Natural learning Multiple intelligence Bert de Vos Chantal Bordier.

Monday Report 05 September 2016 - Bordier & Cie...Monday Report 05 September 2016 Economy Markets...

Transcript of Monday Report 05 September 2016 - Bordier & Cie...Monday Report 05 September 2016 Economy Markets...

05 September 2016Monday Report

Economy Markets

Swiss Market Recommended Stock Watch

Sentiment of traders

PerformancesToday’s graph

This document has been issued for information purposes. The views and opinions contained in it are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held liable for any unauthorised reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment advice. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities

INGENICO (Satellites) reacted sharply during Friday trading (down 4%) after US competitor Verifone released poor (lower than expected) Q3 results and a profit warning. Note that this event was specific to Verifone, which is more exposed to the US market and has been adversely affected by a decline in demand for EMV-compatible terminals. We think the migration will continue, albeit slightly less quickly, and that Ingenico remains very well placed (US market share gains).

As part of its asset disposal programme, RD SHELL (Satellites) has announced the $425m cash sale of four blocks in the Gulf of Mexico with production of 25k barrels a day.

SGS (Core Holdings) has acquired 75% of Brazilian player Unigeo, which specialises in agricultural technologies (sampling, satellite and drone imaging, data monitoring, etc.), and announced the finalisation of its acquisition of Taiwanese electromagnetic certifica-tion player Compliance Certifications Services Inc. The former has 170 employees and annual sales of BRL 30m (CHF 9m); the latter has 300 employees and annual sales of TWD 800m (CHF 25m). These are the 14th and 15th acquisitions of companies or assets in the year to date.

TELECOM ITALIA (removed from Satellite Recommendations): following recent events in the Italian market (EC approval of the Wind/3Italia merger; arrival on the market of French operator Iliad), we feel the looming reorganisation of the Italian mobile market is relatively unfavourable to the legacy operator, which will eventually have to find new strategies – including, for example, a broader offering of convergent products.

To be monitored this week: OFS July overnight hotel stays, OFS August CPI, SECO Q2 GDP, SNB end August currency reserves, KOF economic forum, SECO August unemployment figures and Swiss Air Lines August statistics.

The following companies are also due to release their H1 results: Helvetia, BKW, Santhera, dorma+kaba (2015/16), Leclanché, Bur-khalter and Romande Energie.

HELVETIA (HR) this morning reported slightly stronger than ex-pected H1 earnings of CHF 238m. Underwriting performance was impressively robust (with a combined ratio of 91.9%), offset by investment losses of CHF 31m. A particularly low tax rate (13% instead of the normalised 21%) helped bring net profit back into line with expectations.

Stock marketMarkets are supported by continuing low yields, especially follow-ing mixed US jobs figures. This week will bring few macro figures apart from European PMIs and Thursday’s ECB meeting, at which Mario Draghi is expected to extend QE. Against this backdrop, a fall in indices appears unlikely.CurrenciesEUR/USD is still stuck at around 1.12; range: 1.1125-1.1350. Cau-tion, however, re the ECB meeting of 8 September, likely to leave interest rates unchanged. This decision could trigger a correction to 1.0950, and even further if USD/CHF breaks through 0.9885, which will be a strong bullish signal for USD. In the medium-to-long term in general, we expect a weaker EUR (Europe) and a flat or stronger USD (US protectionism). Support for gold is at $1,301/oz, with a target of $1,344/oz. Oil could return to $51 a barrel.

Strong performance by equities (with the MSCI World up 0.5% and the Stoxx Europe up 2%) was driven by investors’ surprisingly strong reaction to Friday’s somewhat disappointing US employ-ment report. While US 10-year yields fell slightly in the week (down 4 bps), this was not caused by US employment. Elsewhere, yields even rose (DE: +5 bps; SP: +10 bps; UK: +9 bps). The US dollar appreciated (with the dollar index up 0.3%), mainly against the yen (up 3.6%), while oil fell (down 6.5%) on the announcement of larger than expected US stocks. To be monitored this week: labour mar-ket conditions, ISM services PMI, Fed Beige Book and consumer credit in the US; Sentix confidence indicator, retail sales and ECB meeting in the eurozone; and currency reserves, trade balance, and consumer and producer price indices in China.

US statistics slowed somewhat. While consumer confidence bounced back in August (up from 96.7 to 101.1) and personal ex-penditure grew by a comfortable 0.3% in July, other figures were less heartening. In particular, the ISM manufacturing PMI fell from 52.6 to 49.4, putting it in contractionary territory. Similarly, the Au-gust employment report, while not bad, fell short of expectations: fewer new jobs were added than expected (151,000 vs. 180,000); pay growth slowed (from 2.7% to 2.4% YoY) and the length of the working week fell from 34.4 to 34.3 hours. In the eurozone, head-line inflation was stable at 0.2% (YoY), while core inflation slowed to 0.8% (from 0.9% YoY). Finally, in China, the official manufacturing PMI climbed from 49.9 to 50.4 while its Caixin counterpart moved in the opposite direction, falling from 50.6 to 50: both confirmed the absence of any acceleration in the sector.

Since 26.08.2016 31.12.2015Switzerland SMI 1.54% -5.94%

Europe Europe Stoxx 600 1.96% -4.20%USA MSCI USA 0.55% 6.58%

Emerging countries MSCI Emerging -0.20% 13.28%Japan Nikkei 225 3.45% -11.08%

As at 02.09.2016CHF vs. USD 0.9803 -1.22% 2.11%EUR vs. USD 1.1163 -1.05% 2.76%

10-year yield CHF (level) -0.46% -0.52% -0.08%10-year yield EUR (level) -0.10% -0.15% 0.63%10-year yield USD (level) 1.60% 1.63% 2.27%

Gold (USD/per once) 1 318.55 -1.16% 24.11%Brent (USD/bl) 46.91 -6.46% 31.40%

Source: Datastream

Source: Thomson Reuters Datastream, 05.09.2016

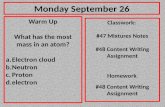

United StatesISM manufacturing vs leading composite

2010 2011 2012 2013 2014 2015 2016

48

50

52

54

56

58

60

-5

0

5

10

15

20

25

New Orders - Inventories (+3M) ISM Manufacturing (RH scale)