Role of Takaful in Islamic Finance Capt. M. Jamil Akhtar Khan

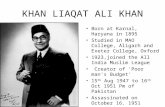

Money Banking & Finance By LIAQAT ALI KHAN MBA (Finance)

-

Upload

jewel-parrish -

Category

Documents

-

view

225 -

download

3

Transcript of Money Banking & Finance By LIAQAT ALI KHAN MBA (Finance)

Money Banking & Finance

By

LIAQAT ALI KHAN

MBA (Finance)

BARRIERS TO TRADE

Invisible Trade Barriers

Tariff Barriers in Pakistan

Non-Tariff Barriers in Pakistan

Invisible Barriers to Trade

Non Transparent and cumbersome Administrative Procedures and Government Policies and Regulations

Market Structure

Institutional Factors

Barriers in Pakistan

Lack of information:Entry of new firms into trading

with Pakistan indicates anonymous entry into trading which is facilitated by modern modes such as the internet.

Lack of Adequate Banking Relations:

Some Indian banks do not Some Indian banks do not recognize L/Cs from all Pakistani banks. recognize L/Cs from all Pakistani banks. Moreover payments through Asian Moreover payments through Asian currency union are delayed.currency union are delayed.

Barriers in Pakistan contd.

Application of standards: Barriers are often encountered

in the application of measures related to standards necessary to protect human, animal or plant life or health, to protect environment and to ensure quality of goods

Visa Restrictions:Visas can be obtained only for

specific cities prior to entry into Pakistan

Barriers in Pakistan

contd. Communication Problems:

Whenever there are disturbances at the Indo-Pak border, the mobile connections are not operational.

Trade Logistics:Goods move by air, sea, and rail

between India and Pakistan . While road routes for trade are non-existent, rail and air connectivity between the two countries has been erratic.

The Channels Of Export Trade 1) Selling from the country; (2) Selling via overseas agents (3) Selling from the overseas base especially

established for this purpose and (4) Giving a licence to the overseas producer

to manufacture and sell the produce in the country.

(1) Selling from the country. A seller can export the goods overseas

without himself having to .go abroad. if the goods of a country are well reputed regarding its high quality and tow price, the buyers will themselves create a permanent market for the products. Home producer can also secure orders from abroad through the export Houses which provide all possible assistance to the home manufacturer in the shipping, packing, insurance, finance, etc., as well.

(2) Selling by Overseas Agents A home producer can sell his goods overseas by

employing a sales-agent in the importing country. The appointment of a home national as sale agent pushes up the sale as the agent can speak his language fluently and understands the habits of his own people and customs prevalent therein. The home producer should however acquaint his sales agent with all the details of the product to be sold. The sales agent must be fully aware of the type of the product, its uses, range of variety, supply position, its performance, etc.

(3) Selling from an overseas Sales Base If there is large scale demand of the goods

abroad, then the firm should appoint full-time persons to develop overseas market to its maximum extent.

(4) Giving a Licence to an Overseas Producer to Manufacture. An exporter can also increase his profits by

allowing the overseas producer to manufacture and sell the products in his country on the payment of a fixed royalty to the home producer. The granting of permission to the foreigners to produce goods and sell in their own market on payment of royalty has proved to be very lucrative business for the exporters in modern world.

Commodity Barter

Barter means direct exchange of goods for goods. Barter system was prevalent at an early stage of man economic life when the wants were very limited in number. Man could easily satisfy all his wants which he produced himself. But as time passes his needs, began to increase. He lost his self sufficiency. He began to produce some goods in greater quantity then he could consume himself

Commodity Barter (Cont….)

The purpose was to exchange some of his products which he had in excess with those who had surplus with themselves. For instant, if a fish man wanted to have sinks, he could get them by giving fish to the hunter. Similarly, if a weaver wastes a par of shoes, he could receive that by giving some surplus cloth to the cobbler. This direct exchange of surplus commodity for commodity with another person without the use of money is termed as barter in economics.

Barter exists more in economically backward and commercially underdeveloped areas of the world. Why we go far off, in many of Pakistani village\, the payment to village artisan is still made in kind. Women and children in villages get sugar, cloth spices, toy etc. directly in exchange for ghee, cotton seeds, wheat etc, from the village shopkeepers. In advanced countries of the world, we do not come across the exchange of this type in their daily business. It is because the range of wants and the range of commodities are so wide that it is actually impossible to satisfy them through a direct exchanged for goods but for money.

Commodity Barter (Cont….)

the earliest stages of man as a commercial animal the exchange of products were conducted by a method known as barter. The barter when considered in its pure form involves the direct exchange of goods for goods. The terms of exchange of goods are not fixed by reference to common denominator value. Hunter for instance exchanged his fish and meat of corn or hides were exchanged for straw fruit was exchanged for arrows. This barter form of exchange was given up because of the difficulties and inconveniences faced by the people. The problems of arriving at a double coincide of want the establishing of a common measure of value, the safe keeping of wealth were all embarrassing for a man. Barter as a method of trade in its pure form has almost ceased to exist. The children for fun sake or the aged people living in isolated areas or a mentally deranged people may have a direct exchange of goods for goods without the use of money.

Commodity Barter (Cont….)

For centuries now the exchange of goods is conducted in an indirect method of barter involving a common denominator of value. The medium in terms of which the value of all commodities is expressed has passed through various stages of evolution. From barter unit of value which simply served as a form of wealth, the bank notes and the bank checking account are the favorite forms of money these days

Commodity Barter (Cont….)

Methods of Payment

Cash in advance; Documentary letter of credit; Documentary collection or draft; Open account; and Other payment mechanisms, such as

consignment sales.

Cash in Advance

Receiving payment by cash in advance of the shipment might seem ideal. In this situation, the exporter is relieved of collection problems and has immediate use of the money. A wire transfer is commonly used and has the advantage of being almost immediate. Payment by check, may result in a collection delay of up to six weeks. Therefore, this method may defeat the original intention of receiving payment before shipment.

Many exporters accept credit cards in payment for exports of consumer and other products, generally of a low follar value, sold directly to the end user. Domestic and international rules governing credit card transactions sometimes differ, so U.S. merchants should contact their credit card processor for more specific information. International credit card transactions are typically done by telephone or fax. Due to the nature of these methods, exporters should be aware of fraud. Merchants should determine the validity of transactions and obtain the proper authorizations.

For the buyer, however, advance payment tends to create cash flow problems, as well as increase risks. Furthermore, cash in advance is not as common in most of the world as it is in the United States. Buyers are often concerned that the goods may not be sent if payment is made in advance. Exporters that insist on this method of payment as their sole method of doing business may find themselves losing out to competitors who offer more flexible payment terms

Cash in Advance (Cont….)

Letters of Credit

A letter of credit adds a bank's promise to pay the exporter to that of the foreign buyer provided that the exporter has complied with all the terms and conditions of the letter of credit. The foreign buyer applies for issuance of a letter of credit from the buyer's bank to the exporter's bank and therefore is called the applicant; the exporter is called the beneficiary.

A letter of credit adds a bank's promise to pay the exporter to that of the foreign buyer provided that the exporter has complied with all the terms and conditions of the letter of credit. The foreign buyer applies for issuance of a letter of credit from the buyer's bank to the exporter's bank and therefore is called the applicant; the exporter is called the beneficiary.

Letters of Credit (Cont ……)

Documentary Drafts

A draft, sometimes also called a bill of exchange, is analogous to a foreign buyer's check. Like checks used in domestic commerce, drafts carry the risk that they will be dishonored. However, in international commerce, title does not transfer to the buyer until he pays the draft, or at least engages a legal undertaking that the draft will be paid when due.

Open Account

In a foreign transaction, an open account can be a convenient method of payment if the buyer is well established, has a long and favorable payment record, or has been thoroughly checked for creditworthiness. With an open account, the exporter simply bills the customer, who is expected to pay under agreed terms at a future date. Some of the largest firms abroad make purchases only on open account

Exporters contemplating a sale on open account terms should thoroughly examine the political, economic, and commercial risks. They should also consult with their bankers if financing will be needed for the transaction before issuing a pro forma invoice to a buyer.

Open Account

Other Payment Mechanisms

Consignment sales International consignment sales follow the same basic

procedures as in the United States. The goods are shipped to a foreign distributor who sells them on behalf of the exporter. The exporter retains title to the goods until they are sold, at which point payment is sent to the exporter. The exporter has the greatest risk and least control over the goods with this method. Additionally, receiving payment may take quite a while.

It is wise to consider risk insurance with international consignment sales. The contract should clarify who is responsible for property risk insurance that will cover the merchandise until it is sold and payment is received. In addition, it may be necessary to conduct a credit check on the foreign distributor

Countertrade

International countertrade is a trade practice whereby one party accepts goods, services, or other instruments of trade in partial or whole payment for its products. This type of trade fulfills financial, marketing, or public policy objectives of the trading parties. For example, a firm might trade by bartering because it or its trading partner lacks foreign exchange.

Many U.S. exporters consider countertrade a necessary cost of doing business in markets where U.S. exports would otherwise not be sold. One consideration for smaller firms is that this type of trade may cause cash flow problems. Therefore, many smaller exporters do not consider this an option as they wish to do business in U.S. dollars.