National Australia Trustees Limited · 2013. 6. 19. · National Australia Trustees Limited (ABN...

Transcript of National Australia Trustees Limited · 2013. 6. 19. · National Australia Trustees Limited (ABN...

-

National Australia Trustees Limited(ABN 8000'7 350405 and Australian Financial Services Licence No. 230703)

(incorpomaxl with limited liability in Australia)in its capacity as trustee of National Capital Trust III

A$400,000,000Floating Rate National Capital Instruments

bane Price 100 per cent.

National Australia Bank Limited(ABN 12 004 044 937)

(incorporated with limited liability in Australia)

The AS400,000,000 Floating Rate National Capital Instruments (the "NCIs") are expected to be issued on 18 September 2006 (the "IssueDate"). The NCIs will entitle holders, subject to the conditions described in this Information Memorandum, to receive non-cumulativedistributions ("Distributions") quarterly in arrears on each 31 March, 30 June, 30 September and 31 December, commencing on 31December 2006 (each, a "Distribution Payment Date").

Distributions on the NCIs will accrue from (but not including) the Issue Date at a rate equal to the Bank Bill Rate (as defined in clause 3.1("Distributions") of the tams of issue of the NCIs (the "NCI Terms") (see Terms and Concktions of the NCIs below) plus a margin of 0.95per cent. per =MUM (the -Initial Margin") up to (aid including) 30 September 2016 (the "Step-Up Date') and, from (but not including) theStep-Up Date at a rate equal to the Bank Bill Rate plus a margin of 1.95 per cent per annum (the "Distribution Rate") (see further Termsand Conditions of the NCIs - Distributions below).

Payment of any Distribution on the NCIs is subject to the Trust (as defined below) having sufficient funds to pay that Distribution. Thefunds available to the Trust in respect of any Distribution Payment Date will be limited to the funds it receives in respect of the securitiesissued by National Capital htstruments (AM] LLC 2 ("National LLC 2") and held by the Trust (the "LLC 2 Securities"). The fundsavailable to National LLC 2 to make a payment on the LLC 2 Securities will, in turn, be limited to the interest received from the notes issuedby National Capital Instruments [AM) LLC 1 ("National LLC 1") and held by National LLC 2 (the "LLC Notes"). Payments of intereston the LLC Notes are limited to payments received by National LLC 1 on the subordinated debentures issued by National Australia BankLimited ("National") acting through its New York Branch and held by National LLC 1 (the "Subordinated Debentures"). In addition,interest on the LLC Notes and the Subordinated Debentures is subject to the payment tests and conditions contained in the terms of the LLCNotes and Subordinated Debentures (see Summary of Prinipal Documents - Terms of the LLC Notes and Summary of Principal Documents -Terms of the Subortfinated Debentures below). Distributions are non-cumulative and holders of NCIs ("NCI Holders") will not be entitledto recover my Distributions which are not paid because those tests have not been met.

The NCIs are perpetual instruments with no set maturity date. However, the NCIs may be redeemed or converted into preference shares ofNational (the "Preference Shares") in the circumstances described in this Information Memorandum. NCI Holders will have no right torequire the NCIs be redeemed or converted into Preference Shares.

The NCIs are expected to be assigned on issue a rating of "A2" by Moody's Investor Services Pty Ltd ("Moody's"), "A-" by Standard &Poor's Rating Services, a division of the McGraw Hill Companies Inc. ("S&P") and an "A+" rating by Fitch Ratings Limited ("Fitch"). Acredit rating is not a recoinmendatica to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time bythe relevant rating agency.

See Risk Factors bedew tor a &scission of certain factors that should be considered by prospective iavestors.

The NCIs are not guaranteed by and do not represent deposits or other liabilities of National sr any related parties or associates ofNational

Joint Lead Managers

DEUTSCHE BANK NATIONAL AUSTRALIA BANK LIMITED

The date of this Information Memorandum is 12 September 2006

8578329 11.doc

-

IMPORTANT NOTICE

This Information Memorandum relates solely to a proposed issue of units (the "NCIs") inNational Capital Trust III, a wait trust established under the laws of Victoria (the "Trust"), byNational Australia Trustees Limited (ABN 80 007 350 405 and Australian Financial ServicesLicence No. 230703) ("NATL") in its capacity as trustee (the "Trustee") of the Trust (the"Issuer").

This Information Memorandum does not relate to, and is not relevant for, any other purpose thanto assist the recipient to decide whether to proceed with a further investigation of the NCIs. It isonly a summary of the terms and conditions of the NCIs and does not purport to contain all theinformation a person considering investing in the NCIs may require. The definitive terms andconditions of the NCIs and the Trust are contained in the Transaction Documents, which shouldbe reviewed by any intending purchaser. If there is any inconsistency between this InformationMemorandum and the Transaction Documents, the Transaction Documents should be regarded ascontaining the definitive information. A copy of the Transaction Documents may be viewed byintending purchasers at the office of the Trustee referred to in the Directory at the back of thisInformation Memorandum.

This Information Memorandum is not, and should not be construed as, an offer or invitation toany person to subscribe for or purchase or otherwise deal in any NCIs, and must not be reliedupon by intending purchasers of the NCIs.

Definitions

All defined terms used in this Information Memorandum are indexed in the Index of DefinedTerms appearing at the end of this Information Memorandum.

Unless otherwise stated, references in this Information Memorandum to "AS", "S", "Australiandollars" or "dollars" are to the lawful currency of Australia.

Documents Incorporated by Reference

This Information Memorandum is to be read in conjunction with all of the documents that areincorporated by reference (see Documents Incorporated by Reference below).

Responsibility for Information

The Issuer and National (each a "Primary Party") have prepared this Information Memorandumand have requested and authorised the distribution of this Information Memorandum and havesole responsibility for its accuracy.

None of the Joint Lead Managers, the Initial Subscriber, NATL (in any capacity other than as theIssuer), National LLC 1, National LLC 2, the LLC Manager, the Registrar, the Issuing and PayingAgent, any other party named or referred to in this Information Memorandum (other than thePrimary Parties) or any of their respective "Related Parties" or "Associates" (each as defined inthe Corporations Act 2001 of Australia (the "Corporations Act")), or any external adviser to thePrimary Parties or any of the foregoing (each, an "Other Party") makes any representation orwarranty, express or implied, as to, nor assumes any responsibility or liability for, the authenticity,origin, validity, accuracy or completeness of, or any errors or omissions in, any information,statement, opinion or forecast contained in this Information Memorandum or any previous,accompanying or subsequent material or presentation. The Other Parties and the Primary Partiesare together referred to in this Information Memorandum as the "Parties".

2

-

Except for having checked their respective names and addresses in the Directory at the back ofthis InformMien Memorandum, no person listed in the Directory other than the Primary Partieshas authorised, caused the issue of, or have any responsibility for, any part of this InformationMemorandum.

No recipient of this Information Memorandum can assume that any person referred to in it hasconducted any investigation or due diligence concerning, or has carried out or will carry out anyindependent audit of, or has independently verified or will verify, the information contained inthis Information Memorandum.

Preparation Date

This Information Memorandum has been prepared based on information available and facts andcircumstances known to the Issuer and National as at 12 September 2006 (the "PreparationDate").

The delivery of this Information Memorandum, or any offer or issue of NCIs, at any time after thePreparation Date does not imply, nor should it be relied upon as a representation or warranty, that:

(a) there has been no change since the Preparation Date in the affairs or financial condition ofthe Issuer, the Trust, the Trustee, National LLC 1, National LLC 2, National or any otherparty named in this Information Memorandum; or

(b) the information contained in this Information Memorandum is correct at such later time.

No one undertakes to review the financial condition or affairs of the Issuer, the Trust, the Trustee,National LLC 1, National LLC 2, National or any other party named in this InformationMemorandum at any time or to keep a recipient of this Information Memorandum or a holder ofNCIs (a "NCI Holder") or a holder of Preference Shares (if issued) informed of changes in, ormatters arising or coming to their attention which may affect, anything referred to in thisInformation Memorandum.

Neither the Primary Parties nor any other person (including any Other Party) accepts anyresponsibility to purchasers of the NCIs or intending purchasers of the NCIs to update thisInformation Memorandum after the Preparation Date with regard to information or circumstanceswhich come to its attention after the Preparation Date.

It should not be assumed that the information contained in this Information Memorandum isnecessarily accurate or complete in the context of any offer to subscribe for or an invitation tosubscribe for or buy any of the NCIs at any time after the Preparation Date, even if thisInformation Memorandum is circulated in conjunction with the offer or invitation.

Authorised Material

No person is authorised to give any information or to make any representation which is notexpressly contained in or consistent with this Information Memorandum and any information orrepresentation not contained in or consistent with this Information Memorandum must not berelied upon as having been authorised by or on behalf of the Primary Parties.

Intending Purchasers to make Independent Investment Decision

This Information Memorandum is not intended to be, and does not constitute, a recommendationby any Party that any person subscribe for or purchase any NCIs. Accordingly, any personcontemplating the subscription or purchase of the NCIs must:

3

-

(a) make their own independent investigation of:

() the terms of the NCIs, including reviewing the Transaction Documents; and

(ii) the financial condition, affairs and creditworthiness of the Issuer and the otherParties,

after taking all appropriate advice from qualified professional persons; and

(b) base any investment decision on the investigation and advice referred to in paragraph (a)and not on this Information Memorandum.

Offering restrictions

This Information Memorandum is not a Product Disclosure Statement for the purposes ofChapter 7 of the Corporations Act or a prospectus for the purposes of Chapter 6D of theCorporations Act and is not required to be lodged with the Australian Securities and InvestmentsCommission ("ASIC") under the Corporations Act as each offer for the issue, and invitation toapply for the issue, and any offer for sale of, and any invitation for offers to purchase:

(i) NCIs must not be made to a person who is a retail client for the purposes of Chapter 7 ofthe Corporations Act; or

(ii) Preference Shares, if issued, must not be made to a person for which disclosure is requiredunder Part 6D.2 of the Corporations Act.

The distribution of this Information Memorandum and the offer or sale of NCIs and PreferenceShares (if issued) may be restricted by law in certain jurisdictions. No Party represents that thisdocument may be lawfully distributed, or that any NCIs or Preference Shares (if issued) may belawfully offered, in compliance with any application, registration or other requirements in anysuch jurisdiction, or pursuant to an exemption available thereunder, or assume any responsibilityfor facilitating any such distribution or offering. In particular, no action has been taken by anyParty which would permit a public offering of any NCIs or Preference Shares (if issued) ordistribution of this Information Memorandum in any jurisdiction where action for that purpose isrequired. Accordingly, no NCIs or Preference Shares (if issued) may be offered or sold, directlyor indirectly, and neither this Information Memorandum nor any advertisement or other offeringmaterial may be distributed or published in any jurisdiction, except under circumstances that willresult in compliance with any applicable laws and regulations. Persons into whose possession thisInformation Memorandum or any NCIs or Preference Shares (if issued) come must informthemselves about, and observe, any such restrictions. In particular, there are restrictions on thedistribution of this Information Memorandum and the offer and sale of NCIs in Australia, theUnited Kingdom, the European Economic Area, Hong Kong, Singapore, Japan and the UnitedStates of America (see Subscription and Sale below).

Limited Liability of the Issuer

The liability of the Trustee as the Issuer to make payments in respect of the NCIs is limited to theassets of the Trust. The personal assets of the Trustee are not available to meet payments inrespect of the NCIs except to the extent of the Trustee's fraud, negligence or wilful default.

See further Description of the Issuer below.

4

-

Disclosure of Interest

Each of the Joint Lead Managers and the Initial Subscriber discloses that it and its respectiveRelated Parties or Associates and their respective directors and employees:

(a) may have a pecuniary or other interest in the NCIs; and

(b) will receive fees, brokerage and commissions, and may act as principal, in any dealings inthe Wis.

References to credit ratings

There are references in this Information Memorandum to credit ratings. A credit rating is not arecommendation to buy, sell or hold securities and does not comment on the adequacy of marketprice or the suitability of any security for a particular investor. A credit rating may be subject torevision, suspension, withdrawal or placed on ratings watch at any time by the relevant ratingagency. Each rating should be evaluated independently of any other rating.

No rating agency has been involved in the preparation of this Information Memorandum.

References in this Information Memorandum to:

(a) "S&P" are to Standard & Poor's Rating Services, a division of the McGraw HillCompanies Inc. or any of its subsidiaries or successors;

(a) "Moody's" are to Moody's Investor Services Pty Ltd or any of its subsidiaries orsuccessors; and

(b) "Fitch" are to Fitch Ratings Limited or any of its subsidiaries or successors.

Disclaimers

The NCIs do not represent deposits or other liabilities of National or any Related Parties orAssociates of National.

No Party in any way:

(a) stands behind the NCIs, the Trust or the Preference Shares (if issued), except to the extentof their specific obligations under the Transaction Documents;

(b) makes any representation about the value or performance of the NCIs, the Trust or thePreference Shares (if issued);

(c) makes any representation with respect to income tax or other taxation consequences ofany investment in or holding of NCIs or the Preference Shares (if issued); or

(d) guarantees the distributions or return of investment in respect of the NCIs or thePreference Shares (if issued).

The holding of the NCIs is subject to investment risk, including possible delays in repayment andloss of distributions or return of investment in respect of the NCIs (see Risk Factors below).

5

-

U.S. INFORMATION

NEITHER THE NCIS NOR THE PREFERENCE SHARES HAVE BEEN OR WILL BEREGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE"SECURITIES ACT"), OR WITH ANY SECURITIES REGULATORY AUTHORITY OFANY STATE OR OTHER JURISDICTION OF THE UNITED STATES. NEITHER THENCIS NOR THE PREFERENCE SHARES (IF ISSUED) MAY BE OFFERED OR SOLDWITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF,U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT)UNLESS THE NCIS OR THE PREFERENCE SHARES (AS THE CASE MAY BE) AREREGISTERED UNDER THE SECURITIES ACT OR OFFERED AND SOLD INCOMPLIANCE WITH AN EXEMPTION FROM THE REGISTRATIONREQUIREMENTS OF THE SECURITIES ACT AND ANY APPLICABLE STATESECURITIES LAWS. NEITHER THE NCIS NOR THE PREFERENCE SHARES HAVEBEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES ANDEXCHANGE COMMISSION OR ANY OTHER SECURITIES COMMISSION OROTHER REGULATORY AUTHORITY IN THE UNITED STATES, NOR HAVE THEFOREGOING AUTHORITIES APPROVED THIS INFORMATION MEMORANDUMOR CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THEINFORMATION CONTAINED IN THIS INFORMATION MEMORANDUM. ANYREPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE IN THEUNITED STATES.

NO PARTY MAKES ANY REPRESENTATION TO ANY INVESTOR IN THE NCIS ORTHE PREFERENCE SHARES (IF ISSUED) REGARDING THE LEGALITY OF ITSINVESTMENT UNDER ANY APPLICABLE LAWS. ANY INVESTOR IN THE NCIS ORTHE PREFERENCE SHARES (IF ISSUED) SHOULD BE ABLE TO BEAR THEECONOMIC RISK OF AN INVESTMENT IN THE NCIS OR THE PREFERENCESHARES (AS THE CASE MAY BE) FOR AN INDEFINITE PERIOD OF TIME.

6

-

TABLE OF CONTENTS

TRANSACTION DIAGRAM -... 8

TRANSACTION SUMMARY.-- 9

RISK FACTORS.---- 15

DOCUMENTS INCORPORATED BY REFERENCE ....... ...... ........ 24

DESCRIPTION OF THE ISSUER-. 26

DESCRIPTION OF NATIONAL LLC 2.. 32

DESCRIPTION OF NATIONAL LLC 1 35

DESCRIPTION OF NATIONAL .... 37

TERMS AND CONDITIONS OF THE NCIS 44

SUMMARY OF PRINCIPAL DOCUMENTS 66

USE OF PROCEEDS .... 87

TAXATION. . 88

SUBSCRIPTION AND SALE-- ----------.---.... 92

GENERAL INFORMATION 97

INDEX OF DEFINED TERMS•.....•..•.. 100

DIRECTORY - . - - -----.---- 103

7

-

LLCNotes

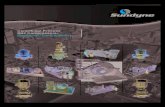

TRANSACTION DIAGRAM

The diagram below setts out a simplified form of the structure of the transaction and of theexpected periotrtc cash flows in the structure. This diagram is qualified in its entirety by the moredetailed information contained elsewhere in this Information Memorandum.

ConvertibleDebentures

NationalHead Office

Non-interestbearing

Nationallegalentity

National LLC 2

LLC 2 DistributionsLLC 2Seenriti

NationalCapital Trust III

National CapitalInstruments(NCIs)

Distributions

8

-

TRANSACTION SUMMARY

These tables provide a sinmnary of certain principal parties and of certain principal terms of theNat This summary is qualed in its entirety by the more detailed information containedelsewhere in this Information Memorandum.

Key parties

Issuer National Australia Trustees Limited (ABN 80 007 350 405and Australian Financial Services Licence No. 230703) in itscapacity as trustee (the "Trustee") of the Trust. See furtherDescription of the Issuer below.

Trust A Victorian law governed special purpose trust (the "Trust").See further Description of the Issuer below.

National LLC 2 National Capital Instruments [AUD] LLC 2, a limited liabilitycompany established under the laws of Delaware. Asubsidiary of National will be the manager of National LLC 2under Delaware law but neither it, nor National, will hold anyequity interest in National LLC 2. See further Description ofNational LLC 2 below.

National LLC 1 National Capital Instruments [AUD] LLC 1, a limited liabilitycompany established under the laws of Delaware. Asubsidiary of National will be the manager of National LLC 1under Delaware law and a subsidiary of National ("NationalSub") will hold all memberships interests in National LLC 1.See further Description of National LLC 1 below.

National National Australia Bank Limited (ABN 12 004 044 937), alimited liability company established under the laws ofAustralia. National is the holding company of the Nationalgroup, which consists of National and its consolidatedsubsidiaries (the "National Group"). See further Descriptionof National below.

National New York Branch National acting through its office at Level 28, 245 ParkAvenue, New York, New York, United States of America10167 ("National New York Branch").

National Head Office National acting through its head office at Level 13, 140William Street, Melbourne, Victoria 3000, Australia("National Head Office").

Initial Subscriber Deutsche New Zealand Limited, a limited liability companyestablished under the laws of New Zealand, with its registeredoffice at Level 6, 66 Wyndham Street, Auckland, NewZealand.

Registrar The Issuer or any other person appointed by the Issuer tomaintain the register of NCIs.

9

-

ssuing and Paying Agent Austraclear Services Limited (ABN 80 007 350 405), alimited liability company incorporated under the laws ofAustralia, with its registered office at 30 Grosvenor Street,Sydney, New South Wales, Australia 2000 (the "Issuing andPaying Agent").

Summary of the Offering. .Issue The Issuer will issue A$400,000,000 Floating Rate National

Capital Instruments (the "NCIs") to investors.

Each NCI is a unit in the Trust conferring an undivided sharein the beneficial interest in the assets of the Trust.

NCIs do not represent deposits or securities of National, arenot guaranteed by National and a NCI Holder has no claim onNational for payment of any amount in respect of the NCIs.

Issue Date The NCIs are expected to be issued on 18 September 2006(the "Issue Date").

Maturity Date The NCIs are perpetual instruments with no set maturity date.However, a NCI is redeemable for cash (subject to APRA'sprior written approval) and in certain circumstances will beautomatically converted into a preference share of National("Preference Share") according to the terms of issue of theNCIs (the "NCI Terms").

Use of Proceeds The proceeds of issue of the NCIs will be used to purchase theLLC 2 Securities the proceeds which will be used, in turn, topurchase other Component Instruments as described underSubscription and Sale - Subscription, Assignment and Sale ofthe Relevant Instruments below.

National New York Branch will use the ultimate proceeds ofissue for its general business purposes including on-lending(see further Use of Proceeds below).

Distributions on the NCIs NCIs will pay distributions ("Distributions") at a floatingrate.

Distributions on the NCIs will be paid quarterly in arrears on31 March, 30 June, 30 September and 31 December of eachyear commencing on 31 December 2006 (each a"Distribution Payment Date").

The amount of each Distribution will be calculated inaccordance with the relevant formula set out in the terms andconditions of the NCIs (the "NCI Terms") (see Terms andConditions of the NCIs - Distributions below).

10

-

Distranstion Limitations Distributions on the NCIs are limited to the distributionsreceived from National LLC 2 on the LLC 2 Securities anddistributions on the LLC 2 Securities are limited to interestreceived by National LLC 2 from National LLC 1 on the LLCNotes. Payment of interest on the LLC Notes is subject to thetests and conditions set out in the terms of the LLC Notes (seeSummary of Principal Documents - Terms of the LLC Notesbelow). In turn, interest on the LLC Notes is limited tointerest received by National LLC I from National New YorkBranch in respect of the Subordinated Debentures. Paymentof interest on the Subordinated Debentures is also subject tosimilar tests and conditions as set out in the terms of theSubordinated Debentures (see Summary of PrincipalDocuments - Terms of the Subordinated Debentures below).

Distributions are non-cumulative and the holders of the NCIs(the "NCI Holders") will have no claim for any Distributionnot paid, or for any part of any Distribution not paid pursuantto the limitations discussed above.

Consequences of Non-Payment Failure to pay in full, for any reason, Distributions on orof Distributions within seven Business Days of the scheduled Distribution

Payment Date, will trigger the Conversion Event (see Termsand Conditions of the NCIs - Conversion), but will notconstitute an event of default and will not otherwise entitle theNCI Holder to a return of its investment.

Failure to pay in full, for any reason, Distributions on thescheduled Distribution Payment Date, will also immediatelytrigger distribution restrictions for National as described in theTerms and Conditions of the NCIs - Distributions -Restrictions in the case of non-payment and, when thePreference Shares are issued, substantially in the formdescribed in Summary of Principal Documents - Terms of thePreference Shares - Dividends - Distribution Restrictionsbelow.

1 1

-

Withholding Tax andAdditional Amounts

The Issuer will make all payments of Distributions withoutdeduction or withholding for, or on account of, tax unless thatdeduction or withholding is required by law. If any deductionis required, the Issuer must pay the full amount required to bededucted to the relevant revenue authority and, subject to:

(a) certain exceptions (see Terms and Conditions of theNCIs - Payments to NCI Holders - Gross-up below);and

(b) having received sufficient amounts from NationalLLC 2 in respect of the LLC 2 Securities or fromNational under the NCI Gross-up Indemnity (asdefined below),

an additional amount ("Additional Amount") to the NCIHolders so that the NCI Holders receive the same amount inrespect of that payment as if no such deduction had been madefrom the payment.

National will covenant in a deed of covenant entered intobetween National, National LLC 1, National LLC 2 and theIssuer (the "Deed of Covenant") to indemnify the Issuer forthe payment of any Additional Amounts (See Summary ofPrincipal Documents - Terms of the Deed of Covenant -Undertakings by National below) (the "NCI Gross-upIndemnity"), subject to the same tests and conditions thatapply to payment of interest on the Subordinated Debentures(see Summary of Principal Documents - Terms of theSubordinated Debentures - Interest below).

Conversion Events In certain circumstances the Conversion Event (as defined inthe NCI Terms (see Terms and Conditions of the NCIs -Conversion below)) will occur with respect to the NCIs. ANCI Holder may not initiate the Conversion Event.

Conversion Mechanics Upon the occurrence of the Conversion Event, each NCI willbe redeemed in consideration for the delivery of a PreferenceShare in accordance with the steps set out under Summary ofPrincipal Documents - Terms of the Convertible Debentures -Conversion below. In certain circumstances National may beprevented by law from issuing the Preference Shares (seeSummary of Principal Documents - Terms of the ConvertibleDebentures - Failure to Issue Preference Shares below).

Optional Redemption Subject to APRA's prior written approval, National has theoption to redeem for cash:

(a) all (but not some) of the Convertible Debentures onthe occurrence of a Regulatory Event, a Tax Event oran Acquisition Event (each as defined in the NCITerms (see Terms and Conditions of the NCIs -Interpretation and Definitions - Definitions below));

12

-

and

(b) some or all of the Convertible Debentures on the Step-Up Date or any subsequent date which is aDistribution Payment Date in respect of the NCIs.

A redemption of the Convertible Debentures will, in turn,trigger a redemption of the NCIs for cash (see Terms andConditions of the NCIs - Redemption below).

Redemption Price Where the NCIs are redeemed as provided under "OptionalRedemption" above, they will be redeemed in consideration ofthe payment of the Redemption Price. This will generally bean amount equal to the Liquidation Amount of the NCIs plusany accrued but unpaid Distribution for the then currentDistribution Period.

See further - Terms and Conditions of the NCI's - Redemption -Redemption Price below.

Voting and Other Rights The Trust Deed contains provisions for convening meetings ofthe NCI Holders to consider any matter affecting theirinterests, including any variation of the NCI Terms whichrequires the consent of NCI Holders.

Subject as provided above, NCI Holders will have no votingrights in respect of National Head Office, National New YorkBranch, National LLC 1, National LLC 2, the LLC Manager,National Sub or the Trustee (each a "National Entity") unlessand until the Preference Shares are issued (see furtherSummary of Principal Documents - Terms of the PreferenceShares - Voting and Other Rights below).

No Set-Off A NCI Holder has no right to set off any amounts owing by itto any National Entity against any claims owing by anyNational Entity and no offsetting rights or claims on anyNational Entity if a National Entity does not pay a Distributionor interest when scheduled under any Component Instrument.

No Guarantee Payments on the NCIs are not guaranteed by National or anyRelated Parties or Associates of National.

Not Deposit Liabilities The NCIs do not represent deposits or other liabilities ofNational or any Related Parties or Associates of National.

Rating It is expected that the NCIs, when issued, will be assigned an"A2" rating by Moody's, on "A-" rating by S&P and in "A+"rating by Fitch.

Listing Neither the NCIs nor the Preference Shares (if issued) will belisted on any stock exchange.

Clearing and Settlement It is expected that the NCIs will be eligible to be lodged into

13

-

Austraclear. If issued, it is expected that the PreferenceShares will also be eligible to be lodged into Austraclear. Seefurther General information - Clearing Systems below.

Risk Factors An investment in the NCIs is subject to investment risks,including possible delays in repayment and loss ofdistributions and the amount invested in respect of the NCIs.See Risk Factors below.

Selling Restrictions The NCIs are not to be offered and sold in Australia to anyperson who is a retail client for the purposes of Chapter 7 ofthe Corporations Act and the Preference Shares, if issued,must not be offered or sold in Australia to a person for whichdisclosure is required under Part 6D.2 of the Corporations Actand, in each case, only in circumstances which otherwisecomply with laws and restrictions or any applicablejurisdiction. There are also specific restrictions on offering orselling the NCIs in the United Kingdom, the EuropeanEconomic Area, Hong Kong, Singapore, Japan and the UnitedStates. See Subscription and Sale below.

Governing Law The LLC 2 Securities, the LLC 2 Security Terms, the LLC 2Agreement, the LLC 1 Agreement, the LLC 2 ManagementAgreement, the LLC 1 Management Agreement and theLLC I Common Securities are governed by the laws of theState of Delaware, United States of America.

The Preference Shares (if issued), the Preference Share Termsand each of the other Component instruments and TransactionDocuments will be governed by the laws of Victoria, Australiaother than the Agency Agreement, which will be governed bythe laws of New South Wales, Australia.

Transaction Documents means:

(a) each Component Instrument (including, in each case,the terms of such Component Instrument);

(b) each document constituting a Component Instrument;

(c) the Agency Agreement, the NCI SubscriptionAgreement and the Subscription, Sale and AssignmentAgreement;

(d) the LLC 1 Agreement, LLC 1 ManagementAgreement and the LLC 2 Management Agreement;and

(e) any other document agreed by the parties to be aTransaction Document,

(the "Transaction Documents").

14

-

RISK FACTORS

Prospective isvestors should consider carefully the risks set forth below and the other informationcontained in this Information Memorandum prior to making any investment decision with respectto the NCIs.

Each of the risks highlighted below as being risks relating to National and its business could havea material adverse effect on National's business, operations, financial condition or prospects,which, in turn, could have a material adverse effect on the amount which investors will receive inrespect of the NCIs. In addition, each of the risks highlighted below as being risks relating to theNas could adversely affect the trading price of the NCIs or the rights of investors under the NCIsand, as a result, investors could lose some or all of their investment.

Praspective investors should note that the risks described below are not the only risks faced bythe Issuer and National. The Issuer and National have described only those risks relating to theiroperations that they consider to be material. There may be additional risks that the Issuer orNational currently considers not to be material or of which it is not currently aware, and any ofthese risks could have the effects set forth above.

Risks relating to the Issuer

Payments on the NCIs will only be made from the assets of the TrustThe Trustee will issue the NCIs in its capacity as trustee of the Trust.

A NCI Holder's claim against the Trustee with respect to the NCIs is limited to and can beenforced only to the extent to which the claim can be satisfied out of the assets of the Trust.Except in the case of fraud, wilful default or negligence of the Trustee, the assets of the Trustee inits personal capacity are not available to meet payments of Distributions or repayments of theamount invested in respect of the NCIs.

The assets of the Trust are limitedThe assets of the Trust consist only of the LLC 2 Securities and the rights of the Issuer under theTransaction Documents.

If the assets of the Trust are not sufficient to make payments of Distributions or repayments of theamount invested in respect of the NCIs, then payments to NCI Holders will be reduced.

Risks relating to National and its business

General Economic ActivityThe business activities of National are dependent on the level of banking, fmance and financialservices required by its customers. In particular, levels of borrowing are heavily dependent oncustomer confidence, employment trends, the state of the economy and market interest rates at thetime. As National conducts its business in various locations, including Australia, the UnitedKingdom and New Zealand, its performance is influenced by the level and cyclical nature ofbusiness activity in those locations, which is, in turn, affected by both domestic and internationaleconomic and political events. There can be no assurance that a weakening in the economies inwhich National operates will not have a material effect on its future results.

Risks relating to the business of National

As a result of its business activities, National is exposed to a variety of risks, the most significantof which are credit risk, market risk, operational risk and liquidity risk. Failure to control these

15

-

risks could result in material adverse effects on the financial performance and reputation ofNational.

Credit RiskRisks arising from changes in credit quality and the recoverability of loans and amounts due fromcounterparties are inherent in a wide range of the businesses of National. Adverse changes in thecredit quality of its borrowers and counterparties or a general deterioration in the economicconditions in the locations in which it operates or globally, or arising from systemic risks in thefinancial systems, could affect the recoverability and value of its assets and require an increase inthe provision for bad and doubtful debts and other provisions of National.

Market RiskThe most significant market risks National faces are interest rate, foreign exchange and bond andequity price risks. Changes in interest rate levels, yield curves and spreads may affect the interestrate margin realised between lending and borrowing costs. Changes in currency rates affect thevalue of assets and liabilities dominated in foreign currencies and may affect income from foreignexchange dealing. The performance of financial markets may cause changes in the value of theinvestment and trading portfolios of National. National has implemented risk managementmethods to mitigate and control these and other market risks to which it is exposed and exposuresare constantly measured and monitored. However, it is difficult to predict with accuracy changesin economic or market conditions and to anticipate the effects that such changes could have on thefinancial performance and business operations of National.

Operational RiskOperational risk is the risk of loss resulting from inadequate or failed internal processes, peopleand systems or from external events. Losses can result from fraud, errors by employees, failure todocument transactions properly or to obtain proper internal authorisation, failure to comply withregulatory requirements and conduct of business rules, equipment failures, natural disasters or thefailure of external systems, for example, those of suppliers or counterparties. Although Nationalhas implemented risk controls and loss mitigation actions and substantial resources are devoted todeveloping efficient procedures and to staff training, there are always elements of residualoperational risk which cannot be entirely mitigated.

Liquidity RiskThe inability of any bank, including National, to anticipate and provide for unforeseen decreasesor changes in funding sources could have consequences on such bank's ability to meet itsobligations when they fall due.

Impact of Regulatory ChangesNational is subject to financial services laws, regulations, administrative actions and policies inthe locations in which it operates. Changes in supervision and regulation, in particular inAustralia, could materially affect the business of National, the products and services offered or thevalue of its assets. Although National works closely with its regulators and continually monitorsthe situation, future changes in regulation, fiscal or other policies can be unpredictable and arebeyond the control of National.

National is subject to capital requirements that could limit its operationsNational is subject to capital adequacy guidelines adopted by the Australian Prudential RegulationAuthority ("APRA") for a bank or a bank holding company, which provide for a minimum ratioof total capital to risk-adjusted assets both on a solo basis and on a consolidated basis. National's

l6

-

failure to maintain its ratios may result in administrative actions or sanctions against it which mayimpact its ability to fulfil its obligations under the Subordinated Debentures (with the effect thatthe Issuer would not be able to make scheduled payments on the NCIs) or the Preference Shares(if issued)). APRA has recently revised its capital adequacy regime following the introduction ofAustralian equivalent International Financial Reporting Standards. This revised regime becameeffective on 1 July 2006 and the NCIs are being issued under this regime. The revised regimealso provides for transition arrangements and National is working in conjunction with APRA as tothe application of transition provisions to it.

In addition, the risk-adjusted capital guidelines (the "Basel Accord") promulgated by the BaselCommittee on Banking Supervision (the "Basel Committee"), which form the basis for APRA' scapital adequacy guidelines, have recently been revised. In June 2004, the Basel Committeepublished International Convergence of Capital Measurement and Capital Standards, a RevisedFramework ("Basel II"). APRA currently expects to implement Basel II on a common startingdate of I January 2008. The principal changes effected by the revised guidelines include theapplication of risk-weighting (depending upon the credit status of certain customers, using an"internal ratings-based" approach to credit risk, and subject to approval of supervisingauthorities), allocation of risk assets in relation to operational risk and supervisory review of theprocess of evaluating risk measurement and capital ratios. At this time, National is unable topredict how the revised guidelines will affect its calculations of capital and the impact of theserevisions on other aspects of its operations.

Risks relating to the NCIs

NCIs may not be a suitable investment for all investors

Each potential investor in any NCIs must determine the suitability of that investment in light of itsown circumstances. In particular, each potential investor should:

(a) have sufficient knowledge and experience to make a meaningful evaluation of the NCIs,the merits and risks of investing in the NCIs and the information contained orincorporated by reference in this Information Memorandum;

(b) have access to, and knowledge of, appropriate analytical tools to evaluate, in the contextof its particular financial situation, an investment in the NCIs and the impact suchinvestment will have on its overall investment portfolio;

(c) have sufficient financial resources and liquidity to bear all of the risks of an investment inthe NCIs, including where the currency for payments in respect of the NCIs is differentfrom the potential investor's currency;

(d) understand thoroughly the terms of the NCIs; and

(e) be able to evaluate (either alone or with the help of a financial adviser) possible scenariosfor economic, interest rate and other factors that may affect its investment and its abilityto bear the applicable risks.

The NCIs are complex financial instruments. A potential investor should not invest in NCIsunless it has the expertise (either alone or with a financial adviser) to evaluate how the NCIs willperform under changing conditions, the resulting effects on the value of the NCIs and the impactthis investment will have on the potential investor's overall investment portfolio.

17

-

If National's financial condition were to deteriorate, holders could lose all or a part of theirinvestmentIf National's financial condition were to deteriorate, payments of distributions or other paymentson the Subordinated Debentures (and, therefore, the NCIs) or the Preference Shares (if issued)could be suspended and holders would not receive any distributions or other payments. Potentialinvestors should not assume that unfavourable market or other conditions or events will not harmNational's financial condition. If National liquidates, dissolves or winds up, NCI Holders andholders of the Preference Shares (if issued) could lose all or a part of their investment. NoComponent Instrument is a deposit liability of National for the purposes of the Banking Act orany other similar law of any jurisdiction and no Component Instrument will be insured by anygovernmental agency or compensation scheme of Australia or any other jurisdiction.

If National does not issue the Preference Shares pursuant to the terms of the ConvertibleDebentures following the occurrence of the Conversion Event, NCI Holders will not receive themand will continue to hold the NCIs and the LLC Notes will automatically vest in National HeadOffice as assignee (see further Summary of Principal Documents - Terms of the LLC Notes -Assignment below). In addition, in the event of the liquidation or dissolution of the Trust incircumstances where National has not issued the Preference Shares in redemption of the NCIs,NCI Holders may not receive the full liquidation amount per NCI and the accrued and unpaiddistribution for the then current Distribution Period if the Trust does not have sufficient fundsafter it pays its (.3 editors.

Distributions on the NCIs are subject to payment and other restrictions and are non-cumulative

A Distribution on the NCIs will only be payable if and to the extent that the Trust has sufficientfunds to make the payment of that Distribution. The funds available to the Trust in respect of anyDistribution Payment Date will be limited to the funds it receives in respect of the LLC 2Securities. The funds available to National LLC 2 to make a payment on the LLC 2 Securitieswill, in turn, be limited to the interest received from National LLC I on the LLC Notes. Paymentsof interest on the LLC Notes are limited to payments received by National LLC 1 on theSubordinated Debentures. In addition, interest on the LLC Notes and the SubordinatedDebentures is subject to the payment tests and conditions described in the LLC Notes andSubordinated Debentures (see Summary of Principal Documents - Terms of the LLC Notes andSummary of Principal Documents - Terms of the Subordinated Debentures for details of thesetests and conditions). These conditions include the exercise of the sole discretion of:

(a) in the case of the LLC Notes, the LLC Manager as manager of National LLC I; and

(b) in the case of the Subordinated Debentures, the directors of National.

Distributions will only be paid when so determined and applicable law so permits, if sufficientresources exist and if all the conditions to payment are satisfied. NCI Holders will not be entitledto recover missed Distributions because they are non-cumulative. Accordingly, if Distributionson the NCIs for any Distribution Period are not paid, the NCI Holders will not be entitled toreceive such Distributions (or any payment in respect of such Distributions) whether or not fundsare, or subsequently become, available.

Upon the occurrence of the Conversion Event (see further Summary of Principal Documents -Terms of the Convertible Debentures - Conversion below), unless National is legally unable orotherwise fails to issue the Preference Shares on the scheduled Conversion Date, the NCIs will beredeemed for Preference Shares. Dividends on the Preference Shares are also non-cumulative andsubject to payment tests and conditions (See Summary of Principal Documents - Terms of thePreference Shares below). If the Conversion Event is the failure of the Issuer to pay a

18

-

Distribution in MI on the Nis, holders of the Preference Shares issued as a result of thatConversion Event will also not receive any Dividends on those Preference Shares for thecorresponding Dividend period, unless National pays an Optional Dividend in its absolutediscretion and with the consent of APRA. National will pay Dividends on the Preference Sharesonly if and when declared by the directors. If the directors do not declare all or any part of aDividend payable on any Dividend Payment Date, then holders will have no right to receive thatDividend at any time, even if National pays other Dividends in the future.

Distributions on the NCIs may be restricted by the terms of other similar instruments

The terms of certain of National's outstanding instruments could limit National's ability to makepayments on the Subordinated Debentures, the Convertible Debentures or the Preference Shares(if issued). If the Issuer does not make payments on the NCIs, distributions may not be permittedto be made in respect of other capital instruments National has previously issued having similareconomic rights and benefits as the NCIs (such as certain other Tier 1 capital instruments issuedby National, directly or indirectly). If a scheduled payment is not made in full on those capitalinstruments, Distributions will not be permitted to be made in respect of the NCIs.

Perpetual nature of the NCIs and the Preference Shares

Neither the NCIs nor the Preference Shares (if issued) have a fixed final maturity date and holdershave no rights to call for the redemption of the NCIs or the Preference Shares. Although the NCIsor the Preference Shares (if issued) may be redeemed (subject to APRA's prior written approval)in certain circumstances (including at National's option on the Step-Up Date or on anyDistribution Payment Date thereafter or following the occurrence of a Tax Event, a RegulatoryEvent or an Acquisition Event through the redemption of the Convertible Debentures which will,in turn, trigger a redemption of the NCIs), there are limitations on National's ability to do so.Therefore, holders should be aware that they may be required to bear the financial risks of aninvestment in the NCIs for an indefinite period of time.

If a holder wishes to obtain the cash value of its investment, that holder will have to sell the NCIsor the Preference Shares (if issued). Neither the Distribution rate on the NCIs nor the Dividendrate on the Preference Shares will be adjusted to reflect subsequent changes in interest rates orother market conditions, National's results of operations or financial condition or any decline inthe market price of National's ordinary shares. As a result, a holder may not be able to sell theNCIs or the Preference Shares (if issued) for the amount of that holder's original investment.

NCIs may be redeemed at the option of NationalNational's ability to cause the NCIs to be redeemed may limit the market value of the NCIs (seeSummary of Principal Documents - Terms of the Convertible Debentures and Terms andConditions of the NCIs - Redemption for the circumstances in which this optional redemptionright may be exercised by National). During any period when National may elect to cause theNCIs to be redeemed, the market value of the NCIs generally will not rise substantially above theprice at which they can be redeemed. This also may be true prior to any redemption period. ThePreference Shares (if issued) will be subject to similar redemption rights and, accordingly, theirmarket value may be similarly limited.

In the period post the Step-Up Date, National may be expected to bring about the redemption ofthe NCIs or the Preference Shares (if issued) when its cost of borrowing is lower than thedistribution rate on the NCIs or the Preference Shares (as the case may be). At those times, aninvestor generally would not be able to reinvest the redemption proceeds at an effective rate ashigh as the rate of Distribution on the NCIs or the rate of Dividend on the Preference Shares (asthe case may be) being redeemed and may only be able to do so at a significantly lower rate.

19

-

Potential investors should consider reinvestment risk in light of other investments available at thattime.

NCIs may he converted into Preference Shares

Because NCI Holders will receive Preference Shares when the Conversion Event occurs (unlessNational is legally 'pubic or otherwise fails to issue the Preference Shares at that time), inconnection with any investment decision with regard to the NCIs, investors are also making aninvestment decision with regard to the Preference Shares. Prospective investors should carefullyreview all the information regarding the Preferences Shares contained in this InformationMemorandum.

If NCI Holders receive Preference Shares following the Conversion Event, the trading value ofthose Preference Shares may be lower than the trading value of the NCIs, which may result in alower return upon a sale of those Preference Shares.

SubordinationNational's obligations under the Subordinated Debentures and the Convertible Debentures areunsecured and will rank subordinate and junior in right of payment to National's obligations to itsdepositors and other creditors, including other subordinated creditors, other than subordinatedcreditors holding subordinated indebtedness that by its terms ranks equally with, or junior to, theholders of the Subordinated Debentures and the Convertible Debentures. Accordingly, National'sobligations under the Subordinated Debentures and the Convertible Debentures will not besatisfied unless it can satisfy in full all of its other obligations ranking senior to the SubordinatedDebentures and the Convertible Debentures.

Further, in the event that National is wound-up, liquidated or dissolved, the assets of Nationalwould be available to pay obligations under the Subordinated Debentures only after all paymentshave been made on such senior liabilities and claims.

There are no terms in the NCis, the LLC 2 Securities, the LLC Notes, the SubordinatedDebentures, the Convertible Debentures or the Preference Shares (if issued) that limit National'sability to incur additional indebtedness, including indebtedness that ranks senior to or equallywith the Subordinated Debentures, the Convertible Debentures or the Preference Shares (if issued)or to issue other instruments which rank senior to or equally with the Subordinated Debentures,the Convertible Debentures or the Preference Shares (if issued) (including other Tier 1 capitalsecurities). In addition to the issue of the NCIs, National may issue further Tier I capitalsecurities which are similar to the NCIs in other capital markets. As part of its ongoing capitalmanagement programme, National is currently considering a further Tier I capital issue in theoffshore markets. Whether such an issue proceeds is dependent on market conditions, necessaryapprovals and other factors. if such an issue proceeds, it will be announced to ASX.

Although the NCIs may pay a higher rate of interest than comparable instruments which are notsubordinated, there is a real risk that an investor in NCIs will lose all or some of his investmentshould National become insolvent.

The NCIs and the Preference Shares have limited voting rights

A NCI Holder has limited voting rights (see Terms and Conditions of the NCIs below) at ameeting of NCI Holders. A holder of Preference Shares after the Conversion Date will also havelimited voting rights as a shareholder of National (see Summary of Principal Documents - Termsof the Preference Shares - Voting and Other Rights below). This limits the rights of holders totake action with respect to the NCIs or the Preference Shares (as the case may be).

20

-

In addition, holders acknowledge in the terms of the NC's and in the terms of the PreferenceShares (if issued) that they have no right to apply for the winding-up or administration of anyNational Entity, or k cause a receiver, or a receiver and manager, to be appointed in respect of aNational Entity merely on the grounds that the National Entity does not make a scheduledpayment of Distributions or iterest.

NCI Holders will not receive Preference Shares on the Conversion Date if National is legallyanable or otherwise fails to issue the Preference Shares

If on the Conversion Date National is prohibited by law from issuing the Preference Shares,National will issue the Preference Shares if and when it is no longer prohibited from doing so.

Under current Australian law, National may be prevented from issuing the Preference Shares onthe Conversion Date if:

• National is in liquidation;

• APRA has assumed control of National under the Banking Act 1959 of Australia (the"Banking Act") and APRA does not cause National to issue the Preference Shares; or

• APRA has appointed a statutory manager under the Banking Act to take control ofNational's business and the statutory manager does not cause National to issue thePreference Shares.

See further Summary of Principal Documents - Terms of the Convertible Debentures - Failure toIssue Preference Shares below.

A holder of NC's has no rights as a shareholder of National

A holder of NCIs, will not have any rights conferred on holders of the Preference Shares,including rights to receive any Dividends or other distributions in respect of the Preference Sharesor to vote as a holder of the Preference Shares, until the Preference Shares are issued on theConversion Date.

There is no prior market for NCIs or the Preference SharesThe NCIs and the Preference Shares (if issued) each constitute new issues of securities with noestablished trading market. National cannot predict whether an active or liquid trading market forthe NCIs or the Preference Shares (if issued) will develop or be sustained.

Therefore, investors may not be able to sell their NCIs or their Preference Shares (if issued) easilyor at prices that will provide them with a yield comparable to similar investments that have adeveloped secondary market. Illiquidity may have a severely adverse effect on the market valueof the NCIs or the Preference Shares (if issued).

Modification, waivers and substitutionProvisions in the Trust Deed permit defined majorities to bind all NCI Holders including NCIHolders who did not attend and vote at the relevant meeting and NCI Holders who voted in amanner contrary to the majority.

The Trust Deed also provides that:

(a) the Trustee may, without the consent of the NCI Holders, agree to certain additions andamendments to the Trust Deed (including the NCI Terms) without the consent of NCIHolders; and

21

-

each Component Instrument (other than the NCIs and the Preference Shares (if issued) butinchmfmg the Preference Share Terms prior to the issue of the Preference Shares) may beadded to or amended in certain circumstances without the consent of NCI Holders.

See further Description of the issuer - The Trust - Amendments and Modifications below.

Similar provisions are contained in the terms of the Preference Shares (if issued).

Change of lawThe terms of each instrument (other than the LLC 2 Securities and the LLC 1 Common Securities)are based on Australian law in effect as at the Preparation Date. The terms of the LLC 2Securities and the LLC I Common Securities are based on Delaware law at that date. National,NATL and the Trust are formed under and subject to the laws in force in Australia and NationalLLC 1 and National LLC 2 are formed under and subject to the laws in force in Delaware. Noassurance can be given as to the impact of any possible change to Australian or Delaware law,judicial decision or administrative practice after the Preparation Date.

Exchange rate risks and exchange controls

Distributions and repayments of amounts invested in respect of the NCIs and the PreferenceShares (if issued) will be made in Australian dollars. This presents certain risks relating tocurrency conversions if an investor's financial activities are denominated principally in a currencyor currency unit (the "Investor's Currency") other than Australian dollars. These include therisk that exchange rates may significantly change (including changes due to devaluation ofAustralian dollars or revaluation of the Investor's Currency) and the risk that authorities withjurisdiction over the Investor's Currency may impose or modify exchange controls. Anappreciation in the value of the Investor's Currency relative to Australian dollars would decrease(a) the Investor's Currency-equivalent yield on the NCIs or the Preference Shares (if issued), (b)the Investor's Currency-equivalent value of any repayments of amounts invested in respect of theNCIs or the Preference Shares (if issued) and (c) the Investor's Currency-equivalent market valueof the NCIs or the Preference Shares (if issued).

Government and monetary authorities may impose (as some have done in the past) exchangecontrols that could adversely affect an applicable exchange rate. As a result, investors mayreceive lesser amounts in respect of the NCIs or the Preference Shares (if issued) than expected,or no amounts.

Credit ratings may not reflect all risks

One or more independent credit rating agencies may assign credit ratings to the NCIs. The ratingsmay not reflect the potential impact of all risks related to structure, market, additional factorsdiscussed above, and other factors that may affect the value of the NCIs. A credit rating is not arecommendation to buy, sell or hold securities and may be revised or withdrawn by the ratingagency at any time.

Legal investment considerations may restrict certain investments

The investment activities of certain investors are subject to legal investment laws and regulations,or review or regulation by certain authorities. Each potential investor should consult its legaladvisers to determine whether and to what extent (a) NCIs or, if issued, the Preference Shares, arelegal investments for it, (b) NCIs or, if issued, the Preference Shares, can be used as collateral forvarious types of borrowing and (c) other restrictions apply to its purchase or pledge of any NCIsor, if issued, the Preference Shares. Financial institutions should consult their legal advisors or

(b)

22

-

the appropriate regulators to determine the appropriate treatment of NCIs under any applicablerisk-based capital or similar rules.

23

-

DOCUMENTS INCORPORATED BY REFERENCE

The lb lowing documents are incorporated in, and form part of, this Information Memorandum:

(a) National's Annual Reports on Form 20-F for the financial years ended 30 September 2004and 30 September 2905 (including the audit report and the consolidated audited financialstatements of the National Group and the non-consolidated audited financial statements ofNational for the financial years ended 30 September 2004 and 30 September 2005respectively);

(b) National's Half Year Consolidated Report on Appendix 4D for the six months ended 31March 2006 (including the consolidated unaudited financial statements of the NationalGroup for the six months ended 31 March 2006); and

(c) the statutory documents of National.

Copies of documents incorporated by reference in this Information Memorandum can be obtainedfrom the registered office of National. Requests for such documents should be directed toNational at its offices set out in the Directory at the end of this Information Memorandum.

The documents listed at (a) and (b) above contain financial information on National, as describedin the table below. Other information contained in such documents is incorporated by referenceinto this Information Memorandum for information purposes only.

Balance sheet

Income statement

Cash flow statement

Accounting policies andexplanatory notes

2004 Page 101Form 20-F

2005 Page 115Form 20-F

2006 Page 20Appendix 4D

2004 Page 100Form 20-F

2005 Page 114Form 20-F

2006 Page 19Appendix 4D

2004 Page 102Form 20-F

2005 Page 1/6Form 20-F

2006 Page 22-23Appendix 4D

2004 Page 103-226Form 20-F

24

-

Review report

Audit reports

Legal and arbitrationproceedings

2005Form 20-F

2006Appendix 4D

2006Appendix 4D

2004Form 20-F

2005Form 20-F

2006Appendix 4D

2005Form 20-F

2006Appendix 4D

Page 117-249

Page 24-80

Page 82

Page 228

Page 251-252

Page 82

Note 44 at page 201-204

Note 16 at page 77-78

25

-

DESCRIPTION OF THE ISSUER

The Trustee

incorporationNational Australia Trustees Limited ("NATL") was incorporated as a public limited companyunder the laws of Australia on 29 December 1989. The ABN of NATL is 80 007 350 405. Itsregistered office is at 105-153 Miller Street, North Sydney, New South Wales 2060, Australia.

NATL will issue the NCIs in its capacity as trustee of the Trust and will acquire and hold theLLC 2 Securities in accordance with the terms of the Transaction Documents. Details of the Trustare set out under Description of the Issuer - The Trust below.

Share Capital

NATL has 5 million fully paid ordinary shares on issue with a paid amount of A$2.5 million. Allof the shares are held by National.

Ownership StructureNATL is a wholly owned direct subsidiary of National.

BusinessThe principal activities of NATL are the provision of trustee, manager, executor, agent,succession and other associated commercial services. NATL is an authorised trustee corporationand holds an Australian Financial Services License under Part 7.6 of the Corporations Act(Australian Financial Services License No. 230703).

ExperienceNATL provides a range of services including custodial and administrative arrangements to thefunds management, superannuation, property, infrastructure and capital markets sectors.

Directors

The directors of NATL are as follows:

Name Business Address Principal Activities

Michael John Sharpe 105-153 Miller Street Non-Executive DirectorNorth SydneyNew South Wales 2060Australia

Robin Edward Clements 105-153 Miller Street Non-Executive DirectorNorth SydneyNew South Wales 2060Australia

Richard Louis Morath 105-153 Miller Street Executive DirectorNorth SydneyNew South Wales 2060Australia

26

-

Name Business Address Principal Activities

Neil James McKissock 105-153 Miller Street Non-Executive DirectorNorth SydneyNew South Wales 2060Australia

Powers of the TrusteeThe Trustee has all the powers in respect of the Trust that it is legally possible for a natural personor corporation to have and as though it were the absolute owner of the assets of the Trust andacting in its personal capacity. However, the Trust is a special purpose trust as described underDescription of the Issuer - The Trust - Purpose of the Trust below and, accordingly, specificrestrictions on the activities of the Trustee are included in the Trust Deed to reflect that specialpurpose (see further Description of the Issuer - The Trust - Purpose of the Trust and Descriptionof the Issuer - The Trust - Assets of the Trust below).

Fees and Expenses of the Trustee

Fees

The Trustee is not entitled to a management fee out of the assets of the Trust. However, while theTrustee is a member of the National Group, the Trustee has the benefit of an agreement fromNational in the Deed of Covenant under which the Trustee is entitled to be paid fees by National(see further Summary of Principal Documents - Terms of the Deed of Covenant below). Thisagreement does not apply if the Trustee is not a member of the National Group.

Expenses

While the Trustee is a member of the National Group, the Trustee has the benefit of anundertaking from National in the Deed of Covenant which entitles the Trustee to recover expensesfrom National (see further Summary of Principal Documents - Terms of the Deed of Covenantbelow). This undertaking does not apply if the Trustee is not a member of the National Group.The Trustee is only entitled to make a claim against the assets of the Trust for expenses to theextent that National fails to honour this undertaking or the undertaking does not apply.

Delegation by the TrusteeThe Trustee may authorise any person to act as its agent or delegate to hold title to any Asset,perform any act or exercise any discretion within the Trustee's power, including the power toappoint in turn its own agent or delegate. An agent or delegate may be an associate of the Trusteeor a member of the National Group.

Limitation of liabilityNATL enters into the Transaction Documents and issues the NCIs only in its capacity as trusteeof the Trust and in no other capacity. A liability arising under or in connection with theTransaction Documents or the Trust or in respect of the NCIs is limited to and can be enforcedagainst NATL only to the extent of the Assets of the Trust. This limitation of NATL's liabilityapplies despite any other provision of the Transaction Documents and extends to all liabilities andobligations of NATL in any way connected with any representation, warranty, conduct, omission,agreement or transaction related to the Transaction Documents or the Trust, however, thelimitation will not apply if under a Transaction Document or by operation of law there is a

27

-

reduction in the limitation of NATL's liability as a result of NATL's fraud, negligence or wilfuldefault.

Removal or Retirement of the Trustee

Vohmkny retirementThe Trustee may retire as the trustee of the Trust by giving 30 days' notice to National and theNCI Holders.

Mandatory retirement

The Trustee must retire as trustee if:

(a) the Trustee becomes "insolvent" within the meaning of section 95A of the CorporationsAct;

(b) required by law; or

(e) the Trustee ceases to carry on business as a professional trustee.

When retirement or removal takes effect

The retirement or removal of the Trustee as trustee takes effect when:

(a) a successor trustee is appointed; and

(b) the successor trustee obtains title to, or obtains the benefit of, the Assets, the Trust Deedand each other Component Instrument to which the Trustee is a party in its capacity astrustee.

The successor trustee and each other party to the Transaction Documents will have the samerights and obligations among themselves as they would have had if the successor trustee had beenparty to them at the dates of those documents.

Appointment of successor trusteeIf the Trustee retires or is removed as trustee, the Trustee agrees to use its best endeavours toensure that a successor trustee is appointed as soon as possible. Any successor trustee appointedunder the Trust Deed must be acceptable to National (acting reasonably).

The Trust

The Trust DeedThe Trust was established in and subject to the laws of Victoria, Australia, on 12 September 2006(being the date on which the Trust Deed was executed (the "Pre-Issue Date")), by National or anominee of National (the "Initial NCI Holder") paying an initial settlement amount (the "InitialSettlement Amount") to subscribe for one partly paid NCI (the "Initial NCI") in settlement ofthe Trust. The Initial NCI is to be fully paid when all other NCIs are issued and from that timehave the same rights as the other NCIs.

The detailed terms of the Trust are set out in the Trust Deed.

The Trust will terminate on the earliest of:

28

-

(a) the date specified by the Trustee as the date of termination of the Trust in a notice given toNCI Holders, (which notice the Trustee must give (unless National consents otherwise) ifall the NCIs have been converted into Preference Shares);

(b) the date of the final distribution on dissolution of National; and

(c) the date on which the Trust otherwise terminates in accordance with the Trust Deed or bylaw.

If the law allows, the Trustee may extend the life of the Trust beyond the date set for terminationif in the Trustee's opinion it is in the interests of NCI Holders to do so. However, no NCIs maybe redeemed after the 80th anniversary of the day preceding the day the Trust commenced, unlessthat redemption would not offend the rule against perpetuities, or any other rule of law or equity.

Purpose of the Trust

The Trust has been established as a special purpose entity for the sole purpose of issuing theNCIs, acquiring the LLC 2 Securities and entering into the transactions and associated activitiescontemplated by the Transaction Documents. The terms of the Trust Deed restrict the ability ofthe Trustee to borrow money, grant security and dispose of the LLC 2 Securities in a manner nototherwise contemplated by the Transaction Documents.

As at the Preparation Date, and prior to the issue of the NCIs, the Trust has not commencedoperations (save for the issue of the Initial NCIs) and the Trust will, following the PreparationDate, undertake no activities other than those contemplated by the Transaction Documents.

Capital

The beneficial interest in the Trust will be represented by the NCIs. There will be no ordinaryunits in the Trust and the Trustee will not be permitted to issue any NCIs after the issue Date.

OfficeAll communications in respect of the Trust must flow through the Trustee. The Trust does nothave, nor is it required under Australian law to have, a separate registered office.

Securities

The Trustee (in its capacity as trustee of the Trust) will not issue any units other than the NCIsand will not issue any other securities.

Assets of the Trust

The Trustee is prevented by the terms of the Trust Deed from acquiring an interest in any assetother than:

• the LLC 2 Securities;

• the Preference Shares to be issued to NCI Holders on a conversion;

• interests in bank accounts in which income or capital of the Trust is invested;

• cash, rights and benefits under the Deed of Covenant;

• cash, rights and benefits under the NCI Subscription Agreement;

29

-

• cash, rights and benefits under the Subscription, Sale and Assignment Agreement;

• cash, rights and benefits under the Agency Agreement; and

• income or other rights arising in connection with those assets.

Amendments and Modifications

Each NCI Holder will acknowledge and agree in the Trust Deed that the Trust Deed (including theNCI Terms) may be amended without the consent or approval of NCI Holders, but with theapproval of National in writing and with the approval of APRA (if required), if the Trustee is ofthe opinion that the amendment:

• is of a formal, minor or technical nature;

• is made to cure any ambiguity or correct any manifest error;

• is expedient for the purpose of enabling NCIs to be lodged in the Austraclear System or toremain lodged in the Austraclear System or to be offered for sale or for subscription underthe laws for the time being in force in any place and it is otherwise not considered by theTrustee to be materially prejudicial to the interests of NCI Holders as a whole;

• is necessary to comply with the provisions of any statute or the requirements of anystatutory authority; or

• in any other case, will not materially adversely affect the NCI Holders' rights.

If the Trustee reasonably considers the amendment will materially adversely affect NCI Holders'rights, the amendment may only be made if it has been approved by a Special Resolution.

A "Special Resolution" is defined in the Trust Deed as a resolution passed:

(a) at a meeting of NCI Holders by a majority of at least 75% of the votes cast; or

(b) by NCI Holders representing at least 75% of the aggregate Liquidation Amount of theNCIs signing a document stating they are in favour of the resolution,

in each case as provided in the Trust Deed.

Each NCI Holder will acknowledge and agree in the Trust Deed that each of the ComponentInstruments (other than the NCIs and the Preference Shares (if issued) but including thePreference Share Terms prior to the issue of the Preference Shares) may be amended without theconsent or approval of NCI Holders, but with the approval of National in writing and with theapproval of APRA (if required), if the issuer of the Component Instrument (the "RelevantIssuer") (or, in the case of the Deed of Covenant, the Trustee) is of the opinion that theamendment:

• is of a formal, minor or technical nature;

• is made to cure any ambiguity or correct any manifest error;

• is expedient for the purpose of enabling NCIs to be lodged in the Austraclear System or toremain lodged in the Austraclear System or to be offered for sale or for subscription underthe laws for the time being in force in any place and it is otherwise not considered by the

30

-

Relevant issuer (or, in the case of the Deed of Covenant, the Trustee) to be materiallyprejudicial to the interests of NCI Holders as a whole;

• is necessary to comply with the provisions of any statute or the requirements of anystatutory authority; or

• in any other case, will not materially adversely affect the NCI Holders' rights.

If the Relevant Issuer (or, in the case of the Deed of Covenant, the Trustee) reasonably considersthe amendment will materially adversely affect NCI Holders' rights, the amendment may only bemade if it has been approved by a Special Resolution.

In addition, the Convertible Debenture Terms may be amended without the consent of NCIHolders as described under Summary of Principal Documents - Terms of the Preference Shares -Redemption below.

In any other case, the terms of any Component Instrument (other than the NCIs and the PreferenceShares (if issued) but including the Preference Share Terms prior to the issue of the PreferenceShares) may be amended or added to if the amendment or addition has been approved by aSpecial Resolution.

Notices to NCI HoldersThe Trust Deed contains provisions for notices to NCI Holders to be:

(a) given in writing (which includes a fax or other electronic communication) or in such othermanner as the Trustee determines; and

(b) either:

(i) delivered or sent to the NCI Holder at the NCI Holder's fax number or physical,postal or (if acceptable to the Trustee) electronic address last advised to theTrustee or the Registrar for delivery of notices; or

(ii) given by an advertisement published in the Australian Financial Review or TheAustralian newspapers.

Meetings of NCI Holders

The Trust Deed contains provisions for convening meetings of the NCI Holders to consider anymatter affecting their interests, including any variation of the NCI Terms which requires theconsent of NCI Holders.

NCI Holders will have no voting rights in respect of National or any other National Entity.

31

-

DESCIUPT1ON OF NATIONAL LLC 2

Introduction and Organisational Structure

National Capital instruments [AUDI LLC 2 ("National LLC 2") is a Delaware limited liabilitycompany that will be formed on or about 12 September 2006 under the Delaware LimitedLiability Company Act (the "LLC Act") by filing a certificate of formation with the Secretary ofthe State of Delaware in the United States pursuant to a limited liability company agreement (the"LLC 2 Agreement"). National Capital Holdings I Inc. will be the manager of National LLC 2(the "LLC Manager").

The LLC 2 Agreement provides, among other things, for the issuance by National LLC 2 of oneclass of limited liability company interests, the LLC 2 Securities, which are expected to be issuedconcurrently with this offering. Terms of the LLC 2 Securities are set forth in the LLC 2Agreement. National LLC 2 will not issue any other class of membership interest.

National LLC 2 has agreed to issue the LLC 2 Securities to the Initial Subscriber in considerationfor the transfer by the Initial Subscriber of the LLC Notes and the Convertible Debentures toNational LLC 2.

See further Description of National LLC 2 - Administration below.

The registered Delaware office of National LLC 2 is c/o The Corporation Trust Company,Corporation Trust Center, 1209 Orange Street, Wilmington, Delaware, United States of America,telephone number +1 212 986 9518.

All correspondence in respect of National LLC 2 should be directed to the LLC Manager (seeDescription of National LLC 2 - Administration below).

Sole Activity