Multifamily Default Rates for Banks - Multi-Housing NewsCommercial Q1 ’11 Q2 Q3 Q4 Q2 Q3 Q4 Q1...

Transcript of Multifamily Default Rates for Banks - Multi-Housing NewsCommercial Q1 ’11 Q2 Q3 Q4 Q2 Q3 Q4 Q1...

0%

1%

2%

3%

4%

5%Commercial

Q1’11

Q2 Q2Q3 Q4 Q3 Q4 Q1’12

Q2Q1’09

Q3 Q4 Q1’10

2.36

%3.

67%

2.53

%3.

76%Multifamily

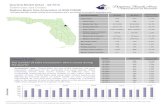

Multifamily Default Rates for BanksDefaults on Commercial Real Estate Mortgages Held by Depository Institutions

Sources: FDIC, Back Call Reports, Chandan Economics

Commercial Multifamily

2009Q1 2.26% 2.43%Q2 2.91 3.13Q3 3.43 3.60Q4 3.85 4.43

2010Q1 4.20% 4.65%Q2 4.30 4.56Q3 4.35 4.71Q4 4.29 3.78

2011Q1 4.31% 3.67%Q2 4.07 3.34Q3 3.93 2.90Q4 3.76 2.53

2012Q1 3.67% 2.36%

• Whereas the apartment default rate peaked at 4.71 percent (higher than the 4.35 percent peak for commercial properties), the default rate gap has subsequently widened in favor of apartments. As of Q1 2012, the apartment default rate was 131 basis points lower than for commercial properties, more than doubling the 64 basis point gap in Q1 2011.

• Banks’ non-performing commercial and apartment loan balances (NPL)—including delinquent loans and loans in default and non-accrual status—fell to $54.3 billion in Q1 2012, down 27.1 percent from the peak level of distress.

Unemployment RateSeasonally adjusted, 16 years and over

Source: U.S. Bureau of Labor Statistics

8.0%

8.5%

9.0%

9.5%

10.0%

Apr. MayJul.Jun. Jun.Sep.Aug. Oct.

8.2%8.2%

Nov. Dec. Feb.Jan. Mar.2011 2012

Per

cent

age

of

Une

mp

loye

d

Apartment Equity REITs PerformancePeriod to Date Performance (%)

Dividend Yield (7-5-12) Price Return (7-5-12) 2.82 -0.43 Total Returns (as of 7-5-12) 7-5-12 Q-T-D Y-T-D -0.43 1.33 10.95

Compound Annual Total Returns Through Prior Month’s Close

1-Year 5-Year 10-Year 10.44% 7.33% 12.56%

Source: National Association of Real Estate Investment Trusts

Improving Fundamentals, Prices and Financing Conditions Lift Apartments

Banks’ apartment NPL is down 47.5 percent, compared to a 22.9 percent decline for commercial property NPL.

• Banks’ net lending to commercial property and apartment borrowers was essentially unchanged in Q1 2012, down 0.05 percent from the previous quarter. Disaggregating the total, however, net commercial property lending fell $3.1 billion from Q4 2011 while apartment lending increased by $2.4 billion.

—Sam Chandan, Chief Economist, Chandan Economics

market pulse

market pulse

Per

cent

age

Cha

nge

Mon

th-o

ver-

Mon

th

Mar. ’12 Apr. ’12 May ’12-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

Cement

Gypsum

Softwood Lumber

Plywood

Steel

2.22.7

2.0

-0.6

-1.9

-0.3-0.9

1.2

4.8

1.3

0.4

1.4 1.2

0.2

-0.4

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

Per

cent

age

Cha

nge

Mon

th-o

ver-

Mon

th

Apr. MayJun.’11

Jul. Aug. Sep. Oct. Nov. Dec. Jan.’12

Feb. Mar.

0.4%

-0.6%

-0.6%Finished

Goods

Materials &Components for

Construction0.1%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

MayJun.’11

Aug. Sep. Oct. Nov. Dec. Feb.Jan.’12

Mar. Apr.Jul.

3-Month Libor0.25%

3-Month Libor0.47%

10-Year Treasury3.00%

Prime Rate 3.25%

10-Year Treasury1.62%

Prime Rate3.25%

Building Materials

Building Materials: The producer price index (PPI) for residential construction fell 0.3 percent on a month-to-month basis during May—the first such decline in the current calendar year. On a year-over-year basis, the pace of growth in residential construction prices slowed sharply, dropping to 1.9 percent—the slowest rate of increase in more than two years. Gypsum prices recouped some of the loss-es seen in April, gaining 1.2 percent in May. With this gain, gypsum prices jumped 13.6 percent above last year’s levels. Lumber prices continued to rebound in May, led by a 4.8 percent month-to-month increase for softwood lumber products. Plywood, OSB and asphalt are the only other key residential construction areas that have seen prices rise by double-digit rates compared to May’s levels last year.

Interest Rates

Finished Goods vs. Construction Materials and Components

100,000

150,000

200,000

250,000

300,000

Uni

ts

MayJun.’11

Aug. Sep.Jul. Oct. Nov. Dec. Jan.’12

Feb. Mar. Apr.

165,000

179,000

Multifamily Starts

Multifamily Starts: During May, the seasonally adjusted annualized rate of unit starts in properties with five or more units fell to 179,000 from 236,000 the previous month. However, this starts rate typically displays a great deal of volatility on a month-to-month basis. Using a three-month moving average, the 5+ starts rate fell from 228,000 in April to 208,000 in May. Despite the decline, May represents the third consecutive month for which the three-month moving average of 5+ housing starts has been above 200,000. Permits for 5+ build-ings surged nearly 18 percent in May, and over the past three months have averaged 258,000—pointing to the likelihood of continued strength in multifamily construction going forward. Overall, NAHB is forecasting that 5+ starts will average approximately 205,000 annual-ized for the remainder of 2012.

MHN ONLINE

Source: Commentary and Data supplied by Brian Lego,the National Association of Home Builders

For more market statistics and reports, visit www.multi-housingnews.com

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

Per

cent

age

Cha

nge

Mon

th-o

ver-

Mon

th

MayJun.’11

Jul. Aug. Sep. Oct. Nov. Dec. Jan.’12

Feb. Mar. Apr.

Rent 1.6%

CPI 1.1%

Rent2.4%

CPI-3.4%

$125,000

$150,000

$175,000

$200,000

Pric

e

Apr. MayJun.’11

Jul. Aug. Sep. Oct. Nov. Dec. Jan.’12

Feb. Mar.

$171,300

$180,000

CPI vs. Rent: The shelter index, which serves as a way to look at overall housing costs, maintained its slow, steady climb by increas-ing 0.2 percent on a month-to-month basis for the 11th time in 12 months. For rental housing, NAHB constructs a separate measure of real rental rates from the CPI for rent of primary residences and overall CPI. On an annualized basis, the real rent index jumped 6 percent in May, based on a trend toward increasing rents, coupled with the sharp (annualized) decline in the full CPI. In addition, this marked the largest percentage rent jump since late 2008. Core CPI, which excludes the often-volatile categories of food and energy, in-creased 0.2 percent month-to-month in May—roughly the same rate of growth it has averaged since the beginning of 2011. On a year-over-year basis, core CPI advanced 2.3 percent for the fourth time in the last five months.

Existing Condo Median Price: Seasonally adjusted condominium and co-op sales came in at a level of 500,000 during May 2012, mark-ing a 5.7 percent drop from April. On a year-over-year basis, sales remain up 4.2 percent and have averaged 518,000 over the past three months. The non-seasonally adjusted median sales price for existing condos and co-ops climbed to $180,000 in May, marking the first time in nearly three years the median price level has been at or above that level. In fact, this latest reported median price exceeds the levels observed during the most recent version of the federal government’s homebuyer tax credit.

CPI vs. Rent Existing Condo Median Sales Price

Brian Lego is a senior economist at the National Association of Home Builders (NAHB). His responsibilities include producing forecasts of housing data for state and metropolitan areas, as well as providing analy-ses of various economic and demographic issues that affect the U.S. housing market. Lego has been an economist for more than 10 years, with prior stops as the Director of Economic Analysis for NEMA and as an Economist for Moody’s Economy.com.

Market Pulse section compiled by Keat Foong, executive editor. To comment, email [email protected].

New York City Foreclosures NYC Multifamily Scheduled Foreclosure Auctions

Q1’09 Q2’09 Q3’09 Q4’09 Q1’10 Q2’10 Q3’10 Q4’10 Q1’11 Q2’11 Q3’11 Q4’11 Q1’12 Q2’1220

30

40

50

60

70

80

Data refers to unique quarterly properties that were scheduled for auction. Postponements are also counted.Source: PropertyShark

U.S

. Job

Chang

e (thousand

s)

Ap

plic

atio

n R

ate

(diff

eren

ce f

rom

avg

)

Apr

’08

Jul’0

8

Oct

’08

Jan’

09

Apr

’09

Jul’0

9

Oct

’09

Jan’

10

Apr

’10

Jul’1

0

Oct

’10

Jan’

11

Apr

’11

Jul’1

1

Oct

’11

Jan’

12

Apr

’12

Signals

Positive Trend

Status Quo

Negative Trend

Jobs Traf�c

-0.020

-0.015

-0.010

-0.005

0.000

0.005

0.010

0.015

-800

-600

-400

-200

0

200

400

600

Apartment Traffic TrendsNational Trends in Rental Applicant Traffic

Source: RentGrow, U.S. Bureau of Labor Statistics

Applicant Score Apr 2012 Last 12 Mos. Apr 2011

Accept 42.51% 40.66% 42.08%

Conditional 37.14% 37.63% 37.14%

Decline 20.35% 21.71% 20.78%

Acceptance Rates

National acceptance rates show slight improvement in April.PositiveTrend

Applicants with: Apr 2012 Last 12 Mos. Apr 2011

Recent Medical Debt 30.86% 34.01% 30.94%

Thin/No Credit 31.22% 32.78% 32.06%

Recent Bankruptcy 2.53% 2.75% 2.55%

Recent Foreclosure 1.02% 1.11% 1.29%

Credit Trends

The percentage of apartment applicants with a recent foreclosure on their credit reports is at its lowest level since 2006.

PositiveTrend

Inconsistent job growth appears to be generating large fluctuations in apartment application volumes.

market pulse