Oils and fats changes and opportunities Capt Ken Tree Associate Consultant to Drewry Shipping...

-

Upload

preston-douglas -

Category

Documents

-

view

218 -

download

0

Transcript of Oils and fats changes and opportunities Capt Ken Tree Associate Consultant to Drewry Shipping...

Oils and fats changes and opportunities

Capt Ken TreeAssociate Consultant to Drewry Shipping

September 2005

Oils and fats changes and opportunities2

Overview & slide references

Oils & fats as organic chemicals (3-4)

Volumes past, present and beyond (5)

Growth drivers - (6-9)

Uses- changes ahead (10-14)

Effect of crude petroleum prices (15)

Previous cargoes – changes/opportunities (16-18)

Comparative earnings (19)

The IMO double hulled future (20)

Oils and fats changes and opportunities3

Oils and fats

Lets call them what they are – Triacylglycerols

They belong to the chemical family of esters their most

important ingredient being triglycerides

Triglycerides are esters of glycerol and oils and fats are mixtures

of triglycerides from various fatty acids

Their chemical and physical properties and the esters derived

from them vary with the individual oils or fats fatty acid profile

Naturally occurring triacylglycerols are all further processed for

further use

Oils and fats changes and opportunities5

0

10

20

30

40

50

60

70

1985 1990 1995 2000 2003 2007

Organics Inorganics Triacylglycerols Others

Forecast seaborne trade of liquid chemicals (1982-2007, mill tons)

Oils and fats changes and opportunities6

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

1970 1980 1990 2000 2010

Europe NAmerica SAmerica Africa China India Others

Main growth drivers - population

Oils and fats changes and opportunities10

Uses - changes ahead

Human nutrition – 80%

Animal Feed – 6 %

Oleo-chemicals – 14%

Bio Fuels (bio-diesel) – to be determined

Oils and fats changes and opportunities11

Oleo - chemical & bio diesel (methyl esters) conventional production technologies

Oils and fats changes and opportunities12

Oleochemical Exports from Malaysia & Indonesia 2004

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

N.Asia S.Asia Europe USA Others

Region

M/tons

Oleo - chemical exports

Oils and fats changes and opportunities16

Previous cargo requirements-oils for edible and/or oleo-chemical use

Oils for Edible and or Oleo-chemical use are presently shipped

using one of the following previous cargo criteria

1. Not on the FOSFA Banned List – (Standard FOSFA

Contract)

2. Immediate Previous cargo on the FOSFA Acceptable List –

(A choice with an AS9 sticker)

3. Immediate Previous cargo on EU 1 or 2 Acceptable List

(Europe)

4. Immediate previous cargo on NIOP 1 or 2 List (USA)

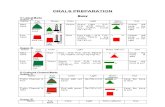

Oils and fats changes and opportunities17

Oleo - chemicals & bio-diesel-previous cargoes

Oleo chemicals fall outside FOSFA-NIOP-EU Hygiene

Legislative & are carried by IMO Class ships

Quality requirements based on other high quality

chemical cargoes between the shippers and owners.

Kosher could be a requirement for glycerine

Methyl Esters used for fuel non edible use last 3 clean

and unleaded same as CPP (Already moving into Europe)

Oils and fats changes and opportunities18

Previous cargo - new approaches?

Stainless steel

– passivation

– recognition of non absorption & ease of cleaning by approved

methods and testing, as with other sensitive chemicals (i.e. Alcohols)

Oils and Fats for non edible use i.e Bio Diesel

Provided strict traceability ensured from origin to end use, last cargo

requirements could be last 3 clean and unleaded, or NOBL at most?

Now moving under last 3 clean & unleaded into EU.

Both the above will/could relieve pressure on freight

Oils and fats changes and opportunities19

1Q00 1Q01 1Q02 1Q03 1Q07 35,000 DWT Voyage Patterns Length

7072 19202 7911 11161 19655 Straits-Europe-Argentina-India-Straits 110 days

8108 18651 10146 13221 21805 Straits-Med-Argentina-India-Straits 102 Days

13244 23375 13203 16957 20078 Karachi R/V 22 Days

8218 18853 8653 11360 21239 Palm to Karachi-Molasses to S.France-Argentina-India-Straits 118 Days

11179 18299 10877 13809 21805 Palm to Karachi-Caustic AG/Durban-Argentina India-Straits 98 Days

13367 23503 13642 16765 25413 Palm to Med-Uan to USAC-Arg-India-Straits 123 Days

10198 20314 10739 13879 21666 Average DVS Earnings

11350 15000 12000 12500 ? Average 30/32000 IMO 3 coated General Trade (mainly CPP)

161 135 153 176 255 Heavy Oil Price HO

244 196 202 242 475 Diesel Oil Price MDO

Comparative earnings