Nasdaq: FOMX May 2017Differentiated Foam Technology with Multiple Platforms •Patented1 - United...

Transcript of Nasdaq: FOMX May 2017Differentiated Foam Technology with Multiple Platforms •Patented1 - United...

Nasdaq: FOMX

May 2017

Disclaimer

To the extent that statements contained in this presentation are not descriptions of historical facts regarding Foamix, they are forward-looking statements reflecting management’s current beliefs and expectations. Forward-looking statements are subject to known andunknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from those anticipated by such statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “intends,” or “continue,” or the negative of these terms or other comparable terminology. Forward-looking statements contained in this presentation include, but are not limited to, (i) statements regarding the timing of anticipated clinical trials for our product candidates; (ii) the timing of receipt of clinical data for our product candidates; (iii) our expectations regarding the potential safety, efficacy, or clinical utility of our product candidates; (iv) the size of patient populations targeted by our product candidates and market adoption of our product candidates by physicians and patients; (v) the timing or likelihood of regulatory filings and approvals; and (vi) our revenues under our agreements with our licensees, including Bayer Healthcare and other companies.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, various factors may cause differences between our expectations and actual results, including, but not limited to, unexpected safety or efficacy data, unexpected side effects observed during preclinical studies or in clinical trials, lower than expected enrollment rates in clinical trials, changes in expected or existing competition, changes in the regulatory environment for our product candidates and our need for future capital, the inability to protect our intellectual property, and the risk that we become a party to unexpected litigation or other disputes. You should read the documents filed by Foamix with the SEC, including our prospectuses, the Risk Factors set forth therein and the documents filed as exhibits to our registration statements, of which the prospectuses are a part, completely and with the understanding that our actual future results may be materially different from what we expect. You may obtain those documents byvisiting EDGAR on the SEC website at www.sec.gov. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the foam technology or product candidates of Foamix.

2

Foamix Value Proposition

3

• Late-stage Products with Potential to Differentiate vs.Market Leaders

• Global, Unencumbered Rights to Lead Programs

• Innovative Platform Allows for Consistent, Organic Innovation

• Extensive IP portfolio

• Strong Cash Position + Recurring Revenue = Runway into 2019

• Experienced Commercial / R&D Teams in Dermatology

Clinical-Stage Lead Products

4

Product Candidate Phase 2 Phase 3 Target Milestone

Minocycline Foam

FMX101

for Moderate-Severe Acne

• Study 04 / 05 TLR announced

• Long-term safety study complete end 2017

• Initiate 3rd Phase 3 mid-2017

• NDA filing – H2 2018

FMX103

for Moderate-Severe Rosacea

• Phase 2 completed

• Phase 3 initiation mid-2017

FMX102

for Impetigo

• Pre IND meeting completed

• Photo-safety Study – H2 2016

Doxycycline Foam

FDX104

for Chemotherapy- Induced Rash• Phase 2 completed

Strong Financial Position

5

• Net proceeds: US $42.3 million

• Price per share: US $6.00

IPO – September 2014

• Net proceeds: US $64.2 million

• Price per share: US $9.30

Follow-on offering, April 2015

• Cash, cash equivalents and investments: US $119 million

• Net cash used in operating activities Q1, 2017 US $12.1 million

• Existing cash provides sufficient financial runway to finance our clinical and business operations, into 2019

Cash position as of March 31, 2017

• Net proceeds: US $54.1 million

• Price per share: US $9.50

Follow-on offering, September 2016

Experienced Management Team

6

Name Track record Location

Dov Tamarkin, PhD

CEO & Director

• Led multiple product developments in dermatology

• Led R&D operations in Israel, EU and USIsrael

Meir Eini

CIO• Founder of multiple healthcare ventures Israel

David Domzalski

President, US

• Head of Commercial Operations at Warner Chilcott & LEO

• Led commercial launch of Doryx® and Taclonex®US

Ilan Hadar

CFO

• Held finance roles at Israeli subsidiaries of Pfizer, HP

and BAE SystemsIsrael

Yohan Hazot

CTO• Led multiple product developments in dermatology Israel

Mitchell Shirvan, PhD

SVP, R&D

• Head of R&D, CNS division at Teva

• CEO of MacroCureIsrael

Russell Elliott, DPhil

VP, Drug Development

• VP, Product Development at Stiefel, a GSK company

• Led product development at Procter & GambleUS

Alvin Howard

VP, Regulatory Affairs

• SVP Regulatory Affairs at Warner Chilcott

• Led approvals of 14 NDA and sNDAsUS

Herman Ellman, MD

VP, Clinical Affairs

• SVP Clinical Development & Medical Affairs at Warner

ChilcottUS

Iain Stuart, PhD

VP, Clinical Development• VP Medical Affairs at LEO US

Clilco Flexiprobe

Technology

7

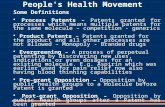

Differentiated Foam Technology with Multiple Platforms

• Patented1 - United States: 50 US patents granted

- Worldwide: 149 Patents granted

• Capability to formulate multiple drugs

• Suitable for a variety of target sites

• Dermal alternative to oral delivery

81. As of October 30, 2016

Cream Foams (Emulsion or Emollient)

Ointment Foams (Petrolatum-based)

Waterless Hydrophilic Foams (Enhanced penetration)

Oil Foams Hydroethanolic Foams

Saccharide Foams (For wounds and burns)

Potent Solvent Foams(High solubility and delivery)

Suspension Foams (Concentrated suspensions)

Nano-Emulsion Foams (Enhanced penetration)

Lead Clinical Products

9

FMX101 (Moderate-to-Severe Acne)

FMX103 (Moderate-to-Severe Rosacea)

FMX101Topical Minocycline Foam 4%For Moderate-to-Severe Acne

10

Acne – the US Market • ~50 million people of all ages and races have acne in the US1

◦ Moderate-to-severe acne affects ~10 million people in the US

• >14 million physician visits per year for treatment of acne2

Classification by severity / current therapies

1. (1) AAD. Acne Stats and Facts. www.aad.org/media-resources/stats-and-facts/conditions. Accessed March 30, 2016. (2) GlobalData, EpiCast. Acne Vulgaris Epidemiology Forecast to 2022;33-34.2. Mancini AJ. Adv Stud Med. 2008;8:100-105.3. Symphony Health Services PHAST: 2016 Branded Only (accessed 1.18.17), Select Market >75% rosacea weighting removed 11

Current Branded Market (United States)3

US Dollars TRxs

Oral antibiotics $1.1 billion 1.2 mm

Topical drugs $2 billion 4.3 mm

Total $3.1 billion 5.5 mmMild AcneLess than 30 lesions

<15 Inflammatory lesions

Moderate Acne <50 Inflammatory lesions

Severe Acne

>50 Inflammatory lesions

Isotretinoin

Topicalcombinations

Topical

Oral antibiotics

Acne – the US Market (2016)Large Market Potential Despite Lack of Innovation

Source: Symphony Health Services PHAST (accessed 1.18.17). (1) market shares of the oral branded prescription acne drug market and the topical branded prescription acne drug market according to the total number of prescriptions.

Top Oral Brands US Dollars TRxs

1 SOLODYNMinocycline, Valeant

$596,079,817 565,040

2 ACTICLATEDoxycycline, Almirall

$321,951,635 388,084

3 DORYXDoxycycline, Mayne

$160,887,307 180,863

Top Topical Brands US Dollars TRxs

1 EPIDUO FRANCHISEAdapalene+BPO, Galderma

$494,186,838 1,179,329

2 ACZONE FRANCHISEDapsone, Allergan

$455,752,396 946,637

3ONEXTON/ACANYA

Clindamycin+BPO, Valeant$225,357,468 503,547

4 RETIN-A FRANCHISETretinoin, Valeant

$210,905,896 273,051

5 ZIANAClindamycin+tretinoin, Valeant

$101,534,314 150,964

12

Top brands oral and topical formulations (LTM December, 2016)

Solodyn, 54%Acticlate, 29%

Doryx, 15%

All Other Oral ABs, 2%

TRx Market Share Oral Brands(1)

Epiduo Franchise

25%

Aczone Franchise23%

Onexton/Acanya11%

Retin-A Franchise10%

Ziana5% All Other

Topicals26%

TRx Market Share Topical Brands(1)

Phase 3: Design of Each Pivotal Study (x2)Studies FX2014-04 & FX2014-05

• Self-apply, once daily, in the evening, for 12 weeks

• Inclusion criteria◦ At least 20 inflammatory and 25 non-inflammatory lesions◦ IGA 6 point scale – Moderate or Severe (Grade 3 or 4)

• Co-Primary Efficacy Endpoints◦ Mean change from baseline in inflammatory lesion count◦ Proportion of subjects with IGA scores of “Clear” or “Almost Clear”, with improvement of at least

2 grades from baseline

13

12-week, randomized, double-blind, vehicle controlled, in subjects with moderate-to-severe acne; followed by 9 month open label safety extension

Week 12(End of treatment)

12 MonthsWeek 3 Week 6 Week 9

Double-blinded PhaseRandomized (2:1), double-blind

N = 450

Minocycline foam 4% – 9 months of treatment

Open Label Safety Extension Subjects who complete one of the randomized, Phase 3 studies may

enter the open-label phase

• Minocycline Foam 4%

• Foam vehicle

Baseline

Acne Phase 3

14

Baseline Data

• Total number of subjects: 466 (Study 04) 495 (Study 05)

• Mean age: 20.3 20.6

• Male/Female: M=42.9% F=57.1% M=41.4% F=58.6%

• Ethnicity: W=62.7% B=27.0% O=10.3% W=74.1% B=20.8% O=5.0%

Study 04 Study 05

FMX-101, 4%(N = 307)

Vehicle(N = 159)

FMX-101, 4%(N = 333)

Vehicle(N = 162)

Baseline Inflammatory Lesion Counts

Mean (SD) 32.2(8.4) 31.6(8.6) 31.6(8.6) 32.3(8.0)

Median 31 30 30 31

Range (min-max) 20-50 20-76 20-69 20-50

Baseline Non-inflammatory Lesion Counts

Mean (SD) 49.5(18.0) 46.5(16.6) 50.5(19.5) 50.9(19.9)

Baseline Total Lesion Counts

Mean (SD) 81.7(21.3) 78.1(19.7) 81.5(21.9) 83.1(23.2)

Baseline IGA Score, n (%)

3 – Moderate 255(83.1) 137(86.2) 296(88.9) 148(91.4)

4 – Severe 52(16.9) 22(13.8) 37(11.1) 14(8.6)

P<.01*P<.01*

15*ANCOVA, Intent to Treat (ITT) Population, multiple imputation

-14.16-13.46 -13.79

-11.17-10.72 -10.94

-16

-14

-12

-10

-8

-6

-4

-2

0

Study 04 Study 05 Pooled

Me

an R

ed

uct

ion

in IL

Co

un

t vs

. Bas

elin

e

Absolute Change in Inflammatory Lesion Count at Week 12

n=307 n=159 n=333 n=162FMX101 Vehicle FMX101 Vehicle

Acne Phase 3 Efficacy ResultsReduction of Inflammatory Lesion Count at Week 12

• In Study 04, absolute change in inflammatory lesion count for the FMX101, 4% treatment group was -14.16 versus -11.17 in vehicle (p=0.0071)

• In Study 05, absolute change in inflammatory lesion count for the FMX101, 4% treatment group was -13.46 versus -10.72 in vehicle (p=0.0058)

• In the Pooled Analysis, absolute change in inflammatory lesion count for the FMX101, 4% treatment group was -13.79 versus -10.94 in vehicle (p=0.0001)

FMX101 Vehicle

P<.01*

n=640 n=321

P<.05*

P<.05*

P>0.21*

16

8.09%

14.67%

11.51%

4.77%

7.89%

6.34%

0%

5%

10%

15%

20%

Study 04 Study 05 Pooled

% o

f Su

bje

cts

Ach

ievi

ng

Tre

atm

en

t Su

cce

ss

IGA Treatment Success at Week 12

n=307 n=159 n=333 n=162FMX101 Vehicle FMX101 Vehicle

Acne Phase 3 Efficacy ResultsIGA Treatment Success at Week 12 [Score Clear (0) or Almost Clear (1)]

• In Study 04, IGA Treatment Success for FMX101, 4% treatment group was 8.09% versus 4.77% in vehicle (p=0.2178)

• In Study 05, IGA Treatment Success for FMX101, 4% treatment group was 14.67% versus 7.89% in vehicle (p=0.0423)

• In the Pooled Analysis, IGA Treatment Success for FMX101, 4% treatment group was 11.51% versus 6.34% in vehicle (p=0.0188)

n=640 n=321

FMX101 Vehicle

*Cochran–Mantel–Haenszel test stratified by investigational site, Intent to Treat (ITT) population, multiple imputation

P<.05*

17

-16.45

-13.20

-14.76

-10.30

-7.00

-8.64

-20.00

-18.00

-16.00

-14.00

-12.00

-10.00

-8.00

-6.00

-4.00

-2.00

0.00

Study 04 Study 05 Pooled

Me

an R

ed

uct

ion

in N

IL C

ou

nt

vs. B

ase

line

Absolute Change in Non-Inflammatory Lesion Count at Week 12

n=307 n=159 n=333 n=162FMX101 Vehicle FMX101 Vehicle

Acne Phase 3 Secondary Efficacy EndpointReduction of Non-Inflammatory Lesion Count at Week 12

• In Study 04, absolute change in non-inflammatory lesion count for the FMX101, 4% treatment group was -16.45 versus -10.30 in vehicle (p=0.0042)

• In Study 05, absolute change in non-inflammatory lesion count for the FMX101, 4% treatment group was -13.20 versus -7.00 in vehicle (p=0.0320)

• In the Pooled Analysis, absolute change in inflammatory lesion count for the FMX101, 4% treatment group was -14.76 versus -8.64 in vehicle (p=0.0011)

FMX101 Vehicle

P<.01*

n=640 n=321

*ANCOVA, Intent to Treat (ITT) Population, multiple imputation

P<.01*

Acne Phase 3 Secondary Efficacy Endpoint% Change in Inflammatory Lesion Count at Weeks 3, 6, 9 and 12^

18

-60%

-40%

-20%

0%

0 3 6 9 12

FMX101 (n=307)

Vehicle (n=159)

Weeks

% R

ed

uct

ion

of

IL

-60%

-40%

-20%

0%

0 3 6 9 12

FMX101 (n=333)

Vehicle (n=162)

Weeks%

Re

du

ctio

n o

f IL

^ANCOVA, Intent to Treat (ITT) Population, multiple imputation

• In Study 04, percent change in inflammatory lesion count for the FMX101, 4% treatment group at week 12 was -44% versus -34% in vehicle (p=0.0033)

• In Study 05, percent change in inflammatory lesion count for the FMX101, 4% treatment group at week 12 was -43% versus -34% in vehicle (p=0.0097)

• Statistical significance demonstrated at all timepoints (beginning at Week 3) for both Study 04 & 05

−44%

−34%

‡P≤.01; †P ≤.001; *P ≤.0001

*†

‡

†

−43%

−34%

‡

*

†

Study 04 - IL Count % Change Study 05 - IL Count % Change

*

37%

32%

20%

9% 2%

FMX101 Phase 3 Patient Satisfaction Questionnaire at Week 12, ITT Population (Observed-Cases, n=534)

19

32%

42%

17%

7%2%

Overall, how satisfied are you with this

product?

Study 04 & Study 05 Pooled Analysis

How satisfied are you with this product

compared to other products you have previously used for

acne, such as gels and creams?

Scale 1- Very Satisfied2- Satisfied3- Somewhat Satisfied4- Dissatisfied5- Very Dissatisfied

~75% of subjects satisfied or very

satisfied with FMX101

~70% of subjects were satisfied or very satisfied

with FMX101 vs. other topical acne therapies

54%

31%

12%2% 1%

FMX101 Phase 3 Patient Satisfaction (cont.)

Questionnaire at Week 12, ITT Population (Observed-Cases, n=534)

20

23%

34%

27%

13%

3%

Study 04 & Study 05 Pooled Analysis

How satisfied are you with how easy this product is to use?

How satisfied are you with how this product feels on your skin after

treatment?

Scale 1- Very Satisfied2- Satisfied3- Somewhat Satisfied4- Dissatisfied5- Very Dissatisfied

>80% of patients were satisfied or very satisfied with the ease of use

of FMX101

Only 16% of patients were dissatisfied or very

dissatisfied with the product feel of FMX101

21

FMX101 – Generally Safe and Well ToleratedStudy 04 AE Frequency (%)

Adverse Event FMX101, 4% Vehicle

One or more 16.9 18.2

Nasopharyngitis 2.0 3.8

Headache 2.3 3.1

CK increase 1.0 0.6

Ligament sprain 0.3 1.3

Nausea 0.7 0.6

Study 05 AE Frequency (%)

Adverse Event FMX101, 4% Vehicle

One or more 33.0 26.5

Nasopharyngitis 7.2 3.7

Headache 6.0 5.6

Upper Respiratory Tract Infection

1.8 1.2

Ligament Sprain 1.8 0.6

CK increased 1.5 2.5

Nausea 1.2 0.6

Vomiting 1.2 0.6

* Non-dermal AEs occurring in at least 1% of subjects in either group

Acne Phase 3 Safety ResultsOverall AE Frequency*

• No drug-related serious adverse events were reported • The most common systemic AE was nasopharyngitis in both studies; overall 2.6% in Study 04 and 6.1% in Study 05• Dermal adverse events were few; most were mild and included instances of acne, dermatitis, rash and discoloration.• A total of 4 subjects discontinued the Trial due to an adverse event including 2 in the active group (pruritus, worsening

acne) and 2 in the vehicle group (ectopic pregnancy, elevated liver enzymes).

FMX101 Phase 3 Results Summary

• Totality of efficacy results for FMX101 in Ph3 are positive, with inconsistent results found in only one endpoint (IGA 0/1 Treatment Success in Study 04)

• Pooled analysis of IGA 0/1 Treatment Success is statistically significant

• % Change in inflammatory lesion count is statistically significant in Study 04 and Study 05 at all timepoints (beginning at Week 3)

• Non-inflammatory lesion count reduction at Week 12 is statistically significant in Study 04 and Study 05

• Overall high level of patient satisfaction with FMX101

• FMX101 appears to be generally safe and well tolerated

22

FMX101 3rd Phase 3 Study DesignStudy FX2017-22

23

12-week, randomized, double-blind, vehicle controlled, in subjects with moderate-to-severe acne

Week 12(End of treatment)

Week 3

Week 6 Week 9

Double-blinded Study (-22)Randomized (1:1), double-blind

N=1,500

Commence Study Mid-2017; Topline results expected Mid-2018

◦ Minocycline Foam 4%

◦ Foam vehicle

Week 3

• 1 US Study, 1,500 subjects, ~80 sites, >9 years of age• Self-apply, once daily, for 12 weeks

• Inclusion Criteria• At least 20 inflammatory and 25 non-inflammatory lesions• IGA 5 point scale – Moderate to Severe (Grade 3 or 4)

• Co-primary Efficacy Endpoints:1. Mean change from baseline in inflammatory lesion count2. Proportion of subjects with IGA scores of “Clear” or “Almost Clear”, with improvement of at least 2 grades from

baseline

• Safety Evaluations: AEs, physical exams, vitals, dermal tolerability, erythema assessments, labs

FMX103Topical Minocycline Foam For Moderate-to-Severe Rosacea

24

Rosacea

• Chronic acneiform disorder affecting both the skin and the eye

• Affects ~ 16 million adults in the US1

• Typical age of onset for rosacea – 30-60

• More common in Caucasian population

• 2 primary subtypes1

◦ Erythemato-telangiectatic – facial flushing and redness

◦ Papulopustular – acne-like papules and pustules (inflammatory lesions)

• Impact on Quality of Life2

• “Devastating impact on emotional well being”

• Low self esteem

• Affects professional interactions

251. (1) National Rosacea Society. Rosacea Review; Winter 2010. http://www.rosacea.org/rr/2010/winter/article_1.php. Accessed

May 16, 2016; (2) Wilkin J, et al. J Am Acad Dermatol. 2002;46:584-587. 2. Pathogenesis and Treatment of Acne and Rosacea, Zouboulis et al., Eds, 2014, p 743-747

26

Market Leaders Volume: ~3mm TRx(~2/3rds of Total Market - $$ & TRx)

Top Brands $ USD TRxs

1 METROGEL/METRONIDAZOLE All forms, Galderma & Generics

$255,414,358 1,350,300

2 ORACEA2

Doxycyline, Galderma$219,689,492 338,160

3 FINACEA2

Azelaic Acid, Bayer$148,738,638 520,061

4 SOOLANTRAIvermectin, Galderma

$102,465,519 334,932

5 MINOCYCLINE (oral)Valeant & Generics

$43,585,959 439,525

6 MIRVASO2

Brimonidine, Galderma$40,517,131 99,378

Total Market Potential: ~$1.1 billion(Approximately 16 million people)

ORACEA2

7%

METRONIDAZOLE (all forms)

28%

FINACEA2

10%

SOOLANTRA7%

MINOCYCLINE (oral)9%

MIRVASO2

2%

OTHER37%

Top Brand Market Share, US TRxLTM December 31, 2016

77%

23%

US TRx: Topicals vs. OralsLTM December 31, 2016

Topicals

Orals

Rosacea – the US Market (2016)Undifferentiated Market with Limited Competition

Current Market (United States)1

US Dollars TRxs

Oral antibiotics $270 million 1.1 mm

Topical drugs $830 million 3.6 mm

Total $1.1 billion 4.7 mm

1. Symphony Health Services PHAST: 2016 Market Data (accessed 1.24.17), weighted values, rosacea usage2. Select brands, unweighted values (>75% rosacea usage)

Phase 2 Clinical Trial

27

12-week, randomized, double-blind, dose range-finding study in subjects with moderate-to-severe papulopustular rosacea

Week 12(End of treatment)

Week 16Week: 6 10

Randomized (1:1:1), double-blindN=233

• Inclusion criteria◦ At least 12 papules and/or pustules

◦ Investigator’s Global Assessment (IGA): Moderate-to-Severe

• Efficacy endpoints◦ Absolute change in inflammatory lesion count at Week 12 compared to Baseline ◦ Investigator’s Global Assessment – IGA

◦ Proportion of subjects with IGA improvement of ≥2 grades

◦ Proportion of subjects with IGA scores of “Clear” / “Almost Clear”

• Safety & tolerability

• Minocycline foam 1.5%• Minocycline foam 3%• Foam Vehicle

1 2 4 80

Follow Up

Once daily, in the evening, for 12 weeks

28ANCOVA; multiple imputation method‡P<.05; †P<.01; *P<.001

IGA Scale: 0=Clear; 1=Almost Clear; 2=Mild; 3=Moderate; 4=SevereITT Population; Cochran–Mantel–Haenszel test; multiple imputation method

FMX103 – Phase 2 Efficacy ResultsClinically and statistically significant lesion reduction and IGA score

% Reduction of Papules & PustulesIGA = “Clear” or “Almost Clear” (Score of 0-1)

and Improvement ≥2 Grades

% S

ub

ject

s w

ith

IGA

= 0

-1

XC

P=.001

XC

P<.05

0%

5%

10%

15%

20%

25%

30%

35%

40%

FMX103 1.5% FMX103 3% Vehicle

25.3%

17.3%

7.7%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

0 2 4 6 8 10 12

FMX103 1.5% (n=79)

FMX103 3% (n=75)

Vehicle (n=78)

−61.4%

−55.5%

−29.7%

*

*

†

Weeks

*

*

% R

ed

uct

ion

of

Pap

ule

s &

Pu

stu

les

*

*

• No statistically significant difference between 1.5% and 3% doses

• Based on these results, FMX103 1.5% has been selected for further development

29

Rosacea Phase 2 ResultsVisible Effects on Moderate-to-Severe Rosacea Subjects

Baseline Visit Week-12 Visit

30

Rosacea Phase 2 ResultsVisible Effects on Moderate-to-Severe Rosacea Subjects

Baseline Visit Week-12 Visit

Rosacea Phase 2 Results

31

Safety and Tolerability

FMX103 – Generally Safe and Well Tolerated

• No SAEs or drug-related systemic adverse events were reported

• Drug-related skin reactions (AEs):

• A total of 4 subjects discontinued the study due to an adverse event (3 in the 3% group and 1 in the vehicle group)

No. Subjects FMX103 1.5% FMX103 3% Vehicle

Eczema of face 0 1 1

Skin exfoliation/scaling 0 1 0

Erythema 0 0 1

Pruritus 0 0 1

Scab/Crust in treatment area 0 0 1

Skin burning 0 0 1

Worsening of Rosacea 0 2 0

FMX103 Phase 3 Study Design Studies FX2016-11, FX2016-12 & FX2016-13

32

12-week, randomized, double-blind, vehicle controlled, in subjects with moderate-to-severe papulopustular rosacea; followed by 9 month open label safety extension

Week 12 (End of treatment) 12 MonthsWeek 2 Week 4 Week 8

Double-blinded Study (-11,-12)Randomized (2:1), double-blind

N=750 (X2)

• Minocycline Foam 1.5%

• Foam vehicleMinocycline foam 1.5% – 9 months of treatment

Open Label Safety Extension Study (-13) Subjects who complete one of the randomized, Phase 3 studies may

enter the open-label study

• 2 US Studies, ~80 sites, 750 subjects per study (N=1,500 subjects), >18 years of age• Self-apply, once daily, for 12 weeks

• Inclusion Criteria• 15 to 75 inflammatory lesions • IGA 5 point scale – Moderate to Severe (Grade 3 or 4)

• Co-primary Efficacy Endpoints:1. Mean change from baseline in inflammatory lesion count2. Proportion of subjects with IGA scores of “Clear” or “Almost Clear”, with improvement of at least 2 grades

from baseline

• Safety Evaluations: AEs, physical exams, vitals, dermal tolerability, erythema assessments, labs

Commence Study Mid-2017; Topline results expected Mid-2018

Upcoming Milestones

33

TLR (Studies 04 & 05)

Mar 27

3rd Ph3 DB (Study 22)

Ph3 LTS

3rd Ph3 TLR

NDA

PDUFA

Ph3 DB (Studies 11 & 12)

Ph3 TLR (DB)

Ph3 LTS

NDA

PDUFA

2017 2020H12017

H2H12018

H2H12019

H2H12020

H2

FMX101, 4% (Acne)

FMX103, 1.5% (Rosacea)

TLR = Topline Results*Actual timelines may vary

Commercial Landscape

34

Recent Acne/Rosacea Product Launches

35

Significant Rx Adoption and Revenue Within 1 year of Commercialization

Source: Symphony Health Analytics PHAST (accessed 1.24.17).

Months since launch

TRx

per

mo

nth

-

10,000

20,000

30,000

40,000

50,000

1 2 3 4 5 6 7 8 9 10 11 12

Acticlate -2014(Doxycycline Tablets)

Aczone 7.5% -2016(Dapsone Gel Pump)

Epiduo Forte -2015(Adapalene/BPO Gel Pump)

Onexton -2015(Clindamycin/BPO Gel Pump)

Soolantra -2015 (Ivermectin Cream) Finacea Foam -2015(Azelaic Acid)

Valeant – PhilidorControversy

A Pro-Commercial Reimbursement Environment Payer mix: branded acne drugs (all payer types / 2016)

Source: Symphony Health Analytics PHAST (accessed 1.24.17).(1) Assistance Programs include aid for “medically indigent” patients (those who are without insurance, have low income or are ineligible for public programs) which can be privately or State funded and coupon programs that have been identified and profiled.

Commercial Payers and Cash account for ~80% of total reimbursement within the Oral Branded Market.

Oral

Commercial Payers and Cash account for ~80% of total reimbursement within the Topical Branded Market.

Topical

36

ASSISTANCE PROGRAMS, 11%

CASH , 3%

COMMERCIAL, 77%

MANAGED MEDICAID , 4%

MEDICAID , 4%

MEDICARE , 1%

Other, 23%

ASSISTANCE PROGRAMS,

20%

CASH , 2%COMMERCIAL,

77% MANAGED MEDICAID , 0%

MEDICAID , 0%

MEDICARE , 1%

Other, 3%

(1)

(1)

Rx Volume Driven by Small Prescriber Base

37

Total Active Derms(~15,000)

Rx Volume (80%)

Rx Volume(100%)

• ~1/3 of Dermatologists generate ~80% of Rx volume

• Optimal Sales Force size < 100 representatives

Target Universe

Derms(~5000)

Ability to reach prescriber base with a lean salesforce and maximize commercial efforts

Source: Symphony Health Analytics DCL (Dynamic Claims Lifecycle). Data from 2015-2016.

Collaborations

• Development and licensing agreements with pharmaceutical companies

• Each license agreement is product specific (Licensee’s drug)

• Licensed products are currently in preclinical, Phase 2, Phase 3 and commercial stages

• Foamix owns the IP for the drug delivery platform

• Foamix retains the rights to develop products for the same indications using our foam technology in conjunction with other drugs

38

• Upfront payments, contingent payments and royalties on sales of products that are commercialized

• Total of ~$25.4 million cumulative revenues as of March 31, 2017

• Recurring royalties since Q4, 2015

Revenues

Nasdaq: FOMX

May 2017