MN2020 Property Tax Report 2002-2010

-

Upload

minnesota-2020 -

Category

Documents

-

view

1.237 -

download

1

Transcript of MN2020 Property Tax Report 2002-2010

Table of ConTenTs

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Recommendations: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

I ..Introduction .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

II ..2002.Property.Tax.Changes .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

III ..State.Aid.Reductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

IV .The.Role.of.Property.Valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

V .Explaining.Homestead.Property.Tax.Growth. . . . . . . . . . . . . . . . . . . . . . . . . . 22

VI ..Trends.in.Specific.Communities.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

VII ..Focusing.on.Cities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

VIII . Conclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Appendix A 39

Appendix B 43

Appendix C 47

1Minnesota 2020 - www.mn2020.org

exeCuTive suMMary

During.the.last.eight.years,.the.state.has.pushed.its.budget.problems.off.to.local.governments,.forcing.both.service.cuts.and.property.tax.increases .“No.new.taxes”.policy.at.the.state.level.has.led.to.more.regressive.taxes.at.the.local.level.and.deep.cuts.in.education,.infrastructure,.and.public.services .This.is.not.the.way.to.move.Minnesota.forward .Minnesota.needs.more.progressive.tax.policy.which.doesn’t.stick.those.least.able.to.pay.with.a.disproportionate.share.of.the.bill.and.that.doesn’t.force.local.councils,.commissions,.and.school.boards.to.slash.critical.public.investments .

From.2002.to.2010,.property.taxes.in.Minnesota.increased.by.26 8.percent.in.inflation-adjusted.dollars.and.by.71 8.percent.in.nominal.dollars * Statewide.property.taxes.during.this.eight.year.span.increased.at.a.faster.annual.average.pace.than.had.been.seen.in.at.least.a.generation

From.2002.to.2010,.local.property.taxes.(excluding.the.state.property.tax).increased.by.$1 7.billion.in.constant.2010.dollars .However,.this.growth.in.property.taxes.cannot.be.attributed.to.growth.in.local.government.budgets;.since.2002.total.local.government.revenue.declined.by.$613.million .The.primary.cause.of.statewide.property.tax.growth.is.reductions.in.revenue.sharing.with.local.governments.known.as.state.aid .In.the.last.eight.years,.aid.to.local.governments.declined.by.$2 6.billion.in.constant.2010.dollars .Local.property.tax.increases.replaced.approximately.two-thirds.of.

* “Nominaldollars”aredollarsthathavenotbeenadjustedforinflation.

“no new taxes” policy at the state level has led to more regressive taxes at the local level and deep cuts in education, infrastructure, and public services.

2 Minnesota 2020 Property Tax report: 2002 - 2010

state.aid.cuts .Local.governments.closed.the.remaining.budget.gap.primarily.by.spending.down.reserves.and.cutting.services,.such.as.public.safety,.education,.and.parks.and.recreation

A.consistent.pattern.of.aid.loss.and.property.tax.increases.is.seen.when.examining.all.three.major.levels.of.local.government—counties,.cities,.and.school.districts—separately .State.aid.reductions,.not.local.spending.increases,.were.the.driving.force.behind.property.tax.increases.for.each.level.of.government.since.2002

Homeowner.property.taxes.have.increased.particularly.rapidly.over.the.last.eight.years .From.2002.to.2010,.residential.homestead.property.taxes.have.increased.by.38 2.percent.in.inflation-adjusted.dollars.and.by.87 1.percent.in.nominal.dollars—a.growth.rate.significantly.greater.than.the.growth.in.total.property.taxes.for.all.types.of.property

After.accounting.for.growth.in.the.number.of.homesteads,.the.inflation-adjusted.average.Minnesota.homeowner.property.tax.increased.by.28 6.percent.from.2002.to.2010,.while.statewide.per.capita.property.taxes.grew.by.“just”.19 2.percent .The.more.rapid.rate.of.growth.in.homestead.property.taxes.has.been.improperly.attributed.to.rising.homestead.values .While.statewide.homestead.estimated.market.value.(EMV).has.grown.rapidly.during.most.of.the.last.eight.years,.it.has.declined.as.a.share.of.statewide.EMV.and.thus.homestead.EMV.growth.does.not.explain.the.more.rapid.rate.of.growth.in.homeowner.property.taxes

Changes.to.the.property.tax.system.passed.in.2001.and.implemented.in.2002.are.the.likely.cause.of.the.more.rapid.rate.of.growth.in.homeowner.taxes.relative.to.most.other.types.of.property .

3Minnesota 2020 - www.mn2020.org

The.2001.tax.act.gave.substantial.property.tax.relief.to.homeowners.and.other.property.owners.in.2002 .However,.it.also.put.into.place.forces.that.caused.homestead.property.taxes.to.increase.more.rapidly.in.subsequent.years

These.include:

•...The.structure.of.the.homestead.market.value.credit,.whereby.the.amount.of.the.credit.shrinks.as.homestead.value.increases

•...The.phase-out.of.the.limited.market.value.program,.which.contributed.to.growth.in.homestead.taxable.value.and.property.taxes.through.at.least.2006

•...The.culmination.of.a.decade.of.“class.rate.compression,”.which.contributed.to.a.shift.of.property.taxes.on.to.homesteads.in.2003.and.2004

•...The.new.state.property.tax.on.commercial/industrial.property,.which.partially.insulates.business.properties.from.the.local.property.tax.increases.that.push.taxes.on.homesteads.and.other.properties.upward

In.addition,.declining.real.per.pupil.state.aid.to.school.districts.contributed.to.rapid.growth.in.“referendum.market.value”.levies .These.levies.fall.more.heavily.on.homeowners.than.do.ordinary.property.tax.levies .The.rapid.growth.in.referendum.market.value.levies.since.2002.shifted.a.larger.share.of.total.statewide.property.taxes.on.to.homeowners

In.2010,.the.change.in.statewide.property.taxes.departed.from.the.trend.seen.during.most.of.the.preceding.seven.years .Inflation-adjusted.statewide.per.capita.property.taxes.increased.only.slightly.(0 6.percent),.while.the.average.homeowner.property.tax.fell.by.1 6.percent .

Increased.public.resistance.to.tax.hikes.due.to.the.troubled.economy.contributed.to.the.low.rate.of.growth.in.aggregate.property.taxes .Another.factor.was.that.a.large.portion.of.the.aid.cuts.in.2010.occurred.after.local.governments.had.set.their.property.tax.levy.for.the.year,.so.aid.cuts.could.not.be.recovered.through.property.tax.increases.until.2011

Furthermore,.many.of.the.forces.that.had.caused.the.more.rapid.rate.of.growth.in.homestead.property.taxes.from.2002.to.2008.were.of.diminished.importance.in.2010 .The.LMV.phase-out.and.class.rate.compression.ceased.to.be.major.contributors.to.homestead.tax.increases .Referendum.market.value.levies.did.not.grow .Finally,.the.market.value.homestead.credit.stopped.decreasing.because.homestead.values.stopped.increasing .The.abatement.of.these.factors.allowed.the.decline.in.homesteads’.relative.share.of.EMV—a.trend.that.had.been.in.place.since.2005—to.finally.manifest.itself.in.the.form.of.lower.homeowner.property.taxes

The 2001 tax also put into place forces that caused homestead property taxes to increase more rapidly in subsequent years.

4 Minnesota 2020 Property Tax report: 2002 - 2010

However,.celebration.would.be.premature .Some.of.the.forces.that.drove.property.taxes.higher.during.most.of.the.period.since.2002.could.resurface .For.example,.with.a.looming.state.budget.deficit.of.nearly.$7.billion,.more.state.aid.cuts.are.a.distinct.possibility .Just.as.they.have.in.the.past,.more.aid.cuts.will.translate.into.less.revenue.for.funding.public.services.and.infrastructure.and.higher.property.taxes

In.addition,.some.of.the.forces.that.caused.especially.rapid.growth.in.homestead.property.taxes.could.also.resurface .For.example:

•...Resumption.of.growth.in.school.referendum.market.value.levies.is.a.distinct.possibility,.given.that.real.per.pupil.state.aids.are.already.projected.to.decline.even.before.the.state.tackles.the.anticipated.FY.2012-13.budget.deficit

•...Business.property.will.continue.to.be.partially.insulated.from.local.property.tax.increases.through.the.state.property.tax.levy,.which.does.not.increase.to.keep.pace.with.population.growth .Over.time,.this.will.likely.contribute.to.a.lower.rate.of.growth.in.business.property.taxes.relative.to.homesteads.and.other.non-business.properties

•...Future.growth.in.homestead.EMV.would.lead.to.further.reductions.in.the.market.value.homestead.credit,.which.will.in.turn.cause.an.accelerated.growth.in.homestead.property.taxes,.all.other.things.being.equal

With a looming state budget deficit of nearly $7 billion, more state aid cuts are a distinct possibility.

5Minnesota 2020 - www.mn2020.org

reCoMMendaTions:

The.property.tax.is.an.unfair.and.unpopular.tax.because.it.falls.disproportionately.on.households.with.the.least.ability.to.pay .For.this.reason,.state.policymakers.should.adopt.reforms.that.ensure.that.trends.observed.since.2002.do.not.reemerge .These.reforms.should.include:

•...An.increase.in.state.revenues.so.that.the.state.budget.problems.will.not.be.shifted.disproportionately.to.local.government.and.property.taxpayers.as.they.have.been.since.2002 .While.belt.tightening.and.spending.reforms.continue.to.be.necessary,.there.is.no.reason.why.equitable.revenue.increases.cannot.also.be.part.of.the.budget.solution

•...Appropriate.funding.of.school.operating.costs.at.the.state.level.so.that.the.need.for.new.referendum.market.value.levies.is.mitigated .

•...Restructuring.of.the.market.value.homestead.credit.so.that.the.credit.does.not.automatically.shrink.as.taxable.market.values.grow

•...Linking.growth.in.the.state.business.levy.to.the.combined.rate.of.inflation.and.population.growth

A.system.in.which.homeowners.are.paying.more.while.local.governments.are.forced.to.make.deep.cuts.to.public.services.and.infrastructure.investments.is.a.system.that.lacks.accountability.and.is.not.a.path.to.prosperity.for.Minnesota .Yet.this.is.precisely.the.system.that’s.developed .The.current.budget.crisis.affords.Minnesota.policymakers.an.opportunity.to.take.the.difficult.and.complex.actions.needed.to.reduce.dependence.on.regressive.property.taxes.and.to.fix.Minnesota’s.system.of.state.and.local.government.finance

a system in which homeowners are paying more while local governments are forced to make deep cuts to services and infrastructure is not a path to prosperity for Minnesota.

6 Minnesota 2020 Property Tax report: 2002 - 2010

i. inTroduCTion

Since.2002,.property.taxes.in.Minnesota.increased.at.a.rate.that.far.surpassed.that.of.inflation.and.population.growth .Homestead.property.taxes.grew.at.a.particularly.rapid.rate .Tax.payable.year.2010.saw.a.rare.deviation.from.this.trend,.with.total.statewide.property.taxes.growing.only.slightly.and.homestead.property.taxes.declining.slightly .However,.2010.is.likely.to.be.only.a.temporary.interruption.of.the.longer-term.trend

The.statewide.growth.in.real.(i e ,.inflation-adjusted).per.capita.property.taxes.in.Minnesota.from.2002.to.2009.was.the.result.of.state.aid.cuts,.not.growth.in.local.government.spending .Various.changes.in.state.law.first.implemented.in.2002.further.exacerbated.growth.in.homestead.taxes .The.slight.decline.in.homestead.property.taxes.in.2010.was.largely.the.result.of.a.decline.in.homestead.valuation.relative.to.other.types.of.property,.in.addition.to.an.abeyance.in.some.of.the.forces.that.had.been.pushing.homestead.property.taxes.higher.in.previous.years .Each.of.these.trends.will.be.examined.below

It.is.important.to.adjust.for.the.impact.of.inflation.when.assessing.changes.in.state.and.local.government.revenue.and.expenditures.over.time.so.as.to.distinguish.between.real.spending.growth.versus.growth.caused.by.erosion.in.the.purchasing.power.of.the.dollar .Unless.otherwise.noted,.dollar.amounts.and.changes.over.time.presented.in.this.analysis.are.adjusted.for.inflation.in.the.cost.of.state.and.local.government.purchases .1

Dates.used.in.property.tax.discussions.can.create.confusion,.because.property.taxes.payable.in.one.year.are.based.upon.valuations.that.were.set.in.the.preceding.year .To.further.complicate.matters,.property.taxes.paid.to.school.districts.are.budgeted.within.the.subsequently.numbered.school.fiscal.year.(FY),.which.begins.on.July.1.of.the.calendar.year .For.example,.valuations.set.in.2009.are.used.to.determine.property.taxes.payable.in.2010,.which.are.part.of.a.school.district’s.FY.2011.budget .For.non-school.local.governments,.the.year.in.which.property.taxes.and.state.aids.are.paid.corresponds.to.the.year.in.which.these.revenues.are.budgeted .For.example,.city.property.taxes.paid.in.2010.and.aid.received.in.2010.are.part.of.a.city’s.2010.budget

1 Allinflationadjustmentsinthisreportarebasedontheimplicitpricedeflator(IPD)forstateandlocalgovernmentpurchases,whichisabettermeasureofinflationforthetypesofgoodsandservicespurchasedbystateandlocalgovernmentsthanistheConsumerPriceIndex(CPI).Thespecificindicesusedherecorrespondwiththemostrecentstatebudgetforecast(February2010).Formoreontheinflationadjustmentusedinthisreport,see“TakingtheSpinoutofInflationEstimates,”Minnesota2020,September9,2008.(http://tinyurl.com/yfo2zgo)

The statewide growth in real per capita property taxes in Minnesota from 2002 to 2009 was the result of state aid cuts, not growth in local government spending.

7Minnesota 2020 - www.mn2020.org

Dates.used.in.this.report.will.refer.to.the.property.tax.payable.year,.unless.otherwise.noted .For.example:

•...“2010.values”.will.refer.to.values.that.were.used.to.determine.property.tax.payments.in.2010

•...“2010.property.taxes”.will.refer.to.property.taxes.paid.in.2010

•...“2010.aid”.amounts.will.refer.to.aids.received.by.non-school.local.governments.in.their.2010.budget.year.and.by.school.districts.in.their.FY.2011.budget.year

A.portion.of.this.report.focuses.on.homestead.property .Generally.speaking,.a.“homestead”.refers.to.a.residential.property.that.is.occupied.by.the.owner.of.the.property.(i e ,.the.“homeowner”) 2.In.regard.to.homestead.property,.this.report.will.focus.primarily.on.residential—as.opposed.to.agricultural—homesteads .Residential.homesteads.comprise.more.than.96.percent.of.all.homestead.estimated.market.value3.in.Minnesota.for.the.2009.assessment.year,.corresponding.to.taxes.payable.in.2010 .In.this.report,.the.term.“homestead”.will.refer.to.residential.homestead.property.unless.otherwise.noted

ii. 2002 ProPerTy Tax Changes

Tax.payable.year.2002.is.the.baseline.year.in.this.analysis.because.it.was.a.transitional.year.for.Minnesota’s.property.tax.system .In.the.preceding.year,.the.legislature.enacted.a.series.of.changes.to.Minnesota’s.property.tax.system;.2002.marked.the.first.year.these.changes.were.in.effect .These.changes.included:

1) The.elimination.of.the.general.education.property.tax.through.full.state.funding.of.general.education

2) The.culmination.of.over.a.decade.of.class.rate.compression

3) The.creation.of.a.new.state.property.tax.on.business.and.seasonal.recreational.property,

4) The.phase-out.of.the.limited.market.value.program,.and

5) Creation.of.a.new.“market.value.homestead.credit ”

2 Residentialpropertyoccupiedbyaparent,stepparent,child,stepchild,grandparent,grandchild,brother,sister,uncle,aunt,niece,ornephewcanalsoqualifyforhomesteadtreatmentunderMinnesotalaw.

3 “Estimatedmarketvalue”(orEMV)asdefinedbytheMinnesotaDepartmentofRevenuereferstowhatapropertywouldsellforinanopenmarkettransactionbasedonsalesandmarketvalueincomeapproachtrendsasestimatedbycountyorlocalassessors.Formoreonthis,see:http://bit.ly/dvMlYU.EstimatedmarketvaluesinMinnesotaarebasedprimarilyonlandandbuildingvalues.

8 Minnesota 2020 Property Tax report: 2002 - 2010

elimination of general education property tax

Perhaps.the.most.prominent.of.the.changes.enacted.in.2001.and.implemented.in.2002.was.a.shift.in.responsibility.for.funding.general.education.away.from.local.property.taxes.and.into.the.state’s.general.fund .In.the.same.year,.the.state.also.reduced.transit.property.taxes.by.assuming.funding.for.transit.operations,.although.the.dollars.involved.in.this.takeover.were.small.in.comparison.to.the.general.education.takeover

Through.these.swaps,.state.general.fund.spending.increased.while.local.property.taxes.fell .Statewide.net.property.taxes.per.capita.fell.by.12.percent,.while.the.average.residential.homestead.property.tax.fell.by.16.percent .While.there.were.many.other.factors.at.work,.the.princip.cause.of.the.decline.in.property.taxes.from.2001.to.2002.was.the.state.takeover.of.general.education.funding

However,.the.dark.side.of.full.state.funding.of.general.education.became.apparent.in.subsequent.years .While.the.legislature.leapt.at.the.opportunity.to.eliminate.the.general.education.property.tax,.it.declined.to.increase.state.taxes.by.the.amount.necessary.to.maintain.the.state.funding.commitment.at.the.2002.level .Since.2002.(school.fiscal.year.2003),.state.aid.to.school.districts.has.fallen,.which.in.turn.caused.an.increase.in.school.property.taxes.and.a.decline.in.total.school.revenue .From.tax.payable.year.2002.(corresponding.to.school.fiscal.year.2003).to.2010.(fiscal.year.2011),.state.aid.to.school.districts.fell.by.$1,366.(13 9.percent).per.pupil.in.constant.FY.2011.dollars,.while.school.property.taxes.increased.by.$1,012.per.pupil.(64 0.percent) .4

Homeowners.were.hit.particularly.hard.by.the.decline.in.state.aid.to.public.schools .Largely.in.response.to.declining.aid,.many.school.districts.sought.to.obtain.revenue.through.locally.approved.referendum.levies .Many.of.these.new.levies.were.“referendum.market.value.levies;”.total.school.referendum.market.value.levies.increased.by.170.percent.from.2002.to.2010 .Unlike.other.levies,.levies.spread.against.referendum.market.value.afford.no.preferential.tax.treatment.to.homeowners;.for.this.reason,.an.increase.in.referendum.market.value.levies.translates.into.a.larger.percentage.increase.in.homestead.taxes.than.business.taxes .This.phenomena.is.described.more.fully.in.the.next.section.on.“class.rate.compression ”

Class rate compression

Another.major.feature.of.the.tax.changes.enacted.in.2001.and.implemented.in.2002.was.the.culmination.of.more.than.a.decade.of.“class.rate.compression ”.A.“class.rate”.refers.to.the.percentage.by.which.the.value.in.a.particular.class.of.property.is.multiplied.in.order.to.determine.the.tax.base.against.which.levies.are.actually.spread .Because.business.property.is.subject.to.higher.class.rates.than.homestead.property,.businesses.pay.higher.taxes.per.each.dollar.of.land.and.building.value.than.do.homesteads

4 Formoreonthedeclineinschoolaidandtheincreaseinschoolpropertytaxessincetaxespayableyear2002(FY2003),seetherecentMinnesota2020analysisat:http://bit.ly/mn2020_school_finance

state aid to school districts fell by $1,366 per pupil in constant fy 2011 dollars, while school property taxes increased by $1,012 per pupil.

9Minnesota 2020 - www.mn2020.org

For.example,.consider.the.following.hypothetical.school.district.with.four.homesteads.each.with.land.and.building.value.of.$250,000,.one.business.property.with.land.and.building.value.of.$2,000,000,.and.a.school.property.tax.levy.of.$10,000 .Under.a.system.in.which.the.school.district’s.levy.is.spread.directly.against.land.and.building.value,.the.calculation.of.school.property.taxes.for.each.property.is.shown.below

ProPerTy land & building value

sChool Tax raTe = levy ÷ ToTal value

sChool ProPerTy Tax = Tax raTe x value

homestead a $250,000 0.333% $833

homestead b $250,000 0.333% $833

homestead C $250,000 0.333% $833

homestead d $250,000 0.333% $833

business $2,000,000 0.333% $6,667

district Total $3,000,000 $10,000

In.this.system,.the.distribution.of.school.property.taxes.among.each.property.would.be.in.direct.proportion.to.each.property’s.share.of.total.land.and.building.value.in.the.school.district .For.example,.in.our.hypothetical.school.district.the.business.property.comprises.two-thirds.of.the.land.and.building.value.in.the.district.and.thus.pays.two-thirds.of.the.total.school.property.tax.levy

Under.Minnesota’s.system.of.property.classification,.a.“class.rate”.is.assigned.to.each.class.of.property .The.class.rate.for.each.class.of.property.is.multiplied.by.a.property’s.land.and.building.value.to.get.its.“tax.capacity ”.The.property.tax.levy.is.then.spread.not.directly.against.the.value.of.each.property,.but.against.its.“tax.capacity ”.The.effect.of.the.class.rate/tax.capacity.system.is.to.shift.the.relative.tax.burden.from.one.class.of.property.to.another

For.example,.let’s.return.to.our.hypothetical.school.district .In.the.following.example,.the.property.values.and.school.levy.are.the.same.as.in.the.previous.example;.what.is.different.is.that.the.distribution.of.the.school.levy.among.properties.is.not.based.directly.on.land.and.building.values,.but.on.each.property’s.tax.capacity .In.this.example,.the.tax.capacity.of.homestead.property.is.determined.by.multiplying.land.and.building.value.by.1.percent,.while.the.tax.capacity.of.business.property.is.determined.by.multiplying.land.and.building.value.by.5.percent .The.table.below.shows.the.calculation.of.the.school.property.tax.for.each.property.under.this.system

ProPerTy land & building value Class raTe Tax CaPaCiTy =

value ? Class raTe

sChool Tax raTe = levy ÷ ToTal Tax CaPaCiTy

sChool ProP. Tax = Tax raTe x Tax CaPaCiTy

homestead a $250,000

1%

$2,500 9.091% $227

homestead b $250,000 $2,500 9.091% $227

homestead C $250,000 $2,500 9.091% $227

homestead d $250,000 $2,500 9.091% $227

business $2,000,000 5% $100,000 9.091% $9,091

district Total $3,000,000 $110,000 $10,000

10 Minnesota 2020 Property Tax report: 2002 - 2010

The.total.property.tax.collected.by.the.school.district.in.both.examples.is.$10,000 .However,.the.distribution.of.property.taxes.by.property.type.changes.significantly.under.the.class.rate/tax.capacity.system .Because.homestead.property.is.assigned.a.much.lower.class.rate.than.business.property,.the.taxes.paid.by.each.of.the.homesteads.in.our.hypothetical.district.falls.from.$833..under.a.system.in.which.taxes.are.distributed.based.directly.on.land.and.building.value.to.$227.under.the.class.rate/tax.capacity.system .Meanwhile,.the.business.property.tax.increases.from.$6,667.to.$9,091

The.primary.goal.of.“class.rate.compression”.was.to.reduce.business.property.taxes.and.increase.the.share.of.local.property.taxes.borne.by.homeowners.by.reducing.the.disparity.between.the.highest.business.class.rate.and.the.lowest.homestead.class.rate 5.The.ratio.of.the.highest.business.class.rate.to.the.lowest.homestead.class.rate.fell.from.5 25.to.1.in.1989.to.3 4.to.1.in.2001 .As.a.result.of.the.changes.enacted.by.the.legislature.in.2001,.the.disparity.fell.further.to.2.to.1.in.2002,.where.it.remains.today

A.comparison.of.homestead.and.business.class.rates.is.not.an.entirely.accurate.way.to.gauge.the.property.tax.disparity.between.homesteads.and.businesses.for.four.reasons:

1) Unlike.most.states,.Minnesota.does.not.tax.personal.property.(e g ,.fixtures,.equipment,.and.inventories) 6.Because.personal.property.comprises.a.larger.percentage.of.business.value.than.of.homestead.value,.businesses.derive.a.greater.benefit.from.the.personal.property.exemption.than.do.homesteads .A.simple.comparison.of.homestead.and.business.class.rates.ignores.the.relative.advantage.that.businesses.receive.as.a.result.of.the.personal.property.exemption.and.thereby.overstates.the.business.taxes.relative.to.homestead.taxes

2) A.comparison.of.the.highest.business.class.rate.to.the.lowest.homestead.class.rate.overstates.business.property.taxes.relative.to.homesteads.because.13 3.percent.of.commercial/industrial.value.is.assessed.at.a.rate.below.the.highest.rate,.while.4 6.percent.of.homestead.value.is.assessed.at.a.rate.above.the.lowest.rate.(based.on.data.for.taxes.payable.in.2010)

3) A.comparison.of.business.and.homestead.class.rates.overlooks.the.fact.that.a.significant.percentage.of.property.taxes.are.spread.against.referendum.market.value—an.alternative.tax.base.which.is.not.subject.to.class.rates .In.2010,.10.percent.of.the.gross.property.tax.levy.in.Minnesota.is.spread.against.referendum.market.value .By.ignoring.referendum.market.value.levies,7.a.simple.comparison.of.class.rates.again.overstates.business.property.taxes.relative.to.homesteads

5 Classratecompressionalsofocusedonreducingtheclassratedisparitybetweenrentalpropertyandhomesteadproperty.Theprimaryfocusofthediscussionhereisonthebusiness-homesteadclassratedisparity,whichisthelargestdisparitybothintermsoftheclassrategapandintermsoftheamountofvalueinvolved.

6 Theexceptionhereiselectricalgenerationmachinery,whichistaxedinMinnesota.Electricalgenerationmachinerycompriseslessthantwopercentoftaxablebusinessvalueinthestateinthe2009assessmentyear,correspondingtotaxespayablein2010.

7 Forleviesspreadagainstreferendummarketvalue,businessesenjoyataxadvantagerelativetohomesteadsbecausethetaxadvantagethatbusinessesderivefromtheexemptionofpersonalpropertystillapplies,whilethepreferentialtreatmentthathomesteadsderivethroughtheclassrate/taxcapacitysystemdoesnot.Forthisreason,referendummarketvalueleviesimposeahighereffectivetaxrate(i.e.,propertytaxasapercentageoftotalrealandpersonalmarketvalue)onhomesteadsthanonbusinesses.

11Minnesota 2020 - www.mn2020.org

4) Homesteads.receive.some.forms.of.tax.relief.that.business.properties.do.not .For.example,.homestead.property.taxes.are.reduced.through.the.market.value.homestead.credit,.the.taconite.homestead.credit,.and.the.homeowners’.property.tax.refund .A.simple.comparison.of.class.rates.ignores.these.additional.forms.of.property.tax.relief.that.homesteads.receive

In.addition.to.providing.business.property.tax.relief,.the.goal.of.class.rate.compression.was.to.discourage.local.government.spending.growth.by.shifting.a.larger.share.of.marginal.property.tax.increases.on.to.homesteads .Lost.on.proponents.of.class.rate.compression.was.the.fact.that.per.capita.county.and.city.spending.levels.were.essentially.flat.during.the.1990s,8.so.to.some.extent.compression.was.addressing.a.problem.that.did.not.exist

Class.rate.compression.results.in.a.shift.of.property.taxes.from.business.properties.on.to.homesteads .However,.in.2002.homestead.property.tax.increases.were.prevented.in.the.vast.majority.of.Minnesota.communities.through.the.elimination.of.the.general.education.property.tax.and.through.the.market.value.homestead.credit,.discussed.below .In.fact,.on.a.statewide.basis.homesteads.enjoyed.greater.property.tax.relief.than.businesses.in.2002 .From.2001.to.2002,.aggregate.homestead.property.taxes.declined.by.14.percent,.while.commercial/industrial.taxes.declined.by.4.percent

However,.residual.effects.of.class.rate.compression.upon.homesteads.that.occurred.after.2002.were.not.“bought.off”.through.new.forms.of.property.tax.relief.and.thus.homestead.property.taxes.increased .In.2003,.homestead.property.taxes.in.the.metropolitan.area.increased.because.of.the.interaction.between.the.2002.class.rate.compression.and.the.metropolitan.tax.base.sharing.program,.commonly.referred.to.as.the.fiscal.disparity.program .Because.of.a.year.lag.in.the.tax.base.data.used.to.make.fiscal.disparity.calculations,.the.effects.of.class.rate.compression.first.implemented.in.2002.did.not.affect.fiscal.disparity.tax.collections.until.2003 .The.corresponding.decline.in.revenue.generated.through.the.fiscal.disparity.program.in.2003.meant.that.a.larger.share.of.local.certified.levies.were.borne.by.homeowners.in.the.metropolitan.area 9

The.property.tax.changes.enacted.in.2001.also.reduced.rental.(i e ,.non-homestead.residential.properties.and.apartments).class.rates,.some.of.which.did.not.occur.until.taxes.payable.in.2003.and.2004 .The.rental.class.rate.reductions.occurring.in.2003.and.2004.produced.a.shift.in.taxes.on.to.homesteads.and.other.non-rental.properties.that.was.not.bought.off.through.increased.state.aids..or.credits

8 BasedonannualcityandcountyexpenditurereportsfromtheOfficeoftheStateAuditoradjustedforinflation,percapitatotalcityexpendituresdeclinedby0.9percentandcountyexpendituresdeclinedby0.1percentfrom1990to2000.

9 Asimilarshiftalsooccurredin2003inthetaconitereliefareaduetoaninteractionbetweenclassratecompressionandthetaconitefiscaldisparityprogram.However,becausethevalueinvolvedinthetaconitefiscaldisparityprogramissmallincomparisontototaltaxablevalue,theshiftontohomesteadswassmall.

12 Minnesota 2020 Property Tax report: 2002 - 2010

Class.rate.compression.also.had.an.impact.on.how.state.aid.cuts.that.occurred.after.2002.would.affect.homeowners .After.the.class.rate.compression.enacted.in.2001,.homesteads.comprised.a.larger.percentage.of.the.local.tax.base;.for.example,.primarily.as.a.result.of.class.rate.compression,.homesteads.jumped.from.47.percent.of.the.statewide.city.“tax.capacity”.tax.base.in.2001.to.53.percent.in.2002 .As.local.governments.raised.property.taxes.to.replace.a.portion.of.the.reduction.in.state.aid,.a.larger.share.of.the.property.tax.increase.fell.on.homeowners.than.would.have.been.the.case.prior.to.2002

As.noted.above,.the.growth.in.referendum.market.value.levies,.which.was.in.part.due.to.the.decline.in.school.aid.after.2002.(FY.2003),.also.contributed.to.the.increase.in.homestead.property.taxes .Referendum.market.value.levies.are.distributed.among.property.types.based.directly.on.total.land.and.building.value,.similar.to.the.first.hypothetical.example.described.above,.except.that.some.classes.of.property—such.as.agricultural.land.and.residential.cabins—are.exempted.entirely .Unlike.levies.that.are.distributed.among.properties.based.on.the.class.rate/tax.capacity.system,.levies.distributed.based.on.referendum.market.value.afford.no.preferential.tax.treatment.to.homesteads .Thus,.as.referendum.market.value.levies.increase.as.a.percentage.of.total.levies,.the.share.of.total.property.taxes.paid.by.homeowners.increases

a new state property tax

The.elimination.of.the.general.education.property.tax.combined.with.class.rate.compression.would.have.produced.a.huge.windfall.of.business.property.tax.relief.in.2002 .In.order.to.reduce.the.magnitude.of.business.property.tax.relief.and.to.generate.additional.revenue.for.the.state.general.fund,.the.state.imposed.on.businesses.a.new.state.property.tax .The.new.state.tax.also.applied.to.seasonal.recreational.residential.property 10

In.future.years,.growth.in.the.state.property.tax.was.linked.to.inflation.as.measured.by.the.implicit.price.deflator.for.state.and.local.government.purchases .However,.the.state.levy.was.not.linked.to.growth.in.the.state’s.economy.or.population;.consequently,.the.real.(i e ,.inflation.adjusted).per.capita.state.property.tax.levy.on.businesses.actually.declined.by.about.six.percent.from.2002.to.2010

The.state.property.tax.levy.also.helped.to.insulate.a.portion.of.business.property.taxes.from.growth.in.local.property.taxes.that.was.occurring.as.a.result.of.the.reduction.in.state.aid .While.homestead.property.taxes.were.increasing,.approximately.one.quarter.of.statewide.business.property.taxes.were.declining.in.real.per.capita.dollars .The.presence.of.the.state.property.tax.levy.is.one.of.the.reasons.why.homestead.property.taxes.have.increased.more.rapidly.than.business.property.taxes.since.2002

10 Effectivefortaxespayablein2006,theseasonalrecreationalportionofthestatepropertytaxbasewasseparatedfromthebusinessportionandsubjectedtoalowerstatetaxrate.

The presence of the state property tax levy is one of the reasons why homestead property taxes have increased more rapidly than business property taxes since 2002.

13Minnesota 2020 - www.mn2020.org

Phase-out of the limited market value program

The.limited.market.value.(LMV).program.was.implemented.in.1994.to.protect.owners.of.homestead,.agricultural,.and.cabin.property.from.tax.increases.resulting.from.rapid.growth.in.value 11.Under.the.LMV.program,.growth.in.the.taxable.value.of.eligibile.property.is.limited.to.a.percentage.of.the.prior.year.taxable.value.or.a.portion.of.the.assessed.value.growth.from.the.prior.year.to.the.current.year,.whichever.is.greater .By.restricting.the.rate.of.taxable.value.growth.in.a.single.year,.the.LMV.program.helps.to.spread.over.time.the.impact.of.property.tax.increases.resulting.from.rapid.escalation.in.property.values

Assessors.generally.oppose.programs.such.as.LMV.which.result.in.properties.being.taxed.at.less.than.full.market.value .Assessors.point.out.that.the.LMV.program.can.create.tax.fairness.issues,.since.it.can.result.in.owners.of.identical.properties.located.in.the.same.taxing.jurisdictions.paying.different.property.taxes .Proponents.of.LMV.argue.that.the.program.simply.cushions.property.owners.from.the.effects.of.rapid.value.growth.by.spreading.tax.increases.out.over.time;.any.tax.unfairness.resulting.from.LMV,.they.argue,.is.temporary

In.2001.the.legislature.sided.with.opponents.of.LMV.and.required.that.the.program.be.gradually.phased-out.beginning.for.taxes.payable.in.2003;.during.the.phase-out.period,.caps.on.valuation.growth.would.gradually.be.loosened,.allowing.for.more.rapid.growth.in.taxable.value .Under.the.2001.tax.act,.LMV.would.have.been.fully.eliminated.for.taxes.payable.in.2008;.however,.in.light.of.rapid.property.tax.growth.among.properties.eligible.for.the.LMV.program,.the.legislature.opted.to.extend.LMV.for.two.additional.years .Tax.payable.year.2010.is.the.first.year.since.1993.with.no.LMV.restrictions.on.taxable.value

In.the.years.immediately.following.the.implementation.of.the.LMV.phase-out.(2003.through.approximately.2006),.the.phase-out.contributed.to.higher.aggregate.statewide.homestead.property.taxes .After.that,.it.is.not.clear.if.the.LMV.phase-out.was.causing.higher.or.lower.aggregate.homeowner.property.taxes.because.no.one.has.calculated.what.homestead.property.taxes.would.have.been.if.the.parameters.of.the.LMV.program.in.2002.(i e ,.prior.to.the.phase-out).had.been.left.in.place.unchanged .While.the.impact.of.the.LMV.phase-out.upon.aggregate.statewide.homestead.property.taxes.is.unclear,.there.is.no.doubt.that.the.majority.of.homesteads.in.the.state.received.no.benefit.from.the.LMV.program.during.the.entire.phase-out.period

It.is.difficult.to.know.with.certainty.if.statewide.homestead.property.taxes.would.be.higher.or.lower.in.2010.if.the.LMV.program.as.constituted.for.taxes.payable.in.2002.would.have.been.left.in.place .However,.we.can.safely.conclude.that.the.LMV.phase-out.contributed.to.growth.in.statewide.homestead.property.taxes.in.2003.and.the.years.immediately.thereafter

11 TheLMVprogramwaslaterexpandedtoincludetimberland.AnLMVprogramwasalsoineffectforMinnesotafortaxpayableyears1974to1980.

14 Minnesota 2020 Property Tax report: 2002 - 2010

Market value homestead credit

The.market.value.homestead.credit.was.enacted.in.2001.and.implemented.for.taxes.payable.in.2002.as.a.replacement.for.the.“education.homestead.credit”.and.as.a.way.of.preventing.possible.homestead.property.tax.increases.that.could.occur.as.a.result.of.class.rate.compression

The.amount.of.the.market.value.homestead.credit.for.a.particular.property.is.entirely.dependent.on.the.taxable.market.value12.of.the.property .For.homesteads.with.a.taxable.value.of.$76,000.or.less,.the.market.value.homestead.credit.equals.0 4.percent.of.the.property.value .Thus,.a.homestead.with.a.taxable.value.of.$76,000.would.receive.a.market.value.homestead.credit.of.$304.($76,000.x.0 4%) .As.home.values.grow.beyond.$76,000,.the.credit.shrinks.at.rate.of.90.cents.per.every.$1,000.of.value.until.hitting.zero.at.a.value.of.$413,778;.all.homesteads.with.a.value.of.$413,778.or.more.receive.no.market.value.homestead.credit

12 Taxablemarketvalueisequaltothe“estimatedmarketvalue”(seefootnote2)minusvalueexcludedfromtaxationastheresultofspecialstatutoryprograms,suchastheLimitedMarketValueprogramor“GreenAcres”program.Formoreonhomesteadtaxablemarketvalue,see:http://taxes.state.mn.us/property_tax_administrators/pages/admin_ed_calc_course_part1_1.aspx

15Minnesota 2020 - www.mn2020.org

Statewide.homestead.taxable.value.grew.from.2002.to.2008.before.leveling.off.in.2009.and.declining.in.2010 .The.homestead.value.growth.from.2002.to.2008.caused.a.significant.decline.in.the.market.value.homestead.credit .The.graph.below.shows.the.statewide.homestead.taxable.value.(left.axis).and.the.market.value.homestead.credit.(right.axis) .To.facilitate.comparison,.both.amounts.are.shown.in.nominal.dollars.(i e ,.unadjusted.for.inflation)

The.graph.illustrates.how.statewide.market.value.homestead.credit.payments.are.inversely.related.to.homestead.taxable.value .As.homestead.taxable.value.increased.from.2002.to.2008,.the.nominal.statewide.market.value.homestead.credit.declined.by.$59.million.or.18 2.percent .Flat.homestead.values.from.2008.to.2009.translated.into.virtually.no.change.in.the.amount.of.the.statewide.market.value.homestead.credit .Finally,.the.decline.in.statewide.homestead.values.in.2010.led.to.a.corresponding.increase.in.the.credit

In.constant.2010.dollars,.the.market.value.homestead.credit.declined.by.$159.million.(36 6.percent).from.2002.to.2010 .As.the.amount.of.the.credit.declines,.the.net.homestead.property.tax.increases.by.an.equivalent.amount,.all.other.things.being.equal .This.is.yet.another.feature.of.the.2001.tax.act.that.has.contributed.to.growth.in.homestead.property.taxes.over.time

iii. sTaTe aid reduCTions

The.2001.tax.act.did.not.mandate.state.aid.reductions.in.future.years .However,.the.act.did.extend.state.spending.commitments.in.ways.that.were.unsustainable.in.the.long.term.without.new.state.revenues .With.a.governor.committed.to.a.“no.new.tax”.agenda,.broad.based.revenue.increases.were.off.the.table.and.state.budget.reductions.became.inevitable .A.disproportionate.share.of.these.budget.reductions.took.the.form.of.cuts.in.state.aid.to.local.governments

16 Minnesota 2020 Property Tax report: 2002 - 2010

These.state.aid.cuts.are.the.primary.cause.of.statewide.property.tax.increases.since.2002 .The.graph.below.examines.the.change.in.statewide.local.government.revenue,.property.taxes,.and.state.aid.in.constant.2010.dollars.since.2002

From.2002.to.2010,.property.taxes.imposed.by.local.governments.increased.by.$1 7.billion.in.constant.2010.dollars 13.However,.this.growth.in.property.taxes.cannot.be.attributed.to.growth.in.local.government.budgets;.since.2002.total.local.government.revenue.declined.by.$613.million 14

The.primary.cause.of.statewide.property.tax.growth.is.reductions.in.state.aid.to.local.governments .From.2002.to.2010,.state.aid.to.local.governments.declined.by.$2 6.billion.(21 7.percent).in.constant.2010.dollars .The.local.property.tax.increase.was.sufficient.to.replace.approximately.two-thirds.of.state.aid.cuts .The.balance.of.the.state.aid.cut.was.dealt.with.primarily.by.cutting.local.budgets

It.should.also.be.noted.that.at.the.same.period.that.local.government.revenue.fell.by.$600.million,.the.statewide.population.that.local.governments.must.provide.services.to.increased.by.approximately.six.percent.(although.statewide.school.enrollment.declined.by.1 2.percent)

13 Amountsinthissectionarecalculatedbasedondatafromthe2010End-of-SessionPriceofGovernment(POG)report.POGdatafor2008through2010(FY2009andFY2011)areestimates.

14 Theparticularlylargedeclineintotallocalgovernmentrevenuefrom2007to2008wasdriveninpartbyaidunallotmentsin2008thatoccurredafterpropertytaxleviesforthatyearhadbeenset.Becauselocalgovernmentswereunableinincreasepropertytaxesin2008toreplaceevenaportionoftheaidcuts,totallocalrevenuedeclined.Localgovernmentswereabletolevytoreplacesomeoftheseaidcutsin2009,whichexplainsaportionoftherevenueincreasefrom2008to2009.2008wasalsoarelativelyhighinflationyearforstateandlocalgovernments,whichcontributedtoadeclineininflation-adjustedrevenue.

17Minnesota 2020 - www.mn2020.org

The.following.graph.adjusts.for.the.impact.of.population.growth.by.showing.the.change.since.2002.in.total.local.property.taxes.and.school,15.county,.and.city.revenue.on.a.per.capita.basis 16.School.revenues.are.shown.on.a.per.capita.basis.to.facilitate.comparison.to.other.data.in.the.graph .In.addition,.because.school.costs.are.driven.more.by.changes.in.school.enrollment.than.on.changes.in.the.entire.statewide.population,.the.change.in.school.revenue.is.also.show.on.a.per.pupil.basis

On.a.statewide.basis,.local.property.taxes.increased.by.24 3.percent.from.2002.to.2010 .However,.the.property.tax.increases.were.not.sufficient.to.replace.the.cuts.in.state.aid.that.occurred.over.this.period .As.a.result,.per.capita.county.and.city.revenue.and.per.pupil.school.revenue.declined.over.this.period .The.following.information.is.based.on.the.2010.end-of-session.Price.of.Government.report.from.Minnesota.Management.&.Budget,.which.includes.nearly.all.revenue.and.state.aid.dollars.received.by.local.governments

15 Schoolrevenuesshownhereexcludeestimatedone-timefederaldollars,withtheexceptionof$500millionthatschooldistrictsreceivedinFY2010toreplaceaone-timecutinstategeneraleducationaid.One-timefederaldollarsareexcludedbecausetheyexaggeratetherevenueavailabletofundschooloperationsonanongoingbasis;basedondatausedinthe2010PriceofGovernmentreport,one-timefederaldollarsgoawayafterFY2011(correspondingtotaxespayablein2010).

16 Omittedfromthisgrapharetownshipandspecialtaxingdistrictrevenues,whichcompriselessthanfivepercentoftotallocalgovernmentrevenuebasedonPriceofGovernmentdatafor2009.

18 Minnesota 2020 Property Tax report: 2002 - 2010

•...For.counties,.per.capita.state.aid.is.projected.to.fall.by.33 8.percent.from.2002.to.2010 .This.projected.decline.in.aid.is.the.principal.cause.of.a.13 3.percent.increase.in.per.capita.county.property.taxes.and.an.8 7.percent.decline.in.total.per.capita.county.revenue 17

•...For.cities,.per.capita.state.aid.is.projected.to.fall.by.45 8.percent.from.2002.to.2010,.contributing.to.a.projected.14 0.percent.growth.in.per.capita.city.property.taxes.and.a.15 1.percent.decline.in.per.capita.city.revenue

•...For.school.districts,.per.pupil.state.aid.is.projected.to.fall.by.13 9.percent.from.fiscal.year.2003.to.2011,.corresponding.to.tax.payable.years.2002.to.2010 .This.state.aid.loss.has.driven.a.64 0.percent.increase.in.property.taxes.per.pupil.and.a.per.pupil.revenue.decline.of.about.2 7.percent,.excluding.one-time.federal.recovery.dollars .The.percentage.increase.in.school.property.taxes.is.extremely.high.because.school.property.taxes.for.2002.were.extremely.low.due.to.the.elimination.of.the.general.education.property.tax

Over.the.eight.year.span.from.2002.to.2010,.total.local.revenues.fell.despite.new.cost.drivers.that.were.foisted.on.local.governments .For.example,.new.testing.requirements.and.higher.achievement.standards.were.mandated.for.public.schools .In.addition,.the.state.shifted.responsibility.for.incarcerating.short-term.felony.offenders.to.counties.and.mandated.that.counties.pay.ten.percent.of.the.medical.assistance.costs.for.nursing.homes.stays.in.excess.of.90.days.for.people.under.age.65

All.three.levels.of.local.government.follow.the.same.basic.pattern:.cuts.in.state.aid.caused.both.reduced.funding.for.local.services.and.infrastructure.and.higher.property.taxes .State.aid.reductions,.not.local.spending.increases,.were.the.driving.force.behind.property.tax.increases.since.2002

The.relationship.between.aid.reductions.and.property.tax.increases.is.complicated.when.aid.cuts.occur.after.aid.to.local.governments.is.already.certified .The.Minnesota.Department.of.Revenue.notifies.counties.and.cities.of.the.County.Program.Aid.(CPA).and.city.Local.Government.Aid.(LGA).they.will.receive.in.a.calendar.year.based.on.current.law.during.the.summer.of.the.preceding.year;.the.act.of.notifying.counties.and.cities.of.their.anticipated.CPA.and.LGA.payments.is.known.as.“aid.certification ”.For.example,.CPA.and.LGA.for.2010.were.certified.during.the.summer.of.2009 .The.state.certifies.CPA.and.LGA.during.the.summer.of.the.preceding.year.so.that.counties.and.cities.know.how.much.CPA.and.LGA.they.will.be.receiving.when.they.set.their.property.tax.levy.in.the.fall.for.the.upcoming.year

However,.occasionally.CPA.and.LGA.are.reduced.after.aid.amounts.have.been.certified .This.can.occur.through.unallotment.or.through.statutory.changes .Cuts.to.certified.aid.amounts.have.become.more.common.in.recent.years.due.to.large.state.budget.deficits .Reductions.in.certified.CPA.and.LGA.occurred.in.2003,.2008,.2009,.and.2010

17 Theseamountsincludeanapproximateadjustmentforthepartialstatetakeoverofcourtadministrationcosts.Withoutthisadjustment,thedeclineinpercapitacountyaidandtotalrevenuewouldhavebeen36.8percentand9.9percentrespectively.

state aid reductions, not local spending increases, were the driving force behind property tax increases since 2002.

19Minnesota 2020 - www.mn2020.org

Typically,.reductions.in.certified.CPA.and.LGA.amounts.occur.after.local.jurisdictions.have.set.their.property.tax.levy.for.the.upcoming.year .Because.local.governments.can.no.longer.increase.property.taxes.to.replace.their.CPA.or.LGA.reduction,.local.governments.are.left.with.a.hole.in.their.budgets.which.must.be.made.up.through.expenditure.reductions,.utilization.of.budget.reserves,.or,.if.necessary,.borrowing

Generally,.CPA.and.LGA.reductions.can.be.recovered.through.property.tax.increases.in.the.subsequent.year .For.example,.a.reduction.in.the.city.LGA.certified.in.the.summer.of.2008.for.calendar.year.2009.can.be.recovered.(in.part.or.in.total).through.an.increase.in.property.taxes.payable.in.2010 .The.bottom.line.is.that.reductions.in.certified.CPA.and.LGA.amounts.that.occur.after.the.levy.for.the.upcoming.year.is.set.do.not.impact.property.taxes.until.the.year.after.the.cut.occurs

In.each.of.the.last.three.years,.the.state.also.cut.the.market.value.homestead.credit.payments.received.by.local.governments 18.Market.value.credit.payments.are.not.certified.to.counties.and.cities.in.the.way.that.CPA.and.LGA.are .Nonetheless,.cuts.in.market.value.credits.made.after.the.levy.certification.date.leave.counties,.cities,.and.towns.(to.date,.school.districts.have.not.been.subject.to.market.value.credit.cuts).with.an.unanticipated.shortfall.in.their.budgets.that.must.be.made.up.for.through.expenditure.reductions,.utilization.of.budget.reserves,.or.borrowing

As.with.CPA.and.LGA.reductions.that.occur.after.the.date.that.the.final.levy.is.set,.market.value.credit.cuts.can.be.recovered.through.a.property.tax.levy.increase.in.the.subsequent.year .For.this.reason,.a.spike.in.property.taxes.and.revenue.can.occur.in.the.year.after.CPA,.LGA,.and.market.value.credit.cuts.are.made

For.example,.the.2008.cuts.in.LGA,.CPA,.and.county.and.city.market.value.credit.payments..caused.a.significant.drop.in.county.and.city.revenues.in.that.year .In.2009,.counties.and.cities.were.able.to.increase.property.taxes.to.recover.a.portion.of.the.aid.and.credit.cuts.made.in.2008,.causing.an.increase.in.county.and.city.revenues.in.2009.relative.to.2008 .This.can.be.seen.in.the.graph.on.page.17

Furthermore,.the.small.increase.in.property.taxes.from.2009.to.2010.was.likely.due.in.part.to.the.fact.that.2009.county.and.city.aid.cuts.made.after.2009.levies.were.set.were.slightly.lower.than.cuts.made.in.the.preceding.year .In.addition,.the.absence.of.large.property.tax.increases.in.2010.despite.large.cuts.in.county.and.city.aid.is.partially.because.many.of.the.2010.aid.cuts.were.made.after.2010.property.tax.levies.were.set.and.thus.could.not.be.recovered.in.the.2010.property.tax.year .The.timing.of.state.aid.cuts.affect.whether.the.cuts.impact.property.taxes.in.the.current.year.or.the.subsequent.year

18 Inrecentyears,thecountyshareofthemarketvaluehomesteadcreditwascutin2008and2010,thetownshipsharewascutin2009and2010,andthecitysharewascutin2008,2009,and2010.Insomestatepublications—andelsewhereinthisreport—credits,suchasthemarketvaluehomesteadcredit,arereferredtobythegenericterm“stateaid.”Technically,“aid”referstopaymentsmadebythestatetolocalgovernmentspriortolevycertification.Credits—ontheotherhand—refertostatepaidpropertytaxrelieftargetedtospecificclassesofproperty.“Stateaid”typicallyreducesthepropertytaxespaidbyallpropertieswithinajurisdictionbyreducingthelocaltaxrate,whereascreditsprovidereliefonlytoaspecificsubsetofproperties.

... local governments are left with a hole in their budgets which must be made up through expenditure reductions, utilization of budget reserves, or, if necessary, borrowing.

20 Minnesota 2020 Property Tax report: 2002 - 2010

While.there.have.been.property.tax.and.revenue.fluctuations.among.local.governments.since.2002,.the.overall.pattern.is.clear .Local.property.tax.increases.have.been.unable.to.fully.compensate.for.large.state.aid.cuts,.so.total.local.revenue.has.fallen .Aggregate.statewide.property.tax.increases.over.the.last.eight.years.are.the.result.of.state.aid.reductions,.not.local.spending.increases

iv. The role of ProPerTy valuaTion

Property.values.plays.an.important.role.in.determining.the.property.tax.borne.by.a.property .However,.the.relationship.between.property.valuation.and.property.taxation.is.often.not.fully.understood

An.increase.in.the.value.of.a.property.from.one.year.to.the.next.does.not.necessarily.translate.into.a.property.tax.increase.for.that.property .The.critical.variable.in.determining.how.property.value.affects.property.taxes.is.not.the.absolute.growth.or.decline.in.value,.but.rather.how.a.property’s.value.compares.to.the.rest.of.the.tax.base

To.illustrate,.consider.a.hypothetical.situation.in.which.property.taxes.are.driven.exclusively.by.the.local.levy.and.local.property.values .Suppose.the.value.of.a.homestead.increases.by.10.percent.

from.one.year.to.the.next .Further.suppose.that.the.levy.of.the.city.where.the.homestead.is.located.remains.constant .If.the.value.of.other.property.in.the.city.also.increases.by.10.percent,.then.the.value.of.the.homestead.will.not.increase.relative.to.the.rest.of.the.tax.base.and.the.portion.of.the.city.property.tax.borne.by.the.homestead.will.also.not.increase .In.this.simplified.example.(which.ignores.the.complexities.resulting.from.classification,.credits,.and.so.forth),.the.critical.factor.in.determining.the.property.tax.paid.by.a.homeowner.(or.any.other.property.owner).is.not.the.value.of.his.property.

in.isolation,.but.the.value.relative.to.all.other.properties.in.the.city

During.the.period.from.2002.to.2008.(corresponding.to.assessment.years.2001.to.2007),.the.estimated.market.value.of.all.Minnesota.homesteads.increased.by.a.whopping.79.percent.in.nominal.dollars .This.large.growth.has.led.some.to.conclude.that.homestead.value.increases.must.have.been.driving.homestead.property.tax.increases .For.example,.in.2007.the.Minnesota.Taxpayers.Association.stated.that.the.period.since.2002.“marked.a.rapid.increase.in.home.values.relative.to.other.properties.and.their.corresponding.assumption.of.a.greater.share.of.the.property.tax.burden ”19

19 FiscalFocus(MinnesotaTaxpayers’Associationpublication),May-June2007.

local property tax increases have been unable to fully compensate for large state aid cuts, so total local revenue has fallen.

The critical variable in determining how property value affects property taxes is not the absolute growth or decline in value, but rather how a property’s value compares to the rest of the tax base.

21Minnesota 2020 - www.mn2020.org

In.fact,.homestead.estimated.market.values.(EMV).grew.less.rapidly.than.the.rest.of.the.tax.base.during.the.period.under.consideration .Thus,.the.homestead.share.of.statewide.EMV.declined.from.2002.to.2008.and.thus.growth.in.homestead.EMV.does.not.explain.the.growth.in.homestead.property.taxes.during.this.period 20.The.graph.below.shows.statewide.homestead.EMV.as.a.percent.of.total.Minnesota.EMV.during.the.entire.period.from.2002.to.2010

While.trends.in.homestead.EMV.do.not.explain.the.growth.in.homestead.property.taxes.from.2002.to.2008,.they.do.play.a.role.in.explaining.the.leveling.and.decline.of.homestead.property.taxes.in.2009.and.2010 .With.the.foreclosure.crisis.and.the.decline.in.home.values,.homestead.EMV.shrunk.as.a.percentage.of.total.EMV .This.factor,.combined.with.the.waning.of.other.forces.that.had.been.pushing.homestead.property.taxes.higher.in.previous.years,.explains.the.leveling.and.decline.in.homestead.property.taxes.in.2009.and.2010

20 Itisimportanttodistinguishbetween“estimatedmarketvalue”(EMV)and“taxablemarketvalue”(TMV).Asnotedabove,TMVdiffersfromEMVinthatTMVdoesnotincludevalueexcludedfromtaxationduetospecialstatutoryprograms,suchasthelimitedmarketvalue(LMV)or“GreenAcres”programs.HomesteadTMVasapercentageoftotalTMVincreasedslightlyfrom2002to2007(assessmentyear2001to2006),butdeclinedslightlyfrom2002to2008(assessmentyear2001to2007).EvenduringtheperiodwhenhomesteadTMVincreasedasapercentageoftotalTMV,thatgrowthwasnotduetogrowthinhomesteadEMV,buttothelegislativedecisiontophase-outtheLMVprogram,describedabove.Thus,itwouldbeamistaketoconcludethatmarketforceswereresponsiblefortheslightincreaseinthehomesteadshareoftotalTMVduringtheperiodfrom2002to2007.

22 Minnesota 2020 Property Tax report: 2002 - 2010

v. exPlaining hoMesTead ProPerTy Tax groWTh

As.noted.above,.property.tax.increases.in.Minnesota.since.2002.have.been.driven.primarily.by.state.aid.reductions,.not.increases.in.local.government.spending .However,.aid.reductions.do.not.explain.why.homestead.property.taxes.have.risen.more.rapidly.than.property.taxes.in.general .This.section.will.compare.homestead.property.taxes.to.total.Minnesota.property.taxes.from.2002.to.2010.in.light.of.factors.identified.in.previous.sections.of.this.report,.including:

•...Changes.in.estimated.market.value.(EMV),

•...The.phase-out.of.the.Limited.Market.Value.(LMV).program,

•...Class.rate.compression,

•...The.state.tax.on.commercial/industrial.property,

•...Growth.in.referendum.market.value.levies,.and

•...The.structure.of.the.market.value.homestead.credit

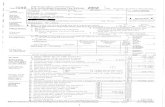

The.table.below.shows.statewide.residential.homestead.and.total.Minnesota.property.taxes.from.2002.to.2010.in.constant.2010.dollars .The.amounts.include.local.property.taxes.plus.state.property.taxes.collected.from.commercial/industrial.and.seasonal-recreational.properties

sTaTe ToTal ConsTanT 2010 dollars, in Millions

2002 2003 2004 2005 2006 2007 2008 2009 2010res. hoMesTead Tax 2,534 2,846 3,001 3,110 3,323 3,427 3,436 3,562 3,501 ToTal ProPerTy Tax 6,210 6,518 6,675 6,672 6,948 7,185 7,342 7,819 7,877

The.graph.below.examines.the.percent.change.in.statewide.residential.homestead.and.total.property.taxes.since.2002.based.on.the.amounts.from.the.above.table

23Minnesota 2020 - www.mn2020.org

From.2002.to.2010,.residential.homestead.property.taxes.increased.by.38 2.percent,.while.total.statewide.property.taxes.increased.by.26 8.percent .(The.increase.in.nominal.dollars.over.this.same.period.is.87 1.percent.for.homesteads.and.71 8.percent.for.total.property.taxes )

Growth.in.homestead.EMV.played.a.small.role.in.the.homestead.property.tax.growth.in.2003,.since.homestead.EMV.increased.as.a.percentage.of.the.total.EMV.of.all.properties.in.that.year .However,.homestead.EMV.as.a.percent.of.all.EMV.remained.essentially.flat.over.the.next.two.years,.yet.growth.in.homestead.property.taxes.still.exceeded.growth.in.total.property.taxes

After.2005,.homestead.EMV.as.a.percent.of.the.total.EMV.of.all.properties.dropped.steadily .By.2010,.homestead.EMV.was.just.52 6.percent.of.total.EMV,.a.decline.of.6 7.percent.over.the.course.of.five.years .All.other.things.being.equal,.homestead.property.taxes.should.have.declined.or.grown.less.rapidly.than.total.property.taxes.over.this.period.based.on.trends.in.EMV

However,.all.other.things.were.not.equal .Other.factors.offset.the.property.tax.relief.that.homesteads.should.have.received.as.a.result.of.their.decline.as.a.percentage.of.statewide.EMV .The.first.of.these.was.the.phase-out.of.the.limited.market.value.(LMV).program,.which.began.in.2003 .Despite.the.fact.that.homestead.EMV.as.a.percentage.of.the.statewide.total.was.essentially.flat.from.2003.to.2005,.the.homestead.share.of.taxable.value.steadily.increased.as.more.homestead.value.became.taxable.as.a.result.of.the.LMV.phase-out .This.contributed.to.homestead.property.tax.increases.in.these.years .After.2005,.it.is.difficult.to.know.with.certainty.the.impact.of.the.LMV.phase-out.upon.growth.in.homestead.property.taxes 21

In.addition.to.the.phase-out,.the.recent.decline.of.homestead.values.began.to.make.the.LMV.program.increasing.irrelevant.to.a.large.number.of.homeowners .Even.without.a.phase-out,.the.amount.of.property.value.excluded.from.taxation.under.LMV.declines.when.property.EMVs.are.flat.or.declining .However,.during.the.early.years.of.the.LMV.phase-out.that.began.in.2003,.the.phase-out.did.contribute.to.higher.homestead.property.taxes

The.class.rate.compression.enacted.by.the.legislature.in.2001.also.contributed.to.homestead.property.tax.increases.in.2003.and,.to.a.lesser.extent,.in.2004 .The.homestead.property.tax.increases.resulting.from.compression.that.occurred.in.2003.was.primarily.the.result.of.an.interaction.with.the.tax.base.sharing.program.known.as.“fiscal.disparities ”.As.a.result.of.the.large.commercial.and.industrial.class.rate.reductions.that.occurred.in.2002,.the.levy.dollars.generated.from.business.properties.through.the.fiscal.disparity.program.dropped.significantly.in.2003,.which.resulted.in.a.larger.share.of.local.certified.levies.being.borne.by.homesteads.and.other.non-business.properties

21 ItisdifficulttoknowpreciselywhenorifaggregatestatewidehomesteadpropertytaxesbegantodeclineasaresultoftheLMVphase-out.WhileannualLMVreportsfromtheDepartmentofRevenue(http://taxes.state.mn.us/legal_policy/pages/research_reports_content_lmv_studies.aspx)showtheshiftoftaxesamongpropertyclassesthatresultsfromtheLMVprogramwithinasingleyear,itdoesnotshowwhatpropertytaxesbyclasswouldhavebeeniftheLMVparametersineffectfortaxespayablein2002(thelastyearbeforecommencementoftheLMVphase-out)wouldhaveremainedineffect.

The homestead property tax increases resulting from compression that occurred in 2003 was primarily the result of an interaction with the tax base sharing program known as “fiscal disparities.”

24 Minnesota 2020 Property Tax report: 2002 - 2010

The.largest.fiscal.disparity.program.in.the.state.is.within.the.seven-county.metropolitan.area22.and.thus.the.greatest.impact.of.the.interaction.between.class.rate.compression.and.the.fiscal.disparity.program.upon.homestead.property.taxes.is.in.that.part.of.the.state .This.contributed.to.higher.homestead.property.tax.increases.in.the.metro.area.in.2003 .The.information.in.appendix.C.shows.that.from.2002.to.2003.the.disparity.between.homestead.and.total.property.tax.growth.was.2 7.percent.greater.in.the.metropolitan.area.than.in.greater.Minnesota

The.class.rate.compression.adopted.by.the.legislature.in.2001.also.included.class.rate.reductions.for.non-homestead.residential.properties.in.2003.and.apartments.in.2003.and.2004 .This.also.contributed.to.property.tax.increases.on.homestead.and.other.non-rental.properties.during.these.two.years,.especially.in.communities.with.large.concentrations.of.rental.property

After.2004,.class.rate.compression.had.little.impact.in.terms.of.contributing.to.the.higher.rate.of.growth.in.homestead.property.taxes,.except.insofar.as.compression.interacted.with.state.aid.reductions .As.noted.above,.real.state.aid.reductions.that.began.in.2003.contributed.to.local.property.tax.increases .As.a.result.of.class.rate.compression,.homesteads.comprised.a.larger.share.of.the.local.tax.base;.consequently,.the.tax.increases.resulting.from.aid.cuts.fell.more.heavily.on.homesteads.than.they.would.have.prior.to.2002

The.state.commercial/industrial.property.tax.levy.also.contributed.to.the.higher.rate.of.homestead.property.tax.growth.relative.to.business.property .The.state.levy.on.business.property.partially.insulates.these.properties.not.only.from.the.impact.of.increasing.spending.demand.arising.from.population.growth,.but.also.from.the.impact.of.state.aid.cuts.that.were.pushing.local.property.taxes.upward .The.presence.of.the.state.property.tax.contributed.to.a.lower.rate.of.business.property.tax.growth.relative.to.homesteads.during.the.period.2002.to.2010 .Approximately.one-quarter.of.property.taxes.paid.by.Minnesota.businesses.is.in.the.form.of.the.state.property.tax.levy

22 Thetaconitereliefareaalsohasafiscaldisparityprogram,butitissmallincomparisontothemetropolitanprogrambothinabsolutedollarsandasapercentofthelocaltaxbase.

The state levy on business property partially insulates these properties from the impact of state aid cuts that were pushing local property taxes upward.

25Minnesota 2020 - www.mn2020.org

The.growth.in.referendum.market.value.levies.also.contributed.to.the.more.rapid.growth.in.homestead.property.taxes .Largely.in.response.to.declining.real.state.aid,.school.districts.began.to.rely.more.heavily.on.“referendum.market.value”.levies.to.fund.school.operating.expenses .The.graph.below.tracks.the.growth.in.statewide.referendum.market.value.levies.(which.are.primarily.for.school.operating.costs).from.2002.to.2010.in.constant.2010.dollars.and.as.a.percentage.of.total.levies .This.graph.includes.non-school.referendum.market.value.levies,.which.comprise.about.four.percent.of.total.referendum.market.value.levies.in.2010

Referendum.market.value.levies.increased.by.167.percent.from.2002.to.2010 .Over.the.same.period,.referendum.market.value.levies.as.a.percentage.of.total.statewide.levies.increased.from.4 5.percent.to.9 7.percent .As.noted.above,.referendum.market.value.levies.fall.more.heavily.on.homesteads.than.do.ordinary.tax.capacity.levies .Thus,.the.increased.reliance.on.referendum.market.value.levies.contributed.to.the.higher.rate.of.growth.in.homestead.property.taxes

The.referendum.market.value.trend.from.2009.to.2010.also.helps.to.explain.the.relative.decline.in.homestead.property.taxes.in.that.year .Referendum.market.value.levies.increased.very.little.in.that.year.as.the.result.of.(1).a.below.average.amount.of.revenue.submitted.to.voters.via.referendum.and.(2).a.below.average.rate.in.the.portion.of.proposed.revenues.that.were.approved .With.little.change.in.referendum.market.value.levies.from.2009.to.2010,.one.of.the.forces.that.had.been.causing.larger.homestead.property.tax.increases.during.the.preceding.seven.years.was.removed

26 Minnesota 2020 Property Tax report: 2002 - 2010

Finally,.the.structure.of.the.market.value.homestead.credit.also.contributed.to.the.faster.rate.of.property.tax.growth.among.homesteads .The.growth.in.homestead.EMV.from.2002.to.2008,.combined.with.the.phase-out.of.the.LMV.program,.contributed.to.a.sharp.rise.in.homestead..taxable.value .Because.the.market.value.homestead.credit.is.inversely.related.to.taxable.homestead.value,.the.credit.declined.as.homestead.taxable.value.increased.from.2002.to.2008 .The.decline.in.the.credit.contributed.to.the.increase.in.net.homestead.property.taxes

Statewide.homestead.EMVs.flattened.and.then.declined.in.2009.and.2010 .In.addition,.the.increase.in.homestead.taxable.value.resulting.from.the.LMV.phase-out.diminished.in.2009.and.2010..as.the.phase-out.reached.its.conclusion .For.these.reasons,.the.market.value.homestead.credit.decline.ceased.in.2009;.in.fact,.the.credit.increased.in.2010 .This.removed,.at.least.temporarily,.one.of.the.factors.than.had.been.pushing.homestead.property.taxes.higher.during.the.period.from.2002.to.2008

In.fact,.many.of.the.forces.that.had.caused.the.more.rapid.rate.of.growth.in.homestead.property.taxes.from.2002.to.2008.were.of.diminished.importance.in.2009.and.2010 .The.LMV.program.ceased.to.be.a.major.contributor.to.increases.in.homestead.taxable.value .The.class.rate.compression.enacted.in.2001—which.contributed.to.a.shift.of.taxes.on.to.homesteads.in.2003.and.2004—was.no.longer.contributing.to.year.to.year.changes.in.property.taxes .Referendum.market.value.levies.did.not.grow .Finally,.the.market.value.homestead.credit.stopped.dropping

The.demise.of.these.forces.allowed.the.decline.in.the.homestead.share.of.statewide.EMV—a.trend.that.had.been.underway.since.2005—to.finally.manifest.itself.in.the.form.of.reduced.homestead.property.taxes.in.2010 .From.2009.to.2010,.aggregate.statewide.homestead.property.taxes.declined.by.$61.million.(1 7.percent).in.constant.2010.dollars.and.the.homestead.share.of.total.statewide.property.taxes.declined.by.1 1.percent

The.above.discussion.has.focused.on.statewide.data .Appendix.C.shows.the.growth.in.homestead.and.total.property.taxes,.as.well.as.homestead.EMV.as.a.percent.of.total.EMV,.within.the.following.groups.of.communities:

•...Seven.county.metropolitan.area

•...Greater.Minnesota

•...Cities.broken.into.15.groups.based.on.cluster.analysis23

23 Usingastatisticaltechniqueknownas“clusteranalysis,”theLeagueofMinnesotaCitieshasclassifiedMinnesotacitiesinto15groupsor“clusters”.Eachcityisassignedtooneoftheseclustersbaseduponitscharacteristics,withsimilarcitiesbeingplacedinthesamecluster.AdescriptionofthemethodologyusedbytheLMCandalistofthecitieswithineachclustercanbefoundat:http://www.lmc.org/media/document/1/clustermethodology.pdf.

The structure of the market value homestead credit also contributed to the faster rate of property tax growth among homesteads.

27Minnesota 2020 - www.mn2020.org

The.general.pattern.observed.in.the.aggregate.statewide.data—that.is,.growth.in.homestead.property.taxes.that.exceeds.the.growth.in.total.property.taxes—is.also.observed.within.all.Minnesota.cities,.all.Minnesota.towns,.metropolitan.cities,.and.greater.Minnesota.cities .It.is.also.observed.within.13.of.the.15.city.clusters

The.city.cluster.that.most.clearly.deviates.from.the.statewide.pattern.in.this.regard.is.the.“metro.high.income.cities,”.which.include.20.high.income.suburbs.in.the.metro.area 24.During.the.period.from.2002.to.2010,.homestead.property.taxes.among.the.cities.in.this.cluster.increased.by.34.percent,.compared.to.45.percent.growth.in.total.property.taxes.paid.by.all.types.of.property .The.characteristics.of.these.cities.that.caused.them.to.deviate.from.the.statewide.pattern.include:

•...Relatively.high.homestead.values .The.2010.average.homestead.value.among.“metro.high.income.cities”.is.$593,000,.compared.to.a.statewide.average.of.$218,000 .Given.that.homesteads.with.a.taxable.value.greater.than.$413,778.receive.no.market.value.homestead.credit,.relatively.few.homesteads.in.metro.high.income.cities.receive.this.credit.and.among.the.homesteads.that.did.receive.it,.the.amount.is.small.in.comparison.to.homesteads.elsewhere.in.the.state .Thus,.property.taxes.on.homesteads.in.metro.high.income.cities.were.affected.relatively.little.by.the.decline.in.the.market.value.homestead.credit,.since.these.homesteads.received.relatively.little.or.no.credit.in.the.first.place

•...A.lower.rate.of.growth.referendum.market.value.levies .From.2002.to.2010,.referendum.market.value.levies.within.metro.high.income.cities.increased.by.97.percent.in.constant.2010.dollars,.compared.to.a.statewide.growth.of.167.percent .The.lower.rate.of.referendum.market.value.levy.growth.in.metro.high.income.cities.contributed.to.a.lower.rate.of.homestead.property.tax.growth.relative.to.other.types.of.property

•...A.tax.base.comprised.overwhelmingly.of.homestead.value .Metro.high.income.cities.have.an.exceptionally.high.concentration.of.homestead.value.and.a.low.concentration.of.commercial/industrial.value.relative.to.other.parts.of.the.state .With.such.a.homogeneous.tax.base,.the.disparity.between.the.homestead.property.tax.growth.and.total.property.tax.growth.is.diminished.because.the.vast.majority.of.all.property.taxes.paid.in.these.cities.are.derived.from.homestead.properties

•...A.relatively.low.dependence.on.fiscal.disparity.distribution.levies .The.shift.of.property.taxes.on.to.homesteads.in.2003.resulting.from.the.interaction.between.class.rate.compression.and.the.metropolitan.fiscal.disparity.program.was.muted.in.metro.high.income.cities.because.these.communities.have.a.very.low.dependence.on.fiscal.disparity.distribution.levies.relative.to.the.rest.of.the.metro.area

•...An.above.average.decline.in.homestead.EMV.relative.to.total.EMV .In.metro.high.income.cities,.homestead.EMV.as.a.percent.of.total.EMV.declined.by.eight.percent.(82 8.percent.to.74 8.percent).from.2002.to.2010,.more.than.in.any.other.cluster.in.the.state .The.exceptionally.large.decline.in.the.relative.share.of.homestead.EMV.partially.explains.why.homestead.property.taxes.declined.as.a.share.of.total.property.taxes.in.these.cities

24 Specifically,“metrohighincome”citiesincludeAfton,Birchwood,Corcoran,Deephaven,Dellwood,Grant,Greenwood,Independence,LakeElmo,Lakeland,LakelandShore,MinnetonkaBeach,Minnetrista,NorthOaks,Orono,PineSprings,Shorewood,SunfishLake,TonkaBay,andWoodland.

28 Minnesota 2020 Property Tax report: 2002 - 2010

As.noted.above,.statewide.homestead.property.taxes.declined.in.2010,.both.in.absolute.terms.and.as.a.share.of.statewide.total.property.taxes .However,.this.trend.will.not.necessarily.continue.into.the.future .For.example,.the.trend.of.declining.homestead.EMV.as.a.percentage.of.state.total.EMV.could.reverse.itself .In.addition,.any.future.growth.in.homestead.EMV—regardless.of.what.happens.to.the.rest.of.the.tax.base—will.contribute.to.a.decline.in.the.market.value.homestead.credit .Furthermore,.referendum.market.value.levy.growth.could.resume,.especially.if.real.state.aid.to.school.districts.continues.to.decline .Finally,.a.portion.of.the.business.tax.base.will.continue.to.be.insulated.from.local.property.tax.increases.as.a.result.of.the.state.property.tax.levy,.something.which.is.not.true.for.homesteads

vi. Trends in sPeCifiC CoMMuniTies

Appendix.A.contains.information.on.total.per.capita.county,.city,.school.district,.special.taxing.district,.and.state.property.taxes.within.all.Minnesota.cities.with.a.population.over.5,000 .These.amounts.were.calculated.by.summing.the.total.property.taxes.paid.by.all.types.of.property.by.the.population.of.the.city .This.appendix.shows.the.per.capita.property.tax.in.constant.2010.dollars.for.each.year.from.2002.to.2010;.in.addition,.the.total.percent.change.from.2002.to.2010.is.shown.in.real.and.nominal.dollars .Aggregate.information.for.(1).all.cities.and.(2).all.cities.and.towns.is.shown.at.the.bottom.of.the.final.page.of.this.appendix .

Appendix.B.contains.average.residential.homestead.property.tax.information.for.all.cities.with.a.population.over.5,000 .These.amounts.were.calculated.by.dividing.the.estimated.total.residential.homestead.property.tax.in.the.city.by.the.number.of.residential.homesteads .The.average.homestead.property.tax.in.constant.2010.dollars.is.shown.for.each.year.from.2002.to.2010.and.the.total.percent.change.over.this.eight.year.period.is.shown.in.real.and.nominal.dollars .As.with.appendix.A,.aggregate.information.for.(1).all.cities.and.(2).all.cities.and.towns.is.shown.at.the.bottom.of.the.final.page.of.appendix.B

a portion of the business tax base will continue to be insulated from local property tax increases as a result of the state property tax levy, something which is not true for homesteads.

29Minnesota 2020 - www.mn2020.org

The.graph.below.shows.the.percent.change.in.real.per.capita.property.taxes.from.2002.to.2010.by.the.population.of.the.city.or.town .For.example,.real.per.capita.property.taxes.in.Falcon.Heights.increased.by.21.percent.from.2002.to.2010;.thus,.the.5,762.residents.of.Falcon.Heights.are.added.to.the.“20%.to.30%.increase”.bar.in.the.graph .This.graph.essentially.shows.the.distribution.of.the.state.population.by.the.percent.change.in.per.capita.property.taxes.within.their.community .The.graph.also.distinguishes.between.cities.and.townships .For.example,.because.Falcon.Heights.is.a.city,.its.population.appears.within.the.city.portion.of.the.bar .The.population.of.townships.appears.within.the.township.portion.of.the.bar

This.graph.shows.the.prevalence.of.large.property.tax.increases.in.Minnesota.over.the.last.eight.years .Even.after.adjusting.for.inflation,.more.than.half.of.the.state’s.population.resides.in.communities.in.which.per.capita.property.taxes.increased.by.more.than.20.percent .On.a.statewide.basis,.per.capita.property.taxes.increased.by.19 2.percent.from.2002.to.2010

Also.noteworthy.is.the.prevalence.of.larger.per.capita.property.tax.increases.among.Minnesota.townships .This.is.due.in.part.to.higher.growth.in.property.values.in.townships.relative.to.cities;.as.the.relative.size.of.the.township.tax.base.increases,.county.and.school.district.taxes.are.shifted.into.townships .Furthermore,.while.the.population.of.Minnesota.cities.has.increased.since.2002,.the.population.of.townships.has.declined,.thereby.contributing.to.higher.per.capita.property.tax.growth.in.townships

30 Minnesota 2020 Property Tax report: 2002 - 2010

The.next.graph.shows.the.percent.change.in.the.average.homestead.property.tax.from.2002.to.2010.by.the.number.of.homesteads.in.the.city.or.town .For.example,.since.the.average.homestead.tax.in.Falcon.Heights.increased.by.28.percent,.the.1,198.homesteads.in.Falcon.Heights.are.added.to.the.“20%.to.30%.increase”.bar .Because.Falcon.Heights.is.a.city,.these.homesteads.appear.within.the.city.portion.of.the.bar

Relative.to.the.preceding.per.capita.graph,.the.taller.bars.are.shifted.more.to.the.right.in.this.graph,.indicating.the.percent.increase.in.average.homestead.property.taxes.are.generally.greater.than.the.percent.increase.in.per.capita.property.taxes.over.this.period .From.2002.to.2010,.the.average.homestead.property.tax.statewide.increased.by.28 6.percent,.9 4.percent.greater.than.the.statewide.per.capita.property.tax.increase .This.is.consistent.with.data.presented.in.the.previous.section

As.in.the.preceding.graph,.the.township.portion.of.each.bar.is.skewed.to.the.right.side.of.the.graph,.indicating.average.homestead.property.tax.increases.were.greater.in.townships.than.in.cities.during.the.period.from.2002.to.2010

31Minnesota 2020 - www.mn2020.org

A.different.picture.emerges.if.we.focus.exclusively.on.the.trend.over.the.last.year .The.graph.below.shows.the.percent.change.in.real.per.capita.property.taxes.from.2009.to.2010.by.the.population.of.the.city.or.town

Approximately.83.percent.of.the.state’s.population.resides.in.communities.that.had.a.per.capita.property.tax.increase.of.3.percent.of.less.in.2010 .The.contrast.between.city.and.town.per.capita.property.tax.increases.from.2009.to.2010.is.not.as.great.as.it.was.during.the.period.from.2002.to.2010 .On.a.statewide.basis,.per.capita.property.taxes.increased.by.0 6.percent.from.2009.to.2010

32 Minnesota 2020 Property Tax report: 2002 - 2010

The.next.graph.shows.the.percent.change.in.the.average.homestead.property.tax.from.2009.to.2010.by.the.number.of.homesteads.in.the.city.or.town

Two-thirds.of.Minnesota.homesteads.are.located.in.communities.that.experienced.a.reduction.in.average.homestead.property.taxes.from.2009.to.2010 .In.contrast.to.the.period.from.2002.to.2010,.homestead.property.taxes.declined.more.in.townships.than.in.cities.from.2009.to.2010 .The.average.homestead.property.tax.in.Minnesota.townships.declined.by.4 0.percent.in.2010,.three.times.greater.than.the.decline.in.cities

In.stark.contrast.to.the.period.from.2002.to.2010,.the.average.statewide.homestead.property.tax.fell.by.1 6.percent.from.2009.to.2010,.while.statewide.per.capita.property.taxes.increased.slightly .As.noted.above,.the.decline.in.homestead.property.taxes.relative.to.other.property.taxes.in.2010.was.due.to.the.relative.decline.in.homestead.values.combined.with.the.subsidence.of.other.forces.that.had.been.pushing.homestead.property.taxes.higher.in.previous.years

One.factor.that.had.little.to.do.with.the.low.rate.of.property.tax.growth.from.2009.to.2010.were.the.statutory.restrictions.on.county.and.city.property.tax.increases.known.as.“levy.limits ”.A.previous.Minnesota.2020.analysis.concluded.that:

The.vast.majority.of.Minnesota.counties.and.cities.subject.to.levy.limits.in.2010.are.not.constrained.by.these.limits.either.because.these.jurisdictions.have.not.levied.the.maximum.allowable.amount.or.because.they.have.“special.levy”.authority.that.they.have.not.claimed .“Special.levies”.are.levies.that.are.exempt.from.levy.limits 25

25 “Pawlenty’sPropertyTaxCapsDon’tWork,”Minnesota2020,January10,2010.(http://tinyurl.com/ykpch5l)

33Minnesota 2020 - www.mn2020.org

With.a.struggling.economy.and.high.unemployment,.local.elected.officials.realized.that.citizens.were.averse.to.more.property.tax.increases.and.did.what.they.could.to.control.property.tax.growth.in.2010 .This.fact.had.more.to.do.with.the.relatively.low.rate.of.property.tax.growth.in.2010.than.did.“levy.limits ”

vii. foCusing on CiTies

It.is.difficult.to.isolate.the.impact.of.local.spending.decisions,.aid.cuts,.and.tax.base.changes.upon.property.tax.levels.when.examining.total.property.taxes.within.a.city.because.the.property.tax.levels.are.dependent.upon.the.actions.of.multiple.local.governments,.each.making.separate.spending.decisions.and.subject.to.differing.changes.in.the.level.of.state.funding .In.addition,.the.boundaries.of.cities.overlap.with.county.and.school.district.boundaries.that.can.extend.well.beyond.the.limits.of.the.city .Thus,.total.property.taxes.within.a.city.are.affected.by.tax.base.changes.that.occur.outside.city.boundaries

For.these.reasons,.it.is.easier.to.isolate.the.impact.of.spending,.aid,.and.tax.base.trends.if.we.focus.on.a.single.level.of.government .The.following.analysis.will.focus.on.the.change.in.city.property.taxes,.revenues,.aid,.and.EMV,.excluding.data.from.all.other.local.governments .Once.again,.2002.was.chosen.as.the.baseline.year.for.this.analysis.in.order.to.underscore.the.impact.of.aid.cuts.imposed.since.2002.and.to.further.highlight.the.impact.of.legislative.changes.enacted.in.2001