Mutual Fund and Ulip

-

Upload

samuel-davis -

Category

Documents

-

view

226 -

download

0

Transcript of Mutual Fund and Ulip

-

8/13/2019 Mutual Fund and Ulip

1/88

1 | P a g e

A

PROJECT REPORT ONCOMPARATIVE STUDY OF MUTUAL FUNDS AND MARKET LINKED INSURANCE

PLANS

FOR THE PARTIAL FULFILLMENT OFMASTERES IN BUSINESS ADMINISTRATION

2009-2011At

Tata Aig Life Insurance companyBhopal, M.P.)

SUBMITTED TO:SUBMITTED BY:MR. PRAVEEN CHOUDHARY AKSHAY KUMBHARE

-

8/13/2019 Mutual Fund and Ulip

2/88

2 | P a g e

-

8/13/2019 Mutual Fund and Ulip

3/88

3 | P a g e

BONAFIDE CERTIFICATE

This is to certify that the Project Report titled Comparative

study of MUTUAL FUNDSand MARKET LINKED INSURANCE

PLANS for TATA AIG LIFEinsurance company is a bonafide

work carried out by Akshay kumbhare of MBA (second

semester) of M.K.PONDA.COLLEGE OF MGMT.for the

fulfillment of MBA course of M.K.PONDA.COLLEGE OF

MGMT BHOPAL(M.P).

Director GuideMR. SHRINIVASAN MR. PRAVEEN CHOUDHARY

Date:

Place: BHOPAL

-

8/13/2019 Mutual Fund and Ulip

4/88

4 | P a g e

ACKNOWLEDGEMENT

I take this opportunity to place on record my grateful thanks and sincere

gratitude to all those who gave me valuable advice and inputs for my study. My

study could not have been completed if I had not been able to get the reference

materials from the company.

I sincerely thank my esteemed guide Miss. Shradha Tiwari (unit manager) forher valuable guidance and co-operation rendered to me throughout the project

report.It would not have been possible for me to complete this project without

there meticulous guidance and suggestions.

I express my sincere regards to MR. SHRINIVASAN(DEAN)and my guideMr.

PRAVEEN CHOUDHARY (FACULTY) for constant Support and valuableguidance from time to time for completion of this project.

Last but not least, I would also like to express my thanks to my family members

who inspired me to put in my best efforts for the research project report.

AKSHAY KUMBHARE

-

8/13/2019 Mutual Fund and Ulip

5/88

5 | P a g e

PREFACE

The research provides an opportunity to a student to demonstrate knowledge,

skill and competencies required during the project. The training project helps to

know the problems in the organization and to suggest them how to get rid of

those problems.

Although I have tried my level best to prepare this report an error free report

every effort has been made to offer the most authenticate position with accuracy.

The report is divided in to five chapters. The first part consists of Introduction to

the topic; Second part gives a brief overview about the Industry and

Organization. The middle part contains the Research methodology used in the

project. Fourth Chapter is the most important part as it contains the Analysis of

data. Last Part contains the Conclusion .

AKSHAY KUMBHARE

-

8/13/2019 Mutual Fund and Ulip

6/88

6 | P a g e

DECLARATION

I hereby declare that, this project title COMPARATIVE STUDY OF MUTUALFUNDS AND MARKET LINKED INSURANCE PLANS is a genuine & bonafideproject prepared by me in partial fulfillment of Master Degree in Business

Administration.

The project work is original & conclusions drawn herein are based on the data

collected & analyzed by myself.

To best of my knowledge, this project work has not been submitted by anyone

else in any other institute or university.

Date : AKSHAY KUMBHARE

Place : Bhopal MBA (2nd

SEM)

-

8/13/2019 Mutual Fund and Ulip

7/88

7 | P a g e

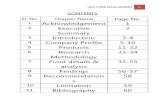

TABLE OF CONTENTS

1.COVER AND TITLE PAGE PAGE NUMBER

a)Certificate of the company Front page

b)Bonafide certificate 1

c)Acknowledgement. 2

d)Preface 3

e)Declaration given by student........ 4

f)Table of contents 5

g)Executive summary... 7

2.INTRODUCTION TO PROJECT

a) Introduction . 9-19b) Scope of the study. 20

c) Objective of the study 21

3.ORGANISATION AND INDUSTRY PROFILE

a)Industry PROFILE. 23-26

b)Company profile....................................................................................... 27-41

-

8/13/2019 Mutual Fund and Ulip

8/88

8 | P a g e

4.RESEARCH METHODOLOGY

a)Conceptual and theoretical review... ... 43-44

b)Research review 45

5.DATA ANALYSIS AND INTERPRETATION

a)Analysis part 1.47-54

b)Analysis part 2.55-66

6.CONCLUSIONS

a)Facts and findings .. 68

b)Limitations of the study..69

c)Suggestions/Recommendations......................... 70-73

d)Conclusion .74-75

..Bibliography .77

.. Annexure.79-85

-

8/13/2019 Mutual Fund and Ulip

9/88

9 | P a g e

EXECUTIVE SUMMARY

Insurance in India is booming ,But not to level comparative with the developed

economics such as Japan,Singapore etc.Also liberization of the Insurance sector

has provided huge self employment opportunity. Insurance is a federal subject

in India. The insurance sector has gone through a number of phases and

changes. Since 1999, when the government opened up the insurance sector by

allowing private companies to solicit insurance and also allowing foreign direct

investment of up to 26%, the insurance sector has been a booming market.

However, the largest life-insurance company in India is still owned by thegovernment.

While doing project at TATA AIG LIFE MP NAGAR BHOPALbranch,I observed

that unit managers were facing some serious problem regarding the awareness

of people about MUTUAL FUNDS AND ULIPS.The TATA AIG LIFEand other

insurance players are facing problem the same problem.to find out the reason

the main objective of the study is kept as COMPARATIVE ANALYSIS OF

MUTUAL FUNDS AND ULIPS

Inadequate information regarding the work of agents/financial consultant/agent

advisors is the main reason of attrition in Insurance industry.

The study is proposed to find out the difference difference mutual funds and

ulips and to compare them.so that a clear picture is depict before Investor.After

analysis I came to the conclusion that mostly people are unaware of ulips and

mutual funds which includes the executive of the company and investors too.

The project work is a sincere attempt to collect the information stating thevarious reasons for attrition and suggests the useful measure for retention ..

-

8/13/2019 Mutual Fund and Ulip

10/88

10 | P a g e

INTRODUCTION

TO

PROJECT

-

8/13/2019 Mutual Fund and Ulip

11/88

11 | P a g e

INTRODUCTION TO TOPIC

ULIPS (UNIT LINKED INSURANCE PLANS):-

The introduction of Unit Linked Insurance Plans has possibly been the singlelargest innovation in the field of life insurance .It has addressed and overcomemany difficulties and concern s that customers had about life insuranceliquidity, flexibility, and transparency.These benefits are possible because ULIPs are differently structured productsand leave many choices to the policyholder. They are structured such that the

protection (insurance) element and the savings element (investment) can bedistinguish and hence managed according to onesspecific needs, offering

flexibility and transparency. Thus we can say it is such a product that takescare of multiple needs.There were some factors which gave entry for ULIPs in the insurance market: -Firstly was the arrival of private of private players, and ULIPs were the mostsignificant innovation done by them, and secondly was the decline of assuredreturns in endowment plans. Besides this as the stock markets were boomingwhich now has become the primary factor. As mentioned earlier enhancedflexibility and merging of investment and insurance in a single entity that havereally endeared them to individuals.

ULIPs are also called as Bundled Policies.

According to Vi jay Sinha (Assistant D ir ector Agency, Tata-AIG Li fe

Insurance,) ULIP isideal for someone who is looking for a long term

investment product, is under-insured and is averse to taking a traditional li fe

insurance product. Ulip shoul d be looked at fr om an investment as well as

insurance point of view and not isolation

UNIT LINKED INSURANCE PLANS:-

Early the market of ULIPs was taken up Birla Sun; they were the first to capturethe market in this field. These are the insurance plans which are attached toUnitsMutual Funds. The premium amount received in this policy, some partis used in investment of funds and remaining is used for insurance cover.ULIPs are remarkably similar to, mutual fund in terms of structure andfunctioning: premium payments are converted into units and net asset value(NAV) is declared regularly. Investors have an option of choosing their fundaccording to their risk taking ability. They disclose all the material facts mostfrequent and consistent (often quarterly or half-yearly) .Also investor has a

fairly good idea about expenses. The expenses which are considered are asfollows:-

-

8/13/2019 Mutual Fund and Ulip

12/88

12 | P a g e

1) Mortality Rate: - These are charged by the life insurance company to coverthe risk of an eventuality to the individual.2) Administration, sales/marketing Charges: - All life insurance companiesincur certain expenses on regular basis. Agents commission, sales & marketingexpenses and overhead costs incurred to run the day to day basis are someexamples.3) Fund Management Charges: - These charges are levied by the insurancecompany to cover the expenses incurred by them on managing Ulip monies.4) Ulip-fund Switch Charges: - These charges are borne by the individualswhen they decide to switch their, money from one type of fund to another.5) Top-up Charges: A certain percentage is deducted from the top-up amountto recover the expenses incurred on managing the same.

ULIPs are very different from the traditional policies because they are based onsome fundamentals of Mutual funds as different types of funds which arecreated wherein the premiums which are received on the policy these areinvested in these funds basically these funds are of following types:-a) Aggressive/Growth Fund:-Such funds invest a major portion in equitymarkets. They are therefore considered to be high on risk parameter.b) Debt Funds: - These types of funds invest the premium money in debtinstruments like gsecs, bonds and AAA rated securities. Such funds are low riskin nature.

c) Balanced Funds: - This fund is combination of growth & debt fund. Thismeans its portfolio consists of both equities and debt instruments. The risk forthis fund is moderate.d) Money Market/Liquid Funds:- Such a fund invests the premium money inshort term liquid instruments like bank deposits and money market instruments.

-

8/13/2019 Mutual Fund and Ulip

13/88

13 | P a g e

MUTUAL FUND

A mutual fundis a professionally managed type of collective investment

scheme that pools money from many investors and invests typically in

investment securities (stocks, bonds, short-term money market instruments,other mutual funds, other securities, and/or commodities such as precious

metals). The mutual fund will have a fund manager that trades (buys and sells)

the fund's investments in accordance with the fund's investment objective. In the

U.S., a fund registered with the Securities and Exchange Commission (SEC)

under both SEC and Internal Revenue Service (IRS) rules must distribute nearly

all of its net income and net realized gains from the sale of securities (if any) to

its investors at least annually. Most funds are overseen by a board of

directors or trustees (if the U.S. fund is organized as a trust as they commonlyare) which is charged with ensuring the fund is managed appropriately by its

investment adviser and other service organizations and vendors, all in the best

interests of the fund's investor

A mutual fund is a trust that pools the savings of a number of investors who

share a common financial goal.The money thus collected is then invested in

capital market instruments such as share.debentures and other securities.The

income earned through these investments and the capital appreciations realized

are shared by its unitholders in proportion to the number of units owned by

them.

-

8/13/2019 Mutual Fund and Ulip

14/88

14 | P a g e

Advantages of mutual fund

Professional management

Diversification

Low costs

Liquidity

Transparency

Flexibility

Tax benefits

WHAT ARE VARIOUS TYPES OF MUTUAL FUNDS

A common man is so much confused about the various kinds of Mutual Fundsthat he is afraid of investing in these funds as he can not differentiate betweenvarious types of Mutual Funds with fancy names. Mutual Funds can beclassified into various categories under the following heads:-

(A)ACCORDING TO TYPE OF INVESTMENTS:- While launching a newscheme, every Mutual Fund is supposed to declare in the prospectus the kind ofinstruments in which it will make investments of the funds collected under thatscheme. Thus, the various kinds of Mutual Fund schemes as categorizedaccording to the type of investments are as follows :-

(a) Equity funds / schemes

(b) Debt funds / schemes (also called income funds)

(c ) Diversified funds / schemes (also called balanced funds)

(d) Gilt funds / schemes

(e) Money market funds / schemes

(f) Sector specific funds

(g) Index funds

-

8/13/2019 Mutual Fund and Ulip

15/88

15 | P a g e

(B)ACCORDING TO THE TIME OF CLOSURE OF THE SCHEME:- Whilelaunching a new schemes, Mutual Funds also declare whether this will be anopen ended scheme (i.e. there is no specific date when the scheme will beclosed) or there is a closing date when finally the scheme will be wind up.

Thus, according to the time of closure schemes are classified as follows :-

(a) Open ended schemes

(b) Close ended schemes

(C)ACCORDING TO TAX INCENTIVE SCHEMES:- Mutual Funds are alsoallowed to float some tax saving schemes. Therefore, sometimes the schemes

are classified according to this also:-

(a) Tax saving funds

(b) Not tax saving funds / other funds

(D)ACCORDING TO THE TIME OF PAYOUT:- Sometimes Mutual Fundschemes are classified according to the periodicity of the pay outs (i.e. dividendetc.). The categories are as follows :-

(A) Dividend paying schemes

(b) Reinvestment schemes

The mutual fund schemes come with various combinations of the abovecategories. Therefore, we can have an Equity Fund which is open ended and isdividend paying plan. Before you invest, you must find out what kind of thescheme you are being asked to invest. You should choose a scheme as per your

risk capacity and the regularity at which you wish to have the dividends fromsuch schemes.

-

8/13/2019 Mutual Fund and Ulip

16/88

16 | P a g e

SOME OF THE TERMS USED IN MUTUAL FUNDS

Net Asset Value (NAV)et Asset Value is the market value of the assets of the scheme minus its

liabilities. The per unit NAV is the net asset value of the scheme divided by thenumber of units outstanding on the Valuation Date.

Sale Price:It is the price you pay when you invest in a scheme and is also called"Offer Price". It may include a sales load.

Repurchase Price : - It is the price at which a Mutual Funds repurchases itsunits and it may include a back-end load. This is also called Bid Price.

Redemption Price : It is the price at which open-ended schemes repurchasetheir units and close-ended schemes redeem their units on maturity. Such pricesare NAV related.

Sales Load / Front End Load : It is a charge collected by a scheme when it sellsthe units. Also called, Front-end load. Schemes which do not charge a load atthe time of entry are called No Load schemes.

Repurchase / Back-end Load :

It is a charge collected by a Mutual Funds when it buys back / Repurchases theunits from the unit holders.

-

8/13/2019 Mutual Fund and Ulip

17/88

17 | P a g e

ULIPS VS MUTUAL FUNDS

ULIPs are all set to pose serious competition to mutual funds. Though

ulips as an investment avenue are closest to mutual funds in terms oftheir structure and functioning like disclosing theirNAVs daily etc.

ULIPs are essentially a long term commitment between thepolicyholder and the insurance company and mutual funds are built tocater to the relatively shortterm need of the investor. Theinvestments are made with a shorter- term duration profile whencompared to ulips.

The seemingly similar structure of both of them makes it vital forinvestors to be aware of the fine distinctions in both the offering andmake informed decisions. Following are some insurance companieswho offer ULIPs:-

-Tata Aig ,Bajaj Allianz, ING Vysya, HDFC Standard, HDFCStandard, HDFC Standard, -Birla Sun life,Aviva Life Insurance,Kotak Mahindra, Max New York Life, Met Life, Sahara Life, etc

Sahara Life, etc

Following are Difference between ULIPs & Mutual Fund:-

-

8/13/2019 Mutual Fund and Ulip

18/88

18 | P a g e

DIFFERENCE BETWEEN MUTUAL FUND AND ULIPS

Points of Difference ULIPS(Unit Linked

Insurance Plans)

MFs(Mutual Funds)

1) Meaning :- These are the Insurance

policies which are linked to

units

of Mutual Fund.

It is an investment

organization with a main

objective of collecting funds

from various segments

of people and investing the

same in a variety of

securities.

2) Primary Objective :- Its main objective is

investment & protection

Its objective is only

investments.

3) Investment Duration: It works out for long term

investment only .

It works out to medium term,

long term, & short

term. Risky for short term

investors.

4) Insurance Cover :- ULIPs provide insurance

cover (except annuity

products

which may be issued with/

without risk cover) and from

the amount invested in

ULIPs after netting out the

risk

premium for life risk cover

and administrative expenses,

the insurer invests the

balance as per the objective

of the

specific ULIP product.

MF schemes do not cover the

life risk and the amount

invested, net of expenses,

gets invested as per the

investment objective of the

scheme

5) Expenses :- Insurance companies have a In MFs, expenses charged for

-

8/13/2019 Mutual Fund and Ulip

19/88

19 | P a g e

relatively free hand in

levying expenses on their

ULIP products with no upper

limits being prescribed by theregulator, the Insurance

Regulatory and Development

Authority (IRDA)

various activities like

sales/marketing,

administration and fund

management are capped (forexample in equity oriented

mutual funds, expenses are

capped at 2.5% per annum)

as per the guidelines of the

Securities and

Exchange Board of India

(SEBI). Similarly funds

usually charge their investors

entry (at the timing of

making an investment) and

exit (at the time of sale)

loads.

6) Flexibility :- Flexibility is limited to

moving across different

funds

offered with policy.

Correcting mistakes can turn

out to

be expensive. Moving funds

from one ULIP to another

ULIP of a different fund

house can be expensive.

Very flexible. Plenty of scope

to correct mistakes if

any wrong investment

decisions are made.

Portfolios

can be easily shuffled in

MFs.

7) Liquidity :- Limited liquidity .It need to

stay invested for minimum

years before redeeming

Very liquid. MF units can be

sold any time(except

ELSS).

-

8/13/2019 Mutual Fund and Ulip

20/88

20 | P a g e

8) Investment Objective ULIPs can be used for

achieving only long term

objectives (Children

education, marriage,

Retirement

planning).

MFs can be used as vehicle

for investments to

achieve different

objectives.(E.g.: Buying a car

three

years from now. Down

payment for a home five

years from now. Childrens

education 10 years from

now. Childrens marriage 15

years from now.

Retirement planning 25 years

from now. Medical

expenses after retirement 25

years from now).

9) Flexibility of Switchovers

:-

Insurance companies permit

their ULIP investors

usually 3-4 switch overs free

of charge and thereafter

every additional switch over

beyond the permissible limit

is permitted at some cost.

In MFs an investor usually is

subjected to exit load

and/or entry load when

he/she exercises a switchover

option.

10) Minimum Lock- in

Period

ULIPs currently are with a

minimum lock-in of three

years.

MF schemes (except ELSS

which has a lock-in of

three years) do not have any

such lock in.

11) Investment styles

and Portfolio

Disclosures :-

Insurance companies declare

their portfolios once in a

quarter and their investment

style are less aggressive and

they resort to less churning.

Most MFs usually declare

their portfolios on monthly

basis and MFs are generally

known to be more active

in fund management

-

8/13/2019 Mutual Fund and Ulip

21/88

21 | P a g e

12) Tax benefits and

implications :-

Irrespective of the nature of

the plan chosen by the

investor, all ULIP

investments qualify for

deductions up

to one lakh under Section

80C of the Income Tax Act.

In

the case of ULIPs the

maturity proceeds are tax-

free.

In the case of mutual funds,

only investments in taxsaving

funds i.e Equity-linked

savings schemes

(ELSS) are eligible for

Section 80C benefits

On the other hand, in the case

of equity-oriented

mutual funds, if the

investments are held for a

period

over 12 months, the gains are

tax free and if sold

within a 12-month period

they attract short-term

capital gains tax @ 10

percent.

Similarly, debt-oriented

funds attract long-term

capital gains tax @ 10

percent while short-term

capital gain is taxed at the

investors marginal tax

rate.

-

8/13/2019 Mutual Fund and Ulip

22/88

-

8/13/2019 Mutual Fund and Ulip

23/88

23 | P a g e

OBJECTIVES OF STUDY

PROJECT STUDY

Comparative Study of Unit Linked Insurance plans and

Mutual Funds

MAIN OBJECTIVE: To study and compare the Unit Linked Insurance Plans and

Mutual Fund.

To know the difference in investing in ULIP & Mutual Fund.

To know whether these two options are substitute for each other

or not.

SUB OBJECTIVES

(1) To know the factors that influence investors while taking

investment decisions.

(2) To know the merits & demerits of mutual funds.

(3) To know investing in Mutual Fund is worthy or not .

(4) To know advantages & disadvantages of investing in ULIP.

(5) To know the suitability of ULIP & Mutual Fund to different

investors.

(6) To know Customer awareness and preferences

-

8/13/2019 Mutual Fund and Ulip

24/88

24 | P a g e

ORGANISATION

ANDINDUSTRY

PROFILE

-

8/13/2019 Mutual Fund and Ulip

25/88

-

8/13/2019 Mutual Fund and Ulip

26/88

26 | P a g e

INSURANCE IS A FEDERAL SUBJECT IN INDIA.

The insurance sector has gone through a number of phases andchanges. Since 1999, when the government opened up the insurance

sector by allowing private companies to solicit insurance and alsoallowing foreign direct investment of up to 26%, the insurance sectorhas been a booming market. However, the largest life-insurancecompany in India is still owned by the government.

IRDAcontrols all the Insurance business in India. They are setting

structure and boundaries for the insurance companies to act upon.Starting from licensing to approving the products, IRDA directs thecompanies in India. They also protect customer interests in thecountry.

-

8/13/2019 Mutual Fund and Ulip

27/88

27 | P a g e

INSURANCE COMPANIES IN INDIA APPROVED BY IRDA

Tata AIG Life Insurance Company Limited Bajaj Allianz Life Insurance Company LimitedBirla Sun Life Insurance Co. Ltd

HDFC Standard life Insurance Co. Ltd

ICICI Prudential Life Insurance Co. Ltd.

ING Vysya Life Insurance Company Ltd.

Life Insurance Corporation of India

Max New York Life Insurance Co. Ltd

Met Life India Insurance Company Ltd. Kotak Mahindra Old Mutual Life Insurance Limited

SBI Life Insurance Co. Ltd

Tata AIG Life Insurance Company Limited

Reliance Life Insurance Company Limited.

Aviva Life Insurance Co. India Pvt. Ltd.

Shriram Life Insurance Co, Ltd.

Sahara India Life Insurance

Bharti AXA Life Insurance

Future Generali Life Insurance IDBI Fortis Life Insurance

Canara HSBC Oriental Bank of Commerce Life Insurance

Religare Life Insurance

DLF Pramerica Life Insurance

Star Union Dai-ichi Life Insurance

Agriculture Insurance Company of India

Apollo DKV Insurance

Cholamandalam MS General Insurance

HDFC Ergo General Insurance Company

ICICI Lombard General Insurance

IFFCO Tokio General Insurance

http://www.iloveindia.com/finance/insurance/companies/tata-aig-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/bajaj-allianz.htmlhttp://www.iloveindia.com/finance/insurance/companies/birla-sun-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/birla-sun-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/birla-sun-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/hdfc-standard-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/hdfc-standard-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/icici-prudential.htmlhttp://www.iloveindia.com/finance/insurance/companies/icici-prudential.htmlhttp://www.iloveindia.com/finance/insurance/companies/ing-vysya-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/ing-vysya-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/lic.htmlhttp://www.iloveindia.com/finance/insurance/companies/lic.htmlhttp://www.iloveindia.com/finance/insurance/companies/max-new-york-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/max-new-york-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/metlife-india-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/metlife-india-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/kotak-mahindra-old-mutual.htmlhttp://www.iloveindia.com/finance/insurance/companies/kotak-mahindra-old-mutual.htmlhttp://www.iloveindia.com/finance/insurance/companies/sbi-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/sbi-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/reliance-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/reliance-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/aviva-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/aviva-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/shriram-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/shriram-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/sahara-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/sahara-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/bharti-axa-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/bharti-axa-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/future-generali-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/future-generali-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/idbi-fortis-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/idbi-fortis-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/canara-hsbc.htmlhttp://www.iloveindia.com/finance/insurance/companies/canara-hsbc.htmlhttp://www.iloveindia.com/finance/insurance/companies/religare-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/religare-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/dlf-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/dlf-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/star-union-dai-ichi.htmlhttp://www.iloveindia.com/finance/insurance/companies/star-union-dai-ichi.htmlhttp://www.iloveindia.com/finance/insurance/companies/aic.htmlhttp://www.iloveindia.com/finance/insurance/companies/aic.htmlhttp://www.iloveindia.com/finance/insurance/companies/apollo-dkv.htmlhttp://www.iloveindia.com/finance/insurance/companies/apollo-dkv.htmlhttp://www.iloveindia.com/finance/insurance/companies/cholamandalam-ms.htmlhttp://www.iloveindia.com/finance/insurance/companies/cholamandalam-ms.htmlhttp://www.iloveindia.com/finance/insurance/companies/hdfc-ergo.htmlhttp://www.iloveindia.com/finance/insurance/companies/hdfc-ergo.htmlhttp://www.iloveindia.com/finance/insurance/companies/icici-lombard-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/icici-lombard-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/iffco.htmlhttp://www.iloveindia.com/finance/insurance/companies/iffco.htmlhttp://www.iloveindia.com/finance/insurance/companies/iffco.htmlhttp://www.iloveindia.com/finance/insurance/companies/icici-lombard-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/hdfc-ergo.htmlhttp://www.iloveindia.com/finance/insurance/companies/cholamandalam-ms.htmlhttp://www.iloveindia.com/finance/insurance/companies/apollo-dkv.htmlhttp://www.iloveindia.com/finance/insurance/companies/aic.htmlhttp://www.iloveindia.com/finance/insurance/companies/star-union-dai-ichi.htmlhttp://www.iloveindia.com/finance/insurance/companies/dlf-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/religare-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/canara-hsbc.htmlhttp://www.iloveindia.com/finance/insurance/companies/idbi-fortis-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/future-generali-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/bharti-axa-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/sahara-life.htmlhttp://www.iloveindia.com/finance/insurance/companies/shriram-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/aviva-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/reliance-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/sbi-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/kotak-mahindra-old-mutual.htmlhttp://www.iloveindia.com/finance/insurance/companies/metlife-india-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/max-new-york-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/lic.htmlhttp://www.iloveindia.com/finance/insurance/companies/ing-vysya-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/icici-prudential.htmlhttp://www.iloveindia.com/finance/insurance/companies/hdfc-standard-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/birla-sun-life-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/bajaj-allianz.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-life-insurance.html -

8/13/2019 Mutual Fund and Ulip

28/88

28 | P a g e

National Insurance Company Ltd

New India Assurance

Oriental Insurance Company

Reliance General Insurance

Royal Sundaram Alliance Insurance Shriram General Insurance Company Limited

Tata AIG General Insurance

United India Insurance

Universal Sompo General Insurance Co. Ltd

http://www.iloveindia.com/finance/insurance/companies/national-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/national-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/new-india-assurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/new-india-assurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/oriental-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/oriental-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/reliance-gen-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/reliance-gen-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/royal-sundaram.htmlhttp://www.iloveindia.com/finance/insurance/companies/royal-sundaram.htmlhttp://www.iloveindia.com/finance/insurance/companies/shriram-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/shriram-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/united-india-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/united-india-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/universal-sompo.htmlhttp://www.iloveindia.com/finance/insurance/companies/universal-sompo.htmlhttp://www.iloveindia.com/finance/insurance/companies/universal-sompo.htmlhttp://www.iloveindia.com/finance/insurance/companies/united-india-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/tata-aig-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/shriram-general.htmlhttp://www.iloveindia.com/finance/insurance/companies/royal-sundaram.htmlhttp://www.iloveindia.com/finance/insurance/companies/reliance-gen-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/oriental-insurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/new-india-assurance.htmlhttp://www.iloveindia.com/finance/insurance/companies/national-insurance.html -

8/13/2019 Mutual Fund and Ulip

29/88

29 | P a g e

ORGANISATION PROFILE

TATA AIG PROFILE

INTRODUCTION

Tata AIG Life Insurance Company Limited (Tata AIG Life) is a joint venture

company, formed by the Tata Group and American International Group, Inc.

(AIG). Tata AIG Life combines the Tata Groups pre-eminent leadership

position in India and AIGs global presence as one of the worlds leading

international insurance and financial services organization. The Tata Groupholds 74 per cent stake in the insurance venture with AIG holding the balance

26 per cent. Tata AIG Life provides insurance solutions to individuals and

corporates. Tata AIG Life Insurance Company was licensed to operate in India

on February 12, 2001 and started operations on April 1, 2001.

THE TATA GROUP

Tata is a rapidly growing business group based in India with significantinternational operations. Revenues in 2007-08 are USD 62.5 billion (around Rs.

251,543 crores), of which 61% was from business outside India. The Groups

Net Profit for 2007-08 is USD 5.4 billion (around Rs. 21,578 crores). The

Group employs around 350,000 people worldwide. The Tata name has been

respected in India for 140 years for its adherence to strong values and business

ethics. The business operations of the Tata Group currently encompass seven

business sectors - Communications and Information Technology, Engineering,

Materials, Services, Energy, Consumer Products and Chemicals. The Group's

28 publicly listed enterprises have a combined market capitalisation of around

-

8/13/2019 Mutual Fund and Ulip

30/88

30 | P a g e

$60 billion, among the highest among Indian business houses, and a shareholder

base of 2.9 million. The major companies in the Group include Tata Steel, Tata

Motors, Tata Consultancy Services (TCS), Tata Power, Tata Chemicals, Tata

Tea, Indian Hotels, Tata Teleservices and Tata Communications.

AMERICAN INTERNATIONAL GROUP, INC. (AIG)

American International Group, Inc. (AIG), a world leader in insurance and

financial services, is the leading international insurance organization with

operations in more than 130 countries and jurisdictions. AIG companies servecommercial, institutional and individual customers through the most extensive

worldwide property-casualty and life insurance networks of any insurer. In

addition, AIG companies are leading providers of retirement services, financial

services and asset management around the world. AIG's common stock is listed

on the New York Stock Exchange, as well as the stock exchanges in Ireland and

Tokyo.

Tata AIG Life Insurance Company Ltd. "Tata AIG Life" offers a broad array of

life insurance products to individuals, associations and businesses of all sizes,with a wide variety of additional coverage to ensure our customers can find an

insurance product to meet their needs.

-

8/13/2019 Mutual Fund and Ulip

31/88

31 | P a g e

HISTORY

TATAAIG LIFE INSURANCE COMPANY LIMITED

TATA GROUPTata Enterprises with 82 companies, spread over seven sectors and with anannual turnover exceeding US $ 8.8 billion, employs more than 262,000 people.Tata Group has shown over years that it is a value driven company and has

pioneering contributions in various fields including insurance, aviation, iron andsteel. Tata companies have forged a number of global alliances with eminentinternational partners in several fields. In terms of capital market performance

as many as 40 listed Tata companies account for nearly 5% of the total marketcapitalization of all listed companies. The Group has had a long associationwith India's insurance sector having been the largest insurance company in India

prior to the nationalisation of insurance.

TATA Group in Insurance

The Late Sir Dorab Tata, was the founder Chairman of New India AssuranceCo. Ltd, a group company incorporated way back in 1919. Government of India

took over the management of this company as a part of nationalization ofgeneral insurance companies in 1972. Not deterred by the move, Tata grouphave ventured into risk management services having tied up with AIG group,

back in 1977, with the incorporation of Tata AIG Risk Management ServicesPvt. Ltd.

-

8/13/2019 Mutual Fund and Ulip

32/88

32 | P a g e

AIG

American International Group, Inc is the leading U.S. based internationalinsuranceand financial services organization and the largest underwriter of commercial

and industrial insurance in the United States. Its member companies write awide range of commercial and personal insurance products through a variety ofdistribution channels in over 130 countries and jurisdictions throughout theworld. AIG's Life Insurance operations comprise of the most extensiveworldwide network of any life insurer. AIG's global businesses also includefinancial services and asset management, including aircraft leasing, financial

products, trading and market making, consumer finance, institutional, retail anddirect investment fund asset management, real estate investment management,and retirement savings products.

The Joint VentureTata AIG Life Insurance Co. Ltd. is capitalised at Rs. 185 crores of which 74

per cent has been brought in by Tata Sons and the American partner brings inthe balance 26 per cent. Mr. George Oommen has been named managingdirector of Tata AIG Life

Tata-AIG plans to provide broad array of life insurance plans to cover to bothindividuals and groups. The company is headquartered in Mumbai, with branchoperations in Delhi, Chennai, Hyderabad, Bangalore ,Calcutta, Pune and

Chandigarh.

Contact AddressTata AIG Life Insurance Company Limited

82, Ahura Centre4th floor, Mahakali Caves Road

Andheri (East)Mumbai - 400 093.

IndiaTel: 1600-119966

Fax: 91-022-6938265URL: www.tata-aig.com

-

8/13/2019 Mutual Fund and Ulip

33/88

33 | P a g e

TATA AIG LIFE INSURANCE

Headquarters Mumbai Area, India

Industry Insurance

Type Public Company

Status Operating

Company Size 10,000 employees

Founded 2001

Website http://www.tata-aig.com

Common Job Titles Manager 17%

Training Manager 7%

Sales Manager 5%

Business Development

Manager

5%

Location Head 4%

Gender Male 79%

Female 21%

http://www.linkedin.com/companyDir?searchByInd=&ind=42°Dist=net&trk=copro_industryhttp://www.linkedin.com/redirect?url=http%3A%2F%2Fwww%2Etata-aig%2Ecom&urlhash=xkxYhttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Training+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Sales+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Business+Development+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Business+Development+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Location+Head¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Location+Head¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Business+Development+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Business+Development+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Sales+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Training+Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/search?search=&company=Tata+AIG+Life+Insurance&title=Manager¤tCompany=co&trk=copro_titleshttp://www.linkedin.com/redirect?url=http%3A%2F%2Fwww%2Etata-aig%2Ecom&urlhash=xkxYhttp://www.linkedin.com/companyDir?searchByInd=&ind=42°Dist=net&trk=copro_industry -

8/13/2019 Mutual Fund and Ulip

34/88

34 | P a g e

SOME MORE INFORMATION

The non-life insurance arm, Tata AIG General Insurance Company, whichstarted its operation in India on Jan 22, 2001, offers the complete range ofinsurance for automobile, home personal, accident, travel, energy, marine,

property and casualty, as well as several specialized financial lines.

BUSINESS DIVISIONS

AgencyAgency

WSM

Alternate Channels GMD Pensions Direct Marketing

FINANCIAL RESULTS FOR THE FISCAL 03-04

Total Premium : Rs 254 cr (253 % growth) First year Premium Income: Rs 180 cr Agent strength : 18,000 Life cover sold : 1,62,000

-

8/13/2019 Mutual Fund and Ulip

35/88

35 | P a g e

VISION AND MISSON

Our VisionTo be the leading provider of wealth management,protection and retirement solutionsthat meets the needs of our customers and adds value to their lives..

Our missionTo be transparent in the way company deal with customers and to act with integrity

To invest in and build quality human capital in order to achieve mission.

Our ValuesOur values represent the core, shared beliefs that guide how we act and work together

to achieve our goals. We share a set of 6 core values: Customer First, People, Passion,

Performance, Integrity and Empathy.

Customer First: Anticipate their priorities. Exceed their expectations.

Integrity: We must conduct our business fairly, with honesty and transparency.

Everything we do must stand the test of public scrutiny.

People: We must work cohesively with our colleagues across the Group and with

our customers and partners around the world, building strong relationships

based on tolerance, understanding and mutual cooperation. Strive to develop

diverse talent and reward excellence.

Performance: We must constantly strive to achieve the highest possible

standards in our day-to-day work and in the quality of the goods and services we

provide.

Passion: We must be excited about what we do. We must have a strong

internalized drive to meet goals. Relentless determination to solve customer

problems.

Respect: We must be caring, show respect, compassion and humanity for our

colleagues and customers around the world, and always work for the benefit of

the communities we serve

-

8/13/2019 Mutual Fund and Ulip

36/88

36 | P a g e

KEY PERSONS

F.K. KAVARANA TATA AIG CHAIRMAN

M SURESH MANAGING DIRECTOR

ASHOK S. GANGULY DIRECTOR

.

H.R.KHUSRO KHAN DIRECTOR

-

8/13/2019 Mutual Fund and Ulip

37/88

37 | P a g e

KEY PERSONS

MR. ADITYA KANADE - Head internal audit

MR. VIVEK SOOD - Chief financial officer

MR. RAJEEV DEWAL - Head legal and compliance

MR.SARAVAN KUMAR- Chief investment officer

MR.HEERAK BASU - Appointed actuary

-

8/13/2019 Mutual Fund and Ulip

38/88

38 | P a g e

TATA AIG PRODUCTS

Tata AIG offers a range of flexible insurance products for children. Policies dedicated

to children and their key features are as given under.

FOR CHILDREN

Life Assure Career Builder financial assistance at key stages of childs life

Life Assure Educare funding childs education

Life Assure 21 years Money Saver cash payments in the form of survival benefits at regular intervals

Life InvestAssure II full life coverhigh returnsflexibility of deciding the length of life cover term

Life InvestAssure Flexi unit linked endowment investment plan flexibility to suite yourneeds

Life InvestAssure Plus single-premium paying termsecurity of life insurance policy

potentially higher returns

Life MahaLife Gold steady income and life-long insurance coverage for child

Life Starkid endowment policy dedicated for childs career and marriage

Life United Ujjwal Bhavishya unit linked endowment plan arranging finance for childs future

FOR ADULTS

The company has a slew of life insurance of plans for adults.

Life Assure Lifeline Plans High coverage at an affordable cost

Life Assure Growth Plans Endowment policyKeep your money safe and have it grow

Life Assure 21 years Money Saver Cash payments at the end of every 3 yearsLife insurance coverage plus the flexibility of periodic payments

Life Assure Golden Years Plan Endowment policySafety as well as returns

Life Easy Retire Annuity plan with Return of Purchase PriceSingle premium payment

Life InvestAssure Health Unit linked investment planHelps achieve financial goals along with a comprehensive health

http://www.assuremydreams.com/financial-planning.htmlhttp://www.assuremydreams.com/life-stage-planning.htmlhttp://www.assuremydreams.com/financial-planning.htmlhttp://www.assuremydreams.com/life-stage-planning.html -

8/13/2019 Mutual Fund and Ulip

39/88

39 | P a g e

policy

Life Hospi CashBack Multiple claims against unforeseen hospitalization expensesMoney back

Life Health Investor Benefit on diagnosis of 12 critical illnessesCover in case of unfortunate death100% return of premium in case of no claims

Life InvestAssure II Life cover plus high returns

Life InvestAssure Apex Unit-linked life insurance planGuaranteed Maturity Unit Price

Life InvestAssure Extra Investment linked insurance planDesigned for customers of premier banks

Life InvestAssure Care Non-participating unit linked insurance planInbuilt Critical Illness benefit

Life InvestAssure Flexi Unit linked endowment planHelps one achieve financial goals

Life InvestAssure Gold flexibility to invest more moneytakes care of emergency cash requirements

Life InvestAssure Insta Unit linked planDual benefits of insurance coverage and wealth creation

Life InvestAssure Plus Fllexible insurance planSingle-premium paying termHigher returns on premiums

Life InvestAssure Optima Unit-linked insurance solutionOptimise investment returns

Life LifePlus If you outlive the term get premium backIn case of death by natural causes get sum assured

Life MahaLife Gold Good for retirement planningProvides for steady income and insurance coverage

Life Raksha large cover at a small premium

Life ShubhLife life insurance protection and high returns

Life Health First Covers health contingencies

Life Health Protector Covers cost of major surgery or treatment

-

8/13/2019 Mutual Fund and Ulip

40/88

40 | P a g e

FOR RETIREMENT PLANNING

If you plan to retire at the age of 60 or 65, you could need to fund your lifestyle for several years without

any regular salary. But if you have invested in a right plan, you can rest assured.

Life Assure Golden Years Plan Endowment policyIf you live past the term you get sum assured along with a host of

bonuses

Life Easy Retire Immediate annuity planSingle premium payment

Life InvestAssure II Flexible planLife cover plus high returns

Life InvestAssure Gold Provides for emergency cash requirements or a steady post-retirement income

Life InvestAssure Future Custom-made retirement solution

Life MahaLife Gold Steady income and insurance coverage

Life Nirvana Freedom to choose retirement age

Life Nirvana Plus Guaranteed addition of 10 percent of sum assured every 5 years

Life InvestAssure Swarna Jeevan Unit linked non participating pension plan

http://www.assuremydreams.com/financial-planning-options.html -

8/13/2019 Mutual Fund and Ulip

41/88

41 | P a g e

ACHIEVEMENTS

(1)TATA AIG LIFE PARTNERS WITH THE INDIAN MEDICAL ASSOCIATION (MUMBAI

BRANCH) TO CREATE INDIAS FIRST HEALTH QUOTIENT

Feb 01, 2007: Tata AIG Life Insurance Company Ltd (Tata AIG Life) in association with theIndian Medical Association

(2)TATA AIG LIFE EXPANDS DISTRIBUTION NETWORK: OPENS OFFICE IN SIKAR

Establishes state-of-the-art training center for advisors and corporate agents

Sikar, July 16, 2004

(3)TATA AI G LI FE INSURANCE COMPANY TIES-UP WITH INDIATIMES SMS 8888

Mumbai, March 30, 2004.

\

(4)TATA AI G LI FE - FI RST INSURANCE COMPANY TO LAUNCH MI CRO INSURANCE

~Full Range of Products and dedicated Offices ~

First major Micro Insurance initiatives venture by an Indian insurance companyLaunches three new Micro Insurance products and five Micro Insurance branchesAdopts a tailor made rural communication strategy to reach out to the ruralcommunity

Mumbai, August 8, 2006

-

8/13/2019 Mutual Fund and Ulip

42/88

42 | P a g e

ACHIEVEMENTS

Health Insurance Solutions from Tata AIG Life

for United Bank of India Customers

Kolkata, March 13, 2008: United Bank of India (UBI) and Tata AIG Life Insurance

(Tata AIG

Life) today announced the launch of United Health Solutionsa customised health

insurance

package for customers of UBI.

United Health Solutions has two powerful plansHealth Investor and Health Protector.

These

products provide effective cover against critical diseases, accident and death.

TATA AIG LIFE INSURANCE COMPANY LIMITED TIES UP

WITH DBS BANK

Mumbai, March 27, 2006: Tata AIG Life Insurance Company Limited (Tata AIGLife) today announced its strategic tie-up with DBS Bank, Singapores largestbank and the fifth largest banking group in Hong Kong. Under this alliance DBS

Bank will make the entire range of Tata AIG Lifes insurance products and

services available to its customers at bank branches across India

-

8/13/2019 Mutual Fund and Ulip

43/88

43 | P a g e

ACHIEVEMENTS

Tata AIG Life Insurance total annual premium up 77 % to Rs 880

Crores

FYP income up 48% to Rs 432 croresAgency Total Premium Income up by 61% with persistency rate of 85%Total Premium Income from Alternate Channels up 132 %; Bancassurancegrowing at 179 %.Geographical network expanded to cover 45 cities with 85 officesLives covered under Rural sector - 21% versus Regulatory obligation of16%.Lives covered under Social sector 101,873 versus Regulatory obligationof 20,000 lives.Mumbai, June 20, 2006: Tata AIG Life Insurance Company Limited (Tata AIG Life)today announced an increase of 77 percent in total premium income to Rs 880 croresfor the annual period ending March 31, 2006, compared to Rs 497 crores for thecorresponding period last year. The First Year Premium income increased by 48percent to Rs 432 crores for the year ended March 31, 2006, compared to Rs 292crores for the same period last year.Through its wide array of Group life insurance, pensions, gratuity and superannuationproducts, Tata AIG Life has covered over 7,16,016 lives during the period April 2005-March 2006, an increase of 43 percent over the last fiscal year. Additionally 3, 17,430individual life business policies were issued from April 2005 to March 2006, an increaseof 34.4 percent over the last fiscal year.

MR. FARROKH KAVARANA, Chairman, Tata AIG Life said, We continue to focus on creating a world class life insurance entity that anticipates the needs of bothcustomers and our stakeholders and provides innovative solutions to address theirneeds. We look forward to the opportunities and challenges that lie ahead and remainconfident of creating increasing value for our policyholders and stakeholders throughour customer centric approach and the high quality of our products and services

MR. TREVOR BULL, MANAGING DIRECTOR, Tata AIG Life added, We are pleasedtoannounce that the company has made significant strides in enhancing our positionwithin India both through corporate and individual customers while continuing toincrease the scale of our operations to better serve our customers. Our wide range of

distribution channels and strategic alliances have all contributed to this result byoffering customers and partners choices which address their growing protection andasset accumulation needs. We will consistently expand our product offerings bydelivering innovative products to complement our commitment to offer quality adviceand service that sets us apart as the company of choice.

-

8/13/2019 Mutual Fund and Ulip

44/88

44 | P a g e

RESEARCH

METHODOLOGY

-

8/13/2019 Mutual Fund and Ulip

45/88

45 | P a g e

RESEARCH METHODOLOGY

CONCEPTUAL AND THEORETICAL REVIEW

RESEARCH DESIGNDescriptive research designDescriptive research designare those studies which are concerned with describing thecharacteristics of a particular individual,or of a group.in this study like,observation,questionnaires,examination of records etc are used for such studies.

DATA SOURCES- Primary data and secondary data

RESEARCH APPROACHFace to face interview, observation, individual depth

interview

RESEARCH INSTRUMENTQuestionnaire.

Questionnaire method:In the study questionnaire was send to the person concerned with a request to answer thequestions and return the questionnaire.a questionnaire consists of a number of questions typed indefinite order on a set of forms.the respondents had to answer the question on their own.

-

8/13/2019 Mutual Fund and Ulip

46/88

46 | P a g e

DATA COLLECTION:

PRIMARY DATA:The primary data are those which are collected afresh and for the first time; and thus

happen to be original in character.In this study data is collected through

observation,guidance of the supervisor and data is collected through questionnaire.

1) Use of a Questionnaire for carrying out a survey2) Presentation given by the Advisors of Tata AIG life.3) Data explaining the working of the ULIPs and mutual funds.

SECONDARY DATA:In this study secondary sources of data were the various websites and insurances manuals

.The mainly provided information about the insurance sector and the companys

profile.These help in gaining knowledge about industry.

1) Books2) Newspapers3) Magazines4) Newsletter5) Internet

6) Television7) Booklet8) Policy Brochures

-

8/13/2019 Mutual Fund and Ulip

47/88

47 | P a g e

RESEARCH REVIEW

SAMPLING

It is the process of obtaining information about an entire population by examining only a

part of it.

SAMPLING UNIT-Individuals

SAMPLE SIZE-150 units

SAMPLING TECHNIQUE-Random convenience

SURVEY PERIOD WAS 6 WEEKS STARTED FROM 4th JULY TO 15th AUGUST 2010

-

8/13/2019 Mutual Fund and Ulip

48/88

48 | P a g e

DATA ANALYSIS

AND

INTERPRETATION

-

8/13/2019 Mutual Fund and Ulip

49/88

49 | P a g e

FINDINGS

(CUSTOMERS SURVEY)

ANALYSIS PART 1

MUTUAL FUND

1.Which of the following investment options would you prefer?

Analysis: 44% of respondents have invested in bank deposits,12% in

postal savings,4% of respondents in shares and bonds and2%

in mutual funds ,3% in Insurance Policy and 34% have invested

in both fixed deposit and postal savings.

0

5

10

15

20

25

30

35

40

45

50

Options

respondents

Bank fixed deposit

Postal savings

Shares and bonds

Mutual funds

Insurance policies

Others

Bank FD & Postal

savin s

-

8/13/2019 Mutual Fund and Ulip

50/88

-

8/13/2019 Mutual Fund and Ulip

51/88

51 | P a g e

3.What is the reason for not investing?

Analysis: According to the above table 5 %of the respondents are

uncertain to invest in Mutual Funds. 1% of the respondents think it is high cost

and 3 % of them are not interested in investments, 90% of respondents have

invested in either investment.

0

10

20

30

40

50

60

70

80

90

100

Options

Respondents

Uncertainty

High cost

Not interested in

investment

Others

Non respondents

-

8/13/2019 Mutual Fund and Ulip

52/88

52 | P a g e

4. Do you think investing in Mutual Fund is worthy?

Analysis: According to the above table 55% of the respondents think

that investing in Mutual Funds is worthy and 43% of the respondents think

it is not , 2 % have not responded.

0

10

20

30

40

50

60

Options

Respondents

Yes

No

No response

-

8/13/2019 Mutual Fund and Ulip

53/88

53 | P a g e

5. According to you why an individual should invest in Mutual Fund?

Analysis: According to the above table 5% of the respondents say that they

have invested to multiply their money, 43 % of the respondents have invested

for moderate returns with moderate risk, 16 % of the respondents have invested

to have a faster rate of growth , 1 % of the respondents have invested as other

reason and 35% have invested so ,not responded for question.

0

5

10

15

20

25

30

35

40

45

50

Options

Respondents

To multiply money

Moderate return with

minimum risk

To have faster rate of

growth

Others

Non respondents

-

8/13/2019 Mutual Fund and Ulip

54/88

54 | P a g e

6. Do you have any plan of investing in near future? (if no go to Q no.8)

Analysis: According to the table 8 % of respondents plan to invest in a

Mutual Fund and 90 % do not plan to invest ,2% have not responded.

0

10

20

30

40

50

60

70

80

90

100

Options

Respondents

Yes

No

Non respondents

-

8/13/2019 Mutual Fund and Ulip

55/88

55 | P a g e

7. When do you plan to invest?

Analysis: According to the table 25% of respondents plan to invest in a

month, 12.5% during a month to a year and 37.5% plan to invest after a year

and 25% have not responded.

0

0.5

1

1.5

2

2.5

3

3.5

Options

respondents A month

1month 1 year

After 1 year

Non respondents

-

8/13/2019 Mutual Fund and Ulip

56/88

56 | P a g e

8. How likely are you to recommend investment in Mutual fund to your

friend?

Analysis:

According to the above table 54 % of the respondents definitely will

recommend about the investment of Mutual Funds. 44 % of the respondents

might or might not recommend and 2% have not responded.

0

10

20

30

40

50

60

Options

Respondents

Definitely recommend

Might not recommend

Non respondents

-

8/13/2019 Mutual Fund and Ulip

57/88

57 | P a g e

ANALYSIS PART 2

ULIPS

1. Are you aware of ULIP concepts in Life Insurance?

Analysis:

According to the table 51% of respondents are aware of ULIP concepts and 49

% are not aware . This shows investors are still not aware of Unit Linked

Insurance Plan .

48.4

48.6

48.8

49

49.2

49.4

49.6

49.8

50

50.2

Options

Re

spondents

Yes

No

-

8/13/2019 Mutual Fund and Ulip

58/88

58 | P a g e

2. In which companies have you invested?

Analysis:

According to the table 66% respondents have invested in LIC, 3 % have

invested in ICICI PRU, 23 % in BAJAJ ALLIANZ, 9% in AVIVA and 1 % in

others which include TATA AIG .

0

10

20

30

40

50

60

70

Options

Respondents

LIC

ICICI Pru

Bajaj Allianz

Aviva Life Insurance

Reliance

others

-

8/13/2019 Mutual Fund and Ulip

59/88

59 | P a g e

3.What made you to go for that company?

Analysis: According to the table 27% of respondents have invested in the

company for the Brand name,15% have invested for the service provided, 39%

have invested for the customer relationship the company maintains. 14% of

respondents have invested for the better policy options available, 1% haveinvested for other reason and 4% have not responded.

0

5

10

15

20

25

30

35

40

45

Options

Respondents

Brand Name

service

customer relationship

better policy option

others

Non respondents

-

8/13/2019 Mutual Fund and Ulip

60/88

60 | P a g e

4. What extra benefits would you like to have along with life cover?

Analysis: According to table the extra benefit customer would like to have is

53 % Want a family income benefit , 15% would like to have critical illness

Benefit,1% would like to have riders ,8% would like to have more return and

2% would like other benefit and 21% would like to have family income benefitand critical illness benefit along with life cover.

0

10

20

30

40

50

60

Options

respondents

Family income benefit

Critical illness benefit

Riders

Return

Others

Family income benefit &Critical illness benefit

-

8/13/2019 Mutual Fund and Ulip

61/88

61 | P a g e

5. What is your expectation from investment plan?

Analysis:

According to table 59% of respondents expect security, 3% expect high returnand 1% expect minimum premium,28% expect easy claim and 2% expect

maximum sum assured ,7% expect security and easy claim.

0

10

20

30

40

50

60

70

Options

respondents

Security

High return

Minimum premium

Easy claim

Maximum sum assured

Others

Security and easy claim

-

8/13/2019 Mutual Fund and Ulip

62/88

62 | P a g e

6. Are you aware of ULIP of TATA AIG? (If no go to question no 10)

Analysis: According to table 1% of customers are aware of traditional plan,

3% are aware of Retirement plans, 5% are aware of Life time and 2% are aware

of Life Link Super, 89% have not responded.

0

10

20

30

40

50

60

70

80

90

100

Options

Respondents

Traditional insurance

planRetirement plan

Life time plan

Life link super

Non respondents

-

8/13/2019 Mutual Fund and Ulip

63/88

63 | P a g e

7. Do you hold Unit linked insurance plan?

Analysis:

According to table 27.27% of customers hold Unit Linked Insurance Plan and

72.72 % do not hold Unit Linked Insurance Plan.

0

1

2

3

4

5

6

7

8

9

Options

respondents

Yes

No

-

8/13/2019 Mutual Fund and Ulip

64/88

64 | P a g e

8.What did you like about Unit Linked Insurance Plan?

Analysis:

According to table 18.18% of customers liked liquidity and 9.09% others and

72.72 % have not responded.

0

1

2

3

4

5

6

7

8

9

Options

respondents

Liquidity

Withdrawal

Flexibility

Others

Non respondents

-

8/13/2019 Mutual Fund and Ulip

65/88

65 | P a g e

9. How do you rank Unit linked plan of TATA AIG as compared to

Mutual Fund?

Analysis:

According to table 18.18% of customer have ranked TATA AIG as good

and 9.09% have ranked as satisfactory, 72.72% have not responded.

0

1

2

3

4

5

6

7

8

9

Options

respondents

Good

Satisfactory

Non respondents

-

8/13/2019 Mutual Fund and Ulip

66/88

66 | P a g e

10. Do you have any plan of investing in ULIP in near future? (if no go

to Q no.12)

Analysis: According to the table 6 % of respondents plan to invest in a ULIP

and 91 % do not plan to invest in near future, 3% have not responded .

0

1020

30

40

50

60

70

80

90

100

Options

Respondents

Yes

No

Non respondents

-

8/13/2019 Mutual Fund and Ulip

67/88

67 | P a g e

11. When do you plan to invest?

Analysis:

According to the table 16.66% of respondents plan to invest in a month,

66.66% plan to invest after a year,16.66 % have not responded .

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

Options

respondents A month

1month 1 year

After 1 year

Non respondents

-

8/13/2019 Mutual Fund and Ulip

68/88

68 | P a g e

12. How likely are you to recommend investment in ULIP to your

friends?

Analysis:

According to the above table 53 % of the respondents definitely willrecommend about the investment of ULIP. 42 % of the respondents might or

might not recommend and 5% have not responded.

0

10

20

30

40

50

60

Options

Respondents

Definitely recommend

Might not recommend

Non respondents

-

8/13/2019 Mutual Fund and Ulip

69/88

69 | P a g e

CONCLUSION

-

8/13/2019 Mutual Fund and Ulip

70/88

-

8/13/2019 Mutual Fund and Ulip

71/88

71 | P a g e

LIMITATIONS

The time constraint was one of the major problems.

The study is limited to the different schemes available under the

mutual funds and ulips selected.

The study is limited to selected mutual fund schemes and ulips

The lack of information sources for the analysis part.

-

8/13/2019 Mutual Fund and Ulip

72/88

72 | P a g e

SUGGESTIONS AND RECOMMENDATIONS

SUGGESTIONS FOR MUTUAL FUNDS

funds advertisement and logo concept

plays major role in awareness about the product. So mutual funds should also

do aggressive ad campaign with the celebrity endorsement and innovative and

creative logo should be there which matches the product and signifies the strength

of the type.

foreign brands, mutual funds should focus on product awareness and product

preference advertising.

actually not aware about mutual funds because of the lack of awareness of mutual

funds, so the company should conduct such a awareness programs that the people

should come to know about the schemes of mutual funds.

investors get to know about the schemes performing well.

brokers

investors and corporate.

preferred scheme.

-

8/13/2019 Mutual Fund and Ulip

73/88

73 | P a g e

SUGGESTIONS FOR ULIPS

Most of the respondents are not aware of Unit Linked

Insurance Plan; the awareness programme for non-investors

should be increased by different medias like TV, Magazines, & News Paper.

The company has to provide proper training to advisors or marketing skills to improve

the marketability of products.

Educate people by arranging a meeting or fair for investors and

explaining about how ULIP works because investors are not aware of

ULIP as an investment option and investors do not have the sufficient

knowledge of the basic concepts of ULIP & about the operating of ULIP.

Complete information should be provided regularly to the advisors as

well as to the investors to keep them updated about the developments.

Many of the investors say that they are ready to recommend about

investment to friends, so the company should approach the investors

through the distributors and explain about the Insurance schemes.

-

8/13/2019 Mutual Fund and Ulip

74/88

74 | P a g e

RECOMMENDATIONS TO THE COMPANY:-

-

to the pockets of the lower and middle income groups.

can invest in such policy

Value) amount but also the SA (sum Assured) i.e. guaranteed SA.

ced.

Additional Support Required by the Agents from the Company:-

- Field support i.e. the company should provide a staff wherein they

will get a field work done from them.

- The company should provide proper database to their agents. For

the database the company can also have some tie-ups with some of

the companies.

- There should be monthly meetings held by the company for the

agents wherein they can solve their problems and suggest the new

ways for the marketing of products.

- There should be separates Claim Settlement Cell so that the

company as well as the agents do not face any problem while

settlement of claims.

- Also the company can support the agents by having some kind of

publicity.

-

8/13/2019 Mutual Fund and Ulip

75/88

-

8/13/2019 Mutual Fund and Ulip

76/88

76 | P a g e

CONCLUSION OF THE SURVEY

Life insurance sector is one of the key areas where enormous business potential exists.

Life insurance is a form of insurance that pays monetary proceeds upon the death of the

insured covered in the policy. The basic urge in man to secure himself against any form

of risk and uncertainty .

After comparing Unit Linked life insurance plans and Mutual Fund it can be concluded

that most of respondents are not aware of ULIP products of tata aig life.

There is the difference between expenses of a ULIP as

compared with the expenses of a mutual fund. If investor are

looking for a long-term investment avenue with an insurance

cover , then ULIP is the product for them and if they are

looking at a product that helps investor to focus purely on

investment and returns over a medium term, then mutual fund

is suitable.

-

8/13/2019 Mutual Fund and Ulip

77/88

77 | P a g e

CONCLUSION FOR COMPANY

Tata Aig is one of the worlds largest life insurance company.it has businesses spread out

across the globe.it came to india 2001.it currently ranks top amongst the insurer in india.

(source:annual premium provided by the company)

The company faces a large amount of competition .To sustain itself it must promote its

products through advertisement and improve its selling techniques.consumer must be aware of

the new plans available at Tata Aig.

The medium of advertising use could be internet since most of its competitiors use this tool to

promote their products.the company must be promoted as an Indian company since consumer

seem to have more trust in investing in Indian firms.

The unit linked concept must be specifically promoted.the general perception of life insurance

has to change in india before progress is made in this field.people should not be afraid to invest

money in insurance and must use it as an effective tool for tax planning and long term savings.

Tata Aig could trap the rural markets with cheaper products and smaller policy terms.There

are individual who are willing to pay small amounts as premium but the plans do not accept

premium below a certain amount .it was usually found that a large number of males were

insured compared to females.individuals below the age of 30 were interested in investment

plans.this was a general conclusion drawn during prospecting clients.

-

8/13/2019 Mutual Fund and Ulip

78/88

78 | P a g e

BIBLIOGRAPHY

-

8/13/2019 Mutual Fund and Ulip

79/88

79 | P a g e

BIBLIOGRAPHY

A. BOOKS

1. Insurance Principles & PracticesM.N.Misra S Chand Publications.

2. InsuranceM.J.Mathew RBSA Publications.

3. Insurance Fundamentals, Environment & ProceduresB.S.Bodla, M.C. Garg, K.P. SinghDeep & Deep Publications of 2003

4. Insurance Institute of India IC 33------S.J. Gidwani5. Taxmann Life Insurance agent ---- P.R. Khanna , Taxmann Allied service pvt ltd

B. NEWSPAPERS1. Economic Times2. Times Of India3. ESCOLIFE PAPER on Insurance by Ritu Nanda

Vol 2, Issue viii June, 2007.

C. MAGAZINES1. Money Simplified --Vol xxx ,Feb 2007 ULIPs how they fit in2. Consumer Voice ---Vol 7, Issue 3

D. NEWSLETTER1. Tata AIG Life Agency Newsletter

Vol 1, Edition 6 , March ,2007.

E. INTERNETwww.tata-aig.comwww.licofindia.com

www.iciciprulife.comwww.reliancelife.comwww.moneycontrol.comwww.personalfn.comwww.et.comwww.google.com

F. CNBC TV 18

G. BOOKLET on the Orientation Programme of Employees at Tata AIG

H. Policy Brochures of Tata AIG, ICICI Prudential, Reliance Life & LIC.

-

8/13/2019 Mutual Fund and Ulip

80/88

80 | P a g e

ANNEXURE

-

8/13/2019 Mutual Fund and Ulip

81/88

81 | P a g e

QUESTIONNAIRE

This information is for our internal use only,will not be disclose to any otherorganization/departmentCOMPARATIVE ANALYSIS OF MUTUAL FUND AND MARKET LINKEDINSURANCE PLANS

Name AddressTelephone AgeOccupation Annual incomeMarital status single or married (age of child if applicable)

SECTION A

1.Which of the following investment options would you prefer?

a)Bank fixed deposit

b)Postal savings

c)Shares and bonds

d)Mutual funds

e)Insurances policies

f)Others

g)Bank FD and postal savings

-

8/13/2019 Mutual Fund and Ulip

82/88

82 | P a g e

2. Have you invested in the following? (Please tick)(if yes, go to Q no.4)

a)Mutual funds

b)Insurance policies

c)Mutual funds and insurance policies both

3.What is the reason for not investing?

a)Uncertainty

b)High cost

c)Not interested in investment

d)Others

e)Non respondents

4. Do you think investing in Mutual Fund is worthy?

a) Yes

b)No

c) No response

5. According to you why an individual should invest in Mutual Fund?

a) To multiply money

b) Moderate return with minimum risk

c)To have a faster rate of growth

d)Others

e)Non respondent

-

8/13/2019 Mutual Fund and Ulip

83/88

83 | P a g e

6. Do you have any plan of investing in near future? (if no go to Q no.8)

a)Yes

b)No