New base special 10 july 2014

-

Upload

khdmohd -

Category

Economy & Finance

-

view

30 -

download

1

Transcript of New base special 10 july 2014

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 1

NewBase 01 July 2014 Khaled Al Awadi

NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

Drydocks World repeats its success with major refurbishment of NDC’s rig Al Ghallan. Press Release DPW

Drydocks World, the international service provider to the shipping, maritime, offshore, oil, gas and energy sectors, announced the completion of a major refurbishment carried out on National Drilling Company’s

(NDC) Offshore Drilling Rig Al Ghallan. The project is part of a series of four rig repair and refurbishment projects signed with NDC in 2013. Before that, eight projects were completed. The numbers of projects carried out for NDC have progressively increased over the years.

Drydocks World has a well-established reputation in the rig repair, refit and refurbishment segment. The company has successfully dry-docked, repaired and refurbished 125 Offshore Platform Vessels (OPV) belonging to major companies. The shipyard has extensive experience on drilling

rigs and jack-up drilling units. There are instances where a basic hull structure was transformed into a complete OPV with newly fabricated bracing legs, columns, spud cans, accommodation structures and jack up & drilling systems.

His Excellency Khamis Juma Buamim, Chairman of Drydocks World & Maritime World is a staunch advocate of offering quality services to the offshore oil & gas and energy sectors as he foresees growing opportunity in these rapidly evolving sectors. According to him, “We are grateful to NDC for their continued faith in our services. We offer services that are suited to the company’s requirements related to rig refurbishment and refit. We have the capability to meet all the requirements of NDC and plan to develop the rig business further by joining hands with major suppliers and certified subcontractors. As a regional service provider we are delighted to work with prominent companies in the region and make effective contributions to the growth of the offshore oil & gas sector. Deep water exploration and the increased requirements for specialized vessels for offshore exploration & production; accommodation rigs or offshore support vessels has been one of our priority targets for future business. We have a dedicated team of highly skilled employees dedicated to address the repair, refit and refurbishment needs of offshore drilling rigs. Our facility has three large graving docks and well-equipped workshops that provide us the flexibility of addressing assignments that are of a highly challenging nature.”

Mr. Abdalla Saeed Al Suwaidi, Chief Executive Officer of NDC underlined the importance of the modernization projects of the existing rigs in maintaining the best fit-for-service condition while extending

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 2

its remaining life in the most reliable, safe, and cost-effective way possible.

“These major refurbishment projects performed in parallel with the fleet expansion plans to obtain new and advanced offshore and onshore rigs are contributing considerably in strengthening NDC’s operational excellence and sustaining the maximum levels of safety, environment protection and effective performance. This will certainly enable NDC to serve its clients competently and always meet their operational requirements and achieve their satisfaction”, he commented. NDC's CEO expressed his appreciation for Drydocks World for their efforts and commitment to HSE and Quality.

Rig Al Ghallan is a Self-Elevating Cantilever Type Mobile Offshore Drilling Unit with three triangular lattice type legs, which are 234 ft long. The work carried out on the rigs include modification of three spud cans of 160 tonnes each, including replacement of cathodic protection, painting, placing height markings, carrying out an inclining experiment and updating the rig’s operating manuals. Nearly 55 tonnes of steel were replaced in the tanks.

Major refurbishment was carried out in the Accommodation. The rig’s three cranes were dismantled and overhauled. High pressure Koomey lines were replaced. Pipes around the rig were revamped. An engineering study was carried out based on which the ventilation in the Sewage Treatment Plant and transformer room were improved. Cantilever skidding gears, air hoists, air tuggers, raw water tower elevation system, gears and bearings and dump and equalizing valves were overhauled. Other work included MPI inspection of legs, painting of the derrick and blasting and painting of hull, tanks and mud pits.Drydocks World has now developed its capabilities to build highly sophisticated drilling rigs.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 3

Middle East crude oil importers shift focus to Asia Oman Observer + NewBase

The ripple effects of the North American energy boom from major importer to soon-to-be exporter are being felt across the Middle East, Russia and China. This trend will result in new sources of supply, increase competition, reshape the global geopolitical landscape and create greater interdependencies among nations, according to the Deloitte’s 2014 Oil and Gas Reality Check report. The report focuses on expansion and contraction on a number of fronts: the waxing and waning of dominance among suppliers; the progression into globalisation from regionalisation in energy markets; the growing shares of some fuels and the declining roles of others in the global energy mix; and, the opening and closing of borders in response to geopolitical concerns. This year, energy markets have been marked by geopolitical motivations and pragmatism to an extent never seen before.

For the Middle East, crude cargoes are anticipating a shift as exports are increasingly being directed eastward towards Asia rather than westward towards the US and Europe,” said Kenneth McKellar, Energy and Resources leader at Deloitte Middle East. “However, we believe that predictions of US disengagement from the Middle East are over stated”. The Deloitte report states that given the fungibility of world oil markets, a disruption in Middle East oil supplies will reverberate back to the US domestic market regardless of whether the region remains a major source of crude imports or not. In addition, the region’s volatility continues as the ‘new normal’ since the “Arab Spring.”

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 4

The Deloitte report finds that if the US is now less dependent on Middle Eastern supplies, Asia and China have grown more so. China adopted a ‘go out’ energy policy after 1992, when the country became a net importer of oil. Sluggish domestic supply growth and poor pipeline economics left China with few options but to search out new supplies overseas, and it found them to a great extent in the Middle East. “Today China is dependent on the Middle East for a large percent of its crude imports and Middle East exports to China are expected to rise,” explains McKellar. The report outlines five key areas: North American revolution: The US is currently positioned to be a net exporter of natural gas by the end of this decade according to projections from the US Energy Information Administration

(EIA). “Some fear this growing feeling of self-sufficiency will translate into greater isolationism and a reluctance to remain engaged in international affairs. However, I believe that this scenario is unlikely as we begin to see new sources of supply and greater competition for demand, particularly in Asia Pacific. A simultaneous shift toward cleaner fuels in the global energy mix bodes well for natural gas, and consequently for LNG as natural gas globalises,” said McKellar. New sources, new geopolitics: The

Organization of Petroleum Exporting Countries (OPEC) and Russia have dominated the oil and gas export environment for over half a century. Today, new suppliers are challenging their dominance, and in the process, altering the geopolitical landscape. “New sources of supply will shake up the global hydrocarbon markets in the next decade. Increased US domestic output, as well as production growth in Canada, Mexico, Brazil and Kazakhstan, will re-shape global oil and gas markets and the geopolitical landscape. “We are likely to see decreased dominance of traditional producers, mainly Opec countries and Russia, that will be challenged, and they will

be forced to compete more aggressively to maintain their market share and influence,” said McKellar. A change in the global order: The global energy mix is shifting towards cleaner fuels such as natural gas. In North America, natural gas is increasingly being used in power generation, manufacturing, and transportation. Japan also plans to increase the share of natural gas in its power mix, continuing a course that was set after the Fukushima Daiichi accident forced a pause in its use of nuclear power. In Europe, the desire to adopt cleaner fuels will continue despite some recent backtracking on more costly renewable sources, which has temporarily driven the region towards greater consumption of coal.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 5

Shale boom confounds forecasts as US set to pass Russia and Saudi Reuters + NewBase

Four years into the shale revolution, the US is on track to pass Russia and Saudi Arabia as the world’s largest producer of crude oil, most analysts agree. When that happens and by how much,

though, has produced disparate estimates that depend on uncertain factors ranging from progress in drilling technology to the availability of financing and the price of oil itself. Forecasts for US shale oil production vary from an increase of 7.5 million barrels per day by 2020 — almost doubling current domestic output of 8.5 bpd — to a gain of 1.5 million bpd, or less than half of what Iraq now produces.

The disparities are a function of the novelty of the shale boom, which has consistently confounded forecasts. In 2012, the US Energy Information Administration (EIA) estimated that production from eight selected shale oil fields would range from 700,000 bpd of so-called tight oil to 2.8 million bpd by 2035. A year later, those predictions had been surpassed.

“The key issue is not whether production grows, it’s by how much,” said Ed Morse, global head of commodities research at Citigroup in New York. “We’re only at the beginning of the first inning and this is a nine-inning game.”

The stakes couldn’t be bigger, ranging from the multibillion-dollar investments needed to explore and drill to oil supply issues that go to the heart of US foreign policy. Relations with countries ranging from Iraq and Iran to Russia, Ukraine, Libya and Venezuela are coloured to one degree or another by the question of energy.

The US, a nation transformed by the 1973 Arab oil embargo, could become energy independent by 2035, according to bullish forecasts from BP Plc and the International Energy Agency. Coupled with growing output from oil-rich neighbours, the continent has a growing shield from supply shocks.

“Looking at North America, including Canada and Mexico, we’re much more politically stable,” said Lisa Viscidi, Programme Director of the Inter-American Dialogue in Washington. Still, many drillers have found that healthy forecasts of oil in the ground don’t guarantee it can be economically extracted. For example, based on the promise of free-flowing oil, Chesapeake Energy’s then-top executive Aubrey McClendon bought up land in Ohio’s Utica shale oil field and touted it in 2011 as a $500 billion opportunity. State geologists estimated the shale play could hold as much as 5.5 billion barrels of reserves.

But last year, after months of drilling, Chesapeake’s average output per well per day was just 80 barrels. Competitor BP wrote off $521 million and exited the Utica just two years after leasing 85,000 acres.

Shale production from the oldest shale patch, the Bakken of Montana and North Dakota, alone may rise to as much as 1.74 million barrels per day in the second half of this decade, according to the highest of six estimates compiled by Reuters. The lowest was 1 million bpd. Even that range belies disagreement over just how fast output will grow — and when it may peak. The EIA, the US agency responsible for energy forecasts, predicts that tight oil output will rise 37 per cent from about 3.5 million bpd in 2013 to 4.79 million barrels per day by 2020. The forecast

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 6

includes the Bakken, Three Forks and Sanish, Eagle Ford, Woodford, Austin Chalk, Spraberry, Niobrara, Avalon/Bone Springs and Monterey.

“There are other forecasts that are much more optimistic than this one,” said agency administrator Adam Sieminski, speaking at a conference in New York. “We’re still a little concerned about what the geology looks like for crude oil production. As technology moves, these numbers could grow.” The agency has already made some big adjustments to previous estimates.

It recently slashed its forecast recoverable reserves for California’s Monterey shale to just 600 million barrels, 96 per cent less than the total amount of oil in place, citing the difficulty in pumping it out economically. IHS Energy’s projections are higher, with an estimated 6 million bpd from the Bakken, Eagle Ford and sections of the Permian and Niobrara by the end of 2020.

At the low end, Energy Aspects Ltd sees production of 3.5 million barrels a day from shale by 2017, a 1.5 million bpd increase from its current output estimate of 2 million bpd. “In order to keep production going, you have to maintain your drilling and therefore, capex investments need to be in a continuous cycle,” said Virendra Chauhan, an oil analyst at Energy Aspects in London.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 7

QPI, Shell sign memorandum of co-operation on partnership in Brazil Gulf-Times , Qatar

Qatar Petroleum International (QPI) and Shell yesterday signed a memorandum of co-operation in support of their new international upstream partnership in Brazil. The agreement follows QPI’s $1bn purchase in April 2014 of a 23% stake in a major oil production asset, offshore Brazil operated by Shell known as BC-10 or Parque das Conchas.

The deal was signed in the presence of HE the Minister of Energy and Industry and Chairman of Qatar Petroleum, Dr Mohamed bin Saleh al-Sada and Chief Executive Officer of Royal Dutch Shell, Ben van Beurden. The agreement was signed by Nasser al-Jaidah, QPI chief executive officer and Wael Sawan, managing director and chairman of Qatar Shell Companies. BC-10 is currently producing approximately 50,000 barrels of oil equivalent a day (boe/d). Since coming on-stream in 2009, BC-10 has produced more than 80mn boe.

Phase 2 of the project, to tie-in the Argonauta O-North field, came online on October 1st 2013, with an expected peak production of 35,000boe a day. A final investment decision for a Phase 3 of the BC-10 project was taken in July 2013 and once online is expected to reach a peak production of 28,000boe a day. Pictured is a vessel involved in BC-10 offshore field development.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 8

Honeywell signed up for UAE refinery project Source – Honeywell

Honeywell, a leading diversified technology and manufacturing leader, said the green fuels process technology of its company UOP has been selected by Petrixo Oil & Gas to produce renewable jet and diesel at a new refinery to be built in Fujairah.

UOP is a leading international supplier and licensor of process technology, catalysts, adsorbents, equipment, and consulting services to the petroleum refining, petrochemical, and gas processing industries.

Petrixo will use UOP Renewable Jet Fuel process technology to process approximately 500,000 metric tons per year of renewable feedstocks into renewable jet fuel and renewable diesel, also known as Honeywell Green Jet Fuel and Honeywell Green Diesel.The process technology is capable of processing a variety of renewable feedstocks. Petrixo announced earlier this year that it will invest $800 million to build the new refinery, which will have a design capacity of 1 million tons per year of biofuel products, and will be the first commercial-scale renewable jet fuel production facility outside of North America. Petrixo Oil & Gas CEO Dr. Eid Al Olayyan said the company believes that new energy solutions were immensely important for scalable, environmental and renewable solutions. “UOP’s green fuels technologies are proven refining solutions that produce high-quality products compatible with petroleum-based fuels,” he noted. According to him, the UOP technology is designed to provide flexibility to adjust the feedstock mix depending on parameters such as cost and availability, as well as to enable adoption of newer-generation feedstocks such as oils derived from algae and halophytes as scalable supply chains for these lipids develop. “UOP’s renewable process technologies produce real fuels, rather than fuel additives like biodiesel, that fit seamlessly into existing fuel supply chains,” remarked Veronica May, the VP and general manager of UOP’s Renewable Energy and Chemicals business unit. “The renewable fuels produced by our technology also offer lower greenhouse gas emissions relative to traditional petroleum-based fuels,” she observed. "Blended up to 50 percent with petroleum-based jet fuel, Honeywell Green Jet Fuel requires no changes to aircraft technology, meets all critical specifications for flight, and can reduce greenhouse gas emissions by 65 to 85 percent compared to petroleum-based fuels," she added.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 9

Forum Energy gets SC72 extension

Forum Energy, the UK incorporated oil and gas exploration and production company with a focus on the Philippines, today confirms that the Philippine Department of Energy has granted the Company’s request for an extension to the second sub-phase of Service Contract 72 (“SC72″).

The deadline for completion of the second sub-phase, comprising the drilling of two appraisal wells, has now been extended by one year to 15 August 2016.

The company has said that further details regarding the Company’s plans for SC72 will be made in due course, as and when appropriate.

During 2011, 2,202 line-km of 2D seismic, gravity and magnetic data was acquired over SC72 in order to further define additional leads already identified, while 565 sq km of 3D seismic data were acquired over the Sampaguita Gas Field.

Seismic data interpretation of these surveys was carried out by Weatherford Petroleum Consultants (“Weatherford”) in 2012. The results have indicated the Sampaguita Gas Field to contain contingent resources of 2.6 TCF Gas in Place (GIP) and potential upside of 5.5 TCF of contingent and prospective Gas in Place (GIP) resources.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 10

Indonesia: Technip secures onshore contract for the Matindok Gas Development project. PR – Technip + NewBase

Technip, in a consortium with Wijaya Karya (Persero) (WIKA), has been awarded an onshore lump-sum contract by Pertamina EP for the Matindok Gas Development project located in Central Sulawesi, Indonesia.

The contract covers the engineering, procurement, construction and installation of gas well pads, flowlines, pipelines; a central processing plant (672 million cubic meters per year of gas) with gas treatment facilities such as acid gas removal as well as sulphur removal, and related infrastructure. Sweet gas from Matindok central processing plant will be sent to the Donggi Senoro liquefied natural gas (LNG) plant.

Technip’s operating centre in Jakarta, Indonesia, will carry out the detailed engineering, procurement of critical process equipment, while WIKA will carry out the construction activities along with the procurement of major items. The project is scheduled for completion in the first half of 2016.

KK Lim, President of Technip in Asia Pacific, stated: 'We are delighted to be renewing our ties with our client Pertamina and supporting them in bringing the Matindok field onstream. Technip’s proven track record in delivering EPC contracts will ensure that the project is delivered to the highest standards of safety and quality.'

The Matindok Gas Development project:

The Matindok field, solely own by Pertamina, has about 1 billion cubic meters per year of gas and consists of the Donggi, Matindok, Maleoraja and Minahaki fields.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 11

UK: ConocoPhillips confirms Jade gas condensate field extension Source: BBC News

US energy giant ConocoPhillips has confirmed that first production has been achieved from an appraisal well, extending the Jade gas condensate field in the UK Central North Sea. The Jade field is tied back to the Judy platform, which is located about 150 miles south-east of Aberdeen. ConocoPhillips is operator and holds a 32.5% stake in the field.

Its co-venturers are BG Group (35%), Chevron North Sea (19.93%) Eni UK (7%) and OMV (UK) (5.57%).

The appraisal well was drilled by the Maersk Resilient rig from the Jade platform and went online

last month.

David Chenier, UK president for ConocoPhillips, said: 'This discovery adds to our company portfolio of commercial discoveries in the Central North Sea and it will help to ensure continuity of

production from the J-Area. The achievement of production from this well means that another structure to the south has also now been de-risked for targeting as a potential development opportunity for the future.'

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 12

Russia: Japan's Mitsui OSK Lines to launch Arctic Ocean LNG

route from Russia's Yamal in 2018 Source: Reuters + NewBase

Japan's Mitsui OSK Lines (MOL) said on Wednesday that it will start transporting liquefied natural gas (LNG) through the Arctic Ocean in 2018 using icebreaker LNG tankers.

MOL, with its joint venture partner China Shipping, has ordered three icebreaker LNG carriers from South Korea's Daewoo Shipbuilding & Marine Engineering Co. The new tankers will deliver LNG to Europe and Asia from a gas plant to be built on the Yamal Peninsula in northern Russia by Russia's second-largest gas producer Novatek, France's Total and China

National Petroleum Corporation.

With the melting of sea ice due to global warming effects, the Arctic Ocean route, the shortest shipping route linking Europe and Asia, has opened up in the past few years, a MOL spokesman said. The icebreaker tankers are expected to deliver LNG to Europe via the route all year while they will likely transport the gas to Asia only between July and November, the spokesman said.

The new route through the Arctic Ocean will enable the gas to arrive from the Yamal plant to Europe in about 11 days, and Northeast Asia including Japan in about 18 days, according to the spokesman.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 13

South Stream Offshore Pipeline ESIA Report released Source: South Stream Transport

South Stream Transport has published the findings of the Environmental and Social Impact Assessment (ESIA) for the Russian Sector of the South Stream Offshore Pipeline.

The ESIA Report contains information about the potential impact of the Project on the environment and people living in the area. The assessment was made by international experts and shows that construction and operation of the four pipelines and landfall facilities in Russia is not expected to have significant environmental or social impacts.

ESIA and EIA ensure responsible Project development

In order to develop the Project in an environmentally and socially responsible manner, South Stream Transport has conducted an impact assessment consisting of two parallel processes: an Environmental Impact Assessment (EIA) in accordance with national Russian legislation; and an Environmental and Social Impact Assessment (ESIA) based on guidelines of international finance institutions, such as those of the World Bank’s International Finance Corporation (IFC).

The EIA Process according to Russian legislation has been finalized, and the Russian Ministry of Construction, Housing and Utilities issued an onshore construction permit in June 2014. The ESIA process following international guidelines is expected to last until early autumn.

The ESIA Report was prepared by independent specialists at URS Infrastructure and Environment UK Limited and provides additional information on environmental, cultural heritage and socio-economic aspects. For example, it includes more detailed information on biodiversity, intangible cultural heritage, social matters and the Company’s ongoing efforts to engage with stakeholders on the Project. It also provides an assessment of potential cumulative impacts, taking into account both the planned South Stream Offshore Pipeline and other planned or known developments in the area.

According to South Stream Transport, the ESIA Report contains numerous mitigation and environmental protection measures to reduce any negative impacts that may otherwise result from the Project. The experts responsible for this ESIA Report are confident that as a result, the Project will not have a significant social or environmental impact.

The ESIA Report is available online at http://www.south-stream-offshore.com/esia/esia-russia/

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 14

Statoil gets approval to drill Ensis well in Barents Sea Source :Statoil

Norwegian oil giant Statoil has been given approval to carry out exploration drilling of

the well 7125 4-3 (Ensis) in production licence 393 in the Barents Sea using the

Transocean Spitsbergen semi-submersible drilling rig.

Water depth at the site is approximately 294 metres and it is around 42 kilometres to the nearest mainland at Knivskjelodden in Nordkapp municipality in Norway.

Drilling is planned to begin 1th of September 2014, with a duration of approximately 30 days, depending on whether a discovery is made.

Transocean Spitsbergen is a semi-submersible drilling facility of the Aker H-6e type. It was built at the Aker Stord yard in 2009.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 15

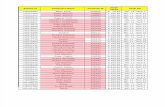

US: Six formations are responsible for surge in Permian Basin

crude oil production . Source: U.S. Energy Information Administration

The Permian Basin in Texas and New Mexico is the nation's most prolific oil producing area. Six formations within the basin have provided the bulk of Permian's 60% increase in oil output since 2007. Crude oil production in the Permian Basin has increased from a low point of 850,000 barrels per day (bbl/d) in 2007 to 1,350,000 bbl/d in 2013.

Largely as a result of this growth, crude oil production from Permian Basin counties has exceeded production from the federal offshore Gulf of Mexico region since March 2013, making the Permian the largest crude oil producing region in the United States. In 2013, the Permian Basin accounted for 18% of total U.S. crude oil production.

The recent increase in Permian crude oil production is largely concentrated in six low-permeability formations that include the Spraberry, Wolfcamp, Bone Spring, Glorieta, Yeso, and Delaware formations. Production from these formations has helped drive the increase in Permian oil production—particularly since 2009—despite declining production from legacy wells.

Almost three-quarters of the increase in Permian crude oil production came from the Spraberry, Wolfcamp, and Bone Spring formations. Counties in these three formations have driven the increase in the Permian Basin's horizontal, oil-directed rig activity in recent months.

Production from these three formations collectively increased from about 140,000 bbl/d in 2007 to an estimated 600,000 bbl/d in 2013, increasing their share of total Permian oil production from 16% to 44%.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 16

Three other formations—the Delaware formation and the adjacent Glorieta and Yeso formations—also increased production from 2007 to 2013, but to a lesser extent. Production from these three formations rose from 61,000 bbl/d in 2007 to an estimated 112,000 bbl/d in 2013.

Source: U.S. Energy Information Administration, U.S. Geological Survey, University of Texas Bureau of Economic

Geology, and Drillinginfo Note: Wolfcamp is found throughout

The Permian Basin region encompasses an area approximately 250 miles wide and 300 miles long, and it contains many potentially productive low-permeability oil formations. Although oil production has previously come from the more permeable portions of the Permian formations, the application of horizontal drilling and hydraulic fracturing has opened up large and less-permeable portions of these formations to commercial production. This is especially true for the Spraberry, Wolfcamp, and Bone Spring formations, which have initial well production rates comparable to those found in the Bakken and Eagle Ford shale formations.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 17

Mozambique Gas-To-Liquid projects to queue behind LNG Plants

The Royal Dutch Shell (Shell) on one side and the tandem Sasol-Eni on another side signed these last weeks agreement with the national oil company (NOC) Empresa Nacional de Hidrocarbonetos (ENH) to start feasibility studies on Gas-To-liquid (GTL) projects in Mozambique.

During the last two years Mozambique emerged as one of the potential key players of the natural gas market with the discoveries performed in the Rovuma Basin, offshore Mozambique on the east of coast of Africa.

Pioneered by Anadarko on the Area 1 and Eni on the Area 4, the Rovuma basin exploration has proven to be one of the most prolific opportunity in the world for non-associated gas over the last ten years.

Although Anadarko and Eni have not completed yet the evaluation of the reserves in their respective Area, their estimations of recoverable reserves in the Rovuma Basin fluctuate between 70 trillion and 100 trillion cubic feet (tcf).

With these gigantic reserves, the Mozambique Government required Anadarko and Eni to align on onshore development in order to optimize the infrastructures required to support the production and exportation of liquefied natural gas (LNG) while both operators will develop the

offshore part of their projects in the Area 1 and Area 4 on their own.

At this stage Anadarko and Eni consider conventional concept, based on offshore platform and export pipeline to shore, as well as floating LNG vessels.

Anyway in both cases, exporting LNG from Mozambique will face tougher competition in coming years because of similar export projects in Tanzania, Australia, Russia and North America.

After the spiraling costs experiences in Australia, all the companies such as Anadarko, Shell or Eni are assessing carefully all multi-$billion LNG projects and investigate solutions to mitigate risks.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 18

Mozambique GTL projects to leverage LNG projects

Among the solutions, the conversion of natural gas into liquids has proven to be pertinent in a context of wide spread between the low gas prices and the high crude oil prices.

From the evidences accumulated these last years, this wide spread between energy prices appears sustainable enough to consider GTL projects in Mozambique.

In Mozambique these GTL projects would provide all parties with solid benefits for all

parties.

For the Government, the Mozambique GTL projects should reduce the import of expensive crude oil for the distribution of transportation fuels.

Through ENH they should also increase the local monetization of the Rovuma Basin resources.

For the companies such as Shell, Sasol, Anadarko and Eni, the integration of GTL projects in the development of large non-associated gas projects will leverage their added value while mitigating reliance on gas markets.

Because of their experience in world-scale GTL projects in Africa, Asia and Middle-East, Shell and Sasol appear as the best partners for Eni and ENH to develop these Mozambique GTL projects.

In starting feasibility studies now, the Shell GTL and Sasol GTL projects in Mozambique with ENH and Eni should run into commercial operations by 2021 – 2022.

Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 19

NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

Your partner in Energy Services

Khaled Malallah Al Awadi, MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990

Energy Services & Consultants Mobile : +97150-4822502

Khaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 years of experience in theof experience in theof experience in theof experience in the Oil & Gas sector. Currently working Oil & Gas sector. Currently working Oil & Gas sector. Currently working Oil & Gas sector. Currently working as as as as

Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for

the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations

ManaManaManaManager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he hasger in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he hasger in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he hasger in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed developed developed developed

great experiences in the designing & constructinggreat experiences in the designing & constructinggreat experiences in the designing & constructinggreat experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the enginof gas pipelines, gas metering & regulating stations and in the enginof gas pipelines, gas metering & regulating stations and in the enginof gas pipelines, gas metering & regulating stations and in the engineering of supply eering of supply eering of supply eering of supply

routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for OUs for OUs for OUs for

the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE anthe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE anthe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE anthe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andddd Energy program broadcasted Energy program broadcasted Energy program broadcasted Energy program broadcasted

internationally , via GCC leading satelliteinternationally , via GCC leading satelliteinternationally , via GCC leading satelliteinternationally , via GCC leading satellite ChannelsChannelsChannelsChannels . . . .

NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE

NewBase 01 July 2014 K. Al Awadi