Nri Banking Main

-

Upload

jinal-mehta -

Category

Documents

-

view

2.823 -

download

14

Transcript of Nri Banking Main

NRI BANKING

Project On

INNOVATIVE BANKING SERVICES

PROVIDED TO NRI

BACHELOR OF COMMERCE

BANKING & INSURANCE

SEMESTER V

2010-2011

Submitted By

JINAL.M.MEHTA

ROLL NO- 34

S.K. SOMAIYA COLLEGE OF ARTS,

SCIENCE & COMMERCE

VIDYAVIHAR

1

NRI BANKING

CHAPTER NO

TOPIC NAME PAGE

NO

ACKNOWLEDGEMENT

EXECUTIVE SUMMARY

RESEARCH METHODOLOGY

OBJECTIVES OF THE STUDY

SCOPE OF STUDY

05

06

07

08

08

01 INTRODUCTION ON NRI BANKING:-

Who is an Nri?

Pio card scheme

What is an OCB?

Key benefits

Types of accounts

Opening of NRI A/c

09

10

11

13

14

15

19

02 DEFINATION:-

Definition of NRI – under Foreign Excange

Management Act,1999

Defination of PIO

24

27

2

NRI BANKING

03 DEPOSITORY’S SCHME FOR NRI’S:-

NRE A/c

Types of Accounts

FCNR A/c

NRO A/c

Tax Benefits for NRI’s

30

30

34

36

41

04 SERVICES OFFERED BY VARIOUS BANK TO NRI’S:-

Banking Services

Services offered by ICICI Bank

Facility available as per RBI/FEMA

guidelines

43

44

45

05 RBI ISSUES GUIDELINES FOR MONEY TRANSFER SCHEME:-

Money transfer

International SWIFT transfer

Demand (or bankers) draft

UAE Exchange

Wester union Money Transfer

Sendwise

Moneygram send money online today

ICICI & HDFC bank NRI money transfer

48

49

49

50

50

50

51

52

3

NRI BANKING

06NRI INVESTMENTS:-

Investment opportunities in India for NRI

RBI forms

52

55

07 NRI INVESTMENT IN IMMOVABLE PROPERTY IN INDIA:-

Rules for acquisition 7 transfer by foreign

citizen NRI’s

Mode of payment

Repatriation of sale proceeds

56

58

59

08 PAN CARD FOR NRIs:-

Applying for pan card, necessity for pan

card,charges of pan card

Demat a/c

60

62

CASE STUDY ON NRI

CONCLUSION

ANEXXURE

FINDINGS AND SUGGESTION

BIBLIOGRAPHY

66

70

71

72

74

4

NRI BANKING

ACKNOWLEDGEMENT

First and Foremost I thank the ALMIGHTY for the Inspiration and strength to complete this project report successfully.

I would firstly like to thank Prof.Parvathy Venkatesh who has provided me the kind opportunity to do this project and to finish it in a successful manner.

My heartily thanks to Mrs. Mahek Mansuri the coordinator of my group and other faculties, who have right from the beginning encouraged me to do the project well.

I consider it my proud privilege and immense pleasure working under the guidance of Ms Marelia Mam, who gave me a constant guidance valuable suggestions and inspiring encouragement to make my study a success.

My sincere thanks toms Ms Marelia Mam, who has done me the corrections and formatting of project report and helped me by providing details and quotations of my topic, this helped me make my project very precise and accurate to a great extent

5

NRI BANKING

On a personal note, I wish to thank my family members and friends for their constant support in helping me accomplish my mission

EXECUTIVE SUMMARY :-

NRI Banking is becoming popular among the Non-resident customers. As India is

showing progress more & more NRI investing in the country. Banks should try to

give their top class service to the NRI’s as they are looking for convenience, speed,

high yield on investments with manageable risk, reasonable cost & quality

services.

Bank should lower the minimum balance requirement which is Rs.50,000 for

NRI,s as compared to resident who have to keep Rs.1000. The documentation

procedure in case of opening of a/c in banks, investing in any property, for buying

shares & debt. should be reduced and in case of loan at a faster speed.

The services of banks should be fast, accurate & upto the standard as they have to

face competition not only from the local banks but also from the banks based

overseas.

Banks should also extend their services by providing ATM’s abroad, E -banking

with efficient facility & balance inquiry message through mobilizes.

Investment of NRI would help to bring more inflow of foreign exchange through

taxes & investment policy & this would help Indian government to repay its debt

to the World Bank. Indian government should give their best services &

efforts to encourage NRI to invest in India. This would help our economy to

flourish & grow in future.

6

NRI BANKING

RESEARCH METHODOLOGY

In order to conduct the research an appropriate methodology became necessary.

In this direction both

primary as well as secondary data were attempted to be collected.

The methodology for collecting data with reference to the secondary data was

taken from the different published articles, books, journals, and the relevant

websites. The library of the college was of great help.The questionnaire was

initially prepared in tough sketch at the first instance. These questions were

discussed with our internal guides and our teaching faculty. They have provided

valuable suggestions, additions deletions and modification of the rough

questionnair Methodology became a preplanned strategy in collecting, editing,

tabulating and in interpreting the required information for the research.Thus

methodology relied on both primary and secondary data with the help of

questionnaires, discussions, observations as well as published work and

unpublished work

7

NRI BANKING

OBJECTIVE OF THE STUDY

To get an overview of NRI BANKING SERVICES

To analyze the growth of NRI banking services

To study the innovative concepts emerging in the banking industry for NRI’s

To observe the facility provided to NRI by Indian banks

To analyse the response of the NRI given to the computerization & new

invention in an Indian banks.

SCOPE OF STUDY:-

The scope of the study is to extended the knowledge about the nri banking services

provided by banks but restricted to only ICICI Bank.

AREA :- In the vicinity of Mumbai (India) services for NRI by banks

BRANCH :- ICICI ( Industrial Credit and Investment Corporation of India)

bank Andheri branch.

TIME FRAME :- Aug 20th 2010 TO SEP 24th 2010.

8

NRI BANKING

NRI Banking – An Introduction:-

As per RBI guidelines, the residential status of an Indian changes to that of the

Non-Resident, in the event of his stay abroad being more than 183 days. This

period of 183 days is not applicable in certain cases like going overseas for

employment or business. It is mandatory to inform the bank of your change of your

residential status.

With a view to attract the savings and other remittance into India through banking

channels from the person of Indian Nationality / Origin who are residing abroad

and bolster the balance of payment position, the Government of India introduced in

1970 Non-Resident(External) Account Rules which are governed by the Exchange

9

CHAPTER 1.

INTRODUCTION

NRI BANKING

Control Regulations. The funds held in Non-Resident (External) Accounts (NRE

Accounts) qualify for certain benefits like exemptions from taxes in India, free

repatriation facilities, etc.

NRI banking facilities are available to NRIs and PIOs.

WHO IS A NON – RESIDENT INDIAN [NRI] ?

A Non Resident Indian (NRI) as per FEMA 1999 is an Indian citizen or Foreign

National of Indian Origin resident outside India for purposes of employment,

carrying on business or vocation in circumstances as would indicate an intention to

stay outside India for an indefinite period. An individual will also be considered

NRI if his stay in India is less than 182 days during the preceding financial year.

To meet the specific needs of non-resident Indians related to their remittances,

savings, earnings, investments and repatriation, the Government of India

introduced in 1970 Non-Resident (External) Account Rules which are governed by

the Exchange Control Regulations.

"Non Resident Indian" (NRI) means an Indian citizen or a foreign citizen of

Indian origin (excluding citizens of Bangladesh and Pakistan) residing outside

India. Students studying abroad are also treated as NRIs.

Indian citizen who stays abroad for an indefinite period on employment, business

or on any vocation is a Non-Resident. Diplomats posted abroad, persons posted in

UN Organizations and Officials deputed by PSU on temporary assignments are

also treated as Non-residents.

10

NRI BANKING

PIO CARD SHCEME

The Government has launched a comprehensive Scheme for the Persons of Indian

Origin-called the ‘PIO Card Scheme’. Under this Scheme, Persons of Indian Origin

up to the fourth generation (great grandparents) settled throughout the world,

except for a few specified countries, would be eligible. The Card would be issued

to eligible applicants through the concerned Indian Embassies/High

Commissions/Consulates and for those staying in India on a long term visa, the

concerned Foreigners Regional Registration Officer (Delhi, Mumbai, Calcutta,

Chennai) would do the same. The fee for the card, which will have a validity of 20

years, would be US$1000.

In this scheme, unless the context otherwise requires-

"Person of Indian origin" means a foreign citizen (not being a citizen of Pakistan,

Bangladesh and other countries as may be specified by the Central Government

from time to time) if,

He/she at any time held an Indian passport; or

He/she or either of his/her parents or grandparents or great grandparents was

born in and permanently resident in India as defined in the Government of India

Act, 1935 and other territories that became part of India thereafter provided

neither was at any time a citizen of any of the aforesaid countries (as referred to

11

NRI BANKING

in 2(b) above); or

He/she is a spouse of a citizen of India or a person of Indian origin covered

under (i) or (ii) above.

Besides making their journey back to their roots simpler, easier and smoother,

this Scheme entitles the PIOs to a wide range of economic, financial,

educationaland cultural benefits. The benefits envisaged under the Scheme

include:-

No requirement of visa to visit India;

No requirement to register with the Foreigners Registration Officer if continuous

stay does not exceed 180 days. If continuous stay exceeds 180 days, then

registration is required to be done within a period of 30 days of the expiry of 180

days;

Parity with Non-Resident Indians in respect of facilities available to the latter in

economic, financial, educational fields etc. These facilities ill include:

Acquisition, holding, transfer and disposal of immovable properties in India

except of agricultural/plantation properties;

Admission of children in educational institutions in India under the general

category quota for NRIs- including medical/engineering colleges, IITs, IIMs etc.

Various housing schemes of Life Insurance Corporation of India, State

Governments and other Government agencies;

12

NRI BANKING

All future benefits that would be extended to NRIs would also be available to

the PIO Card holders;

However, they shall not enjoy political rights in India.

What is an OCB?

Overseas Corporate Bodies (OCBs) are bodies predominantly owned by

individuals of Indian nationality or origin resident outside India and include

overseas companies, partnership firms, societies and other corporate bodies which

are owned, directly or indirectly, to the extent of at least 60% by individuals of

Indian nationality or origin resident outside India as also overseas trusts in which at

least 60% of the beneficial interest is irrevocably held by such persons. Such

ownership interest should be actually held by them and not in te capacity as

nominees. The various facilities granted to NRIs are also available with certain

exceptions to OCBs so long as the ownership/beneficial interest held in them by

NRIs continues to be at least 60%

What are the various facilities available to NRIs/OCBs?

NRIs/OCBs are granted the following facilities:

Maintenance of bank accounts in India.

13

NRI BANKING

Investment in securities/shares of, and deposits with Indian firms/ companies.

Investments in immovable properties in India.

KEY BENEFITS

NRI-Banking follows a modular structure. The various modules render our NRI

Banking solution offerings (which are stated below) in a seamlessly integrated

fashion.

The Masters module permits maximum parameterization to be done, enabling the

end user to make all changes with regard to Interest Rates or with regard to any

changes as per directives from Head Office / RBI.

Maintains Bank, Branch and holiday details

Facilitates maintenance of Instrument, Interest rate and overdue interest rate details

Masters. Inventory, Currency, Country, Exchange rate and return reason details are

also maintainedFavors opening, authorization and freezing of AccountsTransaction

entry and passing is made easy

Provisions availed for issuing, passing and stop payment of cheques.

14

NRI BANKING

Supports Account closure, Preclosure, Renewal & overdue renewal of Deposits.

Aids Day Begin, Day End & Month End Processing

Processes Quarterly, and transfer to Inoperative & Half Yearly - SB Interest

Calculation.

Hastens Deposit Receipt Printing, Changing to RFC, Interest Payment & Overdue

Process.

Supports Acceptance and Execution of standing instruction.

Types of accounts

NRI accounts are maintained by banks which hold authorized dealers' licences

from the Reserve Bank of India. Some cooperative and commercial banks have

also been specifically permitted to maintain NRI accounts in rupees even though

they are not authorized dealers. The financial budget for 2007-08 extends NRI

accounts to regional rural banks (RRBs) as well. This would boost remittances

from NRIs particularly in Bihar, Kerala, Uttar Pradesh and Gujarat where a large

number of persons from rural areas from these states are employed overseas.

Banking Laws for NRIs allow for accounts with authorized dealers to be

maintained in Indian rupees and in foreign currency.

Various accounts:-

NRE A/c - non residential (external) rupee account.

15

NRI BANKING

FCNR-B A/c - foreign currency non residential account.

NRO A/c - non resident ordinary account.

RFC A/c - resident foreign currency account.

All NRIs can open such accounts, with the exception of individuals residing in

Pakistan and Bangladesh, who require special permission from the RBI. Joint

accounts of two or more non-residents and nomination facility are permitted.

While the FCNR (B) is a term deposit only, the NRE and NRO accounts can be

operated as either savings, current, recurring or fixed deposit accounts. As for

interest rates, FCNR (B) and NRE are subject to a cap, and should not exceed the

LIBOR/SWAP rates. In the case of NRO accounts, rates are determined by the

banks. The interest rates, currently at 3.5% apply to a period of 1 to 3 years.

The total NRE/ FCNR deposits during 2006-2007, as per RBI statistics, are USD

37,751 million and are expected to grow with regional rural banks also mopping up

funds. Banks are expected to offer lucrative interest rates to bolster NRI funds.

Banks offer two types of accounts to NRIs, based on their reparability.

Repatriable Accounts

Funds that can be transferred or repatriated abroad are maintained in a Non

Resident External Bank account. Generally, funds remitted from outside India are

credited to this account. Investments made from foreign funds can be repatriated

overseas, and such investments are maintained in a Repatriable Demat account.

Non-Resident (External) Rupee (NRE) Accounts

Both Principal and Interest can be repatriated/transferred out of India

16

NRI BANKING

Savings rate on NRE accounts is at par with savings rates in resident accounts

Term deposits can be made for 1 to 3 years.

The interest rates on (NRE) Term deposits cannot be higher than LIBOR/SWAP

rates as on the last working day of the previous month, for US dollar of

corresponding maturity plus 50 basis points.

The interest rates on three year deposits also apply in case the maturity period exceeds three years. The change in interest rate also applies to NRE deposits renewed after their present maturity period.

FCNR (B) Accounts

As in NRE accounts, both principal and interest are repatriable.

Presently, deposits can be made in 6 specific foreign currencies (US Dollar,

Pound Sterling, EURO, Japanese Yen, Australian Dollar and Canadian Dollar).

Interest rate- Fixed or floating within the limits of LIBOR/SWAP rates for the

respective currency/corresponding term minus 25 basis points (except Japanese

Yen).

The term of deposits can range between 1 to5 years.

17

NRI BANKING

NRO Accounts

Only current earnings are repatriable.

Savings NRO accounts are normally operated to credit rupee income from

shares, interest, rent from property in India, etc.

In case of term deposits, banks are allowed to determine their own interest rates.

Banks can allow remittance up to USD 1 million per financial year for bonafide

purposes from balances in the NRO accounts once taxes are paid out. This limit

includes the sale proceeds of immovable properties held by NRIs and PIOs.

Resident Foreign Currency (RFC) Account

NRIs and PIOs returning to India can maintain an RFC account with an authorized

bank in India to transfer funds from their NRE/FCNR (B) accounts. Proceeds of

assets held outside India before their return to India can be credited to the RFC

account. These funds are free from all restrictions as to their utilization or in

investment in any form outside India.

Non-Repatriable Accounts

18

NRI BANKING

Non-repatriable funds are those which cannot be taken out of India. These have to

be maintained in a separate bank account i.e. a Non Resident Ordinary Bank

account. Investments made from non-repatriable accounts cannot be repatriated but

have to be maintained in a Non-Repatriable Demat account. Money once

transferred from an NRE account to an NRO account cannot be transferred back to

an NRE account.

Non Resident Ordinary (NRO) Account

When a resident becomes an NRI, his existing savings account is designated as a

Non-resident Rupee (NRO) account.

The NRO accounts could be maintained in the nature of current, saving,

recurring or term deposits. NRIs can also open NRO accounts for depositing

their funds from local transactions.

The interest earned from NRO accounts is accountable to tax laws.

NRO accounts can be opened in the name of NRIs who have left India to take up

employment or business temporarily or permanently in a foreign country.

Funds from NRO accounts are not repatriable or transferred to NRE accounts

without the prior approval of the RBI.

However, NRIs, PIOs, Foreign Nationals, retired employees or non-resident

widows of Indian citizens can remit, through the Authorized Dealer, up to USD

one million per calendar year from the NRO account or from income from sale of

assets in India

OPENING OF NRI ACCOUNT

HOW TO OPEN NRI ACCOUNTS WITH A BRANCH IN INDIA

19

NRI BANKING

To open an NRE account please complete the account opening form and mail it to

the branch of your choice along with ;

Passport copy

Visa/residence permit

2 photographs

initial money remittance

Your signature may be verified by anyone of the following;

Indian Embassy/consulate

Any person known to the Bank

Notary public

Any of our offices abroad

You can open

NRE Saving Bank a/c / Current Accounts

Fixed Deposits in Indian Rupees

Fixed Deposits in Foreign Currency

NRO accounts (Rupee accounts for crediting income in India )

You can authorize a resident to operate your account through a Power of Attorney or Letter of Authority

Nomination Facility available (Nominee can be a resident Indian also)

Procedures & Benefits:

Non-Resident accounts can be opened along with your remittances through

20

NRI BANKING

Banking channel.

Photograph shall be enclosed with the opening form.

There is no ceiling on the amounts remitted for your credit in Non-Resident

account.

When the NRI depositor returns to India, the NRE account will be automatically

treated as Resident account. However NRE term deposit will continue to earn

same rate till maturity even after such conversion.

NRE accounts earn more interest than domestic deposits.

Nomination facilities are available for registration in favor of a non resident or

resident.

Loans against deposits are allowed for purposes other than investment up to

90% of the deposit.

The income from deposit is free from Indian Income Tax.

It is also free from Gift tax for one time gifting.

Documents Required:-

In case account opened in person:

21

NRI BANKING

Indian passport with overseas resident address or work permit (i.e. Green Card as

residence permit for USA, H1 Visa as work permit for USA or Hongkong ID card

for residence of Hongkong)

Separate proof of Non Resident status if the passport holds Indian address and

resident Visa permit is not included in passport. Photograph of individual account

holder

For persons employed with foreign shipping company

Initial work contract

Last wage slip

For contract employees

Last work contract

Letter from local agent confirming next date of joining the foreign vessel (not

more than six months from date of last return to India)

Principal's overseas address or current work contract

In case of documents sent by mail

All the relevant above mentioned documents / signatures to be attested by any

one of the following:

Indian embassy overseas notary

Local bank

Minimum balance in which one can open an account (Differs from bank to

bank):-

22

NRI BANKING

NRO – Saving Account – Rs.5,000/-

NRO - Current Account – Rs.10,000/-

NRO – Term Deposit Account – Rs.5,000/-

NRE – Savings Account – Rs.5,000/-

NRE – Current Account – Rs.10,000/-

NRE – Term Deposit Account – Rs.10,000/-

FCNR – Term Deposit Account – USD 500/- or its equivalent in GBP or Euro

If you submit the money for opening/credit to an account. Frequency of Interest

payment on accounts:

NRO – Term Deposit Account – Half yearly

NRE – Savings Account – Quarterly

NRE – Term Deposit Account – Half yearly

FCNR – Term Deposit Account – Quarterly

Opening of JOINT ACCOUNTS:-

23

NRI BANKING

Type of account Joint Account with

Resident Indians

Joint Account with

Non-Resident Indians

NRO Yes Yes

NRE No Yes

FCNR No Yes

24

NRI BANKING

NRI definition- under Foreign Exchange Management Act, 1999

Definition of an NRI :

Introduction:

An Indian abroad is popularly known as an NRI – but the same has two important

definitions - one coined under the Foreign Exchange Management Act, 1999 –

[FEMA] and the other as per the Income Tax Act, 1961.

FEMA definition:

The most relevant definition concerning an NRI's various bank accounts and

investments in movable and immovable properties in India is the one provided by

Foreign Exchange Management Act, 1999 – [FEMA], which has replaced the

Foreign Exchange Regulation Act , 1973- [FERA] with effect from June 1,2000.

Person Residing Outside India is the term used for an NRI , being a person

who has gone out of India or who stays outside India for the purpose of

employment or carrying on business or vocation outside India or any other

circumstances which indicate his intention to stay outside India for an

25

CHAPTER 2.

DEFINITION

NRI BANKING

uncertain period.

Section 2(v) of FEMA,1999

Person resident in India" means—

a person residing in India for more than one hundred and eighty-two days during

the course of the preceding financial year but does not include—

a person who has gone out of India or who stays outside India, in either case—

(a) for or on taking up employment outside India, or

(b) for carrying on outside India a business or vocation outside India, or

(c) for any other purpose, in such circumstances as would indicate his intention to

stay outside India for an uncertain period;

a person who has come to or stays in India, in either case, otherwise than—

for or on taking up employment in India, or

for carrying on in India a business or vocation in India, or

for any other purpose, in such circumstances as would indicate his intention to

stay in India for an uncertain period;

(a) any person or body corporate registered or incorporated in India,

(b) an office, branch or agency in India owned or controlled by a person resident outside India,

(c) an office, branch or agency outside India owned or controlled by a person resident in India;

2(w) "person resident outside India" means a person who is not resident in India;

26

NRI BANKING

Non Resident Indian, the phrase is for the first time defined in the regulations as

“a person resident outside India who is either a citizen of India or a person of

Indian Origin".

Recently RBI has clarified that students studying abroad also be treated as NRIs

under FEMA and accordingly be eligible for foreign investments and

NRE/FCNR a/cs

And the definition of "a person resident outside India " is simply put as " a

person who is not Resident in India."

NOW, reading both the definitions together, it can be summarized that both:

an Indian Citizen residing outside India and also

a Foreign Citizen of Indian origin residing outside India are defined as Non-

Resident Indians.

Person of Indian Origin:

F.E.M.(Deposit) Regulations define a Person of Indian Origin (PIO) as:

a person, being a citizen of any country other than Pakistan and Bangladesh,

who at any time held an Indian Passport. or

a person who himself or either of his parents or any of his grandparents were

citizens of India, or

a spouse of an Indian citizen, or

a spouse of a person covered under (i) or (ii) above.

27

NRI BANKING

2(xii) 'Person of Indian Origin' means a citizen of any country other than

Bangladesh or Pakistan, if

he at any time held Indian passport; or

he or either of his parents or any of his grand- parents was a citizen of India by

virtue of the Constitution of India or the Citizenship Act, 1955 (57 of 1955) or

the person is a spouse of an Indian citizen or a person referred to in sub-clause

Person of Indian Origin (PIO) defined under Regulations re: Immovable

Property in India:

This definition is further narrowed when it comes to rules regarding acquisition

and transfer of immovable property in India. Probably with an intention of

ensuring & restricting control of immovable properties in the hands of strictly

defined persons of Indian Origin only, this definition is further narrowed to

exclude individuals being citizens of Pakistan, Bangladesh, Sri Lanka,

Afghanistan, China, Iran, Nepal and Bhutan.

As regards immovable property transactions it may be noted that herein the

person's father or grandfather is included unlike parents or grandparents and spouse

in earlier definition.

Accordingly a Person of Indian Origin is defined herein as:

a) Who held an Indian Passport at any time?

An individual other than citizens of Pakistan, Bangladesh, Sri Lanka, Afghanistan,

China, Iran, Nepal and Bhutan, or

b) Who himself or his father or grandfather was a citizen of India.

28

NRI BANKING

[Regulation 2(c) of F.E.M. (Acquisition and Transfer of Immovable Property in

India) Regulation 2000]

2(c) 'a person of Indian origin' means an individual (not being a citizen of

Pakistan or Bangladesh or Sri Lanka or Afghanistan or China or Iran or Nepal or

Bhutan), who

(a) at any time, held Indian passport; OR

(b) who or either of whose father or whose grandfather was a citizen of India by

virtue of the Constitution of India or the Citizenship Act, 1955 (57 of 1955);

Conditions of number of days stay in India :-

No doubt, Foreign Exchange Management Act, 1999 definition has also

incorporated an NRI's stay of 182 days or less during a year in India, but simply

speaking if a person of Indian origin has gone out of India for settlement he is to

be treated as an NRI irrespective of number of days he has stayed in India.

Stay in India during visits:

The Act also lays down that such a person will continue to be an NRI during his

visit/stay in India provided he has not returned to India for taking up employment

or carrying on business or vacation or any other circumstances as would indicate

his intention to stay in India for an uncertain period. Accordingly, an NRI settled

abroad, irrespective of the number of days stay in India will continue to be an

NRI during his visit to India provided he has not returned to India for permanent

settlement.

29

NRI BANKING

"Overseas Corporate Body" (OCB) means a Company, Partnership Firm,

Society etc. wherein 60 % or more ownership lies with NRIs or a Trust wherein

60 % or more financial interest is irrevocably held by NRIs.

2(xi) " Overseas Corporate Body (OCB)" means a company, partnership firm,

society and other corporate body owned directly or indirectly to the extent of at

least sixty per cent by Non-Resident Indians and includes overseas trust in which

not less than sixty per cent beneficial interest is held by Nonresident Indians

directly or indirectly but irrevocably.

Conclusion:

At the cost of repetition, it is once again said that an NRI permanently settled and

residing outside India will continue to be treated as an NRI under

F.E.M.A.irrespective of the number of days of his stay in India or otherwise.

30

NRI BANKING

Non-Resident (External) Account - NRE Account

Eligibility -

Non Resident Indians (NRIs) and Persons of Indian Origin (PIOs) can open and

maintain NRE accounts with authorized dealers and with banks (including co-

operative banks) authorized by the Reserve Bank of India (RBI) to maintain

such accounts.

31

CHAPTER 3

DEPOSITORY’

S SCHEME

NRI BANKING

The account has to be opened by the Non Resident account holder himself and not

by the holder of the power of attorney in India.

Opening NRE accounts in the names of individuals/entities of Bangladesh/Pakistan

nationality/ownership requires approval of RBI

Types of Accounts - Savings, Current, Recurring or Fixed Deposit accounts.

Debits & Credits:

Payments for local expenses and investments are allowed freely. Credits to an

account, of funds emanating from a local source would be permissible only if the

funds are of a repatriable nature.

Permitted Credits

Proceeds of remittances to India can be in any permitted currency.

Proceeds of personal cheques drawn by the account holder on his foreign

currency account and of travelers cheques, bank drafts payable in any permitted

currency including instruments expressed in Indian rupees for which

reimbursement will be received in foreign currency, deposited by the account

holder in person during his temporary visit to India provided the authorized

dealer/bank is satisfied that the account holder is still resident outside India, the

travelers’ cheques/drafts are standing/endorsed in the name of the account holder

and in the case of travelers’ cheques, and they were issued outside India.

Proceeds of foreign currency/bank notes tendered by account holder during his temporary visit to

India, provided

(i) the amount was declared on a Currency Declaration Form (CDF), where applicable, and

(ii) the notes are tendered to the authorized dealer in person by the account holder himself and the

authorized dealer is satisfied that account holder is a person resident outside India.

32

NRI BANKING

Permitted Debits

Local disbursements

Remittances outside India

Transfer to NRE/FCNR accounts of the account holder or any other person

eligible to maintain such account.

Investment in shares/securities/commercial paper of an Indian company or for

purchase of immovable property in India within prescribed regulations.

Any other transaction if covered under general or special permission granted by

the Reserve Bank.

Rate of Interest - as per the directives of the Reserve Bank of India.

Loans against Security of Funds held in the Accou

To the account holder

i) For personal purposes or for carrying on business activities (except

agricultural/plantation activities/investment in real estate business).

ii) For making direct investment in India on non-repatriation basis.

iii) For acquisition of flat/house in India for his own residential use.

In January 2007, the RBI imposed a restriction on loans against deposits and

securities for NRIs to a maximum of up to Rs. 20 lakh

To third parties

The loan should be utilized for personal purposes or for carrying on business

activities (other than agricultural/plantation activities/real estate business). The

loan should not be utilized for re-lending.

33

NRI BANKING

Loans outside India

Authorized dealers may allow their overseas branches/correspondents to grant

fund based and/or non-fund based facilities to Non Resident depositors against

the security of funds held in the NRE accounts and also agree to remittance of

funds from India if necessary, for liquidation of debts.

Change of Resident Status of Account Holder

NRE Accounts should be re designated as resident account or the funds held in

these accounts may be transferred to the Resident Foreign Currency (RFC)

Accounts (if the account holder is eligible for maintaining RFC Account) at the

option of the account holder immediately upon the return of the account holder to

India (except where the account holder is on a short visit to India).

Repatriation of funds to Non Resident Nominee can be permitted by the authorized

dealer or bank in the case of an account holder who is deceased.

Other Features -

Joint Accounts - in the names of two or more Non Resident individuals may be

opened provided all the account holders are persons of Indian nationality or

origin. When one of the joint holder become residents, the authorized dealer

may either delete his name or allow the account to continue as NRE account or

redesignate the account as resident account at the option of the account holders.

Opening of these accounts by a Non Resident jointly with a resident is not

permissible.

An Account may be opened in the name of eligible NRI during his temporary

visit to India.

34

NRI BANKING

Operation by Power of Attorney - Resident Power of Attorney holder can operate

on the NRE accounts but only for local payments to be made on behalf of the

account holder. The Power of Attorney (POA) holder cannot credit proceeds of

foreign currency notes/bank notes and travellers cheques to the NRE accounts.

In cases where the account holder or a bank designated by him has been granted

permission by Reserve Bank to make investments in India, the POA holder is

permitted to operate the account to facilitate such investments. POA holders

cannot, however, make gifts from NRE accounts.

Foreign Currency (Non-Resident Indians) FCNR (B) Account

Eligibility to Open and Maintain FCNR A/c

With the exception of persons of Indian origin from Bangladesh and Pakistan, all

NRIs and PIOs are eligible to maintain an FCNR account with an authorised

bank in India.

Accounts may be opened with funds remitted from outside, existing NRE/ FCNR

accounts, etc.

Remittances should be in the designated currency.

Conversion to currency other than the designated currency also permitted at the

risk and cost of the remitter.

Features of FCNR Account

35

NRI BANKING

The account can be opened with funds remitted from abroad, or transferred from

an existing NRE/FCNR account.

FCNR accounts can be opened with designated currencies, which are: GBP,

USD, Deutsche Mark, Japanese Yen and the Euro.

Conversion to another designated currency is permitted at a cost to the account

holder.

Only term deposits can be maintained in FCNR accounts, in a time range of 6

months to 3 years.

As per RBI guidelines, banks are free to offer interest on FCNR deposits below

LIBOR rates, less 25 basis points for deposits between 6 months to one year,

and LIBOR rates plus 50 basis points for deposits over a year.

Banks are also free to decide on a fixed or a floating rate of interest on FCNR

term deposits.

Interest rates are reviewed periodically and determined by directives from the

Reserve Bank (Department of Banking Operations and Development).

The account holder can choose the periodicity of interest, from half-yearly to

annual payments. The interest can be credited to a new FCNR (B) account or a

NRE/NRO account.

For permissible debits and credits, the regulations for FCNR accounts are similar

to the NRE accounts.

For conversion of currencies, from designated currency to rupees and vice versa,

the day’s rate of conversion will apply.

Funds from the FCNR account are allowed to move within the country at no

36

NRI BANKING

extra cost to the account holder.

For loans and overdrafts against FCNR accounts, the same conditions as the

NRE accounts apply.

In case of premature withdrawal of the FCNR Term Deposit, a penalty is levied.

Interest paid on the account is calculated at a

1% below the committed rate if accounts are closed prematurely.

However, no interest is paid on deposits held for less than 6 months, and a

penalty would have to be paid as per directives from the apex bank. The RBI

guidelines prevail on these terms, issued as and when required.

FCNR A/c after Change in Resident Status

NRI deposits such as the FCNR can continue till the maturity date at the

contracted rate of interest even after the account holder’s resident status changes

to resident Indian.

However, except for interest rates and reserve requirements of FCNR deposits,

these accounts are treated as resident accounts effective from the account

holder’s date of return to India.

On maturity, these accounts are converted to either an RFC account or the

Resident Rupee Deposit account.

As for joint accounts, the same rules as those for NRE accounts apply to FCNR

deposits too.

For repatriation of funds from the FCNR account, the same conditions as those

for NRE accounts apply.

The RBI does not provide any guarantee on foreign exchange.

37

NRI BANKING

Other Features -

Reserve Bank will not provide foreign exchange guarantee.

Lending of resources mobilized by authorized dealers under these accounts are

not subject to any interest rate stipulations.

Non-Resident Ordinary Rupee (NRO) Account

Eligibility

Any person or entity residing outside India is entitled to open a NRO account

with an authorised dealer or an authorised bank for transactions conducted in

Indian Rupees.

Individuals or entities of Bangladeshi or Pakistani nationality or ownership

require approval from the RBI.

Types of Accounts

NRO accounts can be opened as current, savings, recurring or fixed deposit

accounts. The RBI determines the rate of interest on these accounts and issues

guidelines for opening, operating and maintaining them.

Joint Accounts with Residents/Non-residents

Joint accounts are permitted with resident and non-residents.

Permissible Credits/Debits -

Credits -

Remittances from outside India through normal banking channels received in

freely convertible foreign currency.

38

NRI BANKING

Any freely convertible foreign currency can be deposited into the account during

the account holder's visit to India. Foreign currency exceeding USD 5000/- or its

equivalent in the form of cash has to be supported by a Currency Declaration

Form. Rupee funds must be supported by an Encashment Certificate, if they are

funds brought from outside India.

Current income earned in India, such as rent, dividend, pension or interest. Even

proceeds from sale of assets including immovable property acquired out of

rupee or foreign currency funds or through inheritance.

Debits -

All payments towards expenses and investments in India

Payment outside India of current income like rent, dividend, pension, interest

etc. in India of the account holder.

Repatriation up to USD One million, per calendar year, for all bonafide purposes

with the approval of the authorised dealer.

Remittance of Assets

NRIs and PIO may remit upto USD One million per calendar year, out of balances

held in the NRO account which could be acquired from the sale proceeds of assets

acquired in India out of rupee or foreign currency funds or by way of inheritance

from a resident Indian, provided:

39

NRI BANKING

Assets acquired in India out of rupee/foreign currency funds

(a) Immovable property: NRIs and PIO may remit sale proceeds of immovable

property purchased by them when they were resident or out of Rupee funds

as NRI or PIO.

(b) Other financial assets: There is no lock-in period for remittance of sale

proceeds of other financial assets

Assets acquired by way of inheritance:

Sale proceeds of assets acquired through inheritance can be remitted. No lock-in

period applies here if the authorised dealer is satisfied that the proceeds are from

inherited property.

Remittance of assets out of NRO account by a person resident outside India other than NRI/PIO A foreign national who is not a citizen of Pakistan, Bangladesh, Nepal or Bhutan and who

has retired as an employee in India,

has inherited assets from a resident Indian, or

is a widow residing outside India and has inherited assets of her deceased

husband who was a resident Indian can remit upto USD one million per calendar

year on production of documentary evidence to support the acquisition by way

of inheritance or legacy of assets to the authorised dealer.

Restrictions

The above facility of repatriation from sale of immovable property is not extended

to citizens of Pakistan, Bangladesh, Sri Lanka, China, Afghanistan, Iran, Nepal and

Bhutan. Remittance of sale proceeds from other financial assets is not extended to

citizens of Pakistan, Bangladesh, Nepal and Bhutan.

40

NRI BANKING

Foreign Nationals of non-Indian origin on a visit to India

Foreign nationals of non-Indian origin are permitted to open a NRO account

(current/savings) on their visit to India with funds remitted from outside India

through normal banking channels or by foreign exchange brought to India. The

balance in the NRO account is converted by the bank into foreign currency for

payment to the account holder when he leaves India, provided the account was

maintained for less than six months. The account should not be credited with any

local funds during the term, except for interest accrued on it.

Grant of Loans/ Overdrafts by Authorised Dealers/ Bank to Account Holders

and Third parties

Loans to NRI account holders and to third parties is granted in Indian Rupees by

authorized dealers (banks) against the security of fixed deposits provided:

The loans are utilized only for meeting the borrower's personal requirements or

for business and not for agricultural/plantation /real estate or relending activities

RBI regulations pertaining to margin and rate of interest will apply

All norms and considerations which apply to loans to trade and industry will

apply to loans and facilities granted to third parties.

The authorized dealer/bank may allow an overdraft to the account holder subject to

his commercial discretion and compliance with the interest rate directives.

Change of Resident Status of Account holder -

(a) From Resident to Non-resident

When a resident Indian leaves India for taking up employment or for carrying on

business outside India, his existing account is designated as a Non-Resident

41

NRI BANKING

(Ordinary) Account, except in the case of persons shifting to Bhutan and Nepal.

For the latter, the resident accounts do not change to NRO accounts.

(b) From Non-Resident to Resident

NRO accounts may be re-designated as resident rupee accounts once the account

holder returns to India for taking up employment, or for carrying on business or for

any other purpose indicating his objective to stay in India for an uncertain period.

Where the account holder is only on a temporary visit to India, the account

continues to be treated as non-resident during the visit.

Treatment of Loans/ Overdrafts in the Event of Change in the Resident Status

of the Borrower

In case of a resident Indian who had availed of loan or overdraft facilities while

resident in India and who subsequently becomes a NRI, the authorised dealer may

at its discretion allow the loan facility to continue. In this case, payment of interest

and repayment of loan may be made by inward remittance or out of bonafide

resources in India.

Payment of funds to Non-resident/Resident Nominee

The amount payable to a non-resident nominee from the NRO account of a

deceased account holder is credited to the NRO account of the nominee.

Facilities to a person going abroad for studies

42

NRI BANKING

Students going abroad for studies are treated as Non-Resident Indians (NRIs) and

are eligible for all the facilities enjoyed by NRIs. All loans availed of by them as

residents in India will continue to be extended as per FEMA regulations.

International Credit Cards

Authorized dealers are allowed to issue International Credit Cards to NRIs and

PIO, without the permission of the RBI. Such transactions can be made by inward

remittance or out of balances held in the cardholder's FCNR/NRE/NRO Accounts.

Income Tax

The remittances, after payment of tax are allowed to be made by the authorized

dealers on production of a statement by the remitter and a Certificate from a

Chartered Accountant in the formats prescribed by the Central Board of Direct

Taxes, Ministry of Finance, Government of India

TAX BENEFITS for NRIs

Interest on NRE & FCNR deposits are free of income tax.

Tax @ 30% will be deducted at source on all interest income in NRO accounts.

43

NRI BANKING

On permanent return to India, income on all investments out of foreign

exchange funds would be eligible for a flat tax rate of 20% (excluding

surcharge) till maturity of the investments.

44

CHAPTER 4

SERVICES OFFERED BY

VARIOUS BANK TO

NRI’S

NRI BANKING

BANKING SERVICES

NRI banking services including deposits, savings accounts, finance like home

loans, personal loans etc. Various banks like ICICI Bank, Citibank, HDFC Bank

and many other nationalized and private banks that hold authorized dealer's

licenses from the Reserve Bank of India (RBI) provide remittances, savings,

earnings, investments and repatriation services.

Besides the major commercial banks, certain cooperative and regional rural banks

(RRB's) have also been specifically permitted to maintain NRI accounts. This

would increase NRI remittances in Bihar, Kerala, U.P. and Gujarat where a large

chunk of the rural population have settled abroad.

The banks also offer finance services to the NRI's that cover home loans for buying

new residential property, housing renovation loans for constructing or modifying

on the existing properties, personal loans and other loan products.

Another FDI (Foreign Direct Investment) magnet has been the various money

transfer services provided. Various banks provide quick, convenient and

economical fund remit to India. These include:

Online remittance services

Remittance of funds to partner exchange houses in India

Telegraphic or wire transfer

Fund transfer through cheques/ DD's and Travelers' cheques.

Many banks also offer Demat account services to the NRI's that enable NRI's

online stock investment and share trading services. Special NRI credit cards

acceptable globally are available with various banks. These specialized services

45

NRI BANKING

and banking accounts have drawn enormous NRI funds to India.

SERVICE OFFERED BY ICICI BANK:-

Rupee plus plan :- At ICICI Bank, we believe in providing you with the most

competitive returns on your hard earned money. Now you can earn even higher

returns on your deposits by investing in Rupee plus plan.

What does the Rupee plus plan offer you :- NRE-FD interest rates rate being

regulated by RBI, is nearly same across banks. In Rupee plus plan we have devised

a way to make your money work harder and smarter and earn higher returns in

terms of NRI as compared to a NRE FD.

Currencies :- you can being funds in any convertible currency, which will be

converted to USD (if not in USD already).

Minimum Deposit :- USD 25,000 or equivalent.

Tenor: - for 1 year only.

How does the Rupee plus plan work? Instead of putting the money in NRE FD

directly, the money is put in USD denominated FCNR. This FCNR earns interest

as per prevailing FCNR interest rates.

Additionally, at the time of booking the FCNR a Forward Agreement is also drawn

to exchange the maturity amount of USD to Rupees at a given rate (Forward Rate).

Rupee plus plan advantage :- on a average the returns are significantly higher

compared to putting your money in NRE FD as per the prevailing market rates.

Returns in rupee terms are assured once the deal is booked irrespective of the

future movements in currency markets.

46

NRI BANKING

The following banking facilities are available to NRIs, as per the current

RBI/FEMA guidelines.

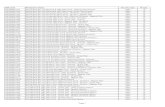

Particulars

Foreign Currency

(Non-Resident)

Account (Banks)

Scheme(FCNR(B)

Account)

Non-Resident

(External) Rupee

Account

Scheme(NRE

Account)

(Non-Resident

Ordinary Rupee

Account

Scheme(NRO

Account)

Who can open an

account

NRIs/PIOs NRIs/PIOs Any person resident

outside India (other

than a person

resident in Nepal

and Bhutan)

Joint account In the names of two

or

NRIs

In the names of

two or more NRIs

May be held jointly

with residents

Nomination Permitted Permitted Permitted

Currency in which

account

is denominated

Pound Sterling, US

Dollar, Jap. Yen or

Euro. Australian

Dollar, Canadian

Dollar

Indian Rupees Indian Rupees

Repatriability Repatriable Repatriable Non-repatriable*

Type of Account Term Deposit only Savings, Current, Savings, Current,

47

NRI BANKING

Recurring, Fixed

Deposit

Recurring, Fixed

Deposit

Rate of Interest Subject to cap:

LIBOR minus 25

basis points except

in case of Japanese

Yen where the cap

would be based on

at the prevailing

LIBOR rates

Rate of interest on

domestic savings

account will also

be applicable to

NRE savings

account. For Fixed

Deposits, the rates

can be fixed by

banks subject to

ceilings prescribed

by RBI

Rate of interest on

domestic savings

account will also be

applicable to NRO

savings account. For

Fixed Deposits, the

rates can be fixed by

banks subject to

ceilings prescribed

by RBI

Tax Aspects Interest income tax

free and no tax

deduction at source.

Interest income tax

free and no tax

deduction at

source.

Interest income

taxable and liable

for TDS @30% plus

applicable surcharge

subject to

conditions. DTAA

benefit may be

available subject to

fulfillment of

conditions.

48

NRI BANKING

MONEY TRANSFER

Money can be transferred either through on line or drafts

or telegraphically or by wire transfer or Cheques. E-Transfer is completely online, paperless money

transfer service which enables the customer to send money directly from one bank account in foreign

country to India. Drafts in Indian rupees can be purchased from exchange companies of one country and

mailed to the branch of another country where the customer has the account. Telegraphic or wire

transfers can be made through branch to branch. Cheques can be deposited for credit of the customer’s

49

CHAPTER 5

RBI issues guidelines for

money transfer scheme

NRI BANKING

accounts and the Cheques will be collected and credited to their accounts.

International SWIFT Transfer

This is a secure, quick and efficient method of transferring funds, which enables

you to send money easily to any bank which is part of the SWIFT network. There

is a flat-rate charge of Rs 500 for each SWIFT transfer made from your account.

There is no charge when you make a transfer from your Barclays NRI account in

India to a Barclays account in UK or UAE.

Demand (or Banker's) Draft

This is a means of initiating a transfer from your account to a named payee. You

can send the Demand Draft to your intended payee, who will then be able to take

the Draft into their bank – following presentation of this Draft, he/she will then

50

NRI BANKING

receive payment.

A Demand Draft made payable to a non-Barclays account will incur a charge of Rs

3.5 per Rs 1,000 sent (minimum charge Rs 100).

A Demand Draft made payable to a Barclays account and a Foreign currency DD

will incur a flat-rate charge of Rs 300.

UAE EXCHANGE

PROVIDING speed, convenience and security of transactions, the Xpress Money

Service of UAE Exchange company is proving to be a modern and reliable way of

sending and receiving money from anywhere in the world, especially among the

immigrant Indian in Gulf countries. With an extensive network of branches in

UAE and a global presence in Australia, India, Kuwait, Oman, Qatar, UK, USA,

Fiji, Sri Lanka and Bangladesh, the UAE Exchange Centre specializes in Fund

Transfer across the globe and enjoys a numerous uno status in the industry. UAE

Exchange and Financial Services Ltd makes 80,000 remittances a month. The

average amount of remittances per transfer is Rs 1,25,000.

Western Union Money Transfer

Western Union is a global leader in money transfer services, with a history of

pioneering dating back more than 150 years. Non-resident Indians can now transfer

their funds to India through the Money Transfer Service offered by Western Union.

This service is currently available for inward remittances in India.

"Credits to NRE/FCNR accounts are not permitted to be routed through Money

51

NRI BANKING

Transfer Service Scheme (MTSS)"

SENDWISE:-

A rupee demand draft delivered to the recipient’s doorstep within three to four

working days and can be encashed at any nationalized bank in India.

MONEYGRAM Send money online today:-

You can send money around the world online to over 84,000 moneygram agent

locations, in more than 170 countries. Not only is sending money with moneygram

safe and convenient, you’ll find the same day services to be one fastest way to send

your money online-usually arriving within minutes. Send money online or at a

moneygram agent location near you. Moneygram is a global leader in international

money transfers and the largest processor of money orders in the U.S. We help

people and business by providing affordable, reliable and convenient payment

services.

ICICI Bank NRI Money Transfer:-

ICICI Bank, the leading bank in India offering financial services to the NRI

community through NRI saving account, NRE Accounts, Fixed Deposit, FCNR

deposits, and the quickest way to send money online to India.

52

NRI BANKING

The Government of India has adopted a liberal policy, with respect to investment

by NRIs and OCBs in India, such investment are allowed, both, through the RBI

route and also through the Government route, i.e., through the Foreign Investment

Promotion Board (FIPB) NRIs and OCBs are permitted to invest up to 100%

equity in real estate development activity and civil aviation sectors. Investment,

made by the NRIs and OCBs, are fully repatriable, except in the case of real estate,

which has a 3 year lock-in period on original investment and, 16% cap on dividend

repatriation.

Various investment opportunities in India available to NRIs:-

53

CHAPTER 6

NRI INVESTMENTS

NRI BANKING

If one is NRI, the following investment opportunities are open to you:

Maintenance of bank accounts in India.

Investment in securities/shares and deposits of Indian firms/companies.

Investment in mutual funds in India.

Investment Policy for Non-resident Indians (NRIs):-

Recognizing the investment potential of the Non-resident Indians, a number of

steps are being taken by the government on an ongoing basis to attract from them

in Indian companies. Some of the investment schemes presently available to Non-

resident Indians (NRIs) include the facility to invest upto 100 percent equity with

full benefits of repatriation of capital invested and income accruing thereon in high

priority industries mentioned in the Annexure-III to the industrial policy 1991, 100

percent export oriented units, sick units under revival, housing and real estate

development companies, etc,. NRIs/PIOs/OCBs are also permitted to make

portfolio investments through secondary markets. In terms of the relaxations

announced in 1998-99, investment limits for an individual NRI has been revised

upwards from 1% to 5%, aggregate portfolio investment limits by all NRIs

increased from 55 to 10% of the issued and paid-up capital of the company. The

aggregate investment limit would be separate and exclusive of FII portfolio

investment limits.

FOR NRI’S INVESTMENT:-

54

NRI BANKING

In order to help the tax-payers to plan their Income-tax affairs well in advance and

to avoid long drawn and expensive litigation, a scheme of Advance Rulings has

been introduced under the Income-Tax Act, 1961. Authority for advance rulings

has been constituted. The tax-payer can obtain a binding ruling from the Authority

on issues which could arise in the determination of his tax liability. A non-resident

or certain categories of resident can obtain binding rulings from the Authority on

any question of law or fact arising out of any transaction/proposed transactions

which are relevant for the determination of this tax liability.

PORTFOLIO INVESTMENT

NRIs/OCBs are permitted to make portfolio investment in shares/debentures

(convertible and non-convertible) of Indian companies, with or without repatriation

benefit provided the purchase is made through a stock exchange and also through

designated branch of an authorized dealer. NRIs/OCBs are required to designate

only one branch authorized by Reserve Bank for this purpose.

NRI’S INTEREST:-

NRIs invested only 5% of their investible assets in India with the balance being

parked overseas. A major reason for this was that the Indian banking system was

not a very preferred and trusted mode of investment for the NRI. The customer was

looking for convenience, speed, high yield on investment with manageable risks,

reasonable costs and quality services – A face of India he could associate with.

Competition was not only from India based banks, but also from local banks based

overseas; conventional and non conventional routes of money transfer.

FACILITATION AGENCIES

55

NRI BANKING

The main regulatory and facilitation agencies involved in the matters related to

NRIs/OCBs investment are Reserve Bank of India (RBI), Securities and Exchange

Board of India (SWBI), Authority for Advance Rulings (AAR), Secretariat for

Industrial Assistance (SIA), Ministry of Commerce and Industry; and Office of the

Chief Commissioner (Investments & NRIs).

RBI FORMS

NRIs/OCBs/PIOs do not have to seek specific permission for approved activities

covered under ‘General permission’ schemes. The activities relating to

NRIs/OCBs/PIOs not covered under those schemes either require declaration to

RBI or permission from RBI. The activities requiring Declaration/Permission

along with corresponding forms are as under;

TS 1 Transfer of Shares/Debentures by Non-residents to Residents

FNC

1

Permission to establish a branch office in India by an Overseas Company

establishing a Representative Office by Overseas Company for Liaison

Activities to open a Project/Site Office in India.

IPI Company/Individual (declaration) acquiring property

56

NRI BANKING

NRIs, irrespective of their citizenship can freely acquire and transfer residential as

also commercial properties in India barring agricultural land and plantation, with

repatriation of foreign exchange equivalent of cost of acquisition (maxi. two in

case of resi.houses) and no restrictions as regards holding period.

Rules for Acquisition & Transfer by NRIs being:

Indian citizen & Foreign citizen

Mode of Payment

Joint Holding / Restrictions

Repatriation of Sale Proceeds

Taxation of Capital Gains & Wealth-Tax

57

CHAPTER 7

NRI Investment In

Immovable Property In

India

NRI BANKING

Rules for Acquisition & Transfer by Foreign Citizen NRIs

Purchase / Acquisition:

There is a general permission to acquire any immovable property (other than

agricultural land, plantation or farm-house property) by way of purchase, provided

the payment is made out of foreign exchange inward remittance or any Non

Resident bank account in India, i.e.NR(E),FCNR(B) or NRO a/c..

Acquisition by way of Gift:

General permission is granted to acquire any immovable property (other than

agricultural land, plantation or farmhouse property) by way of gift from a person

(donor) who is

A person resident in India, or

Aperson resident outside India (an NRI )who is Indian citizen or foreign citizen

of Indian origin.

Acquisition by way of inheritance :

General permission is granted for inheritance of immovable property

including agricultural land, plantation or farm-house property from

A person resident in India, or

A person resident outside India who may be an Indian citizen or foreign citizen

of Indian origin provided such person had acquired said property in accordance

with the provisions of Foreign Exchange Law in force at the time of acquisition.

i.e. FERA, 1973 or FEMA 1999.

58

NRI BANKING

Hence Agricultural land, plantation or farmhouse property can be acquired by

way of inheritance only.

Transfer / Sale:

General permission is granted for sale of any immovable property (other than

agricultural land, plantation or farmhouse property) to a person who is resident in

India.

Transfer of residential or commercial property by way of gift:

General permission is granted to gift residential or commercial property to

A person resident in India, or

A person resident outside India who may be an Indian citizen or foreign citizen

of Indian origin,

Transfer of agricultural land, plantation or farmhouse property by sale/ gift

General permission is granted to sell or gift such property to a person who is

resident in India and also an Indian citizen.

Mode of Payment :-

The payment for purchase of immovable properties is required to be made from

NRI's bank account, being:

a) Non Resident External Account (NRE);

b) Foreign Currency Non Resident (B) Account (FCNR) (B), or

59

NRI BANKING

c) Non Resident Ordinary Account (NRO), or

d) Foreign Exchange Inward Remittance from abroad.

It is advisable to retain records of payment made i.e. banker’s certificate

All incidental expenses such as stamp duty, registration fees etc. should also be

paid through bank only.

Repatriation of Sale proceeds

An NRI being an Indian citizen or a foreign citizen of Indian origin is allowed

to repatriate the sale proceeds of an immovable property subject to the

following conditions:

a) . the acquisition should be in accordance with the existing Foreign Exchange

Laws (i.e. FERA, ‘73 or FEMA ‘99).

b) the purchase price was met out of Foreign Exchange Inward Remittance or

NRE / FCNR (B ) account, and

c) in case of residential properties, repatriation is restricted to a maximum of two

properties.

It may be noted that the eligibility criteria of holding period of 3 years for

repatriation is removed w.e.f. 29-06-02.[ vide notification no FEMA 65/2002 RB

dated 29-06-02.]4

60

NRI BANKING

It may be noted that there are no restrictions as re: repatriation of sale proceeds

vis-a-vis number of commercial or industrial properties.

The amount of repatriation is restricted to foreign exchange equivalent of the

purchase price i.e. profits / gains are not allowed to be repatriated.

For all Indian citizens who are liable to pay tax under the Income Tax Act, 1961,

or are required to enter into financial transactions in India, it is mandatory to have

a Permanent Account Number.

The Permanent Account Number (PAN) is a combination of 10 alphanumeric

numbers issued by the Income Tax Department. The Department has entrusted UTI

Investor Services Ltd. (UTIISL) with the task of managing IT PAN Service

61

CHAPTER 8

PAN Card for NRIs

NRI BANKING

Centers wherever the IT department has an office in the country. The National

Securities Depository Limited (NSDL) has also been engaged to allot PAN cards

from TIN Facilitation centers.

Applying for a PAN

Form 49A, which is the application form for a PAN, can be downloaded from the

Income Tax, UTIISL and NDSL websites:

www.incometaxindia.gov.in & www.utiisl.co.intin.nsdl.com

The forms care also available at the IT PAN Service Centers and TIN Facilitation

Centers. A “tatkal” or priority service has been provided for, to enable speedy

allotment of the PAN card through the Internet. The PAN is allotted through e-mail

on priority in 5 days as against the normal 15 days to the applicant upon online

payment through a credit card. The PAN has lifetime validity.

The necessity for a PAN Card to NRIs

Apart from income returns which must carry the PAN, it is mandatory to submit

the PAN in all financial transactions, like the purchase and sale of property in

India, payments for purchase of vehicles, foreign visits, securing a telephone

connection or making time deposits in a bank worth over Rs.50,000.

For NRI’s, PAN is necessary to conduct monetary transactions in India, invest in

stocks, and pay tax on their Indian income.

The application for a PAN must be accompanied by:

a recent colored photograph of size 3.5 cms x 2.5 cms on the application form .

a proof of residence and identity (attested school leaving/matriculation

certificate/degree/credit card/voter identity/ration/passport/driving

62

NRI BANKING

license/telephone/electricity bill/employer certificate .

code of the concerned Assessing Officer of the IT Department obtainable from

the IT office where form is submitted .

DEMAT ACCOUNT :-

A demat account facilitates buying and selling shares, precluding cumbersome

paperwork and meaningless delays.

63

NRI BANKING

Advantages of a Demat Account -

It is a safe, secure and convenient mode of transacting in shares.

Minimizes brokerage charges

Ensures immediate liquidity

Removes uncertainty on ownership title of securities

Allows quick allotment of public issues

Enables smooth process in pledging shares

Avoids delays due to wrong/incorrect signatures, post, and misplacement of

certificates

Prevents risks like forgery and counterfeit, theft or damage to documents

Saves on stamp duty, paperwork on transfer deeds

Gives immediate benefits from bonus shares and stock splits

Who offers Demat Facility?

Depository Participants or DPs offer demat account services, which would include

banks. Holding a demat account with a bank enables quick on-line dealings,

ensuring credit of a transaction to the account holder’s savings account by the third

day. Banks have an added advantage over other DPs with their large network of

branches.

How to Open a Demat Account in India

Fill up the demat account opening form at the nearest Depository Participant

You may refer to either

64

NRI BANKING

CDSLathttp://www.cdslindia.com/demat_acct/open_demat.jsp or

NSDLathttps://nsdl.co.in/for the list of DPs in India.

Joint demat accounts can be opened, retaining the same order of names

Separate demat accounts have to be opened for different combinations of names

in the case of three or more joint holders.

Any number of demat accounts and DPs are permitted

A multiple-sign demat is feasible, operated by several holders

DPs charge a fee for switching shares from electronic to physical form and vice-

versa, which varies from a flat fee to a variable fee. Remat and demat charges

may also show a discrepancy between DPs.

Some DPs offer a discount to frequent traders.

It is advisable to maintain all demat accounts with the same DP to keep track of

capital gains liabilities. Different DPs follow dissimilar methods of computing

the capital gains, which is determined by the period of holding.

The charges on a demat account vary between DPs. Broadly, they are: account

opening fee, an annual folio maintenance charge paid in advance, a monthly

custodian fee, and a charge on transactions, which may either be charged every

month or as a flat fee per transaction, and its nature. Some DPs may skip the

account opening fee but charge a re-opening fee for the account. Account

holders are also subject to a service tax.

No opening balance is required for a demat account.

Supporting documents to open a demat account

65

NRI BANKING

Passport-size photograph

Proof of identity, address and date of birth

DP-client agreement on non-judicial stamp paper

PAN Card

The applicant receives an account number and a DP ID number which are

required for all future communication with the DP.

NRI Demat Accounts

NRIs need to fill in “NRI” in the type and “repatriable or “non-repatriable” in the

sub-type on the form. No special permission from the RBI is required by NRIs to

open a demat account, though specific cases may require authorization from the

designated authorised dealers.

NRIs require separate demat accounts for securities under the foreign direct

investment (FDI) scheme, which is repatriable; and the Portfolio Investment

Scheme and Scheme for Investment which can be either repatriable or non-

repatriable. Repatriable and non-repatriable securities cannot be held in a single

Demat account.

Resident Indians can continue to hold non-repatriable demat accounts they hold

even after they acquire non-resident Indian status. However, when a NRI returns to

India permanently, he must inform his designated authorised dealer of his new

status, and a fresh account would have to be opened. The securities held in the NRI

Demat account would have to be transferred to the new resident demat account,

and the NRI Demat account closed. The Demat account would have to be linked

66

NRI BANKING

with the NRI’s NRO account for non-repatriable accounts and NRE accounts for

repatriable accounts to credit dividends and interest.

CASE STUDY ON NRI BANKING

Increasingly at Personal we are meeting Indians living abroad who are relocating

to India. Usually such individuals have a significant portion of their assets in the

foreign country; investments in India are usually linked to inheritance or savings

made before shifting abroad

67

NRI BANKING

The task we are entrusted with is to help such individuals plan their finances.

Here's how we assisted one such family.

We recently met a Person of Indian Origin (PIO) who was based in the United

States (US); he has now shifted permanently to India. Let's call this individual

Rajeev.

Almost all of rajeev's savings are in the US; in US mutual funds and bonds. He has

no exposure to India in his asset allocation, although he does expect to inherit some

Indian assets over time.

More about Rajeev -

He is 44 years of age and was settled in US for many years before relocating to

India

He is married and has a 8-yr old daughter

Although he is not sure, there is a likelihood that his daughter might want to go

back to US for further studies

Rajeev's investment details are as follows:

His combined investment in stocks and funds in the US accounts for 50% of his net

assets. Remaining 50% of his investments are in short-term deposits, again in the

US. Important to note that he does not own any residential property, either in the

US or in India.

68

NRI BANKING

As mentioned earlier, since the client is now settled in India, and is certain to be

here for the rest of his life, in our view, it makes sense to shift his assets back to

India. Why do we say that? Well, if you know you are going to be in India, and all

your future incomes and expenses are going to be in Indian Rupees, why take on

the risk of being invested in US Dollars? In case the US Dollar were to depreciate

vis-a-vis the Rupee, the value of your US assets would effectively erode. This is

not to say that no one should have money invested in other currency assets. From

our perspective, one should evaluate such investment opportunities only when one

has completed their investment plans for domestic assets. Importantly, you should

have that much money in another currency asset that is required to meet future

needs (that need to be provided for in the other currency).

In order to reallocate his assets, Sanjeev will need to liquidate his assets in the US