Oilfield Equipment & Services · Energy 5 Yr 4 Yr 3 Yr 2 Yr 1 Yr About the Data The information...

Transcript of Oilfield Equipment & Services · Energy 5 Yr 4 Yr 3 Yr 2 Yr 1 Yr About the Data The information...

M&A MARKETMONITOROILFIELD EQUIPMENT AND SERVICES JULY 2019

5 Yr

4 Yr

3 Yr

2 Yr

1 Yr

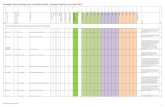

PP

About the DataThe information presented in this report is an analysis of deals in the United States or Canada. A deal is described as any closed or announced M&A transaction where the target is headquartered in the United States or Canada, financial terms of the transaction have been disclosed, and the target has an industry classification that falls into the subject industry group and as such may not be representative of your company's market valuation. Past performance is not indicative of future results. Certain adjustments have been made to the

information to exclude transactions which are not specific to the industry or incorporate relevant transactions for which an industry classification was omitted.

US & Canada M&A Market OverviewOverall Market Transactions

Source: S&P Capital IQ; ArkMalibu; Other publicly available sources

*YTD as of 07/22/2019

22,636 20,803

18,818 19,541

11,012

11.1x 10.7x12.0x

11.2x 11.2x

-

5,000

10,000

15,000

20,000

25,000

2.0x

4.0x

6.0x

8.0x

10.0x

12.0x

14.0x

16.0x

18.0x

2015 2016 2017 2018 2019 YTD*

Dea

l C

oun

t

Med

ian

TE

V/ L

TM

EB

ITD

A

Mult

iple

Deal Count Median TEV/ LTM EBITDA Multiple

Energy

5 Yr

4 Yr

3 Yr

2 Yr

1 Yr

About the DataThe information presented in this report is an analysis of deals in the United States or Canada. A deal is described as any closed or announced M&A transaction where the target is headquartered in the United States or Canada, financial terms of the transaction have been disclosed, and the target has an industry classification that falls into the subject industry group and as such may not be representative of your company's market valuation. Past performance is not indicative of future results. Certain adjustments have been made to the information to

exclude transactions which are not specific to the industry or incorporate relevant transactions for which an industry classification was omitted.

Source: S&P Capital IQ; ArkMalibu; Other publicly available sources

*YTD as of 07/22/2019

US & Canada M&A Market OverviewOilfield Equipment & Services Transactions

114 118 120 134

76

8.9x

10.7x

14.1x

11.7x

13.9x

-

20

40

60

80

100

120

140

160

2015 2016 2017 2018 2019 YTD*

0.0x

2.0x

4.0x

6.0x

8.0x

10.0x

12.0x

14.0x

16.0x

Dea

l C

oun

t

Med

ian

TE

V/ L

TM

EB

ITD

A

Mult

iple

Deal Count Median TEV/ LTM EBITDA Multiple

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTMLast Sale PriceMarket CapitalizationTotal Enterprise ValueLTM EBITDA Margin %CY - 1 TEV/Total RevenuesLTM TEV/Total RevenuesNTM TEV/Forward Total RevenueCY - 1 TEV/EBITDALTM TEV/EBITDANTM TEV/Forward EBITDA

Compression

Archrock, Inc. 10.47 1,336 2,934 37.6% 2.8 3.2 2.8 7.8 8.4

CSI Compressco LP 3.52 166 816 21.1% 2.0 1.8 1.5 8.9 8.5

Enerflex Ltd. 12.94 1,158 1,218 12.1% 0.9 0.9 0.7 7.0 7.3

Exterran Corporation 12.33 442 893 14.9% 0.7 0.7 0.6 5.0 4.4

Natural Gas Services Group, Inc. 15.39 213 174 32.9% 2.3 2.5 2.3 6.8 7.7

Median 12.33 442 893 21.1% 2.0 1.8 1.5 7.0 7.7

Distribution

MRC Global Inc. 15.12 1,263 2,542 4.9% 0.5 0.6 0.6 11.6 12.6

ServiceNow, Inc. 293.81 53,751 53,182 4.8% 12.7 18.9 14.5 NM NM

Median 154.47 27,507 27,862 4.8% 6.6 9.8 7.6 11.6 12.6

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

7.2

6.1

4.9

4.0

5.9

5.9

9.0

52.2

30.6

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Engineering & Construction

Saipem S.p.A. 4.81 4,796 6,772 10.4% 0.6 0.7 0.6 5.5 7.4

Petrofac Limited 5.12 1,724 2,374 11.2% 0.6 0.4 0.4 4.8 3.6

TechnipFMC plc 25.59 11,212 11,365 11.3% 0.6 0.9 0.8 4.0 7.5

Subsea 7 S.A. 11.04 3,292 3,329 15.4% 0.7 0.8 0.8 4.3 5.2

McDermott International, Inc. 10.40 1,895 5,813 4.2% 0.8 0.7 0.6 6.5 15.6

Median 10.40 3,292 5,813 11.2% 0.6 0.7 0.6 4.8 7.4

Energy Efficiency and Clean Technology

Itron, Inc. 60.66 2,354 3,348 11.1% 1.2 1.4 1.4 11.8 12.6

Ameresco, Inc. 14.17 684 1,284 11.4% 1.4 1.7 1.5 13.5 14.6

Median 37.42 1,519 2,316 11.3% 1.3 1.5 1.4 12.7 13.6

Land Drillers

Helmerich & Payne, Inc. 50.86 5,667 5,888 26.9% 2.2 2.1 2.1 8.7 7.8

Nabors Industries Ltd. 2.37 817 4,529 25.2% 1.4 1.5 1.4 6.0 5.7

Patterson-UTI Energy, Inc. 10.94 2,242 3,146 24.4% 1.0 1.0 1.2 3.9 4.0

Pioneer Energy Services Corp. 0.22 18 466 13.7% 0.9 0.8 0.8 6.3 5.7

Precision Drilling Corporation 1.73 499 1,739 23.7% 1.6 1.4 1.4 6.9 6.1

Median 2.37 817 3,146 24.4% 1.4 1.4 1.4 6.3 5.7

5.5

4.3

7.1

5.0

4.8

5.0

12.7

12.6

12.7

7.1

5.2

4.7

5.9

5.8

5.8

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Large-Cap Equipment and Services

ABB Ltd 18.95 40,408 47,184 11.4% 1.3 1.7 1.6 10.0 14.3

Eaton Corporation plc 79.56 33,789 41,400 18.0% 1.7 1.9 1.8 9.7 10.6

Emerson Electric Co. 65.40 40,129 45,128 20.6% 2.4 2.5 2.3 11.5 12.1

General Electric Company 10.21 87,557 203,645 12.9% 1.5 1.7 1.7 31.5 13.3

Honeywell International Inc. 173.58 124,468 131,586 22.5% 2.4 3.4 3.5 11.6 15.1

Schneider Electric S.E. 85.83 46,908 54,300 16.3% 1.6 1.9 1.8 9.8 11.4

Siemens Aktiengesellschaft 111.41 89,090 123,003 10.8% 1.2 1.3 1.2 10.9 11.7

Median 79.56 46,908 54,300 16.3% 1.6 1.9 1.8 10.9 12.1

Large-Cap Service

Baker Hughes, a GE company 23.96 12,147 34,693 12.4% 1.6 1.5 1.4 13.7 12.6

Halliburton Company 23.74 19,009 29,120 16.6% 1.3 1.2 1.2 7.1 7.4

Schlumberger Limited 39.49 53,536 68,264 20.1% 2.0 2.1 2.0 9.2 10.2

Median 23.96 19,009 34,693 16.6% 1.6 1.5 1.4 9.2 10.2

Logistics

ATCO Ltd. 32.78 3,781 14,555 39.6% 3.7 4.0 3.8 10.2 10.0

Bristow Group Inc. 0.10 3 1,210 7.0% 0.9 0.9 NM 10.9 12.8

Civeo Corporation 1.55 259 707 16.8% 1.6 1.5 1.4 10.3 8.9

Hornbeck Offshore Services, Inc. 1.09 38 1,088 13.4% 4.8 4.8 4.0 44.3 36.1

Tidewater Inc. 21.84 805 857 4.9% 1.9 2.0 1.5 NM 48.3

Median 1.55 259 1,088 13.4% 1.9 2.0 2.6 10.6 12.8

9.8

11.2

10.8

7.1

9.6

9.6

9.2

14.0

10.0

11.2

16.8

14.2

10.2

NM

6.4

25.5

6.1

7.8

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Mid and Small-Cap Service

Aspen Aerogels, Inc. 6.83 155 161 -14.3% 0.5 1.5 1.2 NM NM

Basic Energy Services, Inc. 1.87 50 350 5.4% 0.4 0.4 0.4 5.9 6.9

C&J Energy Services, Inc. 10.52 681 616 10.8% 0.4 0.3 0.3 2.9 2.6

Calfrac Well Services Ltd. 1.59 225 937 12.7% 0.6 0.6 0.6 4.6 4.5

CGG 2.06 1,461 2,372 47.4% 1.3 1.9 1.7 4.2 3.9

Core Laboratories N.V. 54.63 2,411 2,774 18.0% 4.1 4.0 3.9 18.1 21.9

Dawson Geophysical Company 2.52 56 42 2.4% 0.3 0.3 0.3 3.2 11.4

DMC Global Inc. 63.00 906 943 19.9% 1.9 2.6 2.2 11.8 13.2

Ensign Energy Services Inc. 3.27 522 1,835 23.4% 1.4 1.8 1.3 8.5 7.7

Flotek Industries, Inc. 2.97 168 91 -15.5% 0.4 0.5 0.5 NM NM

Frank's International N.V. 5.60 1,261 1,128 5.0% 1.9 2.0 1.8 NM 40.9

FTS International, Inc. 4.64 513 852 19.3% 0.7 0.7 0.9 2.4 3.4

Helix Energy Solutions Group, Inc. 8.29 1,202 1,658 21.0% 1.2 2.2 2.1 5.7 10.9

Keane Group, Inc. 5.89 613 937 16.9% 0.5 0.5 0.6 3.0 2.7

Key Energy Services, Inc. 3.11 58 269 4.0% 0.5 0.5 0.5 10.0 13.2

Liberty Oilfield Services Inc. 13.44 961 1,427 18.9% 0.6 0.7 0.7 2.8 3.4

NCS Multistage Holdings, Inc. 2.95 136 173 10.8% 1.1 0.8 0.8 6.2 7.7

Newpark Resources, Inc. 6.83 602 757 11.0% 0.8 0.8 0.8 8.1 7.4

Nine Energy Service, Inc. 13.81 415 794 15.3% 0.9 0.9 0.8 7.2 5.9

ProPetro Holding Corp. 17.39 1,730 1,816 24.3% 0.7 1.0 0.9 3.3 4.0

Ranger Energy Services, Inc. 7.21 60 226 14.1% 0.7 0.7 0.6 7.5 4.9

Select Energy Services, Inc. 9.99 778 1,157 15.1% 0.6 0.8 0.8 3.7 5.1

Solaris Oilfield Infrastructure, Inc. 13.66 409 546 61.7% 2.8 2.5 2.3 4.7 4.1

Superior Energy Services, Inc. 1.01 128 1,339 16.0% 0.8 0.6 0.7 5.1 3.9

Tetra Tech, Inc. 85.07 4,663 4,807 10.6% 1.4 2.1 1.9 12.8 20.1

Trican Well Service Ltd. 0.75 224 279 7.9% 0.5 0.4 0.4 3.9 5.5

Median 6.36 518 894 14.6% 0.7 0.8 0.8 5.1 5.7

53.8

5.2

2.8

5.6

3.3

9.3

4.2

11.3

6.9

5.0

3.3

3.6

3.6

18.7

10.0

9.7

5.4

NM

15.7

5.1

8.5

5.0

3.9

16.4

5.4

5.4

4.8

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Mid and Small-Cap Equipment and Service

AMETEK, Inc. 88.61 20,212 22,505 26.8% 3.6 4.5 4.3 13.8 16.9

AZZ Inc. 44.14 1,183 1,514 14.2% 1.5 1.6 1.5 12.8 11.2

Badger Meter, Inc. 52.09 1,542 1,523 17.1% 3.4 3.6 3.5 24.0 21.1

ESCO Technologies Inc. 82.43 2,141 2,323 18.7% 2.5 2.9 2.6 13.9 15.5

Hubbell Incorporated 124.38 6,836 8,555 16.0% 1.7 1.9 1.8 9.8 11.7

Littelfuse, Inc. 177.24 4,327 4,557 21.1% 2.8 2.7 2.9 12.5 12.7

Powell Industries, Inc. 36.95 425 354 3.2% 0.5 0.7 0.6 52.4 22.9

Thermon Group Holdings, Inc. 25.76 837 1,021 18.9% 2.3 2.5 2.4 11.5 13.1

Valmont Industries, Inc. 128.04 2,824 3,531 11.7% 1.1 1.3 1.2 8.5 11.0

Median 82.43 2,141 2,323 17.1% 2.3 2.5 2.4 12.8 13.1

OCTG

Tenaris S.A. 12.68 14,967 14,758 19.9% 1.8 1.9 1.9 8.3 8.7

The Timken Company 47.66 3,629 5,339 17.4% 1.3 1.5 1.3 8.1 8.3

Vallourec S.A. 2.81 1,287 4,444 5.1% 0.9 1.0 0.9 49.5 18.8

Median 12.68 3,629 5,339 17.4% 1.3 1.5 1.3 8.3 8.7

Oilfield Equipment

Cactus, Inc. 31.34 1,439 1,538 38.0% 2.3 2.6 2.4 6.1 6.9

Dril-Quip, Inc. 48.54 1,711 1,301 2.5% 1.6 3.4 3.2 15.6 138.6

Forum Energy Technologies, Inc. 2.49 269 797 4.4% 0.9 0.7 0.8 16.6 16.7

Gardner Denver Holdings, Inc. 33.45 6,772 8,210 22.9% 2.1 3.1 3.1 9.7 13.3

National Oilwell Varco, Inc. 21.25 8,100 10,231 10.0% 1.4 1.2 1.2 16.1 12.0

Oceaneering International, Inc. 18.63 1,771 2,404 7.5% 0.9 1.2 1.1 10.3 16.5

Oil States International, Inc. 14.13 811 1,162 9.9% 1.2 1.1 1.0 11.0 10.8

Shawcor Ltd. 13.10 923 1,028 7.9% 0.8 1.0 0.8 7.5 12.1

TechnipFMC plc 25.59 11,212 11,365 11.3% 0.6 0.9 0.8 4.0 7.5

Median 21.25 1,711 1,538 9.9% 1.2 1.2 1.1 10.3 12.1

15.8

9.9

17.1

13.4

11.0

12.7

11.2

11.1

9.1

11.2

9.0

6.8

10.6

7.1

9.5

9.0

6.4

22.4

9.5

12.2

12.7

12.9

8.9

6.6

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Proppants

CARBO Ceramics Inc. 1.05 30 111 -13.8% 0.6 0.5 0.5 NM NM

Covia Holdings Corporation 1.80 237 2,228 15.4% 1.0 1.2 1.1 4.7 7.6

Newpark Resources, Inc. 6.83 602 757 11.0% 0.8 0.8 0.8 8.1 7.4

Smart Sand, Inc. 2.46 101 186 30.3% 0.7 0.8 0.8 2.7 2.8

U.S. Silica Holdings, Inc. 11.52 826 2,149 16.1% 1.1 1.4 1.4 5.4 8.4

Median 2.46 237 757 15.4% 0.8 0.8 0.8 5.0 7.5

Infrastructure Services --Environmental Services

Advanced Disposal Services, Inc. 32.32 2,874 4,786 24.6% 2.6 3.0 2.9 10.4 12.3

Clean Harbors, Inc. 71.36 3,966 5,485 14.7% 1.3 1.6 1.6 8.8 11.2

Evoqua Water Technologies Corp. 13.72 1,558 2,474 12.3% 1.5 1.8 1.7 10.9 14.6

Republic Services, Inc. 87.28 28,013 36,606 27.7% 3.1 3.6 3.5 11.4 13.3

Stericycle, Inc. 45.70 4,152 7,310 19.8% 1.7 2.1 2.2 10.0 10.8

US Ecology, Inc. 62.54 1,375 1,716 20.7% 3.0 3.0 2.8 13.3 14.4

Veolia Environnement S.A. 25.75 14,247 26,371 11.0% 0.8 0.9 0.9 7.1 7.8

Waste Connections, Inc. 94.78 24,931 28,827 31.4% 4.8 5.7 5.3 15.1 18.3

Waste Management, Inc. 117.13 49,599 60,298 28.1% 3.3 4.0 3.8 11.7 14.3

Median 62.54 4,152 7,310 20.7% 2.6 3.0 2.8 10.9 13.3

NM

9.3

6.9

3.3

7.6

7.3

10.6

10.4

10.5

12.2

10.9

11.8

6.1

16.4

13.5

10.9

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Industrial Services

Aegion Corporation 18.21 562 896 7.2% 0.6 0.7 0.7 7.5 9.7

Bilfinger SE 29.42 1,185 1,453 1.9% 0.3 0.3 0.3 9.4 13.5

EMCOR Group, Inc. 82.79 4,678 4,966 6.1% 0.4 0.6 0.6 7.0 9.7

Matrix Service Company 18.11 490 443 3.0% 0.4 0.3 0.3 19.0 11.1

Mistras Group, Inc. 14.82 427 711 7.8% 0.7 1.0 0.9 8.9 12.5

Median 18.21 562 896 6.1% 0.4 0.6 0.6 8.9 11.1

Infrastructure Services

Aecon Group Inc. 15.08 915 996 5.2% 0.4 0.4 0.4 6.0 6.8

Fluor Corporation 31.81 4,434 4,705 4.0% 0.2 0.3 0.2 5.9 6.3

Granite Construction Incorporated 41.22 1,960 1,930 6.1% 0.6 0.6 0.5 7.9 9.0

Great Lakes Dredge & Dock Corporation 10.79 701 977 20.1% 1.1 1.4 1.4 8.2 7.2

Jacobs Engineering Group Inc. 84.13 11,463 13,720 6.3% 0.7 0.8 1.1 11.2 13.3

John Wood Group PLC 6.51 4,363 5,933 5.3% 0.7 0.6 0.5 13.5 10.7

KBR, Inc. 26.11 3,654 4,492 7.6% 0.6 0.9 0.8 7.6 9.9

Orion Group Holdings, Inc. 3.76 102 210 -2.9% 0.4 0.4 0.3 6.2 NM

Primoris Services Corporation 20.03 1,021 1,487 7.4% 0.5 0.5 0.5 7.0 6.5

SNC-Lavalin Group Inc. 18.15 3,425 6,333 4.5% 1.0 0.8 0.8 10.6 18.5

Tutor Perini Corporation 13.04 673 1,498 6.1% 0.3 0.3 0.3 7.1 5.6

Median 18.15 1,960 1,930 6.1% 0.6 0.6 0.5 7.6 8.1

6.1

5.7

9.1

13.0

6.4

10.3

6.5

8.5

6.0

9.7

6.1

7.6

7.6

6.1

6.3

8.2

4.4

6.4

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

Public Companies' Trading Metrics | Oilfield Equipment & ServicesAs of: 7/22/2019

USD in millions except per share price

Last Equity Enterprise EBITDA

Price Value Value Margin 2018A LTM NTM 2018A LTM

Category / Company Valuation Statistics Multiples Data

EV / Revenue (x) EV / EBITDA (x)

NTM

Testing, Inspection, & Certification

Alstom SA 41.94 9,407 7,112 8.6% 1.0 0.8 0.8 8.5 7.1

Applus Services, S.A. 14.10 2,013 2,607 12.6% 1.2 1.4 1.3 10.0 11.0

Bureau Veritas SA 23.95 10,681 13,095 17.5% 2.2 2.4 2.3 12.7 13.9

Eurofins Scientific SE 443.17 7,879 10,911 18.7% 2.2 2.6 2.1 12.6 13.7

Intertek Group plc 69.17 11,133 12,147 19.9% 3.0 3.5 3.3 15.2 17.4

SGS SA 2,447.88 18,483 20,702 18.0% 2.7 3.0 2.9 14.8 16.7

Median 55.56 10,044 11,529 17.8% 2.2 2.5 2.2 12.6 13.8

Utility Services

Dycom Industries, Inc. 52.22 1,672 2,573 9.2% 0.9 0.8 0.8 10.7 8.6

MasTec, Inc. 49.31 3,740 5,554 10.2% 0.7 0.8 0.7 7.7 7.5

MYR Group Inc. 36.27 603 731 5.2% 0.4 0.4 0.4 6.2 8.5

Quanta Services, Inc. 37.37 5,378 6,969 7.6% 0.5 0.6 0.6 7.5 7.7

Median 43.34 2,706 4,064 8.4% 0.6 0.7 0.7 7.6 8.1

13.6

11.9

7.5

6.8

6.3

7.3

7.0

7.9

8.0

12.3

11.5

15.9

Source: SP Capital IQ; ArkMalibu;

EV = enterprise value; LTM = last twelve months; NTM = next twelve months

NM = Not Meaningful

ABOUTArkMalibu advises business owners by making highly informed and relevant recommendations on steps towards finding a great partner or monetizing their businesses. We help you maximize value by effectively conveying your company’s investment merits and minimizing the buyers’ perceived investment risks. As one of the most trusted boutique investment banking firms, we leverage our proprietary process to serve our privately-owned clients based on our experience, creativity, and avoidance of conflicts of interest. We focus our energy and talent on turning culture into capital so that we can creatively deliver value beyond our clients’ expectations.

Sell-Side Focused• ArkMalibu’s unique business model is to focus solely

on sell-side clients• Experienced and expert negotiators motivated to

meet all your goals• No conflicts of interest – other investment banks often

find themselves negotiating against their regular clients on the buyside

Art of the Possible• ArkMalibu has a strong track record of achieving

maximum value for our clients• Creativity to explore less obvious avenues for meeting

our client’s goals and achieving maximum value

Four Boxes Methodology• Proprietary process minimizes buyers’ perceived risks

and unlocks value for your company• Focus on your corporate culture fit

Client Focus• Active senior banker involvement• Financial advocates – effectively execute the client’s

chosen deal strategy• Financial confidants – confidentiality is of utmost

importance

Experienced Team• Our team has decades of M&A experience• Decades of operations, leadership, and strategic