Mbs Valuation

Transcript of Mbs Valuation

-

8/8/2019 Mbs Valuation

1/120

-

8/8/2019 Mbs Valuation

2/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Outline1 Customary market size comments

2 Mortgage market structure

3 Prepayment modeling

4 Yield and OAS

5 The Legality of Prepayment Modeling

6 Data and calibration

7 Interest rate models

8 Index projection

9 Monte Carlo analysis10 Greeks

11 Validation

12 Robust parallelization

13 Summary

2 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

3/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Size of mortgage market

The Case for U.S. Mortgage-Backed Securities for Global

Investors, Michael Wands, CFA, Head of U.S. Fixed Income,Global Fixed Income, State Street Global Advisors:

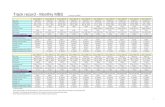

Lehman U.S. Aggregate Index - 2002 MBS 35% U.S. Credit 27% U.S. Treasury 22% U.S. Agency 12% ABS 2% CMBS 2%

The U.S. Mortgage Market, Fannie Mae, and Freddie Mac AIMF Study:

March 2003 $3.2 trillion in mortgage-backed issuance byFannie and Freddie.

3 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

4/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Outstanding debt

4 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

5/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Size over time

5 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

6/120

-

8/8/2019 Mbs Valuation

7/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

CMO issuance

7 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

8/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Mortgage market structure: Mortgages

MBS pools

CMOs

8 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

9/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

The subatomic particles -mortgages

People take out loans (mortgages) to buy homes.

Fixed rate mortgages fixed coupon, monthly payments, selfamortizing, paying principal down to zero at maturity (15-30years).

Balloons amortize on a 30 year basis, but expire in 5 or 7 yeawith payment of the remaining outstanding balance.

Adjustable rate mortgages (ARMS) floating coupon based oan index (LIBOR, treasury rates, . . . ), typically with protectionclauses against overly large coupon changes (lifetime andperiodic caps, annual resets, . . . ).

Low interest rates in recent years have sparked innovation floatinrate balloons with interest only payments, various sorts of built inprotections, option ARMs, . . .

9 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

10/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Mortgage behavior

While it looks like ARM valuation might require some work, in thatthey have embedded caps and ratchets and potentially float on aCMS rate, one might think that at least fixed rate mortgages wouldbe easily valued.With fixed monthly payments, monthly interest payments at a rate oC on the outstanding balance, N monthly payments and an initialbalance of B, then monthly payments are:

C(1 + C)N

B(1 + C)N 1

.

10 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

11/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Mortgage cash flows

Graphically, our cash flows look like:

so why not just discount and be done?

11 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

12/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

The painful intervention of reality

The problem with discounting the scheduled payments is that

People move,

refinance,

default,

make excess payments to pay off principal faster.

So, principal arrives randomly, or perhaps not at all (in default ofuninsured loans).

Payments above the scheduled payments pay down the principal andare known as prepayment.One of the major components of mortgage analysis is in modelingprepayment behavior.

12 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

13/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Impact of prepayment on cashflows

Thus, our simple mortgage, instead of having fixed cash flows, hascash flows that are dependent on prepayment rates. Under one

prepayment assumption, we have:

13 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

14/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Impact of prepayment on cashflows

Under a model that projects prepayments based on interest rates anloan characteristics, we see a different cash flow structure for each

rate path. One example is:

14 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

15/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

The atoms MBS Pools

In 1938, the collapse of the national housing market led to the feder

governments formation of the Federal National MortgageAssociation, AKA Fannie Mae. Now, we have Fannie Mae, FreddiMac (The Federal Home Loan Mortgage Corporation), and GinnieMae The Government National Mortgage Association.

Banks make mortgages.

Government insures conforming mortgages.

Agencies buy conforming mortgages.

Banks have money to make more mortgages.

Agencies sell shares of mortgages on secondary market.

Ginnie, Fannie and Freddie three sets of rules for conforming loan

15 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

16/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS secondary market - poolsThe agencies (Fannie, Freddie and Ginnie) buy mortgages, pool themtogether into MBS pools and sell shares. Pools are pass-throughsecurities, in that the cash flows from the underlying collateral is

passed through to the shareholder, minus a service fee.

16 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

17/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristics -Geographic data

These days, theres substantial information available about poolcomposition, such as geographic data:

17 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

18/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristics -Loan purpose

18 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

19/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristics -Loan to value ratio and credit

ratings

19 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

20/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristics -loan rate distribution

20 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

21/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristicsLTV distribution

21 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

22/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristicsLoan size distribution

22 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

23/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristicsMaturity distribution

23 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

24/120

-

8/8/2019 Mbs Valuation

25/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristicsCredit rating distribution

25 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

26/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristicsServicers

26 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

27/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS pool fine characteristicsSellers

27 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

28/120

-

8/8/2019 Mbs Valuation

29/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Pool analysis

Pool analysis is like mortgage analysis, except that it benefits fromsafety in numbers.

Backed by a substantial number of individual loans, so variance reduced.

While it used to be the case that this was at the cost of only knowingross aggregate data about the pool, these days the fine structure othe pool is often disclosed as well, telling us:

Location of individual loans,

Size of individual loans, LTV,

and credit ratings.

The only thing missing is individual borrower details.

29 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

30/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

The molecules CMOs

In 1983, Solomon Brothers and First Boston created the firstCollateralized Mortgage Obligation (CMO).They realized that more pools could be sold if the pool cash flowswere carved up to stratify risk.CMOs are:

Backed by pools or directly by mortgages (whole loans),sometimes by as many as 20,000 of them.

Split up cash flows of underlying collateral into a number ofbonds or tranches.

By creating desirable risk structures, tranches can be sold to awider audience, and at a profit.

CMOs are essentially arbitrary structured notes backed by mortgagecollateral.

30 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

31/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Tranche types

Tranches vary by how the principal and interest are carved up.

Interest handling:

Fixed cpn Can behave like a pool or very differently,

depending on how principal is paid. POs Only principal payments from underlying collateral. IOs Only interest payments. Floaters Where theres a floater, theres an inverse floater

(when you have fixed rate collateral). Inverse floaters.

Principal handling: Sequential Pay Sequence of tranches. First gets principal un

paid, then 2nd gets principal, etc. Last one is most prepaymentprotected and behaves most like an ordinary bond.

PACs Scheduled principal will be payed as long as prepaymeremains in a specified band.

TACs Scheduled principal will be payed when prepayment is a specified level.

Etc.

31 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

32/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Example CMO

32 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

33/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Example CMO tranche

33 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

34/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Example CMO collateral

34 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

35/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

CMO modeling

Computing the cash flows of a CMO tranche requires modeling theCMO, i.e. converting the prospectus into a mathematicalspecification of the tranche payouts as a function of collateral cashflows.

35 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

36/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

CMO cash flow engine

The cash flow engine computes CMO cash flows for each scenario.Inputs:

CMO deal specification.

Index projections.

Current outstanding balance of each piece of collateral.

Given the above inputs, the cash flow engine parses and evaluates th

deal specification, using the cash flows generated from running theprepayment model on each piece of collateral and amortizing it.

36 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

37/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Prepayment modeling

37 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

38/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Prepayment speeds

Prepayment speeds are to prepayment modeling what yield

calculations are to interest rate modeling. SMM Percentage of remaining balance above scheduled paid

100PiPiBi

.

CPR SMM annualized: 100(1 (1 SMM100 )12).

PSA Prepayment Speed Assumption: 0.2% initially,increasing by 0.2% each month for the first 30 months, and 6.0until the loan pays off. 200 PSA is double this rate, etc.

MHP PSA for manufactured housing (ABS, not MBS).

Looking at the value of a pool or CMO as a function of prepaymentlevel is a useful analysis tool.

38 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

39/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Prepayment speed graph

39 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

40/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Prepayment modeling

Prepayment modeling is a major component of MBS and CMOvaluation. In some sense, CMO and MBS valuation is Monte Carloanalysis of the prepayment model.In prepayment modeling:

Salient features of prepayment are proposed.

Evidence is collected statistically.

Models are developed for these relationships.

40 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

41/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Major prepayment components

Housing turnover.

Refinancing.

Curtailment and Default.

41 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

42/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Housing turnover

Appears as relatively constant baseline level of prepayment =total (existing) home sales divided by total housing stock.

Seasonality Less movement in the winter.

Seasoning Chances of moving increase with age of mortgagebut tend to level off. A function of WAM, loan type, andprepayment incentive.

Lock-in effect High rates relative to mortgage coupon are a

disincentive to moving when LTV is high.

Rarely over 10% CPR.

42 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

43/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Housing turnover illustrationHousing turnover behavior typically dominates prepayment when ratare low.

43 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

44/120

-

8/8/2019 Mbs Valuation

45/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Refinancing S-curveSample refi S-curves for normal credit and poor credit:

45 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

46/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Curtailment and Default

Default results in return of outstanding principal when property issold.Curtailment is the reduction in maturity due to additional partialpayment of principal. Without reamortization, results in additionalprincipal pay downs on a monthly basis. Can also be from paying offremainder of an old mortgage.

Tend to be independent of interest rates.

Default risk grows and then drops as LTV decreases. Curtailment picks up towards end of mortgage life.

46 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

47/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Curtailment and Default graphThese considerations lead to the following typical curtailment anddefault graph.

47 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

48/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Loan level characteristics

Increased disclosure allows improved prepayment modeling.Primary loan attributes:

LTV

FICO score

loan size

Secondary loan attributes:

occupancy

property type

loan purpose

48 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

49/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Yield calculations

49 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

50/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Yield calculations

Internal rate of return at a given price assuming a particularprepayment rate.

Pick a prepayment speed.

Generate cash flows.

Solve for internal rate of return that gives quoted price.

Conceptually simple, but computationally intensive and involved whe

trying to value a CMO backed by 20,000 pools, with cash flowscarved up across 100 tranches.

50 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

51/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Yield example PSA

51 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

52/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Yield example BPM

52 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

53/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

OAS Analysis

53 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

54/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

From Yield to OASConsider a semi-annual bond with cash flows Ci at times ti (withprincipal payment included in CN) and (dirty) price P. When thebond is not callable, OAS is basically Z-spread, which is basically a

spread over a set of bonds which is basically a difference in yields.

P N1

Ci

(1 + Y2 )2ti

Yield

P N1

Ci

(1 + R+S2 )2ti

Spread

P N1

Ci

(1 + Yi+S2 )2ti

Z-Spread

P N1

Ci

(1 + Yi+S2 )2ti

OAS

54 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

55/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Optionality in OASWhen the bond has embedded optionality, OAS attempts to value thoptionality. Doing this requires some assumptions regarding theevolution of interest rates:

55 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

56/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

MBS and CMO OASCompute average value under a large set of realistic scenarios. TheOAS is the shift in the discount rates needed to arrive at a specifiedprice.Because of the complexity and path dependency of the prepaymentmodel and the CMO tranche calculations, OAS analysis is done viaMonte Carlo.

Calibrate interest rate model.

Generate interest rate scenarios discount rates, longer tenorrates, par rates.

Generate indices current coupons, district 11 cost of funds,

and whatever else is needed. For each scenario:

Compute prepayments for each piece of collateral. Amortize each piece of collateral. Compute tranche cash flows. Discount cash flows at specified OAS to generate scenario price

Average of scenario prices is the price at the specified OAS.

56 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

57/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

The Legality of Prepayment Modeling

57 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

58/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Prepayment as determining acontingent claim

How can it be OK to introduce historical analysis (prepaymentmodeling) into a risk neutral valuation (OAS calculation)?

Consider a population holding European options with a commo(unknown) strike and varying maturity dates.

Consider an historical study of the payoff of these options whenexercised.

The historical analysis would yield a discrete, random sampling max(S K, 0), where K is the common strike.

Historical analysis of the payoff would yield a good

characterization of the actual payoff function. Using the historically estimated payoff function in option pricing

would be perfectly correct. No risk neutral adjustment need beapplied.

To the extent that prepayment is truly a contingent claim on interesrates (i.e. that prepayment behavior is a function of interestrates), then there is no logical inconsistency in deducing it viahistorical analysis and using it directly in OAS analysis.

58 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

59/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Problems with prepayment

Problems with the above analysis:

Errors in deducing historical behavior.

Aggregation of behavior.

Behavior independent of rates hedgeable?

59 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

60/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Data and calibration

60 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

61/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Data importance

Data:

Most critical component of interest rate modeling.

Simple model calibrated to good data is far better than asophisticated model calibrated to the wrong data.

Data must have good pricing and capture risks of securities beinvalued.

Characterizing risk in terms of related liquid instruments will heto answer the question of which interest rate model to use.

61 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

62/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Discounting componentTraditionally, the treasury curve. Thought to be closest in risk toagency default risk (i.e. negligible), but:

Heterogeneous coupon bonds, some liquid and some illiquid.

Sparse data large gaps between maturities leaves interimpricing unknown (subject to interpolation method).

Market price of conditional cash flows (i.e. option prices =Volatility data) unavailable.

Newer market standard calibrate to the swap curve.

Denser data monthly at short end, annually further out. Lessubject to interpretation.

Homogeneous cash rates and par rates, not bond prices atvarying coupons. Mostly on a clean, nominal basis.

Rich volatility data ATM and OTM caps and floors are wellknown. ATM swaptions of various tenors and maturities are weknown. Only OTM swaption pricing is subject to discussion.

Hedging swap market often used to hedge MBSs. Calibratinto it makes calculating appropriate hedges easier.

62 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

63/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Volatility calibration

What to calibrate to? Calibrate to full volatility cube? Too expensive to hedge.

Calibrate to one volatility? Which one?

Compromise 1: Two year and ten year swaptions are commonly usedfor hedging, so calibrate to them.Compromise 2: Rather than calibrating to the entire smile, calibrateto the ATMs and pick a model which does a reasonable job of

capturing the overall smile. This is also good because OTM swaptiodata is hard to come by.

63 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

64/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Interest rate models

64 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

65/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Popular short rate models

Log normal short rate models have been popular for many years in tfixed income markets.

Simple and intuitive.

A priori, rates shouldnt go negative.

65 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

66/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

A log normal short rate model(LNMR)

One example is the first model we used for mortgage valuation. Theshort rate process is rt, where:

rt = eRt+t

dRt = aRtdt + dWt,

with a and constants, t is a function of time and chosen tocalibrate the model to the discount curve. Under this model Rt is aGaussian process mean reverting to zero, and rt is log normal andmean reverting as well.

66 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

67/120

-

8/8/2019 Mbs Valuation

68/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

US skews 1 year outIt always pays to look at the data. Here are cap and swaption implievolatilities from the US market. The skew is substantial acrossmaturities.

0

5

10

15

20

25

30

35

40

45

-5 -4 -3 -2 -1 0 1 2 3 4

1y2y

1y5y

1y10y

1y caplet (CFIR)

1y caplet (ICPL)

68 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

69/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

US skews 5 years outThe five year tenors are skewed as well.

0

5

10

15

20

25

30

35

40

45

-5 -4 -3 -2 -1 0 1 2 3 4

5y2y

5y5y

5y10y

5y caplet (CFIR)

5y caplet (ICPL)

69 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

70/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

How normal is it?Fitting the CEV model (dr = rdW) to caplet skews shows that thUS market is fairly close to normal ( close to zero).

0

0.2

0.4

0.6

0.8

1

1.2

0 5 10 15 20 25 30 35

USD

EUR

JPY

70 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

71/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

How normal is it?Fitting errors for the CEV model to the US market arent too large, sabove betas are reasonable.

0%

2%

4%

6%

8%

10%

12%

14%

0 2 4 6 8 10 12

USD

EUR

JPY

71 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

72/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM

The Linear Gaussian Markovian models (AKA Hull-White models) aa family of extremely tractable models. The two factor form is:

rt = t + Xt + Yt

dXt = aXXtdt + X(t)dW1

dYt = aYYtdt + Y(t)dW2

dW1dW2 = dt

72 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

73/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM advantages

Fits overall historical behavior well with fixed mean reversion ancorrelation (ax = 0.03, ay = 0.5, = 0.7).

Can be calibrated to two term structures of volatility.

Very tractable Dont underestimate the value of closed formsolutions (or decent approximations) for bond prices, capletprices,and swaption prices and swap rates as a function of(X

t, Y

t).

Much closer to market skew than log normal models.

73 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

74/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM behavior

High mean reversion factor dampens long term effect of thatparameter, leaving long tenor volatility mostly determined by lomean reversion factor.

Both factors impact short tenor volatility.

Negative correlation reduces volatility of short maturities relativto long maturities and allows this behavior to persist in time.

74 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

75/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Market volatility term structure

0 20 40 60 80 100 12016

17

18

19

20

21

22

23

24

BlackSwaptionVols(%)

Swaption expiries (months)

1year

2year

3year

4year

5year

7year

10year

Swaption term structure implied volatilities as a function ofmaturity for various tenors.

75 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

76/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM volatility term structure

0 20 40 60 80 100 12015

16

17

18

19

20

21

22

23

24

BlackSwaptionVols(%)

Swaption expiries (months)

1year

2year

3year

4year

5year

7year

10year

LGM models swaption term structure implied volatilities produceby the model, as a function of maturity for various tenors.

76 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

77/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Index projection

77 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

78/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Index projection problem

Prepayment model needs appropriate inputs (such as monthlymortgage refi rates).

Floater indices (such as D11COFI) need to modeled.

Neither need be discount rates, and hence, cant be read directfrom model.

78 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

79/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Index projection solutions

Not a problem for discount rates (LIBOR, swap rates, etc).

Compute from model: For one factor log normal build lattice and compute future

implied long tenor rates for each month as a function of the shorate.

For 2 factor LGM rates are given by formulas.

Avoid problem calibrate prepayment model directly todiscount rates (LIBOR, swap rates, etc).

Simplify to first order can ignore volatility of index relative tdiscount rates. How different can refi rates be on two differentdates that have the same swap curve? Regress and model as afunction of the rates. Or get fancy and take vol into account aswell.

79 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

80/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Chosen solution

We chose simple:

Treat implied rates as a function of swap rates.

Regress proxy the current coupon for each collateral type asweighted average of the 2 year and 10 year rates.

Adjust for current actual value of current coupons.

Adjust in prepayment model for fact that a proxy for the refi rais being used.

Potentially use lagged data (e.g. - D11COFI in ARM WrestlingValuing Adjustable Rate Mortgages Indexed to the Eleventh

District Cost of Funds, by Stanton and Wallace: If Di is theindex in month i, and Ti is the 6 month treasury rate, then themodel sets

Di = 0.889 Di1 + 0.112 Ti + 5.6bp.

80 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

81/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Monte Carlo analysis

81 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

82/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

The need for speed

With 20,000 pieces of collateral, interpreted rules for paying out casflows and time consuming prepayment projection calculations, runninthe 100,000 scenarios necessary for accurate valuation will take somtime. If a scenario takes 0.0001 seconds on one piece of collateral,then well have to wait 2.3 days. 100 scenarios would take 3.3minutes.

So, it pays to reduce the number of scenarios needed.

82 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

83/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

1 factor pseudo Monte Carlo

In the one factor case, the method we developed is the bifurcation

tree approach. Begin with two paths starting at the current short rate.

Evolve them to match the moments of the model relative to thlast common point.

Periodically allow the paths to split:

R

u

= E[Rt|Rb = R] +Var[Rt|Rb = R]

Rd = E[Rt|Rb = R]Var[Rt|Rb = R]

83 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

84/120

-

8/8/2019 Mbs Valuation

85/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

1 factor pseudo Monte Carlo

The end result, with 5 selected bifurcation maturities, is the followintree:

85 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

86/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Bifurcation tree behavior

Advantages:

Reasonably straight forward.

Conditional mean and variance of underlying R process ismatched at bifurcation points.

Results look reasonable with fairly small numbers of paths.

Disadvantages:

Variability is coarse (semiannual steps).

Unclear that overall variance is captured.

Doesnt extend well to the multi-factor case.

86 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

87/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM VR1 Numeraireconsiderations

Weve investigated a variety of variance reduction techniques for thefactor LGM model.The first is to recognize that the choice of numeraire has a majorimpact on Monte Carlo efficiency.Consider valuation of a price process V under two differentnumeraires N and N, and corresponding equivalent martingalemeasures Q and Q.

V0 = N0EQ[

Vt

Nt] = N0E

Q [Vt

Nt]

87 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

88/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM VR1 Numeraireconsiderations

The relationship between N, N, Q and Q is that

Nt/N0Nt/N

0

=dQ

dQ,

where dQ/dQ is the Radon-Nikodym derivative of Q with respect tQ.

So, a numeraire thats higher on high rates will have an equivalentmartingale measure thats correspondingly higher as well, and thusthe Monte Carlo associated with the higher numeraire will samplemore heavily from this region.

88 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

89/120

-

8/8/2019 Mbs Valuation

90/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM VR2 path shifting

Adjust paths so that sample at least captures yield curve.

Similar to doing control variate on the discount rates.

rt = t + Xt + Yt, and Xt and Yt are Gaussian and symmetricaround zero, so just compute a new to get discounting correcfor chosen path set.

VR1 + VR2 yields pricing standard deviation of about 1bp for 2,000

paths, or 1 bp error 30% of the time, and 2 bp error 66% the time.

90 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

91/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM VR3 PCA

Randomly sample paths P = (Xt1 , . . . Xtn , Yt1 , . . . Ytn)

Xti and Yti are jointly distributed as a 2n dimensional Gaussian

with zero mean. Let C be the covariance matrix of these 2n random variables.

If Z = (z1,..., z2n)t, and the zi are IID N(0, 1), and C = AA

t,then AZ has the same distribution as P.

Choose A to be the matrix whose columns are the eigenvectorsof C, scaled by the square roots of their eigenvalues. ThenC = AAt.

The best k factor approximation to P is given by using the firstk columns of A.

Small number of vectors capture most of variance.

In 1 factor LGM 7 vectors out of 360 for 95% of variance.

In 2 factor LGM 9 vectors out of 720 for 95% of variance.

91 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

92/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

PCA impact - Low mr factor

The eigenvectors can be inspected by graphing the values for eachfactor separately. The first eigenvector for the low mean reversionfactor captures the overall volatility. Subsequent eigenvalues capture

higher and higher frequency changes.

-0.1

-0.05

0

0.05

0.1

60 120 180 240 300 360

Time (month)

The first 5 eigenvectors (first factor)

eigenvector 1eigenvector 2eigenvector 3eigenvector 4eigenvector 5

92 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

93/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

PCA impact - High mr factor

The high mean reversion factors eigenvectors are harder to interpret

-0.04

-0.03

-0.02

-0.01

0

0.01

0.02

0.03

0.04

60 120 180 240 300 360

Time (month)

The first 5 eigenvectors (second factor)

eigenvector 1eigenvector 2eigenvector 3eigenvector 4eigenvector 5

93 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

94/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM VR4 Weighted PCA

Most of action in pool is up front, both because of prepaymentand because of discounting.

Weight PCA with et to effect this.

Weight two factors differently as well (High MR factor doesnthave as big an impact on MBS pricing as low MR factor).

94 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

95/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Weighted PCA impact - Low mrfactor

As is expected, the impact of weighting is to capture more up frontvolatility at the cost of long term volatility:

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

60 120 180 240 300 360

Time (month)

The first 5 eigenvectors (first factor)

eigenvector 1eigenvector 2eigenvector 3eigenvector 4eigenvector 5

95 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

96/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Weighted PCA impact - High mrfactor

Weighting dampens out much of the long term behavior of the highmean reversion factor:

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

60 120 180 240 300 360

Time (month)

The first 5 eigenvectors (second factor)

eigenvector 1eigenvector 2eigenvector 3eigenvector 4eigenvector 5

96 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

97/120

-

8/8/2019 Mbs Valuation

98/120

-

8/8/2019 Mbs Valuation

99/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

LGM VR1+VR2+VR4 withSobol sequences

Adding Sobol sequences to the mix:

Use Sobol sequences to randomly scale eigenvectors.

Further reduces variance.

99 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

100/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Results

128 256 512 1024 2048 40960.0001

0.0002

0.0003

0.0006

0.0011

0.002

0.0037

Number of Paths

RMSE

FWD

PC UWAN1

PC UWAN2PC UWAN3

PC Sobol

WPC UWAN1

WPC UWAN2

WPC UWAN3

WPC Sobol

100 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

101/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Greeks

101 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

102/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Greek errorsGreeks magnify pricing errors.

dP

dS

P(S + h) P(S h)

2h

If P(S) is the true model price, and P(S) is what we compute, thenthe error is (S) = P(S) P(S).

P(S + h) = P(S) + P(S)h +1

2P(S)h2 +

1

3!P(S)h3 + . . .

soP(S + h) P(S h)

2h= P(S) + h2(

1

3!P(S) + . . .)

andP(S + h) P(S h)

2h=

P(S + h) + (S + h) (P(S h) + (

2h

= dP/dS + h2(1

3!d3P/dS3 + . . .) + /2

The error in the calculation is the error from dropping the higher

order terms and from the change in error with respect to h.102 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

103/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Limits of computationTo see the magnitude of the problem, consider computing thederivative of the cumulative normal distribution by finite difference.Even with a computation as accurate as this, one should not exceed

step size of 105

.

-7e-10

-6e-10

-5e-10

-4e-10

-3e-10

-2e-10

-1e-10

0

1e-10

2e-10

3e-10

-3 -2 -1 0 1 2 3

normal - delta f, h=10^-6normal - delta f, h=10^-5normal - delta f, h=10^-4

103 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

104/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Greek errorsErrors in derivative are caused by:

High order terms corrupting finite difference (convexity).

Pricing error.

Error control: Small h reduces Greek error from convexity.

Large h reduces Greek error from pricing error.

Balance is needed h 3

3f/f if is the relative error 105 for machine precision calculations with 64 bit doubleswhen f/f 1.

Pricing error issues:

Finite difference flat, minimal problems. Monte Carlo large and random error goes to as h

Solution for Monte Carlo:

Make less random Use the same paths, or the same randomnumber seed.

Accurate duration with 25bp shift, even when pricing variance ias large as 6bp.

104 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

105/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Which Greeks?

To compute duration, rates are shifted while other inputs are heldconstant. How should the option data be held constant?

Hold prices constant Doesnt make sense. Option prices havto change as rates make them more or less in the money.

Hold vol constant Vol is a log normal vol, but LGM model isnormal. If vol is held constant, then model volatility will changewhen the rates are shifted.

Hold normal vol constant Most consistent with LGM model.The situation between normal vol and log normal vol is reversed forthe LNMR model.

105 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

106/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Validation

106 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

107/120

-

8/8/2019 Mbs Valuation

108/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

OAS stability

OASs are stable, but related to the current coupons, indicating a lac

of linearity the market demands a higher OAS when rates drop.

-15

-10

-5

0

5

10

15

20

25

04/08 04/15 04/225.6

5.7

5.8

5.9

6

6.1

6.2

6.3

6.4

OAS(bps)

CurrentCoupon(percent)

Date

OAS (April 2006)

FNCL 5FNCL 6FNCL 7

MTGEFNCL

108 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

109/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Duration stability

Durations are stable as well, and exhibit the appropriate relationshipto the current coupon. Durations drop when rates drop, with thelargest impact on coupons near but below the current coupon.

-15

-10

-5

0

5

10

15

20

25

04/08 04/15 04/225.6

5.7

5.8

5.9

6

6.1

6.2

6.3

6.4

OAS(bps)

CurrentCoupon(percent)

Date

OAS (April 2006)

FNCL 5FNCL 6FNCL 7

MTGEFNCL

109 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

110/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Convexity stability

Convexities also become more negative when the current coupondrops because heightened prepayment causes the pool to behave lesbond-like.

-2.5

-2

-1.5

-1

-0.5

04/08 04/15 04/225.6

5.7

5.8

5.9

6

6.1

6.2

6.3

6.4

EffectiveConvexity

Curren

tCoupon(percent)

Date

Effective Convexity (April 2006)

FNCL 5FNCL 6FNCL 7

MTGEFNCL

110 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

111/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Robust parallelization

111 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

112/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Parallelization

Variance reduction alone is insufficient to compute OASs in real timParallelization is needed.

Linux clusters. 6 clusters, 50 dual CPU PCs each = 100 CPUs per cluster

Embarrassingly parallel sometimes isnt

Communication costs to farm out results and get back can rendparallelization useless.

Old cluster - 750 MHZ, 100 MBPS ethernet 60 seconds, 6 iparallel.

New cluster - 3.0 GHZ, 100 MBPS ethernet 15 seconds, 4seconds in parallel.

Data dissemination problem 2 GB of deal and collateralspecifications.

PCA parallelization compute time vs communication speed.

112 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

113/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Request flow

User hits

Computation data is assembled: Current values. User selected values.

Request sent to dispatcher.

Dispatcher queues until an idle server is available. Retries failedrequests.

Server receives request.

Explodes base calculation into individual path requests.

Farms them out across the cluster. Redundancy and robustness.

Assembles the result.

Farms out remaining requests.

Assembles results.

Replies to client.

113 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

114/120

-

8/8/2019 Mbs Valuation

115/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Parallelization robustness

Preventing machine problems from causing calculation failures.Errors encountered:

Unstripable curves.

Overheating machines.

Flakey hard disks.

Data unavailable.

Bad data supplied.

Layered approach:

Requests -> dispatcher -> OAS server -> slaves.

If dispatcher gets an error (on a full request), it resends (up tothe retry limit).

If OAS server gets an error (on a path), it marks the slave as baand tries again. If it gets confirmation of the error, the slave ismarked good and the path is listed as bad. If not, the slave is nlonger used.

115 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

116/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Parallelization issues

Even embarrassingly parallel problems might have troubleparallelizing.

Even the simplest variance reduction adds up startup costs andcommunication overhead.

If startup costs cant be distributed as well, then they yield ahard limit on parallelization speedup.

PCA analysis is slow enough that its hard to make it actuallysave time.

Compression of data being distributed. Tree distribution of data. Optimize PCA. Parallelize PCA. Partial PCA.

116 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

117/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Effectiveness poolsParallelization is most effective when the ratio of scenariocomputation to communication is high. This is not the case for poowhere only one amortization and one prepayment model call are

needed for each scenario, and there are no tranche cash flowcalculations. But even with low efficiency, parallelization is effective reducing run time.

4

6

10

15

20

25

1 2 3 4 5 10 20

25

50

75

100

Executiontime(se

c)

Relativeefficiency(%)

Number of slaves

Parallization Gain on a MBS

TimeEfficiency

117 / 119

http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/http://0.0.0.0/ -

8/8/2019 Mbs Valuation

118/120

MortgageBacked

Valuation

rvey Stein

omaryket sizements

gageket structure

aymenteling

d and OAS

Legality ofaymenteling

andration

est rateels

x projection

te Carloysis

ks

dation

ustlelization

mary

Effectiveness CMOs

CMOs are quite another story. With large collateral sets and complerules, each scenario can be quite intensive, so parallelization at thepath level is far more effective

30

60

120

240

480