Nokia_project_Group 3_1

-

Upload

gauraviiml -

Category

Documents

-

view

236 -

download

0

Transcript of Nokia_project_Group 3_1

Project Report: Nokia

1/26/2011

Submitted to: Prof Satish S M

Section F - Group 3

Gaurav Bhuwania – PGP26341

Neha Kumar – PGP26353

Saurabh Suman Yadav – PGP26365

Sumeet Saurav – ABM07022

Sushil Darveshi – PGP26374

Table of Contents

1. Nokia: Market Channel Strategy..........................................................................................................2

India is a very important country for

Nokia in terms of market share and is

amongst top three markets for it

globally. Nokia works closer with

operators in India to increase

geographical coverage & lower the

total cost of ownership for consumers.

This report is a brief account on the

existing marketing channel strategies &

the existing physical distribution cum

logistics strategies resorted to by

Nokia. It also gives an analysis of the

sales force design carried out by Nokia

to market cell phones, study of pros

and cons along with recommendations

to improve the distribution network.

2. Rural Markets......................................................................................................................................3

3. Nokia distribution structure in India....................................................................................................4

4. Role of Channel Partners.....................................................................................................................4

5. Sales Force Design:..............................................................................................................................6

6. Sales Force Compensation:..................................................................................................................7

7. Fitness of Strategies.............................................................................................................................7

8. Major Problems Faced by the distributors..........................................................................................7

9. Recommendations...............................................................................................................................9

1

1. Nokia: Market Channel Strategy

The mobile phone industry is very competitive and the market channel strategy plays an important role

for a company in determining its market share and hence overall growth prospects. According to V

Ramnath, director Branded Retail - Nokia India, the company has a network of more than 190,000

outlets across the country with a presence in almost every town and villages that fall into the circle of

the nationwide mobile network in the country. Nokia has a retail point at every five kilometres for every

20 sq. km, informs Ramnath. Nokia’s wide distribution reach has gone a long way in ensuring that it

maintains it market leader position.

Let’s us now see Nokia’s channel strategy and examine some of its best practices and compare them

with the competitors namely Samsung, LG, Motorola the new companies like Karbonn, Zen, Micromax.

1.1 The major channels through which Nokia operates are:

1. Multi-brand mobile dealers

2. Nokia Priority dealers

3. Nokia concept stores

4. Tie-ups to penetrate rural market

1.1.1 Multi-brand mobile dealers – To cater to the masses, the conventional mobile phone retail stores

remain the major distribution channel for Nokia. This channel caters to the need of the customers who

demand variety as well as value for making a purchase decision. Apart from distributing to the local

mobile retail stores, Nokia has tie-ups with all multi-brand mobile stores which enjoy nation-wide

presence in India and are recognized for their service and price discounts.

Few of the major players are:

Hotspot

Univercell

The Mobile store

RPG Cellucom

1.1.2 Nokia priority dealers -- Nokia Exclusive Stores namely PRORITY DEALERS are all franchised

outlets. For an existing store to be converted into a priority dealer, the store must satisfy a set of

eligibility criteria like a certain number of footfalls, location in a prime real estate, and so on. This

channel helps Nokia serve its loyal customers and get in direct contact with them.

1.1.3 Nokia concept stores -- Nokia opened its first Concept Store in Bangalore, a store first of its kind

in India, claims Nokia. Here again we see that Nokia was ahead of its competitors in delivering maximum

2

value to its consumers. There are a total of nine Nokia Concept Stores designed in the global formats

across the country and the recent store in Colaba, Mumbai is the second NCS in the city itself. The

intention is to provide a consistent, world class experience to consumers and in doing so, reinforcing

their trust in the Nokia brand. Nokia Concept Stores offer a complete portfolio of Nokia mobile devices,

enhancements and services including email, music, imaging and gaming to its customers. According to

Shankar Subramanian, director retail, Nokia India, the Concept Stores are designed to express Nokia

brand heritage. The aim here is to reach out to the consumers with end-to-end exposure on Nokia

products and services all under one roof.

According to Cliff Crosbie, global director, retail marketing, Nokia, the effort is to de-mystify technology

for consumers and help them make informed choices about mobile telephony.

2. Rural Markets

Initially, Nokia didn’t concentrate on the rural markets, but due to increased and intense competition in

the urban markets, it undertook major strategic steps to enter the rural markets. As per 2009 statistics,

there were about 249 million subscribers and 93 million rural subscribers in India; these represent 81

percent and 12 percent penetration in the respective markets as compared to the national average of 31

percent. This represents a huge, attractive and untapped potential for the telecom companies to exploit.

Tie-up with SKS Microfinance: In 2008 Nokia tied up with SKS Microfinance and Airtel to provide a

bundled offer to the rural consumers. Attracting rural consumers by teaming up with local organizations

has been a key part of the global strategy Nokia since 2006. According to D. Shivakumar, Nokia India's

vice president and managing director, Nokia saw the rural opportunities ahead of competition. Though

Samsung, LG, Sony Ericsson and Motorola have also been selling handsets in India, telecom observers

say Nokia has stood out from the rest by having formally forged a company-wide "social inclusion" policy

in 2006 to encompass low-income consumers in its growth strategy, essentially using India as a

laboratory for that strategy. Strategic tie-ups were a neat innovation from Nokia which created much

buzz and brand equity for the company.

Other Innovative Rural Channels: Further strengthening its first mover advantage Nokia is reaching to

millions of potential rural subscribers through innovative channels ‘showrooms on wheels’ and ‘Rural

care on the go’— marketing and servicing vehicles, respectively.

Tie-up with Yes Bank: To push social and financial inclusion further in the rural and semi-urban areas,

Nokia in August 2010, partnered with Yes Bank to launch mobile-payment solutions. Nokia Priority

Centres as well as multi-brand handset vendors will help rural population open bank accounts with Yes

3

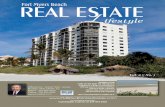

Nokia Chennai factory

Nokia Mother Warehouse, Gurgaon

HCL Distributor

Re-distribution Stockist Supplier (RDSS)

Retailers

Bank as well as perform basic transactions like debit/credit and transfer of funds. Once an account is

opened, customers can debit funds at the Nokia centers which would be transformed into digital money

on the phone. Nokia will train vendors across various cities who would be educating the consumers as

well as perform necessary KYC norms.

At present, rural consumers account for 25% of Nokia phone sales in India. With mobile phone

penetration in the rural market almost doubling to 20% over the past year -- to approximately 150

million, according to the Cellular Operator Association of India (COAI), a trade association -- Nokia has

been aggressively pursuing an even more targeted expansion strategy in smaller towns and villages.

With both home-grown and foreign rivals are muscling in on Nokia's rural territory, beating it down on

price, the challenge now for Nokia is to retain its first mover advantage.

3. Nokia distribution structure in India

Nokia started distributing its phones through a partnership with HCLI (formerly Hindustan Computers

Ltd.), which had already built an extensive network for its own products. Recently, Nokia has decided to

supplement that with its own distribution efforts. Nokia believed that there was a tremendous growth

opportunity and it was best exploited when the resources utilization of both companies was optimized.

Nokia and HCLI have decided to develop a go-to-market strategy to jointly address the coverage needs

of the urban and widely dispersed rural areas, while rest are handled individually. In the cities where the

market is maturing, buyers are looking at more sophisticated mobile phones, such as Nokia's E-series

phones (which serve business users) and the N-series (which have multimedia features). In rural India --

which constitutes 70% of the population -- affordability is an issue. So there is a different range for this

constituency.

4. Role of Channel Partners

4.1 Nokia

Nokia manufactures its mobile in Chennai manufacturing plant and

then it transfers to nokia’s mother depot which is located in Gurgaon.

They also provide assistance in selection of channel partners like

redistributors, Dealers, Franchisees, etc. Besides this they provide

monetary assistance in Store development for Nokia Priority dealers,

4

help in promotion of products on mass scale as well as in store and training of the sales force of partners

at every level.

4..2 HCLI

HCLI Info has been handling distribution of Nokia phones for 10 years. HCLI currently has 30,000 channel

partners (dealers), some of which it will transfer to Nokia. The absence of any other distribution partner

ensures that there will be no price-cutting.

HCLI starts distributing Nokia’s product from Gurgaon depot. HCLI takes order from 4 redistributers

appointed in Delhi to cover North, South, East and West zones and then it supplies the product to the

dealers with the help of RDSS (Re-Distribution stockiest supplier).

HCLI also takes care of appointing partners and operation of Nokia Care centres. Currently there are care

centres in more than 180 cities across India.

4.3 Re-Distribution stockiest supplier (RDSS)

There are 6 RDSS in Delhi NCR region with territories divided as North, South, East and West Delhi,

Noida and Gurgaon. RDSS are supposed to operate only in their designated territorial zone. In case of

conflict HCLI acts as the arbitrator.

RDSS, assisted by Nokia, also take responsibilities like recruiting sales force, training and developing.

Stocking norms of Nokia- HCLI agreement says that HCLI depot should have 7 days supply, RDSS in city

should have 5 days of supply.

4.4 Dealers

Nokia Priority dealers, Multi brand and individual dealers in Delhi NCR are all served by RDSS. Dealers

are explained the features of every new launch mobiles, different schemes and offers by Nokia’s

representatives. Re-supplies are always just a phone call away and the delivery is made within a few

hours. Besides, Nokia assists most dealers in the region in the store set-up and design. The price points

sometimes dictate the type of outlet.

5

Distribution Channel

Sales Force

Penetrate market deeper

Explore new markets

Assist in new product

Receivable collection

Share & gain market insight

Nokia Care Centres

5. Sales Force Design:

Sales Force Objective:

Maximize sales of Nokia handsets with high-end products as the preferred ones

Promotion of services provided by Nokia such as OVI suite, mobile email, music etc.

Sales Force Strategy:

Contractual Sales Force: Outsourcing sales to regional company (People Concept in Lucknow and

some parts in North India)

Sales Force Structure & Size:

6

Sales Force Objective

Sales Force Strategy

Sales Force Structure

Sales Force Size

Sales Force Compensation

1 regional general manager in each region (N,S,E,W)Regional General Manager

3-4 regional sales manager in each regionRegional Sales Manager

1 ASM per state segregated on basis of market & a sales forceFFT reports to Nokia’s ASM

Area Sales Manager (ASM)

Managed by the outsourced companyDirect Interaction with the customersField Force Team (FFT)

6. Sales Force Compensation:

In an interview with Nitin, a sales representative of Nokia in Lucknow, he stated that the entire

Compensation policy is managed by the regional company which has been responsible for the sales of

Nokia.

Quantification of Sales-force compensation components: (People Concept in Lucknow)

Fixed amount: The fixed component is zero

Variable Amount: 100 per cent salary of a sales person is variable. Half of the variable amount is

dependent on the volume of sales (performance) and the other half on behavioral factors

7. Fitness of Strategies

Outsourcing sales responsibility to regional company helps Nokia in lengthening its reach to

remotest area in the region. They need not train their employees to adjust to the local

environment.

Design of sales force compensation is in the hands of regional company and Nokia has to pay

only a commission to that company. 100 per cent variable pay puts an enormous onus on the

sales force to promote the sales or services provided by Nokia.

Main priority of sales force is the sales of high-end products. However, the same sales force also

caters to lower-end products.

Competition in High-end: Nokia is expected to report its third profit fall in a row as the mobile

phone company struggles to compete against high-end smart phones of Apple and Samsung,

while also losing share at the cheaper end of the market. (Source: http://

economictimes.indiatimes.com/news/international-business/nokias-market-share-troubles-to-

hit-profits/articleshow/7319149.cms).

Hence, the strategy to promote high-end phones is to increase profits and market share, which

has been diminishing in recent times.

8. Major Problems Faced by the distributors

Terms and condition of the deal between Nokia and HCLI has never been revealed in the public domain.

Hence, the problems faced by HCLI are not known publicly. Since, the deal to divide distribution

territories was signed in 2006, there has been some issues for HCLI. HCLI shares have suffered on share

7

market. Nokia has also refused to confirm or deny plans on appointing distributors for the territories

under its control after the revised agreement.

On its part RDSS are quite happy with their functioning. They are satisfied with the products, quantum of

sales and promotional support provided by the company.

A few minor issues that possibly could become concern in future were :

Credit period given by Nokia is very low compared to its competitors – just 7 days compared to 15

days offered by Samsung and LG

Margins offered are very low compared to competitors who could become larger player over new

few years. Nokia offers just 2% margin to dealers compared to around 10% offered by LG and 18%

offered by Samsung

The damage piece policy has been cause of concern for some dealers/ RDSS. Although minimal

damaged pieces have been reported over years, if any physically damaged handset is found, it

sometimes leads to dealer/RDSS having to bear with it.

8.1 Major Points of conflict

There has been no point of conflict reported by RDSS or the dealers over the years. Nokia-HCLI

has marked the territories very effectively and has been strict in ensuring that territories are not

encroached upon by dealers or RDSS. There has also been no conflict amongst channel partners

at different levels or channel partners at same level. Payments, delivery of goods ordered and

services have also been impeccable.

Relations between Nokia and HCLI are deeply ingrained in their system and if there has ever

been any conflict or disagreement, it has never been reported in any open forum.

8.2 Major Problems / Issues Identified

With market scenario changing, smart phones are increasing their share of total mobile phones

market. Although Nokia too has presence in this segment, but with multiple recent offerings

launched by Blackberry, Apple and Samsung market is set to become more competitive for Nokia.

Compared to Nokia all these companies are offering better credit terms and margins and this may

lead to dealers and RDSS moving over to these competitors.

Dealers reported Nokia’s executives never try to pressurize them in keeping their phones on

prominent displays or push sales when customer walks into the store. On the contrary, LG,

Samsung and other rival brand’s sales executives repeatedly exhort dealers to keep their products

in prominent displays. They even ask the dealers to push their handsets when customer asks for

Nokia. Till now Nokia has done strong promotion and relied on the pull of its products and brand

8

to make the sales. But in future, as the market gets competitive, Nokia will find this tougher and

should start forming strategy to counter such moves of its competitors.

Service centers of Nokia are managed by HCLI in assistance with Nokia personnel. Although,

defects and problems in handsets have been very low compared to competitors, the handling of

service has not been impeccable. Service centers usually take time and at some centres have long

waiting list. This makes customers to move to cheaper and convenient local mobile repair shops.

As parts used are not genuine and sometimes results in handset damage, customers end up

blaming Nokia as much as they blame Local shop.

9. Recommendations

Review the credit period allowed to dealers and RDSS periodically taking in consideration the

competitive structure of the market

Have a multiple complaint channels as channels tend to get choked due to the bulk of complaints

coming in everyday. Nokia Priority dealers can be used as centres where complaints can be

registered and can be dealt in an organised way

Nokia has to be make its sales executives more pushy keeping in mind the tougher competition

from previously smaller players like LG and Samsung

The distribution network of Nokia is very wide but there are certain areas where no brands has

reached like sector -3,4, Harola market in Noida , Govind puram in Ghaziabad , Certain areas on GT

road, but in these areas distribution is not very effective and thus Nokia should work on its

distribution in these areas.

Some dealers said that missing piece in Nokia’s product line is absence of stylish mobiles in range of

Rs.3000-5000. This highlights reliance of Nokia on HCLI for market information gathering. Nokia in itself

is disconnected from its dealers and has no mechanism to gather this insight from them.

9

![RakutenTechConf2013] [D-3_1] LeoFS - Open the New Door](https://static.fdocuments.in/doc/165x107/545cf17fb1af9f4b0a8b4920/rakutentechconf2013-d-31-leofs-open-the-new-door.jpg)