Municipal Affairs · Election training for returning officers and administrators October Municipal...

Transcript of Municipal Affairs · Election training for returning officers and administrators October Municipal...

Municipal AffairsVolume 3 Issue 2October 2013

Inside This Issue1 Message from Municipal Affairs1 Ongoing Training for Municipalities2 HonorariumsforElectedOfficials2 Emergency Planning2 Dates of Note 2013/143 Quorum 3 VolunteerFirefighterHonorariums4 Public Notice of Meetings4 Tips and Best Practices

Message from Municipal AffairsSummer tends to be a quieter time for many of our municipal councils, but here at Municipal Affairs, we continued to develop a range of resources for municipalities, including fact sheets, templates, and handbooks.We encourage you to take a look at the range of documents posted to our website. Please visit gov.pe.ca/mapp/municipalinfo to make use of all the resources available.

Ongoing Training for MunicipalitiesWe were pleased at how many people attended our orientation sessions in February and March.It is our hope to hold more sessions for municipal administrators and for elected officials over the coming months. Councils do not have to wait for formal sessions, however, to ask those burning questions. Municipal Affairs always welcomes the opportunity to come out and speak with councils and staff on a range of topics. Contact us to set up a session.If a presentation or session isn’t in the cards, visit gov.pe.ca/mapp for information on various aspects of municipal governance, municipal finances, council meetings, land use planning and much more. This newsletter includes a range of tips and reminders about how to ensure compliance with legislation, meet minimum standards for municipal governance, and ensure accountability to your residents. Please feel free to contact us if you have any questions on the information provided.

1

Who Are We?Finance, Energy andMunicipal Affairs

Minister: Hon. Wesley J. SheridanDeputy Minister: David ArsenaultDirector: Albert MacDonaldManager: Samantha MurphyMunicipalOfficer: John Chisholm FinancialOfficer: Stephen MutchMunicipalOfficer: Kevin CoadyAdministration: Natalie Dow

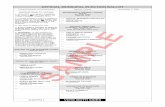

All decisions are made by resolution

of council, voted on by councillors

at a public meeting.

Communities: if the meeting is

not a regular monthly meeting,

it must be advertised.

The public must be able to attend all council meetings and have accessto the minutes.

Council sets priorities and

makes policies. The administrator

implements council decisions.

Councils are elected to establish

services for the area. Services are mostly funded by property taxes.

The chair/mayor provides

leadership, presides over

meetings, creates committees and

breaks ties.

Municipal Affairs Newsletter – 2

HonorariumsforElectedOfficialsIn order for municipalities to legally pay honorariums to elected officials under the Municipalities Act, the Charlottetown Area Municipalities Act, or the City of Summerside Act, they must first pass a bylaw that outlines the payment of expenses and benefits, as well as the amount of honorariums for each member of council, including the mayor or chair. If your municipality does not currently have a remuneration or honorarium bylaw and the municipality does wish to pay members of council in one form or another, please contact us at Municipal Affairs so we can assist you in ensuring that you enact an appropriate bylaw.

Emergency PlanningNow that we’ve entered the sometimes busy hurricane season, it is time to think about whether your municipal contact information is up to date.The first step is to check the information located on our website to ensure that we have the correct details. Let us know if any changes are required by calling 902-620-3558 or by emailing [email protected] is also recommended that someone from the municipality touch base with the provincial Emergency Measures Organization (EMO).Even if your municipality has not begun the process of developing an emergency management program, the provincial Emergency Measures Organization may need to reach someone in an official capacity with area-specific information. Please ensure that contact information is left with PEI EMO in case they need to contact you before or during an emergency. This information should include after hours contact numbers for the municipality’s Municipal Emergency Management Coordinator, or the individual responsible for emergency response if you do not have any formal emergency management planning in place.PEI EMO is available to assist municipalities in developing an emergency management program, including passing a by-law, writing a plan, training and exercising. You can contact them at peipublicsafety.ca or call them at 902-894-0385 (toll free 1-877-894-0385).

Dates of Note 2013-2014October19 – FPEIM Semi-annual meetingJanuary 20141 – Municipal Fiscal Year beginsFebruary1-28 – start scheduling AGM1-28 – hire your auditor1-28 – prepare budget for 2013, determine tax ratesMarch1-31 – Community Annual MeetingsAnnual meeting minus 9 days – 1st ad (timing is important!)Annual meeting minus X days – 2nd ad (timing is flexible)31 – Deadline to submit municipal property tax rate to Provincial Tax CommissionerApril1 – Financial documents due Financial statements Municipal Financial Information Return 2014 budget1 - Provincial funding year beginsJune1 – Appoint returning officers and determine time and location for municipal electionsSeptemberElection training for returning officers and administrators OctoberMunicipal election ads (2)November3 – Municipal Election Day

Visit our branch site atgov.pe.ca/mapp

Email comments or questions to [email protected]

Social Media: social media offers new tools to municipalities when seeking to communicate with residents, businesses, and visitors. Don’t forget, though - what’s said on social media stays out there forever and reflects on your municipality, as well as on you. Always maintain a professional focus when tweeting or posting to Facebook.

Municipal Affairs Newsletter – 3

QuorumQuorum must be in place for the following types of meetings:

Council Meetings Committee Meetings Annual Meetings Special Meetings

If no quorum is present, no decisions can be made (no resolutions can be passed).As the annual meeting is a meeting of a community council, council must form a quorum at that meeting. Ensure that a date is picked that suits at least the majority of council members, if not all.The quorum at any council meeting is:(a) the mayor or chairperson or,

in their absence, the deputy mayor or vice-chairman; and

(b) at least one-half of the councillors then holding office.

The quorum at any committee meeting is(a) the committee chair or, in their

absence, the committee deputy or vice chair; and

(b) at least one-half of the committee members then appointed.

VolunteerFirefighterHonorariumsMunicipalities who pay out firefighters' honorariums during the year must issue T4’s to the individuals receiving these amounts.* The first $1,000 of this honorarium is eligible to be received tax-free by recipients. The federal government implemented a Volunteer Firefighter Tax Credit (VFTC) in 2011 that allows volunteer firefighters who have completed a minimum of 200 hours of eligible volunteer firefighting services with one or more departments in the year, to claim a $3,000 tax credit. Recipients must be aware that they cannot claim both the VFTC and receive the $1,000 tax-free income exemption. If a recipient chooses to claim the income exemption, then they will not be able to claim the VFTC in that year. Therefore, to be able to claim the VFTC, the entire honorarium amount must be claimed as taxable income in the year received. Prince Edward Island also has a $500 Provincial Tax Credit for volunteer firefighters which can be claimed as long as they meet the rules in place for claiming the federal tax credit.For more information, please see the following link from the Canada Revenue Agency:http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns360-390/362-eng.html

It’s an electronic world – maximizing communicationsIf you would prefer to receive our newsletter and other Municipal Affairs updates by email, please contact Natalie Doyle at [email protected].

Contact Municipal Affairs anytime to schedule

a presentation to staff or Council.

A great reminder about the important role of municipalities– Sign outside the Community of O’Leary office

Municipal Affairs Newsletter – 4

Resources and InformationCheck out the Municipal Affairs website for the latest on:

• Canada Revenue Agency information on issuing receipts for donations

• New handbooks on: planning processes annual meetings municipal bylaws

• Updated planning checklists TIPS AND BEST PRACTICES • Committee of the Whole meetings

are informal meetings of a committee made up of all members of council, sitting in a deliberative rather than legislative capacity, for informal debate and preliminary consideration of matters. These may be open or closed (in camera) meetings, but they can only be held after a resolution is passed at a public meeting of council.

• “In camera” means behind closed doors – these meetings should only be held under certain circumstances. Decision-making should never be a rubber-stamping of a discussion already held behind closed doors, except where it involves legitimately sensitive information such as legal or personnel issues, in which case the public discussion would only provide the information necessary to provide a basis for the decision (resolution).

• Start each meeting with a conflict of interest disclosure.

Public Notice of MeetingsAll three pieces of municipal legislation set out responsibilities for councils with regards to public notification regarding meetings.

Regular Meetings of Council:• Set by resolution of council, usually on the x (day) of the

month (ie 1st Monday of the month). This pattern can also be used to set up a regular meeting schedule even if you are not meeting on a monthly basis. (ie 1st Monday of every third month).

• It is strongly recommended that the date of each meeting or the schedule be posted somewhere publicly accessible, such as on a municipal sign or website.

• The public must be able to attend all council meetings, even if they are being held in a private residence.

• It is strongly recommended that the resolution establishing the regular meetings schedule also establish a procedure for rescheduling or cancelling regular meetings in the event of unforeseen circumstances (snow storm, power outage, lack of quorum).

• The CAO/Administrator or their delegate must be present at the meeting in order for it to be considered a properly constituted meeting of council at which decisions can be made (resolutions).

Special Meetings of Council:• Community councils may only hold special meetings

after advertising twice in a newspaper, with the first advertisement in at least 7 clear days before the meeting (don’t count the day of the ad or the meeting).

• Cities and towns are not required to advertise in a newspaper, but as the public has the right to attend all meetings of council, steps must be taken to ensure that the public is aware that the meeting is taking place so that they can attend, should they so desire. A best practice would be to adopt a policy or procedural bylaw establishing the notification procedures for special meetings (ie posting on a website, on a municipal sign, on social media, or via the media), to ensure consistency.

• Failure to properly notify the public may invalidate decisions made at a special meeting of council.

Howtofindus:Visit: 3 Brighton Road, Aubin-Arsenault BuildingMail: Municipal Affairs, Department. of Finance, Energy and Municipal Affairs PO Box 2000, Charlottetown, PE C1A 7N8Email: [email protected] | [email protected] | [email protected] | [email protected] [email protected] | [email protected] Web: gov.pe.ca/finance/municipalaffairsPhone: 902-620-3558 or Fax: 569-7545

13MA28-37896