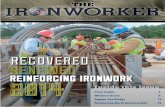

ONE BRAND - Aditya Birla Group · validated by the company’s performance this year. It was also...

Transcript of ONE BRAND - Aditya Birla Group · validated by the company’s performance this year. It was also...

ANNUAL REPORT 2017�18

Aditya Birla Health Insurance Co. Limited(A subsidiary of Aditya Birla Capital Ltd.)

that motivates people to PROTECT their health.HEALTH INSURANCE

ONE BRAND

About ABHICLAditya Birla Health Insurance Co. Limited (ABHICL) is committed to transforming the perception of health insurance in India. We believe the emphasis of health insurance in the country should be on health, rather than insurance, and this is what we are focusing on.

ABHICL serves as an enabler and influencer of health and healthcare choices that customers make, in addition to being a payer of healthcare expenses. Thus, ABHICL acts like the much‑needed catalyst to grow the health insurance landscape in India through product innovations and a wider choice of consumer‑relevant products.

What’s insideCompany Overview Message from the Chief Executive OfficerABHICL at a GlanceOur Product SuiteOur Marketing and Branding ActivitiesOur Unique InitiativesLeadership TeamBoard of DirectorsAwards and AccoladesKey Performance Highlights

Statutory ReportsBoard’s ReportCorporate Governance Report

Financial StatementsIndependent Auditors’ ReportManagement ReportFinancial Statements

01-21

22-56

58-96

020408101214161820

2232

586466

View our Annual Report 2017-18 onlineWe publish our Annual Report online, which allows us to limit the amount of paper we use.

https://www.adityabirlacapital.com/investor‑relations/financial‑reports

Inspired by the Aditya Birla Group legacy, we are emerging as a force to reckon within India’s Health Insurance sector. At ABHICL, we have integrated our core purpose in each of our initiatives.

For us, health insurance is not an additional value‑added service, but the essential ‘value’ itself. Our strategy is to design and offer solutions to motivate citizens to aspire for positive health outcomes.

During the reporting year, we strengthened each aspect of our business and designed a comprehensive range of offerings through a dedicated team that delivers a unique customer experience.

We are delighted to have touched more than a million people in their journey towards a healthier and richer life.

We are taking big steps for bigger impact.

To benefit all our stakeholders.

KEY HIGHLIGHTS FOR FY 2017-18

D243Crores

20%

Gross written premium

ABHICL customers began their healthjourney

15,684Advisors

4,200+Hospital tie-ups

1Millions+

42,549

Lives insured

Claims settled

5

1,391

Bank partners

Team members

Big Steps for a Better Tomorrow

02 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

It gives me immense pleasure to share with you the Aditya Birla Health Insurance Co. Limited’s (ABHICL) Annual Report, 2018. It was the first full year of our operations in which we laid a solid foundation of financial and health related resources to build a responsible organisation that is working towards sustainable value creation. The year’s performance and the tremendous response from the market has reaffirmed our belief that health insurance companies like ours have a pivotal role to play in driving a positive change in society. We at ABHICL go beyond the conventional approach of being just another insurer playing the role of a health financier. We wish to augment that role by first acting as an enabler and influencer of better health and healthcare choices that a customer makes, and encourage them to make health and fitness a key part of their everyday life. In reality, we are driving a shared culture of ‘managing and improving’ health outcomes than just ‘curing’.

Message from the Chief Executive Officer

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

03Corporate Overview

We set ourselves some stretched targets right across our business, and our teams worked to ensure that we succeed. Our refreshing and positive approach towards health insurance and our broad‑based purpose resonated well with the external environment. The year saw our flagship product Activ Health gain greater acceptance in the market. Created as the physical representation of the company’s overarching philosophy, Acitv Health offers the unique proposition of ‘incentivised wellness’ wherein we pay back up to 30% of the premium every year as long as our customers take good care of their health and also activate a unique “chronic care management program” if they still develop a chronic health condition. Our product suite was further bolstered by the launch of two new products – Activ Assure, our second offering under our Indemnity portfolio, and also our foray into Fixed Benefit portfolio by launching Activ Secure, which helped us offer a growing products of products aligned to our consumers’ long‑term health protection requirements.

Our company’s differentiated move has pushed us to focus significantly on the ‘health’ proposition in health insurance. Going forward, we have weaved our purpose of ‘Putting Health at The Heart of Health Insurance’ across all our activities and processes. It has also helped us keep our promise of demystifying all elements of our customer interactions with special focus on the claims process, which we realised during our journey, was one of the most difficult processes to navigate. We launched our care manager service – a team of specialists who handhold customers through the claims, hospitalisation and discharge procedures. Such services enable us to deliver higher convenience that will go a long way in building customers’ trust and loyalty towards the company.

We practise what we preach, and hence the culture of healthy living flows across our ecosystem – from the top management, employees and distributors to customers and even our other group companies. To make it smoother for our stakeholders to adopt a healthier lifestyle, we have initiated campaigns such as “Sehat hai to Zindagi behad hai” and ‘#JumpForHealth’. Likewise, we encourage our employees to start small but inculcate regular health practices in their daily routines. Through our Vitalize program, we have partnered with expert

health consultants including dieticians to provide customised health plans to our employees, enabling them to adopt a holistic approach towards better health. Our employees in turn pass on this message to our customers and assist them in smoothly adopting the approach. We are proud to announce that our efforts are starting to fructify, as over a fifth of our customers have embarked upon their health journey and have thus also begun to engage with us.

With the adoption of such dynamic steps our company is looking to redefine the way health insurance is perceived by all sections of the society, and also hopes the other players in the industry will replicate the move so that more customers can be benefitted.

The strength of our business model was validated by the company’s performance this year. It was also characterised by reinforcing capacities across products, people and distribution domains. Our success story of the year is best explained by the numbers we have achieved, which is 2.9% of the market share amongst standalone health insurers over the past year as opposed to 0.9% in the previous year. Widespread acceptance of our products has helped us establish our position in the market.

Currently we are present in over 150+ cities through a multi‑channel distribution network and have covered over 1 million individual lives and more than 1,000 corporates. We have partnered with five leading banks for distribution of our products and have tied up with over 190 brokers. Non‑metro cities now contribute 30% to our business, up from 14% in the first quarter of FY 2017‑18. Our Gross Written Premium (GWP) has multiplied 4.5 times to ₹243 Crores in the year. This is on the back of robust growth in retail GWP where contribution from retail as % of GWP has gone up from 6% in Q1 to 65% in Q4 FY 2017‑18. We have originated almost 70% of our policies through our best‑in‑class digital platforms, which are now key to acquiring and servicing customers.

In the coming years, our development pipeline will deliver the next generation of differentiated services. In FY 2018‑19, our growth strategy will be two‑pronged –

1. We will continue to build new capabilities and further strengthen our framework.

2. Leverage these capacities to their full potential.

Our focus will be to improve productivity, enhance our presence in non‑metros, expand our retail franchise and partner with more players in the healthcare ecosystem. With a firm eye on addressing all the inherent and latent needs of consumers, we will continue to launch new and innovative products. Our differentiated offerings will focus on providing a high level of service and building personal relationships with our customers. We will continue to meet all the regulatory requirements given the lineage of strong governance practices in both our shareholder groups.

Given the under‑penetration of health insurance in India, the opportunity to develop the market is enormous, and our company will be a key partner in this growth. The Government of India is creating significant awareness about the benefits of health insurance products among the mass segments. We want to not only leverage this push from the government, but also would like to partner with them in all their awareness initiatives as we strongly believe that good health and access to good healthcare is intrinsic to building a healthy and prosperous nation.

Everything that we have achieved this year, everything we aim to achieve next year, and all the promises we have made to our customers, have been borne out of our vision of good health and healthcare for everyone. I want to thank everyone who has shared this vision and worked relentlessly to ensure we deliver on these promises. It is our belief in our purpose that is driving this organisation to achieve so much scale in so little time and create significant value for our stakeholders. I am extremely excited about this journey that we have embarked upon together, and I look forward to the changes and growth we will bring to the industry going forward. We will continue to push boundaries as we take big steps for better impact.

Best Regards,

Mayank Bathwal

Chief Executive Officer and Whole‑Time Director Aditya Birla Health Insurance Co. Limited

04 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

1. Ahmedabad 2. Asansol 3. Aurangabad 4. Bangalore 5. Baroda 6. Bhopal 7. Bhubaneswar 8. Chandigarh 9. Chennai 10. Coimbatore 11. Delhi 12. Goa 13. Gurgaon 14. Guwahati 15. Hyderabad 16. Indore

17. Jaipur 18. Jodhpur 19. Kanpur 20. Kolkata 21. Lucknow 22. Ludhiana 23. Madurai 24. Mumbai 25. Mysore 26. Nagpur 27. Nasik 28. Noida 29. Patna 30. Pune 31. Raipur 32. Rajkot

33. Ranchi 34. Secunderabad 35. Siliguri 36. Surat 37. Thane 38. Trichy 39. Vashi 40. Vijaywada 41. Vizag

OUR GEOGRAPHIC PRESENCE

Our Network at a GlanceAditya Birla Health Insurance Co. Limited (ABHICL) is a joint venture between Aditya Birla Group and MMI Holdings of South Africa. ABHICL was incorporated in 2015 wherein Aditya Birla Capital Limited (ABCL) and MMI Strategic Investments (Pty) Ltd. hold 51% and 49% shares, respectively. ABHICL commenced operations in October 2016 and its current product portfolio includes unique offerings including chronic care and incentivised wellness.

ABHICL AT A GLANCE

1

5

36

12

2437

3930

27

6

1718

16

822

1128

19

21

20

13

2

35

33

14

326

7

31

29

425

15

40

4134

32

9

38

10

23

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

05Corporate Overview

Digital• Presence across all digital channels

• Partnership with key online aggregators

• Presence through tele callers & direct sales team

Agency• Presence in 41 cities with 59 branches

• 15,684 advisors in March 2018

Bank Partners

Broker• Focused on tie‑up with top brokers

across 50+ cities

06 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Our Approach

Putting health at the heart of health insurance for all stakeholders

ABHICL AT A GLANCE

ADITYA BIRLA HEALTH INSURANCE

KNOW YOUR HEALTH

Understand your health through specially formulated online questionnaires and a series of clinical tests

STAY PROTECTEDComprehensive health insurance

cover that ensures support for any medical event.

IMPROVE YOUR HEALTHFollow our Incentivised Wellness program and start becoming active. Being active earns you Active DayzTM which you can use to earn rewards.

GET REWARDED

While some say good health is its own reward, we at Aditya Birla Health are taking this a step further. For every step you

take to be healthy, we will reward you for it.

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

07Corporate Overview

Our CustomersWe motivate our customers and their families to prioritise their health and lead fulfilling lives through our approach of:

• Know your health

• Improve your health

• Get rewarded

• Stay protected

Our EmployeesWe empower our employees to live our purpose through ‘Vitalize program’ – fitness activities, sponsoring participation in Marathons, Walkathons, Treks, Cricket and Football tournaments, etc.

Empowering and motivating families to prioritise their health and lead fulfilling lives

Our DistributorsWe strongly believe our distributors are real brand endorsers. When they live our purpose can they empower our customers to lead a healthy life. Hence, we motivate our distributors and their families through various activities like health check‑up camps, professional fitness training workshops and sponsoring local marathons and walkathons to create awareness towards healthy living.

Living our Purpose

08 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Offerings to Drive Better Health Outcomes

I N D E M N I T Y

GROUP INSU

RAN

CE

Activ Health

• Platinum

Activ Assure

• Diamond

Group Insurance

• Group Activ Health

• Group Activ Secure

Activ Secure

• Personal Accident

• Critical Illness

• Hospital Cash

• Cancer Secure

OUR PRODUCT SUITE

FIX

ED BENEFITS

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

09Corporate Overview

Activ Health - Platinum– the flagship product rewards you through the HealthReturnsTM programme

Activ Secure– an umbrella retail fixed benefit

Activ Assure - Diamond Plan– a health insurance indemnity product that incorporates ABHICL’s unique HealthReturnsTM programme

Group Health Insurance Products– a group hospitalisation cover with world‑class features

• Comprehensive Insurance plan• Earn upto 30% of your annual policy premium as HealthReturnsTM. One

can use the earned HealthReturnsTM to pay renewal premium, or to pay for health medicines, diagnostic tests and more

• Flexibility of room choice• 527 day care procedures covered• Day 1 cover for cost of medicines, diagnostic tests, and doctor

consultation for chronic conditions like Diabetes, Hypertension, High Cholesterol, and Asthma under the Chronic Management Program

• Cumulative bonus of 10% of sum insured for every claim free year. Maximum accumulation of 100% of sum insured

Critical Illness• Complete protection against 20, 50, or 64 critical illnesses as per

plan chosen• Sum insured options until 1 Crore for enhanced protection• Lump sum payout on detection• Option to avail Second E‑Opinion

Personal Accident• Complete protection for Death & Disability• Protection against income loss• Protection for hospitalisation related expenses• Cumulative bonus leading to increased protection every year

Cancer Secure• Protection for all three stages of Cancer – Early, Major & Advanced• Upto 150% of sum insured on detection of Advanced Stage Cancer• Cumulative bonus leading to increased protection every year• Option to avail Second E‑Opinion

• 150% reload of sum insured, for subsequent claims due to unrelated illness, maximum up to ₹50 Lakh

• Covers 586 day care procedures even if hospitalisation is for less than 24 hours

• International/Domestic Emergency Assistance services (Including Air Ambulance)

• Earn HealthReturnsTM worth upto 30% of your premium for staying fit and healthy

• Group Activ Health plan offers a comprehensive coverage with world‑class features and several optional covers customised by the way of features, limits and waivers of restrictions along with cashless claim settlement

• Group Activ Secure plan offers a lump sum benefit on the occurrence of health events under plans such as:

• Group Personal Accident cover • Group Critical Illness cover • Group Hospital Cash benefit

GROUP INSU

RAN

CEF

IXED

BENEFITS

10 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Widening our Brand OutreachWe planned campaigns for marketing and branding to encourage conversations on the importance of health insurance, demonstrating the unique features of ABHICL’s portfolio.

OUR MARKETING AND BRANDING ACTIVITIES

OUR KEY ABOVE THE LINE (ATL) CAMPAIGNS

Sehat Hai Toh Zindagi Behad Hai• Our multimedia advertising campaign was launched on

national television and radio channels.

#BehadZindagi• We also commenced several digital drives and showcased

inspirational stories in which individuals overcame hardships to accomplish their life goals.

• A series of live interactions, contests and video, and blog posts on social media under the hashtag ‘BehadZindagi’.

60

20

62

27

IMPACT OF OUR CAMPAIGNSBrand awareness score

Pre‑ATL campaign

Pre‑ATL campaign

Post‑ATL campaign

Post‑ATL campaign

Brand consideration score

30,000+social media fans

49% SOVPR – TV Visibility Share amongst Stand Alone Health Insurance Players

5.9Millions

ON DIGITAL PLATFORMS

#1 PR – TV visibility rank during the campaign month

THROUGH EARNED MEDIA (PR)

views

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

11Corporate Overview

OUR KEY BELOW THE LINE (BTL) CAMPAIGNS

#TogetherWeCan • On February 4, 2018 – World Cancer Day – an initiative to

encourage conversations about the emotional aspect of cancer with patients and their families was launched by ABHICL.

• We created a dedicated microsite on one of India’s leading news websites, News18.com and promoted the campaign through social media channels with the hashtag ‘TogetherWeCan’.

• ABHICL and Apollo Hospitals together offered a discount on check‑ups for cancer as well.

World Diabetes Day • ABHICL collaborated with IndianExpress.com

and launched a microsite, strategically placing digital banners that asked questions to diabetes patients in the context of health insurance.

• Our Chronic Management Programme helps patients with chronic lifestyle conditions such as diabetes.

We engaged in both Above The Line (ATL) campaigns that use conventional media and Below The Line (BTL) campaigns with unconventional resources, each catering to a specific branding initiative.

90,000visits to the microsite so far

1,000 people went to our own website

500,000 impressions recorded on the 1st day

IMPACT

ENGAGEMENTProvocative engagement events around health and wellness

LEAD GENERATIONActivities that generate lead through local events, among others

ACTIVATIONInitiatives towards branding and local visibility at select new locations

16,500+visits to the microsite hosted by News18.com

IMPACT

12 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

2Millions jumps counted

200prosthetic limbs donated

Creating Bigger Impact Through Unique InitiativesAt ABHICL, we strongly believe in following a differentiated view on health and partnering our customers for healthier living. We go beyond the traditional role of a health insurer and introduce initiatives to mobilise a meaningful discourse on health.

#JumpForHealth:• ‘Jump For Health’ campaign encouraged people to jump and share their videos

across social media.

• Research by the American Journal of Health Promotion shows that jumping 20 times a day can significantly lower one’s risk of osteoporosis.

• Jumping helps improve mental wellness, has cardiovascular benefits and increases resistance to fatigue.

• ABHICL supported amputees from weaker section of society – donating a prosthetic leg for every 10,000 jumps received.

OUR UNIQUE INITIATIVES

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

13Corporate Overview

Active Health:Our ‘Activ Health’ app delivers a complete digital health ecosystem, empowering customers to take charge of their fitness journey. The app is integrated with ABHICL’s HealthReturnsTM programme, rewarding users for better health management.

Access to healthcare

Access to wellness

Health communities/

infor

mat

ion

Managing health

Fund

ing

of h

ealth

• Find a doctor/hospital

• Buy medicines

• Second opinion

• Tele‑medicine

• Tie‑up wellness providers

• Track physical activity

• Personalised health advice

• Get rewarded for staying healthy

• Health assessment tools

• Health blogs • Digital health records

• Book appointment

• Personalised chronic condition info

• Buy Health Insurance (HI)

• Manage/self service HI

• Claim and track insurance & rewards

2

1

34

5

Guidance with pre‑authorisation and cashless processes

Help with speedy discharge

Support and explain the policy terms

Proactive calling to explain the documents required

Virtual Care ManagersWe at ABHICL believe in elevating the standards of customer services beyond the traditional methods adopted so far. Our customer support extends beyond selling policies. In a pioneering effort to put true compassion in care, ABHICL has put in place an expert team of virtual Care Managers which provides valuable assistance to customers during the critical period of hospitalisation.

Our incredibly responsive and reliable Care Managers ensure that the burden on our customers is reduced by taking care of major aspects of hospitalisation as well as claim‑related documentation. Moreover, they also facilitate cashless procedures, speedy hospital discharge and clarification of policy terms.

Easing the hospitalisation experience

14 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Leadership Team

MR. MAYANK BATHWALChief Executive Officer (CEO) & Whole-time Director

Mayank’s expert leadership led ABHICL to enter the Indian health market with a differentiated business model and to grow rapidly in less than two years. He has rich experience of nearly 21 years in financial services across various functions and multiple lines of business.

MS. DARSHANA SHAHHead-Marketing

Darshana oversees the varied aspects of brand marketing and communications, such as product marketing, customer and channel engagement, digital marketing and corporate communication functions. She also drives marketing research and insight initiatives. Darshana has over 21 years of experience in marketing and communication.

MR. AMAR JOSHIChief Distribution Officer

Amar has been instrumental in setting up an efficient multi‑channel distribution channel, such as third‑party distribution, tied agency, direct ‑ online and tele sales channel, bancassurance, group business and sales training. He also oversees the building of strategic banking relationships and variable agency models to explore growth opportunities. Amar has over 28 years of experience in the insurance industry.

MS. ANURADHA SRIRAMAppointed Actuary (Chief Actuarial Officer)

Anuradha manages different aspects of the actuarial function, such as pricing, reserving as per regulatory requirements, valuation, experience review and reporting. Additionally, she is responsible for the product function as well as product design and market planning. Anuradha has 25 years of industry experience.

MS. VARIJ PUJARAExecutive Vice President - Institutional Business and Strategic Alliances

Varij drives key aspects of the Company’s business development agenda, including the Payment Bank and the formulation of important strategic banking relationships. She possesses more than 20 years of experience in sales and marketing, and business development.

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

15Corporate Overview

MS. SHIKHA BAGAIChief Finance Officer

Shikha oversees finance, accounts, taxation, investments and financial planning functions. She has 19 years of industry experience.

MR. RAJIV JOSHIHead of Legal, Risk, Compliance and Secretarial

Rajiv has been instrumental in making an effective governance and risk framework by drafting policies and processes that ensure regulatory compliances and risk management. In addition, through internal audit programmes and periodic monitoring, he maintains the efficacy of these policies and processes. He handles the Company’s legal affairs as well. Rajiv has over 29 years of experience in secretarial, legal and compliance affairs.

MR. SANJAY KARNATAKHead of Information Technology (IT)

Sanjay plays an important role in partnering with businesses that enable ABHICL to enhance its technology focus. He helps define the IT architecture as well as the Company’s digital strategy. Sanjay has more than 22 years of experience in technology management in sectors like insurance, telecom, manufacturing and consulting.

MR. SRINIVAS SUBRAMANIANHead of Operations

Srinivas manages functions such as operations, customer service, underwriting, claims, provider management, distribution operations, DRM, quality and business excellence and group operations processes. He has over 26 years of experience in operations, quality, business excellence, machine design, process engineering, industrial engineering and project management.

MR. SANTANU BANERJEEHead of Human Resource & Administration

Santanu is responsible for ABHICL’s human resource strategy, talent management, learning and organisational effectiveness. He has over 19 years of experience in IT, retail, consulting and financial services.

16 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Board of Directors

MR. AJAY SRINIVASANNon-Executive Director

MR. ASOKAN NAIDUNon-Executive Director

MR. SUSHIL AGARWALNon-Executive Director

MR. LOUIS VON ZEUNERNon-Executive Director

MR. DEVAJYOTI BHATTACHARYANon-Executive Director

MR. MAYANK BATHWALChief Executive Officer (CEO) & Whole-time Director

MR. S. RAVIIndependent Director

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

17Corporate Overview

DR. AJIT RANADENon-Executive Director

MS. SUKANYA KRIPALUIndependent Director

MR. DANIE BOTESNon-Executive Director (Resigned w.e.f. June 30, 2017)

MR. RISTO SAKARI KETOLANon-Executive Director(Appointed w.e.f November 3, 2017)

MR. C. N. RAMIndependent Director

LATE MR. P. VIJAYA BHASKARIndependent Director(Ceases to be a Director w.e.f. May 4, 2018)

MR. MAHENDREN MOODLEYIndependent Director

18 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Recognised for ExcellenceABHICL’s efforts to strengthen India’s health insurance segment was acknowledged and rewarded generously in the reporting year.

Overall

Declared ‘Rising Star of the Year’ at the 2nd Annual India Insurance Summit & Awards 2017

Won ‘Most Innovative Life‑Health Insurers’ Start up 2017 at the Life Insurance International Organisation

Declared ‘Digital Insurance Innovation of the year’ at the World Quality Congress Global Awards for Excellence in Banking, Finance and Insurance Management

Declared ‘Digital Innovation Insurers 2017’ at the Life Insurance International Organisation

Product

Declared ‘Product Innovator of the Year’ at the 2nd Annual India Insurance Summit & Awards 2017

Won ‘Innovation of The Year Award 2017’ for Activ Health (ABHICL’s retail indemnity product) at the Changing Dynamics of Insurance & Awards 2017 by Associated Chambers of Commerce and Industry of India (ASSOCHAM); the campaign was also declared the ‘New Insurance Product of the year’ by the World Health and Wellness Congress

Recognised for excellence in health insurance products at the 9th Edition of Federation of Indian Chambers of Commerce and Industry (FICCI) Healthcare Excellence Awards 2017

Won ‘Best Product Innovation’ at the Health Insurance Fintelekt Insurance Awards 2017

AWARDS AND ACCOLADES

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

19Corporate Overview

Won Best Use of ‘Social Media & Most Engaging Customer Experience 2017’ at the Life Insurance International Organisation

Marketing

Awarded bronze at the Abby Awards 2017 for the innovative use of mobile in ABHICL’s Movekar Campaign

Declared ‘Digital Marketer of the Year 2017’ by the Internet and Mobile Association of India (IAMAI) and Money Control

Declared ‘Emerging Brand’ at the 8th CMO Asia Awards for Excellence in Branding & Marketing, Singapore 2017

Recognised as one of the ‘Hot 50 Brands’ by Paul Writer

Declared ‘Best Health Insurance company of the year’ by the Times Network National Marketing Excellence Awards for Excellence in Banking Finance services and Insurance Sector 2017

Won ‘Best Crowd Sourced (User Generated) Content – Silver’ at the Second Edition of E4M Content Marketing Awards in September 2017 for the ABHICL’s #JumpForHealth Campaign. The campaign also won ‘Best Promotion/Launch of Product – Silver’ and ‘Best Use of Mobile for Active App campaign – Bronze’ at the Big Bang Awards, conducted by Ad Club, Bangalore

Operations

Recognised under Star Performer Outreach category by the ASSOCHAM India’s ‑ Health Insurance Congress 2018 and Service Providers Awards 2018

Awarded gold for new business process; silver for hospital empanelment; and silver for new business dispatch process, by the Quality Circle Forum of India, Mumbai chapter

20 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Our Performance Highlights for FY 2017-18

KEY PERFORMANCE HIGHLIGHTS

GROSS WRITTEN PREMIUM (GWP)(` in Crores)

243

54

2016-17 2017-18

350%

HOSPITAL NETWORK ACROSS NO. OF CITIES

543

120

2016-17 2017-18

NO. OF CLAIMS SETTLED

42,549

2,523

2016-17 2017-18

NO. OF HOSPITAL TIE-UPS

4,200

1,600

2016-17 2017-18

RETAIL GROSS WRITTEN PREMIUM (GWP)(% of total GWP)

34

6

2016-17 2017-18

NO. OF LIVES COVERED

1.0

0.2

2016-17 2017-18

(in Mn)

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

21Corporate Overview

In the first full year of our operations, we have grown rapidly and achieved commendable performance.

Big Steps for a Better Tomorrow

NO. OF AGENTS

15,600

1,800

2016-17 2017-18

NO. OF BRANCHES

59

9

2016-17 2017-18

NO. OF BANK PARTNERS

5

2

2016-17 2017-18

HEADCOUNT

1,391

484

2016-17 2017-18

NO. OF BROKERS

192

161

2016-17 2017-18

22 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Board’s Report

Practise diaphragmatic breathing or deep breathing. It helps lower blood pressure, blood sugar the stress hormones adrenaline and cortisol and also Eliminates free radicals from the body, improving cellular function and lifespan.

Dear Shareholders,The Directors of Aditya Birla Health Insurance Co. Limited (“your Company” or “the Company” or “ABHICL”) are pleased to present the Second Annual Report and the audited financial statements of your Company for the financial year ended March 31, 2018.

OVERVIEW AND STATE OF COMPANY’S AFFAIRS:A. Financial ResultsYour Company ended its first full operating year on a strong note having registered ` 243 crores of Gross Written premium. The Company had adopted holistic approach towards Health + Incentivized Wellness and has launched chronic care and incentivized wellness at launch in FY 2016‑17.

In FY 2017‑18, the focus was to create distribution capacity for our multi‑channel distribution network and to drive our innovative CVP based on the philosophy of health first. The Company created and activated capacities in all channels which include 15,600+ agents across 59 branches, 5 bancassurance partnerships, 190+ brokers and Direct Tele‑assisted and online channels. In FY 2017‑18, the Company enhanced its existing line of retail products by launching Retail Activ Assure and Retail Activ Secure. In terms of its service delivery model, the company has put in place a robust platform for supporting end‑to‑end customer journey from sales to servicing to wellness. The Company has empaneled 4,200+ hospitals to enable cashless services across 540 cities.

Against the above backdrop, the Company has recorded good performance on key business and financial parameters as detailed below:

• The Company has broad‑based its Channel mix with sizeable GWP contribution from all channels;

• Gross Written Premium (GWP) of ` 243 crores in FY 2017‑18 from ` 54 crores in FY 2016‑17, translating to growth of 350%;

• Number of lives covered at 1 million in FY 2017‑18 as against 0.2 million in FY 2016‑17, translating to growth of 418%;

• Increasing retail business forming 35% of the total GWP;

• 71% of retail business issued through digitally enabled mode;

• Total capital infused including share premium at ` 133 Crores in the current year;

• Solvency margin at 1.67 for FY 2017‑18 against the regulatory requirement of 1.5;

• Net Loss at ` 189.2 crores for FY 2017‑18 primarily attributable to funding new business growth and distribution network creation.

A brief on financial information is tabled below: (` in Crores)

ParticularsStandalone

2017-18 2016-17

Gross Written Premium 243.1 54.0Net Written Premium 228.9 51.2Net Earned Premium 151.9 13.5Net Incurred Claims 135.3 16.6Net Commission (Income) / Expenses 18.9 3.2Expenses of Management 206.9 83.5Premium Deficiency Reserve 0 3.8Investment Income – Policyholders 10.1 5.9General Insurance Result (195.3) (87.7)Investment Income – Shareholders 7.5 7.2Other Expenses 1.4 6.2Profit before Tax (189.2) (86.7)Credit balance in P & L account at the year end

(210.1) (101.9)

Key highlights of the Company:Industry PerformanceHealth insurance segment had registered consistent growth rate in recent years. It now constitutes around 28% of total non‑life insurance in FY 2017‑18 as against around 22% in FY 2011‑12. The health insurance industry registered premium of ` 42,300 Crores in FY 2017‑18 which translates to growth of 23% YoY.

Currently, there are 30 players operating in the health insurance industry and these can be broadly divided in to 3 categories i.e. PSU Insurers with 57% market share, private general insurers contributing 23% and stand‑alone health insurance companies which contribute to 20% of the market.

Health Insurance has 3 broad customer segments namely 1) Group segment for Corporates with around 46% market dominated by PSU insurers; 2) Retail segment with 45% market has seen relatively higher growth due to increased penetration in tier‑2, tier‑3 cities and 3) Government segment which forms around 9% of the Market.

At the end of the year under review, your Company’s market share stood at 0.61% (2.9% among Stand‑alone health insurers) which is in line with management expectations. We expect that SAHI players will be growing at a faster pace than the industry average in the coming years. Within SAHI Players, with a strong brand, unique CVP, wide spread distribution network and robust digital and servicing capabilities to manage

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

23

scale, Aditya Birla Health Insurance is well positioned to exploit the growth opportunity.

B. Review of Business Operationsi) New Product launchesWe decided to create our business model on the philosophy of health first. We are creating a differentiated model from traditional ‘buy and forget’ to ‘buy and engage’. Your Company would serve as an enabler and influencer of health of customers, in addition to fulfilling traditional role of funding healthcare expenses. We will continue to focus on holistic approach towards health which goes beyond sickness funding into disease prevention and wellness management.

We already had chronic care and incentivized wellness products in our product portfolio. In FY 2017‑18, the Company further fortified its existing line of retail products:

• Launched Diamond (Activ Assure) which focuses on Mass Customer and price sensitive segment of customers. With the launch of Diamond, we have enhanced our indemnity product portfolio catering to all classes of prospective customers

• Launched Activ Secure offering coverage of personal accident, critical illness, cancer care as well as hospital cash benefits, which will serve as a robust customer acquisition engine

• Going forward the focus will be on broad‑basing the product mix and mapping product and customer segments.

With the above, we have extended our product portfolio catering to all classes of prospective customer segments. Currently have a comprehensive product suite which includes Group Activ Health, Retail Activ Health, Retail Activ Assure and Retail Activ Secure and Group Activ Secure.

ii) Distribution ChannelsThe Company follows a multi‑channel distribution model across agency, broking, bancassurance, digital and direct marketing channel. The Company will continue to create distribution capacities that are sustainable in the long‑run.

Our Agency network consists of around 15,600+ Advisors with their spread across 36 locations through 59 branches. The Company has taken various initiatives in Agency channel to increase geographical expansion and to penetrate further in existing locations. We Continue to build our capacity in Agency channel. It will be imperative to manage capacities through timely recruitment, activation and training of sales force and agents going forward.

In Bancassurance, we have achieved partnerships with 5 bank partners & are in advanced discussion with other potential bank partners. Partnerships with Corporate Agents and Brokers are also going strong. We will continue to look at new tie‑ups in third party distribution segment with a view of creating long‑term strategic partnerships with key distributors. In the coming years, we plan to build a strong franchisee in the bancassurance segment.

In Group segment, we have diversified the Group portfolio through SME and Creditor business. We are leveraging Aditya Birla Group Companies as well as new client segments including Large corporates and SMEs for our business. We are maintaining an optimal channel mix from broker as well as direct channel. Going forward, we will continue to focus on new segments to manage our top‑line and margins.

To summarize, last year we focused on creating distribution capabilities across various channels and our focus for coming year would be to optimally utilize the distribution capabilities we created last year and achieve maximum productivity from the available capacity. Given the strength of our innovative CVP and the differentiated service model including wellness and chronic care management we are confident that we will be making further in‑roads in our distribution channels in the years ahead.

With an aim to simplify and digitize the policy issuance, a unique seller portal app has been launched and utilized by all the channels.

iii) Customer and Claims ManagementAditya Birla Health Insurance has entered the health insurance market with an aim to expand the category to wider customer segments, beyond the ones that health insurance companies traditionally have marketed to and through a full range of offerings by providing “Health Insurance for All”. By focusing on health in health insurance, our business model has been built around the philosophy of “health first” – to promote healthy living.

Through extensive research, we charted out the customer’s journey and identified the major pain points that the customers faced and designed our processes and products to ensure we address those and provide adequate differentiation from the market. Hospitalization and Claims journey of the customer came out to be the most important Moment of Truth.

In line with our vision and purpose, keeping health and customer centricity at its core, we have initiated the below measures to promote healthy living.

Chronic care management:We have Health Coaches to provide chronic care service for customers with Diabetes, Asthma, Hypertension & Hyperlipidemia. Our Health Coaches are the One Point contact for the customer and facilitate in arranging a doctor’s appointment, delivery of medicines, laboratory services, physiotherapy sessions at the customer’s residence. Personalized diet plan according to the customer’s health history is created to improve the customer’s overall health.

Our website has been enabled to allow the customers to request cashless services like medicines at home or lab test at home/ lab or doctor’s consultation.

Life style management: For customers who are at borderline for any of the 4 ailments mentioned above, there is a life style call made to advise them on preventive health checks

Board’s Report

24 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

to be undertaken and diet plans to be followed which help in maintaining a healthy life style.

Speciality calls for multiple admissions: For our customers who have been hospitalized for multiple treatments, our Health Coaches get in touch with them and advise them on treatments to be taken to prevent the illness from getting chronic.

Claims Management: We have a best in class Claims team which has been appreciated through various customer testimonials received. Some of the notable achievements for our Claims team are enumerated below:

• Special Recognition by the Jury of Kaizen Institute of India at National Level for case study presented on Six Sigma Project on Reduction in Claims settlement TAT. TAT for Claim settlement reduced from 10 days to 5.9 days by Dec’17.

• More than 40,000 claims have been processed through TPAs for Group Health Policies and more than 2,200 claims have been processed In‑house for Retail Health Policies.

• Process Automation in claims processing has improved operational efficiency.

• Best in Industry NPS for Claims‑ highest touched NPS of 46%.

• ‘Know your policy’ campaign initiated by Claims team for its group clients which has increased awareness of policy benefits with Insured / Employee; which is one of the major factor contributing to high NPS.

• Digital options (website, app login) enabled to service our customers.

ReservesIn view of carried forward losses, the Company has not transferred any amount to the General Reserve.

DividendIn view of carried forward losses, the Directors do not recommend any dividend for the year under review.

Share CapitalThe Authorized Share Capital of the Company is ` 150,00,00,000.

The Issued, Subscribed and Paid up Capital of the Company was ` 132,88,02,020 as on March 31, 2018.

During the FY 2017‑18, following allotments of Equity Shares were made:

Sr. No. Date of Allotment Name of the Shareholder No. of Shares Face Value Amount (`)

1 September 1, 2017 Aditya Birla Capital Limited 1,36,82,927 10/‑ 13,68,29,2702 September 1, 2017 MMI Strategic Investments (Pty) Limited 1,31,46,341 10/‑ 13,14,63,4103 March 28, 2018 Aditya Birla Capital Limited 28,60,976 10/‑ 2,86,09,7604 March 28, 2018 MMI Strategic Investments (Pty) Limited 27,48,780 10/‑ 2,74,87,800

Issue of Equity shares with differential voting rightsDuring the financial year, the Company has not issued equity shares with differential rights.

Admission of Equity Shares with National Securities Depository LimitedDuring the year, the Company’s 2,68,29,268 Equity Shares were admitted in the records of the National Securities Depository Limited (‘NSDL’).

Transfer of Shares/ Change in Nominee ShareholdersDuring the year, the name of the Holding company was changed from Aditya Birla Financial Services Limited to Aditya Birla Capital Limited w.e.f. June 21, 2017. Further, the Company had received request from the Holding company to change its Nominee shareholders as follows:

Sr. No. Name of old Nominee (Folio No.) Name of new Nominee (Folio No.) No. of Shares

1 Mr. Shriram Jagetiya* (009) Ms. Pinky Mehta** (016) 102 Mr. Rajesh K Shah* (010) Mr. Subhro Bhaduri** (017) 103 Mr. Rakesh Gupta* (011) Mr. A. Dhananjaya** (018) 104 Mr. Mahendra Bhandari* (012) Mr. Ajay Kakar** (019) 105 Mr. Nirmal Mehta* (013) Ms. Anjali Makhija** (020) 106 Mr. Niraj Maheshwari* (014) Mr. Mukesh Malik** (021) 10

* Nominees of Aditya Birla Financial Service Limited

** Nominees of Aditya Birla Capital Limited

Public Deposits During the year under review, the Company has not accepted any deposit from the public falling within the ambit of Chapter V (Section 73) of the Companies Act, 2013 and the Companies (Acceptance of Deposits) Rules 2014.

Particulars of Loans given, investment made, guarantees given or security provided under Section 186 of the Companies Act, 2013The Company, being Insurance Company, provisions of Section 186 of the Companies Act, 2013, are not applicable. Hence no disclosures have been provided.

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

25

Conservation of Energy & Technology AbsorptionThe provisions of Section 134(3)(m) of the Companies Act, 2013 read with Rule 8(3) of the Companies (Accounts) Rules, 2014 are not applicable to the Insurance Industry. However, the Company has been increasingly using information technology in its operations.

Foreign Exchange earnings and outgoThe details of the foreign exchange earnings and outgo is as follows:

Particulars 2017-18 (Amount in crores)

Foreign Exchange earned ‑Foreign Exchange outgo 1.4

Particulars of EmployeesIn pursuance of the Company’s aspirations to become the most preferred employer in the insurance industry, the Company continued to invest in creating a pool of talent for the growing business needs. The Company’s total workforce stood at 1,391 as at March 31, 2018. Structured initiatives around talent management, learning and development and long term retention plan for talent pool across levels were implemented for skill development to enhance productivity and performance of workforce. As required under the provisions of Rule 5(2) and 5(3) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the name and other particulars of the employees are set out in the Annexure to the Board’s Report. The Board’s Report is being sent to the shareholders excluding the Annexure. Any shareholder interested in obtaining a copy of the Annexure may write to the Company Secretary at the Registered Office of the Company.

Material Changes and Commitment affecting Financial Position of the CompanyThere are no material changes and commitments, affecting the financial position of the Company which has occurred between the end of the financial year of the Company i.e. March 31, 2018 and the date of this Board’s report.

Change in nature of businessDuring the year under review, there has been no change in the nature of business of the Company.

Employee Stock OptionThe Aditya Birla Capital Limited Employee Stock Option Scheme (the “Scheme 2017”) has been formulated by the Nomination, Remuneration and Compensation Committee of the Board of Directors of Aditya Birla Capital Limited (ABCL), the Holding Company, with an aim to provide competitive remuneration opportunities to its employees and further by way of a separate special resolution, the shareholders of ABCL at their AGM held on July 19, 2017, extended the benefits and coverage of the Scheme 2017 to the employees of ABCL’s Subsidiary Companies.

The Nomination and Remuneration Committee and the Board of Directors of ABHICL had adopted the Scheme 2017 and had approved the extension of benefits of the Scheme 2017 to its permanent employees in the management cadre, including Managing and Whole‑time Directors of the Company. The Scheme 2017 inter‑alia involves the granting of employee stock

options in the form of options (“Options”) and/or Restricted Stock Units (“RSUs”), which will be exercisable into equity shares of ` 10/‑ each of the Holding Company (the “Equity Shares”) in accordance with the terms of the Scheme 2017 and on such terms and conditions as may be fixed or determined by the Board and/or by Aditya Birla Capital Limited in accordance with the SEBI SBEB Regulations or other provisions of the law as may be prevailing at that time.

The approval for extension of benefits of Scheme 2017 as well as the payment of ESOP charge for the allocation of Options and RSU’s as applicable has also been approved by the shareholders of the Company at its EOGM held on August 8, 2017.

Management ReportPursuant to the provisions of Regulation 3 of the Insurance Regulatory and Development Authority (Preparation of Financial Statements and Auditor’s Report of Insurance Companies) Regulations, 2002, the Management Report forms a part of the financial statements.

Corporate GovernanceThe Company is committed to maintain the highest standards of Corporate Governance. The Company has taken structured initiatives towards Corporate Governance and its practices are valued by its stakeholders. The Corporate Governance principles form an integral part of the core values of the Company. A separate report on Corporate Governance is attached separately as Annexure 1.

In compliance with “Guidelines on Corporate Governance for the Insurance Sector” issued by IRDAI, a Compliance Certificate issued by the Compliance Officer is annexed to and forms part of the Corporate Governance Report.

Holding Company/ Joint Ventures/ Associate CompaniesDuring the year under review, a Composite Scheme of Arrangement (“Scheme”) was entered between Aditya Birla Nuvo Limited (“ABNL”), Grasim Industries Limited (“Grasim”) and Aditya Birla Capital Limited (formerly known as Aditya Birla Financial Services Limited) (“ABCL”), a subsidiary of ABNL.

The Scheme was approved by the National Company Law Tribunal bench at Ahmedabad on June 1, 2017. ABNL has been amalgamated with Grasim with effect from July 1, 2017 and accordingly, Grasim became the Holding Company of ABCL. Consequently, the ultimate Holding Company of your Company has been changed from ABNL to Grasim with effect from July 1, 2017.

Further, in accordance with the Scheme of arrangement, the demerger of the Demerged Undertaking (‘the financial services business’) from the Demerged Company (“Grasim Industries Limited”) and subsequent transfer to the Resulting Company (“Aditya Birla Capital Limited”) (formerly known as Aditya Birla Financial Services Limited) comes into effect. Accordingly, ABCL continues to be the Holding Company of your Company.

Statement containing salient features of financial statements of subsidiariesThe Company does not have any subsidiary company.

Board’s Report

26 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Risk Management Framework The Company has Risk Management framework covering procedures to identify, assess and mitigate the various key business risks. The Company has a Risk Management Committee for developing and promoting the risk management culture of the Company. It sets overall risk policies and frameworks for the Company in line with its defined risk strategy and risk tolerance.

The Company endeavors that all material risks can be identified and managed in a timely and structured manner with an objective to achieve sustainable growth. The Risk management approach is developed by taking into account the overall governance, management, reporting process, policies, philosophy, culture & regulatory framework applicable to the Company.

The Company has an Enterprise Risk Management (ERM) framework and policy which includes key components such as Risk identification, Risk assessment, Risk response and risk management strategy, Risk monitoring, communication and reporting to mitigate key risks which are inherent in nature to Company’s activities. The risks of the Company are broadly classified into 8 categories namely Reputation Risk, People Risk, Regulatory Risk, Operational Risk, Investment Risk, Insurance Risk, Strategic Risk and Business Risk. The key business risks identified are approved by the Risk Management Committee and monitored by the Risk Management team thereafter.

The Risk Governance Structure of the Company has 3 lines of Defense mechanism the apex is Board of Director and Risk Management Committee which provide overall oversight and governance direction on Risk strategy and Risk appetite of the Company. The Audit Committee provide assurance through Internal Audit and independent control evaluation. The Risk Management function along with support from various functions of the Company ensures smooth implementation of Risk Management Policy and framework through various mechanism such as risk awareness, self‑assessments, risk monitoring, operational controls etc.

The Company has identified key risk indicators for each risk categories and these are monitored on Monthly as well as on Quarterly basis by Risk Management function. Dashboard of risk movement is presented to Risk Management Committee on Quarterly basis. Operational risks are governed through Enterprise Risk Management Policy and Framework. The Company has initiated a Risk Control Self‑Assessment process to embed the control testing as a part of day to day operations.

The Company has Operational loss framework to document and report any internal loss events which occurs in the Company while execution of various activities throughout its lifecycle.

The Company’s Business Continuity and Disaster Recovery Plan ensure managing risk arising from business interruption having business impact on its operations.

Fraud risk is managed through Fraud Management which is governed by the Anti‑Fraud Policy and is handled internally through an Alert Committee.

Information Security risks will be governed through Information Security policy which provides management direction and

support for information security in accordance with business requirements and relevant laws and regulations so that its information assets are provided comprehensive protection against the consequences of breaches of confidentiality, failures of integrity or interruptions to their availability.

The Company’s Investments Function is governed by the Investment Committee appointed by the Board of Directors. Investment Policy and Operating Guidelines laid down by the Board while ensuring regulatory compliances also provide the framework for management and mitigation of the risks associated with investments. Asset Liability Policy and various ALM strategies are adopted to ensure adequate controls are put in place to mitigate risk related to Asset Liability Management.

Insurance risk identified for the Company are morbidity risk, medical inflation, concentration risk and reinsurance risk. The Company mitigates this risk by adopting various measures such as diversification of business across demography, geographical areas, underwriting policy for appropriate selection of risks, claim review policies, reinsurance arrangement etc.

Strategic risks such as changes in environment, technology, economy and the industry are monitored by the Company through its strategic planning and budgeting process.

The Company manages its capital and solvency margin requirement through capital management policy for its insurance business to hold sufficient capital in order to cover the statutory requirements based on the IRDAI directives.

Contracts and Arrangements with Related PartyRelated Party TransactionsAll the Related Party Transactions that were entered into during the financial year 2017‑18 were on arm’s length basis and were in ordinary course of business except the Extension of Benefits of the Aditya Birla Capital Limited Employee Stock Option Scheme 2017 (The “Scheme 2017”). The ESOP charge on the basis of stock options allocated and the valuation arrived was borne by the Company in proportion of the grant done over the period of vesting as applicable and determined by the Board/ Committee. Therefore, this payment of ESOP charge resulted in a Related Party Transaction between Aditya Birla Health Insurance Co. Limited and Aditya Birla Capital Limited.

Pursuant to Section 134(3)(h) read with Rule 8(2) of the Companies (Accounts) Rules, 2014, there are no transactions to be reported under Section 188(1) of the Companies Act, 2013.

The Board has formulated and adopted a Related Party Transactions Policy (‘Policy’) for the purpose of identification, monitoring and reporting of related party transactions. The Policy is available on the Company’s website at www.adityabirlahealth.com/healthinsurance.

All related party transactions as required under Accounting Standard 18 are reported in Related Party Disclosures under Notes to Financial Statements.

Internal Financial ControlsThe Board of Directors confirms that the Company has laid down set of standards, processes and structure which enables

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

27

to implement Internal Financial controls across the organization with reference to Financial Statements and that such controls are adequate and are operating effectively. During the year under review, no material or serious observation has been observed for inefficiency or inadequacy of such controls.

Assurance on the effectiveness of internal financial controls is obtained through management reviews, control self‑assessment, continuous monitoring by functional experts as well as testing of the internal financial control systems by the internal auditors during the course of their audits. During the year under review, no material or serious observation has been received from the Auditors of the Company, citing inefficiency or inadequacy of such controls.

Internal Audit Framework The Company received registration from Insurance Regulatory and Development Authority of India on 11th July 2016 and thereafter commenced its health insurance business from October 5, 2016.

The Company had appointed M/s Suresh Surana & Associates, LLP as its Internal Auditor for FY 2017‑18. The Internal Audit Plan was designed to assess and strengthen the operational processes and monitor the efficacy of internal policies and controls with the objective of providing to the Audit Committee and the Board of Directors, an independent, objective and reasonable assurance on the adequacy and effectiveness of the organization’s risk management, control and governance processes. The audit approach verifies compliance with the regulatory, operational and system related procedures and controls.

The process followed by the Company for Internal Audit is as stated below: ‑

a) Establish and communicate the scope and objectives for the audit to appropriate management;

b) Kick off meeting between Auditor and Auditee before commencement of audit;

c) Perform walkthroughs to understand major processes and related sub‑processes along with different interfaces;

d) Communicate data requirements to the auditee;

e) Assess and identify significant risks and perform detailed evaluation of controls over identified risks;

f) Release Issue trackers to the process owners to arrive at agreement over the issue and develop an action plan;

g) Discussions to be held between the auditee and auditor on issue trackers;

h) Once the issues are agreed, incorporate in the presentation format and release draft report to the process owner for consensus;

i) Closure of audit between Auditor and Management wherein issues are clarified and agreement on the associated risk (if any). Also resolution is agreed upon any other issue/concerns;

j) Final Audit Report is released to the concerned stakeholders;

k) Key audit observation along with status of implementation of open audit findings are presented by External auditor to the Audit Committee;

The Internal Auditor ensure the audit findings of the previous reports and recommendations of the Audit Committee are implemented by the concerned department through an Action Taken Report.

Directors’ Responsibility Statement Pursuant to Section 134(5) of the Companies Act 2013, your Directors, to the best of their knowledge and belief confirm that:

a) in the preparation of the annual accounts, the applicable accounting standards have been followed along with proper explanation relating to material departures;

b) the Directors have selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the profit and loss of the Company for that period;

c) the Directors have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of Companies Act, 2013 preventing and detecting fraud and other irregularities;

d) the Directors have prepared the annual accounts on a going concern basis; and

e) the Directors have devised proper systems to ensure compliance with the provisions of all applicable laws and that such systems were adequate and operating effectively.

Directors As on March 31, 2018, your Board of Directors comprises of 13 (Thirteen) Directors including one CEO & Whole Time Director, 5 (five) Independent Directors including a Woman Director.

During the year, following were the changes in the directorship of the Company:

• Mr. Danie Jacobus Botes (DIN 07550406) resigned as Director w.e.f. June 13, 2017.

• Mr. Risto Sakari Ketola (DIN 07980685) was appointed as Director in casual vacancy w.e.f. November 3, 2017 in place of Mr. Danie Jacobus Botes.

In accordance with the provisions of the Companies Act, 2013, Mr. Ajay Srinivasan and Mr. Devajyoti Bhattacharya shall retire by rotation at the ensuing Annual General Meeting (‘AGM’) of the Company, and being eligible, offers themselves for re‑appointment.

Mr. Risto Sakari Ketola who was appointed as Directors in casual vacancy shall hold office up to the date up to which Mr. Danie Botes would held the office if it had not been vacated. The Company has received notice pursuant to the provisions of Section 160 of the Companies Act, 2013 proposing appointment of aforesaid Directors at the ensuing AGM subject to the approval of Shareholders at the AGM.

Board’s Report

28 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

The Company has also received requisite disclosures and undertakings from all the Directors in compliance with the provisions of the Companies Act, 2013 and the Corporate Governance Guidelines issued by the IRDAI.

A detailed profile of all the Directors seeking appointment at the ensuing Annual General Meeting of the Company is given in the Corporate Governance Report, forming a part of this Annual Report.

None of the Directors of the Company are in receipt of commission from the Holding Company.

The details of the remuneration paid to the Non‑Executive Chairman, Executive and Non‑Executive / Independent Directors of the Company for the year ended March 31, 2018 and the details on number of meetings of the Board of Directors of the Company is provided in detail in the Corporate Governance Report.

Meetings of the Board of DirectorsDuring the year under review 5 Board Meetings were convened and held, the details of which are given in the Corporate Governance Report. The intervening gap between the Meetings was within the period prescribed under the Companies Act, 2013. The detailed information about Composition, Meetings and attendance are provided in the Corporate Governance Report.

Audit CommitteeThe Company has a duly constituted Audit Committee comprising of 5 members consisting of 3 Independent Directors and 2 Non‑Executive Directors. Mr. S. Ravi (an Independent Director & a Practicing Chartered Accountant) is the Chairman of the Audit Committee. Mr. P Vijaya Bhaskar and Mr. C N Ram, Independent Directors and Mr. Ajay Srinivasan and Mr. Louis von Zeuner Non‑Executive Directors, are the members of the Committee.

The composition of the Committee is in conformity with the provision of Section 177 of the Companies Act, 2013 and the Corporate Governance Guideline issued by IRDAI.

The other details about the Committee are provided in the Corporate Governance report.

Nomination and Remuneration CommitteeThe Company has a duly constituted Nomination and Remuneration Committee comprising of 4 members consisting of 2 Independent Directors and 2 Non‑Executive Directors. Ms. Sukanya Kripalu is the Chairperson of the Nomination and Remuneration Committee.

Ms. Sukanya Kripalu and Mr. Mahendren Moodley, Independent Directors and Mr. Ajay Srinivasan and Mr. Asokan Naidu, Non‑Executive Directors, are the members of the Committee.

The composition of the Committee is in conformity with the provision of Section 178 of the Companies Act, 2013.

The other details about the Committee are provided in the Corporate Governance report.

Declaration by Independent DirectorsThe Independent Directors of the Company have given the declarations and confirmed that they met the criteria of Independence as provided under Section 149(6) of the Companies Act, 2013.

Key Managerial PersonnelPursuant to the provisions of the Companies Act, 2013, the following employees were holding the position of Key Managerial Personnel (‘KMP’) of the Company during the FY 2017‑18:

• Mr. Mayank Bathwal, Chief Executive Officer,

• Mr. Shikha Bagai, Chief Finance Officer,

• Mr. Rajiv Joshi, Company Secretary,

There have been no resignations/ removal of the Key Managerial Personnel of the Company during the FY 2017‑18.

Annual Performance EvaluationA formal evaluation mechanism has been adopted for evaluating the performance of the Board, Committees thereof, individual Directors and the Chairman of the Board. The evaluation is based on criteria which includes, among others, providing strategic perspective, Chairmanship of Board and Committees, attendance and preparedness for the meetings, contribution at meetings, effective decision making ability and role of the Committees.

Pursuant to the requirement of the Companies Act, 2013, the annual performance evaluation of the Board, the Directors (Independent and others) individually, Chairperson, as well as applicable Committees of the Board viz. Audit Committee, Nomination and Remuneration Committee, Investment Committee, Risk Management Committee, Policyholders Protection Committee, was carried out for FY 2017‑18. The outcome of the said performance evaluation was placed at the Board Meeting held on April 20, 2018. The Committees and the Board as a whole are functioning effectively.

Extract of Annual Return (including Managerial Remuneration)The details on remuneration (sitting fees) paid to the Non‑Executive Directors are disclosed in the Corporate Governance Report and Form MGT‑9, which forms part of the Board’s Report.

Auditors• Statutory Auditors, their Report and Notes to Financial

Statements Appointment of M/s MSKA & Associates (formerly known

as M/s MZSK & Associates), Chartered Accountants (Firm Reg. No: 105047W) and M/s Khimji Kunverji & Co., Chartered Accountants (Firm Reg. No: 105146W) as the Joint Statutory Auditors of the Company for the FY 2018‑19, are due for ratification at the forthcoming Annual General Meeting (‘AGM’).

M/s MSKA & Associates, Chartered Accountants, one of the Joint Statutory Auditors have expressed their inability to continue as the Statutory Auditors due to regulatory limits on the number of insurance audits. M/s Khimji Kunverji & Co., Chartered Accountants who were

Financial Statements 58-96Statutory Reports 22-56Corporate Overview 01-21

29

appointed at the 2nd AGM to hold office till the conclusion of the 7th AGM, have expressed their willingness to continue as one of the Joint Statutory Auditors.

In terms of Corporate Governance Guidelines issued by the IRDAI, an insurance company is required to have minimum 2 Joint Statutory Auditors. The Corporate Governance Guidelines also prescribes requisite criteria for eligibility of firms to be appointed as Joint Statutory Auditors of the Company. M/s GBCA & Associates LLP, Chartered Accountants who being eligible have offered themselves to be appointed as one of the Joint Statutory Auditors in place of M/s MSKA & Associates, the retiring auditors for a term of 1 year from conclusion of this AGM till the conclusion of 4th AGM.

The Company has received certificates from M/s GBCA & Associates LLP, Chartered Accountants and M/s Khimji Kunverji & Co., Chartered Accountants confirming their eligibility and willingness for the appointment as the Joint Statutory Auditors pursuant to Section 139 (1) of the Companies Act, 2013 and as per the requirement stipulated by IRDAI.

Accordingly, the Board has, after assessing eligibility, willingness and experience, proposed appointment of M/s GBCA & Associates LLP, Chartered Accountants along with ratification of appointment of M/s Khimji Kunverji & Co., Chartered Accountants as the Joint Statutory Auditors of the Company.

There are no observations made by the Statutory Auditors of the Company in their report hence does not call for any comments.

• Secretarial Auditors Pursuant to Section 204 of the Companies Act, 2013

read with rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, your Company had appointed M/s. Dilip Bharadiya & Associates, a firm of Company Secretaries in Practice, as its Secretarial Auditor. The Secretarial Audit Report for the financial year 2017‑18 is annexed to this Report.

The Board has duly reviewed the Report of the Secretarial Auditor of the Company. The observations and comments, if any, appearing in the Secretarial Audit Report are self‑explanatory and do not call for any further explanation/ clarification by the Board of Directors under Section 134 of the Companies Act, 2013.

• Cost Auditors The provisions of Cost Audit as prescribed under Section

148 of the Companies Act, 2013 are not applicable to the Company.

• Internal Auditors M/s. Suresh Surana & Associates, LLP were appointed as

the Internal Auditors of the Company for the financial year 2017‑18.

Corporate Social Responsibility The provisions of Corporate Social Responsibility were not applicable to the Company for the FY 2017‑18.

Whistle Blower PolicyThe Company has implemented a Whistle Blower Policy providing a platform to all the employees and Directors to report any suspected or confirmed incident of fraud/ misconduct through any of the determined reporting protocols. More details are provided in the Corporate Governance Report.

Policy on Prevention of Sexual Harassment at WorkplaceThe Company has in place a Policy for Prevention of Sexual Harassment as per the requirements of the Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013. The Complaints Committee has been set up to redress complaints received regarding sexual harassment. All employees (permanent, contractual, temporary, trainees) are covered under this policy. During the year under review there were no cases filed pursuant to the Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressed) Act, 2013.

Secretarial Standards of ICSIPursuant to the approval by the Central Government to the Secretarial Standards specified by the Institute of Company Secretaries of India on 10th April, 2015, the Secretarial Standards on Meetings of the Board of Directors (SS‑1) and General Meetings (SS‑2) came into effect from 1st July, 2015. Thereafter, Secretarial Standards were revised with effect from 1st October, 2017. The Company is in compliance with the revised SS‑1 and SS‑2.

Accounting MethodImplementation of Indian Accounting Standards (IND AS) converged with International Financial Reporting Standards (IFRS)The IRDAI has, vide its circular dated June 28, 2017, deferred implementation of Ind AS in the Insurance Sector in India for a period of two years and the same shall now be implemented effectively from 2020‑21. However, your Company submits Proforma Ind AS financial statements to the Authority on a quarterly basis as directed under IRDAI circular dated December 30, 2016.

Re-appointment of Independent Director after term of five (5) years by passing of a Special resolutionThe provisions of Section 149(10) of the Companies Act, 2013 read with their relevant rules framed thereunder, does not apply to the Company and as such, reporting requirements as mentioned are not applicable.

Disclosure of receipt of commission by Managing Director or Whole-Time Director from Holding Company or Subsidiary CompanyDuring the year under review, your Company did not pay any commission to Whole‑time Director and as such disclosure requirements as per section 197(14) of the Companies Act, 2013 are not applicable.

Significant and Material Orders Passed by the Regulators/ Courts / TribunalsNo significant and material orders were passed by the regulators or courts or tribunals impacting the going concern status and Company’s operations in future.

Board’s Report

30 Annual Report 2017-18

Aditya Birla Health Insurance Co. Limited

Awards/ Recognitions

During the year, our Company has won the following awards: ‑

• Best digital marketing campaign & Best digital integrated campaign by BBC Knowledge National Digital Marketing Awards

• New Insurance Product of the Year by Global Health Insurance Awards

• Mobile (Bronze) Goafest 2017 – Abby Awards

• Product Innovator of the Year & Rising Star of the Year at 2nd Annual India Insurance Summit & Awards 2017

• Best Health Insurance company of the year by Times Network Present the National Marketing Excellence Awards for Excellence in BFSI Sector

• Innovation of The Year Award 2017” for our Product ‑ (Activ Health) by The Changing Dynamics of Insurance & Awards 2017 by ASSOCHAM India

• Digital Insurance Innovation of the year by World Quality Congress ‑ Global Awards for Excellence in Banking, Finance and Insurance Management

• Best Product Innovation ‑ Health Insurance at Fintelekt ‑ Insurance Awards 2017

• Emerging Brand at 8th CMO Asia Awards for Excellence in Branding & Marketing, Singapore

• Health Insurance Products at 9th Edition of FICCI Healthcare Excellence Awards 2017

• Best Crowd Sourced (User Generated) Content ‑ Silver for #JumpForHealth Campaign at 2nd Edition of E4M Content Marketing Awards

• Hot 50 Brands Award by Paul Writer

Transfer of Amounts to Investor Education and Protection Fund (IEPF)The Company did not have any funds lying unpaid or unclaimed for a period of seven years. Therefore, there were no funds which were required to be transferred to Investor Education and Protection Fund (IEPF).

BASIC INFORMATION ABOUT THE COMPANY AND BUSINESS OUTLOOKIRDA LicenseThe Company has received the Certificate of Registration from the Insurance Regulatory and Development Authority of India on July 11, 2016.

The IRDAI vide its Circular dated April 7, 2015 bearing reference number IRDA/F&A/CIR/ GLD/062/04/2015 has pursuant to amendment in Insurance Laws (Amendment) Act, 2015 to Section 3A of the Insurance Act, 1938, discontinued the requirement to apply for Renewal Certificate of Registration (IRDA/R6) on an annual basis. We hereby confirm that the Company has made payment of the annual fees for the financial year 2018‑19 on January 17, 2018 and the certificate of registration which was issued by the IRDAI on July 11, 2016 shall continue to be valid and the same is in force till the Company continues to pay such annual fee as may be prescribed by the Regulations.

Change in name of the CompanyDuring the year under review, there was no change in the name of your Company.

Change in Registered Office AddressDuring the year under review, there was no change in the registered office of your Company.

CORPRATE GOVERNANCE AND SECRETARIAL MATTERS:Committees of BoardFollowing are the Committees of the Board of Directors:

i. Audit Committee;

ii. Policyholders’ Protection Committee;

iii. Nomination & Remuneration Committee;

iv. Risk Management Committee; and

v. Investment Committee.

The detailed description, composition, number of meeting(s) held and attendance of member of respective Committees are mentioned separately in Corporate Governance Report.

a) the state of affairs of the Company at the end of the financial year and of the profit and loss of the Company for that period;