Moduleco, a multi-agent modular framework for the ... · At time t0=0, 50% of the agents believes...

Transcript of Moduleco, a multi-agent modular framework for the ... · At time t0=0, 50% of the agents believes...

Moduleco, a multi-agent modular framework for thesimulation of network effects and population dynamics in

social sciences, markets & organisations Denis Phan*, Antoine Beugnard** (1)

* École Nationale Supérieure des télécommunications de Bretagne, Dpt Economie & ICI-Université Bretagne Occidentale

** École Nationale Supérieure des télécommunications de Bretagne, Dpt Informatique

preliminary versionfor a more extended version see :

http://digemer.enst-bretagne.fr/~phan/moduleco /english/moduleco00.htm

*

Moduleco is a "multi-agent" platform, at the crossroads between several disciplines, designed tosimulate markets and organisations, social phenomenon and population dynamics.

Multi-agent systems are popular in computing science and within the domain of artificialintelligence. Generally, the Agent is defined as referring to a software component which is capableof acting in order to accomplish a specific task, such as finding information on the Internet.

The most famous Multi-agent systems is SWARM, initiated by Langton [1995]. Applications tothe economic field are reviewed by Luna, Stefansson [2000]. This paper is dedicated to thepresentation of MODULECO, a Multi-agent system, built in order to simulate a marketphenomenon in a "virtual lab", and more generally models of social choices involving bothindividual learning and collective learning : it's a part of "cognitive" economics (see section II)

Main concepts in dynamic modelling of complex adaptive systems : attractor, hedge of chaos,critical system (phase transition), self-organised critical system.

1 We acknowledge financial support from FT R&D and GET (Group of Telecommunications engineer Schools). Wethankful Nigel Gilbert and the University of Guilford ; Marco Valente, Luigi Marengo, Corrado Pasquali and theUniversity of Trento for their material and intellectual contribution of the early development of Moduleco, and all thecontributors for their help.

[email protected] ; Antoine [email protected]

2

Specific concepts from multi-agents literature : organisation, emergence, constraints, interactionand communication structures.

The aim of those models is to abstract general (analogue) formal properties from social and naturalsystems, independently of the specific context. The key feature is viewing the emerging order as aproduct of the system dynamics (system attractor), and more specifically of its elementinteractions. ( see Bonabeau [1994]).

I - Dynamics & emergence within the multi-agent systems• The emergence of ghettos by « tipping » in Shelling ’s model from simple rule of

neighbourhood at the agent ’s level.

• Self-organised criticality : the model of species coevolution by Back-Sneppens

• Marketing and Social networks : endogenous social network and emergence of « opinionleaders » in neural-like diffusion process on a network

1.1. Emergence in very simple models : Shelling's segregationIn Shelling's segregation model, ghettos emerge from a simple neighbourhood rule and : no agent wants more than 66% different coloured agents in his neighbourhood. In this Modulecosimulation, "tipping" agents move towards the closest place having an acceptable ratio.

1 -Original (checkerboard) Schelling Modelhttp://digemer.enst-bretagne.fr/~phan/complexe/schelling.html

[email protected] ; Antoine [email protected]

3

2- Moduleco adaptation of the Schelling's model

1.2. In multi-agent systems, complex behaviour may arise with very simplerules (i.e. spatial prisoner dilemma )

In the spatial Prisoner dilemma, very complex behaviour may arise (for a narrow range ofparameter values) with very simple rule : each agent chooses the strategy followed by the mostsuccessful agent in his MooreNeighbourhood (including himself).

[email protected] ; Antoine [email protected]

4

Sometimes processes converge towards equilibrium or limit cycle, sometimes towards aperiodic orchaotic evolutions (Nowak, May [1992],[1993]). Snapshot from an older version (0.1) ofModuleco

1.3. Self Organised Criticality : the Back-Sneppen model of species coevolutionEach species coevolve with his Von Neuman Neighbourhood. green curve is the average fitness ofall the population.

For more information on this model see (in French) :http://www-eco.enst-bretagne.fr/~phan/complexe/baksnep.htm

[email protected] ; Antoine [email protected]

5

1.4. Diffusion and Criticality in Marketing : Neural Adaptive Social NetworkIn this model, social network is formalised as a neural network with a small degree of connectivity(say in average 1,5%). After learning, some people will became the centre of larger network (sayin average 10%) as act as kind of "leader of opinion". as a result, we have an inhomogeneousprocess of diffusion, with classical S- shaped curve, but non classical increments, which arefollowing a power law distribution.

From Plouraboué, Steyer, Zimmermann [1998] Deroïan [1999], Steyer, Zimmerman [2000],Deroïan, Steyer Zimmerman [2000]

for more information see (in French) :

http://www-eco.enst-bretagne.fr/~phan/complexe/fpasjbz.htm

* * *

II - Markets are social systems with complex dynamicsinvolve learning

One can associate some emergence proprieties with the notion of collective learning. But, inEconomics, we must take into account the cognitive capacities of individual agents, with a specialemphasis upon the revision rules and beliefs process, in a situation of incomplete information(individual learning). (http://digemer.enst-bretagne.fr/~phan/artifice/wehia/)

"Cognitive" Economics is an attempt to take into account the incompleteness of the information inthe individual decision making process, on the one hand, and the circulation and appropriation ofthe information within the social networks, on the other hand.

Because incompleteness of Information, In cognitive economics, learning is a central feature bothat individual and collective levels. Walliser (Economie cognitive, Odile Jacob 1999) call"cognitivist" and "evolutionnist" these two complementary research programs. Multi-agent

[email protected] ; Antoine [email protected]

6

modelling and simulation of complex systems are complementary tools as well as experimentaleconomics for investigate this field.

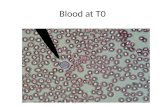

2.1 A very simple social influence model (Orléan [1995])The population of Agents in the world have some beliefs about the state of this world. Morespecifically, the world may be in two states, say {0,1}.

At time t0=0, 50% of the agents believes that this state is, say 0 (the "blue" ones); for all t>0 anagent given at random receives a private information on the state of the world and can change hisopinion. The "theta" parameter gives the proportion of signals coherent with a state of the world at"1". On this simulation, theta = 0.1 for both 0 < t < 200 and for 600 < t. Between 200 < t < 600.theta turns to be 0.9.

To take their decision, agents have two information : a private one (the thetabiased-signal) and theaverage opinion of their neighbourhood.

When the majority rule ("social information") is in accordance with the private information, anagent don't changes his opinion. When the majority rule is not according with the privateinformation, the agent are in a kind of "cognitive dissonance" and may change his opinion atrandom, according with their confidence in their private information.

Set mu as the probability of taking in account the private information only. Then, 1-mu is theprobability of following the majority rule, so to be mimetic with the members of this majority.When mu = 0 only private information matters. When mu =1, agent are fully mimetics.

In the simulation below, mu = 0.1 for all agents until t=600 ; afterwhise, mu = 0.9 for all agents, sothey became mimetics. As a result, social opinion is "lock in" in dominant opinion of state {1},despite 90% of the private information, which suggested that we are in state {0}.

Orléan [1995] provide evidences on the existence of a bifurcation of the asymptotic invariantmeasure of this process which became bimodal , for smaller value of mu (strong social influence)

The following results are given for 3 neighbourhood : World (the original model) Moore andVonNeuman. In theses cases, initial distribution is the same (same seed for the pseudo-random

[email protected] ; Antoine [email protected]

7

generation), but not the exact random process, but results are quite similar for World and Moore.In the Von Neuman case, each agent have only four neighbour, so it is more easy to get outside thelook-in. One can observe also the emergence of quasi-frozen zones, like in the Shelling'ssegregation model (and more others, on that question, see for instance Weisbuch [1989/1991])

From Orléan [1995]

Remark : in an other version available on Moduleco (following an Orléan's suggestion), Agentsdon’t' take longer their decision at random, but the world is composed of two categories of agents :the mimetic ones and the non mimetic, which follow only their own information. When theproportion of each categories of agents are fixed at random at the beginning of the simulation,previous results are preserved. But interesting results arises when this proportion is endogenous,state dependant.

2.2. Two part tariff and diffusion with consumption externality : the monopolycaseThe basic-version of this model is a strictly neo-classical monopoly with two part tariff andconsumption externality, following Littlechild (1975). Consumers have variable willingness topay, according to an idiosyncratic parameter, distributed on [0,1] and with an externality effectfrom their neighbourhood. In this simulation, neighbourhood is a local one (VonNeuman).

At the first step innovative consumers form rational expectations (full information) about theirneighbourhood, given their idiosyncratic parameter, and choose to adopt only if this adoption isan attempt to provoke a sufficient level of adoption in their neighbourhood. In cognitive versions(under development) both consumers and monopolist learn some unknown parameters throughexperimentation.

A full competition model is more extensively presented at :

http://digemer.enst-bretagne.fr/~phan/moduleco/english/modulecoA11.htm

The customers are "blue" people. red people doesn't adopt. Yellow people are just becomingmember of the "club"

A is the fixed part, p the price of one unit of the usage epsilon is the price elasticity for the usage

[email protected] ; Antoine [email protected]

8

2.3. A Lux-like model of financial market2.The models of Thomas Lux (1997, 1998, Lux & Marchesi, 1999, 2000) are multi-agent (withoutindividual agents !) simulations of financial markets. Lux purpose is to replicate the statisticstylized facts observed in real markets, namely :

1. Fat tails (series are leptokurtic)2. Volatility clustering (large fluctuations are followed by large fluctuations) and even...3. The hyperbolic decay of the volatility autocorrelation ( the so-called long memory

property).

These features of financial data imply that the probability distribution function is highly non-gaussian. This simulation shows that with gaussian information arrivals, and a market composedof heterogeneous agents who switch between different strategies, the price exhibits thecharacteristics of real data.

This kind of model is used by an increasing number of authors, see, e.g. Youssefmir andHuberman [1997] and Kirman [1993] among others. In a complex environment, adaptive agentscontinuously switch between different strategies, influenced in their decisions by the interactionswith other investors. The population of investors is divided into two groups, chartists (using pastdata to infer future price) and fundamentalists (they trade only on information). The chartist groupis also divided in two sub-groups, the "optimistics", who extrapolate the price trend (positivefeedback trading) and the "pessimistics" who believe that the price will revert (negative feedbacktrading, the so-called "contrarian" strategy). In this setting, agents compare profits obtained withthese different strategies. As the chartist profits depends on a opinion index, mimetism isintroduced. This leads to large waves of optimism and pessimism. Readers may refer to thedifferent articles of Lux to understand the transition probabilities between different strategies oftrading.

2 The authors are indebted to Nicolas Boitout, Sebastien Chivoret, Thierry Delahaut for their contribution on Lux.

[email protected] ; Antoine [email protected]

9

Note : in Moduleco, the right-part graph represents the evolution of the market price (which isarbitrarily fixed to 100 at the beginning, and is equal to the fundamental price) and the fractions ofdifferent groups, namely, blue for fundamentalists, green for optimistics and red for pessimistics.

* * *

III - Moduleco is an object oriented modular Framework,designed for the multi-agent simulations and using medium to

formalise agent interactions.

3.1. What is a framework ?• A Set of classes which defines a model of interaction among objects…

• In an attempt to be enhanced by inheritance

Dynamic links : more than a library...

[email protected] ; Antoine [email protected]

10

Concepts of object oriented programming and multi-agent systemsObject and encapsulation : data, methods (computation - behaviour)

Inheritance (from abstraction towards implementation) and modular architecture

Diagramatic presentation of UML (= Unified Modelling Language) : to make easier the dialogbetween computer scientist and economist, and to enhance the economic model semantics.

Four (non exclusive) levels for multi-agent systems :

1. "Cell within array" (or spreadsheet)2. Software object (i.e. objects in array list - this model)3. Active (software) objects (i.e. threads)4. Autonomous (software) objects (the real "agents") > threshold effects and individual

deterministic auto-regulation (i.e. viability principle : Aubin [1991]) cf. Varela, Bourgine[1992])

Advantages and constraints of this approach.

Advantages

Very few code lines are necessary to develop new models and services …

Implies specialisation and modularity Difficulties :

• the framework must predict as perfectly as possible future evolutions

• the framework must be able to evolve by the way of adaptations…

Constraints

[email protected] ; Antoine [email protected]

11

To use the names and methods as expected by the framework.

As a consequence, further developments depend on :

• the structure of the framework

• the knowledge of the possibility to redefine methods and variables

• Knowledge of the « entry point »

3.2. The Moduleco Framework :Basic objectsEAgent : each agent has a specific "state" ; Agent behaviour depends on the informationavailable from its « neighbourhood ».

Given this information, the agent "state" could be changed …

EWorld : set of Eagents, with a specific interaction structure.

An interaction structure has both :

• an individual spatial dimension : the « neighbourhood » of each agent

• a spatio-temporal dimension : « activation zones » (evolution area)

Medium and NeighbourBuilderMedium : a link between agents, and a way to formalise their interactionssee : http://www-info.enst-bretagne.fr/medium/index.html

• NeighbourMedium : social interaction in the Neighbourhood of an Agent

• Market : interaction between agents with two roles : buyer and seller. One agent may beplay both roles.

Information & Communication : Medium & institutional structure

• What kind of information is known by an Agent ?

• how does this information evolve ?

How is this information communicated between Agents ?

the NeighbourBuilder builds the neighbourhood of each agent ; for example :

WorldZone NeighbourVonNeuman NeighbourMoore BoundedRandomZone

[email protected] ; Antoine [email protected]

12

Agent's evolution& ActivationZone

• The agents

• The World activation

• activation zone

• strategies of evolution

At each period, the area which evolves (the activation zone) is activated by the ZoneSelector ; forexample :

WorldZone RandomIndividualZone RandomZone BoundedRandomZone

Scheduler & strategies of evolution.TimeScheduler : the world will evolove by zone, in two ways

LateCommitScheduler : agents choose simultaneously their behaviour given the informationavailable at the end of the previous period, and produce information available at the beginning ofthe next period

EarlyCommitScheduler : agents choose sequentially their behaviour given the informationavailable at the moment of their choice. The information produced is immediately available forthose agents which can access this information, given their neighbourhood.

3.4. UML Diagrams (Unified Modelling Langage)

Original Illustration : Two part Tariff Competition with consumption externality

see : http://digemer.enst-bretagne.fr/~phan/moduleco/english/modulecoA11.htm

[email protected] ; Antoine [email protected]

13

SynthesisThe use of objects and components to model the social interactions : mediums

Possible Variants of the same model in driving the scope and the evolution of the simulations

• Variants upon the zones chosen

Variants upon schedulers...

Bibliography

Aoki M. [1996] ; New Approaches to Macroeconomic Modelling : Evolutionary Stochastic Dynamics, MultipleEquilibrium and Externalities as Field Effect ; Cambridge University Press

Arthur W.B, Durlauf S.N., Lane D.A. (eds). [1997]; The Economy as an Evolving Complex System II ; Santa FeeInstitute, Studies in the Sciences of Complexity, Addison-Wesley Reading Mass.

Axelrod R. [1997] ; The Complexity of Cooperation ; Princeton Studies in Complexity , Princeton University Press NJ.Axtell R. [2000] ; « Why Agents ? on carried motivations for agent computing in social sciences » WP17 Center on

Social and Economic Dynamics The Brooking Institution.Axtell R. [2000] ; « Effect of Interaction Topology and Activation Regime in Several Multi-Agent Systems » SantaFee Institute Working Papers 00-07-039.Bak P., K. Sneppen [1993] ; « Punctuated equilibrium and critically in a simple model of evolution » Phys.Rev. Letters71 (1993) p. 4083-408Bak P. [1996] ; How Nature Works, the science of self-organized criticality ; Springer Verlag.Ballot G., Weisbuch G. (eds.) [2000] Applications of Simulation to Social Sciences ; Stanmore, Hermès ScienceBeugnard A. [2000] ; "Un modèle architectural à base de composants pour les applications distribuées", LMO'00

Langages et Modèles à Objets, C. Dony et H. Sahraoui, éditions Hermès, Paris p. 27-41.Bonabeau, E., Theraulaz, G. [1994] Intelligence collective ; Hermès, Paris.Bourgine P. [1993], « Models of autonomous agents and of their coevolutionary interactions » Entretiens Jacques Cartier, Lyon.Cariou E, Beugnard A. [2000] ; "Specification of Communication Components in UML" ; PDPTA, Las Vegas, june 26-29, 2000Dalle J.M., Jullien N. [2000] ; NT vs Linux or some Exploration in the Economics of Free software in Ballot G.,

Weisbuch G. (eds.)Deroïan F., Steyer A., Zimmermann J.B. [1999] ; « Influence Sociale et apprentissage dans les phénomènes de diffusion de

l’innovation » Communication aux journées AFSE « Economie de l’innovation » Sophia Antipolis 20, 21 mai.Epstein J.M. Axtell R. [1996] ; Growing Artificial Societies, Social Sciences from the Bottom Up, Brooking

Institution Press, MIT Press Washington D.C.,Cambridge Mass.Ferber J. [1997] ; Les Systèmes Multi-Agents ; vers une intelligence collective ; Inter Editions ; Multi-agent Systems

Addison Wesley Reading, MA.Gilbert N., Troitzsch K.G. [1999] Simulation for the Social Scientist ; Open University Press.Greenwald, A. et J. Kephart, 1999, “Shopbots and Pricebots.” Proceedings of the IJCAI'99, Stockholm, Sweden.Heudin. [1998] ; L'évolution au bord du chaos ; Hermes, ParisHolland J. [1995] ; Hidden Order ; How Adaptation Builds Complexity ; Perseus Books, Reading, Massachusetts.Holland, J. [1999] Emergence: From Chaos to Order ; Perseus Books.Kirman [1983] ; « Communications in Markets : A suggested Approach »; Economic letters 12 p. 1-5.Kirman A. [1993], « Ants, rationality and recruitment », Quarterly Journal of Economics, Volume 108Kirman [1997] ; « Interaction and markets » ; WP GREQAM 97A02, janvier.Kirman [1998] ; « Information et prix » ch 6 in P.Petit (ed.) Economie de l'Information, La Découverte, Paris.Kirman A., Vriend N.J. [2001] ; « Evolving market structure : an ACE model of price dispersion and loyalty » ;

Journal of Economic Dynamics & Control ; 25 p. 459-502.Lane [1993] ; « Artificial worlds and Economics » part I & II Journal of Evolutionary Economics, 3 p.89-107, p.177-197.LeBaron B. [2000] ; « Agent Based computational finance : Suggested readings and early research » ; Journal of

Economic Dynamics & Control, 24 p. 679-702.LeBaron B. [2001] ; « A builder’s Guide to Agent Based Financial Markets » ; Quantitative Finance ; 1-2 p.254-261.Littlechild S. C. [1986] ; « Three types of market process » ; Ch2 in Langlois (ed.) Economic as a Process Essays in

the New Institutional Economics ; Cambridge University Press.Littlechild S. C. [1975], "Two-part tariffs and consumption externalities", Bell journal of economics, 6/2, pp. 661-670.Luna F., Stefansson B. [2000] ; Economic Simulations in Swarm: Agent-Based Modelling and Object ; Advances in

Computational Economics V14 Kluwer Academic Publishers.Lux T. [1997], « The socio-economic dynamics of speculative markets: interacting agents, chaos, and the fat tails of

return distributions », Journal of Economic Behavior & Organization, Volume 33

[email protected] ; Antoine [email protected]

14Lux T., M. Marchesi [1999], « Scaling and criticality in a stochastic multi-agent model of financial market », Nature

vol. 397 pp 498 - 500Lux T., M. Marchesi [2000], « Volatility clustering in financial markets: a microsimulation of interacting agents »,

International Journal of Theoretical and Applied FinanceMarengo, Tordjman [1996] ; « Speculation, Heterogeneity and Learning : A simulation Model of Exchange Rates

Dynamics » KYKLOS, 49 –3 p. 407-438.Nadal J.P., Weisbusch G., Chenevez O., Kirman A. [1998] « A Formal Approach to Market Organisation : Choice

Functions, Mean Field Approximation and Maximum Entropy Principle… » in Lesourne, Orléan (eds.) Advancesin Self-Organization and Evolutionay Economics ; Economica, Londres Paris

Nicolis G. Prigogine I. [1989] ; Exploring Complexity : An Introduction ; trad. française : A la rencontre du complexe ; PUF ParisNowak M.A., May R. [1993] ; « The spatial dilemmas of Evolution » ; International Journal of Bifurcation and Chaos, 3-1 p.35-78.Orléan A. [1995] ; « Influence informationnelle et efficacité » WP CREAOrléan A. [1996] ; « The role of imitation in collective learning » WP CREA September 25.Parker M.T. [2001] ; « What is Ascape and Why should you care ? » Journal of Artificial Scocieties and Social

Simulation ; 4-1 < http://www.soc.surrey.ac.uk/JASSS/4/1/5.html >Phan P. [2000] ; « Apprentissages individuels et collectifs dans un système multi-agents reposant sur laprogrammation par objet », Ecole Thématique du CNRS "économie cognitive", Berder, 14-19 mai 2000Phan D., Piatecki C., Beugnard A. [2000] « Local and global learning on virtual distributed market modelled as a

multi-agent system » ; WEHIA 2000 - 5TH Workshop on Economics with Heterogeneous Interacting AgentsMarseille, June 15th to 17th

Plouraboué F., Steyer A, Zimmermann, J.B. [1998] « Learning Induced Criticality in Consumer's Adotion Pattern : aneural network approach » ; Economics of Innovations and New technologies, V6 p. 73-90.

Schelling, T. S.; « Dynamic Models of Segregation [1971] ; Journal of Mathematical Sociology ; 1, p.143-186.Schelling T.S. [ 1978] ; Micromotives and Macrobehavior W.W. Norton and Co, N.Y., Trad Française : La tyrannie

des petites décisions ; Puf, Paris 1980Sichman J., R. Conte, and N. Gilbert, (eds,), [1998] Multi-Agent Systems and Agent-Based Simulation, Berlin,

Springer-Verlag.Stauffer D., Aharony A. [1985] ; Introduction to percolation theory ; Taylor & francis LondonTesfatsion L. [2001] ; « Agent-Based Computational Economics : A Brief Guide to the Literature » in JonathanMichie (ed.), Reader's Guide to the Social Sciences, Volume 1, Fitzroy-Dearborn, London.Valente M. [2000] ; Evolutionary Economics and Computer Simulations : a Model for the Evolution of Markets ; phthesis, Aalborg University, DRUID February.Varella, F.J., Bourgine P. [1992] ; Towards a Practice of Autonomous Systems ; Bradford Book MIT PressCambridge.Vriend N. J. [1995] ; "Self-Organization of Markets: An Example of a Computational Approach," ; ComputationalEconomics 8, pp. 205--231Vriend N.J. [2000] ; « An illustration of the essential difference between individual and social learning, and its

consequences for computational analyses » ; Journal of Economic Dynamics & Control ; 24 p. 1 -19.Walliser [2000] ; L'économie Cognitive ; Odile Jacob, Paris.Weisbusch G. [1989] ; Dynamique des Systèmes Complexes ; une introduction aux réseaux d'automates ;InterEditions / CNRS ; Complex Systems DynamicsYoung P.J. [1998] ; Individual Strategy and Social Structure, Princeton University Press, N.J.

Agent-Based Computational Economics Web site by L. Tesfatsion : http://www.econ.iastate.edu/tesfatsi/ace.htm

Antoine Beugnard’s Medium Web site : http://www-info.enst-bretagne.fr/medium/index.html

Multi-Agent Platforms

Ascape : http://brook.edu/es/dynamics/models/ascapeCormas : http://cormas.cirad.fr/fr/outil/outil.htmLSD : http://www.business.auc.dk/~mv/research/topic_Lsd.htmlMadKit : http://www.madkit.org/Moduleco : http://www-eco.enst-bretagne.fr/~phan/moduleco/oRis : http://www.enib.fr/~harrouet/StarLogo : http://lcs.www.media.mit.edu/groups/el/projects/starlogo/Swarm : http://www.swarm.org/Zeus : http://www.labs.bt.com/projects/agents.htm

[email protected] ; Antoine [email protected]

15

Annex : Some others classical models in Moduleco

Heatbug (Swarm, Ascape) Conway's Game of Life (planer)

Network percolation NT versus Linux*

Sugarscape** (Ascape) Random Walkers

* WinNT versus Linux based on Dalle Jullien [2000]http://www-eco.enst-bretagne.fr/Recherche/Biblio/Nicolas/FS_Dalle_Jullien.pdf** J.M. Epstein, R. Axtell Growing Artificial Societies, Social Science from Bottom Up; Brooking Institution. PressWashington D.LC. & MIT Press, Cambridge Mass. http://www.brook.edu/sugarscape/