Monaco In The Tropics - RS - Issue III - 25Nov07

Click here to load reader

-

Upload

roman-scott -

Category

Economy & Finance

-

view

170 -

download

2

Transcript of Monaco In The Tropics - RS - Issue III - 25Nov07

alternative investments in the world’s fastest growing markets

2008

2007

Roman Scott Managing Director

Calamander Group Economic Spokesman

British Chamber of Commerce Singapore

Issue III 25 November 2007

Calamander Capital Economic Outlook, Q4 2007

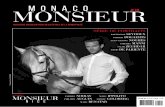

Monaco in the Tropics

25 November 2007

Economic Outlook Q2, 2008 Page 2

Monaco in the Tropics

s the year draws to a close, and businesses turn to closing their books for the year, I thought

that this quarter I would not focus on my usual big picture economic themes. This is the

season of Christmas giving (hopefully matched by decent retail sales figures), stuffed turkeys,

and yearend bonuses. Assuming you have a bonus to bank (CDO salesman can stop reading now), it

seems appropriate to take a quick look at one interesting, fashionable, and unashamedly high end

sub sector of the Asian economy-the world of private banking.

I do not intend to regurgitate the usual fare of market sizing that are regularly reported, and with

which I have been closely associated with in my past lives. This data is readily available from the

annual world wealth reports produced by Merrill Lynch/Cap-Gemini (good) and The Boston

Consulting Group (even better) - a judgment I can make having been on both teams. Suffice to say,

non-Japan Asia remains the fastest growing, and one of the most profitable, wealth management

markets in the world; and the number of newly-minted Asian millionaires continues to grow as

quickly as Roger Federer’s serve. The wealth of the wealthy in Asia (10.6 trillion dollars end 2006

according to BCG) has almost caught up with Japan (11.9 tn), and I believe will very soon overtake it.

At the beginning of the decade Japan was 6.5 tn, and Asia only 1.9 tn. In five years, the major private

banks in Asia have tripled AUM from 200bn dollars to 600bn today.

Singapore in particular, with the explicit support of the government, has sought to build itself as the

Asian industry’s centre, complete with the lifestyle trappings of the rich: a world class concert hall

and theatre, exclusive villas with berthing for yachts, a planned freshwater lake, a high end casino,

and lower taxes. The best grade A office spaces are filled with the biggest names in private banking,

and every young banker that isn’t in capital markets wants to become a private bank relationship

manager. It’s Monaco in the tropics. Surrounded by big, powerful neighbours, the European

princely state long ago discovered that offering its neighbours discreet wealth management and low

taxes with the buzz of gambling and the thrills of rich men’s’ sports-yachts and racing cars- was a

recipe for success, and survival. Monaco’s casino first opened in 1856, it’s fabled grand prix in 1929.

A thriving arts scene and world class shopping, eating and luxury real estate provided the finishing

post-war touches. By September 2007’s Formula One race in Singapore, the city state will look little

different, save for the chili sauce.

Behind the big numbers, what is not included in the market reports is how the individual players are

doing in this region. The industry as a whole has done a sterling job in building presence and

gathering assets, but some have done much better than others. Nor is there much data on what

customers’ think, which is the way competitors should be judged, rather than by asset gathering or

profits. In discussions with customers, one gets the feeling that growth in customer satisfaction has

not kept pace with the 25% pa growth in AUM. For all the advances in the range and quality of

investment product on offer, customers have a limited voice, and for the new customer looking for

advice on who to choose there is little to go on. Awards, such as they exist, appear to be based on

A

25 November 2007

Economic Outlook Q2, 2008 Page 3

marketing prominence rather than actual results delivered to customers, and serve to make the

private bank or banker feel good rather than a basis for customer choice.

For the latter issue, I have some hope that a forum may yet emerge to entertain customer feedback.

Watch this space. For the former, I have attempted over the last few years to create a ‘league table’

ranking the major players in terms of asset size in non-Japan Asia, managed out of Singapore and HK.

I make no apologies for my use of English Premier League football labels for the three tiers. Other

than betraying my origins, the Premier league table supports the logic of the relative competitive

advantage that accrues to the teams that get to the top. You may not know anything about EPL

football, or care, but you will undoubtedly have heard of Manchester United (yes, there is a reason

for putting them first), Chelsea, Liverpool, or Arsenal. But Port Vale? The Tranmere Rovers? That is

not to say that size matters as much in private banking as in football, given the points made about

customer service above. But scale has always created competitive advantages in business, for

building brand identity, the perception of safety, and in the ability to draw and afford the best

players. So whilst my league is very flawed, until such time as a customer satisfaction version is

available, this will have to do. And before those banks who feel hard done by in the figures squeal,

please understand that these are estimates, many players will have undoubtedly grown fast since

this was last updated Q1 this year. The point is that the table is conservative, plus or minus 10%

accurate in total, and revisions are to the upside not the downside. Please note also that some

newer entrants, such as EFG and Standard Chartered, are not in the list, although Amex Private Bank

stands as a proxy for SCB since its acquisition by the latter.

Clearly, the industry in Asia has matured from the early days of the ‘rising tide lifts all ships’. A more

mature pattern of competitive dominance has been established, with a limited group of mega banks

25 November 2007

Economic Outlook Q2, 2008 Page 4

dominating the market (in this case, five players with 55% of the market); a mid market group with

double the number of teams compared to the premier league, but one third of the market; and

finally a fragmented division league where over fifteen smaller banks control less than 10% of

customer assets. Size matters. That said, many of the smaller players are not necessarily losers in

the battle for volume dominance, but are genuinely niche or ‘boutique’ banks, much as Porsche can

thrive comfortably alongside Toyota. In customer’s bank relationships, as in their garages, there is a

place for both. These boutiques are often privately owned, and continue to shine in the areas that

count for many customers: real relationship management, a personal approach, thinking of the

client’s interests not just their own P&L, and not being reliant on a global investment banking

parent. Whilst an IB parent confers advantages, such private banks risk yielding to the pressure to

serve as a sales channel for the endless stream of products pushed out by their IB factory. For

customers, this is the biggest source of complaints.

As ever, it is in the middle league that the competitive dynamics of being ‘stuck in the middle’ are

most intense. The teams in this space are all divisions of very large, universal or investment banking

groups (with the exception of Julius Bar), and thus have a model that may differ in targeted

customer segment, but are generally as sophisticated, or claim to be, as the premier league. All are

very solid teams, although some a lot solid than others. What then is their differentiation? Very

little for most, it appears, on the surface. And the surface is what most new customers see. The US

IB’s (Goldman, Morgan Stanley and JPM) have managed to define a market position built around

bringing their institutional investment banking offerings to private individuals, and a higher net

worth target segment. For the rest, I guess that if I secretly stole all their strategic plans in the

middle of the night, mixed them up and returned then randomly to their CEO’s desk, he or she

would not know the difference.

It is not my business to advise readers on the relative merits of one team over the other if they are

shopping for a bank. I will leave that to when real consumer feedback data appears. But assuming

that success in asset gathering does bear some relation, at least partially, to the ability to deliver

value to customers, it is worth ending with a few words on those teams that have made the most

progress in moving up the league tables. Again, I will let the data do the talking, based on a similar

table I prepared five years ago five years ago. Noteworthy rises in the mid-pack championship

league have been Deutsche Bank and SG (both up over four times in AUM), and for US IB’s Morgan

Stanley (up five times). Singapore’s own DBS has also done well, also up over four times. In the

Division players, many are relatively new entrants; others started and remain relatively small.

Barclays stands out as the most surprising to remain in this category, given the banks global strength

in asset management and the quality of Barclays Capital, its IB. At the opposite end of the spectrum

is Julius Bar, which wasn’t on my 2001 list at all, sat in the Division for no more than two years, and

recently jumped into the Championship tier with a $12bn. This extraordinary growth reflects a

carefully planned ‘hothouse’ strategy led by Alex Widmer, the former head of Credit Suisse in Asia,

and many may argue that the young upstart has yet to prove itself. That may be true, but I have

seen many over the years who have tried the same and failed, which means they must be doing

something right other than just buying talent.

Finally, in the premier league, the standout team is undoubtedly UBS. To triple its size when it was

already big five years ago (30bn), and maintain leadership in the premier league, is a great

25 November 2007

Economic Outlook Q2, 2008 Page 5

performance. UBS does appear to have been the most successful in defining, and most importantly

consistently executing, a clear strategic vision for the market with less of the management mishaps

and internal conflicts that other teams have faced (and this is not an easy business to manage). One

hopes that its customers feel the same way. Its challenge is one that troubles many hugely

successful mega banks: how do you manage size to stay an advantage and not a disadvantage, as the

private banking world returns to its small bank roots with the entry of the boutiques. As ever, for all

these questions, we look forward to letting the customers be the ultimate judge.

Global Disclaimer

This research note and/or opinion paper, article, or analysis has been released by Calamander Capital (Singapore) Pte Ltd., or its parent company or affiliates, to professional investors, clients, and business members of the British Chamber of Commerce for information only, and its accuracy/completeness is not guaranteed. All opinions may change without notice. The opinions expressed, unless stated otherwise, are not investment recommendations, or an offer or solicitation to buy/sell any funds, investments or other services of the Calamander Group, Calamander Capital, or its affiliates. Calamander Capital does not accept any liability arising from the use of this communication. Copyright © 2008 Calamander Capital. All rights reserved. Intended for recipient only and not for further distribution without the consent of Calamander Capital Pte Ltd

For further details, please contact [email protected]. calamander capital (singapore) pte ltd (co. reg. no. 200723396M) MAS exempted fund manager 85 a/b circular road, singapore 049437 tel. +65 6723 8129 fax. +65 6491 1227

25 November 2007

Economic Outlook Q2, 2008 Page 6

alternative investments in the world’s fastest growing markets

singapore property fund II one of asia’s best performing value added real estate funds

sri lanka private equity fund a world first: the cinderella of the indian growth story

emerging asia banking fund specialist in smaller asian consumer banks

meridian emerging markets art fund world’s first emerging markets contemporary art fund

the wine growth fund the world’s best performing investment grade wine fund

www.calamandergroup.com