My original projects of rm (autosaved)

-

Upload

mehul-mehul -

Category

Education

-

view

295 -

download

3

Transcript of My original projects of rm (autosaved)

ANKIT SHAHARPAN SHROFFCHIRAG ZALAJAYANT RAJPUTRAHUL JAINER. MEHUL SINH RAJPUT

A COMPARATIVE STUDY BETWEEN PRIVATE SECTOR BANKS AND PUBLIC SECTOR BANKS

2

D ECLARATION:-

Title: A Comparative Study between Private Sector Banks and Public Sector Banks.

Degree for which the Thesis is submitted: Master of Business Administration

We declare that the presented thesis represents largely our own ideas and work in our own

words. Where others ideas or words have been included, we have adequately cited and listed

in the reference materials. The thesis has been prepared without resorting to plagiarism. We

have adhered to all principles of academic honesty and integrity. No falsified or fabricated

data have been presented in the thesis. We understand that any violation of the above will

cause for disciplinary action by the Institute, including revoking the conferred degree, if

conferred, and can also evoke penal action from the sources which have not been properly

cited or from whom proper permission has not been taken.

Submitted By: Submitted To:

ANKIT SHAH AMISH SONI

ARPAN SHROFF

CHIRAG ZALA

JAYANT RAJPUT

RAHUL JAIN

Er. MEHUL SINH RAJPUT

3

ACKNOWLEDGEMENT:-

We take this opportunity to render our deep sense of gratitude to our professor, DIRECTOR

DR. HITESH RUPARELL Mr. AMISH SONI, Assistant Professor, Department of

Management Studies for his constant and valuable guidance in the truest sense throughout the

course of the work. It was his encouragement and support from the initial to the final level

enabled me to develop an understanding of the topic. Every time we had a problem, we

would rush to him for his advice, and he would never ever let us down. His timely

suggestions helped me to circumvent all sorts of hurdles that we had to face throughout our

work. we are deeply indebted for his motivation and guidance.. Thanks go out to all our

friends as they have always been around to provide useful suggestions, companionship and

created a peaceful research environment. We wish to acknowledge the continuous support

and blessings of our parents which made this work possible. Although they were physically

far away from us, their immense faith and wish is gratefully acknowledged. Finally we

believe this research experience will greatly benefit our career in the future.

4

PREFACE

Management today is must for day-to-day life. Management is the integral part of the

business. In this world, all things need proper management for its success. Business without

proper management is like a castle of sand built on seashore. Even individuals need proper

management for running their life smoothly. Only theoretical knowledge is not enough in

MBA along with one needs some practical exposure in the corporate world also. MBA

provides this opportunity through the medium of group projects. This project has made one

thing clear that there are two pillars for getting success in business i.e. efficiency and

Effectiveness; it means not only doing right things but also doing things rightly.

In MBA Theory of any subject is important but without its practical knowledge it becomes

unless particularly for the Management Students. As a students of the Business

Administration, we have studied many theories and concepts in the classroom, but only after

taking up this project work we have experienced & understood these Management theories

&practices in its fullest sense, which plays a very vital role in business field today. The

knowledge of management is incomplete without knowing the practical application of the

theories studied. This project report gives knowledge of difference between public or

private sector bank.. This project has brought positive changes in our lifes & career. The

Project gave us a lot exposure which will be helpful to us for the rest of the MBA curriculum.

We consider ourselves fortunate enough for getting guidance from one of the best banks at a

very important stage of my career.

5

EXECUTIVE SUMMARY :-

The objective of the study is to have a comparative study of the PSU Banks and Private Sector Banks

in Semi urban areas and also to find out the most preferred Banking Sector among them.

For the above study a questionnaire was designed and the same was provided to the respondents for

their valuable inputs. Some of the inputs were taken from Qualtrics Survey Software and others were

provided in the form of hard copies.

All the aspects of the study included introduction of the study, objective of the study, research

methodology, literature review, data interpretation and analysis, findings, suggestions and

recommendations.

The study suggests that in this part of the country the Public Sector Banks are ahead of the Private

Sector Banks. The main reasons according to our study are the trust and reliability factor (DICGC

assurance on deposits) and the location of the branch (Financial Inclusion policy of Reserve Bank of

India)

The data collection of the study was mainly taken from primary source i.e. Questionnaire and

secondary sources of the data i.e. internet and Kiran Prakashan Books and Arihant Books AND 10

days of MBA.

6

INDEX

Sr. No particular page no

RESEARCH METHODOLOGY

Chapter 1 Research proposal

Objective of study

Statement of problem

Literature review

Sample design

Data collection

Primary data

Secondary data

Sample plan

Sample size

Sample unit

Sample unit

Sample technique

Sample description

THE BANKING INDUSTRY IN INDIA

Chapter 2 Introduction of banking

Banks overview

History of banks

Public sector banks

Private sector banks

DATA ANALYSIS

Chapter 3 Analysis of the banks

Two variables

Hypothesis

Hypothesis –Chi -Square

Chapter 4 Finding of the study

Finding respects of the objective

7

INDEX

Chapter 5 suggestion

Chapter 6 recommendation

Chapter 7 conclusion

Chapter 8 annexure

Chapter 9 bibliography

FIGURES AND CHARTS

Fig 1 Business of banking

Fig 2 Function of banking

Fig 3 Banking system

Fig 4 All banks account

Fig 5 Public and private difference

Fig 6 Sector preference

Fig 7 Preferred bank

Fig 8 Transaction in bank

Fig 9 Service provider by bank

Fig 10 Different charges time of transaction

Fig 11 Bank efficiency

Fig 12 Satisfaction level with the bank

8

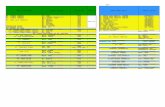

Tables

Table 1 Statics

Table 2 Bank account details

Table 3 Statics

Table 4 Bank public and private

Table 5 Statics

Table 6 Bank account prefer

Table 7 Statics

Table 8 Bank account maintain

Table 9 Performance

Table 10 Facilities provider

Table 11 Types of service provider

Table 12 Statics

Table 13 Bank levy the charges

Table 14 Overall efficiency

Table 15 Statics

Table 16 Decision about transaction

Table 17 Statics

Table 18 Satisfaction level

Table 19 Statics

Table 20 Service provider

Table 21 Improve facilities

Table 22 Statics

Tables 23 Change the sector

Tables 24 Hypothesis

Table 25 Chi-square test

Chapter 1

9

RESEARCH METHODOLOGY

OBJECTIVE OF THE STUDY

This study has been conducted with a variety of important objectives in mind. The

following provides us with the chief objectives that have tried to achieve through the study.

The extent to which these objectives have been met could judged from the conclusions and

suggestions, which appear in the later of this study.

The Chief Objectives of this study are:-

1. To find the banking sector largely preferred by the customers.

2. To find out the factors which influence the customers to choose a bank.

3. To study the problems faced by the customers in public as well as private

sector banks and also to compare between them.

STATEMENT OF PROBLEM-

The “expectations” of customers influence their buying behaviour. The customers

relate this expectation to the quality of service provided by the banks. The level of

expectation differs from person to person but everyone wants the banks to provide the

products and services which can satisfy their needs up to their expected level or to a higher

level so as to offer them a higher satisfaction. The level of satisfaction of customers is

affected by some other attributes also other than the quality of service such as their

experience with the bank employees etc. As there is a huge competition in the banking sector

in India, the customer satisfaction is an important factor in the success of the banks. So with

this background an attempt has been made to study the satisfaction of the customers of

various banks taking into consideration some important attributes which customers consider

for rating their satisfaction with a particular bank.

LITERATURE REVIEW:-

10

A literature review provides an overview and a critical evaluation of a body of

literature relating to a research topic or a research problem. It analyses a body of literature in

order to classify it by themes or categories, rather than simply discussing individual works

one after the other. A literature review often forms part of a larger research project such as

within a thesis, or it may be an independent written work, such as a synthesis written paper.

PURPOSE OF A LITERATURE REVIEW -

A literature review situates our topic in relation to previous researches and illuminates a

spot for our research. It accomplishes several goals –

Provides background for topic using previous research.

Shows we are familiar with previous, relevant research.

Evaluates the depth and breadth of the research with regards to our topic.

Determines relating questions or aspects of our topic in need of research.

In our research the main source of information has been the questionnaire filled up by the

respondents as well as the internet. The topic of our research “comparative study of the PSU

banks and private banks.” has not been published earlier. So the main argument of the topic

whether PSU banks or private banks rule has been the main focus. The internet, questionnaire

served by us to the respondents, website of particular banks has been the major source of

information. Few worth literatures like Kiranprakashan bank books, Arihants banking

knowledge have been very valuable.

PRASHANTA ATHMA (2000 ):-

In his Ph D research submitted at Usmania University Hyderabad, “Performance of

Public Sector Banks – A Case Study of State Bank of Hyderabad, made an attempt to

evaluate the performance of Public Sector Commercial Banks with special emphasis on State

Bank of Hyderabad. The period of the study for evaluation of performance is from 1980 to

1993-94, a little more than a decade. In this study, Athma outlined the Growth and Progress

of Commercial Banking in India and. analyzed the trends in deposits, various components of

profits of SBH, examined the trends in Asset structure, evaluated the level of customer

satisfaction and compared the performance of SBH with other PSBs, Associate Banks of SBI

and SBI. Statistical techniques like Ratios, Percentages, Compound Annual rate of growth

and averages are computed for the purpose of meaningful comparison and analysis. The

major findings of this study are that since nationalization, the progress of banking in India has

been very impressive. All three types of Deposits have continuously grown during the study

period, though the rate of growth was highest in fixed deposits. A comparison of SBH

11

performance in respect of resource mobilization with other banks showed that the average

growth of deposits of SBH is higher than any other bank group. Profits of SBH showed an

increasing trend indicating a more than proportionate increase in spread than in burden.

Finally, majority of the customers have given a very positive opinion about the various

statements relating to counter service offered by SBH.

ZACHARIAS THOMAS(1997 ):-

Ph D Thesis, ‘Performance effectiveness of Nationalised Bank- A Case Study of

Syndicate Bank’, submitted to Kochin University (1997), Thesis studied the performance

effectiveness of Nationalized Bank by taking Syndicate Bank as case study in his Ph.D thesis.

Thomas has examined various aspects like growth and development of banking industry,

achievements of Syndicate Bank in relation to capital adequacy, quality of assets,

Profitability, Social Banking, Growth, Productivity, Customer Service and also made a

comparative analysis of 'the performance effectiveness of Syndicate Bank in relation to

Nationalized bank. A period of ten years from 1984 to 1993-94 is taken for the study. This

study is undertaken to review and analyze the performance effectiveness of Syndicate Bank

and other Nationalized banks in India using an Economic Managerial efficiency Evaluation

Model (EMEE Model) developed by researcher. Thomas in this study found that Syndicate

Bank got 5th Position in Capital adequacy and quality of assets, 15th in Profitability, 14th

Position in Social Banking, 8thin Growth, 7th in Productivity and 15th position in Customer

Service among the nationalized banks. Further, he found that five nationalized banks showed

low health performance, seven low priority performance and eleven low efficiency

performance in comparison with Syndicate Bank.

SINGH R (2003):-

In his paper Profitability management in banks under deregulate environment, IBA

bulletin, No25, has analyzed profitability management of banks under the deregulated

environment with some financial parameters of the major four bank groups i.e. public sector

banks, old private sector banks, new private sector banks and foreign banks, profitability has

declined in the deregulated environment. He emphasized to make the banking sector

competitive in the deregulated environment. They should prefer noninterest income sources.

JHA AND SARANGI (2011) :-

12

Analyzed the performance of seven public sector and private sector banks for the year

2009-10. They used three sets of ratios, operating performance ratios, financial ratios, and

efficiency ratios. In all eleven ratios were used. They found that Axis Bank took the first

position, followed ICICI Bank, BOI, PNB, SBI, IDBI, and HDFC, in that order.

DANGWAL AND KAPOOR (2010):-

Evaluated the financial performance of nationalized banks in India and assessed the

growth index value of various parameters through overall profitability indices. The data for

19 nationalized banks, for the post-reform period from 2002-03 to 2006-07, was used to

calculate the index of spread ratios, burden ratios, and profitability ratios. They found that

while four banks had excellent performance, five achieved good performance, four attained

fair performance, and six had poor performance.

SHARMA (2010 ):-

Assessed the bank failure resolution mechanism to analyze the powers given by the

countries to their regulators to carry out resolution of failed banks among 148 countries

during 2003. She used 12 variables for correlation and regression analysis. Her study

revealed that the countries which had faced systemic crisis were more prone to providing

liquidation powers to their regulators. These countries had a tendency to protect their

regulators through immunity, rather than any legal action. Systemic crisis did not

significantly influence the regulators’ powers for the restructuring of the banks.

PAT (2009):-

Made an assessment of the RBI’s Report on “Trend and Progress of Banking’ in India,

2007-08, which reported a relatively-healthy position of the Indian banking system. He noted

that the various groups of banks reported improvements in net profits, return on assets and

return on equity. Two basic indicators of sound banking system, namely, capital to risk

weighted assets and quality of assets, also revealed considerable improvements over the year.

SINGLA HK (2008):-

In his paper,’ financial performance of banks in India,’ in ICFAI Journal of Bank

Management No 7, has examined that how financial management plays a crucial role in the

growth of banking. It is concerned with examining the profitability position of the selected

sixteen banks of banker index for a period of six years (2001-06). The study reveals that the

profitability position was reasonable during the period of study when compared with the

previous years. Strong capital position and balance sheet place, Banks in better position to

deal with and absorb the economic constant over a period of time.

JOSHI VIJAYA (2007) :-

13

Observed that on the eve of banking reforms Indian Banking Sector was financially

unsound, unprofitable and inefficient. They made a critical examination of the changes that

have taken place in the banking sector after reforms. Further, what remains to be done with

respect of pre-emption of bank resources, directed credit, deregulation of interest rates, etc.

in the field of banking sector were also elaborately discussed.

Qamar (2003) :-

Identified the differences in terms of endowment factor, risk factor, revenue

diversification, profitability, and efficiency that might have existed among 100 scheduled

commercial banks, divided into three groups for the year 2000-2001. His study revealed that

the public sector banks were better endowed in terms of their assets base, share capital and

shareholders equity than other banks, whereas foreign banks and old private sector banks

operated at a very high capitalization ratio.

Joshi Vijaya (2007) :-

Observed that on the eve of banking reforms Indian Banking Sector was financially

unsound, unprofitable and inefficient. They made a critical examination of the changes

that have taken place in the banking sector after reforms. Further, what remains to be

done with respect of pre-emption of bank resources, directed credit, deregulation of

interest rates, etc. in the field of banking sector were also elaborately discussed.

Muniappan (2002):-

Studied paradigm shift in banks from a regulator point of view in Indian Banking :

Paradigm Shift, IBA Bulletin, No 24 -3. He concluded the positive effect of banking

sector reforms on the performance of banks. He suggested many effective measures to

strengthen the Indian banking system. The reduction of NPAs, more provisions for

standards of the banks, IT, sound capital bare are the positive measures for a paradigm

shift. A regulatory change is required in the Indian banking system.

14

Research is an art of scientific investigation. In other words research is a scientific

and systematic search for pertinent information on a specific topic. The logic behind taking

research methodology into consideration is that one can have knowledge regarding the

method and procedure adopted for achievements of objective of the project. With the

adoption of this others can also evaluate the results too.

The methodology adopted for studying the objective of the project was surveying the

bank account holders of the Semi urban areas. So keeping in view the nature of requirement

of the study to collect all the relevant information regarding the comparison of public sector

banks and the private sector banks direct personal interview method with the help of

structured questionnaire was adopted for collection of primary data.

Secondary data has been collected through the various magazines and newspaper and

by surfing on internet and also by visiting the websites of Indian Banking Association.

SAMPLE DESIGN:- A sample design is a definite plan for obtaining a sample from a given

population. It refers to the techniques or the procedures that the researchers would adopt in

selecting items for the samples. Sample design may as well lay down the number of items to

be included in the sample i.e. the size of the sample. Sample design is determine before data

are collected. Here we select the population as sample in our sample design. The selected

respondents should be as representatives of the total population.

POPULATION:- The persons holding bank accounts in the semi urban areas were taken into

consideration.

DATA COLLECTION:- Data was collected by using two main methods i.e. primary data

and secondary data.

PRIMARY DATA:- primary data is the data which is used or collected for the first time and

it is not used by anyone in the past. There are number of sources of primary data from which

the information can be collected. We took the following resources for our research.

a) QUESTIONNAIRE:- This method of data collection is quite popular, particularly in case

of big enquiries. Here in our research we set 15 simple questions and requested the

respondents to answer these questions with correct information.

SECONDARY DATA:- Secondary data is the data which is available in readymade form

and which has already been used by other people for various purposes.

15

SAMPLE PLAN:-

SAMPLE SIZE:- Keeping in mind all the constraints the size of the sample of our study was

selected as 100.

SAMPLING UNIT:- State bank of India, Due to nature of study we also visited various

branches of SBI, UBI, ICICI, AXIS.

SAMPLING TECHNIQUE:- Stratified convenient sampling. All the bank account holders

were taken into considerations. Research was conducted on clear assumptions that the

respondents would give frank and fair answer in a pragmatic way without any bias.

SAMPLING DESCRIPTION:- In order to understand the nature and characteristics of

various respondents in this study, the information was collected and analyzed according to

their socio - economic background like education, occupation, age, gender, place of domicile

etc .This descriptions show that these respondents that have been included in the study belong

to different background and this in turn enhances the capability and accuracy of the study.

16

Chapter | 3

INTRODUCTION TO BANKING:-

Bank is defined in many ways by various authors in the book son economics and

commerce. It is very difficult to define a bank; because a bank performs multifarious

functions may be defined in many ways according to their functions. The evolution of

different types of banks, each specializing in a particular field, gives emphasis on each and

every kind of bank. A general and comprehensive definition to cover all types of banking

institutions would be unscientific and probably impossible. Each type of bank should have its

own definition, explaining its specialized functions. Legislators have understood this

difficulty and that is why the bill of exchange Act 1882 (England) defines “A bank includes a

body of persons, whether incorporated or not, who carry on the business of banking” From

this definition it is clear to us that any institution, which performs the various banking

functions, may be termed as bank. But in practice it is found that many banking functions

wary from time to time and country to country. It is not possible on the part of a single bank

to perform all the banking functions at a time. So there originated numbers of specialized

banks with the objective of performing one or more functions. As for example, Central Bank,

Commercial bank, Industrial Bank, Agricultural Bank, Co-operative Bank etc., are seen in the

practical field.Dr. Herbert L. Hart has defined a banker as “A banker is one who in the

ordinary course of business honours cheques drawn upon him by persons for whom he

receives money on current account “According to Sir John Paget “No one and nobody

corporate and otherwise can be a banker who does not (i) take deposit accounts (ii) take

current accounts (iii) issue and pay cheques drawn upon him(iv) collect cheques crossed and

uncrossed for his customers “Hilton banking commission defines bank or banker as “Every

person, firm or company using in the description or its title, bank or banker or banking and

accepting deposits of money subject to withdrawal by cheque, draft or order”In view of the

above definitions, a simple and short definition can be given as “Bank is an institution, which

deals in money and credit “According to this precise definition a bank accepts deposits from

public and makes advances and loans to them. In practice bank receives deposits of money in

savings and current accounts at lower rate of interest or profit and gives on credit to needy

persons and businessmen at a higher rate of interest or profit.

17

BANKING IN INDIA:-

Banking in India in the modern sense originated in the last decades of the 18th

century. The first banks were Bank of Hindustan (1770-1829) and The General Bank of

India, established 1786 and since defunct..The largest bank, and the oldest still in existence,

is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which

almost immediately became the Bank of Bengal. This was one of the three presidency banks,

the other two being the Bank of Bombay and the Bank of Madras, all three of which were

established under charters from the British East India Company. The three banks merged in

1921 to form the Imperial Bank of India, which, upon India's independence, became the

State in 1955. For many years the presidency banks acted as quasi-central banks, as did their

successors, until the Reserve Bank of India was established in 1935..In 1969 the Indian

government nationalized all the major banks that it did not already own and these have

remained under government ownership. They are run under a structure know as 'profit-

making public sector undertaking' (PSU) and are allowed to compete and operate

as commercial banks. The Indian banking sector is made up of four types of banks, as well as

the PSUs and the state banks; they have been joined since the 1990s by new private

commercial banks and a number of foreign banks.Banking in India was generally fairly

mature in terms of supply, product range and reach-even though reach in rural India and to

the poor still remains a challenge. The government has developed initiatives to address this

through the State Bank of India expanding its branch network and through the National Bank

for Agriculture and Rural Development with things like microfinance.Indian Banking

Industry currently employees 1,175,149 employees and has a total of 109,811 branches in

India and 171 branches abroad and manages an aggregate deposit of 67504.54

billion (US$1.1 trillion or €820 billion) and bank credit of 52604.59 billion (US$880 billion

or €640 billion).

HISTORY OF BANKING IN INDIA:

In ancient India there is evidence of loans from the Vedic period (beginning 1750

BC). Later during the Maurya dynasty (321 to 185 BC), an instrument called adesha was in

use, which was an order on a banker desiring him to pay the money of the note to a third

person, which corresponds to the definition of a bill of exchange as we understand it today.

During the Buddhist period, there was considerable use of these instruments. Merchants in

large towns gave letters of credit to one another.

18

COLONIAL ERA:-

During the period of British rule merchants established the Union Bank of Calcutta in

1829, first as a private joint stock association, then partnership. Its proprietors were the

owners of the earlier Commercial Bank and the Calcutta Bank, who by mutual consent

created Union Bank to replace these two banks. In 1840 it established an agency at

Singapore, and closed the one at Mirzapur that it had opened in the previous year. Also in

1840 the Bank revealed that it had been the subject of a fraud by the bank's accountant.

Union Bank was incorporated in 1845 but failed in 1848, having been insolvent for some

time and having used new money from depositors to pay its dividends.

The Allahabad Bank, established in 1865 and still functioning today, is the

oldest Joint Stock bank in India, it was not the first though. That honour belongs to the Bank

of Upper India, which was established in 1863, and which survived until 1913, when it failed,

with some of its assets and liabilities being transferred to the Alliance Bank of Simla.

Foreign banks too started to appear, particularly in Calcutta, in the 1860s.

The Comptoird'Escompte de Paris opened a branch in Calcutta in 1860, and another

in Bombay in 1862; branches in Madras and Pondicherry, then a French possession,

followed. HSBC established itself in Bengal in 1869. Calcutta was the most active trading

port in India, mainly due to the trade of the British Empire, and so became a banking centre.

The first entirely Indian joint stock bank was the Oudh Commercial Bank, established in

1881 in Faizabad. It failed in 1958. The next was the Punjab National Bank, established in

Lahore in 1895, which has survived to the present and is now one of the largest banks in

India.

Around the turn of the 20th Century, the Indian economy was passing through a

relative period of stability. Around five decades had elapsed since the Indian Mutiny, and the

social, industrial and other infrastructure had improved. Indians had established small banks,

most of which served particular ethnic and religious communities.

The presidency banks dominated banking in India but there were also some exchange banks

and a number of Indian joint stock banks. All these banks operated in different segments of

the economy. The exchange banks, mostly owned by Europeans, concentrated on financing

foreign trade. Indian joint stock banks were generally undercapitalized and lacked the

experience and maturity to compete with the presidency and exchange banks. This

segmentation let Lord Curzon to observe, "In respect of banking it seems we are behind the

19

times. We are like some old fashioned sailing ship, divided by solid wooden bulkheads into

separate and cumbersome compartments."

The period between 1906 and 1911, saw the establishment of banks inspired by

the Swadeshi movement. The Swadeshi movement inspired local businessmen and political

figures to found banks of and for the Indian community. A number of banks established then

have survived to the present such as Bank of India, Corporation Bank, Bank, Bank, Canara

Bank and Central Bank of India.

The fervour of Swadeshi movement lead to establishing of many private banks

in Dakshina Kannada and Udupi district which were unified earlier and known by the

name South Canara ( South Kanara ) district. Four nationalised banks started in this district

and also a leading private sector bank. Hence undivided Dakshina Kannada district is known

as "Cradle of Indian Banking".

During the First World War (1914–1918) through the end of the Second World

War (1939–1945), and two years thereafter until the independence of India were challenging

for Indian banking. The years of the First World War were turbulent, and it took its toll with

banks simply collapsing despite the Indian economy gaining indirect boost due to war-related

economic activities. At least 94 banks in India failed between 1913 and 1918 as indicated in

the following table:

YearsNumber of banks

that failed

Authorised Capital

( Lakhs)

Paid-up Capital

( Lakhs)

1913 12 274 35

1914 42 710 109

1915 11 56 5

1916 13 231 4

1917 9 76 25

1918 7 2091

20

POST-INDEPENDENCE:- The partition of India in 1947 adversely impacted the

economies of Punjab and West Bengal, paralysing banking activities for months.

India's independence marked the end of a regime of the Laissez-faire for the Indian banking.

The Government of India initiated measures to play an active role in the economic life of the

nation, and the Industrial Policy Resolution adopted by the government in 1948 envisaged

a mixed economy. This resulted into greater involvement of the state in different segments of

the economy including banking and finance.

The major steps to regulate banking included: The Reserve Bank of India, India's

central banking authority, was established in April 1935, but was nationalised on 1 January

1949 under the terms of the Reserve Bank of India (Transfer to Public Ownership) Act, 1948

(RBI, 2005b).

In 1949, the Banking Regulation Act was enacted which empowered the Reserve

Bank of India (RBI) "to regulate, control, and inspect the banks in India".

IN THE 1960S:

Despite the provisions, control and regulations of the Reserve Bank of India, banks in

India except the State Bank of India (SBI), continued to be owned and operated by private

persons. By the 1960s, the Indian banking industry had become an important tool to facilitate

the development of the Indian economy. At the same time, it had emerged as a large

employer, and a debate had ensued about the nationalization of the banking industry. Indira

Gandhi, the then Prime Minister of India, expressed the intention of the Government of

India in the annual conference of the All India Congress Meeting in a paper entitled "Stray

thoughts on Bank Nationalization."[7] The meeting received the paper with enthusiasm.

Thereafter, her move was swift and sudden. The Government of India issued an ordinance

('Banking Companies (Acquisition and Transfer of Undertakings) Ordinance, 1969') and

nationalised the 14 largest commercial banks with effect from the midnight of 19 July 1969.

These banks contained 85 percent of bank deposits in the country.[7] Jayaprakash Narayan, a

national leader of India, described the step as a "masterstroke of political sagacity." Within

two weeks of the issue of the ordinance, the Parliament passed the Banking Companies

(Acquisition and Transfer of Undertaking) Bill, and it received the presidential approval on 9

August 1969.

A second dose of nationalisation of 6 more commercial banks followed in 1980. The

stated reason for the nationalisation was to give the government more control of credit

21

delivery. With the second dose of nationalisation, the Government of India controlled around

91% of the banking business of India. Later on, in the year 1993, the government merged

New Bank of India with Punjab National Bank. It was the only merger between nationalised

banks and resulted in the reduction of the number of nationalised banks from 20 to 19. After

this, until the 1990s, the nationalised banks grew at a pace of around 4%, closer to the

average growth rate of the Indian economy.

LIBERALIZATION IN THE 1990s:-

In the early 1990s, the then government embarked on a policy of liberalization,

licensing a small number of private banks. These came to be known as New Generation tech-

savvy banks, and included Global Trust Bank (the first of such new generation banks to be

set up), which later amalgamated with Oriental Bank of Commerce, UTI Bank (since

renamed Axis), ICICI Bank and HDFC Bank. This move, along with the rapid growth in

the economy of India, revitalised the banking sector in India, which has seen rapid growth

with strong contribution from all the three sectors of banks, namely, government banks,

private banks and foreign banks.

The next stage for the Indian banking has been set up with the proposed relaxation in

the norms for foreign direct investment, where all foreign investors in banks may be given

voting rights which could exceed the present cap of 10% at present. It has gone up to 74%

with some restrictions.

22

CURRENT PERIOD:-

All banks which are included in the Second Schedule to the Reserve Bank of India Act,

1934 are Scheduled Banks. These banks comprise Scheduled Commercial Banks and

Scheduled Co-operative Banks. Scheduled Commercial Banks in India are categorised into

five different groups according to their ownership and/or nature of operation. These bank

groups are:

State Bank of India and its Associates

Nationalised Banks

Private Sector Banks

Foreign Banks

Regional Rural Banks.

In the bank group-wise classification, IDBI Bank Ltd. is included in Nationalised Banks.

Scheduled Co-operative Banks consist of Scheduled State Co-operative Banks and Scheduled

Urban Cooperative Banks.

By 2010, banking in India was generally fairly mature in terms of supply, product range

and reach-even though reach in rural India still remains a challenge for the private sector and

foreign banks. In terms of quality of assets and capital adequacy, Indian banks are considered

to have clean, strong and transparent balance sheets relative to other banks in comparable

economies in its region. The Reserve Bank of India is an autonomous body, with minimal

pressure from the government.

With the growth in the Indian economy expected to be strong for quite some time-

especially in its services sector-the demand for banking services, especially retail banking,

mortgages and investment services are expected to be strong. One may also expect M&As,

takeovers, and asset sales.

In March 2006, the Reserve Bank of India allowed Warburg Pincus to increase its

stake in Kotak Mahindra Bank (a private sector bank) to 10%. This is the first time an

investor has been allowed to hold more than 5% in a private sector bank since the RBI

announced norms in 2005 that any stake exceeding 5% in the private sector banks would

need to be vetted by them.

In recent years critics have charged that the non-government owned banks are too

aggressive in their loan recovery efforts in connexion with housing, vehicle and personal

loans. There are press reports that the banks' loan recovery efforts have driven defaulting

borrowers to suicide.

23

ADOPTION OF BANKING TECHNOLOGY:-

The IT revolution has had a great impact on the Indian banking system. The use of

computers has led to the introduction of online banking in India. The use of computers in the

banking sector in India has increased many fold after the economic liberalisation of 1991 as

the country's banking sector has been exposed to the world's market. Indian banks were

finding it difficult to compete with the international banks in terms of customer service,

without the use of information technology.

The RBI set up a number of committees to define and co-ordinate banking

technology. These have included:

In 1984 was formed the Committee on Mechanisation in the Banking Industry (1984) whose

chairman was Dr. C Rangarajan, Deputy Governor, Reserve Bank of India. The major

recommendations of this committee were introducing MICR technology in all the banks in

the metropolises in India. This provided for the use of standardized cheque forms and

encoders.

In 1988, the RBI set up the Committee on Computerisation in Banks (1988) headed by Dr. C

Rangarajan. It emphasized that settlement operation must be computerized in the clearing

houses of RBI in Bhubaneshwar, Guwahati, Jaipur, Patna and Thiruvananthapuram. It further

stated that there should be National Clearing of inter-city cheques at

Kolkata, Mumbai, Delhi, Chennai and MICR should be made operational. It also focused on

computerisation of branches and increasing connectivity among branches through computers.

It also suggested modalities for implementing on-line banking. The committee submitted its

reports in 1989 and computerisation began from 1993 with the settlement between IBA and

bank employees' associations.

In 1994, the Committee on Technology Issues relating to Payment systems, Cheque

Clearing and Securities Settlement in the Banking Industry (1994) was set up under

Chairman W S Saraf. It emphasized Electronic Funds Transfer (EFT) system, with the

BANKNET communications network as its carrier. It also said that MICR clearing should be

set up in all branches of all those banks with more than 100 branches.

In 1995, the Committee for proposing Legislation on Electronic Funds Transfer and

other Electronic Payments (1995) again emphasized EFT system.

Total numbers of ATMs installed in India by various banks as on end June 2012 is

99,218. The New Private Sector Banks in India are having the largest numbers of ATMs.

24

1.5 EXPANSION OF BANKING INFRASTRUCTURE:-

As per Census 2011, 58.7% households are availing banking services in the country.

There are 102,343 branches of Scheduled Commercial Banks (SCBs) in the country, out of

which 37,953 (37%) bank branches are in the rural areas and 27,219 (26%) in semi-urban

areas, constituting 63% of the total numbers of branches in semi-urban and rural areas of the

country. However, a significant proportion of the households, especially in rural areas, are

still outside the formal fold of the banking system. To extend the reach of banking to those

outside the formal banking system, Government and Reserve Bank of India (RBI) are taking

various initiatives from time to time some of which are enumerated below:

Opening of Bank Branches: Government had issued detailed strategy and guidelines

on Financial Inclusion in October 2011, advising banks to open branches in all habitations of

5,000 or more population in under-banked districts and 10,000 or more population in other

districts. Out of 3,925 such identified villages/habitations, branches have been opened in

3,402 villages/habitations (including 2,121 Ultra Small Branches) by end of April, 2013.

Each household to have at least one bank account: Banks have been advised to ensure

service area bank in rural areas and banks assigned the responsibility in specific wards in

urban area to ensure that every household has at least one bank account.

Business Correspondent Model: With the objective of ensuring greater financial inclusion

and increasing the outreach of the banking sector, banks were permitted by RBI in 2006 to

use the services of intermediaries in providing financial and banking services through the use

of Business Facilitators (BFs) and Business Correspondents (BCs). Business correspondents

are retail agents engaged by banks for providing banking services at locations other than a

bank branch/ATM. BCs and the BC Agents (BCAs) represent the bank concerned and enable

a bank to expand its outreach and offer limited range of banking services at low cost,

particularly where setting up a brick and mortar branch is not viable. BCs as agents of the

banks, thus, are an integral part of the business strategy for achieving greater financial

inclusion. Banks had been permitted to engage individuals/entities as BC like retired bank

employees, retired teachers, retired government employees, ex-servicemen, individual owners

of kirana/medical/fair price shops, individual Public Call Office (PCO) operators, agents of

Small Savings Schemes of Government of India, insurance companies, etc. Further, since

September 2010, RBI had permitted banks to engage "for profit" companies registered under

the Indian Companies Act, 1956, excluding Non-Banking Financial Companies (NBFCs), as

BCs in addition to individuals/entities permitted earlier. According to the data maintained by

25

RBI, as in December, 2012, there were over 152,000 BCs deployed by Banks. During 2012-

13, over 183.8 million transactions valued at 165 billion (US$2.8 billion) had been

undertaken by BCs till December 2012.

Swabhimaan Campaign: Under "Swabhimaan" - the Financial Inclusion Campaign

launched in February 2011, banks had provided banking facilities by March, 2012 to over

74,000 habitations having population in excess of 2000 using various models and

technologies including branchless banking through Business Correspondents Agents (BCAs).

Further, in terms of Finance Minister's Budget Speech 2012-13, the "Swabhimaan" campaign

has been extended to habitations with population of more than 1,000 in North and to

habitations which have crossed population of 1,600 as per census 2001. About 40,000 such

habitations have been identified to be covered under the extended "Swabhimaan" campaign.

Setting up of Ultra Small Branches (USBs): Considering the need for close

supervision and mentoring of the Business Correspondent Agents (BCAs) by the respective

banks and to ensure that a range of banking services are available to the residents of such

villages, Ultra Small Branches (USBs) are being set up in all villages covered through BCAs

under Financial Inclusion. A USB would comprise of a small area of 100 sq ft (9.3 m2) -

200 sq ft (19 m2) where the officer designated by the bank would be available with a laptop

on pre-determined days. While the cash services would be offered by the BCAs, the bank

officer would offer other services, undertake field verification and follow up on the banking

transactions. The periodicity and duration of visits can be progressively enhanced depending

upon business potential in the area. A total of over 50,000 USBs have been set up in the

country by March, 2013.

Banking Facilities in Unbanked Blocks: All the 129 unbanked blocks (91 in North

East States and 38 in other States) identified in the country in July 2009, had been provided

with banking facilities by March 2012, either through Brick Mortar Branch or Business

Correspondents or Mobile van. As a next step it has been advised to cover all those blocks

with BCA and Ultra Small Branch which have so far been covered by mobile van only.

USSD Based Mobile Banking: National Payments Corporation of India (NPCI)

worked upon a "Common USSD Platform" for all banks and telcos who wish to offer the

facility of Mobile Banking using Unstructured Supplementary Service Data (USSD) based

Mobile Banking. The Department helped NPCI to get a common USSD Code *99# for all

telcos. More than 20 banks have joined the National Uniform USSD Platform (NUUP) of

NPCI and the product has been launched by NPCI with BSNL and MTNL. Other telcos are

likely to join in the near future. USSD based Mobile Banking offers basic Banking facilities

26

like Money Transfer, Bill Payments, Balance Enquiries, Merchant Payments etc. on a simple

GSM based Mobile phone, without the need to download application on a phone as required

at present in the IMPS based Mobile Banking.

STEPS TAKEN BY RESERVE BANK OF INDIA (RBI) TO STRENGTHEN THE

BANKING INFRASTRUCTURE:-

RBI has permitted domestic Scheduled Commercial Banks (excluding RRBs) to open

branches in tier 2 to tier 6 cities (with population up to 99,999 as per census 2001) without

the need to take permission from RBI in each case, subject to reporting.

RBI has also permitted SCBs (excluding RRBs) to open branches in rural, semi-urban

and urban centres in North Eastern States and Sikkim without having the need to take

permission from RBI in each case, subject to reporting.

Regional Rural Banks (RRBs) are also allowed to open branches in Tier 2 to Tier 6

centres (with population up to 99,999 as per Census 2001) without the need to take

permission from RBI in each case, subject to reporting, provided they fulfill the following

conditions, as per the latest inspection report:

CRAR of at least 9%;

Net NPA less than 5%;

No default in CRR / SLR for the last year;

Net profit in the last financial year;

CBS compliant.

Domestic SCBs have been advised that while preparing their Annual Branch Expansion

Plan (ABEP), they should allocate at least 25% of the total number of branches proposed to

be opened during the year in unbanked Tier 5 and Tier 6 centres i.e. (population up to 9,999)

centres which do not have a brick and mortar structure of any SCB for customer based

banking transactions.

RRBs have also been advised to allocate at least 25% of the total number of branches

proposed to be opened during a year in unbanked rural (Tier 5 and Tier 6) Centres).

New private sector banks are required to ensure that at least 25% of their total branches are in

semi-urban and rural centres on an ongoing basis.

TYPES OF BANKS:-

27

Central bank

Development Bank

Investment Bank

Cooperative Credit Bank

Regional Rural Bank

Non Banking Financial Companies

CENTRAL BANK:-

The money market that acts as the central monetary authority of the country, serving as the

government bank as well as the bankers’ bank is known as a central bank of the country. The

main functions of central bank of a country are functions of note issue, bankers to

government, banker’s bank etc. The RBI as the central bank of the country is the centre of the

Indian financial and monetary system. It has been guiding, monitoring, and regulating,

controlling, and promoting destiny of the IFS. It is quite young compared with such central

banks as the Bank of England, Risks bank of Sweden, and the Federal Reserve Board of the

U.S.

MAIN FUNCTIONS OF THE RESERVE BANK OF INDIA :-

As the central banking authority of India, the reserve Bank of India performs the

following traditional functions of the central bank:

It provides currency and operates the clearing system for the government and banks.

It formulates and implements monetary and credit policies.

It functions as the government’s and banker’s bank

It supervises the operations of credit institutions.

It regulates foreign exchange transactions.

It moderates the fluctuations in the exchange value of the rupee.

In addition to the traditional functions of the central banking authority, the Reserve bank

of India performs several functions aimed at developing the Indian financial system:

It seeks to integrate the unorganized financial sector with the organized financial

sector.

It encourages the extension of the commercial banking system in the rural areas.

It influences the allocation of credit.

It promotes the development of new institutions.

DEVELOPMENT BANKS:-

28

A development bank may be defined as a financial institution concerned with

providing all types of financial assistance to business units in the form of loans, underwriting,

investment and guarantee operations and promotional activities-economic development in

general and industrial development in particular.A development bank is basically a term

lending institution. It is a multipurpose financial institution with a broad development

outlook. The concept of development banks in a post independence phenomenon in India.

With the end of II World War there was an urgent need for speed industrial development in

India. The usual agencies that provided finance for large industries were inadequate. So the

govt. of India came forward to set-up a series of financial institution to provide funds to

industries. The industrial finance corporation of India, the first development bank was

established in 1948. Subsequently many other institutions were set-up. Ex. IDBI, IFCI,

SIDBI etc.

INVESTMENT BANKS:-

Financial intermediaries that acquire the savings of people and direct these funds into

the business enterprises seeking capital for the acquisition of plant and equipment and for

holding inventories are called ‘investment banks’.

Features:-Long term financing, Security, merchandiser, Security middlemen, Insurer,

Underwriter

Functions: - Capital formation, Underwriting, Purchase of securities, Selling of

securities, Advisory services, Acting as dealer.

COOPERATIVE BANKING SECTOR:-

These banks play a vital role in mobilizing savings and stimulating agricultural

investment. Co-operative credit institutions account for the second largest proportion of

44.6% of total institutional credit of Rs.3854000 corer to agricultural and allied activities in

the rural sector in 1998 to 99.

TYPES OF CO-OPERATIVE BANKING SECTOR:-

29

The co-operative sector is very much useful for rural people. The co-operative banking

sector is divided into the following categories.

State co-operative Banks

Central co-operative banks

Primary Agriculture Credit Societies

NON BANKING FINANCE COMPANIES:-

According to RBI it means financial institutions which is a company and a non

banking institution and which has as its principal business the receiving of deposits under any

schemes or arrangement or in any other manner or lending in any manner.

MERCHANT BANKS:-

Institution that render wide range of services such as the management of customer’s

securities, portfolio management, counseling, insurance, etc are called ‘Merchant Banks’.

Functions: - Sponsoring issues, Loan syndication, Servicing of issues, Portfolio,

management, arranging fixed deposits, helps in merger& acquisition.

COMMERCIAL BANKS:-

Commercial banks comprising public sector banks, foreign banks, and private sector

banks represent the most important financial intermediary in the Indian financial system.

The changes in banking structure and control have resulted duet wider geographical

spread and deeper penetration of rural areas, higher mobilization of deposits, reallocation of

bank credit to priority activities, and lower operational autonomy for a bank management

The largest commercial Banks in India, (SBI), was set up in 1955 when the Imperial

Bank was nationalized and merged with some banks of the princely states. In 1969, in one

fell swoop, the fourteen largest privately – owned commercial banks were nationalized.

Subsequently, several other privately – owned commercial banks were nationalized. As a

result of these actions, public sector commercial banks, dominate the commercial banking

scene in the country.

FUNCTIONS OF COMMERCIAL BANKS:-

30

Saving mobilization

Special loans

Bills discount

Credit creation

Agencies function

General utility function

COMPANY OVERVIEW

PUBLIC SECTOR BANKS:-

State Bank of India.

17 out of 20 nationalized banks except Andhra Bank, Bank of Maharashtra and

Bharatiya Mahila Bank.

Regional rural banks, Assam Grameen Vikas Bank, sponsored by United Bank of

India

REGIONAL RURAL BANK:-

They are oriented towards meeting the needs of the weaker section of the rural

population consisting of small and marginal farmers, agricultural laborer and small

entrepreneurs. These banks were set up after the nationalization of banks in 1969.

REGIONAL RURAL BANKS ACT, 1976 ACT NO. 21 OF 1976 [9th February, 1976.]

An Act to provide for the incorporation, regulation and winding up of Regional Rural

Banks with a view to developing the rural economy by providing, for the purpose of

development of agriculture, trade, commerce, industry and other productive activities in the

rural areas, credit and other facilities, particularly to the small and marginal farmers,

agricultural laborers, artisans and small entrepreneurs, and for matters connected therewith

and incidental thereto.

DEFINITION OF PUBLIC SECTOR BANK:-

Public Sector Banks (PSBs) are banks where a majority stake (i.e. more than 50%) is

held by a government. The shares of these banks are listed on stock exchanges. There are a

total of 21 PSBs in India.

EMERGENCE OF PUBLIC SECTOR BANKS

31

The Central Government entered the banking business with the nationalization of the

Imperial Bank of India in 1955. A 60% stake was taken by the Reserve Bank of India and the

new bank was named as the State Bank of India. The seven other state banks became the

subsidiaries of the new bank when nationalised on 19 July 1960.[2] The next major

nationalisation of banks took place in 1969 when the government of India, under Prime

Minister Indira Gandhi, nationalised an additional 14 major banks. The total deposits in the

banks nationalised in 1969 amounted to 50 crores. This move increased the presence of

nationalised banks in India, with 84% of the total branches coming under government

control.

The next round of nationalisation took place in April 1980. The government

nationalised six banks. The total deposits of these banks amounted to around 200 crores. This

move led to a further increase in the number of branches in the market, increasing to 91% of

the total branch network of the country. The objectives behind nationalisation where:

To break the ownership and control of banks by a few business families,

To prevent the concentration of wealth and economic power,

To mobilize savings from masses from all parts of the country,

To cater to the needs of the priority sectors.

LIST OF PSU BANKS :-

Allahabad Bank

Bank of Baroda

Bank of India

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

IDBI Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab National Bank

Punjab & Sind Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

State Bank of India

STATE BANK OF INDIA ( SBI )

32

State Bank of indies an Indian multinational, Public Sector banking and Services

Company. It is a government-owned corporation with its headquarters in Mumbai,

Maharashtra. As of December 2013, it had assets of US$388 billion and 17,000 branches,

including 190 foreign offices, making it the largest banking and financial services company

in India by assets. State Bank of India is one of the Big Four banks of India, along with Bank

of Baroda, Punjab National Bank and Bank of India].The bank traces its ancestry to British

India, through the Imperial Bank of India, to the founding, in 1806, of the Bank of Calcutta,

making it the oldest commercial bank in the Indian Subcontinent. Madras merged into the

other two "presidency banks" in British India, Bank of Calcutta and Bank of Bombay, to

form the Imperial Bank of India, which in turn became the State Bank of India.[8] India

owned the Imperial Bank of India in 1955, with Reserve Bank of India (India's Central Bank)

taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took

over the stake held by the Reserve Bank of India. State Bank of India is a regional banking

behemoth and has 20% market share in deposits and loans among Indian commercial banks]

HISTORY

Seal of Imperial Bank of India. The roots of the State Bank of India lie in the first

decade of the 19th century, when the Bank of Calcutta, later renamed theBank of Bengal, was

established on 2 June 1806. The Bank of Bengal was one of three Presidency banks, the other

two being the Bank of Bombay (incorporated on 15 April 1840) and the Bank of

Madras (incorporated on 1 July 1843). All three Presidency banks were incorporated as joint

stock companies and were the result of royal charters. These three banks received the

exclusive right to issue paper currency till 1861 when, with the Paper Currency Act, the right

was taken over by the Government of India. The Presidency banks amalgamated on 27

January 1921, and the re-organised banking entity took as its name Imperial Bank of India.

The Imperial Bank of India remained a joint stock company but without Government

participation. Pursuant to the provisions of the State Bank of India Act of 1955, the Reserve

Bank of India, which is India's central bank, acquired a controlling interest in the Imperial

Bank of India. On 1 July 1955, the Imperial Bank of India became the State Bank of India. In

2008, the government of India acquired the Reserve Bank of India's stake in SBI so as to

remove any conflict of interest because the RBI is the country's banking regulatory authority.

In 1959, the government passed the State Bank of India (Subsidiary Banks) Act, which made

eight state banks associates of SBI. A process of consolidation began on 13 September 2008,

when the State Bank of Saurashtra merged with SBI.SBI has acquired local banks in rescues.

The first was the Bank of Bihar (est. 1911), which SBI acquired in 1969, together with its 28

33

branches. The next year SBI acquired National Bank of Lahore (est. 1942), which had 24

branches. Five years later, in 1975, SBI acquired Krishnaram Baldeo Bank, which had been

established in 1916 in Gwalior State, under the patronage of Maharaja Madho Rao Scindia.

The bank had been the Dukan Pichadi, a small moneylender, owned by the Maharaja. The

new bank's first manager was Jall N. Broacha, a Parsi. In 1985, SBI acquired the Bank of

Cochin in Kerala, which had 120 branches. SBI was the acquirer as its affiliate, the State

Bank of Travancore, already had an extensive network in Kerala. The State Bank of India and

all its associate banks are identified by the same blue keyhole logo. The State Bank of

India word mark usually has one standard typeface, but also utilises other typefaces. On

October 7, 2013, Arundhati Bhattacharya became the first woman to be appointed

Chairperson of the bank.

UNITED BANK OF INDIA (UBI)

United Bank of India is one of the 14 major banks which were nationalized on July

19, 1969. Its predecessor the United Bank of India Ltd., was formed in 1950 with the

amalgamation of four banks viz. Comilla Banking Corporation Ltd. (1914), Bengal Central

Bank Ltd. (1918), Comilla Union Bank Ltd. (1922) and Hooghly Bank Ltd. (1932) (which

were established in the years indicated in brackets after the names). The origin of the Bank

thus goes as far back as to 1914. As against 174 branches, Rs. 147 crores of deposits and Rs.

112 crores of advances at the time of nationalization in July, 1969, today the Bank is 100%

CBS enabled with2000 branches and offices and is having a Total business of more than

Rs 2 lac crore. Presently the Bank is having a Three-tier organizational set-up consisting of

the Head Office, 35 Regional Offices and the Branches.

After nationalization, the Bank expanded its branch network in a big way and actively

participated in the developmental activities, particularly in the rural and semi-urban areas in

conformity with the objectives of nationalization. In recognition of the role played by the

Bank, it was designated as Lead Bank in several districts and at present it is the Lead Bank in

30 districts in the States of West Bengal, Assam, Manipur and Tripura. The Bank is also the

Convener of the State Level Bankers' Committees (SLBC) for the States of West Bengal and

Tripura.

UBI played a significant role in the spread of banking services in different parts of the

country, more particularly in Eastern and North-Eastern India. UBI has sponsored 4 Regional

Rural Banks (RRB) one each in West Bengal, Assam, Manipur and Tripura. These four

RRBs together have over 1000 branches. United Bank of India has contributed 35% of the

34

share capital/ additional capital to all the four RRBs in four different states. In its efforts to

provide banking services to the people living in the not easily accessible areas of the

Sunderbans in West Bengal, UBI had established two floating mobile branches on motor

launches which moved from island to island on different days of the week. The floating

mobile branches were discontinued with the opening of full-fledged branches at the centers

which were being served by the floating mobile branches. UBI is also known as the 'Tea

Bank' because of its age-old association with the financing of tea gardens. It has been the

largest lender to the tea industry.

The Bank has three full fledged Overseas Branches one each at Kolkata, New Delhi and

Mumbai with fully equipped dealing room and SWIFT terminal . Operations of all the

branches have since been computerized and Electronic Fund Transfer System came to be

implemented in the Bank's branches across the country. The Bank has ATMs all over the

country and customers can use United International Debit Card at all VISA ATMs across the

globe.

PRIVATE BANKS:-

35

The private-sector banks in India represent part of the Indian banking sector that is

made up of both private and public sector banks. The "private-sector banks" are banks where

greater parts of stake or equity are held by the private shareholders and not by government.

Banking in India has been dominated by public sector banks since the 1969 when all major

banks were nationalised by the Indian government. However since liberalisation in

government banking policy in the 1990s, old and new private sector banks have re-emerged.

They have grown faster & bigger over the two decades since liberalisation using the latest

technology, providing contemporary innovations and monetary tools and techniques. The

private sector banks are split into two groups by financial regulators in India, old and new.

The old private sector banks existed prior to the nationalisation in 1969 and kept their

independence because they were either too small or specialist to be included in

nationalisation. The new private sector banks are those that have gained their banking license

since the liberalisation in the 1990s.

OLD PRIVATE-SECTOR BANKS:-

The banks, which were not nationalized at the time of bank nationalization that took

place during 1969 and 1980, are known to be the old private-sector banks. These were not

nationalized; because of their small size and regional focus. Most of the old private-sector

banks are closely held by certain communities their operations are mostly restricted to the

areas in and around their place of origin. Their Board of directors mainly consist of locally

prominent personalities from trade and business circles. One of the positive points of

these banks is that, they lean heavily on service and technology and as such.

NEW PRIVATE-SECTOR BANKS:-

The banks, which came in operation after 1991, with the introduction of economic

reforms and financial sector reforms are called "new private-sector banks”. Banking act was

then amended in 1993, which permitted the entry of new private-sector banks in the Indian

banking s sector. The private sector bank some of those criteria being:#The bank should have

a minimum net worth of Rs. 200 crores.

The promoters holding should be a minimum of 25% of the paid-up capital.

Within 3 years of the starting of the operations, the bank should offer shares to public and

their net worth must increased to 300 crores.

LIST OF PRIVATE BANKS :-

36

Axis Bank

Federal Bank

HDFC Bank

ICICI Bank

IndusInd Bank

Yes Bank

AXIS BANK LIMITED

Axis bank limited (formerly UTI Bank) is the third largest private sector bank in

India. It offers financial services to customer segments covering Large and Mid-Corporate,

MSME, Agriculture and Retail Businesses. Axis Bank has its headquarters in Mumbai,

Maharashtra.

HISTORY

Axis Bank began its operations in 1994, after the Government of India allowed new

private banks to be established. The Bank was promoted in 1993 jointly by the Administrator

of the Unit Trust of India (UTI-I), Life Insurance Corporation of India (LIC), General

Insurance Corporation Ltd., National Insurance Company Ltd., The New India Assurance

Company, The Oriental Insurance Corporation and United India Insurance Company. The

Unit Trust of India holds a special position in the Indian capital markets and has promoted

many leading financial institutions in the country. Axis Bank (erstwhile UTI Bank) opened its

registered office in Ahmedabad and corporate office in Mumbai in December 1993. The first

branch was inaugurated on 2 April 1994 in Ahmedabad by Dr. Manmohan Singh, the then

Finance Minister of India. In 2001 UTI Bank agreed to merge with and amalgamate Global

Trust Bank, but the Reserve Bank of India (RBI) withheld approval and nothing came of this.

In 2004 the RBI put Global Trust into moratorium and supervised its merger into Oriental

Bank of Commerce.UTI Bank opened its first overseas branch in 2006 Singapore. That same

year it opened a representative office in Shanghai, China.UTI Bank opened a branch in

the Dubai International Financial Centre in 2007. That same year it began branch operations

in Hong Kong. The next year it opened a representative office in Dubai. Axis Bank opened a

branch in Colombo in October 2011, as a Licensed Commercial Bank supervised by the

Central Bank of Sri Lanka. Also in 2011, Axis Bank opened representative offices in Abu

Dhabi. In 2013, Axis Bank's subsidiary, Axis Bank UK commenced banking operations. Axis

Bank UK has a branch in London. In 2014, Axis Bank upgraded its representative office in

Shanghai to a branch.

ICICI BANK;-

37

ICICI bank is an Indian multinational banking and financial services company

headquartered in Mumbai, Maharashtra. As of 2014 it is the second largest bank in India in

terms of assets and market capitalization. It offers a wide range of banking products and

financial services for corporate and retail customers through a variety of delivery channels

and specialized subsidiaries in the areas of investment banking, life, non-life

insurance, venture capital and asset management. The Bank has a network of 3,820 branches

and 11,162 ATMs in India, and has a presence in 19 countries. ICICI Bank is one of the Big

Four banks of India, along with State Bank of India, Punjab National Bank and Bank of

Baroda. The bank has subsidiaries in the United Kingdom, Russia, and Canada; branches in

United States, Singapore, Bahrain, Hong Kong, Sri Lanka, Qatar and Dubai International

Finance Centre; and representative offices in United Arab Emirates, China, South Africa,

Bangladesh, Thailand, Malaysia and Indonesia. The company's UK subsidiary has also

established branches in Belgium and Germany. [6]In March 2013, Operation Red

Spider showed high-ranking officials and some employees of ICICI Bank involved in money.

After a government inquiry, ICICI Bank suspended 18 employees and faced penalties from

the Reserve in relation to the activity

HISTORY:-

ICICI's branch located in Knightsbridge, London.ICICI Bank was established by

the Industrial Credit and Investment Corporation of India (ICICI), an Indian financial

institution, as a wholly owned subsidiary in 1994. The parent company was formed in 1955

as a joint-venture of the World Bank, India's public-sector banks and public-sector insurance

companies to provide project financing to Indian industry. The bank was initially known as

the Industrial Credit and Investment Corporation of India Bank, before it changed its name to

the abbreviated ICICI Bank. The parent company was later merged with the bank.ICICI Bank

launched internet banking operations in 1998. ICICI's shareholding in ICICI Bank was

reduced to 46 percent, through a public offering of shares in India in 1998, followed by an

equity offering in the form of American Depositary Receipts on the NYSE in 2000. ICICI

Bank acquired the Bank of Madura Limited in an all-stock deal in 2001 and sold additional

stakes to institutional investors during 2001-02.In the 1990s, ICICI transformed its business

from a development financial institution offering only project finance to a diversified

financial services group, offering a wide variety of products and services, both directly and

through a number of subsidiaries and affiliates like ICICI Bank. In 1999, ICICI become the

first Indian company and the first bank or financial institution from non-Japan Asia to be

38

listed on the NYSE. In 2000, ICICI Bank became the first Indian bank to list on the New

York Stock Exchange with its five million American depository shares issue generating a

demand book 13 times the offer size. In October 2001, the Boards of Directors of ICICI and

ICICI Bank approved the merger of ICICI and two of its wholly owned retail finance

subsidiaries, ICICI Personal Financial Services Limited and ICICI Capital Services Limited,

with ICICI Bank. The merger was approved by shareholders of ICICI and ICICI Bank in

January 2002, by the High Court of Gujarat at Ahmedabad in March 2002 and by the High

Court of Judicature at Mumbai and the Reserve Bank of India in April 2002. In 2008,

following the 2008 financial crisis, customers rushed to ICICI ATMs and branches in some

locations due to rumours of adverse financial position of ICICI Bank. The Reserve Bank of

India issued a clarification on the financial strength of ICICI Bank to dispel the rumours.

BUSINESS OF BANKING:-

Figure no.1

Business of Banking

Money Surplus Units

Money deficit Units

( Savers)

(Investors)

MoneyIntermediary( Banks)

39

Figure no.2

Figure No. 3

Functioning of a Bank

General Functions of a

Bank

Lending Money To Public ( Loans)

Transferring Money from One place to another ( remittance)

Accepting Deposits from public/Others ( deposits)

Doing Government Business Transactions

Keeping Valuables in safe custody

Acting as Trustees

40

Chapter | 4

LIMITATIONS OF THE STUDY:-

Due to constraints of time and resources the study is likely to suffer from certain

limitations. Some of them are mentioned below so that the findings of the study are

understood in proper perspective.

The limitations of the study are –

1) Some of the respondents of the survey were unwilling to share information.

2) The research was carried out in a short period of time so. Therefore the sample

size and other parameters were selected accordingly so as to finish the work in

given time frame.

3) The information given by the respondents might be biased because some of them

might not be interested in providing correct information.

4) The officials of the bank supported us a lot but did not have sufficient time to

clear all the points elaborately.

5) Since the sample unit is a semi urban place i.e. with less presence of private sector

banks, hence the result is likely to tilt a bit towards the public sector banks.

41

3. ANALYSIS

1) Do you have any bank A/C?

a) Yes b) No

TABLE NO :1

Statistics

Do you have any

bank a/c ?

N

Valid 100

Missi

ng0

Mean 1.00

Median 1.00

Mode 1

TABLE NO :2

Fig No:-4

ANALYSIS AND INTERPRETATION

Do you have any bank a/c ?

Frequency Percent Valid

Percent

Cumulative

Percent

Valid Yes 100 100.0 100.0 100.0

42

From the above results we come to know that out of 100 respondent only who have

bank account. This shows majority of our respondents are all have bank account.

2) Are you aware of the difference between public and private sector banks?

a) Yes b) No c) Partially

TABLE NO:-3

Statistics

Are you aware of the

difference between public

and private sector banks ?

NValid 100

Missing 0

Mean 1.65

Median 1.00

Mode 1

TTABLE NO:-4

Fig No:-5

ANALYSIS AND INTERPRETATION:-

From the above results it can be said that regarding the awareness between public

sector and private bank with respects to differarence,the response are mixed.18% are aware

of the differences which comprises 50% the tally while 29% don’t know the difference

between PSU banks and private banks.18% are not sure.

Are you aware of the difference between public and

private sector banks ?

Frequen

cy