MOD Resources Limited ASX Code: MOD Price: $0.073 Business ... · P/E Relative % 0.0 0.4 0.2 0.0...

Transcript of MOD Resources Limited ASX Code: MOD Price: $0.073 Business ... · P/E Relative % 0.0 0.4 0.2 0.0...

Business SummaryMOD Resources Limited (MOD, formerly Medical Corporation AustralasiaLimited) is a mineral exploration company focusing on the development of itsGMR Copper Project in Botswana.

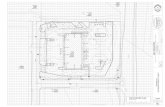

GMR Copper Project: MOD has interest in the prospective GMR CopperProject in the Kalahari Copper Belt in NW Botswana. The project comprisesthe Southern Licences (eight prospecting licences covering a total of5,686.4sqkm) and the Northern Licences (six prospecting licences covering atotal of 2,673.5swkm) situated within the Kalahari Copper Belt. Copper andSilver deposits have been found in close proximity and on strike areas withinthe 6 Northern licences.

GICS - Materials

MOD Resources Limited

ASX Code: MOD Price: $0.073

Important Disclaimer - This may affect your legal rights: Because this document has been prepared without consideration of any specific client's financial situation, particular needs and investmentobjectives, a Bell Potter Securities Limited investment adviser (or the financial services licensee, or the proper authority of such licensee, who has provided you with this report by arrangement withBell Potter Securities Limited) should be consulted before any investment decision is made. While this document is based on the information from sources which are considered reliable, Bell PotterSecurities Limited, its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate.Nor does Bell Potter Securities Limited accept any responsibility to inform you of any matter that subsequently comes to its notice, which may affect any of the information contained in this document.This document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Bell Potter Securities Limited. This is generalinvestment advice only and does not constitute advice to any person. **Bell Potter covers the following ASX Codes: AAX,ACL,AHE,ALZ,AMM,ANG,ANN,ANZ,API,APK,AQA,AQG,ASL,AUN,AWC,BDR,BEN,BHP,BKN,BOQ,BRC,BTT,BYL,CAA,CAH,CBA,CGF,CHN,CMG,CMJ,CND,COH,CQT,CSL,CTM,CVN,DJS,DLX,EHL,ELD,FFF,FGE,FMG,GBG,GCS,GNC,GRR,HIN,HZN,IDO,IFL,IIN,ILU,INQ,IRD,JBH,JMS,JPR,KAM,KCN,KRM,KZL,LCM,MGX,MIN,MLB,MLX,MND,MQG,MRM,MYR,NAB,NCM,NEC,NEN,NVT,NWH,NXS,OZL,PDN,PEA,PLA,PMV,PPC,PPT,PRG,PRY,PTM,QRX,RCR,RDF,RED,RHC,RIC,RIO,RMD,RMS,ROK,RRL,SBM,SDL,SDM,SHL, SHV,SKE,SLR,SLX,SPL,SUL,SUN,SWM,TFC,TLS,TRS,TRY,TWO,VMG,WBB,WBC,WDS,WEB,WEC,WPL,WSA,WTP.Disclosure of Interest: Bell Potter Securities Limited receives commission from dealing in securities and its authorised representatives, or introducers of business, may directly share in thiscommission. Bell Potter Securities and its associates may hold shares in the companies recommended.

Snapshot

DateMarket Cap.Shares on issue12 Month High12 Month Low

10 July 2012$30m406.7m$0.26$0.06

Investment FundamentalsFYE 30 Dec 2008A 2009A 2010A 2011A

Profit $m -0.1 1.2 2.3 -1.7Profit (norm)* $m -0.1 1.2 2.7 -3.0

EPS* ¢ -0.1 0.5 0.9 -0.5EPS Growth % 0.0 0.0 87.8 0.0P/E* x 0.0 14.9 7.9 0.0P/E Relative % 0.0 0.4 0.2 0.0

DPS ¢ 0.0 0.0 0.0 0.0Yield % 0.0 0.0 0.0 0.0Franking % 0.0 0.0 0.0 0.0* Adjusted for unusual itemsSource: Aspect Huntley historical financials

Share Price Chart

Total Return on $10,000 Investment

Profit & Loss ($000)2007A 2008A 2009A 2010A 2011A

Sales Revenue 336 223 123 5 --Total Revenue ex. Int. 787 335 1,275 2,652 44EBITDA -477 -549 1,068 3,205 -2,693Depreciation & Amort. -18 -8 -2 -0 -2Goodwill Amortisation -- -- -- -- --EBIT -495 -557 1,066 3,205 -2,695Net Interest 391 419 153 175 454Profit Before Tax -104 -138 1,219 3,380 -2,241Income Tax -- -- -- -1,077 562Outside Equity Int. -- -- -- -- --Profit after Tax -104 -138 1,219 2,303 -1,680Significant Items after Tax -750 -- -- 405 -1,281Reported Profit after Tax -854 -138 1,219 2,707 -2,960Preferred Dividends -- -- -- -- --

Cash Flow ($000)2007A 2008A 2009A 2010A 2011A

Receipts from Customers 3 -- -- -- --Funds from Operations -1,082 -764 -675 -654 -1,827Net Operating Cashflow -324 -139 -393 -397 -1,346Capex -- -- -- -0 -8,876Acquisitions & Investments -360 -969 -12,906 -3,052 -52Sale of Invest. & Subsid. 782 875 10,186 8,407 3,412Net Investing Cashflow 416 -94 -2,720 5,355 -5,516Proceeds from Issues -- -- -- -- 4,800Dividends Paid -- -- -- -- --Net Financing Cashflow -- -- -- -- 4,575Net Increase Cash 92 -233 -3,113 4,958 -2,287Cash at Beginning 5,970 6,062 5,829 2,597 7,555Exchange Rate Adjust. -- -- -119 -- 14Cash at End 6,062 5,829 2,597 7,555 5,282

Ratios and Substantial Shareholders2007A 2008A 2009A 2010A 2011A

Profitability RatiosEBITDA Margin % -142.21 -246.41 865.54 59,766 --EBIT Margin % -147.58 -249.79 863.72 59,763 --Net Profit Margin % -30.96 -61.76 987.54 42,935 --Return on Equity % -1.75 -2.38 17.39 23.70 -5.74Return on Assets % -1.66 -2.29 16.94 21.16 -5.52

Debt/Safety RatiosNet Debt/Equity % -102.24 -100.65 -37.05 -77.75 -18.04Interest Cover x 1.27 1.33 -6.98 -18.36 5.94

Top 5 Substantial ShareholdersPhoenix Properties International Pty Ltd 20.6%SHL Pty Ltd and associates 3.6%

Balance Sheet ($000)2007A 2008A 2009A 2010A 2011A

Cash & Equivalent 6,062 5,829 2,597 7,555 5,282Receivables 41 52 50 484 365Inventories 26 -- -- -- --Other Current Assets 98 134 4,390 2,844 151Current Assets 6,226 6,014 7,037 10,883 5,797Prop. Plant & Equipment 33 2 -- 0 483Intangibles -- -- -- -- --Other Non-Current Assets 98 134 4,390 2,844 151Non-Current Assets 33 2 159 0 24,622Total Assets 6,258 6,016 7,196 10,883 30,420Interest Bearing Debt -- -- -- -- --Other Liabilities 329 225 186 1,166 1,141Total Liabilities 329 225 186 1,166 1,141Net Assets 5,929 5,791 7,010 9,717 29,279Share Capital 34,306 34,306 34,306 34,306 49,267Reserves -- -- -- -- 7,560Retained Earnings -28,377 -28,514 -27,295 -24,588 -27,548Outside Equity Int. -- -- -- -- --Total Shareholders Equity 5,929 5,791 7,010 9,717 29,279

Price vs. EPS Principals & DirectorsPrincipals

Company Secretary Mr Mark Andrew Clements

Directors

Mr Miles Alistair Kennedy(Non-Executive Chairman)Mr Simon Lee(Executive Director)Mr Mark Andrew Clements(Company Secretary,Director (other))Mr Mark Drummond(Non-Executive Director)Mr Derek Byrne(Executive Director)

To access further Research or for information regarding our recommendations and ratings please seewww.bellpotter.com.au

© 2012 Morningstar, Inc. All rights reserved. Neither Morningstar, nor its affiliates nor their content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have anyliability for its use or distribution. Any general advice has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Limited, subsidiaries of Morningstar,Inc, without reference to your objectives, financial situation or needs. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (in respect of Australianproducts) or Investment Statement (in respect of New Zealand products) before making any decision to invest. Neither Morningstar, nor Morningstar's subsidiaries, nor Morningstar's employees can provide you withpersonalised financial advice. To obtain advice tailored to your particular circumstances, please contact a professional financial adviser. Some material is copyright and published under licence from ASX OperationsPty Limited ACN 004 523 782 ("ASXO"). DISCLOSURE: Employees may have an interest in the securities discussed in this report. Please refer to our Financial Services Guide (FSG) for more informationwww.morningstar.com.au/s/fsg.pdf

MOD Resources Limited

Bell Potter Securities Research

AFS Licence No. 243480 ABN 25 006 390 772

Email [email protected]

Website www.bellpotter.com.au