Our VisionMs. Chin Lee Phing (MAICSA 7057836) 5HJLVWHUHG2IÀFH Suite 16-1, (Penthouse Upper) Menara...

Transcript of Our VisionMs. Chin Lee Phing (MAICSA 7057836) 5HJLVWHUHG2IÀFH Suite 16-1, (Penthouse Upper) Menara...

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Eagles are rulers of the skies with strong and focused vision. Their eyes are created for long distance focus and are said to be able to spot a rabbit 3.2km away. We have the vision of eagles as leader in the aerospace contract manufacturing industry. As leader, we perceive the world as our battlefield. Led by our values and strengths to perceive beyond the horizons, a bright future is our goal.

Our Vision and Focus

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

High GroundAlways on

Eagles love high altitude and are the only birds that can be found at 10,000ft high. They like to build their nest on high ground. For Golden Eagles, their nest are found on cliffs and mountains. Like eagles, we uphold highly our core values and business conducts. We value and respect our customers and suppliers. We are also responsible and accountable to our shareholders and employees.

The Spirit of SAM

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

OurCoreValues

Our core values are built upon the foundation of self-actualisation, goodness, uprightness and truth. These core values are deeply ingrained in our genetic make-up. The basis of who we are – our DNA. It makes us unique.

IntegrityOur pillar of long-term success that encompasses honesty, dedication and responsibility.

Value creationWe embrace a continuous improvement culture and formulate solutions through collective efforts to achieve extraordinary results.

CourageWe will accept change to take up challenges and seize opportunities that may arise.

CommitmentWe will go the extra mile to achieve our objectives and strive for higher standards in our endeavours.

CompassionWe care for others and offer support in times of difficulty in the community.

RighteousnessRighteousness is characterised by accepted standards of morality, justice, virtue or uprightness. Our every action will be consistent with these standards.

Serving OthersThis demands that we are not only fulfilled and enriched by what we do but also that others benefit from it.

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Contents

56.

58.

140.

143.

146.

149.

150.

Other Information

Financial Statements

Analysis of Shareholdings

Analysis of ICULS Holdings

Notice of Annual General Meeting

Statement Accompanying Notice of AGM

Administrative Details

Proxy Form

5.

6.

8.

10.

11.

16.

18.

24.

30.

32.

47.

53.

Corporate Information

Nurture for Success

The Management Team

Group Structure and Activities

Profile of Directors

Group Financial Highlights

Management Discussion and Analysis

Sustainability Statement 2017

Particulars of Properties

Corporate Governance Statement

Audit Committee Report

Statement on Risk Management and Internal Control

Management Discussion and Analysis

18-23Group Financial Highlights

16-17

(RM’ 000)

537,397

TURNOVER

0

100

200

300

400

500

700

600

2013 2014 2015 2016 2017

Sustainability Statement 2017

Sustainable Living is Our Promise to You

24-29

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017 5

Corporate Information

Company SecretariesMs. Ong Tze-En (MAICSA 7026537)Ms. Chin Lee Phing (MAICSA 7057836)

Registered OfficeSuite 16-1, (Penthouse Upper)Menara Penang Garden42A, Jalan Sultan Ahmad Shah10050 Penang.Tel: 604 - 229 4390Fax: 604 - 226 5860

Principal Place of BusinessPlot 17, Hilir Sungai Keluang TigaBayan Lepas Free Industrial Zone Phase IV, 11900 Penang.Tel: 604 - 643 6789Fax: 604 - 644 1700

RegistrarsPlantation Agencies Sdn. Bhd. (2603-D)

3rd Floor, Standard Chartered Bank ChambersBeach Street, 10300 Penang.Tel: 604 - 262 5333Fax: 604 - 262 2018

Board of Directors

Non-Independent Non-Executive Chairman

Mr. Tan Kai Hoe

Executive Director and Chief Executive Officer

Mr. Goh Wee Keng, Jeffrey

Non-Independent Non-Executive Director

Mr. Shum Sze Keong

Independent Non-Executive Directors

Dato’ Mohamed Salleh Bin Bajuri

Dato’ Seo Eng Lin, Robin

Dato’ Wong Siew Hai

Dato’ Sri Lee Tuck Fook

Mr. Lee Hock Chye

Datuk Dr. Wong Lai Sum

Audit Committee

Chairman

Mr. Lee Hock Chye

Members

Mr. Shum Sze Keong

Dato’ Mohamed Salleh Bin Bajuri

Dato’ Sri Lee Tuck Fook

Risk Management Committee

Chairman

Dato’ Wong Siew Hai

Members

Dato’ Mohamed Salleh Bin Bajuri

Dato’ Seo Eng Lin, Robin

Nominating & Remuneration Committee

Chairman

Dato’ Wong Siew Hai

Members

Mr. Tan Kai Hoe

Dato’ Seo Eng Lin, Robin

Mr. Lee Hock Chye

Investment & Divestment Committee(The Committee was disbanded after the financial year)

Chairman

Dato’ Mohamed Salleh Bin Bajuri

Members

Dato’ Sri Lee Tuck Fook

Mr. Lee Hock Chye

Vision beyond Horizons

AuditorsKPMG PLT (LLP0010081 - LCA & AF 0758) Level 18, Hunza Tower,163E, Jalan Kelawai, 10250 PenangTel: 604 - 238 2288Fax: 604 - 238 2222

Principal BankersCitibank BerhadHong Leong Bank BerhadMalayan Banking Berhad

Authorised CapitalRM200,000,000

Issued and Paid-Up Capital(Inclusive of share premium)(As at 31 March 2017) RM 193, 249, 767

Company Websitewww.sam-malaysia.com

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 20176

Nurture for Success

Like an eagle teaching its young to fly, catching them safely on its spreading wings

-

7SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Born with leadership and a sense of responsibility, eagles take care of their hatchlings and teach them survival skills. At SAM, our engineers are our assets. To nurture their engineering capabilities, our talent development programmes include attachments in SAM Group of Companies across Asia and Europe.

-

The Management Team

TAN GUAN THONG Chief Operating Officer, SAM Group of Companies

Age

Gender

Nationality

Date Joined

56

Male

Singaporean 15 Aug 2011

Academic / Professional

Qualification(s)

• BachelorofEngineering,Nanyang Technology University of Singapore, Singapore.

LIM KEAN THYEGeneral Manager, SAM Meerkat

Age

Gender

Nationality

Date Joined

50

Male

Malaysian

28 Jun 2010

Academic / Professional

Qualification(s)

• BachelorofElectrical&Electronics Engineering, Imperial College of

Science & Technology, University of London,

England, UK.

LIM HEE SENGPETERGeneral Manager, Avitron

Age

Gender

Nationality

Date Joined

55

Male

Singaporean

1 Jan 2017

Academic / Professional

Qualification(s)

• BachelorofMechanicalEngineering (First Class Honours), The Queens’ University of Belfast, UK.

•MastersofBusinessAdministration, University

of Leicester, UK.

TEO SIEW GEOKHELENChief Financial Officer,SAM Group of Companies

Age

Gender

Nationality

Date Joined

58

Female

Singaporean

15 Aug 2011

Academic / Professional

Qualification(s)

• BachelorofAccounting,National University of Singapore, Singapore.

From left to right

GOH WEE KENGJEFFREYCEO & Executive Director

Details are disclosed inProfile of Directors.

* Save as disclosed, the above management team

has no family relationship with any Director and/or major shareholder of SAM Engineering and Equipment, or any personal interest in any business arrangement involving SAM Engineering and Equipment and has not been convicted of any offence within the past 5 years.

Together, we are swifter and stronger than eagles

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 20178

-

HO PON CHOWGeneral Manager, Meerkat Precision

Age

Gender

Nationality

Date Joined

48

Male

Malaysian 15 Jan 1988

Academic / Professional

Qualification(s)

• ProfessionalCertificate(SPVM 2), Menengah Vokasional Butterworth, Penang, Malaysia.

YAP HAN LINOperations Director, SAM Precision - Aerospace

Age

Gender

Nationality

Date Joined

42

Male

Malaysian

16 Feb 2011

Academic / Professional

Qualification(s)

• BachelorofAerospaceEngineering (Honours), Royal Melbourne Institute of Technology, Victoria, Australia.

NITHIANANDA A/L VENNAYAGAM Operations Director, SAM Technologies

Age

Gender

Nationality

Date Joined

42

Male

Malaysian

22 Apr 2002

Academic / Professional

Qualification(s)

• BachelorofEngineering(Mechanical), University

Technology Malaysia, Malaysia.

NG BOON KEATChief Operating Officer,SAM Malaysia

Age

Gender

Nationality

Date Joined

49

Male

Malaysian 17 Apr 2006

Academic / Professional

Qualification(s)

• MastersofScience(Mechatronics

Engineering), De Montfort University of Leicester, UK.

SEE JORN JORN JEFFREY Operations Director, SAM Precision - Machining& SAM Tooling

Age

Gender

Nationality

Date Joined

40

Male

Malaysian 29 Dec 2005

Academic / Professional

Qualification(s)

• DiplomainCivil Engineering, University Technology Malaysia,

Malaysia.

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017 9

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 201710

Group Structure and Activities

LKT TECHNOLOGY SDN BHD

(418108-T) (currently dormant)

Design and manufacture precision tools and

machinery parts

SAM TECHNOLOGIES (M) SDN BHD

(1007889-D) (Formerly known as

ESMO Automation (M) Sdn Bhd)

Design, develop and manufacture automation

equipment

MEERKAT PRECISION SDN BHD (265589-V)

Manufacture of aircraft and precision engineering

components

LKT INTEGRATION SDN BHD

(455256-X) (currently dormant)

Develop and manufacture computer process control system for printed circuit board handling systems

SAM MEERKAT (M) SDN BHD (364889-X)

Integrate modular or complete equipment

LKT AUTOMATION SDN BHD

(75724-W) (currently dormant)

Design and assemble automation equipment

AVITRON PRIVATE LIMITED

(201116715M)

Manufacture aircraft components

MEERKAT INTEGRATOR SDN BHD

(479992-T) (currently dormant)

Design, manufacture and assemble metal and

non-metal ergonomic workstations and electronic

products

SAM TOOLING TECHNOLOGY SDN BHD

(265822-D)

Design, develop and manufacture trim and form

dies and suspension tooling for disk drive components

SAM PRECISION (M) SDN BHD

(43230-K)

Fabricate of precision tools and machinery and

precision engineering parts. Manufacture of aircraft and other aerostructure parts, spares and components.

SAM PRECISION (THAILAND) LIMITED

(0145543000048)

Manufacture dies, jigs, parts and cutting tools for disk drive,

electronics, semiconductor and other industries

MEERKAT TECHNOLOGY PTE LTD

(200008724 Z)

Design, manufacture and provide service support for semiconductor, electronics,

disk drive, medical, solar, LED and other industrial equipment

SAM ENGINEERING &

EQUIPMENT (M) BERHAD(298188-A)

-

SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017 11

SAM ENGINEERING & EQUIPMENT (M) BERHAD

Profile of Directors

Present Directorship(s) and/or Appointment(s) • DeputyChairman&Director,SingaporeAerospace

Manufacturing Pte Ltd• Member,BoardofGovernors,TemasekPolytechnic• President&ChiefExecutiveOfficer/Director,Accuron

Technologies Limited• CouncilMember,SingaporeRedCross• Director,SingaporePrecisionEngineeringLimited

Past Directorship(s) and/or Appointment(s) • Chairman&Director,SPRINGSEEDSCapitalPteLtd• Director,AdvancedMaterialsTechnologiesPteLtd• Director,EmploymentandEmployabilityInstitute• Director,GrowthEnterpriseFundPteLtd• Director,SPRINGEquityInvestmentsPteLtd• ChiefExecutive,SPRINGSingapore

51

Male

Singaporean

26 August 2015

17 August 2016 (Pursuant to Article 98)

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

Academic / Professional Qualification(s)• BachelorofArts(Physics)UniversityofCambridge,UK• MastersofScience(Management)StanfordUniversity,

USA

Non-Independent Non-Executive Chairman

TAN KAI HOE

-

12 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

DSPN, DMPN, Independent Non-Executive Director

DATO’ WONG SIEW HAI

66

Male

Malaysian

4 June 2007

17 August 2016 (Pursuant to Article 91)

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

Academic / Professional Qualification(s)• BachelorofScienceinMechanicalEngineering,UniversityofLeeds,UK• MastersofScienceinManagementScience,ImperialCollegeofScience&

Technology, University of London, England, UK

Present Directorship(s) and/or Appointment(s) • Director,PenangTechCentreBhd• Director,PenangScienceClusterBhd• Director,NationGateGroupBhd• Chairman,MalaysianAmericanElectronicsIndustry(MAEI),AMCHAM• HonoraryGovernor,AmericanMalaysianChamberofCommerce(AMCHAM)• Director,MalaysiaExternalTradeDevelopmentCorporation (MATRADE), Ministry of International Trade and Industry (MITI)• Member,PEMUDAH

Past Directorship(s) and/or Appointment(s)• VicePresident,TechnologyandManufacturingGroup(TMG),Intel• GeneralManager,AssemblyandTestManufacturing(ATM),Intel• VicePresidentandManagingDirector,AsiaPacificCustomerCenter,Dell

GOH WEE KENG, JEFFREYExecutive Director & Chief Executive Officer

58

Male

Singaporean

4 March 2008

17 August 2016 (Pursuant to Article 91)

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

Academic / Professional Qualification(s)• BachelorofScience(FirstClassHonours)inAeronautical Engineering Science, Salford University, UK• MastersofScience(TurbineTechnology),CranfieldUniversity,UK

Present Directorship(s) and/or Appointment(s)• Director,SingaporePrecisionEngineeringLimited• President&ChiefExecutiveOfficer/DirectorofSingapore Aerospace Manufacturing Pte Ltd• Chairman,SAM(Suzhou)Co.,Ltd• Chairman,Aviatron(M)SdnBhd• Chairman,AvitronPteLtd

-

13SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Non-Independent Non-Executive Director

SHUM SZE KEONG

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

55

Male

Singaporean

4 March 2008

3 September 2014 (Pursuant to Article 91)

Academic / Professional Qualification(s)• BachelorofScienceinAeronauticalEngineering,EmbryRiddle Aeronautical University, USA

Present Directorship(s) and/or Appointment(s)• IndependentNon-ExecutiveDirector,LafeCorporationLimited• GeneralManager,ShumEnterprisesPteLtd• Director,SingaporeAerospaceManufacturingPteLtd

Past Directorship(s) and/or Appointment(s)• SeniorIndustryOfficer,SingaporeEconomicDevelopmentBoard• ExecutiveDirector,GrandeHoldingsLtd• Consultant,GrandeGroupLimited

66

Male

Malaysian

15 March 2004

25 August 2015 (Pursuant to Article 91)

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

Academic / Professional Qualification(s)• CharteredAccountant,Ireland• MalaysianInstituteofAccountants(MIA)(Member)

Present Directorship(s) and/or Appointment(s) • GroupDeputyChairman,CRSCHoldingsBerhad• Non-IndependentNon-ExecutiveDirector,MiluxCorporationBerhad• IndependentNon-ExecutiveDirector,AsianPacHoldingsBerhad• SeniorIndependentNon-ExecutiveDirector,EdenIncBerhad• Directorforseveralprivatelimitedcompanies• TrusteeandTreasurerforTanSriMuhyiddinCharityGolfFoundation

Past Directorship(s) and/or Appointment(s)• Director,AmanahSahamSabahBerhad• Chairman,AgrobankBhd(formerlyknownasBankPertanianMalaysia)• ManagingDirector,JBSecuritiesSdnBhd• GeneralManager,MalayanBankingBerhad• Trustee,TabungMelayuPontianBerhadandYayasanKebajikanSDARA• IndependentNon-ExecutiveDirector,HabourLinkGroupBerhad

DPTJ, Independent Non-Executive Director

DATO’ MOHAMED SALLEH BIN BAJURI

-

14 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Independent Non-Executive Director

DATO’ SEO ENG LIN, ROBIN

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

66

Male

Malaysian

15 May 2006

25 August 2015 (Pursuant to Article 91)

Academic / Professional Qualification(s)• BachelorofEngineering(Mechanical),UniversityofMelbourne,

Australia• MastersofBusinessAdministration,NovaUniversity,Florida,USA

Past Directorship(s) and/or Appointment(s)• ManagingDirector,MotorolaTechnologySdnBhd• VicePresidentandDirectorofSupplyChainOperations,Motorola

Technology Sdn Bhd• MotorolaCountryPresidentforMalaysia

SSAP, DIMP, Independent Non-Executive Director

DATO’ SRI LEE TUCK FOOK

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

63

Male

Malaysian

8 July 2008

25 August 2015 (Pursuant to Article 91)

Academic / Professional Qualification(s)• Member,MalaysianInstituteofAccountants(MIA)• Member,MalaysianInstituteofCertifiedPublicAccountants• MastersinBusinessAdministration

Present Directorship(s) and/or Appointment(s) • IndependentNon-ExecutiveChairman,PesonaMetroHoldingsBerhad• ManagingDirector,WCTHoldingsBerhad• ExecutiveDirector,PavilionReitManagementSdnBhd• Directorforseveralprivatelimitedcompanies

Past Directorship(s) and/or Appointment(s)• VicePresidentofSamlingGroupinSarawak• ManagingDirector,RenongOverseasCorporationSdnBhd• Chairman,ExecutiveCommitteeontheBoardofPeremba-KentzLtd• ManagingDirector,CementIndustriesofMalaysiaBerhad• ManagingDirector,ParacorpBerhad• ManagingDirector,MaltonBerhad• Director,LandmarksBerhad

-

15SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

* Save as disclosed, the above Directors have no family relationship with any Director and/or major shareholder of SAM Engineering and Equipment, or any personal interest in any business arrangement involving SAM Engineering and Equipment and have not been convicted of any offence within the past 5 years.

Independent Non-Executive Director

DATUK DR. WONG LAI SUM

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

62

Female

Malaysian

1 October 2016

Not Applicable

Academic / Professional Qualification(s)• PhDBusiness,UniversityMalaya• MastersinPublicAdministration(MPA),UniversityMalaya• BachelorofScience(Hons)Biochemistry,UniversityMalaya

Present Directorship(s) and/or Appointment(s) • Director,PRGHoldingsSdnBhd• EconomicAdviser,MinisterofTransport,MinistryofTransportMalaysia• ConjointProfessor(Practice),FacultyofBusiness,UniversityofNewcastle,Australia• AssociateProfessor,FacultyofBusiness,TARUniversityCollege• Adviser,FacultyofBusinessandAccountancy,UniversityMalay• SingaporeBusinessAdvisoryGroup,UniversityofNewcastle• Director,PortKlangAuthority

Past Directorship(s) and/or Appointment(s)• ChiefExecutiveOfficerofMalaysiaExternalTradeDevelopmentCorporation(MATRADE)• Director,MalaysiaPetroleumResourcesCouncil(MPRC)• Director&Trustee,MalaysiaFurniturePromotionCouncil(MFPC)• Director,MyCEB(Tourism)• Co-Chairman,ProfessionalServicesDevelopmentCouncil,Malaysia(PSDC)• Adviser,NationalExportCouncil(MATRADE)

Independent Non-Executive Director

LEE HOCK CHYE

57

Male

Malaysian

8 July 2008

25 August 2015 (Pursuant to Article 91)

Age

Gender

Nationality

Date of Appointment

Date of Last Re-election

Academic / Professional Qualification(s)• BachelorofLaws(Hons),NationalUniversityofSingapore, Singapore

-

16 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Group Financial Highlightsfor the financial year ended 31 March 2017

Financial Year Ended

2013 2014 2015 2016 2017

TURNOVER (RM’ 000) 383,444 452,755 451,520 620,054 537,397

PROFIT BEFORE TAXATION (RM’ 000) 21,631 32,394 39,474 68,672 55,354

PROFIT AFTER TAXATION (RM’ 000) 19,960 28,316 34,634 63,094 43,607

EARNINGS PER SHARE (Sen) 27.97 38.84 42.42 73.55 36.33

DILUTED EARNINGS PER SHARE (Sen) 19.81 21.77 26.12 47.07 32.31

(RM’ 000)

537,397

TURNOVER

0

100

200

300

400

500

700

600

2013 2014 2015 2016 20170

10

20

30

40

50

70

80

60

2013 2014 2015 2016 2017

(RM’ 000)

55,354

PROFIT BEFORE TAXATION

0

10

20

30

40

50

70

80

60

2013 2014 2015 2016 2017

(Sen)

36.33

EARNINGS PER SHARE

0

10

20

30

40

50

70

60

2013 2014 2015 2016 2017

(RM’ 000)

43,607

PROFIT AFTER TAXATION

-

17SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

for the financial year ended 31 March 2017

Group Financial Highlights (Cont’d)

Financial Year Ended

2013 2014 2015 2016 2017

DIVIDEND (Sen) 8.30 17.25 32.20 40.31 17.23

CASH AND CASH EQUIVALENTS (RM’ 000) 38,213 97,961 103,585 173,644 99,001

NET ASSETS PER SHARE (RM) 4.13 4.48 4.46 5.08 3.61

RETURN ON EQUITY (%) 6.7 8.6 9.2 14.4 9.6

0

2

4

6

8

10

14

16

12

2013 2014 2015 2016 2017

(%)

9.6

RETURN ON EQUITY

(Sen)

17.23

DIVIDEND

0

10

20

30

40

50

60

2013 2014 2015 2016 2017

(RM)

3.61

NET ASSETS PER SHARE

0

1

2

3

4

5

6

2013 2014 2015 2016 2017

(RM’ 000)

99,001

CASH AND CASH EQUIVALENTS

0

50

100

150

200

2013 2014 2015 2016 2017

-

18 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

We started off under challenging circumstances in FY2017 but delivered a stronger performance in the second half of the year for both the Aerospace and Equipment business sectors.

Aerospace

Our aero-engine casing division was not able to sustain the revenue attained the previous year due to a reduction in the production rates for Airbus A380 aircraft program and the weak demand for business jets and industrial gas turbines (using aircraft derivative engines). However, the stronger USD versus MYR exchange rate and the delivery of parts for the new programs helped to bring our aerospace second half-year revenue to the level close to the previous year corresponding period.

Equipment

The business was negatively impacted by the weak Hard Disk Drive (HDD) market. However, revenue in the second half-year improved by 18.9% compared to the first half due to a pick-up in the semiconductor market.

The Group’s full year revenue was RM537.4m, 13.3% lower than the previous year revenue of RM620.1m. With the lower revenue and cost incurred for Aerospace start-up projects, the full year Profit Before Tax (PBT) for the Group was RM55.4m, a decrease of RM13.3m from the previous year profit of RM68.7m.

In FY2017, the Group invested RM82.8m in capital expenditure, of which RM76.1m was for new aerospace programs. The Group ended the year with a healthy projected order book of RM3.7 billion, an increase of RM200 million from the previous year.

The Company declared a first interim single tier dividend of 10.28 sen per ordinary share, and a special single tier dividend of 6.95 sen per ordinary share in June 2017.

REVIEW

Management Discussion and Analysis

First Half Performance:

Key Notes:

Aerospace:Lower revenue due to reduction in production rates for the Airbus A380 aircraft program and the weak demand for business jets and industrial gas turbines (using aircraft derivative engines).

Equipment:Lower revenue due to weak Hard Disk Drive market.

164

139

303

249

104

145

Revenue(RM’m)

Aerospace Equipment Total

Apr-Sep 15 Apr-Sep 16

18

.0

17.0

35.0

18

.7

10.2

8.5

Profit Before Tax (PBT)(RM’m)

Aerospace Equipment Total

Apr-Sep 15 Apr-Sep 16

-

19SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

18

.9

14

.8

33

.7 36

.7

13

.6

23

.0

28

9

12

3

16

5

Management Discussion and Analysis (Cont’d)

Key Notes:

Aerospace:Stronger USD versus MYR exchange rate, and start of production and the deliveries of parts for the new programs.

Equipment:A pick up in the semiconductor market enabled us to achieve higher sales compared to the preceding half-year.

Second Half Performance:

16

9

14

8

31

7Revenue(RM’m)

Aerospace Equipment Total

Oct 15 - Mar 16 Oct 15 - Mar 16Oct 16 - Mar 17 Oct 16 - Mar 17

Profit Before Tax (PBT)(RM’m)

Aerospace Equipment Total

Total Asset Employed

As at 31 March 2017, the Group’s total asset of RM580.9m was RM25.3m or 4.6% higher than that of 31 March 2016. The increase was mainly due to higher property, plant and equipment, largely as a result of investments in new aerospace projects.

FINANCIAL POSITION

Total Assets Employed(RM’m)

Property, Plant & Equipment

Intangibles & Other Assets

Trade Receivables & Other Receivables

Inventories

Cash & Cash Equivalents

FY2016

FY2017

100 200 300 400 500 6000

-

20 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Management Discussion and Analysis (Cont’d)

Capital Employed

The average capital employed in FY2017 was RM450m as compared to RM415m in FY2016.

Capital Expenditure

During the year, the Group invested RM82.8m in capital expenditure (FY2016: RM24.6m), of which RM76.1m or 91.9% was utilised for the new aerospace projects.

* Others include foreign currency translation reserve and hedging reserve** Loans relate to liability component of ICULS

Capital Employed(RM’m)

Equity

Others*

Loans**

100 200 300 400 500

FY 2016

FY 2017

0

Cash Flows

Operating Activities:The Group generated net cash of RM38.6m from its operating activities compared to RM103.5m in FY2016. Cash flows generated from operating activities before changes in working capital was RM73m, lower than FY2016 by RM9.1m. However, as a result of higher working capital requirements from higher sales in the second half of the year and more requirements of inventory to take over the management of raw material from one of the aerospace customers, cash flows generated from operations was RM51.5m as compared to RM108.8m in FY2016.

Operating Activities

(RM’000) FY2017 FY2016

Operating Activities before

changes in Working Capital

73.0 82.1

Changes in Working Capital -21.5 26.6

Income Tax -12.9 -5.2

“Net Cash from

Operating Activities”

38.6 103.5

FINANCIAL POSITION (Cont’d)

-

21SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Management Discussion and Analysis (Cont’d)

Cash Flows (Cont’d)

Investing Activities:Net cash used in investing activities of RM82.2m was primarily for investment in Plant and Machinery for the new aerospace projects.

Financing Activities:Net cash used in financing activities of RM51.5m was mainly attributable to FY2016 interim and special single tier dividend (RM50.7m).

FINANCIAL POSITION (Cont’d)

Cash Flows(RM’m)

FY 2016

FY 2017-100 -50 50 100 150

Financing Activities (31.9)

(51.5)

Investing Activities (24.1)

(82.2)

Net Cash from Operating Activities

103.5

38.6

0

FY 2016

FY 2017

Dividend

For FY2017, a total dividend of 17.23 sen per ordinary share (interim single tier dividend of 10.28 sen per ordinary share and special single tier dividend of 6.95 sen per ordinary share) was declared in June 2017 and represents 50% of our net profit. Based on the average share price of RM6.48, the dividend per share of 17.23 sen translates to a dividend yield of 2.66%.

Dividend Per Share(sen)

Interim / Final

Special

10

20

30

40

50

FY 2013 FY 2014 FY 2017FY 2015 FY 20160

-

22 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Management Discussion and Analysis (Cont’d)

Equipment Business

• SecuredthreenewcustomersthataremajorplayersintheSemiconductorindustry.

• Securedadditionalnewbusinessesfromcurrentcustomers.Oneprojectledustoincreaseour market share in big format machining with the Front-End Semiconductor customer, while another project requires the use of our existing cleanroom Class 1K assembly facility. This allows us to increase our work scope and value-add to our customers, as well as increasing the utilisation of our core assets.

• IncreasedthenumberofSemiconductorFront-Endcustomersandattainedamorebalancedmix of our revenue from HDD, Semiconductor Front-End as well as Back-End applications.

HIGHLIGHTS

Aerospace Business

• Initiatedproductionmodeanddeliveriesofaero-enginecasingproducts fornewaircraftplatforms – Airbus A320neo and Boeing 737max.

• Completedfirstarticleprocessandinitiateddeliveriesfornewaerostructureproductsforthe new Airbus A320neo aircraft platform.

• Secured first article approvals for more than 100 new part configurations in our newmanufacturing set-up of prismatic products. These parts are for Boeing B787, Airbus A350 and A320neo, and Bombardier C-Series aircraft platforms. Part production and deliveries have started.

Capital Expenditures

• WehaveinvestedRM82.2mthisfinancialyear,mostofwhichonnewmachinestoinitiateproduction and timely deliveries of parts for the new aerospace programs.

• Topreparefordemand increases in thecomingyears for thenewaerospaceprograms,we have secured additional factory space and will be investing in more machines over the next few years, as well as in automation to improve productivity and optimisation of our manpower.

• For the Equipment business,we have also increased ourmachining capabilitywith theprocurement and installation of a new 5-axis milling machine this year, and additional ones in the coming year. The investments are necessary to support the demand ramp-up of new programs, and will enable us to offer better solutions for more complex parts to our customers in the future.

Customers& Programs

ProductionLaunches

Investments

-

23SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Management Discussion and Analysis (Cont’d)

Aerospace

Global air travel remains strong, and the global airline industry is expected to be profitable again in calendar year 2017. With the airline industry’s return on invested capital (ROIC) projected again to be higher than the weighted average cost of capital (WACC) for the third consecutive year, this has translated to continued acquisition of new aircraft (for growth as well as replacement of old aircraft) by global airlines, with the narrow body configuration making up the bulk of orders. Driven by strong demand for next-generation aircraft, but off-set by declining orders for matured aircraft platforms, there is still an expected small increase in production rates of large commercial aircraft (from Airbus and Boeing) compared to the previous year.

The short-term market outlook will be positive for our aerospace business. We project an increase in demand for our parts used in the newly launched Airbus A320neo and Boeing 737max platforms, and steady demand for parts used in the still-popular Boeing B737 and B787 platforms. However, we will see a decrease in demand for parts used in matured platforms like the Boeing B777 and Airbus A380 platforms, and we believe demand will continue to be soft and uncertain for those used in business jet. Overall, our aerospace revenue is projected to improve in FY2018 compared to FY2017, and we continue to bid and secure more business to add to our order book.

The mid-term market outlook for aerospace is also healthy. The commercial aircraft backlog (for Airbus and Boeing), at ~ 13,500 aircraft units, is at record level, representing more than nine years of current yearly production rate.

Over the long term, passenger and freight air traffic are likely to grow at an average annual growth rate (AAGR) of 4.8% and 4.2% respectively, translating into a steady growth for aircraft production. Excluding regional jets, total global demand for new aircraft production over the next 20 years will be more than 35,000 aircraft units.

Equipment

Global sales of semiconductors increased towards the end of the last financial year, and is poised to remain strong, with semiconductor equipment spending expected to reach an industry all-time record in calendar year 2017 and extending further to 2018. This short term positive outlook bodes well for our Equipment business, especially with the securing of new customers and new programs related to the semiconductor equipment industry. Beyond the short term, it will be difficult to establish firm projections of the semiconductor market due to the dynamic nature of the industry and new market-disrupting developments.

For storage, specifically the Hard Disk Drive (HDD) market, we do not expect a positive outlook in the near term. HDD sales declined by more than 10% for the mobile and Personal Computer (PC) market in the first quarter of calendar year 2017. This is due to the continuing erosion of the consumer PC market and aggravated by the penetration of Solid State Drives (SSD). This has affected our orders with our customer involved in the HDD industry, and we do not expect the condition to improve very much in the coming financial year. However, we will be supportive of our customers’ strategy to develop products that serve the SSD market, and we believe this will help us to grow our revenue in our Storage-related business in the coming years.

OUTLOOK

We would like to thank all shareholders, stakeholders and supporters for the continued support for SAM Engineering & Equipment Berhad and the trust you place in us.

We would also like to express our appreciation to our Chairman and members of the Board for their dedication and support in guiding us towards greater achievements and success.

The Management Team

-

24 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Sustainability Statement 2017

We are pleased to launch our first Sustainability Report that encompasses three pillars of a successful sustainability programme, namely Economic, Environment, and Social. It is our Company’s commitment to change our values towards sustainability of businesses and communities. This report validates our commitment in creating long-term sustainable values to everyone connected to us. Additionally, this annual report on sustainability allows for greater transparency for our sustainable progress as we establish our priorities for the well-being of our stakeholders. Striving towards a cleaner and greener future with better social standards, we have contributed to the communities we serve through corporate responsibility efforts.

To this end, we want to ensure our sustainable business practices are embedded in our business processes, becoming a part of our value creation. It is important for us to create a positive environment for every stakeholder through sharing our sustainable accomplishments. In short, we continuously encourage our colleagues and business partners to achieve more in work and in life. As we progress, we shall create greater positive impacts to our business partners and the communities we serve.

Sustainable Living is Our Promise to You

-

25SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Our Sustainability Governance Structure

Our board of directors is accountable for sustainability strategies and performance while our CEO has overall management responsibility for sustainability. For the Group’s Chief Sustainability Officer, he is responsible for the overall operational sustainability performance.

Reporting Period & Scope

This Sustainability Statement is the Company’s first report that covers the operations for the Financial Year ending 31 March 2017. SAM Malaysia opted for an early adoption of Sustainability Statement as recommended by the regulators. (Para 29, Part A – Appendix 9C of LR)

The statement contains information that spans throughout our subsidiaries/operations in Malaysia, but excludes our operations in Singapore and Thailand. Information on the Group’s legal structure can be found in the Annual Report, page 10.

Materiality

We began by collecting a number of sustainability topics that have emerged from our understanding of sustainability. Subsequently, we weighted these topics based on the input from our internal stakeholders of different divisions and departments.

Through our discussion and reviews, we recognise saving resources and improving efficiency are our priorities. Moreover, our employees are very important to us, as we consider their expertise, experiences, efforts and commitments to the company are all important assets. Last but not least, our business partners are equally important to us as well as our community, for our cooperations have positive impacts in stimulating the economy.

Environment Management – Profit from Efficiency

It is our goal at all SAM sites to reduce the use of resources in our production sites. We always prefer more environmentalfriendly options when considering the purchases or replacements for our resources. We are also convinced of the need for the use of resources in careful and economical manners, in which the resources will go into our production processes. Consequently, we will continue to develop initiatives in our factories over the next few years. The followings include four (4) efforts we are executing:

Energy Saving & Carbon Footprint Reduction High Bay LED Lights were implemented from year 2015 to 2016. SAM Malaysia has upgraded its lighting system from the conventional High Bay Lights to LED Lights in its entire production floor across the Group. The result turned out to be remarkably prominent as the total lighting electricity consumption has reduced by approximately 75%or 1,162,749.6 kHW/Year.

1. Energy Saving & Carbon Footprint Reduction

Electricity Consumption

Total Convention HB Lighting (Previously)

Total LED HB Lighting (Current)

Total Saving

Per Year

1,097.3 MT CO2MT CO2283.4MT CO2813.9

CO2Per Year

1,567,620 kWHkWH404,870kWH1,162,749.6

kWH

SAM Malaysia has taken necessary steps to manage the environmental impacts for the past years. All of the metal chips produced during manufactures are recycled through licensed recycling companies in Malaysia in accordance with scheduled waste regulatory requirements; the total weight for the metal chips recycled is up to 500 metric ton per year.

2. Recycling of Production Waste

Sustainability Statement 2017 (Cont’d)

-

26 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Sustainability Statement 2017 (Cont’d)

To promote recycling in our business as well as our community, SAM Malaysia has minimised the usage of wooden products, especially for production and transportation. We changed the wooden crates to recyclable corrugated boxes for transportation and crates are being reused for “in-process” packing.

4. Reducing Wooden Crates & Pallets

SAM Malaysia has started to use battery operated forklifts to replace conventional fuel for forklifts in certain sites of the Group. Battery operated forklifts not only can produce zero emissions during operation, but they also reduce noise pollution in our workplace.

3. Reducing Carbon Emissions

Our Social Commitment – Caring for Our People & Community

Our employees play a significant role for the success of the company. Their safety in the workplace is our prime concern. Hence, we strive to reduce the numbers of accidents in our operations. In addition, the concern also includes our contractors and vendors who work for us. In short, SAM Malaysia endeavours to provide a safe working environment to all employees with a sole aim to minimise accident rates.

Comparing to ratio of male to female employees in our company, the heavy machinery manufacturing environment leads to a higher proportion of male employees. Nevertheless, we are committed to providing equal employment opportunities to everyone based on merits and talents. For our review of applicants (regardless of their race, gender, and age), we encourage talents to join our company as we provide equal opportunity at all levels, both at recruitment stage and through opportunities for development and promotion.

Workforce Statistic

Executive Non-Executive

40% 60%

Male Female

82% 18%

Age Group

-

27SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Sustainability Statement 2017 (Cont’d)

The Company conducted periodic meetings, on-site inspections and complied with all EHS legal requirements. Furthermore, briefings and trainings on health and safety were conducted for the workforce to create health and safety awareness in the workplace.

1. Protecting the Health and Safety of Our Workforce

The Company has appointed a committee on a yearly basis to coordinate and organise various activities involving employees of the Group to develop a positive relationship between managers and employees as well as amongst coworkers. The activities are not just about having fun, being healthy and feeling good about ourselves, but they also bring our people from different backgrounds together and open their hearts and minds.

In October 2016, the Group organised 2 cross country sports tournaments with teams representing SAM Singapore and SAM Malaysia. The tournaments served as a bridge between different business units of the Group and fostered the relationships amongst the employees of the Group.

2. SAM Sports & Recreation Committee

-

28 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

SAM Malaysia supports the students from low income families. We then further support some of them who have studied subjects that are of technological relevant to the Group. These students have signed the trainee contracts with SAM Malaysia and will have their contracts turned into full employee contracts upon graduation. Since 2011, SAM Malaysia has supported 630 students and a total of RM479,718 had been disbursed to the students.

3. Education Sponsorship Programme - Providing Financial

Aid to Children of Our Employees and Students

Their Foundations are Our Future

630 studentssupported by SAM

since 2011

Sustainability Statement 2017 (Cont’d)

-

29SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Sustainability Statement 2017 (Cont’d)

For every business SAM is involved, it requires local content/supports which account for about 25% of the Company’s yearly revenue. As we progress, we wish to push the figure higher in order to empower the business performances of our business partners. Furthermore, SAM Malaysia is posed to develop as well as to promote AS9100 certified suppliers over the next few years, estimatedly 3 to 5 years.

Positive Economic Impacts – Empowering Business Performance

Supplier Development Roadmap

SAM’s Order

Award of Contract to Supplier

Commercial Bid/Discussion

Identification of Packages

Technology Sharing/Transfer

1

2

3

4

5

6

Qualify/Select Suppliers

-

30 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

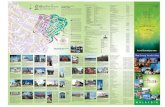

Particular of Propertiesheld as at 31 March 2017

1

2

3

4

5

1 2

Location Tenure Area(sq. ft.)

Build-uparea

(sq. ft.)

Description Approximateage of

building

Expirydate

Date of revaluation

Carryingamount as at 31 Mar 2017

(RM’000)

SAM TECHNOLOGIES (M) SDN BHD / LKT AUTOMATION SDN

BHD – PE2/4

Plot 7 Hilir Sungai Keluang 4,Bayan Lepas Free Industrial Zone Phase 4,11900 Penang.

Leasehold 60 years

111,988 18,472

26,000

Office &Factory

Office & Factory

26 years

19 years

9 September 2051

14 August2009

5,557

SAM PRECISION (M) SDN BHD – PE1

Plots 31-34 Lengkok Kampung Jawa 2,Bayan Lepas Non-Free Industrial Zone Phase 3, 11900 Penang.

Leasehold60 years

54,013 33,500 Office &Factory

33 years 22 November 2041

14 August2009

2,737

SAM PRECISION (M) SDN BHD / SAM TOOLING TECHNOLOGY

SDN BHD – PE5

Plot 77 Lintang Bayan Lepas,Bayan Lepas Non-Free Industrial Zone Phase 4,11900 Penang.

Leasehold60 years

131,104 67,500 Office &Factory

17 years 16 June 2057 14 August2009

8,065

MEERKAT PRECISION SDN

BHD / CORPORATE OFFICE

– PE3

Plot 17 Hilir Sungai Keluang 3, Bayan Lepas Free Industrial Zone Phase 4,11900 Penang.

Leasehold60 years

131,406 92,000 Office &Factory

21 years 14 May 2051 14 August2009

14,879

SAM MEERKAT (M) SDN BHD – PE6

Plot 103, Hilir SungaiKeluang Lima, Taman Perindustrian Bayan Lepas 4,11900 Penang, Malaysia.

SAM MEERKAT (M) SDN BHD – PE7

Plot 104, Hilir Sungai Keluang Lima, Taman Perindustrian Bayan Lepas 4,11900 Penang, Malaysia.

Leasehold60 years

Leasehold60 years

176,629

148,218

92,500

134,000

Office &Factory

Office &Factory

11 years

10 years

18 December 2074

23 April 2068

17 August2009

17 August2009

11,803

12,383

Note:1. The land area disclosed herein based on the survey conducted by Jabatan Ukur dan Pemetaan Pulau Pinang.2. ESMO Automation (M) Sdn Bhd has changed the Company’s name to SAM Technologies (M) Sdn Bhd, effectively from 23rd May 2017.

3 4 5

-

31SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Sanctuaries for Nurturing the

Best Leaders

-

32 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

SAM Malaysia is committed to meeting sound standards of corporate governance and it is our steadfast belief that such standards are essential to uphold business integrity and performance of the Company and its subsidiaries (“Group”). The Board of Directors (“Board”) and each individual Director is directly accountable to the shareholders and stakeholders for ensuring that good governance is practiced at every level of the Group’s operations, in compliance with Malaysian Code on Corporate Governance 2012 (“Code”). The main focus is to adopt the substance behind good corporate governance practices with the ultimate aim to ensure effectiveness and efficacy towards enhancing shareholder value.

The Group’s corporate governance practices are also guided by its Core Values which balance commercial and financial success with the interests of all stakeholders. The set of core values guides the Board, management and employees at all levels in the conduct and management of the business and affairs of the Group.

The Board is pleased to provide the following statement, which outlines the main corporate governance practices that were in place throughout the financial year and are currently still in place, unless otherwise stated.

Principle 1: Establish Clear Goals and Responsibilities

1.1 Clear Functions of the Board and Management

The Group acknowledges the pivotal role played by the Board in the stewardship of its direction and operations, and ultimately the enhancement of long-term shareholder value.

In addition, the Board has established clear functions reserved for the Board and those delegated to the Chairman, Board Committees, the Executive Director and management as part of initiative to enhance accountability. The Board has a formal schedule of matters reserved for its decisions to ensure that direction and control are within purview of the Board. Principal matters reserved for the Board include approving acquisition and divestiture, major capital expenditure, projects and budgets, quarterly and annual financial statements as well as monitoring of financial and operating performance of the Group.

The Board Committees refer to the Audit Committee (“AC”), Risk Management Committee (“RMC”), Investment & Divestment Committee (“IDC”) and the Nominating & Remuneration Committee (“NRC”). These Committees operate within specific terms of reference that were drawn up in accordance with best practices in the Code and function principally to assist the Board in the execution of its duties and responsibilities.

The authority and terms of reference of the Board Committees are reviewed from time to time with the aim to ensure its relevance and enhance its efficacy.

The clear demarcation of roles established in the Board Charter is the reference point for Board activities and reinforces the supervisory role of the Board going forward. The Board Charter provides reference for Directors in relation to the Directors’ and the Board’s role, powers, duties and functions.

Notwithstanding the delegation of specific powers, the Board retains full responsibility for the direction and control of the Company and the Group. The ultimate responsibility for decision-making on all matters lies with the Board.

The Chairman performs a leadership role in the conduct of the Board and its relations with the shareholders and other stakeholders. The Chairman is primarily responsible for the following, among others:

(a) leading the Board in the oversight of management;(b) representing the Board to shareholders and chairing general meeting of shareholders;(c) ensuring the adequacy and integrity of the governance process and issues;(d) maintaining regular dialogue with the Group Chief Executive Officer (“CEO”) over all operational matters and consulting

with the remainder of the Board promptly over any matters that gives him/her cause for major concern to optimise the effectiveness of the Board and its Committees;

(e) functioning as a facilitator at meetings of the Board to ensure that no member, whether executive or non-executive, dominates discussion, that appropriate discussions takes place and that relevant opinions among members is forthcoming. The Chairman will ensure that discussions result in logical and understandable outcomes;

(f) ensuring that all Directors are enabled and encouraged to participate in its activities. This includes ensuring that all relevant issues are on the agenda and that all Directors receive timely, relevant information tailored to their needs and that they are properly briefed on issues arising at Board meetings;

(g) ensuring that the Executive Director/CEO looks beyond his executive function and accepts his full share of responsibilities for governance and provides regular updates on all issues pertinent to the welfare and future of the Group to the Board; and

(h) guiding and mediating Board actions with respect to organisational priorities and governance concerns.

Corporate Governance Statement

-

33SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Corporate Governance Statement (Cont’d)

Principle 1: Establish Clear Goals and Responsibilities (Cont’d)

1.1 Clear Functions of the Board and Management (Cont’d)

The CEO is responsible for the day-to-day supervision of management and operations and leads the senior management team to ensure high level of work efficiency and optimum production activity.

Other key roles assumed by the CEO include the following:

(a) leads executive management of the Group’s business covering, inter alia, the development of a strategic plan; an annual operating plan and budget; performance benchmarks to gauge management performance against and the analysis of management reports;

(b) develops long-term strategic and short-term profit plans, designed to ensure that the Group’s requirements for growth, profitability and return on capital are achieved;

(c) effectively oversees the human resources of the Group with respect to key positions in the Group’s hierarchy, makes recommendations to the Board for recruitment of senior management staff, determination of remuneration as well as terms and conditions of employment for senior management and issues pertaining to discipline;

(d) assures the Group’s corporate identity, products and services are of high standards and are reflective of the market environment;

(e) acts as the official spokesman for the Company and takes responsibility for regulatory, governmental and business relationships;

(f) maintains and facilitates a positive working environment and good employee relations;(g) assists in the selection and evaluation of Board members through the NRC; and(h) assists the Chairman in organising information necessary for the Board to deal with the agenda and for providing this

information to Directors on a timely basis.

On the other hand, management is responsible for the execution of activities to meet corporate plans as well instituting various measures to ensure due compliance with various governing legislations.

1.2 Clear Roles and Responsibilities

The Board is responsible for the effective control of the Group. To that end, the Board has assumed and established the following responsibilities aimed at effective discharge of its functions:

(a) Review and formalisation of strategic direction for business sustainability

The management has established an annual strategy planning process aimed at developing business strategies and plans. These recommendations are then presented to the Board for deliberation and approval.

The Board also reviews and approves annual budgets including major capital commitment and expenditure. Generally, the annual budget and strategies are presented to the Board before the start of the new financial year.

(b) Identify principal risks and ensuring implementation of systems to manage risks

There is in place a dynamic risk management and internal control framework which is applied consistently throughout the year to identify, assess and manage significant risks faced by the Group. Details of the framework are more particularly spelt out in the Statement on Risk Management and Internal Control.

(c) Succession planning

The Board acknowledges that succession planning is a key responsibility and believes that a properly implemented succession plan will support operations and provide continuity following a change in CEO, senior management talent or key business leaders. The Board oversees the identification and development of key senior management talent through mentoring, training and job rotation. Separately, the NRC and the Human Resource division assist the Board to oversee Board succession planning by identifying suitable candidates for Board seats.

(d) Developing and managing investor relations program

The Group has set-up an Investor Relation (IR) structure and is in the process of developing its IR program and strategy. The CEO together with the Chief Operating Officer and Chief Financial Officer (“CFO”) are the main persons leading the communication with all stakeholders and respond to all queries in relation to Group activities, business and operations, financial results and prospects.

-

34 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Principle 1: Establish Clear Goals and Responsibilities (Cont’d)

1.2 Clear Roles and Responsibilities (Cont’d)

(d) Developing and managing investor relations program (Cont’d)

The IR employed key channels of communication such as the general meeting, electronic bulletin as provided by Bursa Malaysia Securities Berhad (“Bursa Securities”), press releases, Company website and analyst briefings as means to reach its audiences.

(e) Review adequacy and integrity of the Group’s internal control and management information systems

The Group has an in-house Internal Audit (“IA”) function which reports directly to the AC and assists the AC in the discharge of its duties and responsibilities.

The IA function’s key role is to review the integrity, effectiveness and adequacy of the Group’s system of risk management and internal controls.

Field audits are carried out by the IA service providers regularly in identified areas of concern. These reports are issued quarterly and the in-house IA function will scrutinise and coordinate management response before forwarding to the AC for review.

The AC conducts annual review of the IA function focusing on its resources and scope of work, among others. The AC reports to the Board, on quarterly basis, is part of scheduled matters which enabled the Board to be updated and maintains effective supervisory control in the Group.

(f) Establishing goals for management and monitoring the achievement of these goals

Management goals are defined in the strategies and annual budgets approved by the Board. Progress reports comparing actual to budget are presented to the Board quarterly for their understanding and decision-making as needed.

1.3 Formalise Ethical Standards Through a Code of Ethics

There is in place a Standard Code of Conduct, Business Ethics, Conflicts of Interest (collectively referred to as “Code of Ethics”) and Whistle Blowing Policy (“WBP”) within the Group. The Code of Ethics spells out the standards of ethics and conduct expected from both the Board and employees. The implementation of both the Code of Ethics and WBP reflects the Board’s commitment and sets the tone for proper ethical behaviour expected from all. The Board will take the necessary measures to ensure compliance by all with the Code of Ethics.

The WBP outlines when, how and to whom a concern could be properly raised about the actual or potential corporate fraud and or breach of ethics involving employees, Management or Director(s) of the Group.

All concerns reported by the whistle blower(s) are directed to the Chairman of the AC in accordance with the conditions prescribed under the WBP. The contact email address is: [email protected]. The WBP has been published on the Company website.

1.4 Strategies Promoting Sustainability

The Board is mindful of the need for business sustainability over the long term within the environmental, governance and social context.

Strategic development and operational progress are reviewed on a quarterly basis taking into consideration changing business environment and risk factors such as competition, consumer demand, raw material pricing, fluctuations in foreign exchange and changes to governmental policies.

With due recognition towards business sustainability, the Board has in place a Sustainability Policy which embeds elements of environment, social and governance in the Group’s corporate strategies. The Sustainability Report is disclosed in this Annual Report.

Corporate Governance Statement (Cont’d)

-

35SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Corporate Governance Statement (Cont’d)

Principle 1: Establish Clear Goals and Responsibilities (Cont’d)

1.5 Access to Information and Advice

The Board recognises that the decision-making process is highly contingent on the quality of information furnished. Following from this, all Directors have unrestricted access to any information pertaining to the Company and the Group.

The Board receives documents on matters requiring its consideration prior to and in advance of each meeting (including Board Committee meetings) and vide circular resolutions. The Board papers and papers accompanying circular resolutions are comprehensive and encompass both quantitative and qualitative factors so that informed decisions are made.

The Chairman ensures that all Directors have full and timely access to information with Board papers distributed at least 7 days in advance of meetings or a shorter time period when unavoidable. This allows the Directors to have sufficient time to appreciate issues to be deliberated at the meetings and expedites the decision making process.

Verbal explanations are provided by the Executive Director, management personnel and or external consultants, as applicable, to further the Directors’ understanding of operational management and or other matters tabled for Board’s deliberation.

The Board has unhindered access to the advice and services of the Company Secretaries who are responsible for ensuring that all Board procedures are followed and that applicable rules and regulations are complied with. The Company Secretaries also act as the Secretaries for the Board Committees. The Directors may seek the advice of Management on matters under discussion or request further information on the Group’s business activities.

The Board will review, consider and authorise the release of all major corporate announcements to Bursa Securities.

The Directors, whether as full Board or in their individual capacity, may upon approval from Chairman, seek independent professional advice if required, in furtherance of their duty, at the Group’s expense.

1.6 Qualified and Competent Company Secretaries

The current Company Secretaries are competent, qualified and capable of providing the needful support to the Board in discharging its fiduciary duties. They have attended regular trainings and seminars to keep abreast of relevant statutory and regulatory requirements under the Main Market Listing Requirements (“MMLR”) of Bursa Securities, the Companies Act 1965, the Companies Act 2016, Capital Market Services Act 2012 and the Code.

In the event that the Company Secretaries fail to fulfil their functions effectively, the terms of appointment permit their removal and appointment of a successor only by the Board as a whole.

In discharging their duties and responsibilities, the Company Secretaries are present at all meetings to record the deliberations and decisions taken.

The duties of the Company Secretaries include, among others, the followings:

(a) preparing agendas and coordinating the preparation of the Board papers;(b) ensuring that Board procedures and applicable rules are observed; (c) maintaining records of the Board and ensure effective management of the Group’s records;(d) preparing comprehensive minutes to document Board proceedings and ensuring conclusions are accurately recorded;

and(e) timely dissemination of information relevant to Directors’ roles and functions and keeping them updated on new or

evolving regulatory requirements.

1.7 Board Charter

The Board Charter, approved in late 2014, took into account various recommendations of the Code and the changes to the MMLR of Bursa Securities. The Board Charter will be reviewed from time to time. The Board Charter is available on the Company website.

-

36 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Corporate Governance Statement (Cont’d)

Principle 2: Strengthen Composition

As at the date of this statement, the Board comprises nine (9) members as set out below:

Directors Designation

Tan Kai Hoe Non-Independent Non-Executive Chairman

Goh Wee Keng, Jeffrey Executive Director & CEO

Shum Sze Keong Non Independent Non-Executive Director

Dato’ Mohamed Salleh Bin Bajuri Independent Non-Executive Director

Dato’ Seo Eng Lin, Robin Independent Non-Executive Director

Dato’ Wong Siew Hai Independent Non-Executive Director

Dato’ Sri Lee Tuck Fook Independent Non-Executive Director

Lee Hock Chye Independent Non-Executive Director

Datuk Dr Wong Lai Sum Independent Non-Executive Director

On 1 October 2016, the Group announced the appointment of Datuk Dr Wong Lai Sum to the Board as Independent Non-Executive Director.

A brief profile of each Director is presented in the corresponding section of this Annual Report.

The Directors, with their different background and specialisation, collectively bring with them a wide range of experience and expertise in areas such as finance, engineering, corporate affairs, legal, marketing and operations.

The Independent Non-Executive Directors bring objective and independent judgment to the decision making of the Board and provide a capable check and balance to the Executive Director and management. They contribute significantly in areas such as policy and strategy development, performance monitoring, allocation of resources as well as improving governance and controls.

Together with the Executive Director who has intimate knowledge of the business, the Board is constituted of individuals who are committed to business integrity and professionalism in all its activities and have proper understanding of and competence to deal with the current and emerging business issues.

2.1 Nominating & Remuneration Committee

The NRC, which comprises solely of Non-Executive Directors with a majority being Independent. Members of the NRC and their meeting attendance during financial year under review are as set out below.

Designation Directors Attendance

Chairman Dato’ Wong Siew Hai 2/2

Members Mr. Tan Kai Hoe 2/2

Dato’ Seo Eng Lin, Robin 2/2

Mr. Lee Hock Chye 2/2

The NRC was established with specific terms of reference to recommend to the Board, candidates for Directorships, oversee

assessment of Directors, appoint Board Committee members as well as review Board succession planning and training programs.

The Board is satisfied that the current Board size and composition has the right mix of skills, core competencies and balance for the Board to discharge its duties effectively.

-

37SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Corporate Governance Statement (Cont’d)

Principle 2: Strengthen Composition (Cont’d)

2.2 Develop, Maintain and Review Criteria for Recruitment and Annual Assessment of Directors

The NRC conducts an annual Board evaluation, through a questionnaire, for Directors to assess the effectiveness of the Board as a whole, the Board Committees and individual Director self-assessment, required mix of skills and experiences to enhance Board efficacy. The assessment and comments from the Directors are collated, distilled, summarised and reported to the Board by the NRC Chairman with an aim towards continuous improvement of the Board, Directors and Board Committees.

The NRC will look into the development of a set of criteria for use in the recruitment process.

The current criteria for annual assessment of Directors are as set out in the assessment form.

The effectiveness of the Board is assessed in the areas of board size, mix or composition, conduct of Board meetings and Directors’ skills set matrix. The Board Committees are assessed based on their roles and scope of work, frequency and length of meetings, supply of sufficient and timely information to the Board and also overall effectiveness and efficiency in discharging their duties.

In the case of individual Directors, the assessment involved a self-review where Directors assessed their own performance on their contribution and competencies such as ability to give constructive suggestions, demonstrate objectivity and a high level of professionalism and integrity in decision-making process and provide realistic advice to the Board and Board Committees.

The suitability of candidates will be considered and evaluated by the NRC based on, among others, experience, commitment (including time commitment), competency, contribution and integrity of candidates including, where appropriate, criteria for assessing the independence for any appointment as Independent Non-Executive Directors. The NRC will then recommend the candidates to be approved and appointed by the Board. The Company Secretaries will ensure that all appointments are properly made, and that legal and regulatory obligations are met.

During the year, the NRC carried out the following activities:

(a) Reviewed and assessed the mix of skills, expertise, composition, size and experience of the Board, contribution of each Director, the effectiveness of the Board as a whole, Board Committees and the re-election of Directors who retire by rotation.

(b) Reviewed and adopted Board Evaluation Report for financial year ended 31 March 2017.(c) Discussed the character, experience, integrity and competency of the Directors and the CFO and ensured all of them

have the time to discharge their roles.(d) Reviewed the Directors’ retirement by rotation and recommended to the Board, Directors who are due for retirement at

the Annual General Meeting (“AGM”).(e) Reviewed and recommended the retention of Independent Non-Executive Directors who have served a cumulative term

of more than nine (9) years to the Board for endorsement and to seek shareholders’ approval at the AGM.(f) Reviewed and recommended the Directors’ Fees for the Non-Executive Directors.(g) Reviewed the NRC’s Report for inclusion in the Annual Report.(h) Evaluated the suitability of potential female director candidates based on human capital perspective and individual

character and recommended to the Board.(i) Reviewed the candidacy of Datuk Dr Wong Lai Sum as Independent Non-Executive Director. In assessing her

candidacy, the NRC considered her academic background, past professional experience, skill sets and current role as Independent Non-Executive Director of other public listed companies in Malaysia where she could share her experience and knowledge with the Board.

The Articles of Association provide that all Directors shall retire from office once at least in each three years, but shall be eligible for re-election. An election of Director(s) shall take place each year. A retiring Director shall retain office until the close of the annual general meeting at which he retires.

In any case of a Director appointed during the year, he shall hold office only until the next AGM and shall be eligible for re-election. This provides an opportunity for shareholders to grant or renew mandates for the Directors.

The election of each Director is voted on separately. To assist shareholders in their decision, sufficient information such as personal profile, meeting attendance and the shareholdings in the Company of each Director standing for election are disclosed in various sections of this Annual Report.

-

38 SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Principle 2: Strengthen Composition (Cont’d)

2.2 Develop, Maintain and Review Criteria for Recruitment and Annual Assessment of Directors (Cont’d)

Following any appointment of Directors, the Board will ensure that a formal induction process be conducted to allow them to have a good understanding of the Group’s operations and business, present issues (if any), corporate strategies and direction and structure and management of the Group.

In its Board Diversity Policy, the Board encourages diversity and there is no discrimination on any basis, including but not limited to, race, age, ethnicity and gender. The Board is of the opinion that the evaluation of suitability of candidates should be based on their performance and merit, in the context of skills, time commitment and experience to bring value and expertise to the Board.

In this regard, the Board, through the NRC following evaluation of suitable women candidates as part of its Board recruitment exercise, appointed its first lady Director, Datuk Dr Wong Lai Sum, after SAM Singapore took over.

Remuneration Policy

The NRC also makes recommendations to the Board on the remuneration of the Executive Director and Non-Executive Directors of the Company. The aim is to provide remuneration package sufficient to attract, retain and motivate Directors of calibre to oversee the affairs of the Group and ensuring compliance with the requirements of relevant authorities and best practices to meet the interests of both the shareholders and Group.

All Directors are to be paid Directors’ Fees of RM50,000 each for serving as members of the Board. In recognition of their commitment and additional time contributed, the Directors also will receive annual Committee Fees of RM5,000 for each of their participations on various Board Committees, inclusive of those formed on ad-hoc basis. The Directors’ fees are appropriate to their contribution, taking into consideration effort, commitment and time spent as well as the responsibilities of the Directors.

The Board would seek shareholders’ approval at the forthcoming annual general meeting for the payment of these fees.

All Directors are also paid meeting allowance of RM2,000 for each meeting attended.

The aggregate remuneration, with categorisation into appropriate components and distinguishing between Executive and Non-Executive Directors, paid or payable to all Directors of the Company from the Company and the Group for the financial year ended 31 March 2017 was as follows:

From the Company/Group Fees

Salaries

Bonuses

Benefits in kind Allowance Total

Directorship RM

Executive 50,000 - - - 50,000

Non-Executive 450,000 - - 142,000 592,000

Total 500,000 142,000 642,000

Note: The Directors’ fees for, Tan Kai Hoe and Goh Wee Keng, Jeffrey shall be paid to Accuron and SAM Singapore respectively

where they are employed as at 31 March, 2017.

The number of Directors whose total remuneration paid or payable falls within the following bands of RM50,000 is tabulated below.

Number of Directors

Remuneration band Executive Non-Executive

Below RM 50,000 1 *1

RM 50,001 to RM 100,000 - 7

Note: *Datuk Dr Wong Lai Sum was appointed to the Board on 1 October 2016.

Corporate Governance Statement (Cont’d)

-

39SAM ENGINEERING & EQUIPMENT (M) BERHAD CROSSOVER . ANNUAL REPORT 2017

Corporate Governance Statement (Cont’d)

Principle 2: Strengthen Composition (Cont’d)

2.2 Develop, Maintain and Review Criteria for Recruitment and Annual Assessment of Directors (Cont’d)

Remuneration Policy (Cont’d)

The Board chose to disclose the remuneration bands pursuant to the MMLR of Bursa Securities and is of the opinion that detailed disclosure of individual Directors’ remuneration will not add significantly to the understanding and evaluation of the Group’s governance.

Principle 3: Reinforce Independence

The Board also complies with paragraph 15.02 of the Listing Requirements, which requires that at least two Directors or one-third of the Board of Directors of the Company, whichever is the higher, are Independent Directors. The six Independent Non-Executive Directors form the majority on this Board.

3.1 Annual assessment of Independent Non-Executive Directors

The NRC assesses the independence of Independent Non-Executive Directors annually, taking into account the individual Director’s ability to exercise independent judgment at all times and to contribute to the effective functioning of the Board.

3.2 Tenure of Independent Non-Executive Directors

The concept of independence adopted by the Board conforms with the definition of an Independent Director under paragraph 1.01 and Practice Note 13/2002 of the MMLR of Bursa Securities. An Independent Director is not a member of management and is free from any business or other relationship which could interfere with the exercise of independent judgment or the ability to act in the best interests of the Company.

Recommendation 3.2 of the Code states that the tenure of an Independent Director should not exceed a cumulative term of nine years. Recommendation 3.3 of the Code further states that the Board must justify and seek shareholders’ approval in the event it retains as an Independent Director, a person who has served in that capacity for more than nine years.

These Recommendations are intended to ensure the independence of Directors for the protection of the minority shareholders. The Securities Commission accepts that compliance with Code is voluntary as there can be no “one size fits all” rules for all companies.

The controlling shareholders of the Company changed on 26 September 2007 when Singapore Precision Engineering Limited and Singapore Aerospace Manufacturing Pte Ltd, collectively, acquired 44.787% of the entire issued share capital of the Company.

Thus, for the purposes of Recommendations 3.2 and 3.3 respectively, the NRC and the Board had determined that the nine years shall commence from 26 September 2007 or the date of appointment of each Independent Director, whichever shall be the later.