NYSE MKT: DEJ TSX: DEJ Q4 2014 Updated 02.16.2015 First Location in Kokopelli Field Production at...

-

Upload

tiffany-julie-lyons -

Category

Documents

-

view

216 -

download

0

Transcript of NYSE MKT: DEJ TSX: DEJ Q4 2014 Updated 02.16.2015 First Location in Kokopelli Field Production at...

NYSE MKT: DEJ TSX: DEJ

Q4 2014 Updated 02.16.2015

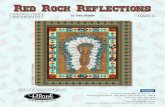

First Location in Kokopelli Field

Production at Kokopelli

Corporate Presentation Q4 2014

Updated 02.16.2015

Kokopelli Project Pad 21B

NYSE MKT: DEJ TSX: DEJ

Page 2

SAFE HARBOR

Disclosure StatementStatements Regarding Forward-Looking Information: This presentation contains statements about oil and gas production and operating activities that may constitute "forward-looking statements" or “forward-looking information” within the meaning of applicable securities legislation as they involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions. Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated by Dejour and described in the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, adverse general economic conditions, operating hazards, drilling risks, inherent uncertainties in interpreting engineering and geologic data, competition, reduced availability of drilling and other well services, fluctuations in oil and gas prices and prices for drilling and other well services, government regulation and foreign political risks, fluctuations in the exchange rate between Canadian and US dollars and other currencies, as well as other risks commonly associated with the exploration and development of oil and gas properties. Additional information on these and other factors, which could affect Dejour’s operations or financial results, are included in Dejour’s reports on file with Canadian and United States securities regulatory authorities. We assume no obligation to update forward-looking statements should circumstances or management's estimates or opinions change unless otherwise required under securities law.

Non-GAAP Measures: This presentation contains references to non-GAAP measures as follows: EBITDA is a non-GAAP measure defined as net income (loss) before income tax expense, interest expense and finance fee, and amortization, depletion and accretion. Certain measures in this document do not have any standardized meaning as prescribed by Canadian GAAP such as EBITDA therefore are considered non-GAAP measures. These measures may not be comparable to similar measures presented by other issuers. These measures have been described and presented in this document in order to provide shareholders and potential investors with additional information regarding our liquidity and our ability to generate funds to finance our operations.

BOE Presentation: Barrel of oil equivalent amounts have been calculated using a conversion rate of six thousand cubic feet of gas to one barrel of oil. The term “BOE” may be misleading if used in isolation. A BOE conversion ratio of one barrel of oil to six MCF of gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head. Total BOEs are calculated by multiplying the daily production by the number of days in the period.

Q4 2014 Updated 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Page 3

2013Foundation Production Commences at Kokopelli•Secured $6.5mm from Drill Fund to support the drilling & completion of 4 Williams Fork Wells

•Established PDP reserves and held land – held by production

•Defines type curve of WF production at 1.25BCFe incl. 150k barrels NGL/oil

2014Secondary Development Drives North American Projects•Closed $20M JV at Kokopelli to drill additional 7 WF, 1 Mancos and 1 PWD well/ retire all US debt Dejour retains a 25% WI.

•New Mancos discovery at 11,000-13000’. Logs indicate strong presence of gas

•YE 2014 2P Reserves – Kokopelli US$ 47.5mm•Announced significant resource potential at Roan Creek

•Acquisitions:•Woodrush bolt on Hunter Project including wells, infrastructure and processing facilities

•Woodrush additional WI, now 99%WI•Drilled one oil well and one Gething gas well•YE Total Reserves post sale:•NPV-10 C$65mm avg.

2015Building Production•Expect 26 producing wells:•4 oil wells and 9 gas wells at Woodrush/Hunter with production over 700 BOE/d

•11 liquids rich WF wells at Kokopelli plus•A successful Mancos test to validate reserve additions

•Potential for 220 Williams Fork locations and 40 Mancos well sites at Kokopelli

•2.6% WI in Wiley project JV commences production – 3 additional locations proposed – 24,000 gross acres

•Enter 2015 with Cdn. $65mm in 2P reserves at Kokopelli and Woodrush

•Production profile forecast:1200+ BOE/d (26 wells) with Kokopelli completions in Q3

Milestones and Development Summary

Q4 2014 Updated 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Page 4

Property PortfolioLocated in North America’s Piceance Basin (45,425 net acres),

and Peace River Arch Regions (19,000 net acres)

Kokopelli Liquids Rich Natural Gas

Dejour retains a 25% WI, retires all US debtCarried through a $16mm drill program

Current: 4 Wells in Production since Q3 2013 (7.2% WI)2014 Program: 7 new WF wells plus 1 Mancos well drilled, Production expected in Q3 2015 2015 Program: Add’l Mancos well planned

Woodrush/ Hunter Oil and Natural Gas

99% ownership 4 Oil wells and 9 Natural Gas wells 2 add’l gas wells to be placed into production in Q1 2015: estimate 700+ BOEPD (1/26/15)

Roan CreekProspect

Mancos GasDevelopment

100% Logistically located among 28 new Mancos producers SW PiceanceAPD filed to 2015 drilling

Plateau WF/Mancos Gas

100% 1260 acres unitized with Encana, plus1740 acres adjacent to Laramie Buzzard unit

Pinyon Ridge Niobrara Oil 2.60% WIDEJ carried for $500k in program

Unitized with EndeavourCurrently testing a 16,200’ Hz in the Niobrara Production 800 BO/d plus gas expected in Q1 2015

Q4 2014 Updated 02.16.2015

North Rangely Oil Exploration

100% Planning 3D seismic study

NYSE MKT: DEJ TSX: DEJ

Page 5

Woodrush: NE BC - Growth Driven By Acquisitions & Drilling

As of Q3-2014: ~19,000 net acres 99% WI in 4 light oil wells/ 9 gas wells 2 additional gas wells for Q1 2015 Current net 2P reserves valued at

$5.8mm Net production of 700 BOEPD

(1/26/15) estimated Additional development leveraging

$13mm in place infrastructure including:

Halfway pool optimization Notekewin gas addition Gething gas expansion Tie in to adjacent 2P reserve

opportunities

Project Overview

*Year End 2014 Reserve Evaluations in accordance with Canada’s National Instrument 51-101* Standards of Disclosure

Q4 2014 Updated 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Kokopelli: 12 Well Production Base with Mancos Upside

Page 6

Liquids-rich, high BTU gas25% WI in 2200 acresPotential for 220 Williams Fork drillable well locations, including 139 PUD’s

$20 mm JV closed on June 30, 2014 for project funding.

2014 program of 7 Williams Fork wells plus 1 high pressure Mancos drilled and cased

Completion and tie in expected in Q3 2015

2015 Production ProfileEstimate 500 BOE/d net production to DEJ in Q3 2015 from current 8 well program

Net 2P reserves valued at C $57.5mm from Williams Fork

Important enhancement from deeper Mancos

2015 CAPEX Program Additional Mancos Well*Year End 2014 Reserve Evaluations in accordance with Canada’s National

Instrument 51-101* Standards of Disclosure

Piceance Basin, Western Colorado

Q4 2014 Updated 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Roan Creek: West Piceance Hi-Pressure Niobrara Gas

Position 1960 net acres, 100% WI

ProspectivityTargeting 6-8 high pressure Mancos/ Niobrara 8200’ vertical / Hz wells. Independent contingent/ prospective estimate of 67.5 BCF recoverable*

*Gustavson July 2014 report

Proximity Chevron WF production to the north OXY WF production to the east. Encana Niobrara production to the west (Hz wells ~6BCFe/well)

Black Hills production to the SW Plan

EA submitted, APD to drill in 2015.

Page 7Q4 2014 Updated 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Other Active Dejour Colorado Leaseholds

Pinyon Ridge Project2.60% carried WI to this pointEndeavour Corp created Wiley unit on 23,000 acres including DEJ Pinyon Ridge interest. Target is Niobrara oil.

DEJ carried for $500k in operations.16,200’ Hz test to the Niobrara tested 800 B)/d and 1.3mmcf/d

Production Anticipated in H1 2015 Plateau Prospect

100% WI in 3000 acres prospective for WF and Mancos gas

1260 acres unitized with Encana1740 acres working on a new unitTwo years until expiryOffsets Piceance Energy and OXY production base

adjacent to 3 high volume vertical Mancos wells

X

Page 8Q4 2014 Updated 02.16.2015

NYSE MKT: DEJ TSX: DEJ

North Rangely: Wildcat Oil Shale Resource

Page 9

Prospectivity 12,000+ acres, 100% WI Contingent/ Prospective Resource

analysis underway. High risk potential for significant

quantities of oil recoverable from the Phosphoria Shale, the source of the 1BO recovered to date from the Rangely Oil Field, 10 miles to the south.

Historical well data from the 50’s to 70’s show the tight Phosphoria is oil stained 10’-150’, with small production documented, TOC to 15%.

Plan is for a 3D seismic program to establish drill target for a Hz test to 9400’

Serendipity Multi-zonal alternatives indicated in the

Morrison, Dakota, Niobrara, Weber

Q4 2014 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Financial Performance 2014 Highlights - Year to Date

7% Increase in Average Annual Production to 496 BOEPD 10% Increase in Revenue to $7.6 mm Positive Operating Cash Flow of $252,000 Closed $20mm Kokopelli JV Retired all U.S. secured debt ($3.5mm)

Catalysts for 2015 Performance Production ramp at Kokopelli- 25%WI in 8 new wells with completion in Q3 2015 (seven

Williams Fork and one Mancos) Significant improvement for NGL Contract at Kokopelli (4/1/14) increases netbacks per BOE 90% reduction in Dejour USA G&A expense by mid 2015 Hunter Acquisition (3/26/14) + Acquisition of 24% WI of Woodrush (Effective June 1, 2014) +

successful Q4 2 well drill program boost production base of Canadian operations to 700BOE/d + 2 additional gas wells for Q1 2015

Targeting 1200+ BOE/D by Q3 2015 from existing wells Balance sheet significantly improved / US debt eliminated

Page 10

*Year End 2013 Reserve Evaluations in accordance with Canada’s National Instrument 51-101* Standards of Disclosure

Q4 2014 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Corporate Snapshot

Page 11

Trading Exchanges: NYSE MKT /// TSX: DEJ

Liquidity: 0.700 mm shares/day (3 month combined average)

Shares O/S: 180 mm basic / 215 mm fully diluted

Market Cap: US$ 36 mm

Corporate debt: C$2.0 mm facility

Analyst Reports: SeeThruEquity: Revised Target: US $0.66

Zacks: Revised Target: US $0.51

Casimir Capital: Initial Target: US $0.50

Key Colorado exploitation leases host over 400 drill locations, with ~ 7,500 net acres productive in multiple reservoirs adjacent to major oil and gas producers, drilling active

Proven producing, undeveloped and probable reserves (independently engineered) indicate substantial resource upside with a successful Mancos test at Kokopelli, Roan Creek or Plateau

Two-pronged growth profile for the Piceance assets: a) Develop NGL rich Williams Fork to provide sustainable returns and solid cash flow to finance future drilling leverage, and

b) Test and produce the high deliverability resource potential from Mancos/Niobrara, the new focus for “significant value upside” in the Piceance Basin

Exploit NE BC lands production improvement via 2015 acquisition plan De-risk the high potential Phosphoria resource project (12,000+ acres) with planned 3D seismic

Value Proposition

Q4 2014 02.16.2015

NYSE MKT: DEJ TSX: DEJ

Contact Information

Robert L. Hodgkinson Chairman & CEO Vancouver, BC Canada 1-604-638-5055 [email protected]

Page 12

David Matheson CFO Vancouver, BC, Canada 1-604-638-5054 [email protected]

Craig Allison Investor Relations NYC, New York [email protected]

http://www.facebook.com/DejourEnergy

@dejourenergy

Follow Dejour

Q4 2014 02.16.2015