Mogul Ventures Corp Presentation - Oortsog Ovoo Tin Project

-

Upload

jamul-jadamba -

Category

Investor Relations

-

view

139 -

download

5

Transcript of Mogul Ventures Corp Presentation - Oortsog Ovoo Tin Project

2

THE FOLLOWING INFORMATION may contain forward–looking statements. Forward

looking statements address future events and conditions and therefore involve

inherent risks and uncertainties. Actual results may differ materially from those

currently anticipated in such statement. Forward-looking information is subject to

known and unknown risks, uncertainties and other factors that may cause Mogul

Venture Corp’s actual results, level of activity, performance or achievements to be

materially from those expressed or implied by such forward-looking information.

Such factors include, but are not limited to: uncertainties related to the historical

resource estimates, the work expenditure commitments; the ability to raise

sufficient capital to fund future exploration or development programs; changes in

economic condition or financial markets, regulatory, political and competitive

developments; technological or operational difficulties or an inability to obtain

permits required in connection with maintaining, or advancing projects; and labour

relation matters *All historical resource estimates quoted herein date from the 1960s, 1970s and 1980s and are based on

prior data and reports obtained and prepared by previous operators and information provided by the State,

using a Russian classification system not compatible with 43-101. Insufficient data exists to compare

Russian categories to current C.I.M. categories. A qualified person has not completed sufficient work to

verify the classification of the historic mineral resources and as such they should not be considered as

current resources and they should not be relied upon. Mogul Ventures believes these historical results

provide an indication of the potential of the property and are relevant to ongoing exploration. It should also

be noted that mineral resources which are not mineral reserves do not have demonstrated economic

viability as defined by NI 43-101 guidelines.

www.mogulvc.com

3

COMPANY OVERVIEW

www.mogulvc.com

• The Khar Tolgoi property is a 34,055 ha Mining

License located in Dundgovi Province

• Within the Khar Tolgoi property,the Oortsog

Ovoo (OO) tin + polymetallic project has a

historic resource* totalling 39k t of contained tin

with additional credits for accompanying metals and

a significant upside potential

• Based on previous work and historical resources*

OO appears to have potential to become one of the

highest grade open-pittable tin deposits in the world

• Mogul aims to focus on exploration, engineering and

economic evaluation of several key portions of OO to

Fast Track a production decision within the next 2 years

Shares Outstanding 117,698,831

Warrants Outstanding 2,286,712

Fully Diluted 119,985,543

Options 0

Insider Ownership ~65%

Capital Structure (08.22.2014)

*Historical resources - see note on Page 2 of Presentation

• Mogul Ventures Corp. focuses on

exploration, development and production of

metals and coal in Mongolia

• Seeking a listing on TSX-V in early Q4, 2014

via a reverse takeover (RTO) of Knowlton

Capital Inc.

4

MOGUL VENTURES TEAM

STEVEN KHAN, MBA, CFA Executive Chairman & Director

Previous 20+ years of experience in all aspects of the investment industry including executive positions with regional and

national full-service Canadian investment brokerage houses. Focused on strategic corporate and business development as

well as resource and venture capital financing during the last decade. Holds Director and Executive Officer roles in a

number of public and private resource companies. Successfully completed major corporate development initiatives both

domestically and internationally including in Japan, Korea and China.

www.mogulvc.com

JAMUL JADAMBA , MBA CEO, President & Director

Formerly a natural resource and mining-focused investment banker with an extensive capital raising background,

servicing worldwide companies, especially in Mongolia. Former Director and co-founder of the Metals & Mining Group at

Rodman & Renshaw LLC. Native Mongolian with well-established relationships with influential business and government

leaders in his country, Jamul was recognized by the Mineral Resources Authority of Mongolia as the leading financial

advisor to the country’s mining sector in 2011. He extensively writes and speaks on topics of Mongolian economy,

development and politics on Mongolian media as well as international publications such as Oxford Analytica, Institutional

Investor and Business New Europe. He holds a B.S. in Business Administration from Northeastern University and M.B.A

from N.Y.U.-Stern School of Business.

5

MOGUL VENTURES TEAM

DAVID A. TERRY, Ph.D., P.Geo. Senior Technical Advisor

Over 20 years of business experience in the natural resource sector, focused primarily on exploration of precious

and base metal deposits in North and South America. Director of and advisor to several publicly-listed mineral

exploration companies. Specializes in public company management, strategic planning, finance, advanced project

evaluation, identification and acquisition of opportunities, design and implementation of effective and cost-efficient

exploration programs. Held positions with a number of senior mining companies including Boliden Limited, Westmin

Resources Limited, Hemlo Gold Mines Inc., Cominco Limited and Gold Fields Mining Corporation.

www.mogulvc.com

PUJI JADAMBA Country Manager

Over twenty years of experience running various entrepreneurial ventures in Mongolia including natural resources, real estate, cashmere, agriculture and import/export. Was a key principal at the first commercial gold mining company in Mongolia. Extensive local network of business and government contacts and unsurpassed ability to execute locally.

HENRY PARK, MBA Director

A highly experienced commodity strategist and investor with a background among some of the world’s most elite

investment firms, Henry brings a depth of knowledge and an impressive network of contacts within the resource

sector. Henry was most recently the Managing Director and Commodity Strategist at Electrum Group, a US based

mining private equity firm. Prior to Electrum, he held the same position at Soros Fund Management where he

oversaw commodity investing in equities and futures. Henry started his career at GE Capital where he was Assistant

Vice President in the distressed debt business, followed by Long/Short equity analyst in basic materials sector for

Wingspan platform of Ospraie Fund Management. He holds a B.A. in Economics from University of Chicago and

M.B.A. from Columbia University.

6

MONGOLIA OVERVIEW

• One of the fastest growing economies in the world: GDP growth of 17% in 2012, 13%

in 2013 and estimated 11% in 2014(1)

• Recognized as the home of some of the world’s largest natural resource deposits

including coal, gold and copper

• Strategic location

• Next door to the biggest consumer of commodities in the world – China

• Friendly relations and no border disputes with both of its neighbors – Russia and

China

• Mining is the most important sector:

• “Contributes 30% of GDP and 70% of exports”(2)

• Favorable political environment:

• Mongolian Government focused on the long-term development of resource-related

sectors and favorable policies towards business and foreign investments

• Stable business-friendly democracy:

• 23 year history of uninterrupted peaceful and democratic government

• Homogenous country with minimal risk of ethnic or religious conflict

www.mogulvc.com

Source: (1) IMF (2) the Ministry of Mineral Resources & Energy of Mongolia

7

TIN MARKET OVERVIEW

• There is an ongoing supply deficit, likely to worsen over the next several years as very few

new projects are expected to come on line

• World stocks of tin are at a forty year low

www.mogulvc.com

According to LME, Tin (Sn) is the only industrial metal with ongoing

physical supply deficits for 2014

Source: LME, ITRI

8

TIN USAGE

• Over 50% of Tin is used as a solder.

Emergence of lead-free solders has

boosted demand

• Tinplate’s share (tin coated steel, such as

in cans and containers) has come down

significantly

• There is an increasing trend of tin usage

for various chemical and industrial

applications such as:

• Stabilizer for PVC plastics

• Lithium-ion batteries

• Cutting-edge technologies such as

carbon nanotubes and graphene

• Solar cells, acid batteries and electric

car batteries

• Various chemical catalysts

www.mogulvc.com

Tin Usage

Source: ITRI

9

TIN PRODUCTION

• Most of Tin production is from underground mines. Estimated cash costs for a typical underground mine with 1% grade is ~$20,000/t1 of Sn contained

• Open pit production is in a small minority, but has advantage as estimated cash costs at 1% grade are under $10,000/t1 of Sn contained

• 10% of world mine production comes from the San Rafael underground mine in Peru (owned by Minsur) which is slated to run out of ore within 3 years2. Small and artisanal mines, which account for ~100ktpa of global mine supply, are being closed as well

• Top ten producers have experienced production volume declines in 2012 and 20133

• Indonesia, which supplies 40% of globally mined tin, has tightened regulations requiring tin ingots to trade on ICDX and introducing a floor price4

www.mogulvc.com

Top Ten Producers in 2012 and 2013

Source: (1) Greenfields Research (2) Minsur (3) ITRI (4) Indonesian Tin Association

(t) % change (t) % change

1 Yunnan Tin (China) 56,174 69,760 24% 70,383 0.89%

2 Malaysia Smelting Corporation 40,267 37,792 -6% 32,668 -13.56%

3 Minsur (Peru) 30,162 24,822 -18% 24,397 -1.71%

4 PT Timah (Indonesia) 38,132 29,512 -23% 23,718 -19.63%

5 Thaisarco (Thailand) 23,864 22,847 -4% 22,986 0.61%

6 Yunnan Chengfeng (China) 15,430 16,600 8% 18,300 10.24%

7 Guangxi China Tin (China) 15,517 14,034 -10% 11,870 -15.42%

8 EM Vinto (Bolivia) 10,960 11,241 3% 11,253 0.11%

9 Metallo Chimique (Belgium) 10,007 11,350 13% 10,344 -8.86%

10 Gejiu Zi-Li (China) 8,600 7,000 -19% 6,000 -14.29%

Total 249,113 244,958 -2% 231,919 -5.32%

2013

RankingCompany

2011

(t)

2012 2013

10

TIN SECONDARY SUPPLY

• Including alloys, more than 30% of

world tin consumption is from

recycled tin

• Not surprisingly, China again is the

biggest recycler

• Tin recycling is likely peaking or has

peaked

www.mogulvc.com

Secondary Recycled Tin Production

Source: ITRI

11

TIN MARKET

• In early 2011, Tin prices hit a high of over $32,000/t

• For significant new mine supplies to materialize, prices need to be closer to $30,000/t

www.mogulvc.com

Tin Vs. Other LME Metals Historic and Forecasted Demand (kt)

Source: ITRI

12

0.00

0.20

0.40

0.60

0.80

1.00

1.20

0 50,000 100,000 150,000 200,000 250,000 300,000 350,000

LARGEST UNDEVELOPED TIN DEPOSITS

www.mogulvc.com

Source: SNL Metals Economics Group, Company websites, BGR, Mogul Ventures Corp

. ***Historical resources - see note on Page 2 of Presentation regarding OO historical resources

Gra

de

(%

)

Xitian (UG) Pravourmiiskoye (UG)

Catavi Tailings (Tailings)

Achmmach (UG)

Mount Lindsay (OP)

Syrymbet (OP)

Rentails (Tailings)

Heemskirk (UG)

Tongkah (Dredge)

Mount Garnet (Placer)

Mount Pleasant (UG)

Oropesa (OP)

Narsiin Khundlen (OP)

Oortsog Ovoo (OP)***

Blue Tier (UG)

Jeannie River (Placer)

Resources (t of Sn contained)

UG

Eco

no

mic

OP

Eco

no

mic

13

OORTSOG OVOO DEPOSIT

• Located ~300 km south of Ulaanbaatar, capital

of Mongolia

• 100 km southwest of paved road and railroad

to China at Choir

• 35kV power line on concession

• 24 discrete tin-magnetite skarn bodies within

8 mineralized zones within a 3 km by 3 km

area and studied to varying extents

• Cassiterite (Sn)-magnetite (Fe) skarn system

with accessory Zn-Pb-Cu-Fe-W-Ag-In

• Mineralization at or near surface

• All work to date summarized in the NI 43-

101-compliant report by APEX Geoscience

Ltd., dated 13 May 2014 (available upon

request)

Crystalline Cassiterite from Oortsog Ovoo

Cities

Major Mines

Border Posts

Oortsog Ovoo Deposit

Main Roads

Existing Railway Line

Phase I Planned Railway

Phase II Planned Railway

Phase III Planned Railway

35kV Power Line on Property

Rare Metals Belt

Base Metals Belt

14

OORTSOG OVOO DEPOSIT A significant body of historical exploration work

exists and includes:

• >41 holes (~3,300 m) drilled on the North,

Central and Eastern Zones and ~207

trenches excavated and sampled

• Historical Resources*:

• C2 (Indicated) resources of

5,759,898 t @ 0.64% Sn (36.9 kt Sn)

• P1 (Inferred) resources of

313,665 t @ 0.77% Sn (2.4 kt Sn)

• The Historical Resources, if verified, would

place Oortsog Ovoo amongst the top 20

deposits in the world measured by

contained metal1

• Accessory metals not incorporated into the

historical resource estimate

• The deposit was proposed to be mined via 5

open pits to a maximum depth of 150 m,

with average stripping ratio of 4:1

*Historical resources - see note on Page 2 of Presentation (1) Based on resource size ranking by ITRI

15

GROUND MAGNETICS PROGRAM

1km

1km

North Zone

Middle Zone

Central Zone

Eastern Zone

South-Eastern

Zone

Magnetic

Intrusive?

• The Company contracted a detailed 100

line km ground magnetic survey in 2013

covering a 3.5km by 4km area

• Ground Magnetics is an effective

exploration tool as tin is associated

with magnetite throughout the OO

system

• The RTP magnetic image on the left

shows a significant number of magnetic

anomalies were detected; the results

highlight the exploration potential

beyond the portions of the Northern,

Central and Eastern zones delineated by

historical drilling

16

www.mogulvc.com

2013 DRILLING PROGRAM

Northern Zone

Eastern Zone

0 500

meters

0 500

meters

• Mogul conducted a 1,500 meter drill program in

Oct 2013 with 9 holes on the eastern portion

Northern zone and 6 at the Eastern zone

• The program’s main objectives were:

• Parallel drill (twin) select historic holes to

confirm and correlate accuracy of historic

work

• Drill vertical and horizontal step out holes to

delineate mineralized zones in detail

• Conduct modern assays based on a +90% core

recovery rates, which were achieved.

• Improve the overall geological understanding of

the deposits

• Subsequent to this program, the Company has

prioritized the Eastern zone which it believes is

amenable for fast track development

17

2013 DRILLING PROGRAM

Photo: Drill rigs at the Eastern Zone of

Oortsog Ovoo, magnetite core from

drilling

Results and Conclusions:

• Verified significant Sn mineralization in Eastern

zone

• DH-01W: 95.2m @ 0.55% Sn

• DH-70Q: 34.7m @ 0.55% Sn

• DH-70Q was a twin hole for historic DH-70 and

compares favorably with the historically reported 56m @

0.47% Sn

• Other drillholes intersected good visual tin

mineralization; assays pending

• The program generally confirms historical work on the

sections of the deposits drilled in this program

• Tin is associated with magnetite skarn (wide intervals of

>20% Fe); the Company believes that there is good

potential for an iron ore by-product (magnetite -

Fe3O4 )

• Excellent potential to define a Current NI 43-101

Compliant Mineral Resource with a focussed drilling

program using the historical work as a guide and,

furthermore, expanding resources through step-out

drilling, exploring zones with limited work to date, and

testing additional targets

19

www.mogulvc.com

OO – EASTERN ZONE m

asl

134.5m

OO13-01W

mas

l

1110

1070

1030

1110

1070

1030

meters

0 20 40

LOOKING N 70E

OO13-04X

80.5m

12.2m @ 0.62% Sn

Main Foliation

Russian Trench

Mostly Skarn

Intrusive

Russian DDHs

2013 DDHs

Proposed DDHs

OPEN

B B’

20

GOALS AND OBJECTIVES EXPLORATION AND ECONOMIC ASSESSMENT

• Metallurgical testing program

• Delineate Current NI 43-101 Compliant Mineral Resources focusing on Eastern zone first, then

Northern and Central zones

• Identify water source and commence environmental baseline work

• Engineering and process design; complete PEA

• Review engineering alternatives to maximize economics

• Progress to PFS or BFS based on the most advanced mineralized zones by Q2 2016

www.mogulvc.com

DEVELOPMENT

• Focus is on Eastern, Central and Northern zones believed to be amenable to FAST TRACK

development to reach production

• Mogul already has a Mining License, which is the main permit required to construct a mine, a

number of other permits will be required to commence mining operation

EXPANSION

• Conduct additional exploration to increase resources at Oortsog Ovoo with the

goal of delineating +100 kt of contained tin

• Seek acquisition opportunities aimed at consolidating and growing Mongolia’s tin

sector

21

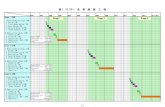

TIMELINE

www.mogulvc.com

2014

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

GIS database, Sat Foto, Maps, etc.

Geochemistry for 2013 Drilling Program

Planning for 2014 Work Program

Preliminary Metallurgical Testing

Blasting and Trenching - Bulk Sample for Metallurgy (N Zone)

HQ drilling - Infill & Delineation/Met sample

Water exploration

Resource Modelling

Metallurgical Testing

PEA

Environmental Baseline - Permitting

Tailings Impoundment - Engineering

Processing Design

PFS/BFS

Geophysics

Geochemistry (trenches)

2015 2016Item

22

COAL PROJECT

• Mogul’s license also contains a large coal system consisting of two deposits: Ovdog Hudag and Ikh Ulaan Nuur

• Ovdog Hudag has a NI 43-101 Resource Estimate and Report by SRK Consulting which found:

• Estimated Inferred Resources - 89.6 Mt* of Thermal Coal

• 8 coal seams recognized – 4 fully mineable, 2 partially

• Average Gross Calorific value – 5,636 to 6,431 kcal/kg (daf)*

• Ovdog Hudag coal deposit historical resources, based on Russian drilling from the ‘60s and ‘70s, using a Russian Classification system and based on >85 drill holes:

• 1968: C1+C2 resources totalling 201.2 Mt*1

• 1970: B+C1+C2 resources totalling 168.2 Mt*1

• Ikh Ulaan-Nuur coal deposit is located 7km NNE of Ovdog Hudag and was defined by Russian drilling in the ‘60s and ‘70s

• 1970: A+B+C1+C2 resources totalling 86.4 Mt*1

• Excellent potential for additional coal resources to be delineated in the undrilled area between Ovdog Hudag and Ikh Ulaan-Nuur

• Open pit accessible coal resources with expected low strip ratio

* Ovdog Hudag Coal Deposit – NI43-101 Report by SRK Consulting, June 30, 2012 *1 SRK Consulting External Technical memo, May 28, 2011; “Technical Report on the Coal Resources of the

Ovdog Hudag Coal Deposit Dundgovi Province, Mongolia” prepared by Flora Tungalag

www.mogulvc.com

Contact Information Jamul Jadamba, CEO & President

+1 416.318.6501 | [email protected]

Suite 307 – 47 Colborne Street

Toronto, Ontario

M5E 1P8, Canada