Noble Announces Acquisition of Pacific Drilling...4 High Specification UDW Drillship Fleet Pacific...

Transcript of Noble Announces Acquisition of Pacific Drilling...4 High Specification UDW Drillship Fleet Pacific...

Trusted Partner

Noble Announces Combination with Pacific Drilling

Company Presentation | 25 March 2021

2

Transaction Overview

Summary

Transaction

Structure

▪ All- stock transaction

▪ Pacific Drilling (“PACD”) to receive 16.6 mm newly-issued Noble Corporation (“Noble”) shares

Pro-Forma

Ownership(1)

▪ Noble shareholders: 75.1%

▪ PACD shareholders: 24.9%

Leadership and

Governance▪ Noble’s board of directors and senior executive leadership will continue

Key Approvals /

Closing

Conditions

▪ Already approved by majority of PACD shareholders

▪ Customary closing conditions

Financing /

Capital Structure

▪ PACD to be acquired on a debt-free basis

▪ Noble to receive PACD cash balance at closing

Timeline ▪ Targeted closing: April 2021

(1): Ownership is calculated using 50mm shares for Noble. Share count excludes dilution from outstanding Noble warrant tranches and MIP.

3

Strong Strategic Rationale

1 High specification UDW drillship fleet

2 Shared culture of safety and operational excellence

3 Expands customer relationships and geographic footprint

4 Ability to integrate quickly and realize meaningful cost synergies

5 Strengthens balance sheet

4

High Specification UDW Drillship Fleet

Pacific Drilling Fleet Overview

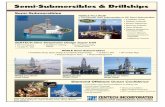

7th Generation Drillships 6th Generation Drillships

Rig Name Khamsin Sharav Meltem Santa Ana Scirocco

Rig Design Samsung 12,000 Samsung 10,000

Year In Service 2013 2014 2014 2011 2011

Max Water Depth – 12,000 ft

Main Hookload –2,500,000 lbs

2,000,000 lbs

Dual BOP Dual BOP capable

Dual Activity

Customer(1)

Note: Excludes Bora and Mistral

(1): Currently (or will be) under contract

✓ ✓ ✓ ✓ ✓

✓ ✓ ✓

✓ ✓ ✓ ✓ ✓

✓ ✓ ✓

5

Ability to Realize Meaningful Synergies; Noble Committed to Capital Discipline

1

Expect to realize at least $30 million of annual pre-tax cost synergies

• Ability to integrate Pacific Drilling assets into Noble quickly; run rate

achieved by end of 2021

Capex synergies given the complementary nature of the two drillship fleets

• Sharing of capital spares / efficiencies gained through improved inventory

management

2

The Bora and Mistral will be divested quickly to eliminate stacking costs

• Represents over $10 million per year at current run rate

3

6

Rig Demand Expected to Bottom in 2021

Historical and Estimated Floater Demand Historical and Estimated Jack-up Demand

Source: Rystad Energy UCube; Rystad Energy research and analysisNumber of rigs operated will exceed number of rig years of demand

340

310

330

350

0

360

320

300

324

20222016 2020 20242017 2019 2021 2023 2025

291

296

308

314

2018

321

300

318

338

307

+38

110

190

170

150

0

130

140

160

120

180

20252016 2021

120

2020 202320222019

109

2024

129

102

124

140

2018

111110

2017

155

120

+38

Rig years Rig years

The Noble Platform

8

3

1

Unique Investment Opportunity and Timing

Premium fleet of 24 offshore drilling rigs (1)

(1): Pro Forma for the Pacific Drilling fleet

Unwavering commitment to safety and operational excellence

Cash flow focused

Strong, resilient and flexible balance sheet

Ideal platform to capture value in a changing offshore drilling landscape

2 Strategic and diverse customer relationships supported by strong backlog

4

5

6

9

Note: Pro Forma for the Pacific Drilling fleet

(7) 7G Floaters (4) 6G Floaters (9) High-Spec Jack-Ups (“HS JU”) (1) Ultra HS JU

High Specification Fleet

The Noble Fleet

Contract / future contract

✓ Young fleet (average fleet age of 8 years)

✓ Technically advanced

✓ Strategically positioned

✓ Strong contract coverage

(1) Semisubmersible

(2) Premium Jackups

✓ ✓

✓ ✓

✓✓

✓

✓ ✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

10

Region Middle East

Select Customers

Strong Customer Relationships, Diverse Footprint

Expanding Existing Geographical Footprint and Customer Roster

Note: Pro Forma for the Pacific Drilling fleet, Excludes Bora and Mistral

Noble Floaters Noble Jack-ups Pacific Drilling

22

1

4

5

5

1

1

Region North Sea

Select Customers

Region Guyana / Suriname

Select Customers

2

Region Far East / Australia

Select Customers

1

Pacific Drilling Stacked

Region West Africa

Select Customers

Region US GOM / Mexico

Select Customers

Region Malaysia

Select Customers

Region Trinidad & Tobago

Select Customers

Noble Floaters

Pacific Drilling

Pacific Drilling Noble Jack-ups

Noble Jack-ups

Noble Jack-ups

Noble Jack-ups

Noble Floaters

Noble FloatersRegion US GOM

Select Customers

11

60%20%

10%

7%3%

Acquisition Enhances Already Strong Backlog Position and Strategic Customer Relationships

Revenue Backlog By Contractor Pacific Drilling’s Customer History

Note: Noble backlog as of emergence date, backlog for other companies as of latest company fillings. Pro Forma for the Pacific Drilling fleet, and Pacific Drilling

customer history is sourced for all rig years worked from IHS Rigbase.

$1.9

$1.3

$1.2

$1.2

$10.2

$1.7

$1.7b of revenue backlog with blue chip customers such as Exxon, Shell, Equinor and Saudi Aramco

Rig Years$b

Combination with Pacific Drilling enhances relationships with customers with significant drillship demand

Pacific Drilling

12

Track Record for Beating the Market

Jack-Up & Modern Drillship Contract Awards & Utilization

Note: Average total utilization for all jack-ups excluding owner operated, and those rigs working in China and Iran and 6th and 7th generation drillships. Contract

term fixed includes only new, mutually agreed contracts, excluding owner operated, Iranian & Chinese fixtures

Co

ntr

act

Term

Fix

ed (

mo

nth

s)

Noble Ownership of

Global Rig Fleet

Total U

tilization

(%)

5% 4% 4% 4% 4% 4% 4%

0

10

20

30

40

50

60

70

80

90

100

2 000

500

0

1 000

1 500

2 500

3 000

3 500

4 000

4 500

2018

3%

10%

2014

3%

7%

2015 2016 2017

6%

2%

2019

12%

2020

Noble Competitors % Noble % Competitors

89% Noble fleet utilization vs. 65% competitor utilization in 2014-2020

13

Culture of Operational Excellence

Key Drivers

Core Values• Honesty and

Integrity• Safety • Environmental

Stewardship• Respect• Performance

Committed and accountable

Problem solvers

Relationship driven

Invest in our people✓ Top Quartile Utilization

✓Best in class cost efficiency

✓ Zero Process Safety Events in 2020

✓ Top Quartile Subsea Downtime

✓ 2020 LTI Free

✓ Long Term Customer Partnerships

14

Reduced Rig Operating Costs

Reduced Shorebased

Costs

Disciplined Approach to Fleet Mgmt

Disciplined Approach to

Bidding

Improved Capital

Structure

Cash Flow Focused

✓ Reduced labor costs through standard manning and nationalization

✓ Improved inventory management and realized maintenance program efficiencies

✓ Centralized support functions

✓ Significantly rationalized onshore resources

✓ Dispose of rigs to eliminate stacking costs when rig has unfavorable outlook

✓ Meaningfully reduced interest expense

✓ Appropriately priced liquidity through new credit facility

✓ Continue to evaluate new tenders based on “fully burdened” costs

✓ Appropriately highlight the value of Noble’s assets, people and brand

Noble is laser focused on cost structure optimization

15

Drillship Jack-up (JU-3000N)

Meaningful Reduction in “Fully Burdened” Breakeven Dayrate

“Fully Burdened” Breakeven Dayrate

Note: Allocations based on expected operating days for 2021, including a higher allocation for a Drillship than a Jackup.

Sub $200k

2 Years Ago Current

Sub $100k

2 Years Ago Current

✓ “Fully Burdened” includes all direct costs and allocations of indirect costs (all of Noble’s indirect costs are allocated to rigs)

✓ Includes handrail costs, capex, downtime, and allocations for shorebased burden, interest expense and cash taxes

$k/day $k/day~35%

reduction

~35% reduction

16

Strong Balance Sheet and Ample Liquidity

Best-in-Class Balance Sheet with M&A Flexibility Pro Forma Capital Structure Highlights

✓ Strong balance sheet supported by significant liquidity position

✓ Pacific Drilling assets are being acquired on a debt-free basis

✓ Noble to receive approximately $30 million in cash from PACD at closing (net of estimated transaction costs)

✓ Capital structure has built in flexibility to facilitate M&A

✓ Pacific Drilling will be in separate credit silo

(1) Pro forma for PACD acquisition

Total Debt

Sub $400 million

Total Liquidity

$600+ million

First Debt

Maturity

2025

Backlog

$1.7 billion

(1)

(1)

(1)

17

High Cash Generation Potential

Illustrative EBITDA generation from active fleet(1)

(1): Annual EBITDA calculation for 11 active floaters (assumes 1 floater is stacked/scrapped) and 12 active jack-ups under Noble’s current cost structure. Noble

Lloyd Noble dayrate is illustratively assumed at $300k for all cases.

Floater Dayrates $200k $250k $300k

Jackup Dayrates $75k $100k $125k

Fleet Utilization 80% 90% 95%

EBITDA ~$130mm ~$520mm ~$880mm

18

Why Noble?

Noble is theplatform for

investment in offshore drilling

Premium Fleet

Solid Backlog, Customers

Operational Excellence

Strong Balance Sheet

Cash Flow Focused