Okanagan Waterwise: Water Centric Planning in the Okanagan - Building Sustainable Communities

Okanagan Business Examienr

-

Upload

niche-media -

Category

Documents

-

view

218 -

download

1

description

Transcript of Okanagan Business Examienr

OCTOBER 2010

U P S S y s t e m s I n c

Always nTM

www.alwayson.com(250) 491-9777 ext. 451

We didn’t invent clean power, we merely perfected it!

“A Proud Okanagan Valley Employer” • Kelowna, BC

Power Protection & Backup for All Industrial & Commercial Applications

PM#41835528

INSIDE:

Financial literacy needs to start young

The old-new-old-but-new-again story of Case Furniture

The 10 Commandments of Customer Service

Sidual’S

Stephane RoyerOne part of the re-creation of Summerland

BEx October 2010 cover.indd 1 10-10-15 11:00 AM

Kelowna Ford lincoln SaleS ltd.2540 enterpriSe way, Kelowna, Bc V1X 7X5 250-868-2330

lincolncanada.com

A higher level of luxury, now At A lower rAte.

LEASELEASEEVENTEVENT

PREMIERPREMIER

Be the first to experience the surprisingly advanced 2011 Lincoln lineup.

turn your drive into a wi-fi hotspot with available Mylincoln touch™±.

experience your music with the available thx ii Certified Audio

System. And keep your l ife connected with SynC®†.

2011MKS

2011MKX

optionAl wheelS Shown.

optionAl wheelS Shown.

2011MKZ

2011MKT

optionAl wheelS Shown.

Offers available at participating dealers only. Dealer may sell or lease for less. Factory order may be required. Limited time offers. Offers may be cancelled at any time without notice. See participating Dealer for details. *Lease a new 2011 Lincoln MKS/MKZ/MKX/MKT and get 0% APR for up to 48 months on approved credit (OAC) from Ford Credit. Not all buyers will qualify for the lowest APR payment. Additional payments may be required. Example: $45,000 at 0% APR for 48 months, monthly payment is $XXX.XX, total lease obligation is $XX,XXX, optional buyout is $XX,XXX, cost of leasing is $0 or 0%. Example based on no trade-in or down payment. Taxes payable on full amount of lease financing price after any price adjustment is deducted. Some conditions and mileage restrictions of 80,000km over 48 months apply. A charge of 16 cents per km over mileage restrictions applies, plus applicable taxes. **Receive 0% APR purchase financing on all new 2011 Lincoln MKZ/MKS/MKX/MKT models for a maximum of 48 months to qualified retail customers, on approved credit (OAC) from Ford Credit. Not all buyers will qualify for the lowest APR payment. Example: $40,000 purchase financed at 0% APR for 48 months, monthly payment is $833.33, cost of borrowing is $0 or APR of 0% and total to be repaid is $40,000. Down payment on purchase financing offers may be required based on approved credit. Taxes payable on full amount of purchase price. ± Driving while distracted can result in loss of vehicle control. Only use mobile phones and other devices, even with voice commands, when it is safe to do so. Certain functions require compatible mobile devices. †Some mobile phones and some digital media players may not be fully compatible - check www.syncmyride.com for a listing of mobile phones, media players, and features supported. Driving while distracted can result in loss of vehicle control, accident and injury. Ford recommends that drivers use caution when using mobile phones, even with voice commands. Only use mobile phones and other devices, even with voice commands, not essential to driving when it is safe to do so. Sync is standard on select new Lincoln vehicles.

0% 48*

MonthSApr

on MoSt 2011 ModelS

leASefinAnCingfor up to

viSit your loCAl linColn deAler todAy.

or purChASe finAnCe with 0%Apr for up to 48 MonthS**.on MoSt 2011 ModelS

VEHICLE LEASE TERMS DOWN PAYMENT

MONTHLY PAYMENT

0%/48MthS* $5,000 $579

0%/48MthS* $5,150 $449

0%/48MthS* $5,300 $499

2011 MKS

2011 MKZ

2011 MKx

2011 MKt 0%/48MthS* $5,400 $649

OBEx Oct ad NEWLincoln_10.8x10.71.indd 1 10-10-15 5:03 PM

What are you wishing for?

New HouseRenovationsDream VacationUniversity Education[insert your wish here]

www.valleyfirst.com

Belong. Be Valued.

Kelowna Ford lincoln SaleS ltd.2540 enterpriSe way, Kelowna, Bc V1X 7X5 250-868-2330

lincolncanada.com

A higher level of luxury, now At A lower rAte.

LEASELEASEEVENTEVENT

PREMIERPREMIER

Be the first to experience the surprisingly advanced 2011 Lincoln lineup.

turn your drive into a wi-fi hotspot with available Mylincoln touch™±.

experience your music with the available thx ii Certified Audio

System. And keep your l ife connected with SynC®†.

2011MKS

2011MKX

optionAl wheelS Shown.

optionAl wheelS Shown.

2011MKZ

2011MKT

optionAl wheelS Shown.

Offers available at participating dealers only. Dealer may sell or lease for less. Factory order may be required. Limited time offers. Offers may be cancelled at any time without notice. See participating Dealer for details. *Lease a new 2011 Lincoln MKS/MKZ/MKX/MKT and get 0% APR for up to 48 months on approved credit (OAC) from Ford Credit. Not all buyers will qualify for the lowest APR payment. Additional payments may be required. Example: $45,000 at 0% APR for 48 months, monthly payment is $XXX.XX, total lease obligation is $XX,XXX, optional buyout is $XX,XXX, cost of leasing is $0 or 0%. Example based on no trade-in or down payment. Taxes payable on full amount of lease financing price after any price adjustment is deducted. Some conditions and mileage restrictions of 80,000km over 48 months apply. A charge of 16 cents per km over mileage restrictions applies, plus applicable taxes. **Receive 0% APR purchase financing on all new 2011 Lincoln MKZ/MKS/MKX/MKT models for a maximum of 48 months to qualified retail customers, on approved credit (OAC) from Ford Credit. Not all buyers will qualify for the lowest APR payment. Example: $40,000 purchase financed at 0% APR for 48 months, monthly payment is $833.33, cost of borrowing is $0 or APR of 0% and total to be repaid is $40,000. Down payment on purchase financing offers may be required based on approved credit. Taxes payable on full amount of purchase price. ± Driving while distracted can result in loss of vehicle control. Only use mobile phones and other devices, even with voice commands, when it is safe to do so. Certain functions require compatible mobile devices. †Some mobile phones and some digital media players may not be fully compatible - check www.syncmyride.com for a listing of mobile phones, media players, and features supported. Driving while distracted can result in loss of vehicle control, accident and injury. Ford recommends that drivers use caution when using mobile phones, even with voice commands. Only use mobile phones and other devices, even with voice commands, not essential to driving when it is safe to do so. Sync is standard on select new Lincoln vehicles.

0% 48*

MonthSApr

on MoSt 2011 ModelS

leASefinAnCingfor up to

viSit your loCAl linColn deAler todAy.

or purChASe finAnCe with 0%Apr for up to 48 MonthS**.on MoSt 2011 ModelS

VEHICLE LEASE TERMS DOWN PAYMENT

MONTHLY PAYMENT

0%/48MthS* $5,000 $579

0%/48MthS* $5,150 $449

0%/48MthS* $5,300 $499

2011 MKS

2011 MKZ

2011 MKx

2011 MKt 0%/48MthS* $5,400 $649

OBEx Oct ad NEWLincoln_10.8x10.71.indd 1 10-10-15 5:03 PM

President Craig N. Brown Vice President Noll C. DerriksanGrand Chief WFN, U.B.C.I.C.

101-1979 Old Okanagan Highway, Westbank, BC V4T 3A4T: 778.755.5727F: 778.755.5728

FOLLOW US ON

COVER

insidE

PublisherCraig [email protected]

associate PublisherChytra [email protected]

busiNess DeVeloPMeNt MaNaGerRoy [email protected]

MaNaGiNG eDitorDevon [email protected]

aDVertisiNG salessales representativeMurray HicksAngus CathroJesse KunickyKathie Nickel

DesiGN / ProDuctioNCorrina [email protected]

assistaNt to the PublisherJoanne [email protected]

coNtributiNG PhotoGraPher Shawn [email protected]

subscriPtioN rates12 issues annually | One year: $27.00778-755-5727

DistributioN The Okanagan Business Examiner is published monthly at Kelowna, BC by Prosper Media Group Inc. Copies are distributed to businesses from Osoyoos to Greater Vernon. The views expressed in the Okanagan Business Examiner are those of the respective contributors and not necessarily those of the publisher or staff.

PUBLICATIONS MAIL AGREEMENT NO. 41835528 RETURN UNDELIVERABLE CANADIAN ADDRESSES TO: 105-1979 OLD OKANAGAN HIGHWAY, WESTBANK, BC, CANADA V4T 3A4

4 Okanagan Business Examiner / October 2010

Follow us on

SIDIT’s Interest - 6Need money, have a great idea and no capital? Tell it to SIDIT. That’s what they’re for.

10 Commandments of Customer Service - 9Thou shalt respect thy customer. Thou shalt listen to thy customer. Thy boss will empower thee to be helpful. Plus a lot more.

Retire Wealthy - 11Our newest columnist, Greg Kalyniuk, says the best things are the simplest things. So he has time-honoured wisdom to pass on from his Dad on how to retire wealthy. And you have to respect that.

Case is Back - 12They were there, they went away (but they were never really gone) and now they’re back. Confused? Figure out the comings and goings of Case Furniture’s ongoing evolution.

Summerland’s rE-creation - 15The District of Summerland is defined by its beauty, its lifestyle and an increasingly senior population bulge. The town knows it and is setting out to change the future. Lucky that several enterprising business people under 40 are already there to show the way.

It’s not just business. It’s the power of your word, your values, youth, doing the best you can and pulling it all together into a semblance of balance. If there’s one thing Stephane Royer knows it’s about balance.Page 16

Mix of philosophy, ethics and business

insidE

Okanagan Business Examiner / October 2010 5

SIDIT 6

peace hIllS TruST 8

Shelley GIlmore 9

lIberTy FooDS 10

GreG KalynIuK 11

caSe FurnITure 12

InFluenTIal leaDerShIp Survey 13

SummerlanD’S re-creaTIon 15

cover STory on SIDual 16

SummerlanD projecTS on The Go 17

The Suburban prInceSS 18

DomInIK Dlouhy 21

Zela Wela KIDS 22

Women’S enTerprISe cenTre 23

roberT SmIThSon 24

moverS & ShaKerS 26

calenDar 28

The eDITor’S TaKe 30

COntRibutORs

robert sMithsoN

Smithson is well known for his regular articles on all aspects of labour law and how it affects business. This month his contribution highlights just how difficult it can be for companies that try to impose restrictions on what former employees can or cannot do after they leave an employer. His advice? “Less is more.” Robert Smithson is a lawyer at the Kelowna law firm, Pushor Mitchell.

shelley GilMore

Shelley Gilmore is a Certified Human Resource Professional with more than a dozen years of experience in a variety of business sectors including wine, health care, non-profits. She has acted as a consultant to many companies and even individuals on how to further their position. This time out she makes the point that there is a direct link between customer service and employee satisfaction. In talking about ‘Taking Zeros to Heroes’ the conversation might be about failing employees, but it is also about failing management.

Big Helping Small Business Do Things

Visit www.ourokanagan.ca

Connecting our Valley | Creating Opportunity

Call your local office for Start-up or Expansion Loans,

Business Counseling and Business Training

Penticton: Karen Chamberlain 250-493-2566 ext 214Kelowna: Dave Scott 250-868-2132 ext 227Vernon: Larry Hogan 250-545-2215 ext 249

The Conference Board of Canada reported earlier this year that once again, Canada got failing grades for its achievements in innovation. Overall we came in at 14 out of 17 in innovation, generating an overall grade of ‘D’ as measured in 12 different indicators.

It is not that we aren’t coming up with any new ideas though: our highest grade among those dozen indicators was a ‘B’ for scientific articles.

Our gap lies between the ideas generated and taking them to market. Even outside of the hi-tech science end there is simply less chance that any entrepreneur in Canada will successfully take an idea to market or onto the international stage than in most of our economic peers.

Back in 2004 the Okanagan Partnership was created to build on the idea that innovation comes from “clusters” of businesses that, through a gathering of related support industries and experts, help to grow the industry and each other, even if they are competitors.

This idea of clusters is part of the essential node of like-thinking people who are credited for creating the Silicon Valley cluster in California and other areas of research and innovation.

One of the factors limiting our ability to develop and take ideas to market is the ability to finance them.

This is where the Southern Interior Development Initiative Trust (SIDIT) comes into play. It’s mandate is to support “economic development initiatives that will demonstrate long term measurable economic benefits with the Southern Interior.”

CEO Luby Pow, who came from what she calls the conventional banking sector, describes one

of SIDIT’s purposes this way: “We come into the picture when they finish research and development and are going into commercialization.”

Formed in 2006 with a one-time $50 million grant from the government of B.C., SIDIT put together a three-year plan that began in 2007, but recently released a new plan to take it to 2013.

Money will go into the projects that have the most promise, but SIDIT’s board has specified 10 sectors where the bulk of its money will be doled out.That will amount, in total, to $7.5 million per year for projects in one or more sectors among agriculture, economic development, energy, forestry, mining, Olympic opportunities, pine beetle recovery, transportation, small business and tourism.

Those sector titles, especially economic development, are so broad that almost anything could, in theory, go into them.

Pow says there was a shift from the first three years to the second. “We’ve moved away from trail creation and beautification projects to something that can be proven to be sustainable.”

The organization fills a needed niche for entrepreneurs with ideas that are simply not yet bankable. She explains, “It’s very difficult to get financing on intellectual property-based companies because there is no collateral to secure. They want real assets.”

“For conventionals [lending institutions] once a cash flow is established they will lend, but until the cash flow is established they won’t take the risk.”

SIDIT is not a copy of Community Futures, the BDC or any other government funded organization supporting entrepreneurs with

Fighting our local Innovation Gapby DeVoN brooks

Photo of luby Pow by DeVoN brooks

Okanagan Business Examiner / October 2010 7

loans even though making loans is part of its mandate.Instead it has a specific geographic focus, and it does finance some non-business ventures, including some educational initiatives. It also collaborates with those other lending institutions and others like community foundations, the B.C. Innovation Council, several post-secondary education institutes, Western Diversification, credit unions, some “enterprising” non-profits, the Okanagan Innovation Fund and conventional banks.

Another difference, says Pow, is that SIDIT does not have, or want, a lock-hold on its clients. “Many financial institutions won’t share their information for fear of losing the [client] company, but we aren’t proprietary at all.”

So if a company does well, and

other lenders want a bigger piece of the action, they are welcome to take the business away. This means that SIDIT will get its capital (with profits) returned sooner, providing the other lender with a new customer.

For entrepreneurs this is a positive sign indicating they are less risky and therefore eligible for lesser interest rates. Pow notes, “Interest rates are based on risk and our deals are substantially riskier.”

The SIDIT board includes five provincial appointees, all from within the mandated area and eight

elected politicians. Then there are two regional advisory committees, one for the Okanagan and another for the Columbia-Kootenay.

One of the companies SIDIT has helped is VeriCorder Technology (digital media recording and editing). In SIDIT’s 2010 Annual Report VeriCorder CEO Gary Symons wrote, “SIDIT funding and support has been the single most critical development for us in our transition from a startup company, to a company generating real revenue.”

Vineyard Networks is another. The company received vital recognition from Network World magazine this year, which named it one of 10 startups to watch, the only Canadian company on the roster.

Pow says the company is already enjoying tremendous success.

“They’re [Vineyard Networks] still very early stage, but to get a $2 million purchase order in your first year is huge.”

Others include SST Wireless, the Pryme Group, Delta C Technologies and Golden Timber Frame.

Another aspect of SIDIT is to provide funding for established companies to jump to the next tier. Whether it is a new company, or it’s funding to take one to the next level, Pow says, “It is patient capital.”

The money comes with a few strings

attached: those that receive these funds must create the companies and the employment within SIDIT’s area of operation. This too feeds into the idea that clusters of innovation must be built if these kinds of enterprise are to grow here.

As Pow acknowledges, once SIDIT loans are paid off the businesses are free to move. “We do anticipate that as some of these companies are sold and our

debt is extinguished they could go elsewhere.”

It’s just that that isn’t in the plan. After all they can only get the money if, she says, “They have to show they can generate the funds to keep it going without government support.” Hopefully it means they can keep the companies and employment growing here. And help jump Canada’s innovation gap.

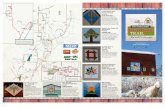

siDit’s GeoGraPhic MaNDate coVers the southerN iNterior of the

ProViNce

SMALL BUSINESS WEEK ®

OCTOBER 17-23, 2010

Take part in activities organized in your region!

NATIONAL SPONSORS

POWER UP YOUR BUSINESSINVEST. INNOVATE. GROW.

wbs/ac.cdb.www | CDB OFNI 888 1

MaP courtesy of siDit

“SIDIT funding and support

has been the single most

critical development for us in

our transition from a startup

company, to a company

generating real revenue.”

- Gary Symons

8 Okanagan Business Examiner / October 2010

Photo Shawn Talbot

Peace Hills Trust, owned by the Samson Cree Nation of Alberta, was the first aboriginal wholly owned financial institution in Canada. Founded 30 years ago in Alberta, Peace Hills Trust is established throughout western Canada with branches located in or urban centres, often on reserve land.

“We operate like any other bank,” explains Tony Shirt, Assistant Vice President of Corporate Marketing and Business Development. “We are not just a bank for First Nations customers many of our customers are non-First Nations.”

“We’ve grown with the success of our customers. As their capacity has grown, we have mirrored that and grown our customer and asset base,” adds Shirt.

The company’s head office is in Hobbema, about 100 kilometers south of Edmonton. In the 30 years since the Samson Cree provided the capital to launch the company, it has grown to more than 120 employees, who serve 20,000 customers.

In addition to the head office Peace

Hills has three other locations in Alberta, two in Saskatchewan, one in Manitoba and, in British Columbia, one location in Kelowna.

In the beginning days, there was a strong focus on helping to develop First Nations communities. That relationship building has brought a wealth of experience to Peace Hills Trust says Scott Baldwin, Assistant VP of the B.C. Region. “Most of our lenders are quite experienced and quite comfortable in dealing with First Nations lending on and off reserve.”

In British Columbia, the branch has done off and on reserve lending for commercial projects including hotels, casinos, and shopping centres. “We did a nice shopping centre in Duncan for the Cowichan band, in partnership with another financial institution,” says Baldwin.

Baldwin also says, “We have forged alliances with other financial institutions. We can come into a deal, do our own analysis, and while we may not be the

lead banker, we do take a share of the risk and the profit.”

A clear advantage Peace Hill Trust brings to building on reserve and serving First Nations is their expertise in the legislative and cultural challenges faced by each reserve. “While many issues are becoming more standardized there is still a lot of variance and challenges in accessing capital. We are able to meet many of those challenges.”

In the past year Peace Hills Trust expanded their capacity to act as a corporate trust for First Nations.

With its very conservative lending policies Peace Hills Trust was able to come through the recent recession relatively unscathed. Shirt credits a strong, independent adjudication process with the smooth sailing. “We are interested in the overall growth of the company on a long term basis, and the attributes and foundational policies which create that growth.”

Peace Hills builds trust across Country

Okanagan Business Examiner / October 2010 9

Taking People from Zeros to HeroesBusiness is competitive, now more than ever. Every business is literally in a fight to not only earn the confidence of the consumer, but to persuade them to spend what money they do have with them. Dedicating attention to the customer service interface components of business ensures longevity and creates the very natural byproduct of a stronger bottom line.

If your mission statement was “the Happiest Place on Earth” would your employees know what the expectations would be day-to-day? Would they be able to answer the ‘why are we here’ question?

Disneyland and Walt Disney World have chosen this simple and yet highly effective mission statement to set the expectations for both their employees and their customers. It is used to model every corporate practice.

According to Tyler Galts, general manager for the award winning Quails Gate Winery in West Kelowna, “As we’ve grown, we’ve needed to get smarter. We had to put a critical eye to our overall front line and we have worked to get better every year, to chip away at it. We measure how we are doing, gathering continuous feedback and constant review.”

He adds, “We believe that the employee experience is the customer experience. A positive effect on the bottom line is definitely a byproduct of good customer service, but it starts with solid communication, connecting the employees to the business through its history and its vision.”

Customer service, by many accounts, is slipping in Canada even though a recent Gallup survey suggests a happy, engaged customer will spend 46% more than one who is merely satisfied or marginally engaged.

When we think of customer service many of us automatically think of retail or restaurant applications. Truth is store front businesses, business to business and professional services, such as legal and accounting and even healthcare, all deserve failing grades across our country when it comes to service.

All businesses need to look at their vision, their mission and ask, ‘Why are we here?’ Many front line staff or customer interface employees cannot answer that question, yet organizations must supply clarity of purpose to ensure a strong bottom line. Customer service training needs to become a mandated component of every business.

Assuming a person with a nursing degree, an accounting designation or other specialized

training knows how to treat customers is a poor practice. Teaching them the basics, ensuring there is a standard and providing reinforcement at all levels of the organization and linking all these pieces to a common mission is a business’ key to success.

We all know our people on the front lines are the face and the voice of the organization yet so many companies set these critical people up for failure, turning them into service zeros instead of heroes.

While standing in a grocery store line up (where I collect my most impressive reconnaissance information) I was speaking with a lady ahead of me. We were chatting about customer service as the store was busy, yet they only had two cashiers open and the lineups were quite long.

She wondered why healthcare employees don’t have strong customer service skills. She often felt her needing care from her doctor was an imposition on the office staff. After repeated occurrences of this she chose to use a walk in clinic versus her own family doctor.

“Showing a customer that you are having a bad day and offering bad service as a result is not an option,” says Katja Oldendorf, manager of Mickey’s Pub in the Ramada Inn in Kelowna. “We have staff meetings to discuss why we’re here, what we’re doing well and where we’re not meeting the goals we have. Regular communication and consistent application at all levels makes the message of service expectations an easy one.”

The comment I hear quite often from managers and business owners is that they don’t have time to stop and reflect, let alone develop a strategy on customer service.

My reply – you can ill afford not to.

Consumers are more fickle than ever, hence the age-old adage about ‘make a customer happy and he’s yours for life, but treat him poorly and he’ll tell 10 people who’ll tell 10 people and so on’ holds very true. You cannot afford to have your front line staff make that kind of impression on a customer or patient – it’s your business’ name and image at stake.

Solutions can be as complex or as simple, as formal or as fun as you want or need them to be. Start with clarity of purpose and train to meet expectations. There are roadmaps available to get you started, but you have to decide to do things differently and commit to a process.

Join a quality standards membership, get your team together and brainstorm your solutions, bring in a qualified consultant to help you create

your strategy – just do something!

A general manager I had years ago had, prior to that position, worked overseas for a large hotel company. To ensure all hotel employees, from housekeepers to administrative staff and front desk agents, were intimately connected to why they were there –which of course was the customer– he staged an unusual training session.

Many patrons arrived at the hotel after hours of travel so they were exhausted, grumpy, dazed due to time zone changes and eager to get settled. To develop a strong sense of empathy with the customer, the general manager took his staff to the airport, where they boarded a plane, got settled in their seats and then sat on the tarmac for six hours. By the end, the employees were frustrated, tired and just wanted off the plane.

When the staff returned to their duties at the hotel, customer satisfaction ratings went through the roof. The employees heard the message, understood their mission and both they and the property benefited. Visitors got the word out.

This same general manager gave me the following 10 commandments of customer service, which I still use to this day!

• Know who is boss – we are in business to service customer needs; • Be a good listener; • Identify and anticipate the customer’s needs; • Make customers feel important and appreciated; • Help customers understand your company and its systems and processes; •Enact the “can do” attitude – use the power of “yes”; • Know how to apologize; • Give more than is expected; • Get regular feedback, and; • Treat employees well – your internal customer will reflect to your external one.

Do your part to improve Canada’s rankings in the customer service arena. Take your organization from zeros to heroes; your bottom line will be healthier for it!

Shelley Gilmore is a Kelowna-based business consultant. Gilmore HR works with businesses to link the people side of business and the people strategy to the business plan. She can be contacted at 250-864-1153 or view her services online at www.gilmorehr.com.

10 Okanagan Business Examiner / October 2010

After three years of a considered move to compete with Wal-Mart and create a more energy efficient operation, Liberty Foods in Fruitvale has completed the first part of an ongoing retrofit program. The results, say the owners, have been a bigger bang for the power consumption buck and an increase in customers and sales.

Liberty foods has been owned and operated by the Dar family since 1957. Derrick Dar is the current operations manager and admits that being the main store in town for so long only took the company so far once big box competition showed up. “We are very fortunate to have a very loyal customer base, but we had to encourage our customers to come back once Wal-Mart arrived. We had to figure out our point of differentiation.”

The store and building had had no visible work done since 1987; it was showing its age. Five years ago, long before he spent a penny, Dar began an in-depth planning process, including consultations with FortisBC.

Fortis did a free walk through audit of the store and made a series of energy efficiency recommendations. Lighting was a key area, as were the coolers and freezers. Going through the consultation process paid off

in more than advice as Liberty Foods was able to access almost $12,000 in rebates from Fortis.

Out of necessity the first change Dar made was to the HVAC system and rooftop compressors. It was a choice customers couldn’t see, but Dar says had an impact on reliability. It wasn’t until Liberty replaced the lighting and store coolers that customers started to notice a difference in their direct experience. Liberty also invested in customer service training and a beautification program that included new lighting.

The old lighting had been warehouse style lighting – it was expensive to operate and left dim areas in the store. The all new T8 lighting is brighter, less expensive to run, and customers are happier. Says Dar, “Our old lighting didn’t even line up with the aisles properly. The result is quite bright and friendly.”

The deli, meat, dairy and produce sections all received new refrigeration units, replacing old style “coffin coolers.” Essentially, every unit around the perimeter of the store was replaced. The sleek new units being the best design available in the industry, that not only look fresh and new, but involve substantial energy savings. The improved energy efficiency allowed

Liberty to install more units for the same energy consumption.

There is still work to be done, says Dar. Sliding aluminum covers for the open coolers are next. With a quarter of a million dollars already spent on retro fits and solid results to show for it, he is confident the next steps will pay for themselves. “Without the rebates from FortisBC I might have been more hesitant to get started, but in some cases where we have spent money we have seen an immediate return and we are able to invest that back into the company.”

“To gain customer confidence we had to show a willingness to invest on our part. Beyond that we had to step up our customer service game to go with the renovation.”

Rebates enervate Store Makeover

Photos by larry Doell,

Doell PhotoGraPhy

liberty fooDs MaNaGer Derrick Dar

Okanagan Business Examiner / October 2010 11

My Dad, William, used to say, “Greg, buy land, they aren’t making any more of it.” While that is true, what Dad didn’t tell me was that if a person owned land he could retire rich. The simple plan I will describe in this short article can help everyone achieve real wealth through real estate ownership.

I credit this plan to a book called The Automatic Millionaire Home Owner by David Bach, which is still readily available. Mr. Bach’s thesis is very simple: buy and live in your own home, pay down the mortgage as quickly as you can, take equity out of your home through a refinance and buy another home. You then rent out one of the homes and live in the other. Repeat as often as you can until you retire.

Once you retire you can live very well off the income from all of those renters paying you every month. You could even sell one of your investment properties if you need extra fun money.

The key to this plan is to not sell your properties, but keep them for the long term. During that time other people help you build wealth by paying down your mortgage. You may even be fortunate enough to experience increased property values over time. If this happens you can use the appreciated value of your home to leverage even more money for other purchases.

The beauty of this plan is that you are forced into a savings plan by having to pay your mortgage every month. When your mortgage is paid off you can live in a home for just the cost of utilities and a few repairs now and then. If you own and rent out a second home you use other people’s money (OPM) to save for you and increase retirement income.

We all have to live somewhere, so why not buy the home you have to live in? With declining home prices in the Okanagan (finally), extremely low mortgage rates, and high inventory levels the time is right for home ownership.

It’s true that to buy a home you have to have a steady job and be able to come up with a down

payment. In this economy, that can be a tall order; however, if you and/or your spouse have reasonably good jobs, with a little patience and a regular savings plan, the down payment won’t be too far off.

If you can’t scrape up a down payment look into a rent to own program. It will allow you to find a home you like and live in it while you build up a down payment. First time home buyers can even take money for a down payment out of RRSPs to get started.

There are potential challenges and risks to this perfect plan that I might as well lay out on the table.

what if you don’t want to be a landlord?

The simplest solution for that challenge is to hire a reputable rental management company. It will cost you a percentage of your income every month, but you won’t have to worry about landlord duties.

what if the property value declines rather than appreciates?

All real estate markets are cyclical and you could buy in an up-market like 2007. We are in a down market now, but the market will recover eventually as it always has. When the market does recover, the low point of the present cycle will be higher than the previous down cycle low point. Your property will appreciate and likely at a rate that far outstrips inflation, but remember this plan calls for a long term view, not a quick flip.

what if the rent doesn’t cover the expenses?

A property that doesn’t pay for itself is a poor investment. You can now find properties in the Okanagan that, when rented out at a fair market rate, will meet that criterion. The key to owning any investment property is to have all costs paid

for by the tenant, leaving extra money in your jeans every month.

There you have it – a great, simple plan for building real wealth through real estate ownership. If you have equity in your home, leverage it and use other people’s money to make you rich.

Greg Kalyniuk is a Vernon REALTOR working for RE/MAX. You can reach him at 250-503-3758 or by e-mail at [email protected]. Views expressed in this article are the opinions of Greg Kalyniuk and do not necessarily reflect the views or positions of RE/MAX Vernon.

Retiring Rich

through

Real Estate

A Simple Plan

February 2010 Okanagan Business Examiner | 15

Trade-Marks

Patents

Trade Secrets& Technology Transfer

Industrial Designs

Copyright

PRACTICE RESTRICTED TOINTELLECTUAL PROPERTY LAW

LAW CO R P O R AT I O N

REGISTERED PATENT & TRADE-MARK AGENT

PHONE: (250) 418-3250FAX: (250) 418-3251TOLL FREE: 1-877-943-9990E-MAIL: [email protected]

t 250.769.2402 f 250.769.2443www.wfn.ca

Noll DerriksaN's estate s

• Keremeos (www.keremeos.com)

12 Okanagan Business Examiner / October 2010

Not too long after Marion and Dennis Case opened their first furniture store in Enderby in 1977 they realized the need for accounting help. Shortly after that they brought on Loydeen Hagman, but finding office space required them to pry the door off a closet, stick up a shelf and squeeze a desk and chair in.

Times have changed.

Case Furniture Gallery today employs 54 people, working 68,000 sq. ft. of home furnishings in three different buildings in Enderby, Vernon and Kelowna.

They ran under the Case name until 1997, when they signed on to the Ashley Furniture business model. In 2004 the pair opened their second Ashley store in Kelowna.

Ashley is a privately owned firm based in Wisconsin, which started up in 1945. Retailers with Ashley are independently owned and operated, but agree in their license to stock only Ashley products.

Marion says the Ashley product line is a good one, but after working that model for 13 years the Cases felt the restriction on bringing in other lines wasn’t the best option for them or their customers. She says, “We want to be a leader in fashion.”

Along with different manufacturers

the company also added outdoor furniture and appliances to the product mix.

In 2009 the Cases decided to expand again. They took over the 18,000 sq. ft. Sandy Furniture store in Vernon. After renovations it was renamed to the Case logo. This time it was not only an expansion in size, but to another generation. The Vernon store is running under the management of Marion and Dennis’ daughter, Jody Swartz along with her husband Brad.

This year the family changed the other two stores to the Case banner. Asked about the loss of identity under the Ashley name, Marion shrugs it off. “In Enderby they still referred to us as Case even though we were Ashley for 10 years.”

While the Case name in furniture was never established in Kelowna, she believes that a strong track record of customer service will keep customers returning to the store.

She lists off several examples of service that make the difference. The customer, she intones, is always right, even to the point where it sometimes hurts them. When a custom-ordered sofa was brought in the customer came to tell them he’d run into financial difficulties and needed his money back.

He got it, but at Case’ expense.

Marion says, “We’re flexible. In fact, we’re too flexible.”

He’d paid for it with a credit card, so they not only had the furniture, but they had to pay the credit card fees. She is certain that this kind of service will bring that fellow back, and likely have him recommend them to others.

All parts of the business work under that service model. Delivery people must check in so that the manager and sales person know a customer is happy with what they bought and how it was delivered.

Explains Marion, “The better the experience the customer has, the better our performance, and [the customer] might not even know why.”

Changes in furniture retailing are about more than the evolution of the Case family business name.

Technology and changing tastes have had profound impacts.

Marion, who is her company’s IT guru, remembers when they used to track inventory using a system of recipe cards. The first computer they brought in, sometime in the early ‘90s – she can’t remember exactly when – was to help with that task.

Unlike many other industries, the computer has not brought a revolution of online buying. Research, yes, but relatively little purchasing. She asks, “There is furniture bought online, but who’s going to buy a sofa they haven’t sat on?”

More important changes have come from how they market and, significantly, to whom. The days when someone would buy a sofa to last 20 years or a lifetime are long gone as is the time when the man believed he ruled the household.

One of the reasons that furniture changes, aside from changing fashions, is our transience. Canadians move much more frequently than they used to, and new homes usually need different furniture. Statistics Canada has

charted a correlation and says, “On average, homebuyers spent twice as much on furniture in 2002 as homeowners who did not move.” Statistics from 2002 show the average non-moving homeowner spent $1,371 on furniture (not including appliances or electronics) while a mover spent $2,788. Given the large number of people, especially retirees coming to the Okanagan, strong sales in this market.

This also ties into who makes the decisions about furniture purchases. Women aged 25 to 54 buy 80% of all furniture, and how they buy is very different from men. Marion explains, “Men will sit on a sofa and like it or not. Women have a relationship with their environment. They’ll relate [furniture] to their room, their living space and family and friends.”

It also ties into how Case (and most other furniture stores nowadays) market. It is also reflected in their advertising where, Marion says, “In graphics we like to have lifestyle images.”

They used to display furniture as is, in rows in their stores. Then in 1992 she says they paid “a fortune” to bring in a San Francisco designer to look at their Enderby store and give them advice. His suggestion was to arrange the furniture into settings the buyer could relate to, that she or he could see being in their home.

That vision shapes how the company arranges displays to this day and it’s reflected in dozens of set ups you see as you wander through the main store.

There is another figure from Statistics Canada that reinforces the Case business plan, which is the growing trend for people to buy their furniture and appliances from furniture store specialists. Sales growth from general merchandise stores like department stores are declining in relative importance as are other retail outlets like supermarkets, drug stores and home building centres.

Making the Case for a Change of Name

After more than ten years of selling under the Ashley banner Case Furniture is back

Photos & story by DeVoN brooks

this DiNiNG rooM suite shows Much More thaN just a table aND

chairs - aN exaMPle of how DisPlays show what a rooM caN

look like, rather thaN just the ProDuct beiNG solD

The Most Influential Business People

It’s about leadership

We at the Okanagan Business Examiner believe it is time to recognize the contributions of our most amazing business leaders.

We will share the results of our work in a future issue, but there are too many people in too many categories for us to do this without

your input. There are so many business people hard at work in the different communities, many of whom fly under the radar.

We would like you to nominate as few or as many people as you think are worthy of the mention, but we need (and require) you to

not only name the person, but to give us a very short explanation of why you think this person is worthy of the mention.

We have some criteria for you to think about. We do NOT mean that any person you decide to nominate must be incredibly

accomplished in every category listed, they must simply have made extraordinary contributions in at least one of these categories.

Be assured we will not be coming back to you to justify or explain your recommendations. There is no follow up on your part – we

are simply looking for as much input from as many people as possible on who has served and represented the business community as

well as possible.

Please name individuals, or at least families, rather than a company name. Who, in any business that you are considering, is

responsible for the amazing contribution you are crediting them with?

CrITErIa:

• Financiallysuccessfulwiththeirbusiness

• Businesspeoplewithinsightful,advancedthinkingintheirHR

practices

• Businessesthathavemadeahugeimpactfortheiremployees

orthelocaleconomy(thinkoftheMissionHillwinery)

• CommunityImpact-Whogivesbackaboveandbeyondthe

call

• Geographiclocation-Notallcommunitieshavethesame

customer draw, so some businesses may not be the biggest, but

that might make them all the more remarkable for their success

• Longevity-businessesthathavesurvivedthetoughtimesand

thrived in the good times for decades

• Productive-weallhearhowCanadiancompaniesaren’t

productive-whoisandhow

• Innovators-notonlythelatest,butthoseusinginnovationsin

service or technology that is shrewdly considered the greatest

BusInEss sECTOrs TO COnsIdEr:

• Wine&Foodproduction

• Tourism-restaurants,sports,recreationactivities,art,

historical&culturalattractions,accommodation

• Agriculture-ranching,research,fruit,dairy,organics

• Forestry-notonlythemajorprocessorsbutsupportservices

• Law&LegalSupportServices

• Transportation

• Education

• Finance-banking,financialplanning,accounting

• Construction/development-architecture,realestate,

renovators, contractors

• Hi-tech-softwareproducers,programmers,Internetservices

• Charity/communitybuilding

• Arts-Roots&BluesFestival,venuemanagement,Chaos(in

Vernon), music, galleries, art creation

• Industry/manufacturing

• Communication-media,PR,print&publishing,radio,TV

• Retail-stores,management,franchises

• Supportorganizations(ChambersofCommerce,networking

groups,EDC,BIAs,BBB,politicians)

• Health-doctors,dentists,research,physiotherapists,

alternative health providers, opticians, specialists

• Serviceproviders-toomanytolistbuteverythingfromair

conditioning to window cleaners

Name: ____________________________________________________________

Achievements: ______________________________________________________

______________________________________________________________

______________________________________________________________

Name: ____________________________________________________________

Achievements: ______________________________________________________

______________________________________________________________

______________________________________________________________

Name: ____________________________________________________________

Achievements: ______________________________________________________

______________________________________________________________

______________________________________________________________

Name: ____________________________________________________________

Achievements: ______________________________________________________

______________________________________________________________

______________________________________________________________

Ifyouhaveanyquestionsorsuggestions,pleasefeelfreetosendthemtomebye-mailorcallme.

ThanksfortakingthetimetohelpraisetheprofileofsomeoftheOkanagan’sbest.

Email: [email protected]

Fax: 778.755.5728

Farmers, artists, craftsman and inventors have been making their home here since well before the turn of the century. Perhaps it’s the fresh, unspoiled charm of living in a small lakeside town, surrounded by orchards and vineyards that inspires them?

They’ve created multiple varieties of fruits and started BC’s first estate winery (now there are 27 in the immediate area). Today they’re patenting one-man vertical take-off and

landing aircraft, perfecting electric car designs and retrofitting microphones for rock stars. All in a little paradise called Summerland.

This is a unique place - close to the amenities of larger urban centres, but without all the hassles. The perfect environment to grow your business and bring up your family. So make an inspired choice!

Brilliant idea.

A brilliant choice for business and family.

250-404-4042 [email protected]

www.summerland.ca

Summerland has always attracted enterprising, creative individuals.

Okanagan Business Examiner / October 2010 15

lisa jaaGer aND scott boswell cooPerate closely iN tryiNG to builD suMMerlaND’s ecoNoMy

The rE-creation of Summerland

Continued on page 16

The title of Summerland’s new economic development plan, Connecting Summerland to the World, couldn’t be more appropriate.

The Okanagan may be the best place to live in Canada, possibly the world, because of its setting, climate and rural character, all advantages Summerland has in abundance.

Rural means many things to many people, including a slower lifestyle, less crime and a know-your-neighbour lifestyle. Unfortunately it also tends to be something young people escape from and older people desire.

Economically speaking youth have less money and older people more, but the other side of the coin is that young people want more, and opportunities are created in the places they gather.

Summerland’s population over 65 is almost double that of the provincial average. By 2028 the

population of British Columbia will decline – if no new migrants came here, but in Summerland the population was in decline, based on children being born to existing residents, as long ago as 1986.

Those in charge of the ship of state are aware of the lack of youthful faces, hence the release of the new development plan with its recommendations on changing the demographic.

Advantages to Summerland, states the report, include the ability of the older generation to pass on their experience through business mentorships or volunteer positions, its beautiful lifestyle, core agricultural and wine businesses including the Pacific Agri-Food Research Centre, quality of life, housing affordability compared to neighbouring communities, its location, which allows residents to live there but work in other communities and the school district’s fibre optic infrastructure.

Working against economic development is the more conservative spending habits of the older generation, less interest in economic development by older constituents, higher business taxes, and aging esthetics in the downtown.

Efforts in attracting people to move there has achieved some success. The regional population has grown every census period from 1976 to the most recent, but at a smaller rate than the Okanagan as a whole or the province. Additionally those moving there are likely to be retirees.

Even before the new plan Summerland was participating in an effort to attract emigrants from the United Kingdom.

The economic plan, completed with input from 225 Summerland individuals, suggests more needs to be done than getting people here. One priority say authors Jamie Vann Struth and

Janey Cruise, should be a business retention and expansion (BRE) program.

After emigrants get here, especially business emigrants, their success depends on them adjusting to local conditions.

Scott Boswell, Summerland’s economic development officer, acknowledges that in the past the emphasis was on getting people here with insufficient followup. He says, “There is no real support here. Lots of people will leave within the first two years.”

Lisa Jaager is the manager of Summerland’s Chamber of Commerce. She says people coming from other countries can be blindsided by differences between our commercial culture and laws and their own. “You almost need someone to hold their hands for a year. Some Dutch owners were shocked that everyday employees here don’t have an employee contract.”

Rather than creating another civil servant position, she believes that either current business owners or the body of retired expertise living in Summerland could be the link to newcomers. “The Chamber’s role,” says Jaager, “is to provide the networking opportunities.”

Boswell and Jaager are quick to point out local successes like the Kettle Valley Railway or the Bottleneck Drive alliance of local wine makers, and the town is a fine dining mecca, but one possibility for youth are e-businesses.

Jaager says young entrepreneurs are quick to make use of new services like social networking. Summerland’s Good Omens coffee house allows customers to order food online through Twitter.

Since, by definition e-businesses sell products and services anywhere, they can also exist

stePhaNe royer here coMbiNes two of his PassioNs, PerforMiNG a bMx flatlaND riDiNG trick with his screeNiNG busiNess Gear

by DeVoN brooks

16 Okanagan Business Examiner / October 2010

anywhere so long as high speed, reliable Internet connections are available.

Currently the best connection in town is a fibre optic cable put in by School District 67.

Boswell says the town is in discussions to see if they can extend that network to existing businesses and to help attract others.

Of course e-business is already here. Fibre optics are really about the retention, and the future expansion of e-business within the community, partly because youth are already wired, literally and metaphorically to changes occurring online. The question is whether Summerland will invest in creating an atmosphere that attracts more people, like the two profiled below, to the town.

Case Study #1 - SidualStephane Royer is unknowingly the poster child for what Summerland needs both demographically and economically.

At 36 years of age Royer’s first child is only a baby. Royer is a focused, energetic, thoughtful man running two small, but growing companies that he created.

One company uses technology to sell apparel (mostly) to youth online and since his contractors are artists scattered across the province and in Washington, he also uses the Internet to bring their work to him where Royer’s company Sidual, creates value-added product in his home studio.

His wife, Devyn, is the main reason he lives in Summerland. She wanted a better place to live and raise their kids than the big city. Although Royer built both his businesses up in Vancouver he says, “When you love the lady as much as I do, you just get up and go.”

As Jaager, who is a mother of young children herself, points out, “What makes people stay is how much they enjoy being here. They’re looking for balance.”

Royer has already known a certain measure of fame. From age 16 to 30 he was renowned for his BMX flatlander riding skills. BMX flatlanding is trick riding on bikes built with extensions coming out of the axles on front and back wheels to stand on.

For years this was Royer’s biggest passion. Then he says, “I needed something new.”

Royer went from tricks on bicycles to silk screening and clothing design, with the same intensity. “I love to screen, which is why I got into it.”

He literally lived in his studio. He admits, “I used to work two days solid and I’d sleep three or four hours, but I was getting close to [burning out].”

On the surface, this sounds like the successful businessman of any age – a passionate, driven man so focused on work that all else is forgotten until he succeeds…or burns up.

His confidence still shows: “There’s no ‘I can’t do that.’ That’s how you push and learn things.”

Except that is only one part of Royer and he has a business ethic that really deserves the word ethic. He says, “The world doesn’t need more product, it needs a product to help people, especially people in need.”

T-shirts can’t feed the world’s poor or prevent global, but they might carry a message, and perhaps prompt people to think a bit about what they are doing.

Royer certainly does, but he is not preachy. He is fully aware of how youth shy away from overt, boy scout moralizing. “We have a spiritual message, but we do it in a cool, marketable way. The spiritual stuff is more personal, more humanitarian.”

In the photo of a man and woman laying head to head, the woman holding the sparkler is wearing a shirt with a design of dying, crushed flowers. The designer, Travis Collier, says, “The idea of taking something that symbolizes beauty in its simplest form and presenting it as something chaotic and stressful has always fascinated me. There is something ironic about it. Mutilation is not always a negative thing.”

Philosophy and poetry? To Royer the medium is why the message works. “Clothing for the fashion conscious, for the visually conscious, but with a message in mind.”

It’s also a business, but there too, Royer is determined to make this about much more than earning a dollar. “It’s not about marketing, marketing, marketing. It’s going to be a company without a CEO – it’s going to be a family business and it’s going to stay that way.”

Ironically Royer’s website (www.sidual.com) is eye-catching, trendy and beautiful both in its own right and its ability to market.

That still fits with Royer’s approach to do everything as well as possible, including putting out a message that is as honest and powerful as he can make it. “People think we’re a lot bigger than we are because we really did a lot of marketing and I spent a lot of money on that.”

The point for Royer isn’t to be the best business person, but to have an honest message and approach to business. People respond well to his integrity, which helps his business.

The apparel sales are the retail side of the business, but silk screening, the behind-the-scenes creation and application of the artwork to the physical reality of T-shirts also captivates Royer.

Take another look at the woman with the sparkler in the photo. Most prints have a print centred smack dab in the middle of the T-shirt. Sidual’s prints wrap around the side, sprawl onto the collars or pockets and he is able to design for sweaters, baseball caps or snowboards.

When Sidual left Vancouver behind, Royer knew he’d have to recreate the silk screening business here in the Okanagan. When he started in Vancouver, he went door to door with a backpack carrying samples of his work. He built it up by perseverance.www.sdcu.com

Commercial Loans& Mortgages

Equipment Lease FinancingCommercial Insurance

Merchant Services

Commercial Account Packages

serving the business communityfor over 65 years

Complete BusinessFinancial Services

250.494.7181

Continued from page 15

Continued on page 18

Okanagan Business Examiner / October 2010 17

David Adams, Managing Partner for KPMG’s Vernonoffice, is pleased to announce the appointment ofPeter Ranson, CA, to Office Managing Partner ofKPMG’s Kelowna office.

Peter is a recognized and sought-after professional inthe area of taxation and business advising and is oneof Canada's leading professionals on Aboriginaltaxation. Please join the partners and the rest of theteam members in the Okanagan in congratulatingPeter on this appointment.

KPMG is proud to serve many of the Okanagan’sleading and growing businesses, providing Audit, Tax,and Advisory services for over 80 years. Ourprofessionals recognize the challenges andopportunities facing businesses, organizations, andindividuals, locally and regionally, across the country,and around the world.

For more information on how KPMG's professionalscan help you, contact us at 250-979-7150.

www.kpmg.ca

© 2010 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independentmember firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Quality. Integrity. Leadership.

OBE_HalfPageIsland_Colour:Layout 1 9/15/2010 8:51 AM Page 1

10918 rennie St (industrial new) – Industrial complex

consultant Okanagan Dev. Consultants – 250-494-0747

project New industrial park – 4.83 acres

Stage Proposed – application for exclusion from the Agricultural Land Reserve submitted

4700 97th St (institutional new) – pesticide Storage bldg

architect TRB Architecture – 604-682-6881

project New pesticide storage building for Pacific Agriculture – 420 sm – non combustible steel frame structure

Stage On hold – pending federal funding

5815 hwy 97 (subdivision) – residential applicant

Jessie Garcha – 250- 492-6479project

New residential subdivision – 21 SFD lotsStage

Construction Start – approx 6 lots ready for building late summer/10

5815 johnson St (subdivision) – residential owner rep

Re/Max Penticton Realty – 250-492-2266project

New residential subdivision – 21 SFD lotsStage

Development Permit Application – approval anticipated fall/10

9511 9521 Wharton St (mixed use dev) – Wharton Square

owner District of Summerland – 250-494-6451

Designer New Future Building Group – 250-372-3572

project New mixed use development – 7 structures – 6 to 8 storeys – 300 condominiums – 30,000 sf of ground level retail – arts centre – library – museum – 1 seniors building

Stage On Hold – pending market conditions

pineo court (institutional new)- rcmp Detatchment

owner District of Summerland – 250-494-6451

architect KMBR Architects Planners – 604-732-1828

project New building to house the RCMP detachment – 1 storey – 9,600 sf

Stage Design – detailed design underway

10511 Quinpool rd (multi family new) – Townhouses

Developer Kirvi Construction Development Co – 250-809-1361

project New townhouses – 2 structures – 1 fourplex – 1 triplex – 7 units total – wood frame construction – peaked roofs – hardy board and cultured stone exterior

Stage Construction Start – anticipated Nov/10

pierre Dr, Giants head mtn to end of Sage ave (subdivision) – residential

owner District of Summerland – 250-494-6451

project New residential subdivision on 3 parcels adjacent to Giants Head Mountain – 7 acres, 8.6 acres, 6.6 acres – 39 SFD lots

Stage Rezoning Application – submitted

Summerland Projects on the Go

18 Okanagan Business Examiner / October 2010

Experience 4 Star, full service accommodation on the shores of Lake Okanagan. Spacious suites feature full kitchens, fireplaces and balconies Enjoy relaxing in our Beyond Wrapture Spa, Outdoor Pool, Hot Tub, Sauna and Exercise Facilities. On site SWR Boat Rentals offers ski boats, wave runners, kayaks, peddle boats and scooters.

13011 Lakeshore Drive South Summerland BC V0H 1Z1ph 250-494-8180 ext 4027 fx 250-494-8190

www.summerlandresorthotel.com

Here Royer decided to experiment with a single billboard in Westbank. He is surprised by the tremendous response. “The billboard that went up in June changed the business.”

He believes, “We really stick out here because we’re really polished with our look, but we’re still a core company.”

By core he means small, responsive and, just like Royer himself, oddly personal. He doesn’t talk at you, he engages you. One suspects he neither knows, nor wants to know, a different way to interact with people. It’s just the way he does business. He explains, “A lot of customers are

used to production talk but aren’t used to being included.”

His approach to service is very much like the golden rule. In the end, he believes, “I want them leaving with the same feeling I’d want when I leave.”

Case Study #2 - The Suburban Princess

Jennifer Kole took a personal infatuation with clothes, turned it into a successful import/export business then transformed it again into a bricks and mortar shop.

It is a store with an e-dge though. Like many businesses the summer flood of tourists take away a huge part of her inventory, but when the winter comes and tourists dry up, her e-business takes up the slack.

In the beginning though this wasn’t a business idea. She kept buying clothes she liked online because she found great deals. Eventually she laughs, “It took over my house.”

Realizing that there was more candy in the shop than she could consume she started selling some of it back through eBay.

As Kole developed the business she found the best way to make money was not to buy one pair of pants and resell it, but to buy loads of clothing at huge discounts. The clothing is brand new,

but is the overstock held by major U.S. retailers, usually from the preceding year.

The companies sell it for huge discounts, but there is a catch, says Kole. You can’t pick out three pairs of pants in sizes you know will sell; instead you buy a load of certain kinds of clothing. Exactly what she will receive and in what sizes is a mystery.

The beauty of the Internet is that oddball sizes are going to be exactly what someone needs, somewhere especially if you have it at a great price. Says Kole, “I can sell it for 70% off U.S. retail prices.”

Once Kole had too much business to run out of her home, she purchased a store in downtown Summerland and started running the business from the second floor, but word of her business got around locally.

“At first I only did online sales, but demand to see what I had was so strong I decided to open a shop,” says Kole.

Today, “Eighty percent of sales are now through the store.” It’s not just locals either. As we talk two women from Vancouver come in, telling her how much they enjoyed shopping there when they visited last year.

So, is Kole now the proverbial kid that owns the candy shop? Ironically, perhaps because she “over ate from the clothing bin”, Kole shakes her head. “I have a rule that I can’t take it home unless it’s been here a month.” If someone doesn’t buy it up online first.

jeNNifer kole, iN her secoND storey shoP,

the suburbaN PriNcess

Continued from page 16

101 10611 victoria rd $396,000 residential new – duplex contractor: Mark 1 Dev Inc – 250-890-7089

103 10611 victoria rd $417,000 residential new – duplex contractor: Mark 1 Dev Inc – 250-890-7089

11815 conway cr $3,000,000 residential new – SFDcontractor: Sierra West Homes & Construction – 250-767-1993

1921 randall St $309,000 residential new – SFD contractor: Bonaventure Homes – 778-516-5762

5310 beaver St $205,000 residential new – SFD contractor: Gurdial & Jaswinder Chahal – 250-492-7974

Summerland Building Permits

Brilliant potential.

A brilliant choice for family and business.

Blue skies. Bright sunshine. Green vineyards and lush orchards. And of course, beautiful unspoiled Lake Okanagan right at your doorstep. It’s the perfect environment to grow your business and bring up your family. A small town lifestyle very close to big city amenities.

This family-oriented town is filled with entre-preneurs creating a brighter future for their families. They’re doing everything from designing electric cars and personal flying machines to

selling handcrafted jams and preserves. While the 27 estate wineries in the immediate area continue winning international awards.

Fresh ideas. Unfettered creativity. Summerland is an amazingly fertile place. So get inspired. Choose a brilliant future for your children and your business!

Summerland boasts all the natural ingredients you need to grow fresh, strong minds.

250-404-4042 [email protected]

www.summerland.ca

20 Okanagan Business Examiner / October 2010

Incorporated: 1906Area: 73.9 sq. km

statisticsPopulation 11,243 (2009)Population growth rate for 2008-2009: 0.9%

(B.C. 1.6%)Population aged 65+ in 2006: 25.7% (B.C.

14.6%)

employment & labour force - 2006 figures

Total labour force: 5,145 people Labour force as % of total population: 47.2% Percent of labour force self-employed: 21.0%

(2006) The three biggest employer sectors in 2006:

health care & social assistance (11.6%); retail trade (11.0%); manufacturing (9.6%)

incomeMedian household income (2006): $58,888

(BC $65,787)Average income from those filing tax returns

(2007): $36,863 (B.C. $40,802) Main source of income for residents in 2007:

Employment (52.1%), Pension (21.2%), Investment (12.3%), Self-employed (5.5%), Other not counting self-employed (5.3%),

Total income from employment (2007): $182,705,000

Total income for the District of Summerland (2007) $350,937,000

businessBusiness incorporations: 36 (2009) 69 (2007)Business bankruptcies: no numbers availableTotal # of firms with no employees: 415

(June 2008)Total # of firms with employees: 424 (June

2008)Chamber of Commerce members: 650

(membership is mandatory)

building PermitsNew residential units built: 26 (2009) 81

(2007)Typical house value: $423,157 (2009)

$225,799 (2005)Typical house taxation: $3,423 (2009); $2,618

(2005)Value of new residential construction: $14.0

million (2009) $25.2 million (2007)Value of other construction: $2.5 million

(2009) $12.3 million (2007)

most numbers courtesy of BC Stats Community Facts (www.bcstats.gov.bc.ca)

District of Summerland Snapshot

Okanagan Business Examiner / October 2010 21

Mania and Phobia come together with TakeoversCorporate America is profitable with $4 trillion in cash and valuations at the cheap end of their historical range. The time is ripe for merger and acquisition activity, where healthy companies buy up others at bargain prices like the offer by BHP Billiton, the Australia-based mining giant, to buy Potash Corp. of Saskatchewan.

Potash Corp is one of the world’s largest fertilizer producers, having 20% of the world’s production capacity. It is used in soybean and corn agriculture in North America. Sales are about 40% in North America and 60% overseas.

The stock traded as high as $300 a share in 2007 on expectations that a growing world population that wanted to shift diets to more meat would require a great deal more fertilizer. The stock crashed to about $65 a share in 2008, and was trading in the $100 range before BHP’s offer of $138 a share. Shares spiked to $150 with the expectation the company was worth much more than $138 a share and that higher bids would emerge. That hasn’t happened as of this writing date and prices have started to tail off. It has been quite a wild ride for investors.

BHP made this bid because they want to produce potash, and it is much cheaper to buy Potash Corp and its existing assets than develop the “greenfield” properties they hold in Canada. The timing is good, as credit markets and BHP have recovered enough from the crash to finance the deal, and the expected agricultural boom and higher Potash Corp. share prices have not yet happened.

I should note the majority of takeovers destroy shareholder value as acquirers tend to pay too much at the top of the market, lose focus on their existing businesses and don’t realize the hoped for efficiency or productivity gains. This deal is different, as the plan is to buy a good asset cheap.

There is a great deal of apprehension, as change is hard and could be detrimental.

There have been calls for the governments of Canada and Saskatchewan to block the deal. Should we be banning foreign takeovers of Canadian assets, like this one, and purchases of Alcan, Inco and Falconbridge?

It turns out that would be hypocritical.

According to the CIA Factbook, Canadians own $81 billion more of foreign assets than foreigners own of Canadian assets, though the case could be made that Canadian companies and assets should not be sold to companies in countries that do not allow Canadian companies

to buy theirs, Brazil’s Vale being a recent example. (Vale was allowed to buy Inco, but a Canadian fertilizer producer was not allowed to buy Brazilian fertilizer assets because they were deemed to be of strategic importance.)

How BHP will pay for $39 billion worth of shares starts with Potash Corp’s cashflow from operations, which in 2008, a notably good year, was about $4 billion. BHP’s cashflow for the 12 months ending June 30 was about $18 billion. That makes for a good start.

Financing with debt also works well as generational low interest rates are made even lower as they are tax deductible. That’s good for BHP, but not Saskatchewan. The Conference Board estimates the province would lose $2 billion over ten years, and federal finances would suffer too.

Many companies taken over by either larger or foreign companies can suffer from “branch plant syndrome.” When an operation is the company’s only asset, the company has an incentive to keep that asset in perfect working order. When it is one of many similar assets and times get tough, it gets very easy to shut down that asset (like the glass plant in Lavington).

A prolonged strike can also help the company, but hurt workers, like the one at Vale’s Inco operations in Ontario and Newfoundland. Vale had no incentive to settle during the Great Recession.

That scenario is unlikely for Potash Corp as BHP has no significant fertilizer assets, and they would have a keen interest in keeping it working.

Minority shareholders might not fare as well. If the takeover is partially successful, BHP could acquire more than 50% of Potash Corp. but not all of it. That would give them control of the company, and the ability to make decisions, like loading it with debt, that benefit BHP, but aren’t in the remaining minority shareholders’ best interests.

There could be some entertaining legal maneuvers if the takeover offer mostly succeeds. Potash can implement a “poison pill” that works for the benefit of minority shareholders by diluting BHP’s position, but it would certainly be challenged in court. Another bidder could emerge, or the bid could fail if too few shareholders tender their shares.

Shareholders who bought Potash shares below $100 would be clear winners over the short term, thought it is uncertain whether they could

make more by holding on a few more years. It’s difficult to place an objective share price on Potash Corp. The three investment banks they hired to give an opinion were quick to say that $130 was inadequate, but careful not to say what they thought would be a fair share price.

Investors have until October 19 to decide, and must be wondering whether the grass is truly greener on the other side.

Dominik Dlouhy P. Eng, MBA, CFA is a Chartered Financial Analyst and planner with Partners in Planning Financial Services Ltd. and The Fraser Financial Group LLP. You can reach Dominik at 545-5258 or [email protected] with any questions, comments or issues you would like to see covered in this column. The opinions expressed in this article are those of the author and not necessarily those of Partners in Planning or The Fraser Financial Group.

22 Okanagan Business Examiner / October 2010

When it comes to children and money management North American culture is oddly bereft of any standard, or rational way forward on the subject. Schools barely acknowledge the concept of personal finances until the older grades and then spend a semester teaching teens how to write a check. Parents are often wrapped up in the heavily charged emotional approach they learned from their own parents. Often enough adults in the situation have a precarious grasp of personal financial management themselves.

Those rare families able to discuss financial planning and health with their children are limited to books aimed at adults, not children. Kelowna based Nancy Phillips, author of the Zela Wela Kids book series on financial literacy, is working to correct that problem.

“A lot of people would rather do anything than talk about money,” says Phillips, “but the best literature shows that children ‘blueprint’ their ideas about money by age 13. You need to start young with teaching your children about money and how to handle it.”

Phillips, who has an MBA, comes from a background in kinesiology and worked with global medical research companies in their marketing and development departments. When

it came time to teach her own children about building wealth and having healthy and realistic attitudes about money, Phillips couldn’t find tools that would help her children learn.

Phillips used her science background to start researching the best literature available about children and money.

“There are fundamental things you need to ensure your child can do, but the problem is children are not getting that education,” says Phillips. “This series is about giving parents the tools they need to help children reach their potential rather than be held back by money.”

Phillips chose to start with books geared to four and five year olds, full of beautiful hand drawn and painted pictures. In the story, the Jack and Emma are taught the importance of allocating their money for specific purposes, and create a special bank to divide their money for giving, saving, investing and spending.

“I wanted to create something enjoyable and objective,” says Phillips. “Children can build their own bank and it gives parents a way to talk to their children. The lesson learned in the book is extremely valuable.”

The books are creative and positive in tone says Phillips. She hopes parents will be able to

use positive language about money with their children and take anxiety and heavy emotion out of the discussion. One example Phillips suggests parents use occurs when children don’t have enough money to make a large purchase. Rather than dwell on not having enough money, talk about creative ways to save for the purchase and carefully consider the value of the purchase.

It can be tough for a parent to separate out lifelong attitudes about personal finances. Phillips is often approached by grandparents who are blunt in stating, “We messed up our own children, and we are buying this book for our grandkids so that doesn’t happen again.”

The next six books in the series are written and Phillips will be launching three books in the spring of 2011, and three books in the fall. The future books are written with older age groups in mind: five to nine year olds and nine to 12 year olds.