ESG questions that investors most requently pose to EM companies

are on environmental perormance and governance

19 Including multilateral inancing institutions

20 Countries whose markets are in the tier below emerging markets in terms o investability are generally classiied

as rontier markets

Nowhere are issues such

as air pollution, water scar-

city and social exclusion

as tangible as in emerg-

ing markets. Enlightened

investors will not only see

the risks but also the huge

opportunities presented

by responsibly engaging in

these rontier market op-

portunities.

Hendrik du Toit

Chief Executive Officer,

Investec Asset Management

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

27/44

28

The lack o ESG research on EM companies was seen as one o the reasons or asset owners

caution in this area. This creates an impasse where research providers are not willing to bear

the cost o developing an expensive ESG research service without a stronger commitment by

asset owners. To unblock this impasse, urther support rom public institutions acknowledging

the public good character o this research may be needed21.

Participants also signalled the paradox o developed markets asset managers that have a strong

ESG pedigree in their home markets do not apply ESG strategies to their EM investments.

Direct engagement with companies and with regulators and exchanges is a key enabler o ur-

ther mainstreaming o ESG in EM. Leading companies and exchanges22 in EM have oten been

very responsive to international investors interest in ESG issues, as was noted during WCW

consultations.

In terms o engaging with regulators in EMs, concert party rules can sometimes inhibit collabora-

tion between investors. Using investors with appropriate local knowledge as a coordinator and

third-party engagement services are both viable alternative mechanisms in emerging markets.

It was also noted that ESG-inclusive indices or EM can be a valuable awareness-raising tool

or both companies and investors. They also serve as a basis or developing investment prod-

ucts, both active and passive.

21 An example is IFCs grant competition or better ESG investment research in emerging markets. IFC has also

commissioned a survey o EM asset managers ESG capabilities and worked with industry partners on ESG-inclusive

strategies or EM

22 The World Federation o Exchanges and single stock exchanges such as the JSE Securities Exchange (South

Arica) and the So Paulo Stock Exchange (BOVESPA) have been active in this regard

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

28/44

29

Perceptions of the importance of different ESG issues vary in the chart below EM companies

described the issues that investors raised most frequently

Source: IFC / Economist Intelligence Unit survey, 2007

The inputs received during WCW consultations lead to the ollowing key recommendations or

investors seeking to improve the integration o ESG issues in their EM investments:

IncludeESGissuesinregularcompanymeetingsandengagementactivities

PerformasystematicreviewoftheESGexposureofinvestmentsinemergingmarkets.

Take into account the act that ESG issues in EM can also aect global investment porto-

lios through macroeconomic eects and the increasing operational exposure o non-EM-do-

miciled companies to EM. Not only equity investments, but also other asset classes (xed

income, inrastructure, project nance, real estate, etc.) are potentially exposed

ConsidercollaboratingwithotherinvestorsinrequiringminimumESGdisclosurestandards

rom EM regulators and exchanges

23

Considerthepotentialforsmallallocationstofrontiermarketsnotonlytodeliverattrac-

tive returns but also to establish basic investability conditions (such as custody, ecient

settlement services, etc.) and management awareness o material ESG issues

23 Examples include ASrIAs engagement with the Hong Kong Stock Exchange on IPO listing particulars, the eorts

o the Carbon Disclosure Project (CDP) to improve carbon disclosure in India and Brazil, and Calverts initiative to

improve ESG disclosure in EM

0% 10% 20% 30% 40% 50% 60% 70%

Social: Other

Environmental: Other

Governance: Other

Social: Commitment to human rights

Social: Workplace standards

Environmental: Climate change

Governance: Minority shareholder rights

Social: Lack of corruption

Governance: Independence among directors

Social: Safety and health benefits of products

Social: Labour standards

Governance: Disclosure/transparency

Environmental: Environmental performance

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

29/44

30

4. Ten recommendations to accelerate ESG integration

The experts we consulted were asked to help to ormulate a limited set o strategic recom-

mendations or key actors (mainly asset owners, asset managers and investment researchers).

We attempted to answer the question, What needs to happen or ESG integration to become

widespread in the course o a 3-4 yr time horizon?

We targeted recommendations or the industry and related actors that are actionable (not

purely aspirational) and economically rational. In ormulating these recommendations we have

also tried to stress the systems nature o the challenges that ESG mainstreaming will ace,

which we set out on the ollowing page.

We emphasise the systems view because we believe that the concept o a simple, one-way low

o demands rom asset owners at the head o the investment chain down through their agents

does not relect the complexities o the interactions in the investment system.

The model shown in the ollowing chart takes a more dynamic, systems-orientated view o theinteractions. When upstream participants request disruptive changes to the way the system

works (BLUE arrows in the chart), they must accompany their requests with assurance (coun-

ter-requests) that the changes they make themselves will be transparent, and that risks taken

will be reciprocated (GOLD arrows in the chart).

For example, requests rom asset owners or ESG-inclusive investment strategies must be

accompanied by awards o mandates that make the asset managers ESG capabilities a ormal

component o the manager selection process. The mandate must also give the manager com-

ort that the perormance criteria are suitable or the type o strategy being requested (e.g. by

using longer-term, rolling perormance measures).

Likewise, when asset managers request improved ESG-inclusive research rom service provid-

ers, they must show that the research will inluence the way they spend their brokerage or

research budgets, and that investment decision-making is inluenced by the research.

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

30/44

31

Regulators

andgovernments,exchanges

Academia,thinktank

s,supportinginitiatives(e.g.PRI,ICGN)

Beneficiaries

Assetowners

Companies

Investment

researchers

Assetmanagers

Investmen

t

consultant

s

Requirementsforgreatertransparency

InternalisationofESG

costs

Assuranceoncompatibility

withfi

duciaryresponsibilities

Innovativeinvestmentstrategies

Research

Mandates;appropriate

performancemeasurement

Thoughtleadership

Groundworkresearch

Lowercoststo

entrythroughcollaboration,

dissemin

ationofbestpractice

Transparent

use;

willingnessto

payforres

earch

EvidencethatESG

drivesinvestmentdecisions

Reliabledata;

managment

engagement

Data

providers

Rating

agencies

REQ

UEST

COUNTER-REQUEST

Enablingchangeinacom

plexsystem

-

8/14/2019 Outcomes of the Who Cares Wins Initiative 2004-2008 (January 2009)

31/44

32

Recommendations

The strength o the discussions with industry proessionals that took place during the WCW Initiative has

been the systems view and the ocus on what is needed to unblock stalled situations and kick-start wide-

spread integration o ESG issues into investment markets. The conclusions o this process are described in

the ollowing set o ten recommendations or dierent investment market actors:

1. All investment actors: mobilise top management. CEO / CIO leadership is needed to unblock

stalled situations between dierent actors and agree on how to share the costs o urther

market-building eorts

2. Regulators and governments: require greater transparency on ESG perormance / integration

rom companies and investors. Engage in an open dialogue with the nancial industry on this issue,

and support neutral platorms aimed at ostering that dialogue. Walk the talk in terms o the way

you invest your own capital. Help the industrys integration eorts by giving a price to public goods,

thereby internalising external environmental and social costs

3. Asset owners: make ESG inclusion a specic criterion in new asset management mandates. Com-

mit to evaluating ESG capabilities systematically when ormulating mandates and selecting manag-ers. Proessional sta: increase the awareness and knowledge o trustees in this area

4. Investment consultants: develop and communicate a house view on the integration o ESG

issues. Be explicit about how that position is refected in your services (e.g. investment strategy,

asset-liability management / asset allocation and manager selection)

5. Asset managers (senior management): lead ESG integration by communicating clear goals

and providing appropriate incentives or employees and service providers (e.g. sell-side re-

search). Involve human resources / compensation managers in your planning

6. Asset managers: pro-actively develop and distribute investment strategies and services that

ocus on ESG as a tool or improving risk-adjusted return. Design integrated methodologies24

or ESG that go beyond simple screening approaches