Motilal Oswal Rain Comm 22022012

-

Upload

jasjit-singh -

Category

Documents

-

view

214 -

download

0

Transcript of Motilal Oswal Rain Comm 22022012

-

8/2/2019 Motilal Oswal Rain Comm 22022012

1/6Pavas Pethia ([email protected]); Tel: +91 22 3982 5413Sanjay Jain ([email protected]); Tel: +91 22 3982 5412

Rain CommoditiesCMP: INR38 TP: INR75 BuyBSE SENSEX S&P CNX

18,429 5,607

Bloomberg RCOL IN

Equity Shares (m) 349.5

52-Week Range (INR) 42/25

1,6,12 Rel. Perf. (%) 11/20/21

M.Cap. (INR b) 13.3

M.Cap. (USD b) 0.3

Consolidated

22 February 2012

4QCY11 Results Update | Sector: Metals

Rain Commodities 4QCY11 consolidated Adj PAT grew 17% YoY to INR 1.8b (v/s est INR1.2b) on higher CPC sales

and better operating margins. Net sales grew 25% QoQ to INR16.2b (v/s est INR14.8b) boosted by higher sales

tonnage of CPC (up 18% QoQ) and better blended realization (up 2% QoQ) in carbon business (CPC and GPC).

Other expenditure was inflated due to forex loss of INR294m on USD denominated working capital loans.

EBITDA grew 54% QoQ to INR3,677m on superior performance from carbon business. Calculated carbon

blended realization increased 2% QoQ and calculated carbon EBITDA per ton increased 41% QoQ to USD107/

ton. Carbon margins continue to hold on to superior levels and remain immune to aluminium price declines

and production cuts.

Cement realization was up 1% QoQ but EBITDA per ton declined 22% QoQ to INR682 due to cost pressure on

inputs.

CY11 gross debt at USD709m (USD625m term debt, USD84m working capital debt) is at the same level as CY10.

Cash equivalents stand at USD167m.

RCOL raised dividend by~20% to INR1.1/share (CY10 dividend INR0.92/share).

It has completed 85% of its proposed buyback of INR350m with maximum price of INR41/share.

We are upgrading CY12 EPS estimate by 20% to INR17.1 as carbon business is expected to continue delivering

superior margins. Stock valuations are compelling with CY12E P/E of 2x and EV/EBITDA of 3x. Maintain Buy

with target price of INR75 (SOTP).

-

8/2/2019 Motilal Oswal Rain Comm 22022012

2/6

Rain Commodities

222 February 2012

Carbon business continues to deliver superior margins; blended carbon

realization up 2% QoQ

Net sales grew 25% QoQ to INR16.2b (v/s est INR14.8b) boosted by higher sales

tonnage of CPC (up 18% QoQ) and better blended realization (up 2% QoQ) in

carbon business (CPC and GPC).

Company sold 533kt (up18% QoQ) of CPC and 523kt (down 3% QoQ) of cement in

4QCY11. Blended realization for carbon business increased 2% QoQ to USD429 per ton

while cement realization increased 1% QoQ to INR199 per 50kg bag.

Calculated carbon EBITDA per ton increased 41% QoQ to USD107.

Cement EBITDA/ton declined 22% QoQ to INR682 due to cost pressure on inputs.

85% buyback complete; USD7m high cost debt repaid in 4QCY11

RCOL has completed 85% of its proposed buyback of INR350m with maximum

price of INR41/share.

CY11 gross debt stands at USD709m including USD84m of working capital loan. The

company repaid USD17m of high interest (11.125%) term loan at first call option in4QCY11. 5% call premium resulted in higher interest and finance charges for the

current quarter.

CY12 EPS upgraded 20% as carbon business margins are expected to remain

strong

Cement demand scenario in South India continues to remain subdued. RCOL

continues to operate its cement capacity at lower levels to support margins.

However margins were low at INR682/ton in 4QCY11 due to high input cost. We

expect margins to improve slightly from current levels as pace of capacity addition

slows down in South India. RCOL carbon realization and margins remains strong and immune to aluminium

price decline and production cuts. RCOL benefits from its long-term relationship

with GPC suppliers in tight supply market. 3 out of its 7 seven facilities in US are

next to oil refineries. As carbon business margins remain resilient we are upgrading

CY12 EPS by 20% to INR17.1.

Stock valuations are compelling with CY12E P/E of 2x and EV/EBITDA of 3x. Maintain

Buy with target price of INR75 (SOTP).

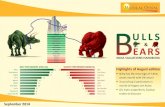

Blended Carbon EBITDA (USD/ton) remains strong Cement margin (INR/ton) declining on cost pressure

Source: Company/MOSL

-

8/2/2019 Motilal Oswal Rain Comm 22022012

3/6

Rain Commodities

322 February 2012

Company description

Rain Commodities (RCOL) is one of the largest calciners

in the world, with a capacity of 2.5mtpa. Its CPC capacity

is located in North America (1.89mtpa), India (0.6mtpa)

and China (0.02mtpa). It has cogeneration capacity of

125MW. It also has cement operations (3.5mtpa) in South

India, which contribute 19% of its overall revenue.

Key investment arguments

Increasing aluminum production is leading to strong

demand for calcined petroleum coke (CPC).

Difficulty in raw material sourcing acts as an entry

barrier.

Strong cash flows to help deleverage balance sheet;

expect D/E to decline to 0.6x in CY13.

Cement scenario in South India to improve as pace

of capacity addition slows down.

Key investment risks

RCOL derives ~90% of its CPC revenue from sales of

carbon anode to aluminum smelters. The aluminum

industry is cyclical in nature, with demand-supply

governed by a variety of factors, especially the

economic wellbeing of the world as a whole.

With its current D/E at 1.4x and significant debt

service obligations in the next couple of years, RCOL

Comparative valuations

Rain Tata Adhunik

commodities Sponge Metaliks

P/E (x) FY12E 2.0 4.5 6.8

FY13E 2.2 6.0 3.6

P/BV (x) FY12E 0.6 0.9 0.7

FY13E 0.5 0.8 0.6

EV/Sales (x) FY12E 0.8 0.4 1.5

FY13E 0.7 0.4 1.0

EV/EBITDA (x) FY12E 3.2 1.8 5.7

FY13E 3.1 2.1 3.8

Shareholding pattern (%)

Dec-11 Sep-11 Dec-10

Promoter 42.9 42.5 42.5

Domestic Inst 18.5 18.0 17.0

Foreign 15.8 16.4 17.9

Others 22.8 23.2 22.7

Rain Commodities: an investment profile

Stock performance (1 year)

EPS: MOSL forecast v/s consensus (INR)

MOSL Consensus Variation

Forecast Forecast (%)

CY12 17.1 - -

CY13 17.3 - -

Target price and recommendation

Current Target Upside Reco.

Price (INR) Price (INR) (%)

38 75 97.4 Buy

will be financially constrained in case of a major

downturn in the aluminum industry.

Recent developments

The Board has declared dividend of INR1.1/share i.e.

55% of the face value.

Valuation and view

Stock valuations are compelling with CY12E P/E of 2x

and EV/EBITDA of 3x. Maintain Buy with target price

of INR75 (SOTP).

Sector view

CPC realization remains strong despite concerns of

slowdown in Europe. With the current growth rate

in aluminium production, additional 5.5mtpa of CPC

will be required by CY15, which will continue to

safeguard CPC margins. We do not expect any

downward pressure on margins in the near future

on account of supply-demand mismatch in the

industry.

Cement demand scenario in South India continues

to be subdued. However margins and realizations

are expected to improve gradually as pace of

capacity addition slows down in South India.

22

27

32

37

42

Feb-11 May-11 Aug-11 Nov-11 Feb-12

Rain Commodities Sensex - Rebas ed

Rain Commodities follows calendar year reporting. Read FY12/

FY13 as CY11/CY12

-

8/2/2019 Motilal Oswal Rain Comm 22022012

4/6

Rain Commodities

422 February 2012

Financials and Valuation

-

8/2/2019 Motilal Oswal Rain Comm 22022012

5/6

Rain Commodities

522 February 2012

N O T E S

-

8/2/2019 Motilal Oswal Rain Comm 22022012

6/6

D

D

i

i

s

s

c

c

l

l

o

o

s

s

u

u

r

r

e

e

s

s

This report is for personal information of the author ized recipient and does not construe to be any investment, legal or taxation advice to you. This research repor t does not constitute an offer, invitation or inducement

to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been

furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form.

Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates

or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt

or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

The information contained herein is based on publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, MOSt and/or its

affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or

employees shall not be in any way responsible and liable for any loss or damage that may ar ise to any person from any inadvertent error in the information contained in this report . MOSt or any of its affiliates

or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness

for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations.

This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any inves tment decision

based on this report or for any necessary explanation of its contents.

MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest

Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report.

DDii sscc lloossuu rreeoo ffIInntt eerreess tt SS tt aa tteemmeenntt RRaaii nnCC oommmmoo ddii tt iieess1. Analyst ownership of the stock No

2. Group/Directors ownership of the stock No

3. Broking relationship with company covered No

4. Investment Banking relationship with company covered No

A

A

n

n

a

a

l

l

y

y

s

s

t

t

C

C

e

e

r

r

t

t

i

i

f

f

i

i

c

c

a

a

t

t

i

i

o

o

n

n

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or

will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible

for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

R

R

e

e

g

g

i

i

o

o

n

n

a

a

l

l

D

D

i

i

s

s

c

c

l

l

o

o

s

s

u

u

r

r

e

e

s

s

(

(

o

o

u

u

t

t

s

s

i

i

d

d

e

e

I

I

n

n

d

d

i

i

a

a

)

)This report is not directed or intended for distr ibution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to

law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions.

FFoo rr UU..KK..This report is intended for distribution only to persons having professional exper ience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity to

which this document relates is only available to investment professionals and will be engaged in only with such persons.

FFoo rr UU..SS ..MOSt is not a registered broker-dealer in the United States (U.S.) and, therefore, is not subject to U.S. rules. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange

Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S.,

Motilal Oswal has entered into a chaperoning agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").

This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional

investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major

institutional investors and will be engaged in only with major institutional investors.

The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, Marco

Polo and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account.

Motilal Oswal Securities Ltd3rd Floor, Hoechst House, Nariman Point, Mumbai 400 021

Phone: (91-22) 39825500 Fax: (91-22) 22885038. E-mail: [email protected]