MCB Hosts Mortgagee Compliance Conference

Transcript of MCB Hosts Mortgagee Compliance Conference

Issue 15. April 2014

Reaching Out to Mortgagees for Stronger Partnerships

MMMCCCBBB HHHooossstttsss

MMMooorrrtttgggaaagggeeeeee

CCCooommmpppllliiiaaannnccceee

CCCooonnnfffeeerrreeennnccceee

III nnn sss iii ddd eee TTT hhh iii sss SSS ppp eee ccc iii aaa lll

CCC ooo nnn fff eee rrr eee nnn ccc eee III sss sss uuu eee :::

••• PPP hhh ooo ttt ooo GGG aaa lll lll eee rrr yyy

••• CCC ooo mmm mmm ooo nnn QQQ &&& AAA

••• LLL iii sss ttt ooo fff TTTooo ppp iii ccc sss

••• CCC ooo nnn fff eee rrr eee nnn ccc eee SSS uuu rrr vvv eee yyy

SSSpppeeeccciiiaaalll CCCooonnnfffeeerrreeennnccceee IIIssssssuuueee MCB-Hosted Industry Conference 3

MCB and Oklahoma City hosted first Mortgagee Compliance Conference.

Common Conference Q&A 8

A few of the issues discussed during the Q&A sessions.

On the Conference Agenda 9

List of topics in each MCM area that was presented.

The Survey Said! 9

100% of those who completed the post-conference survey said

they want to attend another MCB conference!

Who to Call? MCB List of Contacts 12

Keep this list handy when you have MCM questions.

Visit mcbreo.com to subscribe to MCB’s MCM UpDate

If you missed an issue, all past newsletters can be downloaded.

http://www.mcbreo.com/contracting/mortgagee-compliance-manager/

Issue 15. April 2014

Reaching Out to Mortgagees for Stronger Partnerships

MCM UpDate is published by Michaelson, Connor & Boul to provide news, information, and tips on how Mortgagees and Servicers can avoid the issues that cause delays in processing property conveyance to HUD. Our communication goal is to help Mortgagees and Servicers understand the MCM processes and improve the way the various transactions are submitted for pre- and post-conveyance activities.

Photo: Dustin Harjo

MCM UpDate Published by MCB - 3 - April 2014

Oklahoma City – home of Thunder

basketball and a thriving new metro – was the venue where MCB hosted 100 representatives from lender organizations and their field service and claim vendors for the first-ever Mortgagee Compliance focused conference on April 2-3. The theme “Navigating Change Together Through Partnerships” underscores MCB’s intent to be active partners with the industry and provide assistance with the various compliance-related activities needed to manage FHA portfolios. In keeping with the theme, MCB’s conference objectives were to help Mortgagees to: • have a better understanding of the

MCM processes, • gain efficiencies in providing the

right types of supporting documentation, and

• submit higher quality requests and appeals.

The better Mortgagees understand the many, often complicated processes, the more successful they will be in conveying properties to HUD in a timelier manner, and in the proper conveyance condition. Conference photos start on the next page. All

photos (except where indicated) are courtesy of

Dustin Harjo.

MCB Hosts First Mortgagee Compliance Industry Conference Theme of “Navigating Change Together Through Partnerships” brings Mortgagees, HUD and MCB together to learn best practices on MCM processes.

View of Oklahoma City’s downtown skyline. Photo taken by Dustin Harjo.

MCM UpDate Published by MCB - 4 - April 2014

MCB Shares Experience and Best Practices

MCB’s Chief Operating Officer, Gail Hyland-Savage welcomes attendees with opening remarks.

Special HUD Guests (L to R): Matt Martin, Ivery Himes and

William Collins (not pictured is Keith Clay and Kathi Cheatham).

As part of her opening remarks,

MCB’s Chief Operating Officer, Gail Hyland-Savage shared that MCB processed more the 3 million transactions since beginning MCM work in April 2010. With that much experience, MCB directors and managers were able to provide Mortgagees and their vendors an “inside look” at best practices for all MCM areas. Mortgagees were able to see how good quality submissions could have a more favorable outcome for them. Adequate and the right kind of supporting documentation, along with the best way to attach photos so nothing is overlooked, was mentioned in all presentations. Each presentation was followed by lively Q&A sessions to give ample opportunity for discussion.

“We’re proud of our highly trained

staff and efficient operation that

allow us to maintain high standards

of compliance and accuracy while

keeping up with volume.”

- Gail Hyland-Savage

MCM UpDate Published by MCB - 5 - April 2014

MCB’s Welcoming Staff (L to R): Regina Gotbaum,

Aubree Boul and Joseph Bagby.

Pre-Conveyance presenters (L to R) Justin Park, Pre-Conveyance Manager and Ryan McDoulett, Pre-Conveyance Director, discuss the process for submitting Over-allowable, Extension and Surchargeable Damage Requests.

Pam Pounds, Mortgagee Relations Director (left) gives an overview of the Mortgagee Relations functions, and Dustin Harjo, Administrative Remedies Manager (right), tells the story of how incomplete documentation on an Overallowable appeal had a financial impact to the Mortgagee.

Photo by: Marji Pittman

Photo by: Marji Pittman

MCM UpDate Published by MCB - 6 - April 2014

Mary Cambero, Part A and Reconveyance Director, explains the conveyance process and the items required on the 27011A.

Pictured Right: Sheree McClure, Title and Part B Claims Director, (standing far right) and Amie Rother, Part B Claims Manager, present best practices when assembling the Part BCD claim package.

Pictured Left: Gwen VanEvery, Title Manager, explains common title issues, and ways to cure rejected title packages.

MCM UpDate Published by MCB - 7 - April 2014

Mary Lou Wiles, Deputy Project Manager (standing left) and Gail Hyland-Savage, enjoy a light moment with Keith Clay and Kathi Cheatham from HUD.

Matt Martin, Director of the National Servicing Center for HUD, addresses a question from the audience.

Pictured Above and Below Left: Kerry Neterer, MCB Executive Director and MCM Project Manager, conducts one of many Q&A sessions.

MCM UpDate Published by MCB - 8 - April 2014

Common Conference Q&A In preparation for the conference, MCB solicited topics from potential attendees so that they would be incorporated into the Program Agenda as appropriate. Then, over the course of the two-day conference, a total of eleven (11) time slots on the Program Agenda were dedicated to a question and answer period. Here, we’ve highlighted just a few of the topics that were discussed. Q: How do we provide notification if damage is found at First Time Vacancy? A: ML 2010-18, Exhibit A, Section 3 provides the guidance for conveying damaged

properties due to mortgagor neglect. Property condition must be fully documented at the initial inspection. On the 27011A, the “Mortgagee Comments” section must include a description of the damage.

Q: What is the difference between “broom swept condition” and “conveyance condition”? A: “Broom swept condition” (BSC) is part of the standard for acceptable conveyance

condition. BSC is described as being free from dust, dirt, hazardous materials or conditions, personal belongings, interior and exterior debris.

“Conveyance condition” is described as being free from damage resulting from fire,

flood, earthquake, hurricane, tornado, or mortgagee neglect. Property must be secured, lawn maintained, winterized (if applicable), free from interior and/or exterior debris, and in broom-swept condition. (Reference ML 2010-18).

Q: Can we get a list of MCB contacts for points of escalation and other questions? A: A list of relevant MCB contacts is printed on the last page of every MCM UpDate

Newsletter. In this issue, please see page 12. Q: What kind of documentation do you need for an HOA/Condo Variance? A: According to ML 2013-18, the Mortgagee needs to exhaust all methods of obtaining and

paying outstanding HOA fees. Submitting a variance request is through the Surchargeable Damage function in P260. Some of the documentation that should be submitted include:

• HOA contact and address information. • Documentation supporting the various types of contact activities attempted. • Clear explanation of what was attempted to obtain payoff or payment information

from the HOA.

MCM UpDate Published by MCB - 9 - April 2014

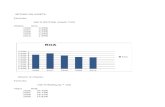

The Survey Said!

At the end of the conference, more

than half the group stayed to

complete feedback forms on what

they liked – or didn’t like.

We were pleased to know that 100%

of those surveyed said they would like

to attend a future conference, and

98.3% said the information was

useful to their company.

In their own words…

“Very helpful. Do it again.”

“The conference was well put together

and extremely educational.”

“I really enjoyed the Q&A feedback.

A lot of useful information was

provided that was not listed on the

agenda.”

“I was very impressed with the level

of detail provided by each presenter.”

“This was wonderful. Lots of great

info being sent back to the office!”

On the Conference Agenda Following opening remarks, the conference got underway with the most pertinent MCM topics covered. Pre-Conveyance

• Overallowable Requests and Appeals o Violations o Specialty Requests o Cycle of Resubmit vs. Appeal

• Extension Requests and Appeals o Pre and Post Conveyance Extensions o “Cookie Cutter” Reasoning

• Surcharge Requests and Appeals o Demolition and Convey as Vacant Lot o Unfinished Renovations o Common Appeal Trends

• Q&A Part A

• 27011A Form • Soft/Hard Edits • Non-Compliance Notices • Q&A

Reconveyance • Reconveyance Triggers • The Reconveyance Process • Q&A

Reconveyance Appeals • Appeal Process • Title, HOA and P&P Reconveyance Appeals • Escalation Process • Q&A

Re-Acquisition • The Re-Acquisition Process • Supporting Documentation • Claim Submission • Q&A

Title • The Title Package • Common Reasons for Rejection • Curing a Rejected Title Package • Q&A

Part BCDE • 27011BCDE Form • Best Practices • Q&A

Demand Appeals • Demand and Appeal Process • Case Examples and Best Appeal Practices • Escalation Process • Q&A

MCM UpDate Published by MCB - 10 - April 2014

Reporting Damaged Properties – Potential Need to Reconvey Field Service Managers – please note the process for submitting reconveyance requests due to damaged properties:

• Upon discovery of a damaged property, the FSM should ensure the HPIR is uploaded to P260. • Supporting documentation should be uploaded in P260 within the HOM 7 Disposition. • Once the HOM 7 Disposition is approved, the case will be assigned to an MCB staff reviewer

for review. • MCB will review, request additional documentation from the Mortgagee and FSM if needed,

and begin the review process. • MCB will notify the FSM and their GTR of the decision via P260. • If the reconveyance is approved, MCB will email the FSM requesting the case be reanalyzed in

P260 so it can be moved to HOM 3. The FSM must notify MCB once this has been done. • We recommend checking P260 to find out the status of your request (see also How to

Determine the Status of a Reconveyance, below). How to Determine the Status of a Reconveyance

• Check the email history, notes and/or the Communications Log in P260 for dates and types of communications that occur between the MCM and Mortgagee. For example:

o Date of the Preliminary Notice of Intent to Reconvey o Date of the Billing Letter o Date of the Notice of Intent to Administrative Offset o Appeals submitted by the Mortgagee; Appeal decisions rendered by the MCM

Placing Properties in HOM 3 in P260. Although FSMs have the P260 capability to move properties in and out of HOM status, please do not perform this function for any Mortgagee related issue - leave this function to the MCM. It is the MCM’s responsibility to initiate reconveyance when appropriate and the MCM will perform this step in P260. Upon doing so, we will notify the HOC GTR and the FSM. The FSM is responsible for preserving and protecting the property throughout the reconveyance process.

MCM Messages for Field Service Managers

MCM UpDate Published by MCB - 11 - April 2014

MCM Requests for Surcharge Inspections/Estimates: When the MCM requests a surcharge estimate/inspection from the FSM, it is generally to determine the actual dollar amount of damage that exists at the property. In some cases the FSMs are sending back a recommendation to demo, or a bid to demo if the property is too damaged to repair. In these scenarios, we are already aware of the property condition and need the estimates to determine the potential dollar amount to demand from the Mortgagee. Please provide an itemized cost estimate to repair that is calculated by cost estimating software; this document will serve as supporting documentation to demands that are issued to Mortgagees. The current HPIR form being used with the cost to cure section filled out is not detailed enough and is not sufficient to be used as documentation to support a demand. Continue to send HOA and Utility issues to: [email protected] How to Send a Demand Request to the MCM:

• Upload supporting documentation to P260 as an attachment under the category “Accounting” and sub-category “Reimburseables”. Label the description as “Supporting Documentation for Demand”.

• Through P260, send an email to [email protected]. o If there are multiple charges for different expenses for the same case, send only one

email and list all the charges to be itemized – not a separate email for each charge. • Format the Subject Line of the email as case number, reason for demand and dollar amount.

Example: “123-456789: Water Charge, $15.75” • In the body of your email, state the amount that is due from the Mortgagee, and ensure the

calculations are clear. Also state that supporting documents are in P260. • Make sure your documents and calculations clearly support the dollar amount demanded. • MCB will review your request and issue the necessary demands.

Field Service Managers may send suggestions for topics of interest and request additional personnel to be added to the MCM UpDate distribution to: [email protected]

The MCM Email Boxes are for Notification Only! � Be sure to upload the attachments to P260 – do not send with the email. � No need to send screen shots of P260 within your email; this adds to the file size.

MCM Messages for Field Service Managers

MCM UpDate Published by MCB - 12 - April 2014

Resources MCB Points of Contact http://www.mcbreo.com/contracting/mortgagee-compliance-manager/ MCM UpDate Issues http://www.mcbreo.com/contracting/mortgagee-compliance-manager/ MCB Customer Service [email protected] Reconsideration/Rescission Requests: Demands/Reconveyances

Voluntary Reconveyances [email protected] Re-Acquisition (return a property to HUD inventory)

Notification of Violations [email protected] HUD Web Page on MCM http://www.hud.gov/offices/hsg/sfh/nsc/mcm.cfm

HUD FAQ’s for P260 Internet Portal http://www.hud.gov/offices/hsg/sfh/nsc/mcmfaqsII2010.pdf

Contact List for FSM and AM Contractors http://www.hud.gov/offices/hsg/sfh/reo/mm/mminfo.cfm

Yardi Help Desk for P260 [email protected]

MCB Contacts Preconveyance, Surcharge and Emergency P&P Requests Susan Sipe (405) 595-2024 [email protected] Justin Park (405) 585-2023 Justin.park@mcbreo,com Ryan McDoulett (405) 595-2025 [email protected] Part A Claims Leana Lim (714) 230-3620 [email protected] Part BCDE Claims Amie Rother (405) 595-2018 [email protected] Sheree McClure (405) 595-2032 [email protected] Title Gwen VanEvery (405) 595-2016 [email protected] Reconveyance/Reacquisitions Cynthia Diaz (714) 230-2390 [email protected] Appeals for All Request Decisions, Demands and Reconveyances Dustin Harjo (405) 595-2012 [email protected] Occupied Conveyance Greg Nelson (405) 595-2020 [email protected]