ONB Webinar - Belgium Market Overview (Feb 2017)

-

Upload

opportunities-nb-opportunites-nb -

Category

Government & Nonprofit

-

view

329 -

download

0

Transcript of ONB Webinar - Belgium Market Overview (Feb 2017)

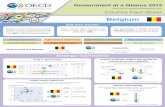

General information about Belgium

General information about Belgium

• A company located in Belgium has access to 200

million consumers within a radius of just 500 km,

thanks to the country’s central geographical location.

• Extensive infrastructure: motorways, waterways and

one of the densest rail networks in the world.

• The port of Antwerp is Europe’s second largest sea

port and hosts the largest European petrochemical

complex.

• Antwerp is also a diamond capital with 80% of the

world’s rough diamonds and 50% of cut diamonds

passing through.

General information about Belgium

Strategic location

Brussels, capital of Europe

General information about Belgium

• Over 1,000 public and private international

organisations have established their

headquarters in Brussels including the main

institutions of the European Union (EU) and of

the North Atlantic Treaty Organisation (NATO)

• Brussels has one of the largest communities of

foreign diplomats and journalists in the world.

• 30 Chambers of Commerce, 700 professional

associations and so on.

Source: Belgium at a glance, belgium.be

Economic Situation and Outlook

• The Belgian economy has been recovering at a

slow pace. With only 1.3% growth in 2014 and

2015, real growth is forecast to rise to 1.7% in

2017 as companies start to see the benefits of

improved competitiveness, employment growth

and increased household spending.

• Private consumption is estimated to have risen by

1.4% in 2015, making it the main growth driver.

• Unemployment fell to 8% in September 2016.

• In terms of sectoral activity, the Belgian economy

continues to become more service oriented, with

services driving economic growth.

Source: European Commission – Country Report

Economic Situation and Outlook

• The structural shift towards a service-based

economy is reflected in the composition of job

growth.

• A significant percentage of new service jobs are

in non-market activities, such as the public sector,

education and healthcare. Total employment in

this segment rose from 31% in 2000 to 35% in

2014, with these sectors representing almost 60%

of total job growth since 2000.

• The Belgian labour market is characterised by a

relatively low overall employment rate and large

employment differentials between regions and

population categories.

Source: European Commission – Country Report

Economic Situation and Outlook

• In 2015 the goods balance shifted into surplus for the first time since 2007.

• Despite the Belgian economy’s strong service orientation, goods still represent almost

three quarters of gross exports.

• Belgium is also a large net commodity importer, with all trade and commercial activity relying on a solvent and stable banking system.

Source: European Commission – Country Report

Economic Situation and Outlook

• Belgian companies are well integrated into the

global economy and global value chains, trading

actively in intermediate goods.

• The overall tax burden is high in Belgium, and

particularly skewed towards labour, although the

government is trying to address this.

• Belgium can also be seen as a test market for

larger European markets as the Belgian economy

and certain consumer preferences largely reflect

the overall European situation, a mini-Europe.

Source: European Commission – Country Report

Customs basis, including re-exports in CAD $ Million

Belgium Rank 12th world (5th destination in the EU) 3.124

Luxembourg Rank 58th world (EU 15th) 205

Netherlands Rank 10th world (EU 3rd) 3.555

Germany Rank 9th world (EU 2nd) 3.612

France Rank 11th world (EU 4th) 3.136

United Kingdom Rank 3rd world (EU 1st) 15.951

CANADA'S MERCHANDISE EXPORTS TO EUROPE 2015

BELGIUM'S MERCHANDISE EXPORTS TO CANADA 2015

Customs basis, including re-exports in CAD $ Million

Belgium Rank 20th world (7th destination in the EU) 2.160

Luxembourg Rank 71st world (EU 21st) 184,6

United Kingdom Rank 6th world (EU 2nd) 9.187

Netherlands Rank 15th world (EU 5th) 3.438

Germany Rank 4th world (EU 1st) 17.341

France Rank 9h world (EU 4th) 6.804

Canadian Direct Investment to Belgium in 2015

Stocks in CAD $ Million: 1,096

Source: Statistics Canada

13

Stocks in CAD $ Million: 5,867

Source: Statistics Canada

Belgian Direct Investment in Canada in 2015

Approved and signed on 30 October 2016 CETA – Next Steps

Canada-European Union Comprehensive Economic and Trade Agreement (CETA)

Canadian Ratification Process EU Ratification Process

Provisional application anticipated in 2017

All economically significant parts of CETA (including tariffs, quotas, services commitments, temporary entry commitments, and government procurement obligations) will be provisionally applied, allowing Canadian

businesses to take full advantage of the expected economic benefits.

Brussels-Capital Region Flemish Region Walloon Region

Investment and Export

Brussels Invest & Export FIT

Flanders Investment and Trade

AWEX

Agence wallonne à l'Exportation et aux

Investissements étrangers

Investment & Trade in Belgium

• Life sciences: Belgium has a strong tradition in life sciences including biotechnology and

pharmaceutical activities, with close cooperation between universities and industry as a

strength of the Brussels-Capital Region.

• Information and communication technology (ICT): the ICT sector is quite dynamic in

Brussels, and the software and multimedia sub-sectors are currently experiencing high

growth.

• International organisations: Given the presence of so many international organizations,

NGOs, industry associations and interest groups, the services industry is fairly strong too.

Brussels - Sectors

• With ports, universities and sector clusters available for industry, Flanders is a key

economic region in Belgium and in Europe.

Flanders - Sectors

High added-value sectors

• Technology − automotive, mechatronics, IT, …

• Healthcare − pharmaceuticals, medical imaging…

• Durable and luxury products − diamonds, fashion …

• Biotechnology, environmental technology …

• Micro-electronics …

• Chemical and metallurgical processing.

Strategic research centres and universities

• imec, VIB, FlandersMake and more.

• KU Leuven, UGent, Antwerp University and more.

• In order to reinforce regional competitiveness in sectors that show clear future potential,

Wallonia decided to develop a policy of company networks in the form of “Competitiveness

Clusters.”

Wallonia - Sectors

Six clusters

• Life sciences - BioWin

• Agrifood - Wagralim

• Transport - Logistics in Wallonia

• Mechanical engineering - Pôle Mecatech

• Aeronautics and space - Skywin

• Environmental technologies - Greenwin