Multifamily Development Site With Current Income

Transcript of Multifamily Development Site With Current Income

KEVIN NOLEN858.546.5487 [email protected] #01840398

JASON [email protected] #01328121

TIM [email protected] #00891667

12

34

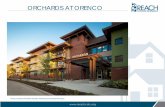

5Property Renderings

Project Overview Market Overview

Market Comparables

Demographics

T A B L E O F C O N T E N T S

P R O J E C T O V E R V I E W

THE OPPORTUNITY246 Nutmeg is a 10,538 SF, 36 unit potential multifamily development site with current

income. The project is currently zoned for 73 DU per acre which allows for 18 units and

27 units after a 50% density bonus or 36 units utilizing the 100% density bonus program

(≤600 square foot overall average unit size; < 800 square foot maximum unit size). The site

is located in San Diego’s charming Bankers Hill sub-market perched right above Downtown

and filled with restaurants and lounges and adjacent to Balboa Park, the nation’s largest

(1,200 acres) urban cultural park that includes 15 museums, performing arts venues,

gardens and the San Diego Zoo. The site provides easy access to San Diego and only a

minute drive to Hillcrest, Downtown and Interstate 5.

5TH AVE.

4TH AVE.

3RD AVE.

2ND AV E.

LAUREL ST.

MAPLE ST.

NUTMEG ST.

SAN DIEGOINTERNATIONAL

AIRPORT

Property Information: Address: 246-48 Nutmeg St. San Diego, CA 92103

APN: 452-718-05

Total Site Size SF: 10,538 SF

Total Site AC: 0.24 AC

Zoning: Residential – High : 43-73 Du/Ac

180 DUs By Right

27 DUs After 50% Density Bonus

36 DUs After 100% Density Bonus (Using The Micro

Unit City of San Diego Density Bonus Program)

Price: $3,400,000

Current Building Stats: Building SF: 4,939 SF

Number of Units: 5

Year Built: 1938

20182018 Gross Rental Income: $96,029

20192019 Gross Rental Income: $101,220

S U M M A R Y

CLICK HERE For Property Confidentiality Agreement

2nd

AVE.

3rd

AVE.

nu t meg s t.

ol i v e s t.

OLIVE STREET PARKFuture Site

Click Here For Details

5TH AVE.

4TH AVE.

3rd AVE.

STREET LIGHTS

6TH & OLIVE204 For-Rent Units

STRAUSS 141 For Rent Units

INNOVATIVE DEVELOPMENT

128FOR RENT UNITS

218 For Rent Units

THE PARK 60 Condo Units

FLOIT PROPERTES+/- 200 Units

GREYSTAR111 Units

VUE ON 5TH45 Condo Units

41 WEST 41 Condos

N E W D E V E L O P M E N T S

nutmeg st.

olive s

t.

maple st.t hird av e.

f our t h ave.

f if t h ave.

A M E N I T I E S

S A N DIEGOIN T ERN AT ION A L

A IRP OR T

DOWNTOWN

HILLCREST

MISSION VALLEY

BANKERS HILL

Mlim Holdings

S A N D I E G O

nutmeg st.

olive s

t.

maple st.t hird av e.

f our t h ave.

f if t h ave.

J O B A C C E S S

Address Sale Date Buyer Reported Sale Price

# of Units Price/Unit Acres Price/AC SF $/SF

12850 6th AvenueSan Diego, CA

1/15/15 Zephyr $10,200,000 64 $175,000 0.83 $13,493,976 36,000 $311

24311 3rd AvenueSan Diego, CA

4/21/17 Camden $20,000,000 130 $153,846 8.24 $2,427,184.47 358,934 $56

34275 Mission Bay Drive San Diego, CA

5/5/17 JPI $21,625,000 172 $125,726 0.3 $7,482,699 125,888 $172

42054 State Street San Diego, CA

12/20/16 Willmark Co. $9,850,000 - - 2.89 $17,589,285 24,294 $405

51810 El Cajon Blvd.San Diego, CA

4/13/2018 Lennar $42,300,000 - - 2.38 $17,773,109 103,606 $408

61579 Morena Boulevard, San Diego, 92110 CA

9/30/2018Fairfield Resi-

dential$15,500,000 145 $106,164 3.79 $2,622,673 252,212 $62

7730 Camino Del Rio N San Diego, CA 92101 (Bob Baker)

12/23/2014 Dinerstein $18,798,000 305 $69,830 5.37 $3,966,108 233,917 $91

8123 Camino De La Reina San Diego, CA

10/18/2017 Trammell Crow $17,001,500 284 $59,864 4.92 $3,455,589 214,315 $79

Untitled map

Untitled layer

1

3

5

4

2

6

78

15

M U L T I F A M I LY S A L E S C O M P S

Untitled map

Untitled layer

1. IL PALZZO 2040 Columbia Street San Diego, CA 92101

2. CAMDEN TUSCANY 1670 Kettner Blvd, San Diego, CA 92101

3. BROADSTONE LITTLE ITALY 1980 Kettner Blvd, San Diego, CA 92101

4. AV8 2155 Kettner Blvd. San Diego, CA 92101

5. VICI 550 W Date St. San Diego, CA 92101

7. BROADSTONE BALBOA 3288 5th Ave. San Diego, CA 92101

17

$4.29 PSF

$4.40 PSF

$3.80 PSF

$3.83 PSF

$3.21 PSF

25

13

4

6

$3.40 PSF

A P A R T M E N T R E N T A LC O M P A R A B L E S

4 AV8

129 Units2155 Kettner BlvdSan Diego, CA 92101

Completed Date: May, 2018Improvements Rating A+Location Rating B+Occupancy: 89.1%

Common Area Amenities - Controlled Access, Fitness Center, Clubhouse, Rental Office - Stand AloneParking - Total Parking - 321 Spaces, Parking Type - SubterraneanFunctional Characteristics -Total Parking - 134 Spaces, Parking Type - Above Ground andSubterraneanFunctional Characteristics - Private Balcony/Patio, Construction Type -Steel FrameOther Factor - View - North San Diego BayApartment Interior Amenities - Internet Access, Above Standard Ceiling Height, Microwave Ovens

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 129 762 98,341 $2,897 $3.80

3 Broadstone Little Italy

199 Units1980 Kettner BlvdSan Diego, CA 92101(619) 230-0888Completed Date October, 2014Improvements Rating A+Location Rating B+Occupancy 96.0%

Common Area Amenities - Controlled Access, Fitness Center, BusinessCenter, Clubhouse, 1 Swimming Pool, 1 Spa, Rental Office - Stand AloneParking - Total Parking - 321 Spaces, Parking Type - SubterraneanFunctional Characteristics - Private Balcony/Patio, Construction Type - Steel FrameOther Factor - Major Street Exposure - Grape Street, View - Downtown San Diego/San Diego BayApartment Interior Amenities - Internet Access, Above Standard Ceiling Height, Microwave Ovens

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 199 823 163,722 $3,152 $3.83

1 Il Palazzo

108 Units2040 Columbia StreetSan Diego, CA 92101

Completed Date: February, 2004Improvements Rating: ALocation Rating: B+Occupancy: 82.4%

Common Area Amenities - Controlled Access, Fitness Center, Rental Office - Stand AloneParking - Total Parking - 108 Spaces, Parking Type - SubterraneanFunctional Characteristics - Private Balcony/Patio, Construction Type - FrameOther Factor - Major Street Exposure - Grape StreetApartment Interior Amenities - Internet Access, Above Standard Ceiling Height, Microwave Ovens

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 108 726 78,407 $2,465 $3.40

2 Camden Tuscany

160 Units1670 Kettner BlvdSan Diego, CA 92101

Completed Date August, 2002Improvements Rating ALocation Rating B+Occupancy 93.1%

Prior Names: Park at Little ItalyCommon Area Amenities - Controlled Access, Fitness Center, BusinessCenter, Clubhouse, 1 Swimming Pool, 1 Spa, Rental OfficeParking - Total Parking - 160 Spaces, Parking Type - SubterraneanFunctional Characteristics - Private Balcony/Patio, Construction Type - Combination Apartment InteriorApartment Interior Amenities - Internet Access, Above Standard Ceiling Height, Microwave Ovens

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 160 886 141,769 $2,846 $3.21

5 VICI

97 Units550 West Date StreetSan Diego, CA 92101

Completed Date: October, 2018Improvements Rating ALocation Rating B

Common Area Amenities - Controlled Access, Fitness Center, Business Center, Clubhouse, 1 Spa, Rental Office - Stand AloneParking - Parking Type - Multi-Level StructureFunctional Characteristics - Private Balcony/Patio, Construction Type - Steel FrameApartment Interior Amenities - Internet Access, Above Standard Ceiling Height

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 97 906 87,900 $3,745 $4.17

7 BROADSTONE BALBOA PARK

100 Units3288 5th AvenueSan Diego, CA 92103

Completed Date: June, 2015 4Improvements Rating ALocation Rating BOccupancy: 94.0%

Common Area Amenities -Controlled Access, Fitness Center, Business Center, Clubhouse, 1 Spa, Rental Office - Stand AloneParking - Total Parking - 321 Spaces, Parking Type - SubterraneanFunctional Characteristics - Private Balcony/Patio, Construction Type -CombinationOther Factor - Major Street Exposure - 5th Avenue, View - Downtown San Diego/San Diego BayApartment Interior Amenities - Internet Access, Above Standard Ceiling Height, Microwave Ovens

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 100 777 77,695 $3,430 $4.40

6 LOFT2015

85 Units2015 Hancock StreetSan Diego, CA 92110

Completed Date: January, 2011Improvements Rating: A Location Rating: BOccupancy: 92.9%

Common Area Amenities - Controlled Access, Rental Office - Stand Alone Parking - Total Parking - 127 Spaces, Parking Type - SubterraneanFunctional Characteristics - Private Balcony/PatioOther Factor - View - Downtown San DiegoApartment Interior Amenities - Internet Access, Above Standard Ceiling Height, Microwave Ovens

% of Total UnitCount

Size (SqFt) Market Rent

Unit Total Total SqFt

TOTAL 100% 85 895 76,035 $2,339 $2.61

A P A R T M E N T R E N T A L C O M P A R A B L E S

Nutmeg Comps_base

Untitled layer

Full Site Address Building Area Sale Date Sales Price

1 2855 5th Ave Unit 1003 2,875 9/4/2018 $3,339,500

2 2500 6th Ave Ph 1 4,715 6/17/2019 $2,800,000

3 2500 6th Ave Unit 1107 3,228 12/27/2018 $2,525,000

4 2500 6th Ave Unit 702 3,228 8/9/2019 $2,049,500

5 2854 6th Ave 2,605 9/5/2018 $1,890,500

6 2500 6th Ave Unit 606 2,625 8/9/2019 $1,624,500

7 2500 6th Ave Unit 401 2,625 10/15/2018 $1,600,000

8 2855 5th Ave Unit 503 1,500 9/17/2018 $1,532,500

9 2855 5th Ave Unit 404 1,540 10/15/2018 $1,455,500

10 475 Redwood St Unit 408 1,580 4/2/2019 $1,389,000

11 235 Quince St Unit 403 2,130 5/1/2019 $1,317,500

12 2665 5th Ave Unit 608 1,895 5/3/2019 $1,263,000

13 475 Redwood St Unit 407 1,560 3/29/2019 $1,160,000

14 301 Upas St 1,612 6/28/2019 $1,158,000

15 309 Upas St 1,701 11/29/2018 $1,150,000

16 475 Redwood St Unit 906 1,574 9/14/2018 $1,150,000

17 2351 Front St 1,581 11/2/2018 $1,015,000

18 2585 Front St 1,782 6/11/2019 $970,000

19 555 Hawthorn St 1,838 5/10/2019 $968,000

20 2056 6Th Ave 1,838 8/13/2019 $960,000

1, 5, 8, 9

2, 3, 4, 6, 7

10, 13, 16

19, 20

14, 15

11

1218

17

C O N D O S A L E S C O M P A R A B L E S

GENERAL PLAN LAND USE

COMMUNITY PLAN DESIGNATION

SPECIFIC USECONSIDERATIONS DESCRIPTION

INTENSITY

RESIDENTIAL DENSITY (DWELLING UNITS/ACRE)

DEVELOPMENTINTENSITY

Parks, Open Space, and Recreation

Open Space None

Provides for the preservation of land that has distinctive scenic, natural or cultural features; that contributes to community character and form; or that contains environmentally sensitive resources. Applies to land or water areas that are undeveloped, generally free from development, or devel-oped with very low-intensity uses that respect natural environmental char-acteristics and are compatible with the open space use. Open Space may have utility for: primarily passive park and recreation use; conservation of land, water, or other natural resources; historic or scenic purposes; visual relief; or land form preservation.

1OR-1-1 zone0.45 FAR

Population - based Parks

None

Provides for areas designated for passive and/or active recreational uses, such as community parks and neighborhood parks. It will allow for facilities and services to meet the recreational needs of the community as defined by the community plan.

N/AOP-1-1 zoneOP-2-1 zone

Residential

Residential -Low

None Provides for single-family housing within a low residential density range and limited accessory uses. 5-9

RS-1-7 zoneFAR Varies

Residential -Low Medium None

Provides for both single-family and multifamily housing within a low medi-um residential density range.

10-15RM 1-1 zone0.75 FAR

Residential -Medium None

Provides for both single-family and multifamily housing within a medium residential density range.

16-29RM-2-5 zones1.35 FAR

Residential –Medium High None

Provides for multifamily housing within a medium-high residential density range.

30-44RM-3-7 zone1.80 FAR

Residential –High None Provides for multifamily housing with a high density range. 45-73

RM-3-9 zone2.70 FAR

Residential –Very High None Provides for multifamily housing with a very high density range. 74-109

RM-4-10 zone3.60 FAR

UPTOWN COMMUNITY PLAN LAND USE DESIGNATION

Click Here for Bankers Hill Community Plan

LAND USE MAP

23

W W

ASHIN

GTON ST

INDIA ST

06TH

AV

W WASHINGTON ST

UNIVERSITY AV

LAUREL ST

HAWTHORN ST

1ST

AV

2ND

AV

INDIA ST

1ST

AV

4TH

AV

03RD

AV

06TH

AV

W WASHINGTON ST

KITE

ST

07TH

AV

FIR ST

IVY ST

BUSH ST

ELM ST

PRINGLE

ST

BRAN

T ST

CURL

EW S

T

HAW

K ST

SUTTER ST

W LAUREL ST

FALC

ON

ST

REYN

ARD

WY

GRAPE ST

MAPLE ST

THORN ST

ROBINSON AV

WASHINGTON PL

W IVY ST

W UNIVERSITY AV

SPRUCE ST

QUINCE ST

LAUREL ST

KALMIA ST

KEATI

NG ST

W KALMIA ST

DO

VE S

T

VINE ST

JUNIPER ST

STATE ST

NUTMEG ST

WASHINGTON ST

W JUNIPER ST

TITUS ST

PENNSYLVANIA AV

BROOKES AVSAN DIEGO AV

FRO

NT

ST

OLIVE ST

NORT

H A

RRO

YO D

R

LARK

ST

ALBA

TRO

SS S

T

TORRANCE ST

06TH

EX

ST

JACK

DAW

ST

IBIS

ST

W QUINCE ST

ST JA

MES

PL

GLENWOOD DR

NEALE ST

05TH

AV

ANDREWS S

T

WIN

DER ST

GUY ST

W REDWOOD ST

EAG

LE S

T

HORTON AV

PALM ST

DO

VE C

T

W MAPLE ST

UNIVERSITY AV

SASSAFRAS ST

WEL

LBORN ST

OTS

EGO

DR

LINWOOD ST

CLARK ST

SHERIDAN AV

W UPAS ST

W GRAPE ST

B EARD

R

W PALM ST

CHALMERS ST

FALCON PL

W HAWTHORN ST

L YNDO NRD

UNION ST

ALBERTA PL

WALNUT AV

W THORN ST

IVY LN

REDWOOD ST

PUTERBAUGH ST

UPAS ST

GOLDFINCH PL

ARROYO DR

W BROOKES AV

VANDERBILT PL

GO

L DF I

NCH

S T

DAN

A P

L

MC KEE ST

W FIR ST

KETTNER BL

GOD

SAL

LN

POR

TOLA

PL

COLUMBIA ST

ROBI

NSO

N M

EWS

W WALNUT AV

EVANS PL

ING

ALL

S ST

IBIS CT

BARNSONPL

W PENNSYLVANIA AV

WSPRUCE ST

SLOANE AV

W OLIVE ST

BAY V

IEW

CT

RAN

DO

LPH

ST

PIO

NEE

R PL

CRA

NE

PL

ALAMEDA DR

CR O WEL

L ST

ANDERSON PL

W NUTMEG ST

UNIVERSITY PL

W ROBINSON AV

NORTH CRESCENT CT

1ST

AV

GOLD

FIN

CH S

T

W MAPLE ST

05THAV

W THORN ST

GOLD

FIN

CH S

T

IBIS

ST

SHERIDAN AV

LARK

ST

JACK

DAW

ST

W PALM ST

STATE ST

W SPRUCE STW SPRUCE ST

CURLEW ST

EAG

LE S

T

UNION ST

UNIO

N ST

W OLIVE ST

W MAPLE ST

HORTON AV

BUSH ST

BRAN

T ST

DOVE ST

UPAS ST

W BROOKES AV

CURL

EW S

T

FRO

NT

ST

05TH

AV

HAW

K ST

NEALE ST

TORRANCE ST

W BROOKES AV

JACK

DAW

ST

W NUTMEG ST

SUTTER ST

FRO

NT

ST

W UPAS STW UPAS ST

REYN

ARDW

Y

FRO

NT

ST

BRANT ST

STATE ST

HORTO

N AV

FRO

NT

ST

W PALM ST

COLUMBIA

ST

IND

I AST

PUTERBAUGH ST

GUY ST

BRAN

T ST

CURL

EW S

T

W UPAS STW UPAS ST

06TH

AV

FALC

ON

ST

DO

VE S

T

REDWOOD ST

COLUMBIA ST

DO

VE S

T

IBIS

ST

UNION ST

FRO

NT

ST

AL BATRO

SSST

DO

VE S

T

WUNIVE RSITY AV

W WALNUT AV

W ROBINSON AV

EAG

LE S

T

GUY ST

REYNARD WY

EAGLE ST

GUY ST

WINDER ST

BRAN

T ST

IBIS

ST

W WALNUT AV

GUY ST

OTS

EGO

DR

TORRANCE ST

COLU

MBIA ST

07TH

AV

WALNUT AV

06TH

AV

W SPRUCE ST

UNIVERSITY PL

EAG

LE S

T

03RD

AV

W WALNUT AV

ALBA

TRO

SS S

T

W UPAS ST

GOLD

FIN

CH S

T

ALB

ATR

OSS

ST

HAW

K ST

W PENNSYLVANIA AV

COLUMBIA ST

BUSH ST

W WALNUT AV

FRO

NT

ST

W PALM ST

SUTTER ST

HAW

K ST

JACK DA

WS

T

W THORN ST

TORRANCE ST

IBIS

ST

4TH

AV

STATE ST

W REDWOOD ST

GUY ST

PUTERBAUGH ST

KEATI

NG ST

STATE ST

LARK

ST

IBIS

ST

CURL

EW S

T

W THORN ST

W PENNSYLVANIA AV

LEGEND

ResidentialResidential - Low : 5-9 Du/Ac

Residential - Low Medium : 10-15 Du/Ac

Residential - Medium : 16-29 Du/Ac

Residential - Medium High : 30-44 Du/Ac

Residential - High : 45-73 Du/Ac

Residential - Very High : 74-109 Du/Ac

Commercial, Employment, Retail, and ServicesCommunity Commercial : 0-29 Du/Ac

Community Commercial : 0-44 Du/Ac

Community Commercial : 0-73 Du/Ac

Community Commercial : 0-109 Du/Ac

Neighborhood Commercial : 0-29 Du/Ac

Neighborhood Commercial : 0-44 Du/Ac

Office Commercial : 0-29 Du/Ac

Office Commercial : 0-44 Du/Ac

Office Commercial : 0-73 Du/Ac

Park, Open SpaceOpen Space

Park

InstitutionalInstitutional

Community Plan Boundary Copyright 2012 SanGIS - All Rights Reserved. Full text of this legalnotice can be found at http://www.sangis.org/Legal_Notice.htm

0 400 800200Feeto

FIGURE 2-4: COMMUNITY PLAN LAND USE MAP - SOUTH

LU-27

LAND USE 2

W W

ASHIN

GTON ST

INDIA ST

06TH

AV

W WASHINGTON ST

UNIVERSITY AV

LAUREL ST

HAWTHORN ST

1ST

AV

2ND

AV

INDIA ST

1ST

AV

4TH

AV

03RD

AV

06TH

AV

W WASHINGTON ST

KITE

ST

07TH

AV

FIR ST

IVY ST

BUSH ST

ELM ST

PRINGLE

ST

BRAN

T ST

CURL

EW S

T

HAW

K ST

SUTTER ST

W LAUREL ST

FALC

ON

ST

REYN

ARD

WY

GRAPE ST

MAPLE ST

THORN ST

ROBINSON AV

WASHINGTON PL

W IVY ST

W UNIVERSITY AV

SPRUCE ST

QUINCE ST

LAUREL ST

KALMIA ST

KEATI

NG ST

W KALMIA ST

DO

VE S

T

VINE ST

JUNIPER ST

STATE ST

NUTMEG ST

WASHINGTON ST

W JUNIPER ST

TITUS ST

PENNSYLVANIA AV

BROOKES AVSAN DIEGO AV

FRO

NT

ST

OLIVE ST

NORT

H A

RRO

YO D

R

LARK

ST

ALBA

TRO

SS S

T

TORRANCE ST

06TH

EX

ST

JACK

DAW

ST

IBIS

ST

W QUINCE ST

ST JA

MES

PL

GLENWOOD DR

NEALE ST

05TH

AV

ANDREWS S

T

WIN

DER ST

GUY ST

W REDWOOD ST

EAG

LE S

T

HORTON AV

PALM ST

DO

VE C

T

W MAPLE ST

UNIVERSITY AV

SASSAFRAS ST

WEL

LBORN ST

OTS

EGO

DR

LINWOOD ST

CLARK ST

SHERIDAN AV

W UPAS ST

W GRAPE ST

B EARD

R

W PALM ST

CHALMERS ST

FALCON PL

W HAWTHORN ST

L YNDO NRD

UNION ST

ALBERTA PL

WALNUT AV

W THORN ST

IVY LN

REDWOOD ST

PUTERBAUGH ST

UPAS ST

GOLDFINCH PL

ARROYO DR

W BROOKES AV

VANDERBILT PL

GO

L DF I

NCH

S T

DAN

A P

L

MC KEE ST

W FIR ST

KETTNER BL

GOD

SAL

LN

POR

TOLA

PL

COLUMBIA ST

ROBI

NSO

N M

EWS

W WALNUT AV

EVANS PL

ING

ALL

S ST

IBIS CT

BARNSONPL

W PENNSYLVANIA AV

WSPRUCE ST

SLOANE AV

W OLIVE ST

BAY V

IEW

CT

RAN

DO

LPH

ST

PIO

NEE

R PL

CRA

NE

PL

ALAMEDA DR

CR O WEL

L ST

ANDERSON PL

W NUTMEG ST

UNIVERSITY PL

W ROBINSON AV

NORTH CRESCENT CT

1ST

AV

GOLD

FIN

CH S

T

W MAPLE ST

05THAV

W THORN ST

GOLD

FIN

CH S

T

IBIS

ST

SHERIDAN AV

LARK

ST

JACK

DAW

ST

W PALM ST

STATE ST

W SPRUCE STW SPRUCE ST

CURLEW ST

EAG

LE S

T

UNION ST

UNIO

N ST

W OLIVE ST

W MAPLE ST

HORTON AV

BUSH ST

BRAN

T ST

DOVE ST

UPAS ST

W BROOKES AV

CURL

EW S

T

FRO

NT

ST

05TH

AV

HAW

K ST

NEALE ST

TORRANCE ST

W BROOKES AV

JACK

DAW

ST

W NUTMEG ST

SUTTER ST

FRO

NT

ST

W UPAS STW UPAS ST

REYN

ARDW

Y

FRO

NT

ST

BRANT ST

STATE ST

HORTO

N AV

FRO

NT

ST

W PALM ST

COLUMBIA

ST

IND

I AST

PUTERBAUGH ST

GUY ST

BRAN

T ST

CURL

EW S

T

W UPAS STW UPAS ST

06TH

AV

FALC

ON

ST

DO

VE S

T

REDWOOD ST

COLUMBIA ST

DO

VE S

T

IBIS

ST

UNION ST

FRO

NT

ST

AL BATRO

SSST

DO

VE S

T

WUNIVE RSITY AV

W WALNUT AV

W ROBINSON AV

EAG

LE S

T

GUY ST

REYNARD WY

EAGLE ST

GUY ST

WINDER ST

BRAN

T ST

IBIS

ST

W WALNUT AV

GUY ST

OTS

EGO

DR

TORRANCE ST

COLU

MBIA ST

07TH

AV

WALNUT AV

06TH

AV

W SPRUCE ST

UNIVERSITY PL

EAG

LE S

T

03RD

AV

W WALNUT AV

ALBA

TRO

SS S

T

W UPAS ST

GOLD

FIN

CH S

T

ALB

ATR

OSS

ST

HAW

K ST

W PENNSYLVANIA AV

COLUMBIA ST

BUSH ST

W WALNUT AV

FRO

NT

ST

W PALM ST

SUTTER ST

HAW

K ST

JACK DA

WS

T

W THORN ST

TORRANCE ST

IBIS

ST

4TH

AV

STATE ST

W REDWOOD ST

GUY ST

PUTERBAUGH ST

KEATI

NG ST

STATE ST

LARK

ST

IBIS

ST

CURL

EW S

T

W THORN ST

W PENNSYLVANIA AV

LEGEND

ResidentialResidential - Low : 5-9 Du/Ac

Residential - Low Medium : 10-15 Du/Ac

Residential - Medium : 16-29 Du/Ac

Residential - Medium High : 30-44 Du/Ac

Residential - High : 45-73 Du/Ac

Residential - Very High : 74-109 Du/Ac

Commercial, Employment, Retail, and ServicesCommunity Commercial : 0-29 Du/Ac

Community Commercial : 0-44 Du/Ac

Community Commercial : 0-73 Du/Ac

Community Commercial : 0-109 Du/Ac

Neighborhood Commercial : 0-29 Du/Ac

Neighborhood Commercial : 0-44 Du/Ac

Office Commercial : 0-29 Du/Ac

Office Commercial : 0-44 Du/Ac

Office Commercial : 0-73 Du/Ac

Park, Open SpaceOpen Space

Park

InstitutionalInstitutional

Community Plan Boundary Copyright 2012 SanGIS - All Rights Reserved. Full text of this legalnotice can be found at http://www.sangis.org/Legal_Notice.htm

0 400 800200Feeto

FIGURE 2-4: COMMUNITY PLAN LAND USE MAP - SOUTH

LU-27

LAND USE 2

HOUSING

existing shortageyoung professionals growing community

restaurants and shops neighbors health & wellbeing

WORKABILITY

CONNECTIVITY

relationships expanding neighborhoods social productivity

multi family Bankers Hill development

OPPORTUNITY

M A R K E T O V E R V I E W

Bankers Hill is literally “up the hill” from downtown San Diego. It is geographically defined by Interstate 5 on

the south, Balboa Park on the east, Interstate 5 and Reynard Way on the west and Upas Street on the north.

It is part of the area known as Uptown, which also includes the communities of Hillcrest (just to the north of

Bankers Hill), University Heights, Mission Hills, Middletown and the Medical District. These communities are some

of the oldest established neighborhoods in San Diego and contain more historically designated properties than

any other community within the City. The development of this neighborhood was assisted by the first cable car

outside of downtown San Diego, which afforded its residents easy access to downtown. Even today, the grid road

system originally established in this neighborhood affords easy access to the numerous businesses and attractions

downtown, the San Diego International Airport, which is within a five-minute drive, Sea World, which is a ten-

minute drive and Mission Valley with its two major shopping malls, which is a five-minute drive.

BANKERS HILL ±13,000RESIDENTS

±28,000EMPLOYEES

±1,400BUSINESSES

BY AGEBY INCOME

<$34

,99

9

9.9%

$75,

00

0 -

$14

9,9

99

29.4%

$35,

00

0 -

$74

,99

9

22.1%

$20

0,0

00

+

21.1%

$150

,00

0 -

$19

9,9

99

10.9%

27%

20-3

4

22%

31-5

4

20%

55-7

4

8%

75+

D E M O G R A P H I C S

Cushman & Wakefield has been retained as the owner’s exclusive advisor and broker regarding the sale of Connect located at 246-48 Nutmeg St. San Diego, CA 92103 .

This Offering Memorandum has been prepared by Cushman & Wakefield for use by a limited number of parties and does not purport to provide a necessarily accurate summary of the Property or any of the documents related thereto, nor does it purport to be all-inclusive or to contain all of the information which prospective investors may need or desire. All projections have been developed by Cushman & Wakefield, the Owner, and designated sources and are based upon assumptions relating to the general economy, competition, and other factors beyond the control of the Owner and, therefore, are subject to variation. No representation is made by Cushman & Wakefield or Owner as to the accuracy or completeness of the information contained herein, and nothing contained herein is, or shall be relied on as, a promise or representation as to the future performance of the Property. Although the information contained herein is believed to be correct, Owner and its employees disclaim any responsibility for inaccuracies and expect prospective purchasers to exercise independent due diligence in verifying all such information. Further, Cushman & Wakefield, Owner, and its employees disclaim any and all liability for representations and warranties, expressed and implied, contained in, or for omission from, this Offering Memorandum or any other written or oral communication transmitted or made available to the recipient. This Offering Memorandum does not constitute a representation that there has been no change in the business or affairs of the Property or the Owner since the date of preparation of the package. Analysis and verification of the information contained in this package is solely the responsibility of the prospective purchaser.

Additional information and an opportunity to inspect the Property will be made available upon written request to interested and qualified prospective investors.

Owner and Cushman & Wakefield each expressly reserve the right, at their sole discretion, to reject any and all expressions of interest or offers regarding the Property and/or terminate discussions with any entity at any time with or without notice. Owner shall have no legal commitment or obligation to any entity reviewing this Offering Memorandum or making an offer to purchase the Property unless and until a written agreement for the purchase of the Property has been fully executed, delivered, and approved by Owner and its legal counsel, and any conditions to Owner’s obligations thereunder have been satisfied or waived. Cushman & Wakefield is not authorized to make any representations or agreements on behalf of Owner.

This Offering Memorandum and the contents, except such information which is a matter of public record or is provided in sources available to the public (such contents as so limited herein are called the “Contents”), are of a confidential nature. By accepting the package, you agree (i) to hold and treat it in the strictest confidence, (ii) not to photocopy or duplicate it, (iii) not to disclose the package or any of the contents to any other entity (except to outside advisors retained by you, if necessary, for your determination of whether or not to make a proposal and from whom you have obtained an agreement of confidentiality) without the prior written authorization of Owner or Cushman & Wakefield, (iv) not use the package or any of the contents in any fashion or manner detrimental to the interest of Owner or Cushman & Wakefield, and (v) to return it to Cushman & Wakefield immediately upon request of Cushman & Wakefield or Owner.

D I S C L A I M E R

KEVIN NOLEN858.546.5487 [email protected] #01840398

JASON [email protected] #01328121

TIM [email protected] #00891667