NRZ needs $400m for short-term recapitalisation

-

Upload

zimpapers-group-1980 -

Category

Business

-

view

197 -

download

33

Transcript of NRZ needs $400m for short-term recapitalisation

By Funny Hudzerema

HARARE –The National Railways of Zimbabwe (NRZ) requires $400 million for its short-term recapitalisation which will result in increased carrying capacity and produc-tion.

The short term funding for the sector is for acquiring new machinery and rehabilitation of the existing infrastructure to increase quality services.

During the early 2000 NRZ used to carry goods weighing 9,5 million tonnes but the car-rying capacity has declined to 3,4 million tonnes in 2015 due to shortage of proper machin-ery for the sector.

News Update as @ 1530 hours, Monday 13 June 2016

Feedback: [email protected]: [email protected]

NRZ needs $400m for short-term recapitalisation

The director in the Ministry of Transport and Infrastruc-ture Development Mr Saston Muzenda said NRZ currently has the capacity to transport around 3,4 million tonnes.

“The NRZ requires $400 million for its short term recapitalisation to increase production in the sector which is currently very low due to reduction of moving wagons and old infrastructure.

“The fund will improve the sector’s total carrying capacity from the current 3,4 to a max-imum of 7,6 million tonnes,” he said.

NRZ owns 168 locomotives, of which only 64 (38 percent) are currently serviceable and the sector also owns 7255 wagons and only 3 467 which is 48 percent that are operational while the rest are set for dif-ferent reasons.

“All the entity’s wagons have long gone beyond their design life of 40 years and the run-

ning fleet is also in a very poor state and most of the wagons are not fit to carry international traffic across the borders.

“The fund will be used to procure 15 new locomotives procure 1000 new wagons and other equipments which currently needs to be main-tained,” he said.

He added that to increase capacity utilisation more investment is required in the infrastructure of NRZ.

“The funding of the project will

result in an improved safety of train movements between sections as a result of stabili-sation of communication and track infrastructure and an improved market share due to improved quality of service,” he said.

He added that if NRZ secures the fund it will be able to increased revenue from oper-ations, return to profitability and in turn will be able to repay salaries and salary back-log, and creditors, improved rolling stock and infrastructure maintenance regime.●

2 NEws

BH243

BH244

By Tawanda Musarurwa

HARARE -Government has granted listed beverages giant Delta Corporation Ltd exemption from paying duty on its planned importation of 535 coolers this year.

Delta Corporation is Zimba-bwe’s biggest company, and one of the biggest taxpayers to Government. Customs Duty is levied on imported goods in terms of the Cus-toms and Excise Act (Chapter 23:02).

The Ministry of Finance and Economic Development has made amendments to the Customs and Excise (Suspen-sion) Regulations, 2003, by deletion of section 9N and replacement with the follow-ing:

“Suspension of Duty on Car-bon Dioxide Compliant and Hydrofluorocarbon-free Cool-ers imported by Approved importers.”

Government has allowed the beverages maker to import the following 535 coolers: EV24 SD R134A Single Door Cooler (x 210), eKOCool-35 Solar Chest Cooler (x 150), ER130 Coke Cooler (x 35), FV 1200 D R134A Coke Dou-ble Door Cooler (x 90) and S12 D Coke Cooler (x 50).

Earlier this year, Delta announced a 13 percent decline in full-year profit due

to a challenging operating environment. The group’s net income amounted to $81 million in the year through March 31, 2016, down from $93 million in the previous period.

Earnings before interest, taxes, depreciation and amortisation fell 10 percent. Delta is about 23 per-cent-owned by London-based SABMiller Plc.●

Delta Corporation gets customs duty exemption

5 NEws

BH246

BH247

BH24 Reporter

HARARE - Government has gazetted the Land Commission Bill effectively laying the foun-dation for the Land Commission to carry out periodic land audits countrywide.

The Land Commission Bill is expected to help resolve land disputes, among other issues. The Commission will take over functions previously performed by the Agricultural Land Reset-tlement Board.

Government is prioritising

the Bill as it moves to realign various laws with the 2013 Constitution and refine the Land Reform Programme. According to the Land Commission Bill published in the Government gazette on Friday, periodic land audits will weed out multiple farms owners, resolve land dis-putes and deal with land reform beneficiaries leasing out farms to white former commercial farmers.

This comes at a time when Gov-ernment announced that many farmers were willingly surren-dering portions of their farms

since the State introduced land rentals and unit tax in July. A1 farmers pay $15 per annum in rental, while their A2 counter-parts are paying $5 per hectare per annum.

The law, once signed by Presi-dent Mugabe, will operationalise the Zimbabwe Land Commis-sion, whose functions will be to ensure accountability, fairness and transparency in the admin-istration of agricultural land.

In terms of Section 297 of the Constitution, the commission will conduct periodic audits of

agricultural land, investigate and determine complaints and disputes regarding the supervi-sion, administration and alloca-tion of agricultural land.

The commission will also make recommendations on land usage and size of agricultural land holdings, simplification of the acquisition and transfer of rights in land, systems of land tenure, fair compensation payable under the law for agricultural land and improvements that have been compulsorily acquired, as well as allocations and alienations of agricultural land.●

8 NEws

Land Bill gazetted

02 03

ADD TO CARTSave big on selected

Products of your choice

PAYMENTYou can purchase

whenever, wherever using:

DELIVERYSpend $30 or moreon your purchases

and get freedelivery

01 Hello Convenience

www.hammerandtongues.com

BIG CONVENIENCE+BIG SAVINGS+BIG OPPORTUNITIES = BIG HAPPINESS

SHOP ONLINE!!

BH249

BH2410

BH24 Reporter

HARARE –Tobacco farmers have so far earned $362, 9 million from the sale of 125 million kilogrammes of virginia tobacco since the tobacco selling season began on March 30, an increase of 12 percent from the same time last year, latest Tobacco Industry and Marketing Board (TIMB) statistics show. The 125 million kg of tobacco were sold at both the auction and contract floors.

The 12 percent increase in deliveries indicates that

tobacco deliveries for the season are now declining since the numbers of bales are declining with this year tobacco is expected to decline by 20 percent due the El Nino induced drought which affected the crop.

TIMB indicated that a total of 23,7 million kg of tobacco worth $60,6 million was sold at the auction floors while 101,2million kg worth $302,3 million was sold at the con-tract floors. Most tobacco farmers have been opting for

contract farming due to high costs of inputs. A total of 111 million kg worth $324, 9 million had been sold during the same period last year.

TIMB said the top price for the contract floors was $5, 60 per kg while at the auction floors it was $4, 99 per kg. The lowest price that has been recorded so far is $0, 10 per kg. A total of 103 516 bales have so far been rejected due to poor quality and poor packaging this season, compared to 130 299 bales rejected the same period last year.●

11 NEws

Tobacco farmers earn $362,9 m

BH2412

BH2413

HARARE -The equities mar-ket opened the week on low as the mainstream industrial index slid 1.32 to settle at 95.19.

Beverages giant Delta was culpable as it led the losers with a $0,0277 loss to close

at $0.5295, while conglomer-ate Innscor dropped $0,0017 to $0,1785.

SeedCo, OK Zim, Dairibord, Pearl Properties, Meikles and Simbisa traded unchanged at $0,5500, $0,0300, $0,0500, $0,0200, $0,0780 and

$0,1400 respectively.

The mining index was flat at 26.24 as Bindura, Falgold, Hwange and RioZim remained unchanged on previous price levels at $0,0120, $0,0050, $0,0300 and $0,1700 in that order - BH24 Reporter ●

Industrials open in the red

14 ZsE

BH2415

BH2416

MovERs CHANGE ToDAy PRICE UsC sHAKERs CHANGE ToDAy PRICE UsC

DELTA -4.97 52.95

INNSCOR -0.94 17.85

INDEx PREvIoUs ToDAy MovE CHANGE

INDuSTRIAL 96.51 95.19 -1.32 points -1.37%

MINING 26.24 26.24 +0.00 POINTS +0.00%

17 ZsE TABLEs

ZsE

INDICEs

stock Exchange

Previous

today

BH2418

BH2419

20 DIARy oF EvENTs

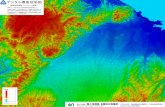

The black arrow indicate level of load shedding across the country.

PowER GENERATIoN sTATs

Gen Station

13 June 2016

Energy

(Megawatts)

Hwange 592 MW

Kariba 682 MW

Harare 30 MW

Munyati 19 MW

Bulawayo 24 MW

Imports 0 - 400 MW

Total 1505 Mw

15 JUNE 2016 -- Rainbow Tourism Group 7th Annual General Meeting; Time: Jacaranda Rooms 2 and 3 at the Rainbow Tourism Hotel and Conference Centre, 1 Pennefather Avenue, samora Machel Avenue west, Harare; Time: 1200 hours...

16 JUNE 2016 -- RioZim 60th Annual General Meeting; Place: No. 1 Kenilworth Road, Highlands, Harare; Time: 10.30 hours...

22 JUNE 2016 -- Zimre Holdings Limited 18th Annual General Meeting; Place: NICoZDIAMoND Auditorium, 7th Floor Insur-ance Centre, 30 samora Machel Avenue, Harare; Time: 1430 hours...

22 JUNE 2016 -- GB Holdings Limited Annual General Meeting; Place: Cernol Chemicals Boardroom, 111 Dagenham Road, wil-lowvale, Harare; Time: 11.30 hours...

23 JUNE 2016 -- Zimpapers 89th Annual General Meeting; Place: Zimpapers Ltd Boardroom, sixth Floor Herald House, Cnr. G. silundika/sam Nujoma street, Harare; Time: 1200hrs…

24 JUNE 2016 -- Dawn Properties Annual General Meeting; Place: Great Indaba Room, at the Monomotapa Hotel, 54 Parklane, Harare on Friday; Time: 10:00 hours...

THE BH24 DIARy

JoHANNEsBURG - South Africa's rand steadied in early trade on Monday, but looked vulnerable to risk aversion before the uS Federal Reserve's monetary policy meeting this week and a referendum of Brit-ain's potential exit from the European union next week.

At 0645 GMT, the rand traded at 15,2350 per uS dollar, not far off its New York close of 15,2420 on Friday.

"Dollar strength and risk aversion threaten the rand," Rand Merchant Bank analyst John Cairns said in a note.

"Event risk is focused on Tuesday’s (South Africa) current account data and Wednesday’s Fed meeting

but it will probably be sen-timent, particularly towards the dollar, that drives mar-kets this week."

The central banks of the united States, Japan, Britain and Switzerland all hold policy setting meetings this week, but investors expect them to stand pat given uncertainty over the looming uK referendum.

Stocks were set to open lower at 0700 GMT, with the JSE securities exchange's Top-40 futures index down 0,93 percent.

In fixed income, the yield for the benchmark instru-ment due in 2026 added 8.5 basis points to 9,155 percent. - Reuters●

21

sA bolsters power capacity as new unit linked to grid: Eskom

Rand steady, vulnerable to risk aversionREGIoNAL NEws

JoHANNEsBURG -South Africa's Eskom linked up the first of four units at its Ingula power plant on Friday, the util ity said on Monday, as it raises capac-ity to overcome chronic electricity shortages in Africa's most developed economy.

Eskom, which has in the past been forced to impose power cuts to prevent demand from surging past capacity, is scrambling to repair its ageing power plants and grid as well as adding new plants.

unit four of the hydro-pow-ered Ingula plant, which is in the northeast Kwazulu Natal province, added 333 megawatts (MW) to the grid.

Construction on the 25 bill ion rand ($1,65 bill ion) plant began in 2006 and all four units are expected to be fully operational in 2017 to produce 1,332 MW.

Other Eskom projects include the Medupi and Kusile coal-fired plants in the northern Limpopo and eastern Mpumalanga provinces respectively, which will have a combined capacity of about 9,500 megawatts.

Six workers were killed in an accident at the pumped storage scheme plant in 2013, forcing construction to halt for a safety review - Reuters●

Gold climbed to the high-est level in four weeks as uncertainty mounts over the potential risks if Britain decides to leave the Euro-pean union, and as traders price in zero chance of the Federal Reserve raising inter-est rates at a meeting this week.

Bullion for immediate deliv-ery advanced as much as 0,8 percent to $1 284,29 an ounce, the highest level since May 16, and traded at $1 282,42 at 2:46 p.m. in Singapore, according to Bloomberg generic pricing.

Gold’s rally has regained its footing as the possibility of further turbulence in markets boosts demand for haven assets. The metal is up 21 percent in 2016 as expecta-tions have diminished for the Fed to raise borrowing costs at its meeting ending June 15, benefiting gold, which doesn’t pay interest. A Brexit vote June 23 could propel prices to $1 400, Capital Economics Ltd. analysts said Friday. Polls published over the weekend showed the vote

was too close to call.

“We’ve got some concerns now about the approaching vote on Britain leaving the Eu which is putting a ripple of that concern in investors’ minds, so all those things are pointing towards a nice

little rally towards $1 300,” David Lennox, an analyst at Fat Prophets in Sydney, said by phone. Reduced prospects for a rate hike are also “cre-ating the environment for the price to rise,” he said.

As of Friday, federal funds

futures implied an 18 percent chance the uS central bank will tighten policy in July, down from 55 percent on June 2, while December is the first month with at least even odds of a rate increase.

- Bloomberg●

22

Gold advances to four-week high on Brexit risk, Fed rate outlook

INTERNATIoNAL NEws

By Nigel Gambanga

EcoCash the most popular mobile money service in Zim-babwe has been going to great lengths to position itself as the primary channel for payments as the country struggles with a cash crisis.

In addition to the flood of adverts that sell some already familiar services like buy-ing airtime, it also removed charges for merchant pay-ments and has now started promoting the option for fuel payments via EcoCash at service stations around the country.

All this is commendable and the truth is, it actually is the obvious thing to do. As the efforts to access cash become increasingly futile any service that gives Zimbabweans a facility to make transactions electronically has to double efforts to work with as many service providers as possible. It’s a crisis, so anyone selling some sort of option for relief has to sell their service.

So it’s a bit disappointing when the other mobile money services (Telecash, OneWallet, Nettcash) fail to do the same thing.

Without an immediate end to the cash crisis in sight, I would have expected to see a

flood of mobile-money related value added services accom-panied by an integration with as many service providers as possible.

Providers like Telecash had already done some of the work by rolling out its agent net-

work, offering service integra-tion and introducing support-ing services like its mobile app and the Gold Card. However, this hasn’t been promoted lately.

Why isn’t the Gold Card being placed in the hand of every Telecash subscriber right now? After all, we are now in an environment where Point of Sale transactions are increas-ingly becoming a primary option.

Why aren’t other transactional charges being slashed or sus-pended through promotions? Why haven’t we seen more services and attempts at being more visible from NetOne’s OneWallet, which has probably been the worst performing fin tech subsidiary in Zimbabwean telecoms?

The answers are proba-bly locked in some strategy meeting for each of these providers. Wherever they are, though, they need to take action for everyone’s sake. – TechZim●

23 analysis23 ANALysIs

Mobile money services fail to explore growth opportunities in a cash dry Zimbabwe