Microf In

-

Upload

ankit-goel -

Category

Documents

-

view

212 -

download

0

description

Transcript of Microf In

MICRO ENTERPRISES FOR RURAL POVERTY ALLEVIATION LayoutAnkit Goel(PGP/17/309)Ankita Prakash(PGP/17/310)Athul Bhargav (PGP/17/316)Bhaskar (PGP/17/317)G. Sahiti (PGP/17/318)

POVERTY IN INDIA- FACTS Indian Population-1/6th of World PopulationAlmost 1/3rd of the countrys population lives below the poverty lineA widening gap between rich and poorTop 5 percent of the households own 38% of assetsBottom 60 percent of the households owns13% of assets70% population live in rural areas

Major Initiatives in Rural CreditSocial Banking : the elevation of the entitlements of previously disadvantaged groups to formal credit even if this may entail a weakening of the conventional banking practices Nationalization of Commercial Banks in 1969Development of Credit Institutions-Regional Rural Banks or Grameen banks Integrated Rural Development Programme is a credit based Rural Poverty Alleviation Programme implemented through commercial banks

Concept of Micro FinanceCredit is an important tool for poverty alleviation programsMicro-credit, as defined by Grameen Bank, symbolizes small loans extended to the poor for undertaking self-employment projects that would generate income and enable them to provide for themselves and their families.Defining criteria :Size of the loansTarget Population : Micro-entrepreneurs from low income households

Main problems of Micro creditThe problem of exact targeting, which means to ensure that the truly needy people gets the benefitIt faces the screening problem of distinguishing the good (creditworthy) from the bad (not-so-creditworthy) borrowers The agencies may not be able to monitor and ensure productive usage of the loans

Role of Micro Finance InstitutionsPoverty Reduction ToolWomen EmpowermentDevelopment of Overall Financial SystemSelf EmploymentSHG- Bank Linkage programs

Poor: Natural Entrepreneurs?Premise : Poor are natural borne entrepreneurs and need the right environment and helpJohn Hatch, CEO of FINCA Give poor the opportunities and get out of the way2 Arguments:Fresh Ideas-Poor never given a chanceInnovations that better the lives of the poor have to be low hanging fruits Hindrances:Less Capital of their own and little access to formal and inexpensive means of creditHigh Interest Rates :4% per month- Still manage to repay the loans: High rate of return on invested capitalBRAC :Incapable clients given an asset, financial allowance for few months and a lot of hand holding

Business of the Poor: Areas of ConcernTiny BusinessNo paid staff 0 to 0.57 in MexicoLimited AssetsNever grow up to sufficient scale

Not making moneyFor small business in Hyderabad : Median Sales figure was Rs 3600 and median profit Rs 1035After subtracting the values of the hours spent by household members, average profits turned negative

http://pooreconomics.com/sites/default/files/A%20PDF%20of%20the%20lecture%20slides_3.pdf

How many paid employees these businesses have ? What percent of business own a machine?

Are These Businesses Profitable? Even after high interest rates , poor still manage to repay loans.Rate of return is highThen why are they not profitable?

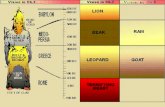

Marginal And Average Return

Why overall returns are low? Small Scale

Most energy spent on small and undifferentiated business

People borrow at a rate of 4 percent a month ,then their marginal return is atleast 4 percent.Overall Return :Total revenue net of operating expenses. If it is not high enough to cover the value of the time, cost to setup the business and if you dont expect the things to improve- Shut downMarginal return is high when investment is small

11

Why do Businesses stay Small?Limit on the loansReluctance on the part of borrowers to borrow Reluctance to invest due to the belief that business will not be able to absorb the investment.Nature of Business

Can it be always like OP ?

Why do Businesses stay Small?

To grow a business requires:Some special skillA large up front investment in new production technologyS Shape Dilemma

If you invest less-Do it in OPWhen have large enough money switch to QRCrossing the hunch requires some specific skills You may end up investing in 3 small business rather than 1 large13

Entrepreneurship is too hard?Loan limits-People cannot borrow to cross the humpSaving up to get there will take too longLack of commitment on the part of micro entrepreneurIs average small Business owner really a natural entrepreneur?Are there really a billion barefoot entrepreneurs?Enterprises are more a way to Buy a Job in absence of a more conventional employment opportunity

Characteristics of a good job Security Stability Control over the future Most Good Jobs are in City

Limitations of MFIMFI s are efficient in financial intermediation onlyLack of human resources to provide business counselingMostly have a single loan productSelf help promoting institutions (SHPI) lack in scale and capacity SHPI promote only weak SHGsBanks usually provide short term loans to MFIs

RecommendationsSpecial bank branches can be set specifically for microenterprise and SHG lendingNeed for new generation livelihood promotion institutions to address the diverse needs relating to livelihoods of the poorDistrict level agencies to link microenterprises with inputs, technology and marketsIncrease in government investment to nurture microfinance groups address their limitations

Urgent need to widen the scope, scale and outreach of financial services to reach vast un-reached poor population.Ref: http://www.slideshare.net/vkumarab/role-of-microfinance-in-promoting-micro-entrepreneurship17

Referenceshttp://indiatoday.intoday.in/story/rich-and-poor-division-penury-hdr-planning-commission/1/157212.htmlhttp://www.irdindia.in/Journal_IJACTE/PDF/Vol2_Iss1/13.pdfReluctant Entrepreneurs-Poor EconomicsAbhijit V. Banerjee and Esther DufloMicro-Credit and Rural Poverty: An Analysis of Empirical EvidenceAuthor(s): Pallavi Chavan and R. RamakumarSource: Economic and Political Weekly

THANK YOU