Nomura Internal Compliance Handbook

-

Upload

sockrateez -

Category

Documents

-

view

219 -

download

0

Transcript of Nomura Internal Compliance Handbook

-

7/22/2019 Nomura Internal Compliance Handbook

1/278

1.

Table of ContentsPage

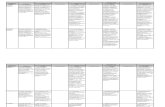

REGULATORY OVERVIEW AND SIIPERVISORY SYSTEM................................ 1Introduction .............. ............... 1Federal Laws........ .................... I(1) Securities Act of 1933 ...................... I(2) Securities Exchange Act of 1934 .......................2(3) Insider Trading, and Securities Fraud Enforcement Act of1988("ITSFEA,')....... .......................3(4) Investment Advisers Act of 1940 ......................3(5) FDIC Compliance ............... .............3State Laws ..............3Regulatory Agencies ................4(1) Securities and Exchange Commission.............. ..................4(2) New York Stock Exchange & National Association of securitiesDealers, Inc............ .........4(3) State Securities Regulators ...............5Supervisory System..... .............5(1) Introduction......... ............5(2) Duties of Supervisors .......... ............. 5(3) Discipline........... ...........10(4) Training and Procedural Review..... ................. l0(5) Branch Office Visits ..... 10Registration of Personnel ............. ........... 11(l) Registration and Qualification Procedures ....... 1l(2) Previously Registered Personne1.............. ........ l l(3) Non-Registered Trainee..... .............12(a) Fingerprints.......... .........12Reporting Requirement Regarding Insiders of Japanese Public Companies .................L2

2. PRINCIPLES OF CONDUCT. ...............13A. General Standards ..................13B. Code of Ethics.......... .............. 13C. Reportable Events .................. 15D. Specific Restrictions and Guidelines ....... 16(1) Marking Positions and Taking Reserves ........... 16(2) Prohibition Against Nomura Affiliates Purchasing New Issues ...........17(3) Finders Fees/Foreign Comrpt Practices Act (.FCPA") Considerations ................17(a) Soft Dollar Arrangements............ .....................17(5) Limitations on Transactions with Nomura Advisory Affrliates ........... 18(6) Books and Records Retention .......... 19

A.B.

C.D.

E.

F.

G.

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

2/278

J.A.

B.

C.

D.

E.

F

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

3/278

4.

G. Research and the Research Restricted List .......... ............31(l) General ............... ..........31(2) Restrictions......... ..........31(3) Confidentiality ..............32(4) Research Restricted List Procedures ................32(5) Monitoring........... .........33ACCOUNT PROCEDURES............... .....................34New Accounts........-.. .............34(1) Completing Customer New Account Form........ ...............34(2) Procedures for Obtaining Documentation......... ................37(3) Penalties ............ ...........38(4) Reassignment of Accounts ............... ...............38Client's Authority to Trade.... ..................38(l) Corporate Accounts ............ ...........38(2) Partnership Accounts... ..................39(3) Municipal and Other Government Entities. .....39(4) ERISAPIans ................40(5) Individual Accounts .....40Discretionary Accounts ..........41Account Records.... ................42

5. SALES AT\TD TRADING PRACTICES ............ .......44A. Suitability. .............44(1) Genera1............... ..........44(2) Institutional Account Suitability .....44B. Markups... .............45(1) General.... .....45(2) Special Mark-Up and Mark-Down Issues Involving Mortgage Products .............47(3) Type of Security ............50(4) Price/Yield and Time to Maturity .....................50(5) The Size of the Trade (number of units or dollar amount) ..................50(6) Prevailing Market Conditions .........50(7) Mark-Up Pattern...... ......50(8) Services Provided to the Customer.. .................50(9) Disclosure .. .................. 51C. Parking and Pre-Arranged Trades................ .............51D. "Adjusted Trading" ................51E. Fixed Price Spreads.............. ...................52F. Free-Riding and Withholding ..................52G. Front Running... .....................54(1) Front-Running of Blocks.. ..............54(2) Self Front-Running ........55(3) Examples of Other Potential Abuses of Market Information...............................56H. Positioning to Facilitate Customer Orders ................56I. Papilsky Rules/Swaps Against New Issues............... .................57

B.

C.D.

iii October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

4/278

J.

6.

Prohibition on Churning............... ..................57K. Guarantees of Accounts, Sharing and Rebates............... ............5gL. Rule l5a-6 (certain crossborder businesses) .............. ................5gFDGD TNCOME ORDER PROCEDURES............... ....... ....... s9A. Fixed Income Order Ticket Completion.............. .....5gB. RRNumbers............. .............60C. Settlement Period...... .............61D. Principal Letter Procedures .....................61E. Confirmations, Unofficial Confirmations, Customer Account Statements andValuations .............62Best Execution.......... .............64Sales ofBearer-Form Debt Securities............ ...........65

7 . EQUTTY ORDER PROCEDURES .............. ............67A. Equity Order Ticket Completion .............67B. Registered Representative Numbers............. ............67C. Best Execution.......... .............6gD. Trade Reporting Requirements............ .....................72(1) NASDAQ, CQS, and OTC Trade Reporting. ....................72(2) IIYSE Rule 4108 ..........74E. Unofficial Confirmations, Customer Account Statements and Valuations....................74F. Settlement Period ...................77G. Short Sale Restrictions ...........77(1) 'Tick Test" for Exchange-Listed Securities .....7g(2) NASD Short Sale "Bid-Test"........... ............... g1(3) Special Provisions for Index Arbitrage ........... g5(4) covering Short Sales in connection with a public offering... ........... g5(5) Procedures Determining the Availability of Securities for DeIivery...................86H. Market-on-the-Close and Limit-at-the-Close Orders.... ..............91(l) Market-on-the-close ("MOC") order Entry Requirements................................91(2) MOC Order Procedures & Governor Lifting Authori2ations..............................91I. OflBoard Trading and After-Hours Trading (I{YSE Rule 390 and Amex Rule 5) ......95(1) NYSE Rule 390 and Amex Rule 5...... ............95(2) Application of NYSE Rule 390 to Off-Board Stock Crosses afterNYSE Hours....... ..........97(3) Trade Reporting Requirements for Trades Executed outside NormalMarket Hours....... .........97Incentive Trading Procedures (Guaranteed Benchmarg. . .. .................9gProcedures for Trade Warehousing............. ..............99(1) Introduction............... .....................99(2) Business Issues ..............99(3) Procedures for Warehousing ......... 100Restrictions on Proprietary Trading - "G Orders"..... ............... l0I(1) Basic Prohibition ......... 101(2) Exemption for "G Orders' ............. 101

F.G.

J.K.

lv

L.

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

5/278

(3) Exemption for Executions by Unaffrliated Brokers (The "Effect vs.Execute" Rule)........ .... 1011. General..... .............. 1012. Procedures for Complyirrg............ ............1O2(4) Statutory Exemptions .......... .........lO21. CertainBlockTransactions.............. .........1022. Bona Fide Arbitrage Transactions ............ 1023. Risk Arbitrage Transactions .... 1034. Bona Fide Hedge Transactions........... .-.... 1035. Stabilizing Transactions............. .............. 1036. Transactions in Error.. ............. 1037. Accounts of Natural Persons..... ................ 103M. Use of the Small Order Execution System ("SOES"). .............. 104N. NASDAQ Trading Guidelines ............... 104(1) Setting/Updating Quotations for Stocks. ........ 105(2) General Trading Principles ........... 106(3) Cooperation with Other Market Makers on Quotes/Trades .............. 107

(4) "News"AJse of "Confidential or Proprietary" Information......... ....... 108(5) Trade Reporting .......... 109(6) The Limit Order Display Rule ("Display Rule") .. .. ............... 110(7) The Quote Rule (the I'ECN, Rule)........ ......... 111(8) SEC and NASD Firm Quote Rule....... ...........112(9) Surveillance/Compliance/Supervision with the Guidelines........... ...112(10) Discipline......... ........... 113(l l) Training and Procedural Review ................... 113O. Married Puts ......... ...............ll4(1) Overview ...114(2) Procedures for Customer Married Put Transactions ........ 115(3) Procedures for Proprietary Married Put Transactions..... .................. 116EQLITTY OPTIONS COMPLIA){CE............ ......... 118Opening of Accounts............... .............. 118Documents Furnished to Customers ............ ........... 118Uncovered Options Writing..... .............. 119Position Limitations ............... ............... 119Discretionary Accounts ........ 119Account Statements .............. 119Complaint Fi1e.......... ........... 119Advertising .........120Supervision of Accounts............... ........I20Equity/Index Option Order Entry ..........120

9. CREDIT POLICIES AND PROCEDURES .............. ..............121

8.

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

6/278

11.

r0. CoMMUNICATIONS WITH TI{E PU8LIC..........,.. .............12tA. General Principles. ...............121B. Correspondence ......... ..........121C. Procedures for Outgoing Electronic Communications @-mails, Bloomberg, etc.) .....123D. Advertisements.......... ..........124E. Recommendations..... ...........124F. Research .............125G. communicationswiththePressandPublicAppearances.............. ............126H. Regulatory and Legal Communications and Customer Complaints............ ................126I. Phone Taping Procedures .....lZ7J. Do Not Call Lists .,............... 128

NEW ISSUANCE OF PUBLIC SECUNTIES......... .........,.....129Introduction .............. ...........I2gSecurities Law Requirements ................12g(l) Pre-Filing Period .........129(2) Waiting Period ........... t3O(3) Press Releases.......... ................... 131(a) offshore Press conferences, Meetings and press Materials ............. 13l(5) ResearchReports ........ l3l(6) Computational Materials and Term Sheets ....134(7) Post-EffectivePeriod............... .... 135(8) ProspectusDelivery............. ........ 136(9) Purchases and Stabilization@egulation M) ....... l3g(l0)Extension of Credit on New Issues........ ........143(11)Public offerings with an over-Allotment option (Green Shoe) ...... t43(12)Advertising......... .........144

Roadshow Procedures ..........144(l) When may a roadshow be conducted? ........... ..................144(2) What materials may be distributed at roadshows?.............. ...............144(3) What can be discussed orally at roadshows?.............. ......145(a) Can overhead slides and videotapes be used in roadshows?............................... 145(5) can "forward-looking" information be discussed at roadshows?........................ 145(6) To whom may you extend an invitation to attend a roadshowpresentation?.............a. General.....b. Public OfferingsNEW ISSUANCE OF PRIVATE SECUNTIES............... ......147General ...............147Primary Offerings ................147(1) Genera1................ ...t47(2) To whom can offers and sales of securities be made.. ..................147

A.B.

C.

145145145

1,2. A.B.

a.b.c.d.

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

7/278

C.

(3) What are the procedures to solicit clients?..... .............152a. No General Advertising or Directed Selling Efforts ..............152b Delivery of Offering Document(s).............. ......... 153c. Federal, State and Other Regulatory Filings ......... 153(4) Advertising......... ....:................ 153Roadshow Procedures ..........154(l) When may a roadshow be conducted?............ ............154(2) What materials may be distributed at roadshows?............. ..........154(3) What can be discussed orally at roadshows? ............. .................. 154(4) Can overhead slides and videotapes be used in roadshows?.......................... 155(5) Can "forward-looking" information be discussed at roadshows? .................. 155(6) To whom may you extend an invitation to attend a roadshowpresentation?............. ..-................ 155a. General .............. 155b. Private Placements ............. 155SECONDARY SALES OF PRIVATE SECURITIES........ .....157$*+k;;;;i.;;;;r;; ............................ i;iRule l44A ................ 159Regulation S .............. .......... 160MARGIN REGULATION.......... ..........162Section ll(d) of the Exchange Act........... .............. 163Regulation T, NYSE Rule 431 and SEC Rule l5c-3 -3.............. ................ 165

(1) Cash Account ......... 165(2) Margin Account.... ................... 166(3) Initial Margin .........167(4) Maintenance Margin...... ..........167(5) Transactions Subject to Margin Regulation ................ 168l. General .................. 1682. Buy/sell back and saley'buyback transactions............... ................ 169(6) Marginable Securities.......... ....L70a. Equity Securities.. ...............170b. Debt Securities ................... 170Customer Option Trading..... .................173(1) Cash Account .........173(2) Writing (Selling) of Options in a Cash Account .........173(3) Margin Account.... ...................173Settlement """""'174(l) OTC Options ..........175(2) Extensions ofTime............... ...175(3) Free Riding; the 90-Day Freeze ................176Arranging. ...........176

13. A.B.C.D.E.

t4. A.B.

C.

D.

E.

vu October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

8/278

15.

C.

CURRENCY TRA}IS ACTION REPORTING AI{D SUSPICIOUSACTIVITIES MONITORING A}{D REPORTING PROCEDURES............... .........177Background............... ...........177Firm Po1icy.............. ............t77(t) What is Money Laundering?............... .......... 178(2) Types of Transactions .......... ....... 179(3) Underlying Crimes................ .......178(4) Examples ofMoney Laundering ................... l7g(s) Culpability ................. 178(6) Money Laundering Penalties .......t79(7) Anti-Money Laundering Policy: Three Basic principles .................179(8) Everyone is Responsible........... ...179(9) Know Your Customer .......... ....... lg0(10) Know Your Customer Analysis - By Type of Customer...... .......... lg0(11) Particular Types of Transactions.......... ......... lg3(12) Documentation.... ....... lg3(13) Questionable Circumstances............ ............. lg4(14) Narcotics Traffickers u.S. Department of Treasury Report...... ...... lg6(15) Reporting Questionable Circumstances............ .............. 196Reporting of Suspicious Activities............... .......... lg7EMPLO\aEE ACTIVITIES............... .... 188A. Employee Securities Transactions............... ........... 1ggB. Limitations on Outside Activities ofEmployees............ .......... lggC. Gifts, Gratuities and Payment of Compensation ..... lg9D. VacationPolicy....... ............. 190CAMPAIGN CONTRtsUTION LIMITATIONS A}{D REPORTINGREQUIREI\{ENTS ............... ................ relBLUE SKY LAW ................ r93Federal Preemption .............. 193Exemptions from Securities Registration............... ..................194State Registrations ...............lg4

A.B.

16.

17.

18.A.B.C.

EX{IBITSSee Exhibit Table of Contents

vlll October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

9/278

I. REGULATORY OVERVMW AND SUPERVISORY SYSTEMA. Introduction

Nomura Securities International, Inc. ('Nomura", "NSf' or the "Firm") is a broker-dealer registered with the Securities and Exchange Commission ('SEC") and with all 50 U.S.states and is a member of the National Association of Securities Dealers, Inc. ("NASD"), theNew York Stock Exchange (the "NYSE') and other principal exchanges. Nomura is alsoregistered as an investment adviser with the SEC. Nomura has ofiices in New Yorh other U.S.cities and in cities outside the U.S. Nomura is subject to regulation by the SEC, self-regulatoryorganizations (including the NASD and the NYSE), and the States in which it conducts business.Nomura's offices outside the U.S. are subject to regulation by the SEC and U.S. self-regulatoryorganizations and to local regulation by the countries in which such offices are located.

This manual is intended primarily for use by employees of Nomura. Certain parts ofthis manual are applicable to the 't{omura Group" generally or involve interactions betweenNomura and the Nomura Group. The "Nomura Group" means Nomura Holding America Inc.and its subsidiaries, including, among others, Nomura Securities International, Inc., NomuraResearch Institute America, Inc., Nomura Securities @ermuda) Ltd., Nomura Asset CapitalCorporatiorq Inc., Nomura Capital Services, Inc. and Capital Company of America LLC. To theextent that there are separate, conflicting policies or procedures that apply to your NomuraGroup entity, or your specific department, those policies and procedures will govern.

B. Federal LawsIn response to the economic problems that grew out of fraudulent practices in thesecurities industry, which culminated in the stock market crash of L929, Congress enacted theSecurities Act of 1933 (the "Securities Act"), and the Securities Exchange Act of 1934 (the

"Exchange Act"). Following the adoption of these statutes, Congress passed the Public UtilityHolding Company Act of 1935, the Trust Indenture Act of 1939 (the *1939 Act"), theInvestment Company Act of 1940 (the *1940 Act") and the Investment Advisers Act of 1940(the "Advisers Act"). Commodities are regulated pursuant to Federal rules and regulations, andrules and regulations issued by the National Futures Association and various commodityexchanges. Details of such rules and regulations are contained in the NSI Futures CommissionMerchant Compliance Manual.Certain aspects of these statutes relevant to broker-dealer and other Nomura Group;activities are briefly discussed below.(1) Securities Act of 1933The Securities Act was designed to protect investors by requiring full and fairdisclosure in offering and selling securities to the public. The Securities Act requires a securityto be registered with the SEC prior to being offered or sold to the public unless the security orthe transaction in which the security is offered for sale is exempt from registration under theterms of the Securities Act. Examples of exempt securities include securities issued by theUnited States, its agencies and instrumentality's, securities issued by state and local governmentsin the United States, and securities issued by banks chartered under the laws of the United Statesor any state. "Private placements" and intrastate offerings are examples of transactions that do

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

10/278

not require registration of the security offered or sold. Whether a particular security ortransaction is exempt from the registration requirements of the Securities Act is often not tlearand advice from legal counsel should be sought in cases ofdoubt.When registration is required, the issuer must make full and fair disclosure of allinformation relating to the issue of securities and itself that is necessary to permit prospective

investors to make informed investment decisions. A declaration of effectirr.r.r, of a iegistrationstatement by the SEC does not imply that the SEC has approved an offering or has in any wayexpressed an opinion on the merits of the security being offered.Even if a particular security or transaction is exempt from registratioq the SecuritiesAct imposes civil and criminal liabilities for various fraudulent practices (including materialmisstatements or omissions of material facts) in connection with the purchase and/or sale ofsecurities. Rule 10b-5, which was promulgated by the SEC under the Exchange Act, prohibitsfraudulent practices in connection with either the purchase or sale of securities whether or notthose securities are exempt from registration.(2) Securities Exchange Act of 1934The Exchange Act was enacted to protect holders of outstanding securities and personsinvesting in the secondary or post-distribution market. It is intended tolegulate trading on thesecurities exchanges and in the over-the-counter ("OTC") market. Thus, the Exchange Actrequires the registration with the SEC of all broker-dealers, securities exchanges, seJuritiesassociations and of non-exempt securities trading in these markets.The Exchange Act:

' prohibits manipulative, fraudulent and deceptive practices in connection withthe purchase and/or sale of securities (in particular, through Rule 10b-5);' requires disclosure of material information by certain issuers (f.e., issuerswhose securities are listed on a U.S. securities exchange, who had securitiesregistered under the Securities Act, or who meet certain tests as to the numberof their shareholders or amount of their assets), which must file Quarterly,Annual and Current Reports on a continuing basis;. establishes books and records requirements;o penalizes unfair trading practices by insiders;o regulates the extension of credit for the purpose of purchasing securities,o establishes safeguards for customer funds and securities;o regulates tender offers and proxy solicitations.o establishes initial margin requirements for extensions of credit; and

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

11/278

o establishes regulatory capital requirements for all positions and regulatorycapital reporting obligations

As a broker and dealer in securities, Nomura is registered under Section 15(a) of theExchange Act and is also a member of the NYSE, NASD and other regulatory organizations.

The Exchange Act, SEC Rules and NASD Rules, as well as rules promulgated by otherself-regulatory organizations, also require broker-dealers to meet certain minimum net capitalrequirements, to maintain certain records, to make certain financial and operational reports, tocomply with certain customer protection rules and imposes other requirements on the conduct ofbusiness.

(3) Insider Trading and Securities Fraud Enforcement Act of 1988 (,"ITSFEA')Passed in November 1988, ITSFEA was designed to prevent, deter and prosecuteinsider trading. Among other provisions, ITSFEA creates a specific requirement for broker-

dealers to maintain procedures designed to prevent the misuse of material nonpublic information.Additionally, ITSFEA provides that the "controlling person" of a person who has violatedITSFEA by purchasing or selling securities while in possession of material non-publicinformation or by communicating such information in connection with a purchase or sale, isliable for up to the greater of $1,000,000 or three times the profit gained or the loss avoided.ITSFEA places an affirmative obligation on broker-dealers to establislq maintain and enforcewritten policies and procedures to prevent the misuse of inside information. Thus, the passage ofITSFEA greatly increased the firm's responsibilities as well as mandated the need for writtenpolicies and procedures.

(4) Investment Advisers Act of 1940The Investment Advisers Act of 1940 requires registration, with certain exceptions, ofpersons furnishing advice with respect to securities and imposes certain reporting and other

requirements on such persons. Nomura is registered as an investment adviser with the SEC.(5) FDIC ComplianceIn addition to obligations under federal securities laws, in connection with certain

business dealings with federally insured depository institutions, Nomura is required to makecertain certifications to the Federal Deposit Insurance Corporation ('FDIC") rwice a year. Inorder to monitor the Firm's compliance with the no-conflict rules of the FDIC, all NomuraGroup Employees must respond to the questions set forth in Exhibit A.C. State Laws

Each state has a law governing the public distribution of securities within that state.Commonly called "Blue-Sky Laws", these state statutes are similar to the Securities Act in thatthey require securities to be registered or otherwise qualified for sale with the local statesecurities commission unless the security offered or the transaction in which it is offered isexempt from registration or qualification. As a result of National Markets Improvement Act of1996, many state Blue-Sky laws are now not applicable to many transactions because of

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

12/278

superseding federal law. Questions about whether a particular transaction is exempt from astate's Blue-Sky laws should be directed to the Legal or Compliance Department.Many state securities laws also require the registration or licensing of brokers,dealers, salespeople and certain investment advisers. Tfiese requirements remain in effectand generally have not been superseded by federal law. Failure to meet registration

requirements may give rise to civil liabitity in connection with a pafticular transaclion, andin many states will give the purchaser of a security the right to rescind the transaction.D. Regulatory Agencies

(1) Securities and Exchange CommissionThe SEC is the principal agency responsible for enforcing the federal securities lawsand has the power to promulgate rules under those laws. Those rulei expand upon and refine thestatutory provisions_enacted by Congress and have the force of law themselvei. Many of thoserules provide specific guidelines (or "safe harbors") for complying with the provisions of thevarious securities statutes. Some of the more important rules promulgated by the SEC under theExchange Act that regulate broker-dealer activities cover the following "."as:. Hypothecation of customers, securities (Rule__15c2-.1);

o Net capital requirements for brokers and dealers Ggle l5g3:D;o Customers' free credit balances (Rule l5c3-2);o CustomerprotecrionGUlC_ jS3:3.);o Confirmation of securities transactions @_ gb-lQ);o Record-keeping and retention requirements Wa:L et seq.); ando "Safe-harbor" exemption from registration for foreign broker-dealers(Rule l5a-6).

The SEC also oversees the various securities exchanges and other self-regulatoryorganizations ("SROs"), such as the NASD. This oversight responsibility includes the power toapprove or disapprove of an SRO's rules.(2) New York Stock Exchange and National Association of Securities Dealers. Inc.The NYSE is the self-regulatory organization ("SRO") designated with primaryregulatory responsibil ity for Nomura.Nomura is also a member of the NASD, a registered national securities association.Nomura is also a member of other SRos and is subject to their regulations.

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

13/278

(3) State Securities RegulatorsAs noted above, the Blue-Sky laws of each state applicable to offerings and sales of

securities are enforced by a state securities commission. While Nomura is registered as a broker-dealer with the state securities commissions of all fifty states, it is still necessary to consider theapplication of Blue-Sky laws to specific transactions.E. Supervisory System

(1) IntroductionIndividual Supervisors, senior management, Compliance and Legal are responsible, invarying ways, for the formulation, administration and continuing review of Nomura'scompliance with securities, commodities, investment advisor, and banking laws. Series 8Supervisors are directly responsible for supervision of the sales activities of their supervisees andSeries 24 Supervisors are directly responsible for supervision of the trading and investmentbanking activities of their supervisees. Under federal securities laws, Nomura and individuals

who have supervisory duties may be subject to sanctions for failing to supervise a person with aview toward preventing violations of applicable laws, if such person commits such a violation.These sanctions generally will not be imposed, however, if (i) procedures, and a system forapplying such procedures, have been established which would reasonably be expected to preventand detect, insofar as practicable, any such violation by such other persor and (ii) the supervisorhas reasonably discharged the duties and obligations incumbent upon him or her by reason ofsuch procedures and system and has reasonable cause to believe that such procedures and systemwere being complied with.

In particular, federal securities laws require that all trading and sales activities of abroker-dealer be supervised by an appropriately registered supervisor.(2) Duties of SupervisorsThe Supervisor, which is usually a registered Principal, is an important factor inensuring compliance with this Compliance Manual and with other applicable rules andprocedures. The Supervisor will perform supervisory reviews designed to ensure that employees

assigned to the Supervisor are complying with their obligations and that the employee does notengage in conduct described as prohibited in this Manual. NSI has instituted a complianceeducation and training program. The program includes among other things, providing copies ofthis Compliance Manual to each employee and requiring a signed acknowledgment from theemployee that the employee has received a copy of the Compliance Manual and agrees to adhereto the Manual. In additiorq the Compliance Department will also conduct annual meetingsinvolving registered personnel to review relevant compliance topics. Also, on an as needed basis,the Compliance Department will conduct meetings to discuss compliance issues, regulatorydevelopments, etc.

In addition to the foregoing, the compliance duties of Supervisors include the approvalof new accounts, the review of incoming and outgoing correspondence received and sent bysupervised employees, the review of transactions conducted by supervised employees and thereview of customer accounts serviced by supervised employees. Supervisors are required tomaintain appropriate written records of these reviews.October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

14/278

At a minimum, the following procedures must be followed or reviews conducted infu lfi lling these supervisory responsibilities:. Supervisors are required to initial and keep on file the computer reports or other writtendocuments used in their daily reviews. Also, each new account must be approved bythe designated supervisor and the new account form must be signed by the supervisor.In addition, on a monthly basis the designated supervisor must sign a report whichindicates that he or she conducted a reasonable review oftransactions on a daily basisduring the past month. This monthly report also indicates some of the types of isiues, ifany, that were the focus of the supervisory process.o Supervisors responsible for reviewing the Firm's transactions on a daily basis mustcarefully review for unusual trading, and whether transactions that were recommendedare suitable for the counterparty, trading in employees' or related accounts, trading inadvance of Firm research recommendations, oflmarket prices (transactions andpositions), mark-ups and other inegularities. Any unusual or irregular activity shouldbe brought to the attention of the Compliance Department.' All transactions entered by employees should be reviewable by their supervisor.Review of trade tickets will suffice, but the suggested method is a computer report thatcontains all relevant information such as security, transaction type, counterparty, price,trade date, settlement date, processing date and time, and the name of the employeeeffecting the transaction. The front page of this report must be initialed by thesupervisor as evidence ofhis or her review and retained for a period ofthree years. Ifthe supervisory reports are warehoused, such warehoused records must be retrievablewithin one business day. The supervisor is subject to a "reasonableness" standard.Therefore, in those areas that have a high volume of transactions, a random samplereview will suffice. Supervisors who rely on the review of order tickets should initialthe ticket.

Cancel and correct entries must be reviewed, particularly when the correction involvesprice, date and counterparty.Excessive use of suspense accounts must be reviewed. Trades that are pending in asuspense account for more than one trade date must be closely reviewed.Trades must be reviewed for pricing. Focus should be made on securities swaptransactions (simultaneous buy and sell with the same counterparty of two differentsecurities) for executions that are above or below market price. Focus should also beon identi$ring any window dressing transactions that have no economic substance, orpossible parking transactions whereby securities are hetd on a temporary basis either inthe Firm's inventory on behalf of a counterparty or in the counterparty's inventory onthe Firm's behalf. (See Section 5 - "Sales and Trading practicesrr)For those areas that do not use computer trade entry order tickets, trades for which notrade ticket was written (a trade ticket must be written and processed for each trade).

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

15/278

Proprietary positions should be reviewed for the accuracy of the traders' mark.Supervisors of traders must provide guidance as to the Supervisor's desired approach tovaluing positions, e.g. closing or last price, bid, mid market, etc.Transactions must be reviewed for improper financing, such as buy/sell backs, extendedsettlements, and unapproved deep in the money options. (See Section 14 - "MarginRegulation")Review should be made for trading activity that seems to be a misuse of material, non-public information, such as in advance of the release of a research report, or asignificant customer order. (See Section 3 - 'oChinese Wall Procedures" andSection 5.G - "Front-Running")Supervisors must be familiar with the Chinese Wall procedures described in Section 3and should be familiar with the contents of the Restricted List (available on the intranetor in hard copy if requested). Supervisors must immediately inform the ComplianceDepartment when they or their supervised employees come into the possession of non-public confidential information and must consult with the Compliance Departmentwhen they wish to share that information with another department at Nomura.Supervisors must assist to ensure that all transactions are processed on a timely basis.Trade support for desks that do not use paper order tickets (i.e., they use electronicentry) must keep a transaction report (which includes time of entry) in their day's work.For those desks that use paper tickets, the tickets must be time stamped and completedas required. For those desks that do not use paper tickets, time of entry into the systemis the time stamping mechanism. Also, where appropriate, tickets must be marked"long" or "short". Supervisors must perform a periodic sample review of order ticketsto veriS that they are being properly completed and time stamped. (See Section 6 -"Fixed Income Order Procedures" and Section 7 - "Equity Order Procedures")Supervisors must ensure that traders are trading within their approved proprietary limitsand that counterparty transactions are within approved credit limits. Such informationis available from the Credit Department.Any significant changes in proprietary trading or hedging strategies by a trader must bereviewed and approved in advance by a supervisor. A different trader or sales personshould trade or cover the relevant account one or two weeks a year as a method todetect improper activities. (See Section 16.D. - "Vacation Policy")All incoming mail must be reviewed by the supervisor or his or her designee. Therecipient's supervisor and the Compliance Department must be immediately notified ofall written or oral customer complaints. Copies of all letters written by clients tosalespersons must be made, with the copy given to the salesperson and the originalletter being reviewed and initialed by the supervisor and kept on file for 3 years. (SeeSection f0.B - '(Correspondence" and Section 10.H. - ttRegulatory and LegalCommunications")

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

16/278

Outgoing written materials (including electronic communications that are material to aninvestment decision) must be reviewed by an authorized Series 8 Supervisoq initialed,and saved for a period of three years. Yield tables and term shiets must also beapproved by the appropriate Supervisor. There are special procedures for providingvaluations to counterparties. (See Section 6.E. and 7.E. - "Unoflicial Confiimations,Customer Account Statements and Valuations", Section 10.B. - ,,Correspondencerand Section 10.D. - 6'Advertisements'r)The missing documentation report must be reviewed and missing documentationobtained or the account closed when appropriate, unless the documentition is waived inconformity with the New Account procedures.Markups and markdowns on customer transactions must be reviewed. No matter howvolatile or thinly traded the security, markups or markdowns in excess of 5Yo are rarelyjustified Compensation on less complicated and more liquid instruments should bLsignificantly less than 5%o. (See Section 5.8. - ,,MarkupsrrjThe sale of securities in unregistered transactions requires that an exemption fromregistration be available. Supervisors of desks involving such securities must insurethat the securities are sold consistent with such exemptions and Firm procedures anddocumentation requirements. For example,l44Aeligible securities should be sold onlyto Qualified Institutional Buyers and appropriate documentation must be executedand/or obtained. Similarly, securities sold pursuant to Regulation S must be sold toappropriate accounts, e.g., offshore accounts of non-U.S. persons, and appropriatedocumentation must be obtained. (See Sectionl2 - "Niw hsuance oi privateSecurities" and section 13 - "Secondary salCI of private Securities,r)Certain departments at Nomura require pre-approval of employee transactions by theemployee's Supervisor. AII Supervisors are now provided with a report showing alltrading activity of their employees and the Supervisor is responsible for reviewing thisltivity for, among other things, conflicts with Nomura activities, trading on insideinformatiorg front running proprietary or customer transactions (to the extent that it isreasonable for the Supervisor to do so), excessive trading, and compliance with anyrestrictions that are particular to that department. (See Section 16.A. - .,EmployeeSecurities Transactions,,)There are strict limits on the size of gifts and gratuities (generally $100) that can begiven by Nomura employees to clients. In addition, it is Nomura'i policy to limit theacceptance of any gift or gratuity to a maximum of $100 from any client. Supervisorsmust insure that they have a method to supervise gifts and gratuities given or receivedby their personnel. (See Section 16.C. - (Gifts, Gratuities ano payment ofCompensation")News media contacts, news releases and seminars must be pre-approved by the PublicRelations Department. (See Section 10.G. - *Communications with the Press andPublic Appearances")

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

17/278

Various desks have regulatory trade reporting requirements. The Supervisor shouldperiodically check to ensure that trades are being reported consistent with theserequirements. Examples of regulatory trade reporting include exchange reporting(NASDAQ), G order reporting, SOES procedures, MOC procedures, Rule 80Alimitations, FIPS (high yield) reporting, Fed reporting, U.S. Agency new issuereporting, after hours (Form T) reporting, Treasury Auction reporting and Treasuryposition reporting. (See Section 5 - "Fixed Income Order Procedures" and"Section 6 - ttEquity Order Procedures").Supervisors should review for situations where sales people cross trades withoutapproval by the trading desk, which is prohibited.The Compliance Department must be notified by Supervisors of changes in the jobfunction of their employees so that a determination can be made as to whether anyadditional registrations are required.Supervisors must ensure that their staff maintains all appropriate registrations. SeeSection F.(l) below Supervisors of employees in remote locations must also visit thoseemployees at least once a year.Sales supervisors should ensure that their employees observe any applicable suitabilityrequirements. This requires that sales people "know their customef', which includes anunderstanding of their customer's sophistication, financial conditioq and tolerance andunderstanding of risks, as well as their investment objectives and tax status (for non-institutional customers). Focus should include compliance with the procedure whichrequires pre-approval by the Compliance Department of derivative transactions, bondsborrow and reverse repos with self-managed or advised municipalities. The ComplianceDepartment has prepared a worksheet (set forth in Exhibit B) that may be used todocument the salesperson's diligence in regard to his/her institutional account suitabilityreview. Series 8 Supervisors, in connection with their signing the new account forms,must be comfortable that the requested lines of business meet any applicable suitabilityrequirements. (See Section 5.A. - 66suitability")Sales supervisors must immediately reassign accounts of terminated salespersons.When supervisors are out of the ofiice for more than two days, an appropriatelyregistered back-up (i.e., another supervisor) should perform the review process.Any instance where a client appears to be incurring a large loss on a trade(s) should bebrought to the attention of the Compliance Department. Erratic trading by a clientshould also be discussed with the Compliance Department.Supervisors should be alert to trades executed at oflmarket prices or trades executedwith reduced commissions. This could possibly be a form of compensation to the clienton previous losing transactions and must be investigated. (See Section s.IC -"Guarantees of Accounts, Sharing and Rebates").

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

18/278

Exhibit C sets forth a Compliance Calendar, which is a supervisory tool developed bythe Compliance Department. The Compliance Calendar can be used as a guide by all Nomurasupervisors. Supervisors should also refer to and comply with the Firm's Supervisory Manual.(3) DisciplineViolations of the requirements of this Compliance Manual should be reported by theSupervisor to Compliance or Legal Department. Violation of the policies and proced,r.esoutlined in this Manual as other policies or procedures may subject the Nomura Group employeeto discipline, including, but not limited to: (l) reprimand; (2) loss of regular or supplementalcompensation; (3) forfeiture of, or decrease in, a regular or discretionary increasJ in futurecompensation; (4) suspension and/or (5) termination.(4) Training and Procedural ReviewA1l employees are required to read and abide by this Manual in addition to otherNomura Group policies and procedures. Employees will be required to sign an acknowledgmentcertifying that the employee has received the Manual.All employees must participate in the compliance education and training program. Theprogram consists of the following:

(a) Each participant in the training program will receive a copy of the Compliance Manual.Each participant must read the Compliance Manual and must sign an acknowledgmentcertiSing that the participant has received the Compliance Manual and agrJes toobserve the policies and procedures set forth in the Manual.(b) At least once each year, the Compliance Department will convene a meeting of allregistered employees. During these meetings, the Compliance Department wilf reviewpertinent issues from the Compliance Manual, as well as other applicabte complianceprocedures and those rules and regulations issued by the SEC or the NASD relevant totheir area.(c) As necessary, the Compliance Department will convene meetings to address othercompliance issues and regulatory developments.(d) Each employee will participate in the mandated Continuing Education program.

(5) Branch Offrce VisitsCompliance Department personnel visit every branch office at least once each year.Such visits will include thorough reviews of the branch's compliance systems and procedures,the handling of customer accounts, proper supervisory procedures and customer complaints orother problems.The purpose of such visits is to oversee the procedures designed to ensure that theFirm's policies, the rules of theExchanges and the SROs, as well as federal and state laws, arebeing complied with.. The visits also provide any branch office personnel with the opportunity

l0 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

19/278

to discuss any problems they have with the Compliance Department. The Firm encourages suchdiscussions.F. Registration of Personnel

(1) Registration and Oualification ProceduresSales, trading and investment banking personnel are required to be registered, throughthe NASD's Central Registration Depository, with the NASD, the New York Stock Exchange,other appropriate securities industry SROs and appropriate states. Employees who engage in thecommodities or futures business are required to be registered with the National FuturesAssociation. Registration requires that an individual take and pass a qualiffing examination.Employees that are involved in a sales, trading, research or investment banking function aregenerally required to take the Series 7 - General Securities Representative examination and the

Series 63 - Uniform Securities Agent State Law examination. This includes sales/tradingassistants as well. Employees who act only in a clerical capacity need not be registered.Employees who engage in the commodities or futures business (and their supervisors) arerequired to take the Series 3 - National Commodity Futures examination. Supervisors are alsorequired to take the Series 24 - General Securities Principal examination (for trading supervisors)and/or the Series 8 General Securities Sales Supervisor examination (for sales supervisors) and,if supervising employees engaged in the options business, the Series 4 - Registered OptionsPrincipal examination.

It is very important that each individual joining Nomura be aware of his or herqualification requirements. The failure of an individual to be appropriately qualifiednecessitates the suspension of sales, trading or investment banking activity for thatindividual. The continued failure to achieve the appropriate qualifications in a reasonabletime period may result in termination of employment. Exhibit D sets forth a list of the majorregulatory examinations and an explanation as to who (positions within Firm) should take whichexam, and a supervisory exam chart which also shows what supervisory positions require whichexam qualification(s).

When each qualified salesperson or trader commences employment with Nomura, he orshe must indicate to the Registration Department the states where his or her customers orpotential customers reside. Thereafter, it is the responsibility of the salesperson or trader tonotify the Registration Department when additional state registrations are needed. It is of utmostimportance that each Nomura salesperson or trader be registered as an agent in a state pUg[ tosoliciting security transactions to residents thereof. Any violation of this policy can resultpotentially in large monetary losses for the Firm.(2) Previously Registered PersonnelSalespersons previously registered and joining Nomura must be cleared through theirprevious FirrrL the appropriate exchanges, the NASD, and their "home state" prior to aRegistered Representative number being issued. Until a Registered Representative number is

issued, salespersons may not service an account or solicit any business at Nomura.

ll October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

20/278

(3) Non-Registered TraineeA non-registered trainee may not solicit or service accounts or trade until successfullycompleting applicable examinations. In addition, servicing or soliciting an account or trading isforbidden until a Registered Representative number is issued.(4) FingerprintsSEC Rule l7f-2 requires the fingerprinting of each person who is a director, oflicer oremployee of a broker-dealer. Although the rule provides foi certain exceptions, every Nomuraemployee will be fingerprinted as a condition of employment.

If it comes to your attention that a customer is an insider (i.e. any of the persons below)of 1y rapanese public company whose shares are listed on any Japanese rto.i exchange oitraded on the Japan Securities Dealers Association's quotation system ("Japanese p-uUticCompany'') and you reasonably believe that such customer might purcirase or sell-such JapanesePublic Company's securities in the near future, a Nomura ToLvo rule requires us to report suchcustomer to Nomura Tokyo. If any of your customers is such a person, iontact the ComplianceDepartment.

(1) A director (or anyone who resigned as a director within one year) of a Japanese publicCompany or his/her family member (Le. spouse, child, parent, brother, .irt"q grand-parent orgrand-child);(2) One of the ten largest shareholders of a fapanese Public Company, or any shareholderowning more than ten percent of a Japanese public Company;(3) An affrliated company (i.e. a company which owns more thanZ0%o of a Japanese publicCompany, or a company in which a Japanese Public Company holds more than a 20%interest); or(4) A general manager (or equivalent position) of a Japanese Public Company or anyonewho resigned from such a position within one year.

G

12 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

21/278

2. PRINCIPLES OF CONDUCTA. General Standards

Nomura seeks to continue to be a premier and respected broker-dealer. As such, itstrives to provide top quality client service and to operate profitably for its own account.. To thisend, Nomura and its employees must conduct business with the highest level of integrity andethics.

It is imperative that Nomura employees uphold the highest ethical standards of conduct.Honest and equitable conduct is not only necessary to avoid potential legal, regulatory orFirm-imposed sanctions, but will enhance the individual employee's, as well as the Firm's,reputation in the securities industry.Maintaining integrity, both personal and professional, involves more than a strictobservance of the securities laws and regulations and the internal policies which relate to them.Integdty involves an awareness and active support of the ethical principles underlying the

relevant regulations. Integrity also requires loyalty to the Firm and its clients, fair and honesttreatment of competitors and their clients, and respect and concern for fellow employees.Integrity is not an occasional requirement but a continuing commitment.The Firm is committed to compliance with federal and state law and the manygovernment and self-regulatory regulations applicable to its businesses and to heighten theawareness of its employees to the ethical considerations and individual responsibilities thoselaws and regulations impose. Nomura expects its employees to observe fully all applicable laws,rules and regulations. It is only in this way that Nomura will maintain its reputation for integrityand professionalism in the financial community.

B. Code of EthicsNomura employees are expected to abide by the highest standards of ethical conduct intheir relationship with each other, the Firm, customers, competitors and the public. Below isNomura's Code ofEthics, which every employee is expected to follow. If an employee perceiveslapses in such standards, he or she is expected to report them to his or her Supervisors. Nomurawill respond promptly to employee concerns about possible violations of laws, rules andregulations. Only in such an open and accountable environment can an auitude prevail by whichevery individual member of the Nomura community shares responsibility for the integrity of theFirm as a whole.

Code of Ethics ofNomura Securities International. Inc.(l) The client's protection must always come first.(2) Opinions, advice and recommendations to clients must always be supported bysound due diligence and good judgment.(3) Principles of good business practice and just and equitable principles of trade mustbe observed.

l3 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

22/278

(4) All employees must comply with all applicable securities laws, rules and regula-tions and company policies must be complied with. When in doubt, consult theLegal Department or Compliance Department.(5) No recommendation may be made which does not meet applicable suitabilityrequirements.(6) All employees must comply with the Firm's policies and procedures concerningthe handling and use of confidential information. See Secti,on 3 - "Chinese WallProcedures". Employees are absolutely prohibited from using confidentialinformation about the Firm or its clients inappropriately.(7) Information about a customer's account is confidential and may not be disclosedoutside the Firm or its affiliates without permission of such customer and./or afterconsultation with the Legal Department or compliance Department.(8) The interests of the Firm must be safeguarded at all times. The Firm's capital andreputation are the responsibility of each individual employee.(9) Personal investment actions must never be permitted to influence advice given toclients.(10) Mutual respect between employees is important to overall success. This principleapplies to all relationships within the Firq whether between Supervisors and staffor between co-workers. All forms of discrimination are strictly prohibited, andany violations of this policy must be promptly reported to the Human ResourcesDepartment immediately.(l l) Supervisors play an important role in the securities industry and have specialresponsibilities in connection with maintaining legal and ethical standards.Supervisors must therefore lead by example and must respond promptly toevidence of legal or ethical violations.(12) It is Nomura's policy to promote free and open competition in the businessenvironment and to comply with applicable antitrust laws and regulations.Employees should be aware that discussion with industry competitors relating tosuch matters as pricing, costs, profits, interest or financing rates, market shire,distribution strategy, sales tenitories or treatment of customers may constitute anunlawful restraint on competition and a violation of u.S. antitrust laws.(13) All corporate contributions, gifts or entertainment to political parties, campaigns oremployees of governmental entities must be made in accordance with applicablelaw, which prohibits corporate contributions to any candidate for national oftice aswell as to candidates for office in certain states. Nomura employees are free tosupport and/or contribute to political parties or campaigns in their individualcapacities as private citizens; however, Nomura will not reimburse employees forsuch contributions. Such contributions must be reported to the ComplianceDepartment. Individuals who are not citizens of the United States are restrictedfrom making certain political contributions and should consult with counsel if they

l4 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

23/278

wish to make a political contribution. See Section 17 - "Campaign ContributionLimitations and Reporting Requirements" for additional detailed proceduresregarding campaign contributions.

The Firm invites each employee to contact the Management Committee when he or shebelieves that improper conduct is not being addressed by the Firm's management.Each employee should report, promptly and directly to the Chief Legal Offrcer, anylegal violation or ethical failure by any employee of Nomura, as well as its subsidiaries andafiiliates, which the employee believes has not been addressed by a member of management.Employees should also report any tactics intended to intimidate employees who are concernedabout ethical or legal failures. Employees should understand the danger of not reportingunethical or illegal conduct since it could result in the appearance of aiding and abetting theviolation.Allegations of discrimination, especially sexual or other prohibited forms ofharassment, should be reported to the E.E.O. Director in the Human Resources Department. The

Employee Handbook describes Nomura's policies regarding equal employment opportunity andsexual harassment. Allegations of infractions of these policies should be brought to appropriatesupervisory personnel and the Human Resources Department, as described in the EmployeeHandbook. Employees should also feel free to come to the Legal or Compliance Departmentswhen they believe these problems are not being quickly or adequately addressed.C. Reportable Events

AII employees must notify the Legal or Compliance Departments, through theirmanager, if at any time they were or become the subject of:(l) any investigation or proceeding by a foreign or domestic governmental agency orself-regulatory organization;(2) arry refusal of registratiorq injunction, censure, fine, suspension, expulsion or otherdisciplinary action of any securities or professional organization or other rules and regulations;(3) written or oral client complaints;(a) any litigation, reparation proceeding or arbitratiorq including litigation or claimsrelated or unrelated to their business at Nomura;(5) any bankruptcy, unsatisfied judgment or lien;(6) contempt proceeding or cease or desist order,(7) any subpoena, arrest, indictment, or conviction for a criminal offense; or(8) any regulatory inquiry.

I5 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

24/278

All inquiries from regulatory agencies including or related to business at Nomura mustbe coordinated and answered through the Compliance Department or Legal Department. Acaller may indicate that he or she represents a regulatory agency, una is bn$ seekinginformation. In such cases, the normal practice will be for a member of the CbmplianciDepartment or Legal Department to return the call, thereby confirming that the inquiry comesfrom a proper source, especially when inquiries are concerned with trading activitiis, ind alsoensuring uniformity of the Firm's responses to any such inquiries.D. Specific Restrictions and Guidelines(l) Marking Positions and Taking ReservesThe Firm maintains a strict policy with respect to marking positions and taking reserves,as set forth below.

Traders must mark their positions to the market. Market is defined anddetermined by the desk supervisor in consultation with the Controller'sDepartment and senior management. The market definition applicable to aposition should be consistentty applied.Traders must not take reserves for P&L in their position prices.Traders must mark every position every day unless otherwise approved bysenior management.The Firm's management and Controller's Department is responsible for takingreserves when potential losses are expected. No one else in the Firm ispermitted to do so. Any other person who does so violates Firm policy andundermines management's ability to evaluate effectively the Firm's positions.The fact that the controller's offtce or anyone in senior management has failedto detect a violation of this policy cannot be construed as an approval of theviolation or exception. Any attempt to justify such a violation by "constructivenotice" could result in disciplinary actiorq including termination.Trading desk supervisors are responsible for the market pricing by the tradersthat they directly supervise and must take prudent steps to review and veri$ithe accuracy and reasonableness of the valuations assigned by theirsubordinates.It is the responsibility of each employee in a position to assist compliance toenforce this policy and to notifr the Compliance Department when he or shesuspects that such policies are being violated.The Firm may also notifu regulatory authorities of such violations.

l6 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

25/278

(2) Prohibition Asainst Nomura Affrliates Purchasing New IssuesNomura policy generally prohibits the purchase of new issues of public debt or equitysecurities by the Nomura Group and their respective employees due to the free-riding andwithholding restrictions imposed by the securities laws. See Section 5.F. -"FreeRiding andWithholding" for a detailed discussion of free-riding and withholding. Exceptions to this policy

must be approved in advance by the Legal Department and the Compliance Department.(3) Finders Fees/Foreign Comrpt Practices Act ("FCPA") ConsiderationsVarious regulations generally prohibit paying transaction based compensation to thirdparties. One exception is paying compensation to a foreign finder, but significant conditionsapply. For further informatiorq speak to Compliance or Legal Departments.AII domestic and foreign "finders fee" relationships must be pre-approved by the LegalDepartment or Compliance Department because the Firm has specific procedures pertaining to

these types of relationships. Related thereto, the FCPA makes it illegal to offer or pay money oranything of value to, or for the benefit of, foreign government officials, political parties orcandidates for political offtce, for the purpose of improperly influencing them to take, or refrainfrom taking any action in order to assist the person making the payment in obtaining or retainingthe business with respect to foreign finders. It is important that appropriate due diligence beconducted to ensure the Firm's FCPA policy is followed.

(4) Soft Dollar Arrangements"Soft dollar arrangements" are those agreements in which NSI provides, or contractswith a third party vendor to provide research or other services to an investment advisor inexchange for the investment advisor directing transactions to NSI.

1. The research or services must be of a type that is lawful and appropriate and that assiststhe advisor in the performance of its investment decision-making responsibilities.Examples of appropriate services include researclq quotation services and on-line dataservices such as Bloomberg and Reuters. Examples of inappropriate services includedlimousines and magazine subscriptions for Sports lllustrated. Any questions regardingacceptable services should be directed to the Legal Department.2. Soft dollar arrangements will be reviewed and approved on a case-by-case basis.3. All existing soft dollar arrangements must be reported to the Legal Department.

No commitments, whether oral or written, may be made to an advisor or vendorand no payments may be made to a vendor on behalf of any customer or client of NSI (orthe Nomura Group) unless and until all of the following steps have been completed and thesoft dollar form (available from the Legal Department) is fully signed:

t7 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

26/278

(a) The salesperson (i) completes the form, (ii) signs it where appropriate, (iii) in the caseof equity transactions, has the form signed by his or her Series 8 SupervisoA (iv) in thecase of fixed income transactions, has the form signed by the Division Head, and(v) gives it to Equity Administratioq or Fixed Income AdministratiorL as applicable;(b) Equity or Fixed Income Administratiorq as applicable, forwards (i) the original copy of

the form to the Legal Department, together with the form of agreement to be enteredinto between NSI and the service providing vendor, and (ii) a photocopy of theforegoing to the Compliance Department;(c) The Legal and Compliance Departments review the proposal and, if satisfactory, theLegal Department shall :

(D review and negotiate the vendor agreement directly with the service providingvendor (the "Vendor Agreement"); and(ii) prepare and negotiate a soft dollar agreement between NSI and the advisor (the"Soft Dollar Agreement");

(d) The form and the agreements are sent to Equity or Fixed Income Administration, asapplicable;(e) Equity or Fixed Income Administratioq as applicable, has (i) the original copy of theforrq and (ii) the execution copies of each of the Vendor Agreement and Soft DollarAgreement signed by one of the Co-Presidents;(f) Equity or Fixed Income Administratioq as applicable, forwards (i) the original, fullysigned approval forrn, together with the execution copies of each of the Vendor

Agreement and Soft Dollar Agreement to the LegalDepartment;(g) The Legal Department will forward the execution copies of the Vendor Agreement tothe vendor and the Soft Dollar Agreement to the advisor for their respective signatures;and(h) Upon receipt of fully executed Vendor and Soft Dollar Agreements, the LegalDepartment shall: (i) retain an original of each agreement, (ii) forward copies of theagreements to each of the Compliance Department, Systems and Facilities Departmentand Internal Audit Department, and (iii) advise Equity or Fixed Income Administratiorqas applicable, that the soft dollar arrangement is approved for implementation andpayment.

At the end of each monttL Equity Administration and Fixed Income Administrationshall distribute a copy of a report showing the existing soft doltar arrangements(5) Limitations on Transactions with Nomura Advisory AffrliatesNomura policy generally prohibits Nomura from purchasing or selling securities asprincipal or agent to or from a Nomura advisory affiliate. Limited exceptions to this policy must

l8 Oetober 1998

-

7/22/2019 Nomura Internal Compliance Handbook

27/278

be approved by the Legal Department or Compliance Department with written consent from theadvisory unit(6) Books and Records RetentionRules l7a-3 and l7a-4 of the Exchange Act, and certain other rules, speciff certainbooks and records that must be created and/or retained. Exhibit P contains a checklist of

documents that must be retained and a description of the acceptable storage methods.

l9 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

28/278

3.This Section sets forth the Nomura Group's policies and procedures for handlingconfidential information, including its "Chinese Wall" procedures. These procedures apply to aiiemployees, including part-time employees and consultants. Specific pohCies and procedures forindividual business units may from time to time be set forth in separate Legal und Co*pliance

Memoranda and shall be deemed to supplement or amend those contained in itris Section.In the normal course of business, members of the Nomura Group and their employeesreceive information of a confidential nature pertaining to the business of clients and of rn"*b.rsof the Nomura Group and its affiliates. Trading in securities (including securities issued byaffiliates of Nomura) for the Firm's account or one's personal account on the basis of materialnon-public information is prohibited. Confidential information is considered an asset of theNomura Group, and it is a fundamental duty of employment to not use such information forpersonal benefit. To break a confidence or to use confidential information improperly orcarelessly is a violation ofNomura Group policy and may violate SEC rules.Chinese Wall procedures are designed to prevent the flow of non-public informationfrom one area to another within the Firm. It is essential that the Legal Dipartment and theCompliance Department be made aware of any internal communications among InvestmentBanking, Researctr, and Sales and Trading which may involve, or create the appiarance o{ apassage of material non-public information. The Compliance Department maintains anddistributes a Restricted List which includes certain issuers *hose securities are subject to tradingorpublication restrictions as a result of applicable regulation of the Firm's policils concerningnon-public information; The Restricted List must be reviewed by all Supervisors to ensure thatthe Firrq and employees (if pre-approval of personat trading is required in your department), donot trade in the securities on the Restricted List without prior approval from the Legal orCompliance Departments. Compliance also maintains other lists of securities subjict torestrictions or review within the Firm (e.g.,the Watch List and the Research Restrictei I-isg.See the Employee Handbook for more information on employee trading procedures.Securities of issuers are placed on the control lists when the ComplianceDepartment or Legal Department is alerted that someone within the Firm has materialnon-public information. This can only happen when persons in possession of suchinformation. contact the Legal or Compliance Departments. Employees who are inpossession of material non-public information regarding a company must contact theCompliance Department or Legal Department. For example, an issuer might be placed on thecontrol lists if a person at Nomura sat on a creditor's steering committee for a distressed issuer orif someone in Research or Investment Banking received material non-public information aboutan issuer he or she covered.The Compliance Department carefully monitors compliance with these policies andprocedures, and Nomura will take action against any violators, which may include termination ofemployment. In certain cases, violations of these policies and procedures must be reported to theSEC or other appropriate authorities.Questions regarding this Section should be directed to the Compliance Department orthe Legal Department.

20 October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

29/278

A. DefinitionsThe definitions used in this Section are set forth below and are an integral part of thisSection. They should be reviewed carefully.(1) "affiliate" of the Nomura Group means any entity that directly or indirectly (A) is

controlled by a member of the Nomura Group, @) controls a member of the Nomura Group or(C) is under common control with a member of the Nomura Crroup. Afiiliates of the NomuraGroup include The Nomura Securities Co., Ltd. and all of its subsidiaries.(2) "client" includes persons or entities with whom employees of the Nomura Group

transact securities or engage in advisory business, including but not limited to, sales and tradingcustomers, companies transacting business with Investment Banking or fuset Backed Financeemployees and companies contacted or covered by Research employees.

(3) "confidential informdh" means non-public information provided by a sourceoutside of the Nomura Group or an affiliate of the Nomura Group (such as a client, prospectiveclient or other third party, or partners, omcers or employees of, or lawyers, accountants or otherprofessionals involved wit[ a client, prospective client or other third party) with the expectationthat such information must be kept confidential and used solely for the business purposes forwhich it was conveyed, and includes materials that contain or are derived from such confidentialinformation. With limited exceptions, non-public information obtained in the course of aclient assignment should be considered confidential. Unless otherwise determined by theCompliance Department, confidential information includes information received directly orindirectly from insiders where the circumstances indicate that the insider may have actedimproperly in disclosing the information. Information that is confidential to an afliliate of theNomura Group should be considered confidential information by members of the NomuraGroup. Any questions regarding the confidentiality of information should be directed promptlyto the Compliance Department or Legal Department.

(4) "employee accounts" include the following securities, commodities and futuresaccounts: an employee's personal accounts; accounts over which an employee has investmentdiscretion or exercises control (pursuant to formal authority, as a fiduciary or otherwise); and anyother account in which an employee has a direct or indirect beneficial or financial interest. Seealso "related accounts" below.

(5) "Investment Bankine" employees include personnel primarily engagedinvestment banking or other advisory activities related to the origination or structuringsecurities transactions.

(6) "material information" means information (A) that a reasonable investor wouldconsider important in making an investment decision as to a security or (B) that is likely to havea material effect on the market price of such security (including trading information). Materialinformation may include, but is not limited to, information about: changes in dividends ordividend policy; financial forecasts, projections or valuations (especially estimates of futureearnings or losses); changes in previously released earnings or earnings estimates, changes inaccounting procedures or the adoption of new accounting rules; write-downs of assets; additionsto reserves for bad debts; liquidity problems; to-be-announced changes of ratings; bankruptcyfilings; proposed transactions such as refinancings, refundings, tender or exchange offers,

lnof

2l October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

30/278

rccapitalizations, leveraged buy-outs, acquisitions, mergers, restructurings or purchases or salesof assets; expansion or curtailment of operations; increases or decreasis in orders; significantproduct developments; major litigation; changes in management; contests for corporatJcontrol,as yet unreleased government reports and statistics, and certain unannounc"d gou..n*aniactions; program orders; repurchase programs; anticipated offerings of securitie{ imminentblock orders; and short positions. Any questions regarding the materillity of information shouldbe directed promptly to the compliance Department or Legal Department.

(7) "non-public" information is information that has not been effectively disseminatedto the general public. Effective public dissemination cannot usually be made on apreferential orselective basis but does include a press release carried over a recognized news service, an articlein a major news publication, a public filing with the SEC or uroth". regulatory agency, or amailing (such as a proxy statement or prospectus) sent to shareholders Jr potential investors.Even following a public announcement of a major transactiorq many aspects of the matter mayremain non-public. Examples of effective public dissemination of unpublished research or otherproprietary information by the Nomura Group include customary oral dissemination by salespersonnel, mailing or other delivery of such information to the regular mailing list of recipientsof such research and use of a generally available electronic transmission systenL such as theBloomberg system. Any questions regarding whether information is non-public should bedirected promptly to the compliance Department or Legal Department.

(8) "proprietary information" means non-public informatiorg analysis and./or plans thatare created, developed or obtained by a member of the Nomura Group for business purposes. Itmay include any of the following: unpublished research; information about the investment,trading or financial strategies or decisions of the Nomura Group or any of its affrliates;information about the securities or futures trading positions or trading intentitns of the NomuraGroup or any of its affiliates; pending or contemplated orders of clients of the Nomura Group orany of its affiliates; soffware; models; personnel files; client records; advice to clients of theNomura Group or any of its affrliates; and analysis prepared by the Nomura Group or any of itsaffiliates of companies or clients that are potential acquirers of other companies or their assets orcompanies that are possible candidates for acquisitiorL merger or sale of assets. Any questionsregarding whether information constitutes proprietary information should be directed fromptly tothe Compl iance Department or Legal Department.

(9) "related--accou$ " include the following securities, commodities and futuresaccounts: accounts of a spouse or a minor child of an employee; accounts of an employee'sother children, if financially dependent on the employee; accounts of other relatives residing withthe employee; and accounts designated by the Compliance Department as related accounts due tothe degree of influence or financial interest of the employee.(10) "Research" includes Nomura Group personnel primarily engaged in the research ofsecurities, issuers or markets.(l l) "Sales and Tradins" includes personnel primarily engaged in the sales or trading ofsecurities, as well as those primarily engaged in the asset management business.(12) "Supervisory person" means a person who has supervisory responsibility withinthe applicable department within the Nomura Group.

October 1998

-

7/22/2019 Nomura Internal Compliance Handbook

31/278

(13) "unpublished reseuff' means information contained in (A) non-public researchopinions, recommendations or analysis of securities, companies or industries that are intended tobe disseminated to clients of the Nomura Group or any of its affrliates, @) the investment,trading or financial strategies or decisions of the Nomura Group or any of its affiliates or(C) advice to clients of the Nomura Group or any of its affrliates. Any questions regardingwhether information constitutes unpublished research should be directed promptly to theCompliance Department or Legal Department.B. Prohibition on Misuse of Confidential or Proprietary Information